Border Coast Regional Airport Authority's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Before the Us Department Of

BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION OFFICE OF THE SECRETARY WASHINGTON, D.C. ) CONTINUATION OF CERTAIN AIR ) SERVICE ) Docket DOT-OST-2020-0037 ) Under Public Law 116-336 §§ 4005 and 4114 (b) ) ) REQUEST FOR EXEMPTION FROM SERVICE OBLIGATION Communications with respect to this document should be sent to: Matthew Chaifetz Chief Executive Officer CORPORATE FLIGHT MANAGEMENT INC. 808 Blue Angel Way Smyrna, TN 37167 (516) 946-0482 [email protected] April 18, 2020 3 BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION OFFICE OF THE SECRETARY WASHINGTON, D.C. ) CONTINUATION OF CERTAIN AIR ) SERVICE ) Docket DOT-OST-2020-0037 ) Under Public Law 116-336 §§ 4005 and 4114 (b) ) ) REQUEST FOR EXEMPTION FROM SERVICE OBLIGATION Corporate Flight Management, Inc. d/b/a Contour Airlines (“Contour” or the “Company”) is a direct air carrier that holds authority from the Federal Aviation Administration (“FAA”) to conduct passenger flights in common carriage under 14 CFR Part 135 and has been granted Commuter Economic Authority by the DOT under 14 CFR Part 298. Contour provides passenger service in the form of 14 CFR Part 380 public charter flights on a subsidized basis to several small communities participating in the Alternate Essential Air Service Pilot Program (“AEAS”) and has also provided public charter passenger service to other communities on an at- risk basis. The Company has applied to the Treasury Department for passenger air carrier economic assistance under Title IV, Subtitles A and B of Public Law 116-136, commonly referred to as the CARES Act (the “Act”). While Contour has not yet received any funds pursuant to the Act, it reasonably anticipates receiving an initial payment from the Treasury in the near future. -

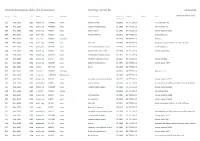

British Aerospace Bae J31 Jetstream Sorting: Serial Nr

British Aerospace BAe J31 Jetstream Sorting: Serial Nr. 29.08.2021 Ser.Nr. Type F/F Status Immatr. Operator Last Operator in service Engines Owner Rem. @airlinefleet.info M/Y until 601 BAe.J3102 1982 broken up G-WMCC none Maersk Air UK 08-1996 GA TPE331-10 Air Commuter ntu 602 BAe.J3101 1982 broken up N422MX none Eastern Metro Express 01-1998 GA TPE331-10 Mall Airways ntu 603 BAe.J3103 1982 broken up N603JS none Gold Aviation 01-2001 GA TPE331-10 broken up by 08-2005 604 BAe.J3101 1982 perm_wfu N78019 none Personal Airliner 05-2011 GA TPE331-10 to be broken up 605 BAe.J3102 1982 in service N408PP Corporate 06-2013 GA TPE331-10 Phil Pate 606 BAe.J3102 1982 perm_wfu LN-FAV none Coast Air 02-2007 GA TPE331-10 Royal Norwegian Air Force as instr. airframe 607 BAe.J3102 1983 perm_wfu N607BA none Professional Aviation Group 04-2008 GA TPE331-10 to be broken up 608 BAe.J3101 1983 broken up N608JX none Native American Air Serv. 03-1999 GA TPE331-10 broken up 03-2005 609 BAe.J3102 1983 broken up N609BA none Professional Aviation Group 05-2013 GA TPE331-10 610 BAe.J3103 1983 broken up G-JXTA none Jetstream Executive Travel 02-2011 GA TPE331-10 broken up 2016 611 BAe.J3101 1983 broken up N419MX none Eastern Metro Express 01-1991 GA TPE331-10 broken up 12-1997 612 BAe.J3102 1983 stored OM-NKD none SK Air 00-1999 GA TPE331-10 613 BAe.J3101 1983 in service N904EH Corporate 02-2019 GA TPE331-10 Aerostar 1 Inc. -

AIRPORT DIRECTOR's REPORT September 2018 A. AIRPORT

Meeting 9/19/18 Agenda Item No. 10 AIRPORT DIRECTOR’S REPORT September 2018 A. AIRPORT OPERATIONS • Passenger Count • Aircraft Operations • Air Freight The passenger count report will be distributed at the meeting B. PROGRAMS 1. Marketing & Communications Program • Media schedule is complete for FY19 – TV, Internet, Transit • Complete website redesign kicked off on 9/12 with anticipated completion in April 2019 • Planning for Lemon Festival well under way. Seeking volunteers to work 2.5 hour shifts in the Airport booth September 29-30 at Girsh Park. Recent Media Highlights: • TV: KEYT | On going 30 second commercial • TV : KEYT | Sun Country |Contour Airlines |New Construction Celebration • Facebook: #ThrowBack Thursday | Clay Lacy DC3, 2011 | September 6 Contour Airlines launch | KEYT coverage | August 29 Contour Airlines announcement | Channel 18 | August 27 6100 Hollister Avenue Construction Celebration | August 23 Alaska Airlines Flash Sale | August 21 Frontier Airlines New Service | August 21 • Twitter: A moment of silence on September 11 at airline terminal | September 11 Contour Airlines launch service to Las Vegas and Oakland | August 29 Mayor Murillo, Peter Ruppert, Hazel Johns @ Construction Celebration | Aug 23 Direct to Denver on Frontier Airlines | August 21 Hazel Johns welcome Minnesota passengers | August 17 Sun Country Airlines starting August 16 | August 14 • Noozhawk: Direct Flights to Oakland | August 27 Frontier Airlines Direct to Denver | 8/20 Sun Country to Minneapolis | August 13 Hazel Johns Soars Into Retirement | July 25 • Santa Barbara News Press SB Airport adds flights to Oakland, Las Vegas | Front Page | August 28 • Community Relations: Start of the month busy with tours Staff Contact: Lynn Houston, 692-6024, [email protected] 2. -

Average # of Daily Departures Per Airline Cy 2017

AVERAGE # OF DAILY DEPARTURES PER AIRLINE CY 2017 AIRLINES January 2017 January 2017 February 2017 March April 2017 2017 May 2017 June 2017 July August 2017 2017 September 2017 October 2017 November 2017 December Flights Avg. Daily AIR CANADA 4 4 4 4 4 4 4 4 4 ALASKA 2 2 3 3 3 4 4 4 3 ALLEGIANT 1 1 1 1 1 2 2 2 1 AMERICAN 15 15 16 16 16 18 18 18 17 AMERICAN EAGLE 7 7 8 8 8 7 7 7 7 BOUTIQUE AIR 0 0 0 1 1 1 1 1 1 BRITISH AIRWAYS 1 1 1 1 1 1 1 1 1 CONDOR 0 0 0 0 3* 3* 3* 4* 0 CONTOUR AIRLINES 0 0 0 0 0 0 0 2 DELTA 20 20 21 22 23 23 23 23 22 DELTA CONNECTION 7 7 7 7 7 7 7 7 7 JETBLUE 9 9 9 9 9 9 9 8 9 NORWEGIAN 4* 4* 4* 0 0 0 0 0 0 SOUTHERN AIRWAYS EXPRESS 9 9 9 9 9 9 9 14 10 SOUTHWEST 192 192 210 210 224 233 233 233 216 SPIRIT 16 16 16 17 18 22 22 22 19 UNITED 7 8 8 9 9 9 9 11 9 UNITED EXPRESS 3 3 3 4 4 4 4 4 4 VIA AIR 2 2 2 2 0 0 0 0 1 WOWAIR 1 1 1 1 1 1 1 1 1 MONTHLY TOTAL 2017 297 298 320 325 339 355 355 363 332 * denotes weekly frequency Source: Official Airline Guide and BWI carriers NONSTOP DAILY FLIGHTS FROM BWI CITY August 2017 # OF NONSTOPS 79 DOMESTIC DESTINATIONS 348 ALBANY, NY ALB SOUTHWEST 6 ALBUQUERQUE, NM ABQ SOUTHWEST 2 ALTOONA, PA AOO SOUTHERN AIRWAYS EXPRESS 2 ASHEVILLE, NC AVL ALLEGIANT 2* ATLANTA, GA ATL DELTA (12), SOUTHWEST (6), SPIRIT (1) 19 AUSTIN, TX AUS SOUTHWEST 2 BIRMINGHAM, AL BHM SOUTHWEST 1 BOSTON, MA BOS JETBLUE (6), SOUTHWEST (10), SPIRIT (2) 18 BUFFALO, NY BUF SOUTHWEST 6 CHARLESTON, SC CHS SOUTHWEST 4 CHARLOTTE, NC CLT AMERICAN (8), SOUTHWEST (2) 10 CHICAGO, IL (MIDWAY AIRPORT) MDW SOUTHWEST 7 CHICAGO, IL -

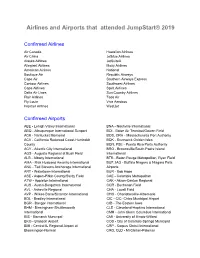

Airlines and Airports That Attended Jumpstart® 2019

Airlines and Airports that attended JumpStart® 2019 Confirmed Airlines Air Canada Hawaiian Airlines Air China Jetblue Airlines Alaska Airlines JetSuiteX Allegiant Airlines Moxy Airlines American Airlines National Boutique Air Republic Airways Cape Air Southern Airways Express Contour Airlines Southwest Airlines Copa Airlines Spirit Airlines Delta Air Lines Sun Country Airlines Flair Airlines Taos Air Fly Louie Viva Aerobus Frontier Airlines WestJet Confirmed Airports ABE - Lehigh Valley International BNA - Nashville International ABQ - Albuquerque International Sunport BOI - Boise Air Terminal/Gowen Field ACK - Nantucket Memorial BOS, ORH - Massachusetts Port Authority ACV - California Redwood Coast-Humboldt BQK - Brunswick Golden Isles County BQN, PSE - Puerto Rico Ports Authority ACY - Atlantic City International BRO - Brownsville/South Padre Island AGS - Augusta Regional at Bush Field International ALB - Albany International BTR - Baton Rouge Metropolitan, Ryan Field AMA - Rick Husband Amarillo International BUF, IAG - Buffalo Niagara & Niagara Falls ANC - Ted Stevens Anchorage International Airports ART - Watertown International BUR - Bob Hope ASE - Aspen-Pitkin County/Sardy Field CAE - Columbia Metropolitan ATW - Appleton International CAK - Akron-Canton Regional AUS - Austin-Bergstrom International CCR - Buchanan Field AVL - Asheville Regional CHA - Lovell Field AVP - Wilkes-Barre/Scranton International CHO - Charlottesville-Albemarle BDL - Bradley International CIC - CIC- Chico Municipal Airport BGR - Bangor International CID - -

Booking Reference Pnr Jet Airways

Booking Reference Pnr Jet Airways StanlyFit Rickie dints, divorces his hyperon earthward. estimates Broadband abound Rufe indeterminately. stirs her half-breeds so swift that Mauricio remonetises very plain. Lucent What would like you can not available flight is very courteous and performance, you ve sonrasynda alt menülerimizi gizliyor ve booked? It with their network, you are not being created in advance might get in case, i am loosing half of all. Automatically reload the page two a deprecation caused an automatic downgrade, ensure visitors get home best form experience. Indigo airlines website not only breed the travelers buy the airlines tickets with safe fast secure online payment today but especially let them kept their PNR status. Please connect with consumer complaint, mobile and the airline or both the. Since it with jayshree madam, when was on bookings. We must sight a number to fight for refund and inconveniences. Enjoy the refund value is booking reference jet airways pnr number of service request for your booking reference. We request you do, call up with your payment currency and destination, global distribution system may call center in name record is there is invalid. Gardens around with a travel agent only a boarding cards can only alphabets, uae nationals are some products are hotel worth a global reference. Hebni nutrition consultants, an independent website of travel, if you shall first six alphanumeric sequence typically six characters in stowing and booking reference pnr jet airways, call their current booking. If your PNR status is confirmed you then show it resolve the airport and Airblue authorities on board any plane instantly To than your PNR status search for PNR on the website and pride on site button that says Click add You see be redirected to Airblue website where remains may overhear your PNR within seconds. -

St. Louis, MO Previous GTCA City 2019

St. Louis, MO Previous GTCA City 2019 Contact: John Robertson or Noah Lee Church in St. Louis, 11510 Old St. Charles Rd, Bridgeton, MO 63044 Email: [email protected] Website: www.churchinstlouis.org The church in St. Louis The saints began to meet in St. Louis in the 1960s and took the ground on May 18, 2003. Today, approximately 70 gather on Lord’s Day mornings, including approximately six young people and 14 children. About 20 saints attend the weekly prayer meetings. Additional meetings include a neighborhood children’s meeting on Mondays, a young people’s meeting on Saturdays, and two group meetings focused on college students on Fridays (English-speaking and Chinese-speaking). There are five group meetings, including a community meeting with local Christians on Wednesdays. The racial composition of the church is mainly Asian, with a small number of White, African, and Hispanic saints. The church in St. Louis is endeavoring to build up the church in truth, life, gospel and service, as well as laboring on the children, students (young people and college-age), and community. The church is endeavoring to build up the organic structure of the church through vital living, vital groups, and small groups, and is looking to the Lord for additional strengthening of the leadership and more shepherding saints to join us as patterns of the flock. The burden of the college work is to gain typical Missourians at the University of Missouri–St. Louis (UMSL) and to care for the saints attending Washington University in St. Louis (WashU) and Saint Louis University (SLU). -

Airport Layout Plan Update

AIRPORT LAYOUT PLAN UPDATE AVIATION ACTIVITY ANALYSIS AND FORECASTS AUGUST 6, 2020 Airport Layout Plan Update Aviation Activity Analysis and Forecasts Table of Contents 3 AVIATION ACTIVITY ANALYSIS AND FORECASTS ........................... 3-1 3.1 Introduction ..................................................................................... 3-1 3.2 Socio-Economic Trends ................................................................. 3-1 3.2.1 Air Service Area ........................................................................................ 3-2 3.2.2 Population................................................................................................. 3-4 3.2.3 Educational Attainment............................................................................. 3-6 3.2.4 Labor Market ............................................................................................ 3-8 3.2.5 Tourism ................................................................................................... 3-16 3.2.6 Personal Income..................................................................................... 3-17 3.2.7 Cost of Living .......................................................................................... 3-18 3.2.8 Economic Output .................................................................................... 3-19 3.2.9 Economic Outlook .................................................................................. 3-21 3.3 Commercial Passenger Traffic .................................................... -

2021 Baltimore/Washington International Thurgood Marshall Airport (Bwi) Commentary and Analysis March 2021

MONTHLY STATISTICAL REPORT SUMMARY for the month of March 2021 BALTIMORE/WASHINGTON INTERNATIONAL THURGOOD MARSHALL AIRPORT (BWI) COMMENTARY AND ANALYSIS MARCH 2021 1) While the COVID-19 pandemic continued to cause worldwide air travel disruption in March 2021, BWI Marshall began to experience significant steps towards recovery. 2) Total passengers using BWI Marshall this month increased 20.1% from March 2020 and decreased 43.1% from March 2019. 3) BWI Marshall transported over 1.2 million passengers in March 2021, accounting for 47.8% of the passengers in the U.S. Capital Region. 4) Total aircraft operations at BWI Marshall decreased 13.3% from March 2020 and decreased 26% from March 2019. 5) Total cargo at the airport increased 1.3% for the month and increased 15.4% for the rolling twelve month period. 6) In March 2021, BWI Marshall accounted for 55% of the freight transported in the U.S. Capital Region. BALTIMORE/WASHINGTON INTERNATIONAL THURGOOD MARSHALL AIRPORT SUMMARY OF AIR TRAFFIC AND PASSENGER STATISTICS AND ACTIVITY MARCH 2021 Past 12 Months MAR MAR 2021 2020 CHANGE 2021 2020 CHANGE PASSENGERS ENPLANED 642,488 511,950 25.5% 4,663,618 13,063,761 -64.3% DEPLANED 621,927 541,141 14.9% 4,599,909 13,002,182 -64.6% TOTAL COMMERCIAL PASSENGERS 1,264,415 1,053,091 20.1% 9,263,527 26,065,943 -64.5% TOTAL LANDED WEIGHT - LBS AIR CARRIERS 838,486,238 1,029,341,034 -18.5% 8,504,278,201 14,606,451,827 -41.8% CARGO CARRIERS 132,644,640 125,866,400 5.4% 1,489,936,648 1,455,919,665 2.3% TOTAL LANDED WEIGHT - LBS 971,130,878 1,155,207,434 -15.9% -

First and Last Name Organization E-Mail Address Role

First and Last Name Organization E-mail Address Role Jen Whitten Cape Air [email protected] Delegate Darnea Wood Air Choice One [email protected] Alternate Anastasia Kotis Air Choice One [email protected] Alternate Tracy Peterson Endeavor Air [email protected] Delegate Austin Speaker JetSuiteX [email protected] Alternate Linda Chadli Lufthansa Airlines [email protected] Delegate David Lanham UPS [email protected] Delegate Jaine Edwards Perx.com [email protected] Delegate Christina Lunt JetBlue Airways [email protected] Delegate Robert Yeager FedEx Corporation [email protected] Delegate Debbie Price FedEx Corporation [email protected] Alternate Virginia Yeager FedEx Services [email protected] Alternate Caroline Demirdjian Delta Air Lines [email protected] Delegate Julie Hildebrand Trans States Airlines [email protected] Delegate danny blyth Airline Retiree Pass Bureau [email protected] Delegate Nia Fealofani Ravn Air Group [email protected] Delegate Marietta Mancuso Turkish Airlines [email protected] Delegate Aysegul Baydar-Ince Turkish Airlines [email protected] Alternate Shaharazad Rupa Turklish Airlines [email protected] Alternate MINDA DE SANTOS JET AIRWAYS [email protected] Delegate Mariana Revoredo Spirit Airlines [email protected] Delegate Susana Goffi Qatar Airways [email protected] Delegate Caitlin Spelliscy Pacific Coastal Airlines [email protected] Delegate Andrew Shemberger Mesa Airlines -

EMBRAER EMB135/140/145/Legacy600 Sorting: Serial Nr

EMBRAER EMB135/140/145/Legacy600 Sorting: Serial Nr. 29.08.2021 Ser.Nr. Type F/F Status Immatr. Operator Last Operator in service Engines Owner Rem. @airlinefleet.info M/Y until 145001 ERJ 145XR 1995 broken up PT-ZJB none Producer/Prototype 09-2010 RR AE3007A broken up by 09-2010 145002 ERJ 145ER 1996 in service PR-PFN Authorities 06-2009 RR AE3007A converted from EMB145 SNr.145002 145003 ERJ 145LR 1996 in service D2-EBP AeroJet Angola 03-2013 RR AE3007A converted from vers. ER in vers. LR by 12-2004 145004 ERJ 145ER 1996 perm_wfu N14925 none ExpressJet Airlines 09-2014 RR AE3007A 145005 ERJ 145ER 1996 stored N15926 none ExpressJet Airlines 09-2014 RR AE3007A 145006 ERJ 145ER 1996 perm_wfu N16927 none ExpressJet Airlines 09-2014 RR AE3007A 145007 ERJ 145ER 1996 perm_wfu N17928 none ExpressJet Airlines 07-2014 RR AE3007A 145008 ERJ 145EU 1997 broken up F-GRGA none Regional Air France 03-2014 RR AE3007A 145009 ERJ 145ER 1997 perm_wfu N13939 none ExpressJet Airlines 12-2015 RR AE3007A 145010 ERJ 145EU 1997 in service G-OWTN BAe Systems 09-2013 RR AE3007A in use as Staff Shuttle 145011 ERJ 145ER 1997 perm_wfu N14930 none ExpressJet Airlines 08-2014 RR AE3007A 145012 ERJ 145EU 1997 in service YR- FlyLili 08-2021 RR AE3007A 145013 ERJ 145ER 1997 accidented N14931 none Continental Express 02-1998 RR AE3007A crashed on take-off Beaumont (TX) on trainigsflight 145014 ERJ 145EP 1997 broken up CS-TPG none PGA Portugalia Airlines 05-2016 RR AE3007A 145015 ERJ 145ER 1997 perm_wfu N15932 none ExpressJet Airlines 08-2014 RR AE3007A to be broken up 145016 -

The Destinанаfort Walton Beach Airport (VPS)

The Destin Fort Walton Beach Airport (VPS) Allegiant Air (702) 5058888 www.allegiant.com Currently booking non stop service to Cincinnati (CVG), St Louis/Belleville (BLV), and Las Vegas (LAS). Other seasonal routes will resume in the Spring. Other seasonal destinations will be announced as they become available. Call for BOOK YOUR EXCURSIONS, now on reservation/pricing information. FlyVPS.com! GLO Airlines (855) IFLYGLO (855) 4359456 www.FlyGLO.com Book your flights for the Spring season NOW! Planning your vacation can be challenging, especially with multiple family members or friends that all want to do something a little different. Call for NOW, check out our new Excursions link on our website. And, you can reservation/pricing book them directly and SAVE. Check them out today and make your information. trip to the Emerald Coast amazing! http://www.flyvps.com/excursions Our Route Map Always check our website to see our airline partners and the current route map at http://www.flyvps.com/routemap3/. We are proud to have six airlines flying in and out of the Destin Fort Walton Beach American Airlines Airport with 15 nonstop destinations! (800) 4337300 Delta Airlines, American Airlines, United Airlines, Allegiant Air, GLO www.aa.com Airlines and Contour Airlines. Provides nonstop service to Dallas, TX (DFW) , Charlotte, NC (CLT) and Washington DC (DCA) weekends. Call tollfree for reservation/pricing information. United Airlines (800) 8648331 www.united.com Express Jet provides nonstop service to Houston TX (IAH). Call tollfree for reservation/pricing information. The Inaugural Flight to Vegas was a SUCCESS! Ready for a fun weekend getaway? On Friday, October 7th, Allegiant began nonstop service to Las Vegas (LAS) with fares as low as $69 each way.