August 8, 2000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sec Form 20-Is

SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 20 OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: [ √ ] Preliminary Information Statement [ ] Definitive Information Statement 2. Name of Registrant as specified in its charter PHILIPPINE BUSINESS BANK, INC. 3. Caloocan City, Philippines Province, country or other jurisdiction of incorporation or organization 4. SEC Identification Number A199701584 5. BIR Tax Identification Code 000-005-469-606 6. 350 Rizal Avenue corner 8th Avenue Gracepark, Caloocan City 1400________ Address of principal office Postal Code 7. Registrant’s telephone number, including area code (02) 363-33-33 8. May 30, 2014- 2:00 p.m. at New World Makati Hotel Esperanza Street corner Makati Avenue, Ayala Center, Makati City, 1228 Philippines. Date, time and place of the meeting of security holders 9. Approximate date on which the Information Statement is first to be sent or given to security holders on or before May 09, 2014. 10. In case of Proxy Solicitations: PHILIPPINE BUSINESS BANK IS NOT SOLICITING PROXIES. 11. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate registrants): Title of Each Class Number of Shares of Common Stock Outstanding or Amount of Debt Outstanding Common 343,333,400 12. Are any or all of registrant's securities listed in a Stock Exchange? Yes __√___ No _______ If yes, disclose the name of such Stock Exchange and the class of securities listed therein: PHILIPPINE STOCK EXCHANGE COMMON SHARES OF STOCK SEC Form 17-IS 1 December 2003 PHILIPPINE BUSINESS BANK, INC. -

TOP LEADERS FORUM Profiles of Roundtable Participants

TOP LEADERS FORUM Profiles of Roundtable Participants MR. FRANCIS C. CHUA Hononary President, Federation of Filipino Chinese Chambers of Commerce and Industry Chairman and President, BA Securities President, Philippine Satelite Corporation Vice Chairman, Basic Energy Corp. Director, Basic Diversified Industrial Holdings Basic Diversified Industrial Holdings Inc. is an investment holding company which operates in sectors like petrochemicals, power generation, industrial gases, water distribution and crystals manufacturing. He is also the Chairman and Independent Director of 2Go Group Inc., 2Go Group Inc. The group maintains the largest and widest logistics infrastructure across the Philippines with seamless links to over 150 countries. Over 185 branches and outlets Over 400,000 TEU capacity (50% market share of domestic freight) 16 passage and freight vessels 15,000 containers; 550 trucks; 1,200 trailers; 250 motorcycles 35 Cross-dock warehouses nationwide 70,000 square meters of Distribution Center operations MR. ROBERTO CLAUDIO Vice Chairman for International Relations, Philippine Retailers Assocition PRA has wide membership base nationwide but it also established effective representation from industry members all over the country. Through the establishment of provincial chapters, the PRA is able to approach the problems and issues facing retailers all over the country with a more unified, comprehensive, and coordinated response. MS. MARGARITA LOPEZ Senior Vice President and Chief Operations Officer, Manulife Philippines She has about 23 years of experience in process, product and technology management with various senior or project lead positions in the insurance, banking, brokering, manufacturing, distribution, airline and mining industries, as well as telecommunications and utilities. Her expertise lie in the areas of strategic planning, strategic product development, customer services, technology & support operations, project management, product implementation, and support & staff development. -

Sec Form 20-Is

SEC Form 17-IS 2 December 2003 SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 20 OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: [ ] Preliminary Information Statement [ √ ] Definitive Information Statement 2. Name of Registrant as specified in its charter PHILIPPINE BUSINESS BANK, INC. 3. Caloocan City, Philippines Province, country or other jurisdiction of incorporation or organization 4. SEC Identification Number A199701584 5. BIR Tax Identification Code 000-005-469-606 6. 350 Rizal Avenue corner 8th Avenue Gracepark, Caloocan City 1400________ Address of principal office Postal Code 7. Registrant’s telephone number, including area code (02) 363-33-33 8. May 26, 2017 @ 2:00 p.m. at the Diamond Hotel, Roxas Blvd. Corner Dr. J. Quintos Street, Manila. Date, time and place of the special meeting of security holders 9. Approximate date on which the Information Statement is first to be sent or given to security holders on or before May 05, 2017. 10. In case of Proxy Solicitations: PHILIPPINE BUSINESS BANK IS NOT SOLICITING PROXIES. 11. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate registrants): Title of Each Class Number of Shares of Common Stock Outstanding or Amount of Debt Outstanding Common 536,458,423 12. Are any or all of registrant's securities listed in a Stock Exchange? Yes __√ ___ No _______ If yes, disclose the name of such Stock Exchange and the class of securities listed therein: PHILIPPINE STOCK EXCHANGE COMMON SHARES OF STOCK SEC Form 17-IS 1 December 2003 PHILIPPINE BUSINESS BANK, INC. -

IMPORTANT: You Must Read the Following Disclaimer Before Continuing. the Following Disclaimer Applies to the Offering Circular Following This Page

IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the Offering Circular following this page. You are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the Offering Circular. In accessing the Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to it from time to time, each time you receive any information from the Issuer, the Arranger, and the Selling Agents (as such terms are defined in the attached Offering Circular). NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICITON WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT, BE REGISTERED WITH THE PHILIPPINE SECURITIES AND EXCHANGE COMMISSION (THE "SEC"). Confirmation of your representation: This Offering Circular is being sent at your request and by accepting the email and accessing this Offering Circular, you shall have confirmed that (1) you are a person to whom it is lawful to deliver, or to grant access to the attached Offering Circular through electronic means, and (2) that you consent to the delivery of, or your being granted access to this document through electronic means. This document has been made available to you in electronic form. You are reminded that documents made available to you through this medium may have been altered or changed during the process of electronic transmission or access and consequently the Issuer, the Arranger, and the Selling Agents and their respective affiliates accept no liability or responsibility whatsoever in respect of any difference between this electronic version of the Offering Circular made available to you and the hard copy version. -

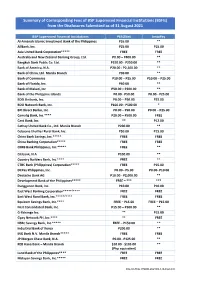

Summary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) from the Disclosures Submitted As of 31 August 2021

Summary of Corresponding Fees of BSP Supervised Financial Institutions (BSFIs) from the Disclosures Submitted as of 31 August 2021 BSP Supervised Financial Institutions PESONet InstaPay Al-Amanah Islamic Investment Bank of the Philippines P55.00 ** AllBank, Inc. P25.00 P15.00 Asia United Bank Corporation***** FREE FREE Australia and New Zealand Banking Group, Ltd. P0.00 – P400.00 ** Bangkok Bank Public Co. Ltd. P150.00 - P250.00 ** Bank of America, N.A. P20.00 - P2,100.00 ** Bank of China, Ltd. Manila Branch P30.00 ** Bank of Commerce P10.00 – P25.00 P10.00 – P25.00 Bank of Florida, Inc. P50.00 ** Bank of Makati, Inc P50.00 – P300.00 ** Bank of the Philippine Islands P0.00 - P50.00 P0.00 - P25.00 BDO Unibank, Inc. P0.00 – P50.00 P25.00 BDO Network Bank, Inc. P100.00 - P500.00 * BPI Direct Banko, Inc. P0.00 – P50.00 P0.00 – P25.00 Camalig Bank, Inc.**** P20.00 – P500.00 FREE Card Bank, Inc. ** P12.00 Cathay United Bank Co., Ltd. Manila Branch P200.00 ** Cebuana Lhuillier Rural Bank, Inc. P50.00 P15.00 China Bank Savings, Inc.***** FREE FREE China Banking Corporation***** FREE FREE CIMB Bank Philippines, Inc.***** FREE ** Citibank, N.A P100.00 ** Country Builders Bank, Inc.**** FREE ** CTBC Bank (Philippines) Corporation***** FREE P15.00 DCPay Philippines, Inc. P0.00 - P5.00 P0.00- P10.00 Deutsche Bank AG P10.00 - P2,000.00 ** Development Bank of the Philippines***** FREE – *** *** Dungganon Bank, Inc. P10.00 P10.00 East West Banking Corporation*****/**** FREE FREE East West Rural Bank, Inc.*****/**** FREE FREE Equicom Savings Bank, Inc.**** FREE – P15.00 FREE – P15.00 First Consolidated Bank, Inc. -

Securities and Exchange Commission Sec Form 17-A

SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended December 31, 2015 2. SEC Identification Number A199701584 3. BIR Tax Identification No. 000-005-469-606 4. Exact name of issuer as specified in its charter PHILIPPINE BUSINESS BANK, INC. 5. CALOOCAN 6. (SEC Use Only) Province, Country or other jurisdiction Industry Classification Code: of incorporation or organization 7. 350 Rizal Avenue corner 8th Avenue Gracepark, Caloocan City 1400________ Address of principal office Postal Code 8. (02) 363-33-33 Issuer's telephone number, including area code 9. Not Applicable Former name, former address, and former fiscal year, if changed since last report. 10. Securities registered pursuant to Sections 8 and 12 of the SRC, or Sec. 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding COMMON 536,458,423 11. Are any or all of these securities listed on a Stock Exchange. Yes [ x ] No [ ] If yes, state the name of such stock exchange and the classes of securities listed therein: PHILIPPINE STOCK EXCHANGE COMMON SHARES OF STOCK 12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17.1 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of SEC Form 17-A Philippine Business Bank 1 The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports); Yes [ x ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. -

Powerpdf File

PHILIPPINE SAVINGS BANK (A banking corporation organized and existing under Philippine Laws) P5,084,500,000 5% Long Term Negotiable Certificates of Time Deposit Due 2024 Issue Price 100% The P5,084,500,000 5% Long-Term Negotiable Certificates of Time Deposit Due 2024 (the “Series 2 LTNCTDs”) will be issued in an aggregate principal amount of P5,084,500,000 by Philippine Savings Bank (“PSBank” or the “Issuer”). The Series 2 LTNCTDs will bear fixed interest at the rate of 5% per annum from and including August 9, 2018 up to but excluding February 9, 2024. The interest of the Series 2 LTNCTDs for the entire term will be payable quarterly in arrears on November 9, February 9, May 9 and August 9 of each year, commencing on November 9, 2018. The Series 2 LTNCTDs will mature on February 9, 2024 (the “Maturity Date”). Subject as set out below and in “Terms and Conditions of the Series 2 LTNCTDs”, the Series 2 LTNCTDs may be redeemed, in whole but not in part only, at the option of the Issuer on the Pre-Termination Date, at 100% of the face value (as defined in “Terms and Conditions of the LTNCTDs”) of the Series 2 LTNCTDs plus accrued and unpaid interest as of but excluding the Pre-Termination Date. In the event of the proper exercise of the Pre-Termination Option, the Issuer shall shoulder the taxes due, if any, on the interest income already earned by the CD Holders. The Series 2 LTNCTDs will constitute direct, unconditional, unsecured and unsubordinated obligations of the Issuer. -

USAID E-PESO ACTIVITY Final Report

USAID E-PESO ACTIVITY Final Report (DRAFT) January 2021 Prepared for the United States Agency for International Development by Chemonics International Inc. under Contract No. AID-492-C-15-0001. The author’s views expressed in this publication do not necessarily reflect the views of the United States Agency for International Development or the United States Government. Contents Acronyms…………………………………………………………………………………….1 Executive Summary…………………………………………………………………………..3 Project Overview and Introduction…………………………………………………………6 Project Achievements and Major Accomplishments………………………………………...8 SUB PURPOSE 1: Rapid Adoption of E-Payments in Financial Systems…………………….8 SUB PURPOSE 2: Infrastructure for E-Payments Expanded………………………………...24 SUB PURPOSE 3: Enabling Environment for E-Payments Improved………………………..32 SUB PURPOSE 4: Gaps in Broader E-Payment Ecosystem Addressed……………………..47 Covid-19 Response………………………………………………………………………….56 Integration of Crosscutting Issues and USAID Forward Priorities…………………………63 Gender Equality, Female Empowerment, And Disability Action………………………63 Policy and Governance Support………………………………………………………..63 Public Private Partnerships (PPP)………………………………………………………66 Stakeholder Participation and Involvement……………………………………………67 Targets and Indicators (M&E)……………………………………………………………….68 ANNEX 1: Press Coverage and Mentions…………………………………………….……82 ANNEX 2: Summary of Results to Date by Key Indicator………………………………....84 ANNEX 3: Institutions with PESONet and/or Instapay-Enabled Products Available on their Internet and/or Mobile Channels……………………………………..126 -

Philpassplus Participants As of 31 August 2021

PhilPaSSplus Participants As of 31 August 2021 Universal & Commercial Banks 46 Thrift Banks 35 Rural Banks 93 Non-Banks with Quasi-Banking Functions 5 BSP Units, FMIs & CSOs 10 Total 189 * All listed institutions/ units are direct participants that initiate payment instruction to PhilPaSSplus Universal & Commercial Banks 1 AL AMANAH ISLAMIC BANK 26 J.P. MORGAN CHASE BANK N.A. 2 ASIA UNITED BANK CORPORATION 27 KEB HANA BANK - MANILA BRANCH 3 AUSTRALIA AND NEW ZEALAND BANKING 28 LAND BANK OF THE PHILIPPINES 4 BANGKOK BANK PUBLIC COMPANY LIMITED 29 MAYBANK PHILIPPINES INCORPORATED 5 BANK OF AMERICA NA MANILA 30 MEGA INTERNATIONAL COMMERCIAL BANK CO. LTD 6 BANK OF CHINA MANILA BRANCH 31 METROPOLITAN BANK AND TRUST COMPANY 7 BANK OF COMMERCE 32 MIZUHO BANK, LTD. 8 BANK OF THE PHILIPPINE ISLANDS 33 MUFG BANK, LTD. - MANILA BRANCH 9 BDO PRIVATE BANK 34 PHILIPPINE BANK OF COMMUNICATIONS 10 BDO UNIBANK, INC. 35 PHILIPPINE NATIONAL BANK 11 CATHAY UNITED BANK CO LTD MANILA BRANCH 36 PHILIPPINE VETERANS BANK 12 CHANG HWA COMMERCIAL BANK, LTD., MANILA BRANCH 37 PHILTRUST BANK 13 CHINA BANKING CORPORATION 38 RIZAL COMMERCIAL BANKING CORP 14 CIMB BANK PHILIPPINES 39 ROBINSONS BANK CORP. 15 CITIBANK NA MANILA BRANCH 40 SECURITY BANK AND TRUST CORPORATION 16 CTBC BANK (PHILIPPINES) CORP. 41 SHINHAN BANK MANILA BRANCH 17 DEUTSCHE BANK AG 42 STANDARD CHARTERED BANK 18 DEVELOPMENT BANK OF THE PHILIPPINES 43 SUMITOMO MITSUI BANKING CORPORATION 19 EAST WEST BANKING CORPORATION 44 UNION BANK OF THE PHILIPPINES 20 FIRST COMMERCIAL BANK LTD. - MANILA BRANCH 45 UNITED COCONUT PLANTERS BANK 21 HONG KONG AND SHANGHAI BANKING CORPORATION 46 UNITED OVERSEAS BANK LIMITED, MANILA BRANCH 22 HUA NAN COMMERCIAL BANK, LTD., MANILA BRANCH 080923 June JuneINDUSTRIAL 2021 2021 AND COMMERCIAL BANK OF CHINA - MANILA BRANCH 24 INDUSTRIAL BANK OF KOREA MANILA BRANCH 25 ING BANK NV Thrift Banks 1 1ST VALLEY BANK INC. -

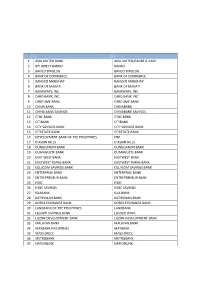

List of Bancnet Member Banks and Short Names

TABLE OF BANCNET MEMBER BANKS AND SHORT NAMES AS OF OCTOBER 2017 CNT BANK NAME BANK NAME IN THE ATM SCREENS 1 ASIA UNITED BANK ASIA UNITED/GLOBE G-CASH 2 BPI DIRECT BANKO BANKO 3 BANCO DIPOLOG BANCO DIPOLOG 4 BANK OF COMMERCE BANK OF COMMERCE 5 BANGKO MABUHAY BANGKO MABUHAY 6 BANK OF MAKATI BANK OF MAKATI 7 BANKWAYS, INC. BANKWAYS, INC. 8 CARD BANK, INC. CARD BANK, INC. 9 CARD SME BANK CARD SME BANK 10 CHINA BANK CHINABANK 11 CHINA BANK SAVINGS CHINABANK SAVINGS 12 CTBC BANK CTBC BANK 13 CITIBANK CITIBANK 14 CITY SAVINGS BANK CITY SAVINGS BANK 15 CITYSTATE BANK CITYSTATE BANK 16 DEVELOPMENT BANK OF THE PHILIPPINES DBP 17 D'ASIAN HILLS D ASIAN HILLS 18 DUNGGANON BANK DUNGGANON BANK 19 DUMAGUETE BANK DUMAGUETE BANK 20 EAST WEST BANK EASTWEST BANK 21 EASTWEST RURAL BANK EASTWEST RURAL BANK 22 EQUICOM SAVINGS BANK EQUICOM SAVINGS BANK 23 ENTERPRISE BANK ENTERPRISE BANK 24 ENTREPRENEUR BANK ENTREPRENEUR BANK 25 HSBC HSBC 26 HSBC SAVINGS HSBC SAVINGS 27 ISLABANK ISLA BANK 28 KATIPUNAN BANK KATIPUNAN BANK 29 KOREA EXCHANGE BANK KOREA EXCHANGE BANK 30 LANDBANK OF THE PHILIPPINES LANDBANK 31 LEGAZPI SAVINGS BANK LEGAZPI BANK 32 LUZON DEVELOPMENT BANK LUZON DEVELOPMENT BANK 33 MALAYAN BANK MALAYAN BANK 34 MAYBANK PHILIPPINES MAYBANK 35 MASS-SPECC MASS-SPECC 36 METROBANK METROBANK 37 NATIONLINK NATIONLINK CNT BANK NAME BANK NAME IN THE ATM SCREENS 38 OMNIPAY, INC. OMNIPAY, INC. 39 ONE NETWORK BANK ONE NETWORK BANK 40 OPPORTUNITY MICROFINANCE OPPORTUNITY BANK 41 PACIFIC ACE SAVINGS BANK PACIFIC ACE SAVINGS BANK 42 PARTNER RURAL BANK PARTNER RURAL -

Pesonet ACH Participants (As of 31 July 2021)

PESONet ACH Participants (as of 31 August 2021) Universal and Commercial Banks (U/KBs) Thrift Banks (TBs) Rural Banks (RBs) 1. Al-Amanah Islamic Investment Bank of the 22. KEB Hana Bank – Manila Branch 1. AllBank, Inc. 1. Bangko Mabuhay, Inc. Philippines 23. Land Bank of the Philippines 2. Bangko Kabayan, Inc. 2. Bangko Nuestra Señora del Pilar, Inc. 2. Asia United Bank Corporation 24. Maybank Philippines, Inc. 3. Bank of Makati, Inc. 3. Bank of Florida, Inc. 4. BPI Direct BanKO, Inc. 4. BDO Network Bank, Inc. 3. Australia and New Zealand Banking Group Ltd. 25. Mega International Commercial Bank Co., Ltd. 5. China Bank Savings, Inc. 5. Camalig Bank, Inc. 4. Bangkok Bank Public Co. Ltd. 26. Metropolitan Bank and Trust Company 6. Dumaguete City Development Bank, Inc. 6. Cantilan Bank, Inc. 5. Bank of America, N.A 27. Mizuho Bank, Ltd. – Manila Branch 7. Equicom Savings Bank, Inc. 7. Cebuana Lhuillier Rural Bank, Inc. 6. Bank of China Ltd. – Manila Branch 28. MUFG Bank, Ltd. 8. First Consolidated Bank, Inc. 8. Community Rural Bank of Romblon 7. Bank of Commerce 29. Philippine Bank of Communications 9. HSBC Savings Bank, Inc. 9. Country Builders Bank, Inc. 8. Bank of the Philippine Islands 30. Philippine National Bank 10. Malayan Bank Savings and Mortgage Bank 10. Dungganon Bank, Inc. 9. BDO Unibank, Inc. 31. Philippine Trust Company 11. Philippine Business Bank, Inc. 11. East West Rural Bank, Inc. 10. Cathay United Bank Co., Ltd. 32. Philippine Veterans Bank 12. Philippine Savings Bank 12. Guagua Rural Bank, Inc. 11. China Banking Corporation 33. -

Sec Form 20-Is

SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 20 OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: [ √ ] Preliminary Information Statement [ ] Definitive Information Statement 2. Name of Registrant as specified in its charter PHILIPPINE BUSINESS BANK, INC. 3. Caloocan City, Philippines Province, country or other jurisdiction of incorporation or organization 4. SEC Identification Number A199701584 5. BIR Tax Identification Code 000-005-469-606 6. 350 Rizal Avenue corner 8th Avenue Gracepark, Caloocan City 1400________ Address of principal office Postal Code 7. Registrant’s telephone number, including area code (02) 363-33-33 8. May 29, 2015- 2:00 p.m. at Diamond Hotel, Roxas Boulevard corner Dr. J. Quintos Street, Manila, Philippines. Date, time and place of the meeting of security holders 9. Approximate date on which the Information Statement is first to be sent or given to security holders on or before May 12, 2015. 10. In case of Proxy Solicitations: PHILIPPINE BUSINESS BANK IS NOT SOLICITING PROXIES. 11. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate registrants): Title of Each Class Number of Shares of Common Stock Outstanding or Amount of Debt Outstanding Common 429,166,750 12. Are any or all of registrant's securities listed in a Stock Exchange? Yes __√___ No _______ If yes, disclose the name of such Stock Exchange and the class of securities listed therein: PHILIPPINE STOCK EXCHANGE COMMON SHARES OF STOCK SEC Form 17-IS 1 December 2003 PHILIPPINE BUSINESS BANK, INC.