For Personal Use Only Use Personal For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investors and Procurement Guide South Africa. Part 1: Heavy Minerals, Rare Earth Elements, Antimony

Deutsche Rohstoffagentur (DERA) Deutsche Rohstoffagentur 21 21 DERA Rohstoffi nformationen Deutsche Rohstoffagentur (DERA) in der Bundesanstalt für Geowissenschaften und Rohstoffe (BGR) Wilhelmstraße 25 – 30 13593 Berlin Tel.: +49 30 36993 226 Fax: +49 30 36993 100 [email protected] www.deutsche-rohstoffagentur.de DERA Rohstoffi nformationen Rohstoffi DERA ISSN: 2193-5319 ISBN: 978-3-943566 -11- 6 Investor‘s and Procurement Guide South Africa Part 1: Heavy Minerals, Rare Earth Elements, Antimony EP-Umschlag_investorsguide.indd 1 13.03.14 15:36 Impressum Editors: Dr. Peter Buchholz, Head of the German Mineral Resources Agency (DERA) Federal Institute for Geosciences and Natural Resources (BGR) Wilhelmstrasse 25-30 13593 Berlin, Germany Tel.: +49 30 36993 226 Fax.: +49 30 36993 100 [email protected] www.deutsche-rohstoffagentur.de Dr. Stewart Foya Head of the Department of Mineral Resources Development Council for Geoscience (CGS) 280 Pretoria Street, Silverton Pretoria, South Africa Tel.: +27 12 841 1101 Fax.: +27 86 679 8334 [email protected] Authors: Dr. Torsten Graupner (BGR), Dr. Napoleon Q. Hammond (CGS), Maren Liedtke (DERA), Dr. Herwig Marbler (DERA), Rehan Opperman (CGS), Dr. Ulrich Schwarz-Schampera (BGR), Dr. Elisa Long’a Tongu (CGS), Abdul O. Kenan (CGS), Unathi Nondula (CGS), Matamba Tsanwani (CGS) Project coordination: Dr. Herwig Marbler (DERA), Rehan Opperman (CGS) Contact DERA: Dr. Herwig Marbler: [email protected] Contact CGS: Rehan Opperman: [email protected] Layout: DERA, label D Druck + Medien GmbH, Berlin Date: March -

Takeovers + Schemes Review

TAKEOVERS + SCHEMES REVIEW 2018 GTLAW.COM.AU 1 THE GILBERT + TOBIN 2018 TAKEOVERS AND SCHEMES REVIEW 2017 demonstrated a distinct uptick in activity for Australian public company mergers and acquisitions. Some key themes were: + The number of transactions announced increased by 37% over 2016 and aggregate transaction values were among the highest in recent years. + The energy & resources sector staged a recovery in M&A activity, perhaps signalling an end to the downwards trend observed over the last six years. The real estate sector made the greatest contribution to overall transaction value, followed closely by utilities/infrastructure. + Despite perceived foreign investment headwinds, foreign interest in Australian assets remained strong, with Asian, North American and French acquirers featuring prominently. Four of the five largest transactions in 2017 (including two valued at over $5 billion) involved a foreign bidder. + There was a material decline in success rates, except for high value deals greater than $500 million. Cash transactions continued to be more successful than transactions offering scrip. Average premiums paid fell slightly. + Regulators continue to closely scrutinise public M&A transactions, with the attendant lengthening of deal timetables. This Review examines 2017’s public company transactions valued over $50 million and provides our perspective on the trends for Australian M&A in 2017 and what that might mean for 2018. We trust you will find this Review to be an interesting read and a useful resource for 2018. 2 -

For Personal Use Only Use Personal for the UKLA Official List

18 May 2015 South32 Level 32 Brookfield Place 125 St Georges Terrace To: Australian Securities Exchange cc: London Stock Exchange Perth Western Australia 6000 Australia JSE Limited south32.net THIS IS NOT A PROSPECTUS. YOUR ATTENTION IS DRAWN TO THE IMPORTANT INFORMATION ON PAGES 2 AND 3. COMMENCEMENT OF TRADING ON THE AUSTRALIAN SECURITIES EXCHANGE, LONDON STOCK EXCHANGE AND JOHANNESBURG STOCK EXCHANGE South32 Limited (ASX, LSE, JSE: S32) (South32) is pleased to announce that it has been admitted to the Official List of the Australian Securities Exchange (ASX) and that its ordinary shares commenced trading on a deferred settlement basis at 12:00 p.m. (AEST) today. South32’s ordinary shares are expected to commence trading on the ASX on a normal settlement basis on 2 June 2015 at 10:00 a.m. (AEST). Graham Kerr, South32’s Chief Executive Officer, said he is very proud of South32’s heritage and thanked shareholders for the trust they have placed in the management and staff of this new company. “Today is a significant occasion; one that we are pleased to be celebrating in what are otherwise challenging times for the resources sector. South32 will start life with a strong balance sheet, along with high quality, well maintained, cash generative assets and highly talented people. We will work hard to maintain the trust of our owners and partners as we seek to unlock the potential of our assets and grow value for our shareholders and the communities in which we operate.” “We believe that our regional model will enable us to improve our productivity and performance in a sustainable way. -

Strategy Delivery Growth

Rio Tinto 2009 Annual report Rio Tinto Financial calendar Strategy 2010 14 January Fourth quarter 2009 operations review 11 February Announcement of results for 2009 24 February Rio Tinto plc and Rio Tinto Limited shares and Rio Tinto plc ADRs quoted “ex-dividend” for 2009 fi nal dividend Delivery 26 February Record date for 2009 fi nal dividend for Rio Tinto plc shares and ADRs 2 March Record date for 2009 fi nal dividend for Rio Tinto Limited shares 11 March Plan notice date for election under the dividend reinvestment plan for the 2009 fi nal dividend 1 April Payment date for 2009 fi nal dividend to holders of Ordinary shares and ADRs Growth 15 April Annual general meeting for Rio Tinto plc 15 April First quarter 2010 operations review 22 April Annual general meeting for Rio Tinto Limited A focused and 14 July Second quarter 2010 operations review 5 August Announcement of half year results for 2010 integrated strategy 11 August Rio Tinto plc and Rio Tinto Limited shares and Rio Tinto plc ADRs quoted “ex-dividend” for 2010 interim dividend 13 August Record date for 2010 interim dividend for Rio Tinto plc shares and ADRs 17 August Record date for 2010 interim dividend for Rio Tinto Limited shares Excellence in 18 August Plan notice date for election under the dividend reinvestment plan for the 2010 interim dividend 9 September Payment date for 2010 interim dividend to holders of Ordinary shares and ADRs operational delivery 14 October Third quarter 2010 operations review 2011 Positioned for growth January Fourth quarter 2010 operations review February Announcement of results for 2010 Useful information and contacts Registered offi ces Investor Centre Rio Tinto Limited Rio Tinto plc To fi nd out more about Investor Centre, go to Computershare Investor Services Pty Limited 2 Eastbourne Terrace www.investorcentre.co.uk/riotinto GPO Box 2975 London Holders of Rio Tinto American Melbourne W2 6LG Depositary Receipts (ADRs) Victoria 3001 Registered in England No. -

Deliver Sustainable Value

Annual Report 2020 DELIVER ABN 34 008 675 018 SUSTAINABLE VALUE ABOUT ILUKA RESOURCES lluka Resources Limited (Iluka) is an international mineral With over 3,000 direct employees, the company has sands company with expertise in exploration, project operations and projects in Australia and Sierra Leone; development, mining, processing, marketing and and a globally integrated marketing network. rehabilitation. Iluka conducts international exploration activities and The company’s objective is to deliver sustainable value. is actively engaged in the rehabilitation of previous operations in the United States, Australia and Sierra With over 60 years’ industry experience, Iluka is a Leone. leading global producer of zircon and the high grade titanium dioxide feedstocks rutile and synthetic rutile. In Listed on the Australian Securities Exchange (ASX) addition, the company has an emerging position in rare and headquartered in Perth. Iluka holds a 20% stake in earth elements (rare earths). Iluka’s products are used Deterra Royalties Limited (Deterra), the largest ASX-listed in an increasing array of applications including home, resources focussed royalty company. workplace, medical, lifestyle and industrial uses. PRODUCTS TITANIUM DIOXIDE ZIRCON TiO2 Zr Iluka is the largest producer of natural Iluka is a leading global producer of rutile and a major producer of synthetic zircon. Zircon is opaque; and heat, water, rutile, which is an upgraded, value added chemical and abrasion resistant. Primary form of ilmenite. Collectively, these uses include ceramics; refractory and products are referred to as high-grade foundry applications; and zirconium titanium dioxide feedstocks, owing to chemicals. their high titanium content. Primary uses include pigment (paints), titanium metal and welding. -

City Square Development Steel Awards 2012 Winner Case Study

CITY SQUARE DEVELOPMENT STEEL AWARDS 2012 WINNER CASE STUDY BUILDINGS - LARGE PROJECTS STATE WINNER (WA) 2012 ARCHITECTURAL MERIT match the corner ‘mega-columns’. The bracing continues beyond the roof of the building to form the highly visible Recently completed, the City Square project, also known ‘column capitol’ or ‘tiara’ structure which rises a further 8 as Brookfield Place, is Perth’s newest high-rise commercial storeys above the roof of the building. office building. Constructed by Brookfield Multiplex, the building incorporates many design features aiming to place it at the leading edge of the high-rise commercial building market. To compensate for the offset core, the designers incorporated a highly visible bracing The overall architectural design of the building aims to make a system to the eastern and western ends of the bold statement on behalf of the main tenant, BHP Billiton. The building. building is a dominant structure on the Perth skyline with the BHP name proudly displayed. The building features an off-set core on the north side of the building, allowing a largely open- Whilst the basement level floors were constructed in concrete, plan internal office layout with floor to ceiling glass achieving the 47 floors and roof above the plaza are all steel framed. uninterrupted spectacular views over the Swan River, to the Composite steel beams span between the circular structural south and to the sea. columns and support Fielder permanent formwork decking with cast-insitu concrete slab floors. Structural columns for the The 47 floors and roof above the plaza are all tower utilise spiral welded steel tubes with bolted end splices steel framed. -

South32 Roadshow Presentation

TAO2013\Comms\2015.03.16 - South32 Global Roadshow Pres\150305 South32 Global Roadshow Pres POST BAC Submission_v14.pptx MAKING A DIFFERENCE FROM THE GROUND UP ROADSHOW PRESENTATION MARCH 2015 TAO2013\Comms\2015.03.16 - South32 Global Roadshow Pres\150305 South32 Global Roadshow Pres POST BAC Submission_v14.pptx IMPORTANT INFORMATION AND DISCLAIMER Nature of this presentation The information contained in this presentation does not constitute a prospectus or other listing document in relation to BHP Billiton or the new company proposed to be demerged from BHP Billiton (‘South32’) in any jurisdiction and is summary information provided for information purposes only. Any investment decision in relation to South32 should be made only on the basis of the information contained in the Listing Document for the relevant jurisdiction. The “Listing Documents”, which are available, subject to applicable securities laws, on the BHP Billiton website at www.bhpbilliton.com/demerger, comprise a prospectus which has been approved by the UK Listing Authority in connection with the proposed admission of South32’s ordinary shares to the standard listing segment of the Official List of the UK Financial Conduct Authority and to trading on the Main Market for listed securities of London Stock Exchange plc, an information memorandum in connection with South32’s application for the admission of its ordinary shares to listing on the Australian Securities Exchange and a pre-listing statement in connection with South32’s application for the admission of its ordinary shares to listing on the Johannesburg Stock Exchange. This presentation should not be relied upon in connection with voting on the proposed demerger. -

ANNUAL REPORT 2020 Competent Persons

ANNUAL REPORT 2020 Competent Persons This Mineral Resources and Ore Reserves Statement as a whole has been approved by Mr D Ian Chalmers, FAusIMM, FAIG, (Executive Director of the Company,) who has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Chalmers has provided his prior written consent to the inclusion in this report of the Mineral Resources and Ore Reserves Statement in the form and context in which it appears. The information in this report that relates to the TGO Mineral Resource estimates is based on, and fairly represents, information which has been compiled by Mr Craig Pridmore, Geology Manager Tomingley Gold Operations, who is a Member of the Australasian Institute of Mining and Metallurgy and an employee of Alkane Resources Ltd. Mr Pridmore has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that is being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. The information in this report that relates to the TGO Open Pit Ore Reserve estimate is based on, and fairly represents, information which has been compiled by Mr John Millbank (Proactive Mining Solutions), an independent consultant, who is a Member of the Australasian Institute of Mining and Metallurgy. -

View Annual Report

For personal use only CORPORATE REGISTRY ASX Code DIRECTORS NWH Michael Arnett Chairman and Non-Executive Director Jeff Dowling Non-Executive Director Julian Pemberton Chief Executive Officer and Managing Director Peter Johnston Non-Executive Director COMPANY SECRETARY Kim Hyman Dividend REGISTERED OFFICE 181 Great Eastern Highway, 2.0 cps Belmont WA 6104 Telephone: +61 8 9232 4200 Facsimile: +61 8 9232 4232 Email: [email protected] AUDITOR Deloitte Touche Tohmatsu Tower 2 Brookfield Place Level 9 123 St Georges Terrace Perth WA 6000 SHARE REGISTRY Link Market Services Limited Workforce Level 4 Central Park 152 St Georges Terrace Perth WA 6000 2,000 Telephone: +61 1300 554 474 Facsimile: +61 2 8287 0303 ASX CODE For personal use only NWH – NRW Holdings Limited Fully Paid Ordinary Shares nrw.com.au 1 NRW HOLDINGS ANNUAL REPORT 2018 | Corporate Registry NRW HOLDINGS ANNUAL REPORT 2018 | Contents CONTENTS PAGE 04 Chairman’s Message 05 CEO Review of Operations 08 Golding 08 Business Unit Performance 09 Civil 09 Mining 10 Drill & Blast 10 People & Safety 11 Outlook 12 Pilbara Capability Milestones For personal use only 14 CFO Financial Report 14 Financial Performance 15 Balance Sheet, Operating Cash Flow & Capital Expenditure NRW HOLDINGS ANNUAL REPORT 2018 | Contents 2 “I would like to thank our employees and leadership team for the quality of work produced and the For personal use only high standards that were achieved this year, together with welcoming Golding into the NRW Group” 3 NRW HOLDINGS ANNUAL REPORT 2018 | Chairman’s Message NRW HOLDINGS ANNUAL REPORT 2018 | Chairman’s Message CHAIRMAN’S MESSAGE It is with great pleasure we present NRW Holdings I would like to thank our employees and leadership annual financial results. -

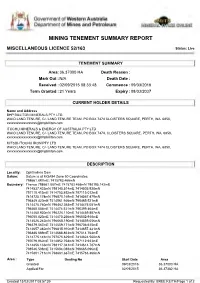

Mining Tenement Summary Report

Government of Western Australia Department of Mines and Petroleum MINING TENEMENT SUMMARY REPORT MISCELLANEOUS LICENCE 52/163 Status: Live TENEMENT SUMMARY Area: 36.37000 HA Death Reason : Mark Out : N/A Death Date : Received : 02/09/2015 08:33:48 Commence : 09/03/2016 Term Granted : 21 Years Expiry : 08/03/2037 CURRENT HOLDER DETAILS Name and Address BHP BILLITON MINERALS PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] ITOCHU MINERALS & ENERGY OF AUSTRALIA PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474, CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] MITSUI-ITOCHU IRON PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] DESCRIPTION Locality: Ophthalmia Dam Datum: Datum is at MGA94 Zone 50 Coordinates. 798661.887mE; 7415783.466mN Boundary: Thence 798661.887mE 7415783.466mN 798195.142mE 7414537.433mN 798145.514mE 7414505.938mN 797110.415mE 7414753.892mN 797115.012mE 7414725.174mN 796870.169mE 7414567.479mN 796849.420mE 7414561.946mN 796465.521mE 7414475.760mN 796462.363mE 7414475.051mN 796460.004mE 7414474.521mN 796399.464mE 7414460.930mN 796226.110mE 7414459.887mN 796050.820mE 7414470.256mN 796032.918mE 7414526.242mN 796068.190mE 7414559.056mN 796379.567mE 7414559.171mN 796736.615mE 7414657.382mN 796815.910mE 7414657.431mN 796886.689mE 7414688.863mN 797014.764mE 7414775.141mN 797075.629mE 7414824.500mN 797079.962mE 7414852.758mN 797112.933mE 7414856.133mN -

STATISTICS DIGEST 2014 Disclaimer Information Provided in This Digest Is Made Available Without Charge, As a Public Service, in Good Faith

Government of Western Australia Department of Mines and Petroleum WESTERN AUSTRALIAN MINERAL AND PETROLEUM STATISTICS DIGEST 2014 Disclaimer Information provided in this Digest is made available without charge, as a public service, in good faith. The information provided is derived from sources believed to be reliable and accurate at the time of publication. However, use of the information in the Digest is at your own risk. The Digest is provided solely on the basis that users will be responsible for making their own assessment of the information provided therein and users are advised to verify all representations, statements and information for decisions that concern the conduct of business that involves monetary or operational consequences. Each user waives and releases the Department of Mines and Petroleum and the State of Western Australia and its servants to the full extent permitted by law from all and any claims relating to the use of the material in the Digest. In no event shall the Department of Mines and Petroleum or the State of Western Australia be liable for any incidental or consequential damages arising from any use or reliance on any material in the Digest. Copyright © 2014 Copyright in this document is reserved to the State of Western Australia. Reproduction except in accordance with copyright law is prohibited. LIST OF FIGURES, TABLES AND MAPS FIGURES Figure 1 Mining Investment 5 Figure 46 Gold Production 16 Figure 2 New Capital Investment 5 Figure 47 Crude Oil and Condensate Quantity 17 Figure 3 Mineral Exploration -

Heavy Mineral Processing at Richards Bay Minerals

Southern African Pyrometallurgy 2006, Edited by R.T. Jones, South African Institute of Mining and Metallurgy, Johannesburg, 5-8 March 2006 Heavy Mineral Processing at Richards Bay Minerals G.E. Williams and J.D. Steenkamp Richards Bay Minerals, Richards Bay, South Africa Keywords: Ilmenite, titania slag, pig iron, rutile, zircon Abstract – Located on the eastern shores of South Africa, 180 km north of Durban, Richards Bay Minerals (RBM) produces approximately 2.0 million metric tonnes of product annually making RBM a leading producer of titania slag, high purity pig iron, rutile and zircon. Heavy minerals are extracted from the nearby dunes by dredging and concentration on a floating gravity separation plant, followed by separation of the ilmenite, rutile and zircon at the mineral separation plant located at the smelter site. The ilmenite is processed through an oxidizing roast followed by magnetic separation and is then partially reduced to an 85 per cent TiO2 slag in one of four six-in-line a.c. electric arc furnaces. The slag is milled and then classified into two product sizes suitable as a raw material for both the sulphate and chloride pigment processes. The high quality iron produced during the reduction process is further processed to produce various grades of low-manganese iron. Around 95 per cent of the products are exported, yielding a world market share of about 25 per cent of titania slag, rutile, high quality pig iron, and zircon. INTRODUCTION History Richards Bay Minerals is the trading name for two registered companies, Tisand (Pty) Ltd and Richards Bay Iron and Titanium (Pty) Ltd (RBIT).