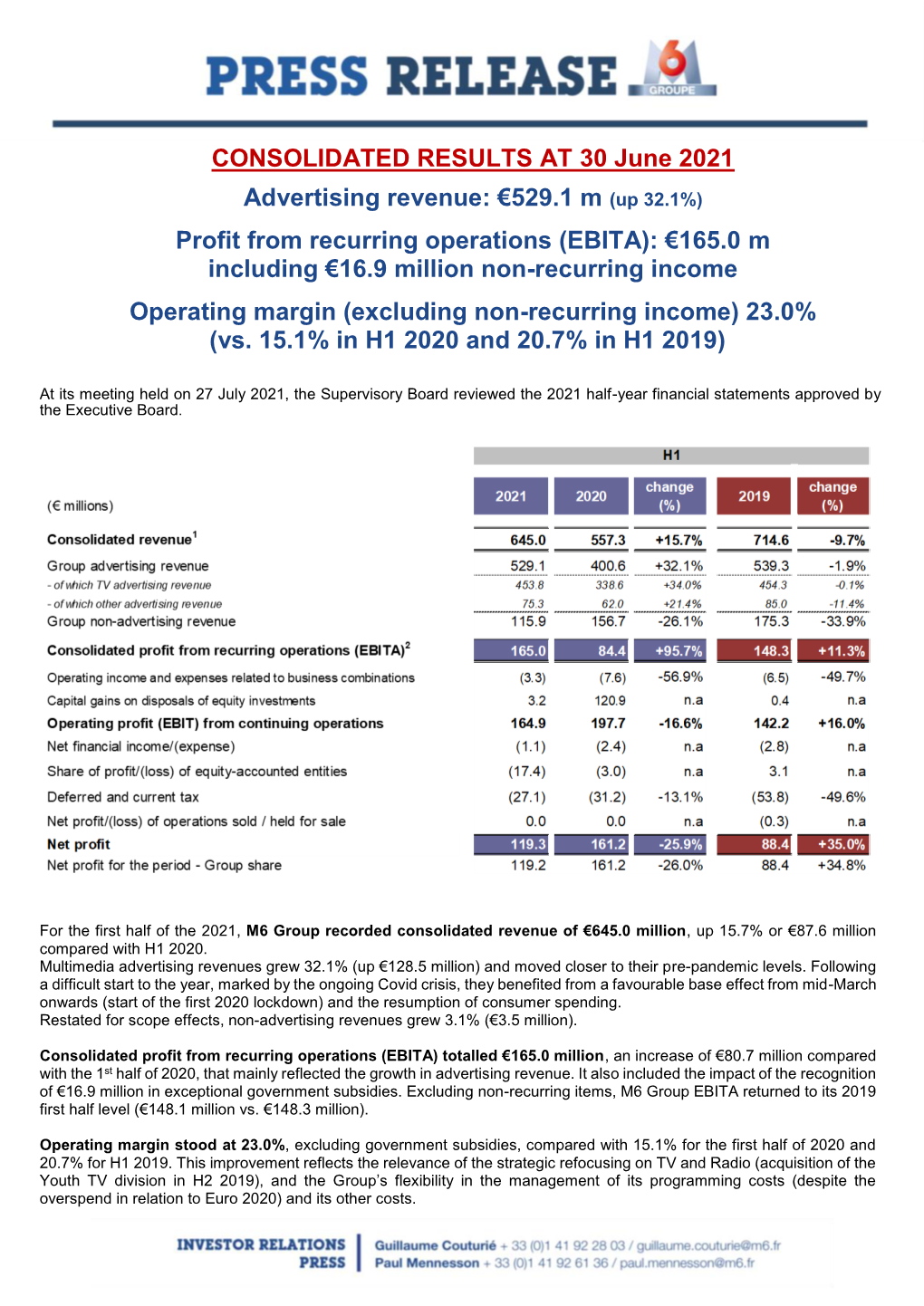

CONSOLIDATED RESULTS at 30 June 2021 Advertising

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Children, Technology and Play

Research report Children, technology and play Marsh, J., Murris, K., Ng’ambi, D., Parry, R., Scott, F., Thomsen, B.S., Bishop, J., Bannister, C., Dixon, K., Giorza, T., Peers, J., Titus, S., Da Silva, H., Doyle, G., Driscoll, A., Hall, L., Hetherington, A., Krönke, M., Margary, T., Morris, A., Nutbrown, B., Rashid, S., Santos, J., Scholey, E., Souza, L., and Woodgate, A. (2020) Children, Technology and Play. Billund, Denmark: The LEGO Foundation. June 2020 ISBN: 978-87-999589-7-9 Table of contents Table of contents Section 1: Background to the study • 4 1.1 Introduction • 4 1.2 Aims, objectives and research questions • 4 1.3 Methodology • 5 Section 2: South African and UK survey findings • 8 2.1 Children, technology and play: South African survey data analysis • 8 2.2 Children, technology and play: UK survey data analysis • 35 2.3 Summary • 54 Section 3: Pen portraits of case study families and children • 56 3.1 South African case study family profiles • 57 3.2 UK case study family profiles • 72 3.3 Summary • 85 Section 4: Children’s digital play ecologies • 88 4.1 Digital play ecologies • 88 4.2 Relationality and children’s digital ecologies • 100 4.3 Children’s reflections on digital play • 104 4.4 Summary • 115 Section 5: Digital play and learning • 116 5.1 Subject knowledge and understanding • 116 5.2 Digital skills • 119 5.3 Holistic skills • 120 5.4 Digital play in the classroom • 139 5.5 Summary • 142 2 Table of contents Section 6: The five characteristics of learning through play • 144 6.1 Joy • 144 6.2 Actively engaging • 148 -

Page 1 “OF the YEAR” FINALISTS

Page 1 “OF THE YEAR” FINALISTS MARKETING TEAM OF THE YEAR FOX SPORTS MARKETING CNN WORLDWIDE COMEDY CENTRAL NATIONAL GEOGRAPHIC TV 2 DENMARK VIACOMCBS CEE AGENCY OF THE YEAR CREATIVE SOLUTIONS DUTCHTOAST KNOWN NEW LAND THE REFINERY WIEDEN + KENNEDY Page 1 BRAND IMAGE PROMO LONG FORMAT BRAND IMAGE INSTANT SUMMER ALL THAT WE SHARE - CONNECTED FINNISH BROADCASTING COMPANY - YLE TV 2 DENMARK HLN “FROZEN MOMENTS 2” PROMO WE ARE SPORT CNN WORLDWIDE ADMIT ONE MEDIA FOR SUPERSPORT & DSTV GET FREE STAY FREE SKY ORIGINALS IMAGE REEL OPENVIEW SKY DEUTSCHLAND FERNSEHEN GMBH & CO. KG ESSENTIAL VIEWING WAS IST DEINE GESCHICHTE? / COSMO SPAIN WHAT’S YOUR STORY? LUXLOTUSLINER GMBH HBO EUROPE WILL ROCK YOU HBO EUROPE BETO & ELENA AMÉRICA TELEVISIÓN ASCENDING TINY HERO GEWOON ONGEWOON ADMIT ONE MEDIA FOR KYKNET BRAND IMAGE PROMO CAMPAIGN BRAND PROMO: WEBSITE OR APP PROMOTION TV 2 SPORT X - LAUNCH CAMPAIGN TV 2 DENMARK CRAVE: BIG MOMENTS BELL MEDIA ID BRAND CAMPAIGN - EVERY ENDING HAS A BEGINNING SHOP RT VATNIK PROMO INVESTIGATION DISCOVERY RT STAR POWER E! RADIO-CANADA OHDIO APP LAUNCH NBCUNIVERSAL INTERNATIONAL NETWORKS RADIO-CANADA TLC DIGITAL COLLECTION A&E PLAY DISCOVERY CREATIVE LONDON A&E LATIN AMERICA NAT GEO BRAND “AWARDS” SPOTS HBO EUROPE THE CURE NATIONAL GEOGRAPHIC HBO EUROPE WOMEN’S WORLD CUP CAMPAIGN CRAVE: SPOILER FREE FOX SPORTS MARKETING BELL MEDIA Page 2 BRAND PROMO: HOLIDAY PROGRAM TRAILER PROMO OR SPECIAL EVENT SPOT CNN FILMS: APOLLO 11 TRAILER 30 YEARS AFTER THE FALL OF THE BERLIN WALL CNN WORLDWIDE DW DEUTSCHE WELLE GORDON RAMSAY: UNCHARTED -

November 2020 Kids Sales

AUSTRALIA NOVEMBER 2020 Brickman's Family Challenge Book Ryan McNaught Lego building challenges for all ages and levels by the star judge of the smash hit TV show LEGO® Masters Australia. Description 'You have ... one minute to buy this book. Your time starts now. Good luck! (Seriously, though - you should. It's great.)' HAMISH BLAKE Challenge each member of your household to a building competition that is the brainchild of Brickman himself, star judge of the smash hit TV show LEGO® Masters Australia and a LEGO Certified Professional. Each of the 30 challenges can be attempted at beginner, intermediate and advanced levels. So whether you're 5 or 105, an infrequent brick builder or a huge LEGO fan, this book will get you off your screen and get your creative juices flowing with even the most basic LEGO collection. Including: - Maze runner: build a maze with obstacles and design themes - Model mashup: roll a die to determine which hybrid model you need to build in under 2 hours-a Supersonic Banana Plane, anyone? - Self-portrait: one of the hardest things to build with LEGO is curves, but Brickman helps you crack the techniques for building a recognisable 3D portrait of yourself. Packed with pro tips and suggestions on how to take your builds to the next level, as well as a 'know your bricks' glossary, this book will turn you into a Master LEGO Builder in no time. Are you up for the challenge? About the Author Price: AU $35.00 NZ $39.99 Ryan 'Brickman' McNaught is the southern hemisphere's only LEGO Certified Professional. -

Full-Year Results 2020

FULL-YEAR RESULTS 2020 ENTERTAIN. INFORM. ENGAGE. KEY FIGURES +18.01 % SDAX +8.77 % MDAX SHARE PERFORMANCE 1 January 2020 to 31 December 2020 in per cent INDEX = 100 -7.65 % SXMP -9.37 % RTL GROUP -1.11 % PROSIEBENSAT1 RTL Group share price development for January to December 2020 based on the Frankfurt Stock Exchange (Xetra) against MDAX/SDAX, Euro Stoxx 600 Media and ProSiebenSat1 RTL GROUP REVENUE SPLIT 8.5 % OTHER 17.5 % DIGITAL 43.8 % TV ADVERTISING 20.0 % CONTENT 6.7 % 3.5 % PLATFORM REVENUE RADIO ADVERTISING RTL Group’s revenue is well diversified, with 43.8 per cent from TV advertising, 20.0 per cent from content, 17.5 per cent from digital activities, 6.7 per cent from platform revenue, 3.5 per cent from radio advertising, and 8.5 per cent from other revenue. 2 RTL Group Full-year results 2020 REVENUE 2016 – 2020 (€ million) ADJUSTED EBITA 2016 – 2020 (€ million) 20 6,017 20 853 19 6,651 19 1,156 18 6,505 18 1,171 17 6,373 17 1,248 16 6,237 16 1,205 PROFIT FOR THE YEAR 2016 – 2020 (€ million) EQUITY 2016 – 2020 (€ million) 20 625 20 4,353 19 864 19 3,825 18 785 18 3,553 17 837 17 3,432 16 816 16 3,552 MARKET CAPITALISATION* 2016 – 2020 (€ billion) TOTAL DIVIDEND/DIVIDEND YIELD PER SHARE 2016 – 2020 (€ ) (%) 20 6.2 20 3.00 8.9 19 6.8 19 NIL* – 18 7.2 18 4.00** 6.3 17 10.4 17 4.00*** 5.9 16 10.7 16 4.00**** 5.4 *As of 31 December *On 2 April 2020, RTL Group’s Board of Directors decided to withdraw its earlier proposal of a € 4.00 per share dividend in respect of the fiscal year 2019, due to the coronavirus outbreak ** Including -

Lesclientsnaviguent Entrelesfrontières

Der Big Rösti Ab 04.01.2021 /m/ cdlu Curly Fries As longasstockslast. ©2021McDonald’s Coca-Cola isteineeingetragene Schutzmarkeder TheCoca-ColaCompany. N°3052 MARDI Les clients naviguent 5 JANVIER 2021 Luxembourg 6 De la neige, mais pas de ski de fond à Weiswampach entre les frontières Les commerces non essentiels fermés, les ré- liers venaient profiter des commerces restés sidents ont opté pour des achats chez les ouverts au Luxembourg. Ce phénomène a voisins, notamment en Belgique, où les sol- mis en exergue le manque de cohésion au ni- des ont débuté hier. L'inverse de ce qui veau européen, comme le souligne Corinne s'était produit en novembre, où les fronta- Cahen, ministre de la Grande Région. PAGE 3 Roi des International 7 Faut-il avoir peur des deux terrains nouveaux virus mutants? et des réseaux FOOTBALL L'année 2021 commence très fort pour Cristiano Ronaldo. Le Portugais, 35 ans, conti- nue de marquer l'histoire du football. Son doublé lors du succès de la Ju- ventus face à l'Udinese dimanche soir a porté son Écrans 19 total de buts en matches Retrouvez cinq séries à ne officiels à 758, soit un de mieux que celui du «Roi» pas manquer cette année Pelé. Mais le règne et les records de CR7 s'étendent désormais bien au-delà des terrains... PAGE 21 Les followers 250 millions Ronaldo est devenu la pre- Météo 24 mière personne à atteindre la barre des 250 millions de MATIN APRÈS-MIDI followers sur Instagram. Il -1°1° devance Ariana Grande Record de buts et record de followers sur les réseaux sociaux, Ronaldo est une star planétaire. -

Only Murders in the Building’ Check out the Entire Bulletin – Murder Makes Strange in Our Weekly E-Edition

Las Cruces Transportation Martin Short stars August 27 - September 2, 2021 in “Only Murders in YOUR RIDE. YOUR WAY. the Building,” which Las Cruces Shuttle – Taxi begins streaming Charter – Courier Tuesday on Hulu. Veteran Owned and Operated Since 1985. Call us to make a reservation today! We are Covid-19 Safe-Practice Compliant Call us at 800-288-1784 or for more details 2 x 5.5” ad visit www.lascrucesshuttle.com For breaking news follow us on social media ‘Only Murders in the Building’ Check out the entire Bulletin – Murder makes strange in our weekly e-edition. investigative partners www.lascrucesbulletin.com2 x 4” ad 2 Your Bulletin TV & Entertainment pullout section August 27 - September 2, 2021 What’s Available NOW On “Movie: Love and Monsters” “Only Murders in the Building” “Movie: Chaos Walking” After an Earth-bound asteroid is destroyed, “Movie: Spell” Steve Martin and John Hoffman are the creative Tom Holland (“Captain America: Civil War”) a subsequent chemical fallout causes the Director Mark Tonderai’s (“Hush”) 2020 stars as a young man who protects a mysterious horror thriller stars Omari Hardwick (“Power”) forces behind this comedic murder mystery world’s cold-blooded animals to mutate into series that follows three strangers (Martin, woman (Daisy Ridley, “Star Wars: Episode VII large monsters who begin killing off most of as a man who crash lands in Appalachia and — The Force Awakens”) in a dystopian world awakens in the attic of a woman (Loretta Martin Short, Selena Gomez) with an obsession humanity. Young Joel Dawson (Dylan O’Brien) with true crime and find themselves wrapped where all females have disappeared and all men manages to survive, although his parents are Devine, “Family Reunion”) whose dark magic are afflicted by a force that puts their thoughts poses a threat to him and his family. -

In Year 2 We Have Had the Opportunity to Make Delicious Jam Sandwiches to Help Us Generate Ideas for Our Writing

Summer 2 Issue 18 Dear Parents & Carers, Summer 2 is always such a busy half-term! Over recent weeks we have held our fabulous Sports Days, Big Draw Three, dance lessons for every class, Lego Workshops, Sharing Assemblies, Sports Tournaments and much much more! Next week we have our Team Points trips (Congratulations to Green Team this year), and coming up soon we have our Whole School Beech Trip (28th June) and the magnificent Lauriston Summer Fair (30thJune). Year 6 are busy rehearsing for their hotly anticipated production- early indications suggest it will be a brilliant show! A special mention for our fabulous school rock bands who performed so brilliantly at Well Street Common Festival. It was wonderful to see them perform so confidently and to such a large and supportive audience. Please make sure you look at the dates for your diary section and please note the information regarding a Federation Update Meeting on Monday 2nd July. Week beginning 2nd of July will also be our school Transition Week where children get the chance to spend time with their new class teachers (more information will be provided shortly). In addition booking for Autumn Term clubs begins on 29th June. Finally, we would like to say Eid Mubarak to all our Muslim families. We hope you have a wonderful day celebrating with loved ones. Mr Louis Harris Head of School In Year 2 we have had the opportunity to make delicious jam sandwiches to help us generate ideas for our writing. In writing we have been learning about how to write instructions using imperative verbs. -

Elizabeth Reeder

ELIZABETH REEDER m: 0401 002 292 [email protected] FILM & TVC PRODUCTION 2019 (selected) PRODUCTION COORDINATOR Vic Health ‘This Girl Can ‘ TVC - Revolver PM: Lucy Sparke / Producer: Kate Menzies PRODUCTION COORDINATOR VRC ‘Go & Let Go’ TVC - Finch PM: Juliet Smith / Producer: Kate Menzies PRODUCTION COORDINATOR TAB ‘Long May We Play 2’ TVC - The Pool Collective PM: John Sandow / Producer: Cameron Gray PRODUCTION COORDINATOR / DA Jeep ‘Launch’ - NB Content PM: Tom Davies / Producer: Tanya Stankovic PRODUCTION COORDINATOR Toyota ‘TMS’ Content - Red Sneakers PM: Rachel Boagey / Producer: Jeremy Brown PRODUCTION COORDINATOR Coles/ Renault/ Yellow Pages (Various TVCs) - Flinders Lane Productions PM: Nina Bos, Jules Moseley, Paul Wagstaff, Rachel Steele / Producer: Vincent Zimbardi PRODUCTION COORDINATOR Four ‘N’ Twenty TVC - Interrogate PM: Sam Kelly / Producer: Tara Riddell PRODUCTION COORDINATOR Ford ‘Straight Talkin’ TVC - Guilty Content PM: Tom Davies / Producer: Jason Byrne PRODUCTION COORDINATOR Honda ‘Lego Masters’ TVC - Powered Studios, Channel 9 Producer: Katrina Olsen PROD / DIRECTOR’S ASSISTANT OPSM TVC - Finch PM: Lucy Sparke / Producer: Marge McInnes PRODUCTION ASSISTANT ALDI TVC - Revolver PM: Natasha Calli / Kate McTernan PRODUCTION COORDINATOR The Gloaming TV Series - Stan Production Coord for Costume Dept (Costume Designer: Marion Boyce) 2018 (selected) PRODUCTION MANAGER Tennis Australia ‘Hot Shots’’ TVC - HP Productions Producer/Director: Hugh Peachey PRODUCTION COORDINATOR Optimum TVC - Flare / Clemenger PM: -

Star Channels, August 29

AUGUST 29 - SEPTEMBER 4, 2021 staradvertiser.com MAMA DRAMA While the cast fi gure out their uncomfortable love triangles, we get to watch from a much more comfortable distance when Season 2 of I Love a Mama’s Boy. The show follows couples navigating the relationship between the “boys” and their mothers who just can’t let go. Premiering Sunday, Aug. 29, on TLC. CAMERA & LIGHTING FOR BEGINNERS Learn how to properly set up, light and shoot in the second of three courses taught by ¶Ōlelo’s in-house experts. To sign up, visit olelo.org/training olelo.org Video Production | Camera, Audio & Lighting | Video Editing $75 per class | Just $50 per class if you commit to and complete all 3 classes 590255_TrainingAds_2021_2in_F.indd 2 4/30/21 4:17 PM ON THE COVER | I LOVE A MAMA’S BOY Mommy dearest TLC launches Season 2 relationship — not always accompanied by room relationship, but it didn’t work out that smothering mothers; something the Season way. of “I Love a Mama’s Boy” 2 trailer does a great job of showing. Complete Trying to help in that department, mommy with awkward professions of mother-son love, dearest accompanied Kim to the lingerie sour looks from partners, mothers feeding store to pick out something special for Matt. By Rachel Jones their sons scrambled eggs and mothers insist- Needless to say, shortly thereafter, Matt and TV Media ing on being “honeymoon buddies,” even view- Kim moved out of Kelly’s house and into their ers will want to tell these moms to butt out. -

Daniel Gaine

Daniel Gaine Camera Operator - Shooting Assistant Full UK Driving License - London e: [email protected] m: +44 (0)7789883423 Selected Operator Credits Television - Entertainment - Documentary Production Title Equipment Company Director Married at First Sight (Series 5) Arri Amira CPL / Channel 4 Dermot Caulfield Will You Be My Player 2? (Pilot) Sony FS7 Bandicoot / BBC Three Marcus Liversedge Jack Whitehall: Travels With My Father Sony FS7 / Canon Christian Watt / (S2 & 4) C300 Tiger Aspect / Netflix Leo Mcrea Jack Whitehall: Christmas With My Father (Queer Eye VT) Arri Amira Tiger Aspect / Netflix Tom Vinnicombe Big Zuu’s Big Eats Panasonic EVA-1 Boomerang / Dave Tom McKay Celebs Go Dating (S3 - 8) Sony FS7 Lime Pictures / E4 Various MTV Cribs UK Sony FS7 Elephant House / MTV Kate Amanarni Strictly Come Dancing: The Professionals Sony FS7 BBC Pete Deagle The Russell Howard Hour (S3, VTs) Sony FS7 Avalon / Sky One Tom Vinnicombe The Lateish Show with Mo Gilligan (VTs) Sony F5 Expectation / Channel 4 Tommy Forbes Sony A7S MKII & Rob and Romesh Vs. DJI Ronin CPL / Sky One Graham Proud Love in the Countryside (S2) Sony FS7 Boundless / BBC Two Eddie Lewis Cunk On Britain (IVs) Arri Amira House of Tomorrow / BBC Two Lorry Powles Nick Helm’s Eat Your Heart Out Sony FS7 North One / Dave Simon Goodman Jamie’s Super Foods (S1 & 2) Canon C300 Fresh One TV / Channel 4 Martha Delap Swim the Channel Canon C300 Mother Hen / BBC Four Stephanie Keelan Commercial - Branded Content American Airlines 'Our Way: Chile' Sony FS7 Ink Group Jonny Dixon -

2015 FIRST LEGO League TRASH TREK World Festival Final Robot

FIRST LEGO League Final Robot Game Scores TRASH TREK World Festival April 2016 Robot Highest Robot Robot Robot World Game Robot Game Game Game Festival local team Score Game Score Score Score Region Team # # Team Name Team City Team Country /State Rank Score Match1 Match2 Match3 Alabama 1 5072 The Variables Birmingham Alabama, USA 67 452 452 407 275 Arizona 2 17132 Gilbert Gearheads Gilbert Arizona, USA 35 682 682 606 590 California-Los Angelas 3 163 2nd Life San Gabriel California, USA 3 972 949 972 731 California - Los Angeles 4 473 Waste Away Tarzana California, USA 38 662 612 662 557 California - Northern 5 6952 TechMagic San Jose California, USA 10 912 393 797 912 California - Northern 6 15821 TacoBots Fremont California, USA 68 449 385 433 449 California - Southern - LEGOLAND 7 1657 Code Crunchers Solana Beach California, USA 36 673 615 673 318 Colorado 8 18124 Automaticus Rex Littleton Colorado, USA 71 434 434 365 97 Georgia 9 3381 Transfomers Marietta Georgia, USA 52 580 497 580 279 Hawaii 10 17561 Dolphinators Honolulu Hawaii, USA 66 455 389 417 455 Illinois 11 5184 Around the World Robotics Chicago Illinois, USA 87 288 288 182 195 Indiana 12 3006 BeigerBots Mishawaka Indiana, USA 33 726 715 726 476 Iowa 13 2838 Flourish & Bots Bettendorf Iowa, USA 70 437 313 437 329 Kansas - Southeast - Greenbush 14 22752 Greenbush Girard Kansas, USA 75 407 341 407 381 Kansas - Liberal 15 9615 Liberal006 Liberal Kansas, USA 92 257 152 203 257 Kansas City Region 16 12639 EVOLVE Overland Park Kansas, USA 95 241 143 241 133 Louisiana 17 4043 Bayou Builders Hammond Louisiana, USA 50 592 435 442 592 Maine 18 19740 Tesla Waffles Kennebunk Maine, USA 42 640 436 260 640 Massachusetts 19 1186 Angry Owls Westborough Massachusetts, USA 17 847 847 655 598 Michigan 20 1807 Rising Eagles Hartland Michigan, USA 21 816 816 508 754 Minnesota 21 3888 The Diamonds Apple Valley Minnesota, USA 16 855 583 855 855 Missouri - Central - Columbia 22 12299 REACH-Bots Richland Missouri, USA 91 257 221 161 257 Missouri - Eastern MO - St. -

Citrus County

Project1:Layout 1 6/10/2014 1:13 PM Page 1 Cycling: Tour de France leader claims 17th stage /B1 THURSDAY TODAY C I T R U S C O U N T Y & next morning HIGH 93 Hot with a few LOW afternoon thunderstorms. 72 PAGE A4 www.chronicleonline.com JULY 15, 2021 Florida’s Best Community Newspaper Serving Florida’s Best Community $1 VOL. 126 ISSUE 281 NEWS BRIEFS Residents don’t want gate Food drive July 20 to Developer polled Brentwood homeowners about proposed Ottawa extension benefit SOS The Esther Chapter of MIKE WRIGHT There’s a traffic signal extend Ottawa across C.R. but current Brentwood access to the proposed the Daughters of the Staff writer at Ottawa, but not at the 486 to a new gated Brent- residents will not. gated Ottawa extension. It entrance to Brentwood, wood community called The county’s Planning would cost members of King at Shepherd of the It’s traffic talk time for which has been a source Davis Reserve. and Development Com- the Brentwood Property Hills Episcopal Church Brentwood residents of angst for Brentwood As it is now proposed, mission will hear the re- Owners Association about in Lecanto is asking for — again. residents for years. Any- the new development quest at its 9 a.m. meeting $140 a year extra to cover food donations to benefit The Lecanto commu- one leaving Brentwood would be separate from Thursday, July 15, at the the costs of a manned SOS food pantry, which nity, part of the Citrus wanting to head east must Brentwood, connected Lecanto Government gate.