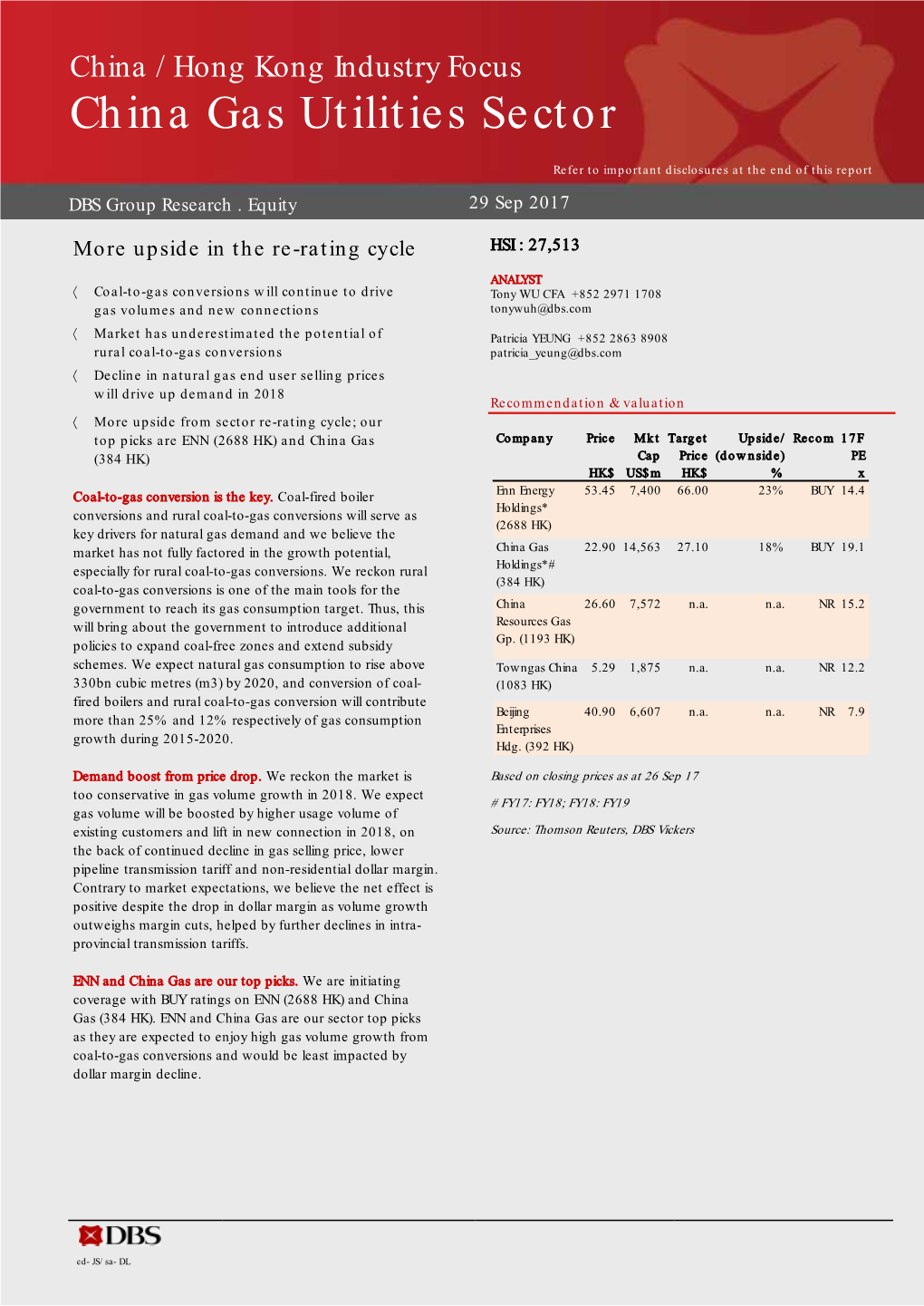

China Gas Utilities Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Company Report Hong Kong Equity Research

Monday, May 30, 2016 China Merchants Securities (HK) Co., Ltd. Company Report Hong Kong Equity Research Anna YU Sinopec Kantons (934 HK) +852 6226 8956 Oil & gas logistics platform to thrive on volume growth [email protected] ■ Key beneficiary of robust China crude oil imports given its more than 50% market share in domestic crude oil jetty services market Initiation ■ Newly acquired natural gas pipeline to leverage on robust China natural gas consumption in the long run BUY ■ Valuation attractive. Initiate with BUY and TP of HK$5.14 Leverage on robust China crude oil imports Price HK$3.72 12-month Target Price We expect China crude oil imports to grow at solid 7% CAGR in 2015- HK$5.14 (+38%) 20E underpinned by lower domestic production, inventory build-up and (Potential up/downside) higher non-state crude oil import quota. Thanks to robust China crude oil imports, we expect the throughput volume in Sinopec Kantons’ 7 Price Performance domestic crude oil terminals to increase from 187mt in 2015 to 244mt in (%) 2018E, representing a CAGR of 9% during the period with overall 10 934 HSI Index utilization up from 69% in 2015 to 83% in 2018E. 0 Gas transmission volume to recover from low base -10 -20 The newly acquired Yu-Ji Pipeline reported a 7.8% YoY decline in -30 transmission volume to 3.0bcm in 2015, mainly due to 37% YoY plunge in -40 volume to Shandong given increased LNG imports in the area upon the -50 operation of Qingdao LNG terminal as at the end of 2014. -

Regional Energy Industry Insights

Regional Energy Industry Insights Volume II Refer to important disclosures at the end of this report DBS Group Research . Equity 5 Jul 2019 The Regional Energy space in Asia-Pacific is evolving rapidly, and we are keeping tabs to share with you. This is the next in a series of short features for the sector in a new and refreshed format, where we will, on a regular basis, present emerging trends and updates that will be of long-term interest for readers. Happy reading! ed: TH/ sa: JC, PY, CS Regional Energy Industry Insights: Issues in regional renewables markets Analyst Issues in regional renewables markets Patricia YEUNG +852 36684189 [email protected] • Investments in renewable energy capacity is on the Suvro Sarkar +65 81893144 rise in most Asia-Pacific markets, but is it all smooth [email protected] sailing? Pei Hwa HO +65 6682 3714 [email protected] • We identify some current issues in renewables sector in select countries in the region and expected progress on these issues in future • In the following pages, we will focus on China, Australia, Vietnam and Bangladesh respectively Page 2 Regional Energy Industry Insights: Issues in regional renewables markets Contents 1. Focus on China – towards grid parity Page 4 2. Focus on Australia – coping with MLFs Page 9 3. Focus on Vietnam – risking agreements Page 13 4. Focus on Bangladesh – land ahoy Page 19 Page 3 Regional Energy Industry Insights: Issues in regional renewables markets SECTION 1: FOCUS ON CHINA Widening shortfall in renewable energy fund. The delay in subsidy payments has been a major overhang for the renewable sector in China. -

Credit Trend Monitor: Earnings Rising with GDP; Leverage Trends Driven by Investment

CORPORATES SECTOR IN-DEPTH Nonfinancial Companies – China 24 June 2021 Credit Trend Monitor: Earnings rising with GDP; leverage trends driven by investment TABLE OF CONTENTS » Economic recovery drives revenue and earnings growth; leverage varies. Rising Summary 1 demand for goods and services in China (A1 stable), driven by the country's GDP growth, Auto and auto services 6 will benefit most rated companies this year and next. Leverage trends will vary by sector. Chemicals 8 Strong demand growth in certain sectors has increased investment requirements, which in Construction and engineering 10 turn could slow some companies’ deleveraging efforts. Food and beverage 12 Internet and technology 14 » EBITDA growth will outpace debt growth for auto and auto services, food and Metals and mining 16 beverages, and technology hardware. As a result, leverage will improve for rated Oil and gas 18 companies in these sectors. A resumption of travel, outdoor activities and business Oilfield services 20 operations, with work-from-home options, as the coronavirus pandemic remains under Property 22 control in China will continue to drive demand. Steel, aluminum and cement 24 Technology hardware 26 » Strong demand and higher pricing will support earnings growth for commodity- Transportation 28 related sectors. These sectors include chemicals, metals and mining, oil and gas, oilfield Utilities 30 services, steel, aluminum and cement. Leverage will improve as earnings increase. Carbon Moody's related publications 32 transition may increase investments for steel, aluminum and cement companies. But List of rated Chinese companies 34 rated companies, which are mostly industry leaders, will benefit in the long term because of market consolidation. -

Towngas China Co Ltd

China / Hong Kong Company Guide Towngas China Co Ltd Version 1 | Bloomberg: 1083 HK Equity | Reuters: 1083.HK Refer to important disclosures at the end of this report DBS Group Research . Equity 21 May 2018 BUY (Initiate coverage) Storing up for growth Last Traded Price ( 18 May 2018):HK$7.90 (HSI : 31,048) First mover advantage in large scale storage facilities Price Target 12-mth: HK$9.00 (14% upside) Dollar margin to remain stable despite winter gas A nalyst shortage Tony WU CFA +852 2971 1708 [email protected] Sales volume to reach CAGR of 14% in FY17-20 Patricia YEUNG +852 28638908 [email protected] Initiate with BUY rating, TP is set at HK$9.00 Price Relative More re-rating to go. Towngas China differs from other gas distributors in its determination to invest in midstream assets. By leveraging on the vast experience and resources of the parent company such as underground storage facility and LNG receiving terminal, it will allow the company to mitigate the dollar margin pressure and we believe the dollar margin will remain stable in FY18. Also, its gas sales volume growth is expected to reach a CAGR of 14% in FY17-20, which will help to drive up the adjusted earnings growth to 14% in FY17-20. This is expected to help the stock re-rate Forecasts and Valuation back to the 15-23x PE range before the oil price collapsed in FY Dec (HK$ m) 2017A 2018F 2019F 2020F 2014 and when volume growth was at double digit. Turnover 8,760 10,120 11,223 12,260 EBITDA 2,619 3,034 3,361 3,663 Where w e differ. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Annual Report

The Hong Kong and China Gas Company Limited (Stock Code: 3) annual report EXPANDING NEW HORIZONS Building on a distinguished history as a local energy supplier in Hong Kong spanning more than a century and a half, we have in recent years consistently embraced new opportunities and challenges as the scope of our operations has progressively expanded. 2014 AWARDS AND RECOGNITIONS TOWNGAS TOWNGAS CHINA Global Chinese Business 1000 Company of the Year Award Yazhou Zhoukan Institution of Gas Engineers & Managers of the United Kingdom and the Energy and Top 100 Hong Kong Listed Companies Utilities Alliance Finet Group Limited and Tencent TOWNGAS & TOWNGAS CHINA The Outstanding Listed Company Award Constituent Companies of The Hong Kong Institute of Financial Analysts the Hang Seng Corporate and Professional Commentators Limited Sustainability Index Series Hang Seng Indexes Company Limited Innovation continued to drive CONTENTS our business in 2014 with the establishment of S-TEch, 02 Towngas’ Businesses In 2014 a new IT services venture 04 Business Highlights focused on the application of 05 Five-Year Summary We have developed a cloud computing. 06 Chairman’s Statement landmark 202 PROJEctS 14 Board of Directors IN MAINLAND CHINA, 15 Biographical Details of Directors Our NEW PLANT IN 19 Executive Committee spanning city-gas, city-water, INNER MONGOLIA was 20 The Mainland Utility Businesses wastewater treatment, natural undergoing commissioning 28 The Hong Kong Gas Business gas pipelines, new energy, to upgrade methanol 36 New Energy and telecommunications and into high-grade fuel Diversified Businesses the production of gas-related chemical products. 44 Corporate Social Responsibility materials and devices. -

Kunlun Energy (135 HK) 23 August 2013

China/Hong Kong China Gas Kunlun Energy (135 HK) 23 August 2013 Company Rating: Outperform Buy on expected earnings miss (maintained) • 1H13 earnings miss was expected; long-term growth story intact. Kunlun’s 1H13 earnings miss should not Price: HK$12.08 obscure the fact that its revenue streams are fundamentally sound given the gradual pickup in LNG plant and pipeline Target: HK$15.50 utilization and the rollout of LNG refilling stations over the (down from HK$16.00) medium term. 1H13 net profit rose 5% YoY to HK$3.68b, 11% below consensus. Earnings were negatively impacted Trading data by a 28% YoY decline in E&P pretax profit, despite higher-than-expected LNG midstream volume growth, 52-week range HK$11.40-17.32 downstream gas sales, and lower D&A expense. Market capitalization HK$97.7b/US$12.6b Shares outstanding (m) 8,063 • We still like the LNG market. As of 1H13, Kunlun had Free float (%) 38 developed 53,000 LNG vehicles versus our estimate of 3M average daily T/O (m share) 20 70,000 vehicles by the end of 2013F. Kunlun stands to 3M average daily T/O (US$ m) 34 benefit from LNG refilling stations built by other gas players Expected return (%) - 1 year 28 over the next two years as overall adoption of LNG vehicles Closing price on 22 August 2013 and LNG demand will rise accordingly. Despite uncertainty over a potential LNG source price hike and signs of a Stock price and HSCEI slowdown in downstream development, we believe the HK$ government will be able to fuel LNG vehicle development 18 through policies implemented over the next few years. -

Expanding New Horizons

(incorporated in the Cayman Islands with limited liability) (Stock Code: 1083) Annual Report 2013 Expanding New Horizons Mission To provide our customers with a safe, reliable supply of gas and the caring, competent and efficient service they expect, while working to preserve, protect and improve our environment. Contents 2 Corporate Information 3 Geographical Coverage 4 Five-Year Financial Summary 5 Financial Highlights 6 Chairman’s Statement 10 Corporate Governance Award 12 Awards 14 Financial Review 18 Business Review 30 Biographical Details of Directors 34 Report of the Directors 49 Corporate Governance Report 61 Independent Auditor’s Report 63 Consolidated Income Statement 64 Consolidated Statement of Comprehensive Income 65 Consolidated Statement of Financial Position 67 Consolidated Statement of Changes in Equity 68 Consolidated Statement of Cash Flows 70 Notes to the Consolidated Financial Statements Corporate Information Board of Directors Registered Office Executive Directors P.O. Box 309 Chan Wing Kin, Alfred (Chairman) Ugland House Wong Wai Yee, Peter (Chief Executive Officer) Grand Cayman Ho Hon Ming, John (Company Secretary) KY1-1104 Cayman Islands Non-Executive Director Kwan Yuk Choi, James Head Office and Principal Place of Business 23rd Floor, 363 Java Road Independent Non-Executive Directors North Point, Hong Kong Cheng Mo Chi, Moses Telephone : (852) 2963 3298 Li Man Bun, Brian David Facsimile : (852) 2561 6618 Chow Vee Tsung, Oscar Stock Code : 1083 Website : www.towngaschina.com Authorised Representatives Chan Wing -

Annual Report 2015

The Hong Kong and China Gas Company Limited The Hong Kong and China Gas Company Limite (Stock Code: 3) Annual Report The Hong Kong and China Gas Company Limited d 香港中華煤氣有限公司 Annual Report 2015 23rd Floor, 363 Java Road, North Point, Hong Kong www.towngas.com 201 5 k h . m o c . t a m r o f . w ww D E T I M I L T A M R O F : N G I S E D CONTENTS 04 Business Coverage in 2015 06 Business Highlights 07 Five-Year Summary 08 Chairman’s Statement 16 Board of Directors 17 Biographical Details of Directors 21 Executive Committee 22 Mainland Utility Businesses 32 Hong Kong Gas Business 40 New Energy and Diversied Businesses 48 Corporate Social Responsibility 58 Risk Factors 59 Financial Resources Review 60 Five-Year Financial Statistics 61 2015 Financial Analysis 62 Comparison of Ten-Year Results 64 Report of the Directors 74 Corporate Governance Report 85 Independent Auditor’s Report 86 Consolidated Income Statement 87 Consolidated Statement of Comprehensive Income 88 Consolidated Statement of Financial Position 90 Consolidated Cash Flow Statement 92 Consolidated Statement of Changes in Equity 94 Notes to the Consolidated Financial Statements 181 Corporate Information and Financial Calendar Slide out the transparent sheet to experience our innovation! As Hong Kong’s first public utility as well as one The Group’s innovative thinking has the of the leading energy providers on the mainland, opportunity to bear fruit because the Towngas we understand the importance of innovation. team is dedicated to recognising bright It is the key to our sustaining contribution in ideas, refining and implementing them in a a rapidly changing business landscape. -

Corporate Rating Component Scores Asia Pacific Q4 2020

Corporate Rating Component Scores Asia Pacific Q4 2020 FALSE APAC Corporate Rating Component Scores Oct. 31, 2020 Corporate Rating Component Scores Asia Pacific Methodology," which is the criteria we use for rating corporate industrial companies and utilities. We list the scores for the 530 public ratings in APAC that are within the scope of our corporate methodology, accompanied by charts that show the distribution of aggregated scores. We believe that the list and charts enhance benchmarking across industries and rating levels for all market participants. We disclose these scores in line with the information we provide in our rating research publications, such as research updates and full analyses. By releasing all scores for public corporate ratings in APAC, S&P Global Ratings confirms its commitment to deliver greater transparency and insight into the ratings process and simplify access for all market participants. Ratings are organized alphabetically by industry sector. The scores reflect the building blocks of the corporate ratings framework (see chart 1). Modifiers and components related to our group rating methodology or government-related entity methodology are indicated only where they have a positive or negative effect on the rating. The report reflects corporate credit ratings and scores as of Oct. 31, 2020. This document will not be updated for future rating actions or score revisions. To keep it concise, the list only discloses scores for the main rated entity of larger corporate groups. We omit certain entities such as subsidiaries or holding companies where the ratings are linked to those on their parent companies. In this report, we highlight changes since Jan. -

SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® Etfs Stock Code: 3073 Website

SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 1st October 2020 to 31st March 2021 SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 Contents Page Condensed Statement of Financial Position (Unaudited) 2 Condensed Statement of Comprehensive Income (Unaudited) 3 Condensed Statement of Changes in Equity (Unaudited) 4 Condensed Statement of Cash Flows (Unaudited) 5 Notes to the Unaudited Condensed Financial Statements 6 Investment Portfolio (Unaudited) 10 Statement of Movements in Portfolio Holdings (Unaudited) 41 Derivative Financial Instruments (Unaudited) 42 Performance Record (Unaudited) 42 Administration and Management 43 1 SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® ETFs Interim Report 2021 CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) As at 31st March 2021 31.03.2021 30.09.2020 Notes HK$ HK$ Assets Current assets Investments 1,385,908,557 969,438,426 Derivative financial instruments 54,331 47,229 Amounts due from brokers – 1,529,953 Dividends receivable 994,452 1,771,941 Other receivables 6(i) 122,017 347,255 Margin deposits 104,721 1,032,223 Cash at bank 6(f) 3,100,556 2,423,717 Total Assets 1,390,284,634 976,590,744 Liabilities Current liabilities Derivative financial instruments – 14 Amounts due to brokers – 1,500,560 Audit fee payable 154,612 309,225 Trustee fee payable 6(e) 382,474 270,773 Management fee payable 6(d) 684,377 481,283 Tax provision 156,265 214,282 Total Liabilities 1,377,728 2,776,137 Equity Net assets attributable to unitholders 4 1,388,906,906 973,814,607 The notes on pages 6 to 9 form part of these financial statements. -

China Gas Utilities Utilities Company Update

Deutsche Bank Markets Research Asia Industry Date Hong Kong 25 July 2016 Utilities China Gas Utilities Utilities Company Update Hanyu Zhang Michael Tong, CFA Research Associate Research Analyst 1H16 preview for gas utilities: BEHL (+852 ) 2203 6207 (+852 ) 2203 6167 remains to be our top pick [email protected] [email protected] 1H16 preview: BEHL is likely to show strongest growth momentum Focus stocks We expect that within China gas utilities space under our coverage, BEHL is Beijing Enterprises (0392.HK),HKD46.00 Buy likely to record highest recurring earnings growth in 1H16 (DBe +19%) driven Price Target HKD57.70 by 23%/6% yoy retail/transmission volume growth and consolidation of EEW (3 China Gas Holdings (0384.HK),HKD12.16 Buy months), partially offset by earnings decline in beer segment (DBe -12%) and Price Target HKD14.00 lower profit contribution from China Gas (reported net profit -45% yoy in ENN Energy (2688.HK),HKD38.05 Hold Price Target HKD42.60 2HFY16). ENN/CR Gas is likely to post mid-teen bottom-line growth while CR Gas (1193.HK),HKD23.60 Hold Price Target Towngas may grow much slower at 5% due to lower-than-peer volume HKD23.40 growth. Kunlun is likely to record another 17% yoy earnings decline for its Towngas China (1083.HK),HKD4.73 Hold Price existing business, but reported net profit may improve 4% yoy after Target HKD4.20 consolidating Kunlun Gas (deal completed in Jun 2016). Kunlun Energy (0135.HK),HKD5.94 Sell Price Target HKD5.40 Volume recovery expected, margins to remain stable in 1H16 Source: Deutsche Bank According to NDRC, China natural gas demand growth recovered to 10% yoy in 1H16 from 5% in 2015.