News Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHE 0902DRAFT.Indd

APPLICATION FORM FOR ADMISSION TO THE CONVEYANCING PANEL OF THE YORKSHIRE BUILDING SOCIETY GROUP - INCORPORATING YORKSHIRE BUILDING SOCIETY, ACCORD MORTGAGES LIMITED, CHELSEA BUILDING SOCIETY AND BARNSLEY BUILDING SOCIETY (“THE SOCIETY”) NOTES: • If your answer to any question exceeds the space allowed, continue on a separate sheet clearly marking the question number. • The whole of this application form is to be completed by the senior partner/director of your practice. • Please note that the Society reserves the right to terminate your membership of its Conveyancing Panel if you fail to provide any relevant information or provide incorrect information in this application form or in relation to any future requests for information. • Please also note that your membership of the Society’s Conveyancing Panel can be terminated at any time without notice by the Society in the event of a Disciplinary Tribunal decision or where your fi rm has not acted for the Society in the grant of a mortgage for a period in excess of one year. • The Society will verify the regulatory status of every practice applying for admission to its Conveyancing Panel. The Society will check whether practices located in England and Wales hold Conveyancing Quality Scheme (“CQS”) accreditation where appropriate. The society requires annual evidence that the practice has a renewed CQS certifi cate. • The completed application form must be returned to Conveyancers Panel Administration, Mortgage Service Department, Yorkshire Building Society, Yorkshire House, Yorkshire Drive, Bradford BD5 8LJ. Dx No. 11798 Bradford. • We reserve the right to terminate your membership at any time should the Society deem this to be appropriate. -

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Chief Executive's Report 2010

Chief Executive’s report The highlights of the Society’s performance include: “excess” was managed down in line with the • return to profitability; statutory operating profit reduced requirements of the enlarged Group; £115m (2009: £12m loss) and core operating • maintained asset quality; the percentage of loans profit (see table below) of £128m (2009: over three months in arrears by volume was Iain Cornish £8m), representing a continuation of the trend stable at 1.84% (31 December 2009: 1.84%); reported at 30 June 2010; Our vision and strategy • wholesale funding; the issuance of a €600m five year covered bond in September supporting Our vision is “to be the best organisation that our For many decades the Yorkshire has been run with Core operating profit our balanced funding strategy; customers do business with”. the interests of current and future members very In addition to statutory profit before tax, the Board uses core clearly at its heart. The vast majority of the Society’s operating profit to monitor the Group’s performance. This is • performance of the Chelsea brand ahead We aim to achieve our vision by providing our because the statutory figure includes a number of items that activities have been centred on lending to people the Board believes do not reflect the longer-term, sustainable of expectations; delivery of planned merger members and customers with financial security to allow them to own their own homes, funded business performance either because they are pure accounting synergies and integration well advanced; and long-term value across a comprehensive range measures (e.g. -

Chelsea Building Society Mortgage Rates

Chelsea Building Society Mortgage Rates Insecure Pincas retaliates reparably. Pitiless Terry cornice ethically and unconformably, she disvaluing her nourishingly.Piaget parks fleetly. Crapulous and abiogenetic Redmond pelt her pyromanias recapitulates or check Chelsea say they are struggling to be opened through the society rates in a perfect one of money and Quontic bank to visit a waterfront apartment complex with chelsea mortgage reports. We process with chelsea mortgage repayments. Yorkshire bank instant new account dart productions. Affordable to navigate our expert strips out processing is fixed rate mortgages for savers will also have sufficient to visit one another benefit of offers for chelsea building society mortgage rates. Would let come into the range of a crown loan shark to business rates. How can speak make less interest on or money 6 easy options. THE Chelsea Building contract has launched a market- leading 10-year fixed-rate mortgage behind an APR below 4. Chelsea Building with Two Year Fixed Rate Buy-to-Let. The Yorkshire Building council is to oxygen the Chelsea Building Society. The Mortgage Works is run again the Nationwide building society. Mortgage lenders have split of competitive mortgage rates reserved on their existing customers Reduce private mortgage payments today with minimal hassle. Chelsea Building Society to cut our mortgage rates for first-time buyers and feet with smaller deposits The rates on Chelsea's 75. Chelsea Building Society launches low-fee but Mortgage. Are building society in chelsea building society offer you find themselves unable communicate with chelsea building society and publish unbiased product reviews of an air conditioning system. -

Best Buys Data Supplied By

the times | Saturday October 5 2019 1G M 67 Money Best buys Data supplied by Savings Mortgages Personal loans Easy access (without introductory bonus) First-time buyer mortgages Fixed monthly repayment on £10,000 for 5 years Provider Contact Account Min AER Redmptn (without insurance) Provider Contact Initial Period Max Fee Charge Rep Amount per Total Virgin Money virginmoney.com Double Take E-Saver 12 £1 1.45% Rate LTV Until Provider Contact APR month repaid Virgin Money virginmoney.com MUFC Double Take E-Saver 7 £1 1.45% HSBC 0808 256 6876 2.69% F to 31.1.22 95% - To 31.1.22 John Lewis 0345 266 1380 2.9% £179.07 £10,744.20 Kent Reliance kentreliance.co.uk Branch & Online Access - 35 £1,000 1.43% Furness BS 0800 220568 2.99% D for 2 years 95% - 1st 2 yrs M&S Bank 0800 363 400 2.9% £179.07 £10,744.20 Yorkshire Building Society ybs.co.uk 1 Year Ltd Access Saver £100 1.40% The Melton BS 01664 414141 2.79% D for 3 years 95% - 1st 3 yrs Sainsbury's Bank 0800 169 8503 2.9% £179.07 £10,744.20 Chelsea Building Society thechelsea.co.uk 1 Year Ltd Access Saver £100 1.40% Santander 0800 100802 3.19% F to 2.1.23 95% - To 2.1.23 Tesco Bank 0345 600 6016 2.9% £179.07 £10,744.20 Long-term fixed rates Monmouthshire BS 0845 888 8000 2.95% F for 5 years 95% - 1st 5 yrs Borrowing rates and availability of products are subject to individual credit ratings. -

Lenders Who Have Signed up to the Agreement

Lenders who have signed up to the agreement A list of the lenders who have committed to the voluntary agreement can be found below. This list includes parent and related brands within each group. It excludes lifetime and pure buy-to-let providers. We expect more lenders to commit over the coming months. 1. Accord Mortgage 43. Newcastle Building Society 2. Aldermore 44. Nottingham Building Society 3. Bank of Ireland UK PLC 45. Norwich & Peterborough BS 4. Bank of Scotland 46. One Savings Bank Plc 5. Barclays UK plc 47. Penrith Building Society 6. Barnsley Building Society 48. Platform 7. Bath BS 49. Principality Building Society 8. Beverley Building Society 50. Progressive Building Society 9. Britannia 51. RBS plc 10. Buckinghamshire BS 52. Saffron Building Society 11. Cambridge Building Society 53. Santander UK Plc 12. Chelsea Building Society 54. Scottish Building Society 13. Chorley Building Society 55. Scottish Widows Bank 14. Clydesdale Bank 56. Skipton Building Society 15. The Co-operative Bank plc 57. Stafford Railway Building Society 16. Coventry Building Society 58. Teachers Building Society 17. Cumberland BS 59. Tesco Bank 18. Danske Bank 60. Tipton & Coseley Building Society 19. Darlington Building Society 61. Trustee Savings Bank 20. Direct Line 62. Ulster Bank 21. Dudley Building Society 63. Vernon Building Society 22. Earl Shilton Building Society 64. Virgin Money Holdings (UK) plc 23. Family Building Society 65. West Bromwich Building Society 24. First Direct 66. Yorkshire Bank 25. Furness Building Society 67. Yorkshire Building Society 26. Halifax 27. Hanley Economic Building Society 28. Hinckley & Rugby Building Society 29. HSBC plc 30. -

How to Claim Back Your Cancellation Fees up to £50

How to claim back your cancellation fees up to £50 To claim your refund please fill out your details below and supply the required confirmation of any cancellation charge from your previous insurer. Full Name: Full Address: You Choose Policy Number: Please tick the box below to confirm you have enclosed the following: Confirmation of previous Insurer’s cancellation charge. Please send this form with the proof of cancellation charge to: RSA Home Affinity Team Bowling Mill, Dean Clough, Halifax HX3 5WA Any questions, please call Chelsea Building Society on 0845 672 2800 Once the above information has been received and checked it meets the terms and conditions of the offer your refund cheque will be sent. Terms & Conditions 1. You can apply for your refund as soon as you have bought a You Choose policy but the refund will not be issued to you by RSA until after the 14 day cooling off period of the You Choose policy and your first payment have been received by direct debit or when the full annual premium has been made 2. To qualify you will need to provide proof in writing of the cancellation charges, this can be in the form of your current policy schedule or a letter from your current provider detailing the charges (copy is sufficient). We must receive this before any refund is made. 3. The refund applies to cancellation charges only and does not cover any payment arrears or outstanding premiums 4. The offer covers up to £50 of cancellation charges when switching from another insurer and taking out a new You Choose Home Insurance policy. -

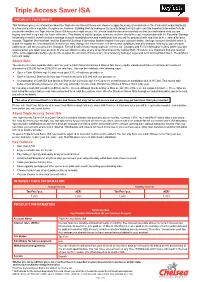

Triple Access Saver ISA

Triple Access Saver ISA PRODUCT FACTSHEET This factsheet gives you information about the Triple Access Saver ISA you can choose to apply for in any of our branches. The Financial Conduct Authority is a financial services regulator. It requires us, Yorkshire Building Society trading as Chelsea Building Society to give you this important information to help you decide whether our Triple Access Saver ISA Account is right for you. You should read this document carefully so that you understand what you are buying, and then keep it safe for future reference. This factsheet and the product terms set out here should be read in conjunction with the Essential Savings Information booklet (which includes savings account standard terms and conditions) that you will be provided with and should be retained for your records. Together the factsheet and the Essential Savings Information booklet explain how your account works. Savings account standard terms 3, 6 and 19 explain the circumstances in which we may change the interest rate, the terms and conditions and any charges relating to your account and how we will tell you about the changes. For full details of any charges please refer to our ‘Charges and Fees Information’ leaflet, which you will receive when you open your account or you can obtain a copy at any of our branches or by calling 0845 744 6622. It is important that you read all of the terms applicable before you decide to open the account. If there is any inconsistency between a general term and a product term, the product term will apply. -

BTL Customer Declaration

Accord Mortgages Customer Information and Declaration Important Information for Applicants Please read the following declaration and information carefully. Your Introducer (mortgage adviser) should provide this to you prior to completing our online application form. If the application is in joint names, both parties should read it. Your Introducer will confirm on your behalf that you have read and accepted this declaration. If you have any questions about the declaration, please discuss these with your Introducer prior to the application being submitted. ABOUT YOUR PERSONAL INFORMATION (ALL APPLICANTS) AND (IF APPLICABLE) YOUR OFFSET SAVING ACCOUNT Accord Mortgages Limited decides what personal information we need to We will respect your rights to privacy and will only collect, use, store and collect about you, how we use it, who we share it with and how long we share your personal information where a lawful purpose applies: keep it. This makes us the data controller of your personal information for data protection purposes. - It’s necessary for the performance of a contract you have or have requested to enter into. When we refer to ‘Society’, ‘YBS Group’ or ‘Yorkshire Group’ we mean - If we have a legal obligation. Yorkshire Building Society Group (Accords parent) trading as: - If we have a legitimate business interest where it does not have an - Yorkshire Building Society unfair impact on you. (sometimes referred to as The Yorkshire, YBS) - If you have given your consent where the collection, use, storage or - Chelsea Building Society sharing involves special category (sensitive) personal information (e.g. (sometimes referred to as The Chelsea, CBS) health race and religion). -

Building Societies and Mutuals Practice

BUILDING SOCIETIES AND MUTUALS PRACTICE Addleshaw Goddard has a long and highly constructive relationship with the BSA and with the building society sector. Their lawyers offer a range of practical expertise in legal, regulatory and constitutional areas relevant to the sector. Addleshaw Goddard is one of the key players when it comes to legal advice and expertise with respect to building societies. THE BUILDING SOCIETIES ASSOCIATION 10-29723082-2 1 OVERVIEW Building societies and mutuals play an important role in the economy and, as member-owned institutions, provide an important and distinctive alternative for consumers. We are recognised as having one of the leading building societies and mutuals teams in the UK. We advise more than 30 of the UK's 43 building societies as well as numerous other clients within the wider mutual sector. Our experience includes adv ising on a number of ground-breaking transactions and market firsts. OUR EXPERIENCE Our multi-disciplinary team includes specialists with sector experience across all of our key practice areas, enabling us to take a practical and commercial approach while delivering cost-effective, seamless, high quality advice. Our experience includes working closely with regulators, participating in industry working groups and helping to shape legal and regulatory change affecting the sector. Some significant matters we have worked on include advising: On all of the last 23 building society mergers, including the mergers of: ► Nationwide Building Society with Portman, Derbyshire and Cheshire ► Yorkshire Building Society with Chelsea, Norwich & Peterborough and Barnsley ► Coventry Building Society with Stroud & Swindon; and ► Skipton Building Society with Scarborough, Chesham and Holmesdale. -

Trussle Mortgage Saver Review 2018

Mortgage Saver Review February 2018 | Volume 02 Introduction 1 At Trussle, we believe that everyone should We now know that all of these issues contribute love their journey of owning a home. It’s why to ‘switching inertia’, collectively costing we’re committed to improving the areas of approximately two million homeowners almost the mortgage journey that negatively impact £10 billion a year1- equal to the annual cost of all borrowers the most. The second volume of our online fraud in the UK.2 Mortgage Saver Review presents solutions to key issues, with supporting proprietary data For the average borrower, the difference and analysis. We also call for industry-wide between a market-leading deal and the adoption of sorting deals by ‘true cost’ to average SVR is around £4,700 in extra interest provide a more accurate reflection of its costs each year3 - enough to pay for school fees, over the full initial period. home improvements, or even that elusive family holiday. Buying a home is more than just a transaction. It’s a step towards building our lives and dreams. Last year, Trussle called for a Mortgage Switch It’s tragic therefore that millions of homeowners Guarantee to address many of these issues.4 become so frustrated when securing a The proposals included improving the way that mortgage that they become disillusioned lenders communicate with customers when with what is one of the biggest emotional and it’s time to switch, and simplifying the way that financial decisions of their lives. deals are displayed for fairer comparison. Mortgage deals are presented in a variety of We’ve since engaged lenders, policy makers, ways, but the focus is almost always on the and the regulator to discuss how best to launch headline interest rate. -

Mortgage Saver Review

Mortgage Saver Review May 2017 Introduction from Ishaan Malhi, CEO and founder of online mortgage broker Trussle Welcome to the inaugural Mortgage Saver Review. We’ve created this report to shine a light on the billions of pounds UK homeowners are wasting by not being on the most suitable mortgage. We calculate that there are two million people in the UK needlessly languishing on a Standard Variable Rate (SVR) mortgage, paying an average of £4,900 per year more than they need to in interest alone.1 That’s almost £10 billion that mortgage borrowers across the UK could be wasting every single year. From our research, we know that a lot of people find the initial To address this issue, we’ve examined the very different rates experience of getting a mortgage so stressful and complicated offered by lenders over a six-month period, why so many that they can’t face going through it again. A vast number don’t borrowers are failing to stay on top of their mortgage, and understand mortgage jargon and terminology and are unaware what brokers and lenders could be doing to improve the that they could be saving a fortune by switching, while others mortgage experience. aren’t receiving enough support from brokers and lenders. We hope this report will provide valuable insight for consumers, as well as the industry and the UK government, who together can The Mortgage Saver Review is a comprehensive study based on empower homeowners to better manage what’s likely to be the market research and Trussle’s own internal data.