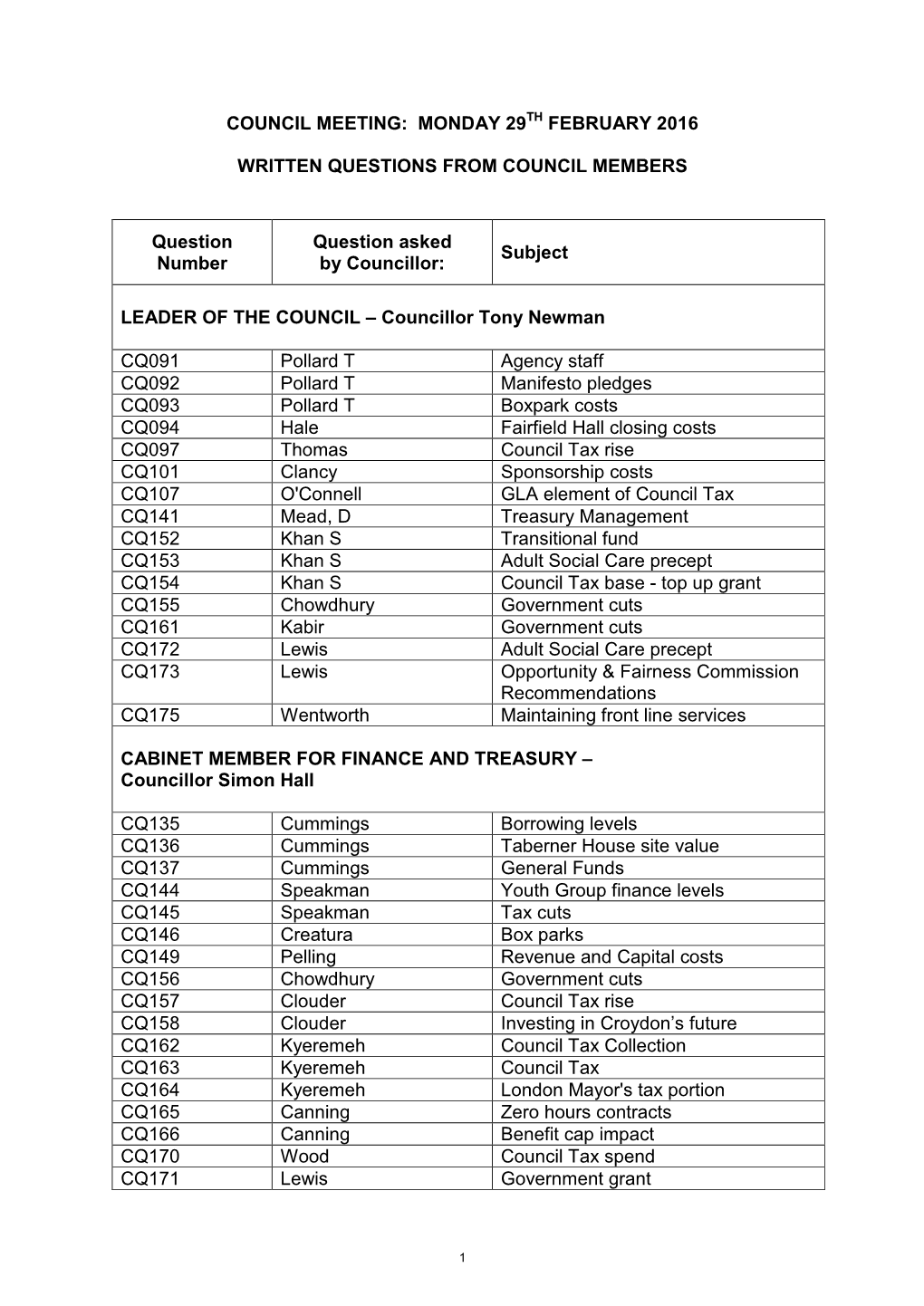

Council Meeting: Monday 29Th February 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parliamentary Debates (Hansard)

Wednesday Volume 506 24 February 2010 No. 44 HOUSE OF COMMONS OFFICIAL REPORT PARLIAMENTARY DEBATES (HANSARD) Wednesday 24 February 2010 £5·00 © Parliamentary Copyright House of Commons 2010 This publication may be reproduced under the terms of the Parliamentary Click-Use Licence, available online through the Office of Public Sector Information website at www.opsi.gov.uk/click-use/ Enquiries to the Office of Public Sector Information, Kew, Richmond, Surrey TW9 4DU; e-mail: [email protected] 281 24 FEBRUARY 2010 282 Ms Katy Clark (North Ayrshire and Arran) (Lab): House of Commons Youth unemployment is a massive problem in Ayrshire, with North Ayrshire having some of the worst levels of Wednesday 24 February 2010 social deprivation in Scotland. Does my right hon. Friend welcome the Ayrshire jobs summit, which is taking place tomorrow, and does he agree that economic The House met at half-past Eleven o’clock growth and job creation are key for the most successful future for Ayrshire? PRAYERS Mr. Murphy: It is very important that we take a team Ayrshire approach to trying to overcome youth unemployment, and not just youth unemployment. We [MR.SPEAKER in the Chair] are keen to ensure that those over 50, who have perhaps not experienced unemployment or been in a job centre for a considerable period—or perhaps never in their BUSINESS BEFORE QUESTIONS lives—do not become used to unemployment and do not spend that period in advance of their retirement MID STAFFORDSHIRE NHS FOUNDATION TRUST settling for a life on unemployment benefits. It is therefore Resolved, essential that we do more together across all the generations, That an humble Address be presented to Her Majesty, That in Ayrshire and across Scotland. -

In the Sri Lankan Conflict

INTRODUCTORY NOTES The focus of this study is on ‘external interventions’ in the Sri Lankan conflict – those ostensibly intended to pressurise both the government of Sri Lanka as well as the LTTE to abandon violent confrontation and seek a negotiated settlement of the conflict. Such pressures on the government take several forms, applied with varying levels of intensity and insistence by the different countries with which Sri Lanka maintains close relations – advice and moral persuasion, economic aid being made conditional upon the resumption of ‘peace negotiations’, prohibitions on the sale of arms, providing lavish support to local NGOs that claim to be engaged in the ‘peace effort’, and, above all, threat of action as envisaged in the emerging doctrine of ‘Responsibility to Protect’ (‘R2P’) against alleged violations of human rights. To the LTTE, with its proclaimed adherence to the belief that terrorist violence is a legitimate instrumentality of ‘liberation struggles’, and ranking as it does among the most violent terrorist outfits in the world, the charge of human rights violations has remained largely inconsequential except where it is given concrete expression in sanctions and proscriptions. To the Sri Lanka government, being placed at par with the Tigers in accusations of human rights violation is, of course, a damning indictment and a humiliating diminution of status in the community of nations. During the period covered by this study (2006-2007), the secessionist campaign of the LTTE suffered major setbacks, exacerbating its earlier losses caused by the Tsunami and the ‘Karuna revolt’. The period has also been featured by an extraordinarily sharp upsurge of external “humanitarian intervention” in the Sri Lankan conflict, the intensity of which has had a remarkable correspondence with the tenor and tempo of LTTE failures. -

Migrant Voters in the 2015 General Election

Migrant Voters in the 2015 General Election Dr Robert Ford, Centre on Dynamics of Ethnicity (CoDE), The University of Manchester Ruth Grove-White, Migrants’ Rights Network Migrant Voters in the 2015 General Election Content 1. Introduction 2 2. This briefing 4 3. Migrant voters and UK general elections 5 4. Migrant voters in May 2015 6 5. Where are migrant voters concentrated? 9 6. Where could migrant votes be most influential? 13 7. Migrant voting patterns and intentions 13 8. Conclusion 17 9. Appendix 1: Methodology 18 10. References 19 1. Migrant Voters in the 2015 General Election 1. Introduction The 2015 general election looks to be the closest and least predictable in living memory, and immigration is a key issue at the heart of the contest. With concerns about the economy slowly receding as the financial crisis fades into memory, immigration has returned to the top of the political agenda, named by more voters as their most pressing political concern than any other issue1. Widespread anxiety about immigration has also been a key driver behind the surge in support for UKIP, though it is far from the only issue this new party is mobilizing around2. Much attention has been paid to the voters most anxious about immigration, and what can be done to assuage their concerns. Yet amidst this fierce debate about whether, and how, to restrict immigration, an important electoral voice has been largely overlooked: that of migrants themselves. In this briefing, we argue that the migrant The political benefits of engaging with electorate is a crucial constituency in the 2015 migrant voters could be felt far into the election, and will only grow in importance in future. -

Understanding Governments Attitudes to Social Housing

Understanding Government’s Attitudes to Social Housing through the Application of Politeness Theory Abstract This paper gives a brief background of housing policy in England from the 2010 general election where David Cameron was appointed Prime Minister of a Coalition government with the Liberal Democrats and throughout the years that followed. The study looks at government attitudes towards social housing from 2015, where David Cameron had just become Prime Minister of an entirely Conservative Government, to 2018 following important events such as Brexit and the tragic Grenfell Tower fire. Through the application of politeness theory, as originally put forward by Brown & Levinson (1978, 1987), the study analysis the speeches of key ministers to the National Housing Summit and suggests that the use of positive and negative politeness strategies could give an idea as to the true attitudes of government. Word Count: 5472 Emily Pumford [email protected] Job Title: Researcher 1 Organisation: The Riverside Group Current research experience: 3 years Understanding Government’s Attitudes to Social Housing through the Application of Politeness Theory Introduction and Background For years, the Conservative Party have prided themselves on their support for home ownership. From Margaret Thatcher proudly proclaiming that they had taken the ‘biggest single step towards a home-owning democracy ever’ (Conservative Manifest 1983), David Cameron arguing that they would become ‘once again, the party of home ownership in our country’ (Conservative Party Conference Speech 2014) and Theresa May, as recently as 2017, declaring that they would ‘make the British Dream a reality by reigniting home ownership in Britain’ (Conservative Party Conference Speech 2017). -

A Guide to the Government for BIA Members

A guide to the Government for BIA members Correct as of 11 January 2018 On 8-9 January 2018, Prime Minister Theresa May conducted a ministerial reshuffle. This guide has been updated to reflect the changes. The Conservative government does not have a parliamentary majority of MPs but has a confidence and supply deal with the Northern Irish Democratic Unionist Party (DUP). The DUP will support the government in key votes, such as on the Queen's Speech and Budgets, as well as Brexit and security matters, which are likely to dominate most of the current Parliament. This gives the government a working majority of 13. This is a briefing for BIA members on the new Government and key ministerial appointments for our sector. Contents Ministerial and policy maker positions in the new Government relevant to the life sciences sector .......................................................................................... 2 Ministerial brief for the Life Sciences.............................................................................................................................................................................................. 6 Theresa May’s team in Number 10 ................................................................................................................................................................................................. 7 Ministerial and policy maker positions in the new Government relevant to the life sciences sector* *Please note that this guide only covers ministers and responsibilities pertinent -

Traffic Management Advisory Committee Agenda

Traffic Management Advisory Committee Agenda To: Councillor Stuart King (Chair) Councillors Jane Avis, Sara Bashford, Robert Canning, Vidhi Mohan and Pat Ryan. Reserves: Councillors Jamie Audsley, Simon Brew, Sherwan Chowdhury, Stephen Mann, Andrew Pelling and Andy Stranack. A meeting of the TRAFFIC MANAGEMENT ADVISORY COMMITTEE which you are hereby summoned to attend, will be held on Wednesday 8th February 2017 at 6:30 p.m. in F10, Town Hall, Katharine Street, Croydon. CR0 1NX JACQUELINE HARRIS-BAKER Victoria Lower Acting Council Solicitor and Action Members Services Manager Monitoring Officer 020 8726 6000 ext. 14773 London Borough of Croydon [email protected] Bernard Weatherill House www.croydon.gov.uk/agenda 8 Mint Walk, Croydon CR0 1EA 31 January 2017 Members of the public are welcome to attend this meeting. If you require any assistance, please contact Victoria Lower as detailed above. AGENDA - PART A 1. Apologies for absence 2. Minutes of the meeting held on 19 December 2016 (Page 1) To approve the minutes as an accurate record. 3. Disclosure of Interest In accordance with the Council’s Code of Conduct and the statutory provisions of the Localism Act, Members and co-opted Members of the Council are reminded that it is a requirement to register disclosable pecuniary interests (DPIs) and gifts and hospitality in excess of £50. In addition, Members and co-opted Members are reminded that unless their disclosable pecuniary interest is registered on the register of interests or is the subject of a pending notification to the Monitoring Officer, they are required to disclose those disclosable pecuniary interests at the meeting. -

Subject: Questions to the Mayor Report Number: 4 Report To: London Assembly Date: 23/05/07 Report Of: Director of Secretariat

Subject: Questions to the Mayor Report number: 4 Report to: London Assembly Date: 23/05/07 Report of: Director Of Secretariat Renewable Energy at the Olympics Question No: 856 / 2007 Darren Johnson Is it correct to conclude from your answer to MQT 656/2007 that 20% of the energy demand during the Olympic Games in 2012 will be provided from on-site renewable energy, and that London Array and other off-site renewables will not count towards this 20%? Response from the Mayor The ODA Sustainable Development Strategy sets out the objective for providing 20 per cent of immediate post Games Park and Village energy demand from on-site renewable sources. This will be achieved through on-site renewable sources. The London Array and other off site renewable sources will not count towards that target. Annual CO2 Reduction Targets Question No: 857 / 2007 Darren Johnson Following your Climate Change Action Plan, will you set annual targets for CO2 reductions in London? Response from the Mayor My Climate Change Action Plan set an overall carbon reduction target of 60% by 2025. As I set out when launching the Plan, this implies a reduction of 4% a year. Clearly we will not achieve emissions reductions in a totally linear fashion, but we will aim to reach this leve of cuts each year. I have also undertaken to report annually on progress with the Plan, and will include within this information about CO2 emissions as well as details of implementation programmes. ODA Sustainability Policies Oral Question No: 858 / 2007 answer Darren Johnson In response to question 374/2007 you expressed concern regarding ODA sustainability policies “particularly on waste, water, timber and procurement issues”. -

18 September 2006 Council Minutes

Agenda item: 2a CROYDON COUNCIL MINUTES MEETING OF THE COUNCIL HELD ON Monday, 18 July 2011 at 6.30pm in the Council Chamber, Town Hall. THE MAYOR, COUNCILLOR GRAHAM BASS – PRESIDING Councillors Arram, Avis, Ayres, Bashford, Bee, Bonner, Butler, Buttinger, Chatterjee, Chowdhury, Clouder, Collins, Cromie, Cummings, Fisher, Fitze, Fitzsimons, Flemming, Gatland, Godfrey, Gray, Hale, Hall, Harris, Hay-Justice, Hoar, Hollands, Hopley, Jewitt, Kabir, Kellett, B Khan, , Kyeremeh, Lawlor, Lenton, Letts, Mansell, Marshall, D Mead, M Mead, Mohan, Neal, Newman, O’Connell, Osland, Parker, Pearson, Perry, H Pollard, T Pollard, Rajendran, G Ryan, P Ryan, Selva, Scott, Shahul-Hameed, Slipper, Smith, Speakman, Thomas, Watson, Wentworth, Winborn, Woodley and Wright. Absent: Councillors Bains, George-Hilley, S Khan and Quadir 1. APOLOGIES FOR ABSENCE (agenda item 1) Apologies for absence were received from Councillor Shafi Khan 2. MINUTES (agenda item 2) RESOLVED that the Minutes of the Annual Council Meeting held on 23 May 2011 be signed as a correct record. 3. DECLARATIONS OF INTERESTS (agenda item 3) All Members of the Council confirmed that their interests as listed in their Annual Declaration of Interests Forms were accurate and up-to-date. Council Sara Bashford declared a personal interest in agenda item 6 (PQ 040) as she mentioned Gavin Barwell MP in her reply to the question and she works for him. Councillor Janet Marshall declared a personal interest in agenda item 10 as co-opted Governor of Quest Academy; C20110718 min 1 Councillor Margaret Mead declared a personal interest in agenda item 10 as a Governor of Whitgift Foundation. 4. URGENT BUSINESS (agenda item number 4) Councillor Tony Newman moved that the Extraordinary Council Meeting be brought forward as urgent business. -

Confidence Now Building As Town Attracts Investors

Big success Confidence now as cycling building as town elite speed attracts investors PROMINENT investors are across town tapping into Croydon’s potential with a succession of THOUSANDS of people lined the major deals helping to change streets of Croydon as the town hosted the face of the town. a hugely successful round of cycling’s elite team competition on Tuesday, Consultant surveyor Vanessa June 2. Clark (pictured) believes deals such as Hermes Investment The town was the subject of an Management’s purchase of the hour-long highlights package on recently-refurbished Number ITV4 after hosting round three of the One Croydon, one of the town’s women’s Matrix Fitness Grand Prix most iconic buildings, are and round seven of the men’s Pearl “game-changing” in terms of Izumi Tour Series. the way the town is being And the event got people talking perceived. about Croydon in a fresh light as, “The good news is that quality central London what the experts described as a investors now see Croydon as an attractive “hugely-technical” circuit produced a proposition,”she said. “A s confidence in the town thrilling evening’s racing. has improved, so have prices.” Council leader Tony Newman and The so-called 50p Building, designed by Richard Mayor of Croydon Councillor Seifert, changed hands in a reported £36 million Patricia Hay-Justice were among the deal, bringing Hermes’ investment in the town this presentation teams. WHEELS IN MOTION: The cycling tour events held in Croydon earlier this month were hailed as a success year to around £70 million, having already acquired the Grants Entertainment Centre in High Street, which features a 10-screen Vue Cinema, health club, bars and restaurants. -

Parliamentary Debates House of Commons Official Report General Committees

PARLIAMENTARY DEBATES HOUSE OF COMMONS OFFICIAL REPORT GENERAL COMMITTEES Public Bill Committee CRIME AND COURTS BILL [LORDS] Eleventh Sitting Thursday 7 February 2013 (Morning) CONTENTS CLAUSE 36 agreed to. SCHEDULE 17 agreed to. CLAUSE 37 agreed to. SCHEDULE 18 agreed to. Programme order amended. Adjourned till Tuesday 12 February at five minutes to Nine o’clock. PUBLISHED BY AUTHORITY OF THE HOUSE OF COMMONS LONDON – THE STATIONERY OFFICE LIMITED £6·00 PBC (Bill 115) 2012 - 2013 Members who wish to have copies of the Official Report of Proceedings in General Committees sent to them are requested to give notice to that effect at the Vote Office. No proofs can be supplied. Corrigenda slips may be published with Bound Volume editions. Corrigenda that Members suggest should be clearly marked in a copy of the report—not telephoned—and must be received in the Editor’s Room, House of Commons, not later than Monday 11 February 2013 STRICT ADHERENCE TO THIS ARRANGEMENT WILL GREATLY FACILITATE THE PROMPT PUBLICATION OF THE BOUND VOLUMES OF PROCEEDINGS IN GENERAL COMMITTEES © Parliamentary Copyright House of Commons 2013 This publication may be reproduced under the terms of the Open Parliament licence, which is published at www.parliament.uk/site-information/copyright/. 367 Public Bill Committee7 FEBRUARY 2013 Crime and Courts Bill [Lords] 368 The Committee consisted of the following Members: Chairs: MARTIN CATON,†NADINE DORRIES † Barwell, Gavin (Croydon Central) (Con) † Lopresti, Jack (Filton and Bradley Stoke) (Con) † Browne, Mr Jeremy (Minister -

Diversity and Democracy: Race and the 2015 General Election

June 2015 Intelligence for a multi-ethnic Britain Diversity and Democracy: Race and the 2015 General Election Summary Table 1. Top 15 Labour vote share increases in diverse seats, 2015 • In 2015, Labour remained the first preference for most Labour Minority Black and minority ethnic voters, with around 60% choosing Constituency increase population Labour. The Conservatives have increased their vote share Birmingham, Hall Green 26.9% 64% significantly, from around 16% in 2010 to over 25% in 2015 Brent Central* 20.9% 61% • The Liberal Democrats got around 5% of the BME vote, and Poplar and Limehouse 18.6% 57% the Greens less. Only 2% of BME voters chose UKIP Bethnal Green and Bow 18.3% 53% • There is increasing variation in how different ethnic minority Birmingham, Ladywood 18.0% 73% groups vote, as well as regional differences Walthamstow 17.0% 53% • There are now 41 BME MPs, a significant rise, suggesting a Manchester, Gorton 17.0% 48% future BME Prime Minister could now be sitting in Parliament Birmingham, Hodge Hill 16.4% 64% • The success of Britain’s democracy depends not only on BME Leyton and Wanstead 15.0% 51% voter participation and representation, but on policymakers Ilford South 14.6% 76% responding to ethnic inequalities Leicester South 14.2% 51% Bradford East 13.8% 47% Introduction Bermondsey and Old Southwark* 13.8% 42% The 2015 General Election saw the Conservative Prime Ealing Southall 13.5% 70% Minister David Cameron returned with his party’s first overall Ealing Central and Acton* 13.1% 37% majority since John Major’s win in 1992. -

A Guide to the Government for BIA Members

A guide to the Government for BIA members Correct as of 20 August 2019 This is a briefing for BIA members on the new Government led by Boris Johnson and key ministerial appointments for our sector. With 311 MPs, the Conservative Government does not have a parliamentary majority and the new Prime Minister may also have to contend with a number of his own backbenchers who are openly opposed to his premiership and approach to Brexit. It is currently being assumed that he is continuing the confidence and supply deal with the Northern Irish Democratic Unionist Party (DUP). If the DUP will support the Government in key votes, such as on his Brexit deal (if one emerges), the Queen's Speech and Budgets, Boris Johnson will a working majority of 1. However, this may be diminished by Conservative rebels and possible defections. Contents: Ministerial and policy maker positions in the new Government relevant to the life sciences sector .......................................................................................... 2 Ministers and policy maker profiles................................................................................................................................................................................................ 8 Ministerial and policy maker positions in the new Government relevant to the life sciences sector* *Please note that this guide only covers ministers and responsibilities relevant to the life sciences and will be updated as further roles and responsibilities are announced. Department Position Holder