The Following Information Is Required to Be Provided to ASX Limited (ASX

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Takeovers + Schemes Review

TAKEOVERS + SCHEMES REVIEW 2018 GTLAW.COM.AU 1 THE GILBERT + TOBIN 2018 TAKEOVERS AND SCHEMES REVIEW 2017 demonstrated a distinct uptick in activity for Australian public company mergers and acquisitions. Some key themes were: + The number of transactions announced increased by 37% over 2016 and aggregate transaction values were among the highest in recent years. + The energy & resources sector staged a recovery in M&A activity, perhaps signalling an end to the downwards trend observed over the last six years. The real estate sector made the greatest contribution to overall transaction value, followed closely by utilities/infrastructure. + Despite perceived foreign investment headwinds, foreign interest in Australian assets remained strong, with Asian, North American and French acquirers featuring prominently. Four of the five largest transactions in 2017 (including two valued at over $5 billion) involved a foreign bidder. + There was a material decline in success rates, except for high value deals greater than $500 million. Cash transactions continued to be more successful than transactions offering scrip. Average premiums paid fell slightly. + Regulators continue to closely scrutinise public M&A transactions, with the attendant lengthening of deal timetables. This Review examines 2017’s public company transactions valued over $50 million and provides our perspective on the trends for Australian M&A in 2017 and what that might mean for 2018. We trust you will find this Review to be an interesting read and a useful resource for 2018. 2 -

For Personal Use Only Use Personal for the UKLA Official List

18 May 2015 South32 Level 32 Brookfield Place 125 St Georges Terrace To: Australian Securities Exchange cc: London Stock Exchange Perth Western Australia 6000 Australia JSE Limited south32.net THIS IS NOT A PROSPECTUS. YOUR ATTENTION IS DRAWN TO THE IMPORTANT INFORMATION ON PAGES 2 AND 3. COMMENCEMENT OF TRADING ON THE AUSTRALIAN SECURITIES EXCHANGE, LONDON STOCK EXCHANGE AND JOHANNESBURG STOCK EXCHANGE South32 Limited (ASX, LSE, JSE: S32) (South32) is pleased to announce that it has been admitted to the Official List of the Australian Securities Exchange (ASX) and that its ordinary shares commenced trading on a deferred settlement basis at 12:00 p.m. (AEST) today. South32’s ordinary shares are expected to commence trading on the ASX on a normal settlement basis on 2 June 2015 at 10:00 a.m. (AEST). Graham Kerr, South32’s Chief Executive Officer, said he is very proud of South32’s heritage and thanked shareholders for the trust they have placed in the management and staff of this new company. “Today is a significant occasion; one that we are pleased to be celebrating in what are otherwise challenging times for the resources sector. South32 will start life with a strong balance sheet, along with high quality, well maintained, cash generative assets and highly talented people. We will work hard to maintain the trust of our owners and partners as we seek to unlock the potential of our assets and grow value for our shareholders and the communities in which we operate.” “We believe that our regional model will enable us to improve our productivity and performance in a sustainable way. -

For Personal Use Only Use Personal For

Neometals Ltd A.C.N. 099 116 631 Annual Financial Report for the financial year ended 30 June 2018 For personal use only Neometals Ltd Review of Operations REVIEW OF OPERATIONS The directors of Neometals Ltd (“Company” and “Neometals”) present the annual financial report for the Company and its controlled entities (“Consolidated Entity” and “Group”). Neometals’ primary focus during the year centred on advancing its advanced integrated lithium business unit, the titanium / vanadium project (Barrambie) and developing its technology business unit. LITHIUM BUSINESS UNIT Figure 1 - Neometals Horizons of Growth MT MARION LITHIUM PROJECT (Neometals Ltd 13.8%, Mineral Resources Limited (MRL) 43.1%, Ganfeng Lithium Co., Ltd (Ganfeng) 43.1% through Reed Industrial Minerals Pty Ltd (RIM)) Production achieved a steady state annualised production of 400ktpa of combined 6% and 4% grade during the year. A total of 382ktpa of spodumene concentrate was exported (209K WMT 6% and 173K WMT 4%). Construction of the upgrade to the concentrator circuits to facilitate production of 6% Li2O only concentrate is in progress and on track for completion in quarter two FY19 with the plant being ramped up to 100% high grade production shortly thereafter. The achieved price for 6% and 4% spodumene products averaged A$879 per wet tonne for all tonnes exported. Pricing is linked to international lithium carbonate and hydroxide prices rather than bilateral spodumene market prices. The 6% spodumene price for quarter four of FY18 was agreed at US$961 per dry tonne CFR China (US$929 per wet tonne). CFR cash costs for FY18 averaged A$576 per wet tonne exported. -

City Square Development Steel Awards 2012 Winner Case Study

CITY SQUARE DEVELOPMENT STEEL AWARDS 2012 WINNER CASE STUDY BUILDINGS - LARGE PROJECTS STATE WINNER (WA) 2012 ARCHITECTURAL MERIT match the corner ‘mega-columns’. The bracing continues beyond the roof of the building to form the highly visible Recently completed, the City Square project, also known ‘column capitol’ or ‘tiara’ structure which rises a further 8 as Brookfield Place, is Perth’s newest high-rise commercial storeys above the roof of the building. office building. Constructed by Brookfield Multiplex, the building incorporates many design features aiming to place it at the leading edge of the high-rise commercial building market. To compensate for the offset core, the designers incorporated a highly visible bracing The overall architectural design of the building aims to make a system to the eastern and western ends of the bold statement on behalf of the main tenant, BHP Billiton. The building. building is a dominant structure on the Perth skyline with the BHP name proudly displayed. The building features an off-set core on the north side of the building, allowing a largely open- Whilst the basement level floors were constructed in concrete, plan internal office layout with floor to ceiling glass achieving the 47 floors and roof above the plaza are all steel framed. uninterrupted spectacular views over the Swan River, to the Composite steel beams span between the circular structural south and to the sea. columns and support Fielder permanent formwork decking with cast-insitu concrete slab floors. Structural columns for the The 47 floors and roof above the plaza are all tower utilise spiral welded steel tubes with bolted end splices steel framed. -

ANNUAL REPORT 2020 Competent Persons

ANNUAL REPORT 2020 Competent Persons This Mineral Resources and Ore Reserves Statement as a whole has been approved by Mr D Ian Chalmers, FAusIMM, FAIG, (Executive Director of the Company,) who has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Chalmers has provided his prior written consent to the inclusion in this report of the Mineral Resources and Ore Reserves Statement in the form and context in which it appears. The information in this report that relates to the TGO Mineral Resource estimates is based on, and fairly represents, information which has been compiled by Mr Craig Pridmore, Geology Manager Tomingley Gold Operations, who is a Member of the Australasian Institute of Mining and Metallurgy and an employee of Alkane Resources Ltd. Mr Pridmore has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity that is being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. The information in this report that relates to the TGO Open Pit Ore Reserve estimate is based on, and fairly represents, information which has been compiled by Mr John Millbank (Proactive Mining Solutions), an independent consultant, who is a Member of the Australasian Institute of Mining and Metallurgy. -

View Annual Report

For personal use only CORPORATE REGISTRY ASX Code DIRECTORS NWH Michael Arnett Chairman and Non-Executive Director Jeff Dowling Non-Executive Director Julian Pemberton Chief Executive Officer and Managing Director Peter Johnston Non-Executive Director COMPANY SECRETARY Kim Hyman Dividend REGISTERED OFFICE 181 Great Eastern Highway, 2.0 cps Belmont WA 6104 Telephone: +61 8 9232 4200 Facsimile: +61 8 9232 4232 Email: [email protected] AUDITOR Deloitte Touche Tohmatsu Tower 2 Brookfield Place Level 9 123 St Georges Terrace Perth WA 6000 SHARE REGISTRY Link Market Services Limited Workforce Level 4 Central Park 152 St Georges Terrace Perth WA 6000 2,000 Telephone: +61 1300 554 474 Facsimile: +61 2 8287 0303 ASX CODE For personal use only NWH – NRW Holdings Limited Fully Paid Ordinary Shares nrw.com.au 1 NRW HOLDINGS ANNUAL REPORT 2018 | Corporate Registry NRW HOLDINGS ANNUAL REPORT 2018 | Contents CONTENTS PAGE 04 Chairman’s Message 05 CEO Review of Operations 08 Golding 08 Business Unit Performance 09 Civil 09 Mining 10 Drill & Blast 10 People & Safety 11 Outlook 12 Pilbara Capability Milestones For personal use only 14 CFO Financial Report 14 Financial Performance 15 Balance Sheet, Operating Cash Flow & Capital Expenditure NRW HOLDINGS ANNUAL REPORT 2018 | Contents 2 “I would like to thank our employees and leadership team for the quality of work produced and the For personal use only high standards that were achieved this year, together with welcoming Golding into the NRW Group” 3 NRW HOLDINGS ANNUAL REPORT 2018 | Chairman’s Message NRW HOLDINGS ANNUAL REPORT 2018 | Chairman’s Message CHAIRMAN’S MESSAGE It is with great pleasure we present NRW Holdings I would like to thank our employees and leadership annual financial results. -

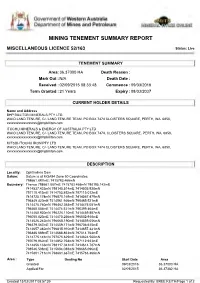

Mining Tenement Summary Report

Government of Western Australia Department of Mines and Petroleum MINING TENEMENT SUMMARY REPORT MISCELLANEOUS LICENCE 52/163 Status: Live TENEMENT SUMMARY Area: 36.37000 HA Death Reason : Mark Out : N/A Death Date : Received : 02/09/2015 08:33:48 Commence : 09/03/2016 Term Granted : 21 Years Expiry : 08/03/2037 CURRENT HOLDER DETAILS Name and Address BHP BILLITON MINERALS PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] ITOCHU MINERALS & ENERGY OF AUSTRALIA PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474, CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] MITSUI-ITOCHU IRON PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] DESCRIPTION Locality: Ophthalmia Dam Datum: Datum is at MGA94 Zone 50 Coordinates. 798661.887mE; 7415783.466mN Boundary: Thence 798661.887mE 7415783.466mN 798195.142mE 7414537.433mN 798145.514mE 7414505.938mN 797110.415mE 7414753.892mN 797115.012mE 7414725.174mN 796870.169mE 7414567.479mN 796849.420mE 7414561.946mN 796465.521mE 7414475.760mN 796462.363mE 7414475.051mN 796460.004mE 7414474.521mN 796399.464mE 7414460.930mN 796226.110mE 7414459.887mN 796050.820mE 7414470.256mN 796032.918mE 7414526.242mN 796068.190mE 7414559.056mN 796379.567mE 7414559.171mN 796736.615mE 7414657.382mN 796815.910mE 7414657.431mN 796886.689mE 7414688.863mN 797014.764mE 7414775.141mN 797075.629mE 7414824.500mN 797079.962mE 7414852.758mN 797112.933mE 7414856.133mN -

STATISTICS DIGEST 2014 Disclaimer Information Provided in This Digest Is Made Available Without Charge, As a Public Service, in Good Faith

Government of Western Australia Department of Mines and Petroleum WESTERN AUSTRALIAN MINERAL AND PETROLEUM STATISTICS DIGEST 2014 Disclaimer Information provided in this Digest is made available without charge, as a public service, in good faith. The information provided is derived from sources believed to be reliable and accurate at the time of publication. However, use of the information in the Digest is at your own risk. The Digest is provided solely on the basis that users will be responsible for making their own assessment of the information provided therein and users are advised to verify all representations, statements and information for decisions that concern the conduct of business that involves monetary or operational consequences. Each user waives and releases the Department of Mines and Petroleum and the State of Western Australia and its servants to the full extent permitted by law from all and any claims relating to the use of the material in the Digest. In no event shall the Department of Mines and Petroleum or the State of Western Australia be liable for any incidental or consequential damages arising from any use or reliance on any material in the Digest. Copyright © 2014 Copyright in this document is reserved to the State of Western Australia. Reproduction except in accordance with copyright law is prohibited. LIST OF FIGURES, TABLES AND MAPS FIGURES Figure 1 Mining Investment 5 Figure 46 Gold Production 16 Figure 2 New Capital Investment 5 Figure 47 Crude Oil and Condensate Quantity 17 Figure 3 Mineral Exploration -

Functions and Events at BFPL Bfplperth.Com TIME WELL SPENT 1 Welcome to Brookfield Place

i Functions and Events at BFPL BFPLPerth.com TIME WELL SPENT 1 Welcome to Brookfield Place PERTH’S GO-TO FASHION, DINING AND EVENT DESTINATION IN THE HEART OF THE CBD. Welcome to Brookfield Place, Perth’s Adjacent to the Perth Convention All venues employ professional and go-to destination for dining and and Exhibition Centre, Elizabeth skilled function staff who work events in busy St Georges Terrace Quay, and just a short walk from with you to identify your individual at the heart of the CBD. Combining RAC Arena, Brookfield Place is needs, ensuring a premium, hassle- world-class architecture with conveniently located to deliver all free, and memorable experience for outstanding amenities, you’ll never your function and event needs, all guests. be in want of choice or style for your catering for all varieties of guests. next event, big or small. Brookfield Place’s lively mix of bars Access to and from the precinct is and restaurants include Arlo by Our venues are keenly sought-after made easy with the Elizabeth Quay Mo, Bar Lafayette, Basilica, Bob’s destinations for the surrounding train and bus station on Mounts Bar, Bobèche, Grill’d, Print Hall, The corporate market, providing a Bay Road, and taxi and Uber pick Apple Daily Bar & Eating House, The diverse choice of dining, function up points on St Georges Terrace. Heritage Wine Bar and W Churchill. and event experiences for special occasions and celebrations. 2 Contents Bar Lafayette ................................................................................................. 03 -

Annual Report

ANNUAL REPORT 3 22 23 Li Ti V Lithium Titanium Vanadium 2018 - + O Li H - + For personal use only O Li H - + O Li H DIRECTORS BANKERS Steven Cole National Australia Bank Ltd Non-Executive Chairman Christopher Reed SHARE REGISTRY Managing Director Computershare Investor Services Pty Ltd David Reed Level 2, Reserve Bank Building Non-Executive Director 45 St Georges Terrace Perth Dr Natalia Streltsova WA 6000 Non-Executive Director Douglas Ritchie STOCK EXCHANGE LISTING Non-Executive Director Neometals Ltd are listed on the Dr Jenny Purdie Australian Stock Exchange Non-Executive Director (Home Branch – Perth) (Appointed 26 September 2018) ASX Code: NMT Les Guthrie ACN: 099 116 631 Non-Executive Director ABN: 89 099 116 631 (Appointed 26 September 2018) North American OTC Market (DR Symbol: RDRUY) COMPANY SECRETARY Jason Carone ANNUAL GENERAL MEETING 3pm Friday 30 November 2018 REGISTERED OFFICE Parmelia Hilton Perth Level 3, 1292 Hay Street 14 Mill St West Perth Perth WA 6000 WA 6005 CONTACT DETAILS Telephone (+618) 9322 1182 Facsimile (+618) 9321 0556 www.neometals.com.au AUDITORS Deloitte Touche Tohmatsu Brookfield Place, Tower 2 For personal use only 123 St Georges Terrace Perth WA 6000 CONTENTS Review of Operations 2 Directors’ Report 19 Remuneration Report 26 Audit Report 41 Auditor’s Independence Declaration 45 Directors’ Declaration 46 Consolidated Statement of Profit or Loss and Other Comprehensive Income 47 Consolidated Statement of Financial Position 48 Consolidated Statement of Changes in Equity 49 Consolidated Statement of Cash Flows 50 Financial Statements Contents 51 Notes to the Consolidated Financial Statements 52 Additional Stock Exchange Information 106 For personal use only NEOMETALS ANNUAL REPORT 2018 REVIEW OF OPERATIONS The directors of Neometals Ltd (“Company” and “Neometals”) present the annual financial report for the Company and its controlled entities (“Consolidated Entity” and “Group”). -

Annual Report 2019

Annual Report 2019 Table of Contents 02 ABOUT CODA MINERALS 05 CHAIRMAN’S REPORT 07 DIRECTORS’ REPORT 12 AUDITOR’S INDEPENDENCE DECLARATION 13 INDEPENDENT AUDITOR’S REPORT 16 DIRECTORS’ DECLARATION 17 STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME 18 STATEMENT OF FINANCIAL POSITION 19 STATEMENT OF CHANGES IN EQUITY 20 STATEMENT OF CASH FLOWS 21 NOTES TO THE FINANCIAL STATEMENTS 1 CODA MINERALS LIMITED ACN 625 763 957 ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 About Coda Minerals Coda holds the rights and interests under the Mt Gunson Copper-Cobalt Project Farm-In Agreement to earn up to 75% interest in the Mt Gunson Project. The Mt Gunson tenements are located 114km southeast of BHP’s world-class Olympic Dam copper- gold-uranium mine and within 40km of Oz Minerals’ Carrapateena copper project. Mt Gunson includes the Windabout and MG14 deposits, Emmie Bluff prospect and over 739 square kilometres of highly prospective tenements. The deposits currently include JORC compliant Resources of 159,000 tonnes of contained copper and 9,500 tonnes of contained cobalt. Recent milestones in the past year include: • November 2018: Completion of a large diameter (C8) metallurgical drilling program at the MG14 and Windabout deposits. • January 2019: Completion of an HQ diamond programme at Emmie Bluff and associated critical risk study. • April 2019: Completion of Mt Gunson passive seismic survey. This is expected to improve drill targeting in brownfields drill prospects around MG14 and Windabout. • July 2019: Completion of detailed metallurgical testwork to refine the processing flowsheet for MG14 and Windabout mineralisation. • Ongoing participation in a MRIWA study on leaching analysis on the MG14 material to determine the effectiveness of the Mining Process Solutions’ proprietary GlyLeachTM glycine technology (to which Coda has a global license). -

Sustainability It’S How We Do Business Contents

2020 ESG REPORT AUSTRALIA Sustainability It’s how we do business Contents 04 We’re breaking the plastic habit 40 Social 06 Who we are 42 Our response to COVID-19 08 Our mission 46 Bringing our spaces to life 09 Our values 48 Creating better connections 10 Our stakeholders 51 Our people 52 Diversity 12 Environment 54 Industry leadership 14 We measure because it matters 56 Employee benefits 14 The impact of COVID-19 on building 57 Training and education performance 58 Brookfield Women’s Network 20 NABERS Energy ratings 60 Brookfield Cares 22 Developing with purpose 30 Single use plastics initiative 64 Governance 32 Coffee cup recycling 68 Our GRESB performance 33 Misfortune cookies 70 Health and safety 34 We’re reducing waste. Every day. 74 Our approach to Supply Chain 37 An industry first in sustainability Management and Modern Slavery 38 What’s next? 76 Looking ahead 78 GRI content index 84 Appendix ABOUT THIS REPORT This annual sustainability report is for the 2020 calendar year reporting period. The report covers Brookfield Properties’ Australian operations and the assets managed by Brookfield Properties Australia. Resource consumption (energy, water, and carbon emissions) is reported for all operational office assets on an operational control basis. Retail and non-office assets are excluded from the resource consumption metrics. This report has been prepared in accordance with the GRI Standards: Core option. For questions relating to our sustainability report or performance, please contact [email protected] 2 Brookfield Properties | 2020 Sustainability Report Brookfield Properties | 2020 Sustainability Report 3 plastic syringes, based on the double-dose In this, our 2020 Sustainability Report, we are We’re requirement.