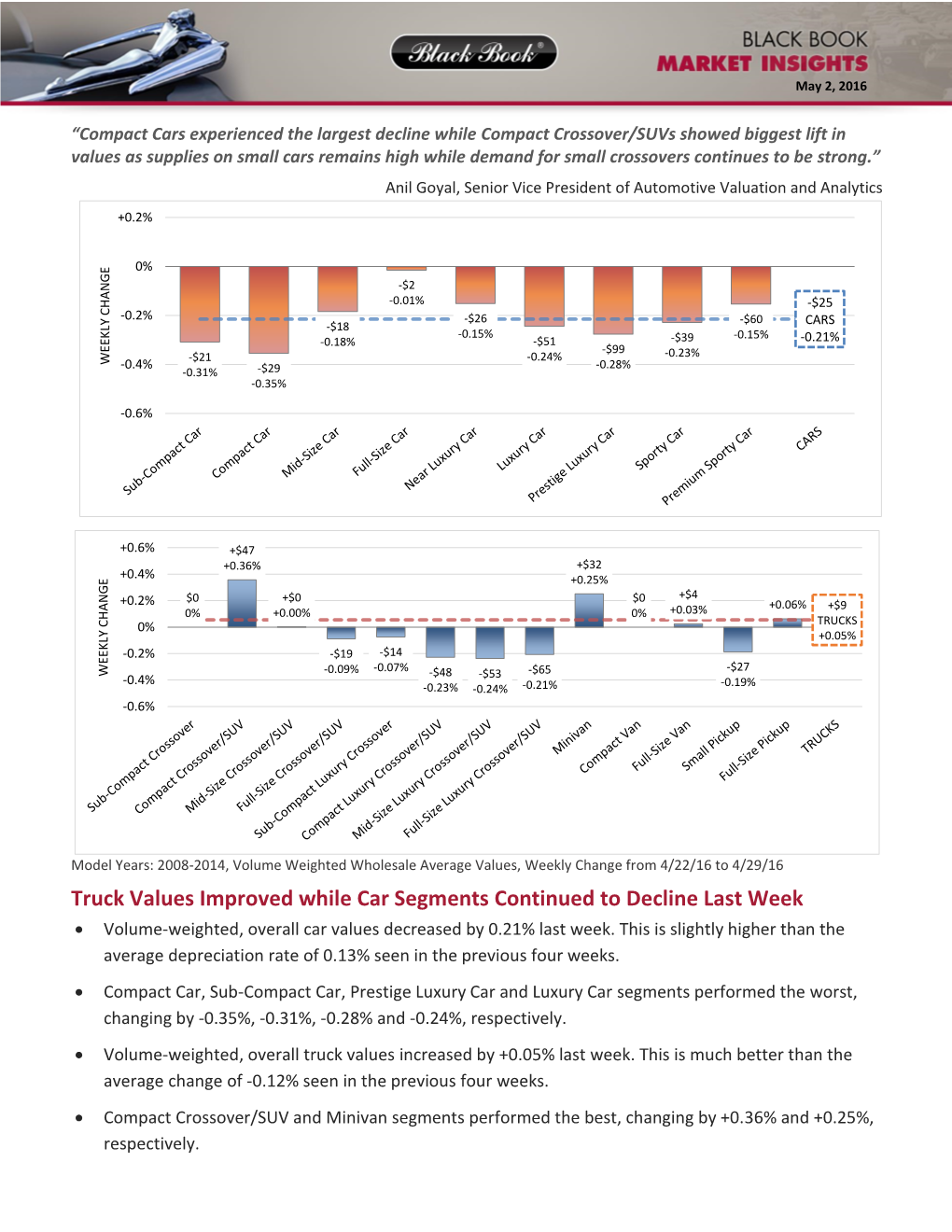

Truck Values Improved While Car Segments Continued to Decline Last Week Volume-Weighted, Overall Car Values Decreased by 0.21% Last Week

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GM End of Lease Guide

END-OF-LEASE GUIDE GOOD THINGS SHOULD NEVER COME TO AN END. As the end of your current lease with GM Financial draws near, we’d like to thank you for your business, and we hope that you’ve had an excellent driving experience in your General Motors vehicle. To help guide you through the end-of-lease process, we’ve created this step-by- step guide. Or, visit gmfinancial.com/EndofLease. What should you do with your current TABLE OF CONTENTS leased GM vehicle? You have several options from which to choose: Your Lease-End Options 1 • Purchase or lease a new GM vehicle Trade in Your Vehicle 2 • Purchase your current leased vehicle Turn in Your Vehicle 2 • Turn in your leased vehicle Want to continue enjoying the GM driving experience? Select Your Next GM Vehicle 3 GM has many new and exciting models available. Check your mail in the coming weeks because you may become Schedule Your Inspection 4 eligible to receive incentives towards the purchase or lease of a new GM vehicle. Review Your Vehicle’s Condition 6 Frequently Asked Questions 11 What will you be driving this time next year? Contact Us 12 GM is consistently developing new and exciting models for our customers. Visit GM.com to check out Wear-and-Tear Card 13 new vehicles and determine which one fits your needs. YOUR LEASE-END OPTIONS Buick Envision Chevrolet Cruze Cadillac XT5 OPTION 1: OPTION 2: OPTION 3: TURN IN YOUR GM VEHICLE PURCHASE YOUR TURN IN YOUR GM VEHICLE AND PURCHASE OR LEASE LEASED GM VEHICLE Return the vehicle to the GM A NEW GM VEHICLE You can purchase your leased vehicle dealership where it was leased.* Are you ready for your next at any time during your lease period, Remember to bring your GM vehicle? Visit your nearest or you may do so near the end of your owner’s manual, extra set of GM dealer to test drive the lease. -

2017 Buick Envision Premium II

WHY CHOOSE US? The family business that has served customers and community for more than 60 years is always here for you! Make Us Your Dealer Of Choice! Internet Value Pricing Convenient Service Hours Shuttle Service Selection We strive to offer a fair, We value your time, and Our goal is to make Our selection of new and competitive price on all realize that sometimes every visit to our facility pre-owned inventory is a of our vehicles. We weekends are the most an efficient and product of partnering with encourage our convenient to take care of enjoyable experience. some of the most customers to do the certain tasks. That’s why Enjoy our competitive brands in the research - we are here to our Service Department is complimentary shuttle market - and the hard work help you find the open from 8 a.m. - 2 p.m. service or our Courtesy of our inventory specialists. vehicle and payment every Saturday. Loaner Program on We are here to help you find that works for your life! your next service visit! your ideal vehicle! Expertise Free Car Washes! Trust in Your Choice We Buy Cars! Our technicians are We hope you enjoy your We only want to offer Not in the market to factory trained and ASE vehicle every day as much the best in vehicle purchase currently? We buy master certified; we as you do the day you selection to our cars even if you don’t sell us feature a state-of-the-art purchase it! Our customers. That’s why yours! We are always Body Shop where we renowned car washes are we stand behind the seeking the best in inventory, complete repairs on all free at any of our three quality of our inventory. -

2063 Section a Layout 09162020.Indd

• CHEVY • BUICK • CHEVY • BUICK • CHEVY • BUICK • CHEVY • BUICK • CHEVY • BUICK • SEPTEMBER 16, 2020 • CHEVY • BUICK • CHEVY • BUICK • CHEVY • BUICK • CHEVY • BUICK • CHEVY • BUICK • BUICK CHEVY • BUICK CHEVY • BUICK CHEVY • BUICK CHEVY • CHEVY P1375 - 2019 Chevrolet 2500 HD P1409 - 2017 Buick Envision P1372 - 2019 Chevrolet Silverado P1362A - 2013 GMC Terrain SLT AWD, B0384A - 2017 Buick Envision Essense P1369 - 2017 Buick Envision Work Truck, Crew Cab 4x4, White, Preferred AWD, Silver, 2.5 EFI, 2500HD Work Truck Crew Cab Goldmist, Sunroof, Power Liftgate, AWD, Metallic Red, Power Liftgate, Essense AWD, White, Only 27,000 6.0 Vortec, Only 60,000 Miles! Rear Camera, Only 30,000 Miles! 4x4, White, 6.0 Vortec, 59,000 Miles! Remote Start, Only 88,000 Miles! Alerts & More! Only 21,000 Miles! Miles! GM Off Lease. Sale Price $34,990 Sale Price $23,990 Sale Price $34,990 Sale Price $12,490 Sale Price $23,990 Sale Price $23,990 WE Need QUALITY PRE-OWNED VEHICLES P1397 - 2020 Buick Enclave Essense P1398 - 2018 Buick Envision Premium for our inventory. P1373A - 2016 Chevrolet Silverado P1297 - 2019 Dodge Grand AWD, Champagne Metallic, 3.6 V6, II AWD, Red Metallic, 2.0 Turbo, Only 2500HD Double Cab WT, White, Caravan GT, Dark Silver Metallic, Only 24,000 Miles! GM Co. Vehicle. 17,000 Miles! GM Off Lease. Your trade has never been worth more. 6.0 Vortec, 146,000 Miles! Only 33,000 Miles! Sale Price $38,990 Sale Price $29,990 Stop in for an appraisal today! Sale Price $19,990 Sale Price $20,990 B0378A - 2017 Buick Envision P1406 - 2020 GMC Yukon Denali P1399 - 2020 Chevrolet Malibu P1401 - 2019 Chevrolet Express 3500 P1395 - 2020 Chevrolet Equinox LT AWD, P1368 - 2019 GMC Terrain SLT Essence AWD, White, Navigation, XL 4x4, Silver, 6.2 Ecotec V8, 22” LT Sedan, Metallic Red, Ebony Passenger Van, White, 12 Passenger Silver Metallic, Aluminum Wheels, 1.5L AWD, White, Ebony Htd. -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

About General Motors China 02 2018 GM China Corporate Social Responsibility Report 03

For years, we have said that the auto industry is experiencing more change today than in the past 50 years. That pace of change is only accelerating. With the right team, technology, resources and scale to achieve our vision of zero Contents crashes, zero emissions and zero congestion, I believe the only thing that can stop us is not acting quickly enough. Disruption creates uncertainty, but it also creates vast possibilities 02 Leadership Message that will lead to a better world. 04 2018 Highlights Mary Barra, General Motors Chairman and CEO 06 Sustainable Vision Creating a Future of Zero Crashes, Zero Emissions and Zero Congestion 08 Sustainable Growth Innovate Now: Seeing Things Not as They Are But as They Could Be Products, Technology and Experience Driving Industry Development 14 On the Spot Optimizing Our Facilities Committed to Safety in Everything We Do Addressing New Security Challenges 20 Special Focus Green Supply Chain 22 Working Together for a Sustainable Future GM and Our Customers GM and Our Employees GM and Our Community 32 Corporate Social Responsibility Management Corporate Social Responsibility Strategy Stakeholder Involvement Honors and Recognition 35 About General Motors China 02 2018 GM China Corporate Social Responsibility Report 03 Leadership Message Corporate Social Responsibility is Synonymous with Our Business Strategy in How do employee volunteers support GM China activities? China at General Motors Our employees have long been active What role does corporate social GM is on track to deliver 10 NEV models participants in many of GM China's CSR responsibility (CSR) play in GM China’s in China between 2016 and 2020, and activities. -

Zero Crashes. Zero Emissions. Zero Congestion

Zero Crashes. 2017 Sustainability Report Zero Emissions. Zero Congestion. IN THIS REPORT CUSTOMERS 26 ASPIRATIONS 3 CORPORATE PROFILE 5 LEADERSHIP MESSAGE 6 2017 HIGHLIGHTS 10 SAFETY PRODUCTS REGIONAL MESSAGES 38 52 GM North America; GM Africa & Middle East Operations 11 GM International 13 GM China 15 PERSONAL SUSTAINABILITY ROAD MAP Q&A 17 MOBILITY SUSTAINABILITY STRATEGY 19 70 STAKEHOLDER ENGAGEMENT 21 REPORTING PRACTICES 23 IMPACTS Customers 26 Safety 38 SUPPLY CHAIN 85 Products 52 Personal Mobility 70 Supply Chain 84 Talent 98 Governance & Ethics 113 GOVERNANCE Operations 124 TALENT & ETHICS Community 142 99 114 GRI CONTENT INDEX 156 UNGC 167 UNSDG 168 SASB 170 TCFD 173 OPERATIONS COMMUNITY 125 143 STATEMENT OF ASSURANCE 177 FORWARD-LOOKING STATEMENTS 180 2 2017 SUSTAINABILITY REPORT ASPIRATIONS WE ACHIEVE SUSTAINABLE PROGRESS BY SETTING OUR SIGHTS HIGH. CUSTOMERS SAFETY PRODUCTS Earn Customers for Life Zero Crashes Zero Emissions Zero Workplace Injuries PERSONAL MOBILITY SUPPLY CHAIN TALENT Zero Congestion Positive Environmental & Realize Everyone’s Potential Social Impact GOVERNANCE & ETHICS OPERATIONS COMMUNITY Full Transparency & Integrity— Positive Environmental & Safe, Smart & Sustainable Always Social Impact Communities 3 2017 SUSTAINABILITY REPORT GENERAL MOTORS VISION A WORLD WITH ZERO CRASHES ZERO EMISSIONS ZERO CONGESTION We Are General Motors WE ARE COMMITTED TO SAFETY IN EVERYTHING WE DO WE EARN CUSTOMERS FOR LIFE WE BUILD BRANDS THAT INSPIRE PASSION AND LOYALTY WE TRANSLATE BREAKTHROUGH TECHNOLOGIES INTO VEHICLES AND EXPERIENCES THAT PEOPLE LOVE WE CREATE SUSTAINABLE SOLUTIONS THAT IMPROVE THE COMMUNITIES IN WHICH WE LIVE AND WORK What We Do How We Do This Why We Exist DELIVER SAFER, SIMPLER BY PUTTING THE CUSTOMER AT THE CENTER TO MOVE HUMANITY AND SUSTAINABLE FORWARD SOLUTIONS OF EVERYTHING WE DO What We Value CUSTOMERS EXCELLENCE RELATIONSHIPS We put the customer at the center of everything We act with integrity. -

Service Bulletin INFORMATION

File in Section: - Bulletin No.: 16-NA-149 Service Bulletin Date: August, 2016 INFORMATION Subject: 2016 Buick Envision New Model Features Model Year: VIN: Brand: Model: Engine: Transmission: From: To: From: To: GASOLINE, 4 CYL, L4, 2.0L, Hydra-Matic DI, DOHC, VVT, " 6T50 6-Speed DCVCP, Buick Envision 2016 2016 All All Automatic TURBO — Transaxle RPO LTG with — RPO M2D STOP/START — RPO KL9 Region — Countries United States and Canada Overview 4421494 Bulletin Purpose 4421124 This is a special bulletin to introduce the 2016 Buick Envision. The purpose of this bulletin is to help the Service Department Personnel become familiar with some of the vehicle’s new features and to describe some of the action they will need to take to service this vehicle. Copyright 2016 General Motors LLC. All Rights Reserved. Page 2 August, 2016 Bulletin No.: 16-NA-149 About the Car " Passive entry and push-button start with standard The Buick Envision was designed, engineered and remote start. tested in the United States and is a world-class luxury " Programmable power liftgate with hands-free crossover vehicle. It targets customers shopping operation. between the Encore, the best-selling Buick in eight years, and the Enclave. It is a four door, five passenger compact crossover with steel body frame (unibody) with front and rear crumple zones; galvanized steel front fenders, roof, door panels and one piece body side outer panel. Efficiency enhancing features include electric power steering, upper grille shutters that open and close to enhance aerodynamics on the highway and a body structure incorporating mass reducing high-strength and ultra-high-strength steels and a lightweight aluminum hood. -

A General Motors Case Study

1st Semester MSc Economics and Business Administration Roskilde University, Department of Social Sciences and Business (ISE) May 2018 Roskilde, Denmark A General Motors case study Written Hui Cui 64341, Durga Narayan Poudel 64336, Philippe Mouritzen 60226, Jakob Aarsoe 62086 and Pietro Di Girolamo 64209 Characters: 136.029 Supervisor Poul Dines Contents 1 Introduction ......................................................................................................................................... 4 1.2 Problem area ................................................................................................................................. 5 1.3 Problem formulation ..................................................................................................................... 5 1.4 Research questions ....................................................................................................................... 5 2 Methodology ........................................................................................................................................ 6 2.1 Purpose of the research ................................................................................................................ 6 2.2 Framework for research methodology ......................................................................................... 6 2.3 Research philosophy/paradigm .................................................................................................... 7 2.4 Research Approach ...................................................................................................................... -

Introduction Car Suv/ Crossover Truck

2021 FLEET GUIDE INTRODUCTION CAR SUV/ TRUCK VAN SPECIALTY RESOURCES CROSSOVER VEHICLES GENERAL MOTORS FLEET AIMING FOR A BETTER TOMORROW In my 36 years with General Motors, I’ve never been more proud of my company. As we started a new decade, I was proud of our vision and the leadership role we had taken in defining the next age of transportation. Now, General Motors is leading in a whole new way. At the onset of the COVID-19 pandemic, we took immediate action to produce ventilators for medical WE’RE LEADING THE INDUSTRY facilities caring for critically ill coronavirus patients, to provide masks for healthcare workers and to fund $2.6 million in grants for non-profit organizations to help those in need. INTO UNCHARTED WATERS — AND WE’RE DOING SO BECAUSE As we work together to rebuild and recover where possible from the aftereffects of the pandemic, General Motors will continue to lead and provide assistance wherever possible. We’ll also continue to aim IT’S THE RIGHT THING TO DO. toward our vision, which is crystal clear — a world with zero crashes, zero emissions and zero congestion. — Ed Peper, General Motors Fleet U.S. Vice President Sure, it’s aspirational but it’s what drives everyone at General Motors. We have the energy, passion and confidence to not only transform our company, but to help create a world that’s better for everyone. OUR I have two young children. I don’t want them to look at me someday and ask, “Why didn’t your company do something about the pollution in the air, the congestion in our cities or the vehicle crashes that take VISION so many lives?” Our vision is to help with these. -

Revision to General Motors' Vehicle Identification Number

GENERAL MOTORS LLC Global Vehicle Safety March 22, 2019 USG 4817 Part 1 The Honorable Heidi King Deputy Administrator National Highway Traffic Safety Administration 1200 New Jersey Avenue, SE Washington, DC 20590 Subject: Revision to General Motors’ Vehicle Identification Number decoding for 2020 Model Year Dear Ms. King: A revision to General Motors’ Vehicle Identification Numbering (VIN) Standard for the 2020 Model Year dated March 20, 2019, is submitted per the VIN reporting requirements of 49 CFR Part 565.16(c). For additional copies of any of the material submitted to the NHTSA for consideration at this time, any additional information regarding items herein, or if further discussion of this matter will be of assistance to the agency during its consideration of this petition, please contact me at the following address: Brian Latouf, Executive Director Global Safety and Field Investigations, Regulations and Certification General Motors LLC, North America GM Global Technical Center 29427 Louis Chevrolet Rd VEC Podium / Floor 02 / Office 2F6-04 Warren, Michigan 48093-2350 Questions may also be directed to either Ms. Lucia Propst, Safety Regulations and Certification, in GM’s Warren office; or Mr. Matthew Jerinsky, of GM’s Washington D.C. office. Sincerely, Brian Latouf, Executive Director Global Safety and Field Investigations Attachment cc: Office of Executive Secretariat Rosalind Proctor, Division Chief, Consumer Programs Division Mail Code: 480-210-2V 29427 Louis Chevrolet Rd • Warren, MI 48090-9020 General Motors LLC 2020 This Vehicle -

2017 UBS Price Book Which Contains the Most Recent Information for Those Models Already in the Marketplace and Available Through UBS

n n Call United Buying Service or visit United Buying Service — ubs4cars.com to ensure you The following Price Guide will help you receive the benefits of using UBS determine the cost of your new vehicle and a Purchase Certificate. and the savings you can expect by using n With United Buying Service you will work United Buying Service. with dedicated advisors and trained s at the UBS affiliated n sale personnel United Buying Service’s pre-negotiated dealership to help you get the vehicle you price includes freight and other want at the right price. costs to the dealer. Manufacturers n will further Be sure to call our UBS advisors incentives and rebates reduce today. We are happy your final cost. to help you get started. UnitedUnited BuyingBuying ServiceService is the reliable, UBS 45 years in the local auto market, With oversimple, and affordable way to buy your next automobile. United Buying Service n 4600 North Park Ave. Chevy Chase, MD, USA 20815 n Email: [email protected] Office Hours: 9am – 5pm, Monday – Friday 301.657. 1920 n 410.792.9070 n ubs4cars.com Washington Area Baltimore Area Visit us on the Web Page 1 of 158 2017 UBS DIGITAL PRICE BOOK TABLE OF CONTENTS 2017 UBS DIGITAL PRICE BOOK (17.3) #1-158 2017 BUICK .....................................#3-16 2017 JEEP.................................... #87-102 2017 Buick Cascada............................. #4 2017 Jeep Cherokee...................... #88-91 2017 Buick Enclave ..........................#5-6 2017 Jeep Compass ...................... #82-94 2017 Buick Encore............................#7-8 2017 Jeep Grand Cherokee........... #95-99 2017 Envision .................................#9-10 2017 Jeep Patriot .......................#100-102 2017 Buick LaCrosse ........................ -

FLEET GUIDE We’Re in the Creating Solutions for Your Business Business

2018 FLEET GUIDE We’re in the creating solutions for your business business. 2018 FLEET GUIDE gmfl eet.com 2018 FLEET GUIDE TABLE OF CONTENTS INTRODUCTION SUV/CROSSOVER PASSENGER VAN A Letter from Ed Peper ...........................................1 Chevrolet Trax .............................................................44 Chevrolet Express Passenger Van .......................82 Safety ..............................................................................2 Buick Encore ................................................................45 GMC Savana Passenger Van ..................................83 Employee Satisfaction ..............................................4 GMC Terrain/Terrain Denali ....................................46 CARGO/CUTAWAY VAN Fleet Efficiency ...........................................................6 Buick Envision .............................................................48 Chevrolet City Express .............................................84 Fleet Management .....................................................8 Buick Enclave...............................................................49 Chevrolet Express Cargo Van ................................86 Customer Experience ...............................................10 Cadillac XT5 .................................................................50 GMC Savana Cargo Van ...........................................88 GM Personnel ...............................................................11 Chevrolet Equinox .....................................................52