2016-17 Potential Linked Credit Plan 2016-17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District Census Handbook, Anantapur

CENSUS OF INDIA 1981 SERIES 2 ANDHRA PRADESH DISTRICT CENSUS HANDBOOK ANANTAPUR PARTS XIII-A & B VILLAGE & TOWN DIRECTORY VILLAGE & TOWNWISE PRIMARY CENSUS· ABSTRACT S. S. JAYA RAO OF THE INDIAN ADMINISTRATIVE SERVICE DIRECTOR OF CENSUS OPERATIONS ANDHRA PRADESH PUBLISHED BY THE GOVERNMENT OF ANDHRA PRADESH .1986 SRI KRISHNADEVARA YA UNIVERSITY, ANANTAPUR The motif given on the cover page is the Library Building representing Sri Krishnadevaraya University, Anantapur. Land of Diamonds and Great Empires, Rayalaseema, heir to a very rich and varied cultural heritage, now proudly advances to a new milestone in her progress when the new University was inaugurated on the 22nd November, 1981. True to the legacy of the golden era, the new University is named after SRI KRISHNADEVARAYA, the greatest of the Vijayanagara Rulers. The formation of Sri Krishnadevaraya University fulfils the long cherished dreams and aspirations of the students, academicians, educationists and the general public of the region. The new University originated through the establishment of a Post-Graduate Centre at Anantapur which was commissioned in 1968 with the Departments of Telugu, English, Mathematics, Chemistry and Physics with a strength of 60 students and 26 faculty members. It took its umbrage in the local Government Arts Col/ege, Anantapur as an affiliate to the Sri Venkateswara University. In 1971, the Post-Graduate Centle moved into its own campus at a distance of 11 Kilometers from Anantapur City on the Madras Highway in an area of 243 hectares. The campus then had just two blocks, housing Physical Sciences and Humanities with a few quarters for the staff and a hostel for the boys. -

Prl. District Court, Anantapur. Sl.No. Name & Designation E-Mail Ids

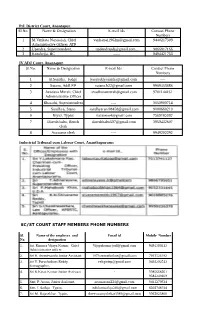

Prl. District Court, Anantapur. Sl.No. Name & Designation E-mail Ids Contact Phone Numbers 1 M.Venkata Narasaiah, Chief [email protected] 9440217309 Administrative Officer, ATP 2 Upendra, Superintendent, [email protected]., 9866917166 3 Kenchejja, BC ----- 9494421753 IV ADJ Court, Anantapur. Sl.No. Name & Designation E-mail Ids Contact Phone Numbers 1 B.Sunitha, Judge [email protected] ---- 2 Sujana, Addl.P.P [email protected] 9989453888 3 Avadana Murali, Chief [email protected] 9701144161 Administrative Officer 4 Bharathi, Superintendent ---- 9059909714 5 Sandhya, Steno [email protected] 9000660210 6 Riyaz, Typist [email protected] 7569105302 7 Dinesh babu, Bench [email protected] 9959432607 clerk 8 Accounts clerk ---- 9949202292 Industrial Tribunal cum Labour Court, Ananthapuramu SC/ST COURT STAFF MEMBERS PHONE NUMBERS Sl. Name of the employee and Email id Mobile Number No. designation 1. Sri. Kinnera Vijaya Kumar, Chief [email protected] 9491200312 Administrative officer. 2. Sri H. Sreenivasulu Junior Assistant [email protected] 7013526182 3. Sri V. Purushotham Reddy, [email protected] 9492292513 Stenographer, 4. Sri K.Kiran Kumar Junior Assistant - 9985668261 9581249469 5. Smt. P. Aruna, Junior Assistant, [email protected] 9441270634 6. Smt. I. Sailaja Typist, [email protected] 6303748744 7. Sri M. Rajasekhar, Typist, [email protected] 9963023800 Judge, Family Court, Ananthapuramu Sl.No. Name & Designation E-mail Ids Contact Phone Numbers 1 T.Venkateswarulu, Judge, [email protected]., 94918 11355 Family Court, Ananthapuramu 2 Y.V.Manohar, A.O. [email protected]., 93814 77809 3 V.Thirupathi Naidu, [email protected]., 99492 10776 Addl. Public Prosecutor 4 G.Nagaraju, Sr.Assistant [email protected]., 77991 50889 5 B.Pushpalatha, Steno [email protected]., 98491 53152 6 K.Sivaprasad , Typist [email protected]., 91829 68283 Prl. -

PROFILE of ANANTAPUR DISTRICT the Effective Functioning of Any Institution Largely Depends on The

PROFILE OF ANANTAPUR DISTRICT The effective functioning of any institution largely depends on the socio-economic environment in which it is functioning. It is especially true in case of institutions which are functioning for the development of rural areas. Hence, an attempt is made here to present a socio economic profile of Anantapur district, which happens to be one of the areas of operation of DRDA under study. Profile of Anantapur District Anantapur offers some vivid glimpses of the pre-historic past. It is generally held that the place got its name from 'Anantasagaram', a big tank, which means ‘Endless Ocean’. The villages of Anantasagaram and Bukkarayasamudram were constructed by Chilkkavodeya, the Minister of Bukka-I, a Vijayanagar ruler. Some authorities assert that Anantasagaram was named after Bukka's queen, while some contend that it must have been known after Anantarasa Chikkavodeya himself, as Bukka had no queen by that name. Anantapur is familiarly known as ‘Hande Anantapuram’. 'Hande' means chief of the Vijayanagar period. Anantapur and a few other places were gifted by the Vijayanagar rulers to Hanumappa Naidu of the Hande family. The place subsequently came under the Qutub Shahis, Mughals, and the Nawabs of Kadapa, although the Hande chiefs continued to rule as their subordinates. It was occupied by the Palegar of Bellary during the time of Ramappa but was eventually won back by 136 his son, Siddappa. Morari Rao Ghorpade attacked Anantapur in 1757. Though the army resisted for some time, Siddappa ultimately bought off the enemy for Rs.50, 000. Anantapur then came into the possession of Hyder Ali and Tipu Sultan. -

A) Highlights: Hon’Ble Chief Ministers Message : ‘Stay Home, Stay Safe, Respect Lockdown’

1 DISTRICT CONTROL ROOM COLLECTORATE, ANANTHAPURAMU Email: [email protected], Land: 08554-220009, Mobile: 8500292992 Media Bulletin No. 17 Date: 12/04/2020 (04.00 PM) A) Highlights: Hon’ble Chief Ministers Message : ‘Stay Home, Stay Safe, Respect Lockdown’ As of now no new cases have been identified from yesterday 06.00 PM to today 09.00 AM. Cumulative Positive case details as mentioned below. Patient District Town Age(Y) Gender Travel / Contact Details Date of No. Reporting Close Contact of Mecca 1 Anantapur Lepakshi 11 M 29.03.2020 Returnee in Karnataka 2 Anantapur Hindupur 34 F Mecca Returnee 29.03.2020 Primary contact of Mecca Returnee (Died on 3 Anantapur Hindupur 60 M 04.04.2020 04.04.2020 at GGH, Ananthapuram) Hindupur, Housing Primary Contact of No.3 4 Anantapur 29 M 05.04.2020 Board Colony Patient(SON) Hindupur, Housing Primary Contact of No.3 5 Anantapur 77 F 05.04.2020 Board Colony Patient(Mother) Hindupur, Driver of Ambulance of No.3 6 Anantapur 39 M 05.04.2020 Mukkidipeta Patient Anantapur, Senior Resident Doctor who 7 Anantapur Ramnagar ,2nd 30 M 08.04.2020 treated No.3 Patient cross Anantapur Anantapur, Jesus House Surgeon who treated 8 24 M 08.04.2020 Nagar No.3 Patient Anantapur, 80 Ft Staff Nurse who has given 9 Anantapur 44 F 08.04.2020 Road,Sri Nagar nursing care to No.3 Patient Anantapur Anantapur, Sai Staff Nurse who has given 10 29 F 08.04.2020 Nagar nursing care to No.3 Patient Anantapur Hindupur, Close Physical Contact with 11 39 M 08.04.2020 Mukkidipeta confirmed case Anantapur Hindupur, Close Physical Contact with 12 36 M 08.04.2020 Mukkidipeta confirmed case Anantapur Kalyanadurgam, 13 70 M Patient Died on 07.04.2020 08.04.2020 Manirevu(v) 14 Anantapur Kothacheruvu 58 M 09.04.2020 Anantapur Lakshminarasayy 15 a colony, 44 F Staff Nurse in GGH 09.04.2020 Anantapuramu DETAILS OF THE POSITIVE CASES AS ON 12.04.2020 Positive Cases District Name Death Positive Alive Total Cases Ananthapuramu 13 2 15 2 As of now 299 people are in different quarantine centers in Ananthapuramu District Containment Zones Details No. -

PROCEEDINGS of the HIGH COURT of JUDICATURE at HYDERABAD for the STATE of TELANGANA and the STATE of ANDHRA PRADESH

PROCEEDINGS OF THE HIGH COURT OF JUDICATURE AT HYDERABAD FOR ThE STATE OF TELANGANA AND ThE STATE OF ANDHRA PRADESH SUB: AWARENESS PROGRAMME — MEDIATION AND ARBITRATION CENTRE, HYDERABAD - Nomination of 10 Judicial Officers of Ananthapuram District to participate in the Awareness Programme on Mediation to be conducted on 23.04.2016 at District Legal Services Authority, Ananthapuram — ORDERS — ISSUED. REF: Letter ROC.No.117/HCMAC/2016, dated 20.04.2016 from the Deputy Director, Mediation and Arbitration Centre, High Court of Judicature at Hyderabad. ORDER ROC..No. 291012016-B.SPL., DATED: 21.04.2016 The High Court is pleased to pass the following Orders: The following 10 Judicial Officers working in Ananthapuram District, are hereby nominated to participate in the Awareness Programme on Mediation to be conducted on 23.04.2016 at District Legal Services Authority, Ananthapuram and directed to proceed to attend the said programme at Ananthapuram. SL.NO. NAME AND DESIGNATION OF THE NOMINATED OFFICERS 1. Smt. G.Malathi, PrI. Senior Civil Judge, Ananthapuram. 2. Sri V.Srinivasulu, Addi. Senior Civil Judge, Ananthapuram. 3. Sri M.Bujjappa, PrI. Junior Civil Judge, Ananthapuram. 4. Smt. C.R.Sumalatha, Senior Civil Judge, Penukonda. 5. Smt. T.Rajya Lakshmi, Senior Civil Judge, Dharmavaram. 6. Sri Shaik Mohammed Fazulullah, Senior Civil Judge, Kadiri. 7. Sri Syed Kaleemullah, Junior Civil Judge, Tadipatri. 8. Sri V.Adinarayana, Addi. Junior Civil Judge, Kadiri. 9. Kum. A.Sai Kumari, Junior Civil Judge, Uravakonda. 10. Sri S.Kamalakar Reddy, Secretary, District Legal Services Authority, Ananthapuram. The PrI. District and Sessions Judge, Ananthapuram is directed to make necessary incharge arrangements in respect of the above said nominated officers to the said Awareness Programme on 23.04.2016, under intimation to the High Court. -

Ministry of Personnel, Public Grievances & Pensions

No. 31/16/2019-EO(MM I) Ministry of Personnel, Public Grievances & Pensions (Department of Personnel and Training) North Block, New Delhi 2nd Dated, the July 2019 OFFICE MEMORANDUM Subject: Appointment of Officers in respect of Jal Shakti Abhiyan. The undersigned is directed to refer to this Department's OM of even number dated 25.6.2019 and 26.6.2019 wherein the appointment of Central Prabhari Officers and Block Nodal Officers for Jal Shakti Abhiyan had been communicated to concerned Ministries/Departments. 2. In this regard, having considered the requests received from various Ministries/Departments for exempting some officers from placement under Jal Shakti Abhiyan, the Competent Authority has approved certain changes in the duties allotted to Central Prabhari Officers and Block Nodal Officers. The revised consolidated lists of Central Prabhari Officers and Block Nodal Officers are attached as Annexure I & II. Further, the lists of Central Prabhari Officers and Block Nodal Officers who have been replaced are attached as Annexure Ill & IV. 3. The Central Prabhari officers (AS/JS level) will be working with a team of Block Nodal Officers at Director/Deputy Secretary level and ground water scientists and engineers apart from the State and District teams. These teams would be visiting the identified blocks and districts coordinating implementation of various water harvesting and conservation measures. 4. The concerned officers who have been appointed as Central Prabhari Officers and Block Nodal Officers for Jal Shakti Abhiyaan may be directed to take up the assignment as soon as possible. For any clarification, they may contact Shri Samir Kumar, Joint Secretary, Department of Drinking Water & Sanitation (Mob. -

IFB No: 1/CE(R&B)

Invitation for bids GOVERNMENT OF ANDHRA PRADESH ROADS & BUILDINGS DEPARTMENT ANDHRA PRADESH ROADS AND BRIDGES RECONSTRUCTION PROJECT (APRBRP) & ANDHRA PRADESH MANDAL CONNECTIVITY & RURAL CONNECTIVITY IMPROVEMENT PROJECT (APMCRCIP) INVITATIONS FOR BIDS (IFB) OPEN COMPETITIVE BIDDING (Two Envelope bidding Processes with e-procurement with Reverse Tendering) Date : 30.07.2020 IFB No: 1/CE(R&B),NABARD,LWE&NDB/01 to 05/ APRBRP &APMCRCIP/2020-21 1. The Government of India has applied financing from the New Development Bank towards the cost of Andhra Pradesh Roads and Bridges Reconstruction Project (APRBRP) and Andhra Pradesh Mandal Connectivity & Rural Connectivity Improvement Project (APMCRCIP) and intends to apply a part of the funds to cover eligible payments under the contracts for construction of works as detailed below. Bidding is open to all bidders from NDB Member Countries. Bidders from India should, however, be registered with the Government of Andhra Pradesh or other State Government / Government of India, or State/Central Government Undertakings. Bidders are advised to note the minimum qualification criteria specified in Clause 5 of the instructions to Bidders to qualify for the award of the contract. 2. The Chief Engineer(R&B), NABARD&LWE and NDB, invites bids for the construction of works detailed in the table given below. 3. The Bid Documents are available online and can be downloaded free of cost by logging on the link https://eprocure.gov.in from 12.08.2020, 3:00 PM (IST) to 11.09.2020, 1:00 PM (IST). The bids are to be submitted online through the e procurement portal “https://eprocure.gov.in” only. -

Annexure-V State/Circle Wise List of Post Offices Modernised/Upgraded

State/Circle wise list of Post Offices modernised/upgraded for Automatic Teller Machine (ATM) Annexure-V Sl No. State/UT Circle Office Regional Office Divisional Office Name of Operational Post Office ATMs Pin 1 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA PRAKASAM Addanki SO 523201 2 Andhra Pradesh ANDHRA PRADESH KURNOOL KURNOOL Adoni H.O 518301 3 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM AMALAPURAM Amalapuram H.O 533201 4 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Anantapur H.O 515001 5 Andhra Pradesh ANDHRA PRADESH Vijayawada Machilipatnam Avanigadda H.O 521121 6 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA TENALI Bapatla H.O 522101 7 Andhra Pradesh ANDHRA PRADESH Vijayawada Bhimavaram Bhimavaram H.O 534201 8 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA VIJAYAWADA Buckinghampet H.O 520002 9 Andhra Pradesh ANDHRA PRADESH KURNOOL TIRUPATI Chandragiri H.O 517101 10 Andhra Pradesh ANDHRA PRADESH Vijayawada Prakasam Chirala H.O 523155 11 Andhra Pradesh ANDHRA PRADESH KURNOOL CHITTOOR Chittoor H.O 517001 12 Andhra Pradesh ANDHRA PRADESH KURNOOL CUDDAPAH Cuddapah H.O 516001 13 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM VISAKHAPATNAM Dabagardens S.O 530020 14 Andhra Pradesh ANDHRA PRADESH KURNOOL HINDUPUR Dharmavaram H.O 515671 15 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA ELURU Eluru H.O 534001 16 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudivada Gudivada H.O 521301 17 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudur Gudur H.O 524101 18 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Guntakal H.O 515801 19 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA -

Fairs and Festivals, Part VII-B

PRG. 179.11' em 75-0--- . ANANTAPUR CENSUS OF INDIA 1961 VOLUME II ANDHRA PRADESH PART VII-B (10) FAIRS AND F ( 10. Anantapur District ) A. CHANDRA S:EKHAR OF THE INDIAN ADMINISTRATIVE SERVICE Sltl}erintendent of Cens'Us Ope'rations. Andhru Pradesh Price: Rs. 7.25 P. or 16 Sh. 11 d.. or $ 2.fil c, 1961 CENSUS PUBLICATIONS, ANDHRA PRADESH (All the Census Publications of this State will bear Vol. No. II) PART I-A General Report PART I-B Report on Vital Statistics PART I-C Subsidiary Tables PART II-A General Population Tables PARt II-B (i) Economic Tables [B-1 to B-1VJ PART II-B (ii) Economic Tables [B-V to B-IXJ PARt II-C Cultural and Migration Tables PART III Household Economic Tables PART IV-A Housing Report and Subsidiary Tables PART IV-B Housing and Establishment Tables PART V-A Special Tables for Scheduled Castes and Scheduled Tribes PART V-B Ethnographic Notes on Scheduled Castes and Scheduled Tribe5 PART VI Village Survey Monographs (46") PART VII-A (I)) Handicraft Survey Reports (Selected Crafts) PART VII-A (2) J PART VlI-B (1 to 20) Fairs and Festivals (Separate Book for each District) PART VIII-A Administration Report-Enumeration "'\ (Not for PART VIII-B Administration Report-Tabulation J Sale) PART IX State Atlas PART X Special Report on Hyderabad City District Census Handbooks (Separate Volume for each Dislricf) Plate I: . A ceiling painting of Veerabhadra in Lepakshi temple, Lepakshi, Hindupur Taluk FOREWORD Although since the beginning of history, foreign travellers and historians have recorded the principal marts and entrepots of commerce in India and have even mentioned impo~'tant festivals and fairs and articles of special excellence available in them, no systematic regional inventory was attempted until the time of Dr. -

A Micro Study on Problems of Migrant Women – with Special Reference to Scheduled Tribes Women in Anantapuramu District

Research Paper Impact Factor: 6.462 IJMSRR Peer Reviewed & Indexed Journal E- ISSN - 2349-6746 www.ijmsrr.com ISSN -2349-6738 A MICRO STUDY ON PROBLEMS OF MIGRANT WOMEN – WITH SPECIAL REFERENCE TO SCHEDULED TRIBES WOMEN IN ANANTAPURAMU DISTRICT Dr.Kummara Nettikallappa* Dr.K.Krishna Naik** Post-Doctoral Fellow (ICSSR, New Delhi), Dept. of History, Sri Krishnadevaraya University, Anantapuramu,, A.P. Professor, Dept. of History, Sri Krishnadevaraya University, Anantapuramu,A.P. Abstract Migration is a physical shifting of an employee or work force from one place to other. It may be permanent in nature or temporary also. The transition of people from rural areas to urban areas having various internal dynamic, most of the times it is due to compulsion and inadequate infrastructure facility, medical care, education etc. In India migration related data is mostly captured by two organisations, viz. Census and National Sample Survey Organisation. Both these two organisation defined migration “ migration as a person residing in a place other than his/her place of birth (place of birth definition) or one who has changed his/her usual place of residence to another place (change in usual place of residence). NSS considered the change in Usual Place of Residence (UPR Approach) to define a migrant. Migration may be due to different factor like economic development, social cultural, environmental, political factors duet to violence, political instability , drought, flood, landslide and low fertility of land. The present study was highlighted various problems by the migrated Scheduled Tribes at migrated places in selected study area. Key words: Migration, Problem, Detachment and Financial Exploitation. -

Final EIA and EMP Report Puttaparthy 051020

Environmental Impact Consultancy Services for A.P. Urban Water Supply & Assessment& Environmental Puttaparthy Septage Management Improvement Project (APUWS& Management Plan ULB SMIP) TABLE OF CONTENT CHAPTER S. NO. PARTICULAR PAGE NO LIST OF TABLES 3 LIST OF FIGURES 4 LIST OF ANNEXURES 5 ACRONYMS 6 EXECUTIVE SUMMARY 9 CHAPTERS 1 1.0 Introduction 12 1.1 Introduction to the overall state-wide project 12 1.2 Sub-project justification 13 1.3 Requirement for an Environmental Impact Assessment 13 1.4 Objectives of the Project’s Environmental and Social 14 Management Planning Framework (ESMPF) 1.5 Scope of Work for this report 15 1.6 Other Legislative and Regulatory Considerations 17 2 PROJECT LOCATION AND BASELINE DATA 2.0 Project Location 25 2.1 Baseline Data 25 2.1.1 Geographical & Demographic characteristics 26 2.1.2 Meteorology of Puttaparthy 28 2.1.3 Air Quality 31 2.1.4 Noise Pollution 33 2.1.5 Water Quality 35 2.1.6 Source Sustainability 36 2.1.7 Surface Water Quality 36 2.1.8 Ground Water Quality 42 2.2 Soils 49 2.3 Flora & Fauna 51 2.3.1 Flora 51 2.3.2 Fauna 56 3 PROJECT DESCRIPTION AND ANALYSIS OF ALTERNATIVES 3.1 Existing and Proposed Water Supply System in Project Area 60 3.2 Potential Impacts and Risks form the Proposed Water Supply 61 Components 3.3 Proposed Water Supply System in project area 64 3.4 Analysis of Alternatives 72 4 KEY ENVIRONMENTAL IMPACTS 4.1 Identification of Impacts 75 4.2 Potential Environmental Impacts Rise during Construction Phase 76 and Operational Phase 4.3 Impacts During Construction And Operation Stages 85 2 of 130 Environmental Impact Consultancy Services for A.P. -

Rrb-Po-Viii Candidates Shortlisted for Interview If Your Name Were Not in This List, You Might Inform to the Institute

RRB-PO-VIII CANDIDATES SHORTLISTED FOR INTERVIEW IF YOUR NAME WERE NOT IN THIS LIST, YOU MIGHT INFORM TO THE INSTITUTE. CONTACT : 9951782792 RRB PO VIII Score Display of Qua. Candidates called for Interview GENERAL - (146) ANDHRA PRADESH - (42) --- CUTOFF MARKS = 79.81 1 BALU JAGADEESH 1740024952 KADAPA 117.69 AP 2 YENIMIREDDY THANMAI 1740427638 NARASARAOPET 108.56 AP 3 RAVURI ALEKHYA 1740425055 SRIKAKULAM 105.38 AP 4 REGATI RAGHU RAMI REDDY 1740342271 BETAMCHERLA 105.31 AP 5 VASA BALASRI 1740061894 JALALAPURAM 105.00 AP 6 BANDI MALLIKARJUN 1740166192 NELLORE 104.75 AP 7 PEPAKAYALA LALITHA DEVI 1740212241 KANDREGULA 104.13 AP 8 MANCHALA VEDAVATHI 1740205914 YALLUR 101.19 AP 9 ADAPA SAISUDHA 1740186026 VEERAGHATTAM 99.38 AP 10 ABBURI BHARAT 1740157527 VISAKHAPATNAM 96.88 AP 11 GOOTY SHAMMOON 1740110160 TADIPATRI 95.88 AP 12 VANGALA GOPA NAGA LAXMI 1740453498 SITARAMAPURAM 95.88 AP 13 ADDAGALLA ASHOKRAJA 1740150363 TADEPALLIGUDEM 95.13 AP 14 BUTHUKURI VENKATA LAKSHMI 1740289711 GUNTUR 92.69 AP 15 YERUVA VENKATA SRAVANI 1740424426 DARSI 92.44 AP 16 YERASI PRAVALLIKA 1740009092 S KULURU 92.06 AP 17 CHIVUKULA SATYA SAI CHARAN 1740116807 PALAKODERU 91.63 AP 18 DAMODALA MONIKA 1740101192 PALAKOL 91.00 AP 19 KANKARA ANUSHA REDDY 1740255739 KOTHAPALLI 90.19 AP 20 GUNDAM CHARISMA 1740167335 TANDUR 89.63 AP 21 MADUGULA KOTI REDDY 1740000647 NIKARAM PALLI 89.05 AP 22 THASLEEM 1740244243 PRODDDATUR 88.50 AP 23 MADHURANTAKAN R MANOJ 1740000651 TIRUPATHI 87.75 AP 24 VENNAPUSA SUMATHI 1740311040 87.31 AP 25 MALLIKARJUNA REDDY REDDY 1740484068 KOTHAPALLI 86.63 AP 26 K RAMA KRISHNA 1740205364 ANDAMAN AND NICOBAR 86.19 AP 27 PEDDI VENKATA SAI LAVANYA 1740108330 TANUKU 85.69 AP 28 GOPALUNI N.S.R.