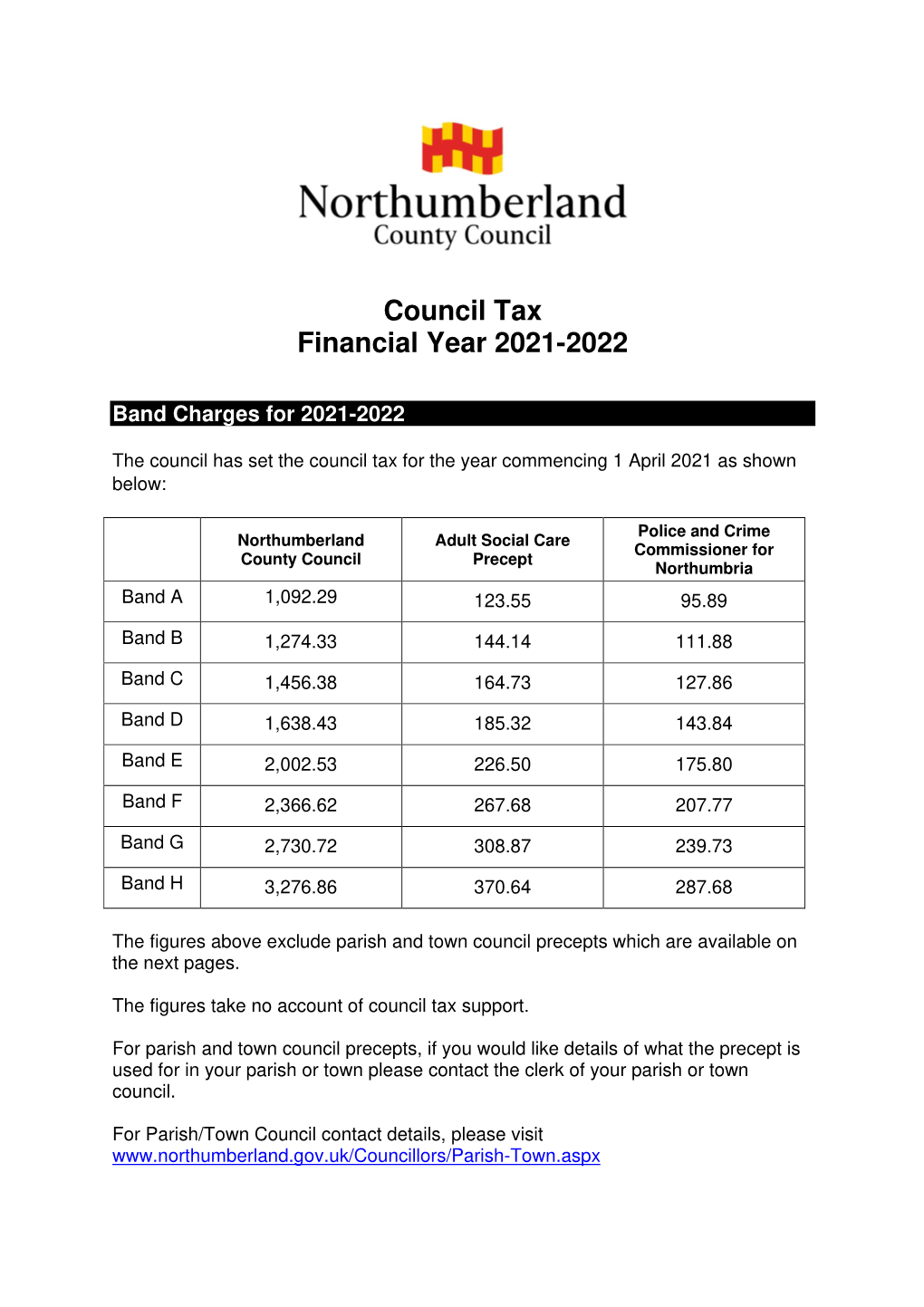

Council Tax Financial Year 2021-2022

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Durham County Council Plan 2020-23

Durham County Council Council Plan 2020-2023 Executive Summary County Durham is a dynamic place, used to overcoming challenges and reinventing itself. Recently, the council and partners agreed a vision for County Durham for 2035 following extensive consultation with our residents. Over 30,000 responses helped shape a vision that people recognise. This is to create more and better jobs, help people live long and independent lives and support communities to be well connected and supportive of each other. Our purpose holds to deliver on these ambitions against a context of COVID-19. This plan sets out how we will achieve this. We want to create more and better jobs by supporting businesses emerging from lockdown back to stability and help to rebuild our economy. We are developing a pipeline of projects and investment plans; our roadmap to help stimulate economic recovery. We will create major employment sites across the county, cementing our position as a premier place in the region to do business. Employability support programmes will be developed to help people back into employment or to start their own business. As young people return to our schools and colleges, we will ensure that they receive a good education and training to equip them with the skills they need to access opportunities of today and the future. We will help our tourism and hospitality sector to recover as a great visitor destination with a cultural offer which will help stimulate the local economy. We want our residents to live long and independent lives and remain in good health for many years to come. -

Visitor Guide 2010

VisitorVisitor GuideGuide 2010 Free to you • FREE PULL OUT WALKING GUIDE INSIDE • • WHAT TO DO • WHERE TO GO • KIDS PAGE • WILDLIFE • EVENTS • www.northumberlandnationalpark.org.uk Welcome Vision for the future in Free to you! Northumberland National Park National Parks are ‘Britain's Breathing Spaces’ and Northumberland National Park with its distinctive open and tranquil landscapes and unique heritage will provide you with wonderful memories to savour. Stretching from Hadrian's Wall in the south, through the rolling valleys of the Tyne and Rede to the impressive hills of the Cheviots on the Scottish Border, the National Park has some of the most unspoilt landscapes in the country. Hadrian’s Wall page 6, page 11 Its’ wealth of history and culture has been shaped by a past that was Tony Gates, National Park Officer Chief Executive NNPA not always peaceful.The landscape of the National Park as it is today has been formed over centuries - from Iron Age hillforts to the legacy Northumberland National Park is a of the Romans, through the Middle Ages to the Victorian industrial age - special place and we have a vision for the 405 scenic square miles and the evidence is everywhere. (1049km2) of this protected landscape that we share with the many people In this Visitor Guide you will see how the National Park Authority, who helped us to develop our latest landowners, farmers, businesses and other organisations are all working Management Plan. to ensure that Northumberland National Park remains one of Britain's Our vision is that Northumberland most beautiful breathing spaces for everyone to enjoy. -

Northumberland Local Plan Core Strategy

Northumberland Local Plan Core Strategy Strategic Land Review – North Northumberland Delivery Area October 2015 Strategic Land Review North Northumberland Delivery Area 1. Introduction 1.1 The North Northumberland Delivery Area is bounded to the north by the Scottish Border, to the west by the Cheviot Hills of the Northumberland National Park and to the south by the Simonside Hills and the Coquet Valley. The coast, which is designated an Area of Outstanding Natural Beauty, forms the eastern boundary. The delivery area includes the Main Towns of Alnwick and Berwick- upon-Tweed, and the Service Centres of Belford, Seahouses, Rothbury and Wooler. The small areas which cover these settlements, and the Rest of the North Delivery Area is shown below. Figure 1: North Northumberland Delivery Area 1 2. Alnwick Introduction 2.1 Alnwick is one of two Main Towns in the North Delivery Area. The small area is comprised of the parishes of Alnwick and Denwick. An emerging Neighbourhood Plan covers the same area. Figure 2: Alnwick small area Role and function 2.2 Alnwick has a number of employment sites, mainly along the south east approach into town, and on the other side of the A1. It is influenced by the Tyne and Wear conurbation in terms of travel to work but to a lesser extent than towns in the Central and South East Delivery Areas of the County. 2.3 The town is linked to the north and south by the A1 road corridor, which is dualled either side of Alnwick but with long stretches of single carriageway separating Alnwick from Morpeth, and Berwick-upon-Tweed. -

Standards for All Archaeological Work in County Durham and Darlington

1 Standards for all Archaeological Work in County Durham and Darlington Contents Standards for all Archaeological Work in County Durham and Darlington ............................. 1 Introduction ......................................................................................................................... 1 General Standards prior to commencement of fieldwork .................................................... 2 The Written Scheme of Investigation .................................................................................. 4 Fieldwork standards............................................................................................................ 8 Post excavation standards ................................................................................................ 12 Public Engagement........................................................................................................... 14 The Report ........................................................................................................................ 15 OASIS ............................................................................................................................... 17 Archiving Standards.......................................................................................................... 18 Publication ........................................................................................................................ 19 Appendix 1 Yorkshire, The Humber & The North East: A Regional Statement Of Good Practice For -

Archaeology in Northumberland Friends

100 95 75 Archaeology 25 5 in 0 Northumberland 100 95 75 25 5 0 Volume 20 Contents 100 100 Foreword............................................... 1 95 Breaking News.......................................... 1 95 Archaeology in Northumberland Friends . 2 75 What is a QR code?...................................... 2 75 Twizel Bridge: Flodden 1513.com............................ 3 The RAMP Project: Rock Art goes Mobile . 4 25 Heiferlaw, Alnwick: Zero Station............................. 6 25 Northumberland Coast AONB Lime Kiln Survey. 8 5 Ecology and the Heritage Asset: Bats in the Belfry . 11 5 0 Surveying Steel Rigg.....................................12 0 Marygate, Berwick-upon-Tweed: Kilns, Sewerage and Gardening . 14 Debdon, Rothbury: Cairnfield...............................16 Northumberland’s Drove Roads.............................17 Barmoor Castle .........................................18 Excavations at High Rochester: Bremenium Roman Fort . 20 1 Ford Parish: a New Saxon Cemetery ........................22 Duddo Stones ..........................................24 Flodden 1513: Excavations at Flodden Hill . 26 Berwick-upon-Tweed: New Homes for CAAG . 28 Remapping Hadrian’s Wall ................................29 What is an Ecomuseum?..................................30 Frankham Farm, Newbrough: building survey record . 32 Spittal Point: Berwick-upon-Tweed’s Military and Industrial Past . 34 Portable Antiquities in Northumberland 2010 . 36 Berwick-upon-Tweed: Year 1 Historic Area Improvement Scheme. 38 Dues Hill Farm: flint finds..................................39 -

Neighbourhood Services Environment, Health

Appendix 3 Neighbourhood Services Environment, Health and Consumer Protection Public Safety (Licensing Services Section) PUBLIC CONSULTATION ON TAXI LICENSING POLICY AND REGULATION BRIEFING PAPER ON HACKNEY CARRIAGES AND PRIVATE HIRE VEHICLE REGULATION IN COUNTY DURHAM (ZONES, THE REGULATION OF HACKNEY CARRIAGE VEHICLE NUMBERS AND COLOUR POLICY) CONTENTS Page 1.0 Introduction 4 2.0 Zoning 4 3.0 Zoning Options 6 3.1 Option A : Removal of the 7 zones and removal of all limits on hackney carriage numbers throughout the County of Durham 6 3.2 Option B : Retain the status quo, with seven zones, two of which are regulated and maintain the existing Limitation on hackney carriage vehicle numbers 9 3.3 Option C : Maintain the zones but with no limitations on numbers of hackney carriages 11 3.4 Option D : Maintain the zones and undertake further demand surveys in all zones 12 3.5 Option E : Removal of the 7 zones with the simultaneous removal of all limitations on hackney carriage numbers in the Chester le street and Durham City zones; and then to undertake a demand survey for the whole of the County of Durham 13 3.6 Opinions of the Department of Transport 15 3.7 Opinions of the Office of Fair Trading 15 3.8 Opinions of Durham Constabulary 15 2 3.9 Opinions of the Licensed Hackney Carriage and Private Hire Trade 3.9.1 Opinions expressed by the local Area Working Groups (AWGs) representing the hackney carriage and private hire trade associated with the existing zones. 16 3.9.2 Opinions expressed by the County Wide Working Group (CWG) comprising representatives from the 7 AWGs whose membership represents the hackney carriage and private hire trade associated with the existing zones. -

(Public Pack)Agenda Document for County

Local Government Act 1972 I Hereby Give You Notice that an Ordinary Meeting of the Durham County Council will be held remotely via Microsoft Teams on Wednesday 20 January 2021 at 10.00 a.m. to transact the following business:- 1. To confirm the minutes of the meetings held on 2 and 16 December 2020 (Pages 5 - 24) 2. To receive any declarations of interest from Members 3. Chair's Announcements 4. Leader's Report 5. Questions from the Public 6. Petitions 7. Report from the Cabinet (Pages 25 - 28) 8. Members Parental Leave Policy - Report of Interim Corporate Director of Resources (Pages 29 - 48) 9. Members Allowance Scheme 2021-22 - Report of Interim Corporate Director of Resources (Pages 49 - 90) 10. Independent Persons - Report of Interim Corporate Director of Resources (Pages 91 - 98) 11. Annual Report of the Standards Committee 2019/2020 (Pages 99 - 108) 12. Report of the Audit Committee - September 2019 to August 2020 (Pages 109 - 118) 13. Motions on Notice Cllr O Temple to Move Durham County Council recognises the importance of transparency in the way it conducts its business, and enshrines it in its constitution by asserting that “The Council is committed to open, fair and transparent decision- making.” Through its constitution the council further seeks to establish how it operates, how decisions are made and the rules and procedures which are followed to ensure that these are efficient, transparent and accountable to local people. It also requires that all members commit to being as open as possible about all the decisions and actions they take, and give reasons for decisions and restrict information only when the wider public interest or the law clearly demands it. -

PDF (Volume 2)

Durham E-Theses Local governance, governmental practices, and the production of policy: local strategic partnerships and area-based 'multiple deprivation' in County Durham Scott, David John How to cite: Scott, David John (2008) Local governance, governmental practices, and the production of policy: local strategic partnerships and area-based 'multiple deprivation' in County Durham, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/2229/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk 2 Local Governance, Governmental Practices, and the Production of Policy: Local Strategic Partnerships and Area-Based 'Multiple Deprivation' in County Durham Volume 2 of 2 David John Scott Ph.D. thesis The copyright of this thesis rests with the author or the university to which it was submitted. No quotation from it, or information derived from it may be published without the prior written consent of the author or university, and any information derived from it should be acknowledged. -

Street Lighting As an Asset; Smart Cities and Infrastructure Developments ADEPTE ASSOCIATION of DIRECTORS of ENVIRONMENT, ECONOMY PLANNING and TRANSPORT

ADEPTE ASSOCIATION OF DIRECTORS OF ENVIRONMENT, ECONOMY PLANNING AND TRANSPORT DAVE JOHNSON ADEPT Street Lighting Group chair ADEPT Engineering Board member UKLB member TfL Contracts Development Manager ADEPTE ASSOCIATION OF DIRECTORS OF ENVIRONMENT, ECONOMY PLANNING AND TRANSPORT • Financial impact of converting to LED • Use of Central Management Systems to profile lighting levels • Street Lighting as an Asset; Smart Cities and Infrastructure Developments ADEPTE ASSOCIATION OF DIRECTORS OF ENVIRONMENT, ECONOMY PLANNING AND TRANSPORT ASSOCIATION OF DIRECTORS OF ENVIRONMENT, ECONOMY, PLANNING AND TRANSPORT Representing directors from county, unitary and metropolitan authorities, & Local Enterprise Partnerships. Maximising sustainable community growth across the UK. Delivering projects to unlock economic success and create resilient communities, economies and infrastructure. http://www.adeptnet.org.uk ADEPTE SOCIETY OF CHIEF OFFICERS OF CSS Wales TRANSPORTATION IN SCOTLAND ASSOCIATION OF DIRECTORS OF ENVIRONMENT, ECONOMY PLANNING AND TRANSPORT ADEPTE SOCIETY OF CHIEF OFFICERS OF CSS Wales TRANSPORTATION IN SCOTLAND ASSOCIATION OF DIRECTORS OF ENVIRONMENT, ECONOMY PLANNING AND TRANSPORT Bedford Borough Council Gloucestershire County Council Peterborough City Council Blackburn with Darwen Council Hampshire County Council Plymouth County Council Bournemouth Borough Council Hertfordshire County Council Portsmouth City Council Bristol City Council Hull City Council Solihull MBC Buckinghamshire County Council Kent County Council Somerset County -

Northeast England – a History of Flash Flooding

Northeast England – A history of flash flooding Introduction The main outcome of this review is a description of the extent of flooding during the major flash floods that have occurred over the period from the mid seventeenth century mainly from intense rainfall (many major storms with high totals but prolonged rainfall or thaw of melting snow have been omitted). This is presented as a flood chronicle with a summary description of each event. Sources of Information Descriptive information is contained in newspaper reports, diaries and further back in time, from Quarter Sessions bridge accounts and ecclesiastical records. The initial source for this study has been from Land of Singing Waters –Rivers and Great floods of Northumbria by the author of this chronology. This is supplemented by material from a card index set up during the research for Land of Singing Waters but which was not used in the book. The information in this book has in turn been taken from a variety of sources including newspaper accounts. A further search through newspaper records has been carried out using the British Newspaper Archive. This is a searchable archive with respect to key words where all occurrences of these words can be viewed. The search can be restricted by newspaper, by county, by region or for the whole of the UK. The search can also be restricted by decade, year and month. The full newspaper archive for northeast England has been searched year by year for occurrences of the words ‘flood’ and ‘thunder’. It was considered that occurrences of these words would identify any floods which might result from heavy rainfall. -

Ethnicity in the North East an Overview

EthnicityNORTH EAST Ethnicity in the North East an overview NORTH EAST ASSEMBLY THE VOICE FOR THE REGION Ethnicity in the Acknowledgements North East I would like to acknowledge the help and guidance received from everyone I have contacted while compiling this guidance. I am particularly indebted to the staff of the Home Office Drugs Prevention Advisory Service, particularly Robert Martin Government Office for the North East and Deborah Burns and Karen Kirkbride, for their continuous support, advice and encouragement. Veena Soni Diversity Advisor Drugs Prevention Advisory Service 1 Ethnicity in the Foreword by Angela Eagle North East The Home Office has committed itself to promoting race equality, particularly in the provision of public services such as education, health, law and order, housing and local government; and achieve representative workforces in its services areas. We are also working hard to promote cohesive communities and deal with the issues that cause segregation in communities. One of the Home OfficeÕs seven main aims is to support strong and active communities in which people of all races and backgrounds are valued and participate on equal terms by developing social policy to build a fair, prosperous and cohesive society in which everyone has a stake. To work with other departments and local government agencies and community groups to regenerate neighbourhoods, to support families; to develop the potential of every individual; to build the confidence and capacity of the whole community to be part of the solution; and to promote good race and community relations, combating prejudice and xenophobia. To promote equal opportunities both within the Home Office and more widely and to ensure that active citizenship contributes to the enhancement of democracy and the development of civil society. -

Festival of the North East Begins Win an English Heritage Family Pass

Northumberland News issue 25 Summer 2013 www.northumberland.gov.uk | Phone 0845 600 6400 Festival of the North East begins LOVE Northumberland Awards Win an English Heritage family pass Plus Markets and summer shopping | Bin collection timetables online | What’s on 6 20 9 21 25 Northumberland In this issue: News 4 Festival of the North East events 9 New library and customer Now available online, by email or in print. information centre Northumberland News is a quarterly magazine 11 Apprenticeships – 100 day packed with features and news articles written challenge specifically for county residents. 14 New county councillors Published in December, March, June and September it is distributed free of charge by 19 Engineering award for new bridge Northumberland County Council. Every effort is made to ensure that all information is accurate at 27 Superfast broadband for all the time of publication. Facebook at: If you would like to receive www.northumberland.gov.uk/facebook Northumberland News in large print, Twitter at: Braille, audio, or in another format or www.northumberland.gov.uk/twitter language please contact us. YouTube at: www.northumberland.gov.uk/youtube Telephone: 0845 600 6400 Front cover: BBC Look North’s Carol Malia with Type Talk: 18001 0845 600 6400 Nicola Wardle (left) from Northumberland County Council, launching the LOVE Northumberland Email: [email protected] Awards. Full story page seven. 2 www.northumberland.gov.uk | Phone 0845 600 6400 Welcome for the huge range of services in We hope you find something Northumberland is included on of interest in the summer pages 14 and 15.