Alternative Investments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inside the Ranking of Private Equity's Biggest Fundraisers Welcome to This Year's PEI 300

PEI 300 Inside the ranking of private equity's biggest fundraisers Welcome to this year's PEI 300 The PEI 300 - 2021 06:19 The changing face of the PEI 300... in 30 seconds Click the button below to see how the ranking has evolved since it was launched in 2007, when $32bn earned top spot Headquartered in North America Europe The Carlyle Group 32,500 KKR 31,000 Goldman Sachs 31,000 Blackstone 28,360 TPG 23,500 Apax Partners 18,850 Bain Capital 17,300 CVC Capital Partners 15,650 Apollo Global Mgt 13,900 2007 Warburg Pincus 13,300 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 Capital raised over preceding five years ($m) Source: Private Equity International 10 biggest risers The firms that made the biggest leap in this year's PEI 300 Headquartered in North America Europe Asia-Pacific Arcline Investment Management (Rank: 128) Up 157 places - Capital raised: $4,250m Värde Partners (135) Up 119 places - Capital raised: $3,980m Charlesbank Capital Partners (60) Up 108 places - Capital raised: $8,600m Wind Point Partners (192) Up 106 places - Capital raised: $2,579m 5Y Capital (171) Up 99 places - Capital raised: $2,872m Coatue Management (121) Up 91 places - Capital raised: $4,430m General Catalyst Partners (116) Up 86 places - Capital raised: $4,520m Vitruvian Partners (79) Up 84 places - Capital raised: $7,263m Vistria Group (112) Up 79 places - Capital raised: $4,664m Hover over the pointer to discover more about the firms making their mark on this Novacap (150) Up 78 places - Capital raised: $3,357m year's PEI 300 -

History, Reorganization and Corporate Structure

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. HISTORY, REORGANIZATION AND CORPORATE STRUCTURE OVERVIEW We are the largest digital medical service platform in China in terms of both the number of Internet hospitals as of December 31, 2020 and volume of digital medical consultations provided in 2019, according to Frost & Sullivan. Guided by our principle of “your health, we care” (“您的健康,我們的責任”), our vision is to establish the largest digital service platform in the world driven by technology and innovation to empower people to live healthier. Our Group was founded by Mr. Liao, the chairman of the Board, executive Director and the CEO of our Company. For the biography and industry experience of Mr. Liao, please refer to the section headed “Directors and Senior Management” in this Document. Our Group was established in 2004. In preparation for the [REDACTED], we conducted the Reorganization, details of which are set out in the sub-section headed “Reorganization” in this section. BUSINESS MILESTONES The following is a summary of our key business development milestones since our inception in 2004: Year Event 2004 Our Company was incorporated in the BVI 2006 Our Company registered by way of continuation in the Cayman Islands 2011 Our Company launched guahao.com, an online doctor appointment platform, in the PRC 2015 We upgraded our brand name from “guahao.com” to “We Doctor” We established Wuzhen Internet Hospital in Wuzhen, China, which was the first Internet hospital in the PRC 2017 We opened our first Internet hospital service center 2018 We launched our “mobile hospital” services empowered by our Internet hospital We established We Doctor Taishan Chronic Disease Internet Hospital, which was the first Internet hospital focusing on CDM in the PRC – 188 – THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. -

Private Equity Value Creation in Finance: Evidence from Life Insurance

University of Pennsylvania Carey Law School Penn Law: Legal Scholarship Repository Faculty Scholarship at Penn Law 2-14-2020 Private Equity Value Creation in Finance: Evidence from Life Insurance Divya Kirti International Monetary Fund Natasha Sarin University of Pennsylvania Carey Law School Follow this and additional works at: https://scholarship.law.upenn.edu/faculty_scholarship Part of the Banking and Finance Law Commons, Corporate Finance Commons, Finance Commons, Finance and Financial Management Commons, Insurance Commons, Insurance Law Commons, and the Law and Economics Commons Repository Citation Kirti, Divya and Sarin, Natasha, "Private Equity Value Creation in Finance: Evidence from Life Insurance" (2020). Faculty Scholarship at Penn Law. 2154. https://scholarship.law.upenn.edu/faculty_scholarship/2154 This Article is brought to you for free and open access by Penn Law: Legal Scholarship Repository. It has been accepted for inclusion in Faculty Scholarship at Penn Law by an authorized administrator of Penn Law: Legal Scholarship Repository. For more information, please contact [email protected]. Private Equity Value Creation in Finance: Evidence from Life Insurance Divya Kirti∗1 and Natasha Sarin2 1International Monetary Fund 2University of Pennsylvania Law School and Wharton School of Business January 13, 2020 Abstract This paper studies how private equity buyouts create value in the insurance industry, where decen- tralized regulation creates opportunities for aggressive tax and capital management. Using novel data on 57 large private equity deals in the insurance industry, we show that buyouts create value by decreasing insurers' tax liabilities; and by reaching-for-yield: PE firms tilt their subsidiaries' bond portfolios toward junk bonds while avoiding corresponding capital charges. -

Kuaishou Technology Annual Report 2020 Corporate Information

Kuaishou AR2020 Cover 04_12.36mm Eng output.pdf 1 20/4/2021 下午3:27 Kuaishou Technology (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) Stock code : 1024 ANNUAL REPORT 2020 C M Y CM MY CY CMY K ANNUAL REPORT ANNUAL REPORT Head Ofce and Principal Place of Business in the PRC Address: Building 1, No. 6, Shangdi West Road, Haidian District, Beijing, the PRC Postcode:100085 Website: www.kuaishou.com Email: [email protected] 2020 WeChat Ofcial Account for Kuaishou: kuaishouApp Contents Corporate Information 2 Financial Summary and Operation Highlights 4 Chairman‘s Statement 7 Management Discussion and Analysis 11 Report of the Board of Directors 31 Corporate Governance Report 76 Independent Auditor‘s Report 92 Consolidated Income Statement 100 Consolidated Statement of Comprehensive Loss 101 Consolidated Balance Sheet 102 Consolidated Statement of Changes in Equity 104 Consolidated Statement of Cash Flows 105 Notes to the Consolidated Financial Statements 106 Definitions 193 Corporate Information BOARD OF DIRECTORS CORPORATE GOVERNANCE COMMITTEE Executive Directors Mr. WANG Huiwen (王慧文) (Chairman) Mr. SU Hua (宿華) (Chairman of the Board) Mr. HUANG Sidney Xuande (黃宣德) Mr. CHENG Yixiao (程一笑) Mr. MA Yin (馬寅) Non-executive Directors JOINT COMPANY SECRETARIES Mr. LI Zhaohui (李朝暉) Mr. JIA Hongyi (賈弘毅) Mr. ZHANG Fei (張斐) Ms. SO Ka Man (蘇嘉敏) Dr. SHEN Dou (沈抖) Mr. LIN Frank (林欣禾) (alias LIN Frank Hurst) AUTHORIZED REPRESENTATIVES Independent Non-executive Directors Mr. SU Hua (宿華) Ms. SO Ka Man (蘇嘉敏) Mr. WANG Huiwen (王慧文) 黃宣德 Mr. HUANG Sidney Xuande ( ) AUDITOR Mr. MA Yin (馬寅) PricewaterhouseCoopers AUDIT COMMITTEE Certified Public Accountants Registered Public Interest Entity Auditor Mr. -

History and Corporate Structure

HISTORY AND CORPORATE STRUCTURE OVERVIEW The Company was incorporated in the Cayman Islands on February 11, 2014 as an exempted company with limited liability, and is the holding company of the Group with businesses conducted through its subsidiaries and Consolidated Affiliated Entities controlled by the Company by virtue of the Contractual Arrangements. The Group was founded by Mr. Su Hua and Mr. Cheng Yixiao. The development history of the Group can be traced back to 2011 when GIF Kuaishou was launched as a mobile app for users to create and share animated images known as GIFs, in essence the earliest form of short videos, according to iResearch. In 2013, we launched our short video social platform. Under the leadership of Mr. Su Hua and Mr. Cheng Yixiao, the Group launched its live streaming business as a natural extension to its platform in 2016, enabling users to be more social and engage with each other in real time on its platform, and has established live streaming, online marketing services, e-commerce, online games, online knowledge-sharing and various other monetization channels. The Group is a leading content community and social platform. Globally, we are the largest live streaming platform by gross billings from virtual gifting and average live streaming MPUs, the second largest short video platform by average DAUs, and the second largest live streaming e-commerce platform by GMV, all for the nine months ended September 30, 2020, according to iResearch. BUSINESS MILESTONES The following is a summary of our key business development milestones: Year Event 2011 GIF Kuaishou was launched for users to create and share animated images known as GIFs, in essence the earliest form of short videos.(1) 2012 We became the first mover in China’s short video industry that enabled users to create, upload and view short videos on mobile devices.(1) 2013 We launched our short video social platform. -

Read the Report

30 Jul 2021 CMB International Securities | Equity Research | Company Update Kuaishou (1024 HK) BUY (Maintain) Mixed 2Q21 with competition & margin pressure Target Price HK$145 (Previous TP HK$382) Up/Downside +29.2% We expect mixed 2Q21 results, with rev +46% YoY, 1% below consensus. Non- Current Price HK$112 GAAP net loss was slightly wider than consensus. Ads and ecommerce momentum will continue, with rev +157%/156% YoY, in our estimates, while livestreaming China Internet Sector weakness is yet over. Stock price pulled back by ~60% in Jul for soft user trend (-9% QoQ based on QM), wider gap between Douyin, and margin dilution for heavier Sophie Huang investment. We cut our topline by 5%/11%/15% in FY21/22/22E, and trimmed our (852) 3900 0889 earnings for higher S&M and content cost. New TP was adjusted to HK$145. [email protected] Multiples might still see temporary pressure due to market correction, regulatory tightening and mixed outlook. Miriam Lu (852) 3761 8728 Mixed 2Q21E. We estimate 2Q21 rev at RMB18.7bn, up 46% YoY, 1% below [email protected] consensus, in which livestreaming/ ads/ecommerce -15%/+157%/+156% YoY. Non-GAAP net loss would reach RMB5.2bn, vs. consensus of Stock Data Mkt Cap (HK$ mn) 466,769 RMB4.2bn. Avg 3 mths t/o (HK$ mn) 1,355.17 Key concern on wider user gap with Douyin and increasing investment. 52w High/Low (HK$) 417.8/ 105.0 Total Issued Shares (mn) 3,394 We expect Kuaishou’s MAU to be flat QoQ in 2Q21E owing to its soft season. -

Kuaishou (1024

17 Mar 2021 CMB International Securities | Equity Research | Company Initiation Kuaishou (1024 HK) BUY (Initiation) A go-to social community Target Price HK$382 Up/Downside +26.0% Current Price HK$303 As a leader in short-video and live streaming, Kuaishou is expected to surf on the growing industry tailwinds, with authentic content and engaged community. We expect its rev to grow at 40% CAGR in FY20-23E, driven by user expansion, China Internet Sector monetization diversification and tech enhancement. Initiate with BUY with DCF- based TP at HK$382. Kuaishou is still at high growing stage, its ads & e- commerce monetization and new initiatives could unlock its TAM and valuation. Sophie Huang (852) 3900 0889 A short-video leader with vibrant & engaged community. Kuaishou ranked [email protected] Top 1 in live streaming and Top 2 in short video and live streaming e-commerce in Sep 2020, according to iResearch. With Kuaishou’s sizable users (305mn Miriam Lu DAU) and vibrant & engaged community, we forecast its rev to surge at 40% (852) 3761 8728 [email protected] CAGR in FY20-23E, backed by user expansion and stepping-up monetization. Bullish on user upside with industry tailwinds and authentic content. We Hanbo Xu expect Kuaishou to surf on the entertainment tailwinds, with ads/ live (852) 3761 8725 streaming/ e-commerce mkt size growing at 34%/20%/58% CAGR in 2019- [email protected] 2025E, according to iResearch. Kuaishou excels itself with authentic content ecosystem, engaged community with interest-based sharing and traffic distribution. We are bullish on its user upside, and expect its MAU/DAU to Stock Data grow at 12%/13% CAGR in FY20-23E. -

Executive Summary

March 19, 2021 Adam Lysenko Testimony before the U.S.-China Economic and Security Review Commission Hearing on U.S. Investment in China's Capital Markets and Military-Industrial Complex Panel II: U.S. Investment in China’s Stock, Debt, and Venture Capital and Private Equity Markets The views expressed in this testimony are the author's alone and do not represent those of any of the organizations with which the author is, or has been, affiliated. Executive Summary Background on China’s Private Equity Ecosystem • Thanks to the rapid expansion of venture capital and other private equity investment in China during the last decade, China is now home to a significant total of global private equity investment each year. In 2020, more than 20% of global venture capital investment dollars funded startups in China, and about 6% of announced non-venture capital PE deals by investment value involved target companies in China. China’s position as a magnet for venture capital investment is particularly striking given that only a few percent of total global venture capital dollars flowed to Chinese startups before 2010. • In 2020, 54% of all venture capital transactions measured by total invested capital included at least one offshore investor, with the US participation rate at 29%. These totals exclude US and other foreign limited partner investment through VC funds managed by general partners from China, which have directed billions of additional dollars of foreign capital to Chinese startups over the last two decades as well. By total announced investment, foreign non-venture capital PE investors matched or narrowly outspent their onshore Chinese counterparts in each of the last two years, making foreign investors relatively more heavyweight players in China’s non-venture capital private equity ecosystem. -

Read the Report

25 May 2021 CMB International Securities | Equity Research | Company Update Kuaishou (1024 HK) BUY (Maintain) 2Q21 E rev to accelerate with better margin Target Price HK$382 (Previous TP HK$382) Up/Downside +64.6% Kuaishou delivered better-than-feared 1Q21 results, with rev +37% YoY, 0%/1% Current Price HK$232 above consensus/our estimate. Non-GAAP net loss was better than consensus. Strong ads (rev +161% YoY) and ecommerce (GMV +220% YoY) offset soft China Internet Sector livestreaming (-20% YoY). After 1Q21 soft seasonality, we expect topline to accelerate and margin to pick up in 2Q21E, backed by solid MAU & DAU trend. We Sophie Huang reiterated our confidence on its user expansion and monetization potential. We lifted (852) 3900 0889 our topline by 1%/3%/3% in FY21/22/2E, but trimmed our earnings for higher S&M [email protected] and sharing cost. Our TP is unchanged at HK$382. Given that recent headwinds have been priced in, we suggest investors move into 2Q21E better outlook. Miriam Lu (852) 3761 8728 Better-than-feared 1Q21. 1Q21 rev was RMB17.0bn, up 37% YoY, 0%/1% [email protected] above consensus/our estimate, in which livestreaming & ads is largely in- Hanbo Xu line and ecommerce beat. Non-GAAP net loss reached RMB4.9bn, better (852) 3761 8725 than consensus/our estimate of RMB5.7bn/RMB6.0bn. [email protected] Users metrics trend well. All user metrics were on track, with MAU +9% QoQ, DAU +9% QoQ, and time spent per DAU +10.5% QoQ. We are impressed by Stock Data its overseas user performance (first time to disclose), with MAU 100mn+ in Mkt Cap (HK$ mn) 953,227 Avg 3 mths t/o (HK$ mn) 2,060.87 1Q21 and 150mn+ in Apr. -

Trends in Global Tech

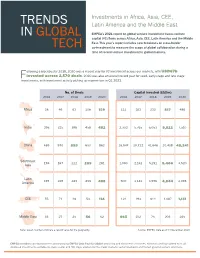

Investments in Africa, Asia, CEE, TRENDS Latin America and the Middle East IN GLOBAL EMPEA’s 2021 report on global venture investment traces venture capital (VC) flows across Africa, Asia, CEE, Latin America and the Middle East. This year’s report includes new breakouts on cross-border TECH co-investment to measure the scope of global collaboration during a time of record venture investment in global markets. ollowing a blockbuster 2019, 2020 was a record year for VC investment across our markets, with USD67b F invested across 2,570 deals. 2020 was also an overall record year for seed, early-stage and late stage investments, with investment activity picking up momentum in Q1 2021. No. of Deals Capital Invested (USDm) 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Africa 28 46 63 108 159 111 163 232 817 486 India 298 315 398 458 482 2,332 5,765 6,053 9,822 7,510 China 489 570 899 630 862 15,547 29,722 41,646 20,438 48,241 Southeast 158 167 222 281 1,083 2,161 5,251 3,520 Asia 289 5,406 Latin 197 249 463 433 500 1,141 1,976 4,093 America 488 4,844 CEE 55 71 48 53 114 124 193 614 1,087 1,131 Middle East 33 27 25 56 52 663 102 75 203 245 Note: Green numbers indicate a record value for the geography. Source: EMPEA. Data as of 31 December 2020. Note: Green highlights contain a record high value for the geography. -

全文本) Acceptance for Registration (Full Version)

公報編號 Journal No.: 2021/31 公布日期 Publication Date:19-03-2021 分項名稱 Section Name: 接納註冊 (全文本) Acceptance for Registration (Full Version) 香港特別行政區政府知識產權署商標註冊處 Trade Marks Registry, Intellectual Property Department The Government of the Hong Kong Special Administrative Region 接納註冊 (全文本) 商標註冊處處長已根據《商標條例》(第 559 章)第 42 條,接納下列商標的註冊申請。現根據《商標條例》第 43 條 及《商標規則》(第 559 章附屬法例)第 15 條,公布申請的詳情。 根據《商標條例》第 44 條及《商標規則》第 16 條,任何人擬就下列商標的註冊提出反對,須在本公告公布日期起計 的三個月內,採用表格第 T6 號提交反對通知。(例如,若果公布日期爲 2003 年 4 月 4 日,則該三個月的 後一日爲 2003 年 7 月 3 日。)反對通知須載有反對理由的陳述及《商標規則》第 16(2)條所提述的事宜。反對人須在提交反對 通知的同時,將該通知的副本送交有關申請人。 有關商標註冊處處長根據商標條例(第 43 章)第 13 條/商標條例(第 559 章)附表 5 第 10 條所接納的註冊申請,請到 http://www.gld.gov.hk/cgi-bin/gld/egazette/index.cgi?lang=c&agree=0 檢視電子憲報。 ACCEPTANCE FOR REGISTRATION (FULL VERSION) The Registrar of Trade Marks has accepted the following trade marks for registration under section 42 of the Trade Marks Ordinance (Cap. 559). Under section 43 of the Trade Marks Ordinance and rule 15 of the Trade Marks Rules (Cap. 559 sub. leg.), the particulars of the applications are published. Under section 44 of the Trade Marks Ordinance and rule 16 of the Trade Marks Rules, any person who wishes to oppose the registration of any of these marks shall, within the 3- month period beginning on the date of this publication, file a notice of opposition on Form T6. (For example, if the publication date is 4 April 2003, the last day of the 3- month period is 3 July 2003.) The notice of opposition shall include a statement of the grounds of opposition and the matters referred to in rule 16(2). -

Powerpoint Template

BeBeez Magazine 17 aprile 2021 - n.15/2021 - Le news del private capital dal 10 al 16 aprile 2021 Per le news del weekend appuntamento lunedì su BeBeez Il fintech italiano raccoglie 247 mln nel 2020 e già 343 mln in poco più di tre mesi nel 2021 In DATI E ANALISI a pag. 22 EdiBeez srl - Corso Italia, 22 – 20122 Milano – P IVA 09375120962 1 I SOMMARIO GREENBEEZ 3 PRIVATE EQUITY & SPAC in Italia 4 VENTURE CAPITAL 7 PRIVATE EQUITY e VENTURE CAPITAL all’estero 8 PRIVATE DEBT 13 REAL ESTATE in Italia 14 REAL ESTATE all’estero 15 CRISI E RILANCI 19 CROWDFUNDING 19 FINTECH 20 ANGELS&INCUBATORS 21 DATI E ANALISI 22 LIBRI 23 ARTE & FINANZA 24 EdiBeez srl - Corso Italia, 22 – 20122 Milano – P IVA 09375120962 2 GREENBEEZ Da Intesa Sanpaolo due sustainability loan ai fondi di fondi di FII sgr per un totale di 55 mln euro 15 aprile 2021 - Fondo Italiano d’Investimento sgr (FII sgr) ha incassato un finanziamento ESG-linked da 55 milioni di euro da Intesa Sanpaolo. Intesa Sanpaolo ha cioè messo a disposizione due linee di credito revolving con caratteristiche ESG, le prime in assoluto destinate a fondi di fondi. Infatti i termini dei due prestiti sono legati a un set di indicatori di sostenibilità e responsabilità sociale. Nel dettaglio i due prestiti ammontano a 30 milioni di euro per il FOF Private Equity Italia e a 25 milioni di euro per il FOF Private Debt Italia. Leggi tutto. Fileni Alimentare ottiene 35 mln euro di plafond di reverse factoring sostenibile da Mps 13 aprile 2021 - Fileni Alimentare spa, leader nel mercato delle carni bianche biologiche, ha ottenuto dal Gruppo Montepaschi la concessione di un plafond factoring di 35 milioni di euro a favore della catena di fornitura dell’azienda marchigiana.