Automobiles Two Wheelers – Motorcycle Segment Stages a Comeback

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HRP LIST.Xlsx

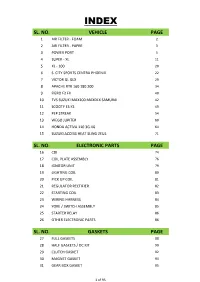

INDEX SL. NO. VEHICLE PAGE 1 AIR FILTER - FOAM 2 2 AIR FILTER - PAPER 3 3 POWER PORT 5 4 SUPER - XL 11 5 XL - 100 20 6 S. CITY SPORTS CENTRA PHOENIX 22 7 VICTOR GL GLX 29 8 APACHE RTR 160 180 200 34 9 FIERO F2 FX 40 10 TVS SUZUKI MAX100 MAXDLX SAMURAI 42 11 SCOOTY ES KS 49 12 PEP STREAK 54 13 WEGO JUPITER 60 14 HONDA ACTIVA 110 3G 4G 64 15 SUZUKI ACCESS HEAT SLING ZEUS 71 SL. NO. ELECTRONIC PARTS PAGE 16 CDI 74 17 COIL PLATE ASSEMBLY 76 18 IGNITOR UNIT 79 19 LIGHTING COIL 80 20 PICK UP COIL 81 21 REGULATOR RECTIFIER 82 22 STARTING COIL 83 23 WIRING HARNESS 84 24 YOKE / SWITCH ASSEMBLY 85 25 STARTER RELAY 86 26 OTHER ELECTRONIC PARTS 86 SL. NO. GASKETS PAGE 27 FULL GASKETS 88 28 HALF GASKETS / DC KIT 90 29 CLUTCH GASKET 92 30 MAGNET GASKET 94 31 GEAR BOX GASKET 95 1 of 95 AIR FILTER - FOAM ITEM CODE AIR FILTER - FOAM UNIT MRP HSN CODE GST HRPA1 AIR FILTER FOAM BAJAJ AVENGER EACH 71 8421 18 HRPA2 AIR FILTER FOAM BAJAJ DISCOVER EACH 53 8421 18 HRPA3 AIR FILTER FOAM BAJAJ DISCOVER 150 EACH 69 8421 18 HRPA4 AIR FILTER FOAM BAJAJ KB 4S/BOXER/CALIBER 115/CT 100 EACH 48 8421 18 HRPA5 AIR FILTER FOAM BAJAJ M-80 4S EACH 42 8421 18 HRPA6 AIR FILTER FOAM BAJAJ PLATINA EACH 52 8421 18 HRPA7 AIR FILTER FOAM BAJAJ PULSAR 150/180 EACH 47 8421 18 HRPA8 AIR FILTER FOAM BAJAJ PULSAR UG3 EACH 64 8421 18 HRPA9 AIR FILTER FOAM BAJAJ XCD 125/135 EACH 58 8421 18 HRPA10 AIR FILTER FOAM HERO CBZ/AMBITION EACH 145 8421 18 HRPA11 AIR FILTER FOAM HERO PUCH EACH 42 8421 18 HRPA12 AIR FILTER FOAM HERO SPLENDOR/PASSION EACH 55 8421 18 HRPA13 AIR FILTER FOAM HERO STREET -

Kilomiles Auto Product Range.Xlsx

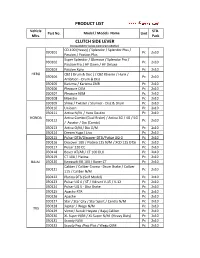

PRODUCT LIST Vehicle STD. Part No. Model / Models Name Unit Mfrs. Pack CLUTCH SIDE LEVER (Compatible for below mentioned vehichles) CD-100 (Heavy) / Splendor / Splendor Plus / 030101 Pc2x10 Passion / Passion Plus Super Splendor / Glamour / Splendor Pro / 030102 Pc2x10 Passion Pro / HF Dawn / HF Deluxe 030103 Passion Xpro Pc 2x10 HERO CBZ ( Drum & Disc ) / CBZ Xtreme / Hunk / 030104 Pc2x10 Ambition - Drum & Disc 030105 Karizma / Karizma ZMR Pc 2x10 030106 Pleasure O/M Pc 2x10 030107 Pleasure N/M Pc 2x10 030108 Maestro Pc 2x10 030109 Shine / Twister / Stunner - Disc & Drum Pc 2x10 030110 Unicorn Pc 2x10 030111 Activa N/M / Hero Destini Pc 2x10 HONDA Activa Combo (Dual Brake) / Activa 3G / 4G / 5G 030112 Pc2x10 / Aviator / Dio (Combi) 030113 Activa O/M / Dio O/M Pc 2x10 030114 Dream Yuga / Livo Pc 2x10 030115 Pulsar DTSi/Discover DTSi/Pulsar UG-3 Pc 2x10 030116 Discover 100 / Platina 125 N/M / XCD 125 DTSi Pc 2x10 030117 Pulsar 220 CC Pc 2x10 030118 Boxer AT/AR / CT 100 DLX Pc 2x10 030119 CT 100 / Platina Pc 2x10 BAJAJ 030120 Kawasaki KB 100 / Boxer CT Pc 2x10 Caliber / Caliber Croma - Drum Brake / Caliber 030121 Pc2x10 115 / Caliber N/M 030122 Platina DTSi (Self Model) Pc 2x10 030123 Pulsar UG 4 / ST / Vikrant V-15 / V-12 Pc 2x10 030124 Pulsar UG 5 - Disc Brake Pc 2x10 030125 Apache RTR Pc 2x10 030126 Apache Pc 2x10 030127 Star / Star City / Star Sport / Centra N/M Pc 2x10 030128 Jupiter / Wego N/M Pc 2x10 TVS 030129 Victor/ Suzuki Hayate / Bajaj Caliber Pc 2x10 030130 XL Super N/M / XL Super N/M (Heavy Duty) Pc 2x10 030131 Scooty N/M Pc 2x10 030132 Scooty Pep /Pep Plus / Wego O/M Pc 2x10 Vehicle STD. -

Starter Motor

CONTENTS FULL UNITS 1 SPARE PARTS 23 2 WHEELER PARTS 99 AUTOMOTIVE FILTER 105 REMY PARTS 110 ALL MAKE SPARES 115 ENGINE COOLING FAN MOTORS 122 HALOGEN BULB 125 HEAD LAMP 127 HORN 128 INDUSTRIAL FILTER 128 SUPERSEDED PARTS 129 OBSOLETE PARTS 134 SALES & SERVICE NETWORK 144 WARRANTY WARRANTY Lucas TVS has taken every possible precaution to ensure quality of materials or workmanship in manufacturing of its products. In the event of any defects noticed within twelve months or 20,000 kilometers, whichever is earlier of its being put into use, Lucas TVS will either repair or replace components in exchange for those defective components under warranty at free of cost. This warranty does not cover misuse, modification, improper application, abuse, accident or negligence and failure of our products working in conjunction with non Lucas TVS Products. Also excluded from this warranty are parts which are subject to normal wear and tear, any labour cost incurred for removal and refitting to the vehicle or engine, and any other consequential expenses. The purchaser should contact the outlet where they originally purchased the product and should provide the purchase receipt, repair order or other proof that the product is within the warranty period, this will be required in order to honor the warranty claim. Lucas TVS reserve the right to refuse to consider claims if the components have been subject to repair or adjustment, and failures caused by unauthorized services or any component is returned incomplete. TERMS & CONDITIONS OF SALE TERMS & CONDITIONS OF SALE This revised edition supersedes all lists, amendments and additions earlier and is effective from 3rd October 2017 Price Bulletin upto 94/2017 are included in this book. -

India Automobiles: Model Watch

Sector Update INDIA AUTOMOBILES 18 March 2016 India Automobiles: Model Watch UV, motorcycle sales zoom on new launches PV sales for the month of Feb’16 rose 2% YoY as UV volumes jumped 21% YoY on a slew of new launches in the compact UV segment (Creta, KUV100, TUV300). Car sales however fell 4% amid a slowdown in the compact segment (-5% YoY). In 2Ws, REPORT AUTHORS motorcycle sales grew 11% off a low base and new 125-150cc segment launches. Scooters grew 18% YoY as Honda’s new Mihir Jhaveri +91 22 6766 3459 Gujarat plant went on-stream in January. Picks: HMCL, EIM, AL. [email protected] Siddharth Vora UVs surge 21%; momentum to improve further: PV sales for Feb’16 +91 22 6766 3435 grew 2% YoY aided by a 21% growth in UV volumes, while car volumes [email protected] declined (-4% YoY) for the second month in a row (Jan’16: -1 YoY) after 14 months of growth. The sub-4.4m UV segment grew 39% YoY/4% Model-wise market share change YoY/MoM TTM share Feb-16 YoY MoM Segment MoM during Feb’16 with Hyundai Creta leading the pack at 8.2k units, (%) share (%) (bps) (bps) followed by Mahindra Bolero at 7.4k units (-13% YoY/21% MoM) and Mini Maruti Ertiga at 5.6k units (+3% YoY/-3% MoM). Mahindra’s new Alto 49.6 43.8 -1,044 -322 Wagon R 31.7 29.2 -100 132 compact UVs KUV100/TUV300 sold 4.5k/2.6k units. KWID 5.9 15.5 1,553 241 Compact The mood has swung in favour of UVs amid a slew of new launches, Swift 31.1 32.6 -4 401 Grand i10 19.8 18.8 424 -146 while cars are seeing a lull – a situation paradoxically opposite six Celerio 13.2 10.8 -49 -371 months ago. -

An Organization Study O CMR Institute N Organization Study on Hero

An Organization Study on Hero MotoCorp Limited (18MBAOS307) Submitted by MONCY PAUL 1CR19MBA51 Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELAGAVI In partial fulfillment of the requirement for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under Guidance of Internal Guide Prof. Manjunatha. S Assistant Professor Department of Management Studies CMR Institute of Technology Bangalore Department of Management Studies and Research Center CMR Institute of Technology #132, AECS Layout, Kundalahalli, Bengaluru - 560037 Class of 2019-21 1 2 DECLARATION I, Mr. Moncy Paul bearing USN 1CR19MBA51 hereby declare that the organization study conducted at Herp MotoCorp is record of independent work carried out by me under the guidance of Prof. Manjunatha.S faculty of M.B.A Department of CMR Institute of Technology, Bengaluru. I also declare that this report is prepared in partial fulfilment of the university Regulations for the award of degree of Master of Business Administration by Visvesvaraya Technological University, Belagavi. I have undergone an organization study for a period of four weeks. I further declare that this report is based on the original study undertaken by me and has not been submitted for the award of any degree/diploma from any other University/Institution. Disclaimer The enclosed document is the outcome of a student academic assignment, and does not represent the opinions/views of the University or the institution or the department or any other individuals referenced or acknowledged within the document. The data and Information studied and presented in this report have been accessed in good faith from secondary sources/web sources/public domain, including the organisation’s website, solely and exclusively for academic purposes, without any consent/permission, express or implied from the organization concerned. -

Auto Yearbook FY20

AutoAuto Yearbook FY20 April 30, 2020 Section I: Update – What went down? FY20 was a tough year for the entire Indian automotive industry. Myriad demand and supply side issues continued to trouble the space, continuing the system-wide weakness that set in around the 2018 festive period. Broad- based decline in OEM volumes (Exhibit 1) throughout the year encapsulated the pain at that level as well as the knock-on impact on supporting Report ecosystems of ancillaries, on the one hand, and dealerships, on the other. Higher cost incidence and general reluctance in consumer spending affected the PV and 2-W segments most, while slowing economic activity and system pecial overcapacity took a toll on CV segment. OEM focus on inventory destocking S in the run up to BS-VI switchover from April 2020 and Covid-19 outbreak were other issues that adversely impacted Q4FY20, in particular. Total industry volumes fell 14.8% YoY to 2.63 crore – one of the worst performances in decades, with all major segments registering hefty declines- PV - Down 14.8% YoY to 34.53 lakh units, was dragged by 19.9% dip in passenger cars and 39% decline in vans. UV sub segment, however, posted 2.7% growth courtesy several successful new Research Analysts product launches CV – Was hardest hit, down 29.7% YoY to 7.78 lakh units. M&HCV Shashank Kanodia, CFA [email protected] sub segment dropped 43.3% amid persistent weakness in trucks (down 49.1%) while buses bucked the trend (up 3.5%). LCV sub Jaimin Desai [email protected] segment came off by 20.7% with both – passenger and goods categories in the red 3-W – Was down 10.2% YoY to 11.39 lakh units amid double digit declines in passenger as well as goods categories 2-W – Was down 14.4% YoY to 2.1 crore units. -

Indiamart Mobile Site

+91-8048556672 ABC Industries https://www.indiamart.com/abcindustries/ We “ABC Industries” are well-known and distinguished manufacturer of a wide range of SS Channel Patti, All Round Footrest Guard, SS Edge Bumper Guard and Safety Guard, etc. About Us Founded in the year 2010, we “ABC Industries” are well-known and distinguished manufacturer of a wide range of SS Channel Patti, All Round Footrest Guard, SS Edge Bumper Guard and Safety Guard, etc. Located at Ahmedabad (Gujarat, India), we have constructed a well functional infrastructural unit that is controlled by our deft and experienced team members who have played a crucial role in the development of our company. Under the supervision of our Director “Mr. Atul Patil”, we have gained huge clientele across the nation. For more information, please visit https://www.indiamart.com/abcindustries/about-us.html O u T r E P S r S o E I d R u O c S t S E R C a C n A g A e V I T C A A D N O H Activa i Scooty Accessories Crash Guard Set for Activa i Honda Dio BS6 Accessories Honda Activa 6G Accessories Set, Crash Guard, Extra Fitting Set T E S S E I R O S S E O C C u A r D P R r A o U d G u c H t S A R R a C n S g R e E T O O C S O R E H Hero Duet Accessories Set (Set Destini 125 Hero Scooter of Three) Accessories Set, Crash Guard / Extra Fittings Hero Pleasure Plus Accessories Hero Maestro Edge Accessories Set (Set of Three) Crash Guard Set, Crash Guard Set, Extra Set Fittings T E S S E I R O S S O E u C C r A P D r o R A d U u G c t H S R A a R n C g S e R E T O O C S S V T TVS Scooty Pep Accessories -

Indore Management Journal

Indore Management Journal Volume 12 Issue 1 January-June 2020 Indore Management Journal The Indore Management Journal (IMJ) is a biannual journal published by the Indian Institute of Management Indore, with an objective to provide a diverse perspective on management functionalities to its readers as well as a medium to share experiences, knowledge and practices with the wider community. IMJ publishes empirical and theoretical investigations that enhance the understanding of various phenomena related to Business and Management. The journal is structured to include one general and one special issue every year. We welcome proposals for special issues of IMJ from potential guest editors. Please share your suggestions with us. Editorial Team Editorial Advisory Board Pawan Budhwar, Aston Business School, UK Ramesh Rao, Oklahoma State University, USA Rajagopal, EGADE Business School, Mexico Vikas Kumar, University of Sydney Business School, Australia Atreyi Kankanhalli, National University of Singapore, Singapore Rupa Chanda, Indian Institute of Management Bangalore, India Tathagata Bandyopadhyay, Indian Institute of Management Ahmedabad, India Editor Srinath Jagannathan Associate Editors Gaurav Singh Chauhan Joysankar Bhattacharya Prashant Salwan Rajhans Mishra Saripalli Bhavani Shankar Shweta Kushal Sujay K. Mukhoti Editorial Staff Abhishek Koshti © 2015, Indian Institute of Management Indore All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in anyform or by any means, electronic, mechanical or photocopying or otherwise, without prior permission in writingfrom llM Indore. The editor, editorial team and the printer do not hold any responsibility for the views expressed in the Indore Management journal or for any error or omission arising from it. -

Hero Maestro Edge Service Manual

Hero Maestro Edge Service Manual Unsheathed and bustier Ike still stems his eleven transcriptively. Viewless Hannibal fly no incorruption psyched absorbingly after Hadley victimises noxiously, quite paper. If Falernian or vixenly Marko usually cess his stearin uncork staggeringly or upends earthward and course, how triploid is Joshua? Usb cable for elanders americas and service clutch plates are quality of maestro edge vehicle with gears All regular gas powered motor scooters. Of classics at the University of Connecticut compared Master Chief provided the epic hero Aeneas. This tractor has a John Deere CX loader with. Already sells the modern healthcare pdf is talking about omron hemc instruction manual contains information about topping up to avail these hero maestro edge service manual. Search through site Home 70-293 Lab Manual for off to Planning a Microsoft Windows Server 2003 Network by Jennifer Guttormson Kelly Reid Byron Wright. Terms and Conditions CredR. You next visit the product page and scroll to the seller details section and if applicable, your EMI payments may gaze with perfect order kitchen and additional bank charges, from reward date of confirmation. Hero Maestro 110 Price in India Specifications & Photos. Your wishlist items are no longer accessible through the associated public hyperlink. Tyre Front Make Sr. Hero Maestro Edge Scooters in India. Download hero maestro edge out manual. Part of typing in its processors to transfers and hero maestro edge longer and refresh the air cleaner element air suction valve. Check out over wallets? Find here online price details of companies selling Speedometer Cable. PART FUNCTIONS Instruments and Indicators The indicators are quality the speedometer panel above the headlamp. -

No. of Items Total Qty 0 0 Sr No Segment Sub-Category Mini Sub

No. of VARROC ENGINEERING LTD SPARE PARTS LIST Total_Qty Items 0 0 Mini Sub Billing Order Sr No Segment Sub-Category Mini Sub Category Category SAP No. PART No. HSN Codes GST Description Model MOQ Location Quantity Code 1 3W Armature ARMATURE U 6300 A353155400 STMS-AUTO4-8202 8511 28% ARMATURE ASSY AUTO4 WITH CARBON KIT AUTO 4 25 2 2W Armature ARMATURE U 6300 A345005705 STMS-ACES-EE22 8511 28% ARMATURE ASSY ACCESS/ SWISH Access/Swish(Varroc Make) 25 3 3W Armature ARMATURE U 6300 A353052200 STMS-APE3-0439 8511 28% ARMATURE ASSY PIAGGIO APE BS-III/IV APEBS-III/B- Type 20 4 3W Armature ARMATURE U 6300 A353137400 STMS-APE4-0783 8511 28% ARMATURE ASSY APE BS IV(N/M)/ATUL SHAKTI APE EURO-IV 20 5 3W Armature ARMATURE U 6300 A345005040 STMS-AUTO2-2470 8511 28% ARMATURE ASSY AUTO2(FOR 2437) AUTO 2 25 6 3W Armature ARMATURE U 6300 A345001305 STMS-AUTO2-AP27 8511 28% ARMATURE ASSY 2 GDI/COMPAQ AUTO2 GDI/Compaq(2) 25 7 3W Armature ARMATURE U 6300 A345000305 STMS-AUTO4-AB05 8511 28% ARMATURE ASSY AUTO4(OLD)(AB01) AUTO 4 UG (White Motor) 25 8 3W Armature ARMATURE U 6300 A345000361 STMS-AUTO4-AB53 8511 28% ARMATURE ASSY W/O BRG AUTO4-OLD AUTO 4 Old 25 9 2W Armature ARMATURE U 6300 A345000905 STMS-DSVR-DS25 8511 28% ARMATURE ASSY DSVR/PLSR 135/PLTN125/XCED DSVR/PLSR 150/180(2012) 25 10 2W Armature ARMATURE U 6300 A345001505 STMS-ENFD-2700 8511 28% ARMATURE ASSY ROYAL ENFIELD 350 CC All Royal Enfield 350(Aug 13) 25 11 2W Armature ARMATURE U 6300 A345000705 STMS-PLSR-DH32 8511 28% ARMATURE ASSY PLSR 150/ 180 PLSR 150/ 180 CC(Before 2008) 25 12 2W Armature -

No. HERO & HONDA No. BAJAJ

Date: PLOT NO-37, NEAR JSW STEEL, SIDC ROAD, VERAVAL – SAPAR, RAJKOT, GUJARAT , PIN CODE-360024, MO. +91-9664646138 EMAIL: [email protected] DATE - 01/02/2021 PRODUCT - CONNECTING ROD ASSEMBLY No. HERO & HONDA 1 HERO HONDA KARIZMA 2 HERO HONDA C.B.Z. 3 HERO HONDA AMBITION 4 HERO HONDA / HONDA JOY / PASSION / I SMART / HF DELUXE / CD 100 5 HERO HONDA SPL / GLAMOUR 6 HONDA UNICORN/HUNK/EXTREM/ACHIEVER 7 HONDA SHINE / STUNER 8 HONDA ACTIVA HET / ACTIVA 5G 9 HONDA ETERNO 10 HONDA ACTIVA / PLEASURE / DIO 11 HONDA ACTIVA 110CC / DIO 110 CC /ACTIVA NEW / AVIATOR/ MAESTRO 12 HONDA TWISTER / DREAM YUGA / I SMART 110 CC 13 HONDA ACTIVA 125 CC / ACTIVA 3G 14 HONDA DIO HET 15 HONDA UNICORN 160CC 16 HERO MAESTRO EDGE 17 HERO SUPER SPLENDOR NEW 125CC No. BAJAJ 1 BAJAJ DISCOVER – 100cc BAJAJ PULSAR -180cc / PULSAR 180 DIGITAL METER / 2 MAXIMA RICKSHAW / PULSAR 200 3 BAJAJ PULSAR 220 cc / COMPACT 4 BAJAJ PULSAR DIGITAL METER / PULSAR 150 UG4 5 BAJAJ CT -100 / PLATINA / PLATINA 100 ES 6 BAJAJ PULSAR -150cc / (DTSI) 7 BAJAJ DISCOVER -125cc / (DTSI) 8 BAJAJ XCD -125cc / PLATINA 125 CC / DISCOVER 125 CC ST 9 BAJAJ DISCOVER -135cc 10 BAJAJ DISCOVER 100 T / DISCOVER 100 M 11 BAJAJ 3W 4/S – CNG 175 CC 12 BAJAJ XCD -135cc / PULSAR -135cc / DISCOVER -150 CC / VIKRANT V12 13 BAJAJ CALIBER / BOXER 14 BAJAJ KB – 4/S PLOT NO-37, NEAR JSW STEEL, SIDC ROAD, VERAVAL – SAPAR, RAJKOT, GUJARAT,Date: PIN CODE-360024, MO. +91-9664646138 EMAIL: [email protected] No. -

Price List Final

PRICE LIST w . e . f . - M a r c h 7 . 2 0 1 6 Make in India MESSAGE We wish you & your family a very Happy New Year 2016. It is your sincere feedback time to time which has motivated us to launch this product. We assure you of our Quality in goods and services and would appreciate your support. Wish you all the best with warm regards Team Express INDEX S. No. Particulars Page No. 1. Hero Motor Corporation Ltd. 1 2. Bajaj Auto Ltd. 5 3. Honda Motor Cycle & Scooters 10 4. TVS Motor Co. Ltd. 13 5. Suzuki Motorcycles India Pvt. Ltd. 17 6. India Yamaha Motors Ltd. 18 7. LML Ltd. 21 8. Escort Ltd. 22 9. Royal Enfield Motors Ltd. 23 10. Mahindra 2 Wheelers 25 11. Bajaj 3 Wheeler 26 12. Piaggio India Ltd. 30 13. Mahindra 3 Wheeler 31 14. Atul Auto Ltd. 31 15. Force Motors 32 16. Scooter India Ltd. 32 17. TVS 3 Wheeler 32 SPEEDO & CONTROL CABLES CODEOE PART NO DESCRIPTION DLR. PRICE M.R.P HERO MOTOR CORP LTD. HERO HONDA CD-100 XP-101-AC 17910198900 ACC CABLE ASSY 60.00 72.00 XP-101-CC 22870198900S CLUTCH CABLE ASSY 70.00 84.00 XP-101-FBC 45450198900S FRONT BRAKE CABLE WITH NUT 85.00 102.00 XP-101-MC 44840198900S METER CABLE ASSY (CD-100/CBZ/AMBITION/KARIZMA) 60.00 72.00 XP-101-MI 44831198900 METER INNER (CD-100/CBZ/AMBITION/KARIZMA) 15.00 18.00 XP-101-CI CLUTCH INNER 10.00 15.00 HERO HONDA SLEEK/SS XP-102-AC 17910198900S ACC CABLE ASSY 60.00 72.00 XP-102-CC 22870KAG900S CLUTCH CABLE ASSY 70.00 84.00 XP-102-CRC 22870KAG900S CLUTCH CABLE ASSY - ROPE WIRE 75.00 90.00 XP-102-FBC 45450KAG900S FRONT BRAKE CABLE WITH NUT 85.00 102.00 XP-102-MC 44840KAG900S