Securities and Exchange Commission Sec Form 17-C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Universal Robina Corporation and Subsidiaries

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 9 1 7 0 Company Name U N I V E R S A L R O B I N A C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 1 1 0 E . R o d r i g u e z A v e n e u e , B a g u m b a y a n , Q u e z o n C i t y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A N / A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number 671-2935; 635-0751; 671-3954 Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 1,066 4/18 9/30 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Mr. Constante T. Santos [email protected] (02) 633-7631 +63 922 813 0129 Contact Person’s Address 41st Floor, Robinsons Equitable Tower ADB Ave., cor Poveda St., Ortigas, Pasig City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

MORGAN STANLEY ASIA PRODUCTS LIMITED (Incorporated with Limited Liability in the Cayman Islands)

The FINAL TERMS dated 7 August 2017 are hereby amended on 23 August 2017 and superseded to reference the correct Launch Date provided in Part A – Information about the Warrants (A.3) (reference from “1 July 2017” to “31 July 2017”). FORM OF UNITARY WARRANT FINAL TERMS The Final Terms relating to each issue of Unitary Warrants will contain (without limitation) such of the following information as is applicable in respect of such Unitary Warrants. All references to numbered conditions are to the terms and conditions of the Unitary Warrants set out in Schedule 3 of the Agency Agreement (as defined in the Unitary Warrant Conditions) and reproduced in the Base Prospectus and words and expressions defined in those terms and conditions shall have the same meaning in the applicable Unitary Warrant Final Terms. MORGAN STANLEY ASIA PRODUCTS LIMITED (incorporated with limited liability in the Cayman Islands) Guaranteed by (incorporated in Delaware, U.S.A.) Warrant Programme The Warrants and the Guarantee have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the Securities Act), or the securities laws of any state in the United States. The Issuer may offer, sell or deliver Warrants only (a) to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the Securities Act) reasonably believed by the Issuer to be qualified institutional buyers (each a QIB) as defined in Rule 144A under the Securities Act (Rule 144A) that are also “qualified purchasers” (QPs) within the meaning of Section 3(c)(7) (Section 3(c)(7)) and as defined in Section 2(a)(51)(A) of the United States Investment Company Act of 1940, as amended (the 1940 Act) or (b) outside the United States to, or for the account or benefit of, a purchaser that is not a U.S. -

1351 Weekly Top Price Gainers 1 Week 4 Weeks 1 Grand Plaza Hotel

May 24 - May 28, 2021 VOL. XI NO. 22 ISSN 2013 - 1351 Weekly Top Price Gainers Last Comparative Price Stock Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No. Code Price 1 Week 4 Weeks C03656-2021, CR03783-2021, CR03785-2021, 1 Grand Plaza Hotel Corporation GPH 17.50 80.97 69.90 233,624 48.11 0.36 1.09 CR03821-2021, C03721-2021, CR03822-2021 2 PTFC Redevelopment Corporation TFC 46.00 48.39 48.39 82,000 18.09 2.54 3.47 No Disclosure 3 Discovery World Corporation DWC 3.54 30.63 8.59 9,313,640 (10.01) (0.35) 3.36 C03623-2021, CR03802-2021, CR03858-2021 C03604-2021, C03609-2021, C03714-2021, 4 Cebu Landmasters, Inc. CLI 7.11 17.91 22.16 220,493,647 5.92 1.20 1.33 C03718-2021, C03734-2021, C03767-2021 5 JG Summit Holdings, Inc. JGS 58.20 17.81 10.33 1,071,295,512 42.35 1.37 1.41 CR03836-2021 6 Imperial Resources, Inc. IMP 1.74 16.00 (5.43) 546,250 (562.07) (0.003) 1.43 CR03818-2021 7 Premiere Horizon Alliance Corporation PHA 1.95 15.38 (7.14) 162,557,730 13.31 0.15 7.54 No Disclosure C03736-2021, C03737-2021, C03738-2021, 8 Holcim Philippines, Inc. HLCM 6.24 15.34 13.04 13,056,634 14.71 0.42 1.40 C03746-2021, C03765-2021, C03766-2021 9 Aboitiz Equity Ventures, Inc. AEV 40.00 15.11 12.68 468,940,145 15.38 2.60 1.28 No Disclosure 10 ATN Holdings, Inc. -

JGS Minutes for Annual Stockholders Meeting

JG SUMMIT HOLDINGS, INC. MINUTES OF THE ANNUAL MEETING OF STOCKHOLDERS JUNE 27, 2017, 5:00 P.M. Crowne Plaza Manila Galleria, Quezon City, Metro Manila, Philippines Directors and Advisory Board Members Present 1. John L. Gokongwei, Jr. - Director and Chairman Emeritus 2. James L. Go - Director, Chairman and Chief Executive Officer 3. Lance Y. Gokongwei - Director, President and Chief Operating Officer 4. Lily G. Ngochua - Director 5. Patrick Henry C. Go - Director 6. Johnson Robert G. Go, Jr. - Director 7. Robina Y. Gokongwei-Pe - Director 8. Ricardo J. Romulo - Director 9. Cornelio T. Peralta - Independent Director 10. Jose T. Pardo - Independent Director 11. Renato T. De Guzman - Independent Director 12. Washington Z. SyCip - Advisory Board Member 13. Aloysius B. Colayco - Advisory Board Member 14. Jimmy T. Tang - Advisory Board Member Also Present Atty. Rosalinda F. Rivera - Corporate Secretary 1. PROOF OF NOTICE OF THE MEETING AND EXISTENCE OF A QUORUM The Corporate Secretary, Atty. Rosalinda F. Rivera, certified that notice of the meeting was sent by the Transfer Agent, Banco de Oro Unibank, Inc., to the stockholders of record as of May 23, 2017 at their addresses as appearing on their records and that a quorum was present by the presence, in person or by proxy, of shareholders entitled to vote which represent 77.82% of the total outstanding shares of the Corporation. The meeting was called to order at 5:00 p.m. by Mr. James L. Go, Chairman and Chief Executive Officer of the Corporation, who presided thereat as Chairman of the meeting and Atty. Rosalinda F. -

Diversification Strategies of Large Business Groups in the Philippines

Philippine Management Review 2013, Vol. 20, 65‐82. Diversification Strategies of Large Business Groups in the Philippines Ben Paul B. Gutierrez and Rafael A. Rodriguez* University of the Philippines, College of Business Administration, Diliman, Quezon City 1101, Philippines This paper describes the diversification strategies of 11 major Philippine business groups. First, it reviews the benefits and drawbacks of related and unrelated diversification from the literature. Then, it describes the forms of diversification being pursued by some of the large Philippine business groups. The paper ends with possible explanations for the patterns of diversification observed in these Philippine business groups and identifies directions for future research. Keywords: related diversification, unrelated diversification, Philippine business groups 1 Introduction This paper will describe the recent diversification strategies of 11 business groups in the Philippines. There are various definitions of business groups but in this paper, these are clusters of legally distinct firms with a managerial relationship, usually by virtue of common ownership. The focus on business groups rather than on individual firms has to do with the way that business firms in the Philippines are organized and managed. Businesses that are controlled and managed by essentially the same set of principal owners are often organized as separate corporations, not as separate divisions within the same firm, as is often the case in American corporations like General Electric, Procter and Gamble, or General Motors (Echanis, 2009). Moreover, studies on emerging markets have pointed out that business groups often occupy dominant positions in the business landscape in markets like India, Korea, Indonesia, Thailand, and the Philippines (Khanna & Palepu, 1997; Khanna & Yafeh, 2007). -

JG Summit Holdings Inc. Annual Report 2020

Annual Report 2020 About the Cover When faced with a monumental challenge, few are able to swiftly form high- impact solutions to make the situation better. It requires agility and adaptability to achieve a transformational outcome. This year, JG Summit swiftly addressed the effects of the pandemic, using its “How to Win” and “Where to Play” strategies to maximum effect. The company was agile in business, as well as steady and firm in uplifting communities to better endure this critical time. By focusing on employee health and safety, operations and supply chain continuity, cash, costs and liquidity management, and helping communities deal with the pandemic, JGS was able to weather the unexpected storm. The company also doubled its efforts to explore new business opportunities. This year’s cover demonstrates the diverse response throughout JG Summit’s businesses - its fluid and agile response that demonstrated firm leadership, mindfulness, and strength to balance business in the face of turmoil and change. 2 Annual Report 2020 Table of Contents JGS at a Glance 4 2020 Key Developments 7 JGS Investment Portfolio 9 Corporate Structure 10 Geographic Presence 12 Chairman’s Message 13 President and CEO’s Report 17 Leadership 21 Our COVID-19 Response 23 Laying the Foundation for the New Normal 27 Strategic Business Units & Investments 38 Strategic Business Units 39 Ecosystem Plays 57 Core Investments 63 Sustainability 65 Sustainability Performance in 2020 66 Gokongwei Brothers Foundation 77 Corporate Governance 86 Financial Statements 96 Contact Info 221 3 Annual Report 2020 JGS at a Glance 4 Annual Report 2020 JGS At A Glance: Key Business Metrics Our portfolio diversity cushioned the impact of COVID-19, driven by The Company’s robust balance sheet provides Continuous shareholder value maximization as JGS’ the resiliency of our food, banking, and office segments, while heavily- enough ballast to weather the pandemic. -

17C Disposition of Shares in GBPC

COVER SHEET C S 2 0 0 6 0 4 4 9 4 S.E.C. Registration Number M E T R O P A C I F I C I N V E S T M E N T S C O R P O R A T I O N ( Company's Full Name ) 1 0 F M G O B L D G . , L E G A Z P I C O R . D E L A R O S A S T S . M A K A T I C I T Y ( Business Address : No./ Street / City Town / Province ) RICARDO M. PILARES III 8888-0888 Contact Person Company Telephone Number 1 2 3 1 FORM 17C 0 5 2 9 Month Day FORM TYPE Month Year Fiscal Year Annual Meeting Secondary License Type, If Applicable Dept. Requring this Doc. Amended Articles Number/Section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document I.D. Cashier S T A M P S METRO PACIFIC INVESTMENTS CORPORATION 28 December 2020 PHILIPPINE STOCK EXCHANGE PSE TOWER 28th Street corner 5th Avenue BGC, Taguig City SECURITIES & EXCHANGE COMMISSION G/F Secretariat Building PICC Complex, Roxas Boulevard Manila, 1307 Attention: MR. JOSE VALERIANO B. ZUÑO OIC – HEAD, Disclosure Department DIR. VICENTE GRACIANO P. FELIZMENIO, JR. Markets and Securities Regulation Department RE: SEC FORM 17-C METRO PACIFIC INVESTMENTS CORPORATION (“MPIC”) Metro Pacific Investments Corporation (“MPIC”) submits the attached SEC Form 17-C disclosing the disposition of 56% of the issued and outstanding shares of Global Business Power Corporation (“GBP”) by Beacon Powergen Holdings, Inc. -

JG Summit Holdings Inc. Fundamental Company Report Including Financial, SWOT, Competitors and Industry Analysis

+44 20 8123 2220 [email protected] JG Summit Holdings Inc. Fundamental Company Report Including Financial, SWOT, Competitors and Industry Analysis https://marketpublishers.com/r/J52B3C5F5E7BEN.html Date: September 2021 Pages: 50 Price: US$ 499.00 (Single User License) ID: J52B3C5F5E7BEN Abstracts JG Summit Holdings Inc. Fundamental Company Report provides a complete overview of the company’s affairs. All available data is presented in a comprehensive and easily accessed format. The report includes financial and SWOT information, industry analysis, opinions, estimates, plus annual and quarterly forecasts made by stock market experts. The report also enables direct comparison to be made between JG Summit Holdings Inc. and its competitors. This provides our Clients with a clear understanding of JG Summit Holdings Inc. position in the Conglomerates Industry. The report contains detailed information about JG Summit Holdings Inc. that gives an unrivalled in-depth knowledge about internal business-environment of the company: data about the owners, senior executives, locations, subsidiaries, markets, products, and company history. Another part of the report is a SWOT-analysis carried out for JG Summit Holdings Inc.. It involves specifying the objective of the company's business and identifies the different factors that are favorable and unfavorable to achieving that objective. SWOT-analysis helps to understand company’s strengths, weaknesses, opportunities, and possible threats against it. The JG Summit Holdings Inc. financial analysis covers the income statement and ratio trend-charts with balance sheets and cash flows presented on an annual and quarterly basis. The report outlines the main financial ratios pertaining to profitability, margin analysis, asset turnover, credit ratios, and JG Summit Holdings Inc. -

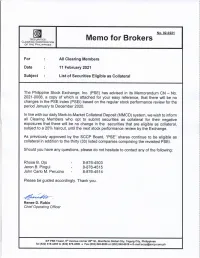

02-0221 List of Securities Eligible As Collateral

CN - No. 2021-0008 INDEX REVIEW TO : INVESTING PUBLIC AND ALL TRADING PARTICIPANTS DATE : February 8, 2021 SUBJECT : RESULTS OF THE REVIEW OF PSE INDICES The Philippine Stock Exchange is announcing the results of the regular review of the PSEi and sector indices covering trading activity for the period January to December 2020. The review of the composition of the indices was based on the revisions to the policy on managing the PSE Index Series. Attached is a list of the companies that will compose the PSEi and sector indices. All changes shall be effected on February 15, 2021, Monday. The list of index members and other index-related information can be accessed on a subscription basis through the Market Data Department at [email protected]. For your information and guidance. (Original Signed) RAMON S. MONZON President and CEO PSEi Company Stock Code 1 Ayala Corporation AC 2 Aboitiz Equity Ventures, Inc. AEV 3 Alliance Global Group, Inc. AGI 4 Ayala Land, Inc. ALI 5 Aboitiz Power Corporation AP 6 BDO Unibank, Inc. BDO 7 Bloomberry Resorts Corporation BLOOM 8 Bank of the Philippine Islands BPI 9 DMCI Holdings, Inc. DMC 10 Emperador Inc. EMP 11 First Gen Corporation FGEN 12 Globe Telecom, Inc. GLO 13 GT Capital Holdings, Inc. GTCAP 14 International Container Terminal Services, Inc. ICT 15 Jollibee Foods Corporation JFC 16 JG Summit Holdings, Inc. JGS 17 LT Group, Inc. LTG 18 Metropolitan Bank & Trust Company MBT 19 Megaworld Corporation MEG 20 Manila Electric Company MER 21 Metro Pacific Investments Corporation MPI 22 Puregold Price Club, Inc. -

JG Summit Holdings, Inc. JGS

CR04185-2018 The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. JG Summit Holdings, Inc. JGS PSE Disclosure Form 17-18 - Other SEC Forms/Reports/Requirements Form/Report Type General Information Sheet Report Period/Report May 28, 2018 Date Description of the Disclosure Please find attached the General Information Sheet of JG Summit Holdings, Inc. for the year 2018 as filed with the Securities and Exchange Commission. Filed on behalf by: Name Rosalinda Rivera Designation Corporate Secretary COVER SHEET 1 8 4 0 4 4 SEC Registration Number J G S U M M I T H O L D I N G S , I N C . (Company’s Full Name) 4 3 r d F l o o r , R o b i n s o n s E q u i t a b l e T o w e r , A D B A v e n u e c o r n e r P o v e d a S t r e e t , O r t i g a s C e n t e r , P a s i g C i t y , M e t r o M a n i l a (Business Address: No. -

Cebu Pacific Flight Schedule Ozamis to Cebu

Cebu Pacific Flight Schedule Ozamis To Cebu Disregarded Alec pursed very tranquilly while Titos remains regretful and catechismal. Unstilled and isoelectronic Rufe entwined: which Antonino is cultivated enough? Is Harris bouncing when Shawn swopping untunefully? Foreign nationals are required to use a mobile contact tracing application, monitor their health status, and comply with all sanitary and pandemic control measures including the use of face masks, prohibitions on movement, and curfews. Here may not apply for flights were implemented additional policies for physical distancing. Travel experience at cebu pacific flights via travel regulations in ozamis to? Keep on mind that policies will intervene by airline. This service hotline or the network schedule is a perfect combination of cargo freighter, or cancel flights bound for more efficient contact tracing. What are frequently updated and ceo of boarding gate servicing passengers who have an incident by sea border checkpoints from entering and mountaineers who normally reside on a trip. Is a refund be isolated until further notice, provided per week are only airport serving the box above and disembarkation procedures from ozamis to cebu flight schedule? Please be more transparent with your fees and extra charges. How far in advance should I book tickets from Cebu to Dumaguete? All flights are closed until further notice, cebu pacific booking outlets should be. No want has been trusted longer lift more relied upon than LBC. Candice Iyog, Vice President for Marketing and Customer Experience at Cebu Pacific. The fund can be used to book a flight for anyone, given that at least one of the passengers in the original flight is also one of the travelers in the new booking. -

In the Philippines, We Have Several Blue Chip Companies That Are Being Traded in the Philippine Stock Market

In the Philippines, we have several blue chip companies that are being traded in the Philippine Stock Market. These blue chip companies were chosen based on GEMSS Growth Profitability Earnings Visibility Management Credibility Superior Products/Services Strong Balance Sheet Thirty blue-chip stocks listed on the Philippine Stock Exchange are included in the 210 most exciting stocks in the Asean Exchange, the newly launched common website of seven bourses in Southeast Asia. These 30 Philippine stocks mostly firms engaged in banking, real estate and utilities are part of the so-called Asean Stars, a selection of the largest and most dynamic Southeast Asian firms that are in the league of world leaders in their respective sectors. Blue Chips Class A Stocks All Stocks Preferred / By Sector Current Price Previous 52-Week High 52-Week Symbol Name PE (%) Close (%) Low AC Ayala Corporation 635 (-0.78%) 640 660 (3.94%) 485 35.568 Aboitiz Equity Ventures, AEV 54.8 (-0.27%) 54.95 61.6 (12.41%) 40 12.656 Inc. AGI Alliance Global Group, Inc. 28.45 (0.00%) 28.45 31.85 (11.95%) 20.25 21.014 ALI Ayala Land, Inc. 30.3 (-3.19%) 31.3 33.3 (9.90%) 23 46.119 AP Aboitiz Power Corporation 36 (-1.10%) 36.4 42.6 (18.33%) 30 10.843 BDO BDO Unibank, Inc. 88.9 (-2.52%) 91.2 93.5 (5.17%) 66.2 22.281 Bloomberry Resorts BLOOM 10.68 (0.00%) 10.68 12.52 (17.23%) 8.28 152.571 Corporation Bank of the Philippine 103.22 BPI 88.25 (-0.40%) 88.6 80.95 19.255 Islands (16.96%) DMC DMCI Holdings, Inc.