Expanding New Horizons

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Company Report Hong Kong Equity Research

Monday, May 30, 2016 China Merchants Securities (HK) Co., Ltd. Company Report Hong Kong Equity Research Anna YU Sinopec Kantons (934 HK) +852 6226 8956 Oil & gas logistics platform to thrive on volume growth [email protected] ■ Key beneficiary of robust China crude oil imports given its more than 50% market share in domestic crude oil jetty services market Initiation ■ Newly acquired natural gas pipeline to leverage on robust China natural gas consumption in the long run BUY ■ Valuation attractive. Initiate with BUY and TP of HK$5.14 Leverage on robust China crude oil imports Price HK$3.72 12-month Target Price We expect China crude oil imports to grow at solid 7% CAGR in 2015- HK$5.14 (+38%) 20E underpinned by lower domestic production, inventory build-up and (Potential up/downside) higher non-state crude oil import quota. Thanks to robust China crude oil imports, we expect the throughput volume in Sinopec Kantons’ 7 Price Performance domestic crude oil terminals to increase from 187mt in 2015 to 244mt in (%) 2018E, representing a CAGR of 9% during the period with overall 10 934 HSI Index utilization up from 69% in 2015 to 83% in 2018E. 0 Gas transmission volume to recover from low base -10 -20 The newly acquired Yu-Ji Pipeline reported a 7.8% YoY decline in -30 transmission volume to 3.0bcm in 2015, mainly due to 37% YoY plunge in -40 volume to Shandong given increased LNG imports in the area upon the -50 operation of Qingdao LNG terminal as at the end of 2014. -

Regional Energy Industry Insights

Regional Energy Industry Insights Volume II Refer to important disclosures at the end of this report DBS Group Research . Equity 5 Jul 2019 The Regional Energy space in Asia-Pacific is evolving rapidly, and we are keeping tabs to share with you. This is the next in a series of short features for the sector in a new and refreshed format, where we will, on a regular basis, present emerging trends and updates that will be of long-term interest for readers. Happy reading! ed: TH/ sa: JC, PY, CS Regional Energy Industry Insights: Issues in regional renewables markets Analyst Issues in regional renewables markets Patricia YEUNG +852 36684189 [email protected] • Investments in renewable energy capacity is on the Suvro Sarkar +65 81893144 rise in most Asia-Pacific markets, but is it all smooth [email protected] sailing? Pei Hwa HO +65 6682 3714 [email protected] • We identify some current issues in renewables sector in select countries in the region and expected progress on these issues in future • In the following pages, we will focus on China, Australia, Vietnam and Bangladesh respectively Page 2 Regional Energy Industry Insights: Issues in regional renewables markets Contents 1. Focus on China – towards grid parity Page 4 2. Focus on Australia – coping with MLFs Page 9 3. Focus on Vietnam – risking agreements Page 13 4. Focus on Bangladesh – land ahoy Page 19 Page 3 Regional Energy Industry Insights: Issues in regional renewables markets SECTION 1: FOCUS ON CHINA Widening shortfall in renewable energy fund. The delay in subsidy payments has been a major overhang for the renewable sector in China. -

STAFF APPRAISAL REPORT Public Disclosure Authorized

INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT STAFF APPRAISAL REPORT Public Disclosure Authorized China: Songliao Plain Agricultural Development Project June 16, 1994 The above-captioned Public Disclosure Authorized Staff Appraisal Report for China: Songliao Plain Agricultural Development Project is a revised version of the report prepared following the approval of the Project by the Executive Directors of the Bank and does not include information deemed confidential by the Public Disclosure Authorized Government of the People's Republic of China. Public Disclosure Authorized I Documentof The World Bank FOR OFFICIAL USE ONLY /3 77P-CAII- F, ~~~11`7?5=CHA STAFIFAPPRAISAL REPORT CHINA SONGLIAO PLAIN AGRICULTURAL DEVELOPMENT PROJECT February 1, 1994 INACCORDANCE WTH THE WORLD BAK'S POUCY D.OISCLOSURE OFINFORMATION TH16DOIC_WEHT ISAVAILABLE TO THE PUBL. Agriculture OperationsDivision / 7 China and Mongolia Department East Aia and Pacific Regional Office eY CURRENCY EQUIVALENTSI/ (January 1, 1994) Currency Unit - Yuan (Y) $1.00 = Y 8.7 Y 1.00 - $0.115 FISCAL YEAR January 1 - December 31 WIGHTS AND MEASURE I meter (m) 3.28 feet (ft) 1 cubic meter (m3) = 35.31 cubic feet I millimeter(mm) = 0.04 inch 1 kilometer (kIn) = 0.62 miles 1 square kdlometer(kmi 2) = 100 hectares 1 hectare (ha) 15 mu I ton (t) 1,000 kg = 2,205 pounds 1 kilogram (kg) = 2.2 pounds 1 kilovolt OMV) = 1,000 volts I ldlowatt (W) = 1,000 watts 1/ Thisproect W appraisdm lune/uly 1993whm the excane atewas $1 - Y 5.7. AUlcosts and finncinghve bee raculaed gtthe ateof $1 - Y 8.7,effective Januay 1, 1994.Economic and A finncial lysis baed onorigal pprisalparmiete. -

Credit Trend Monitor: Earnings Rising with GDP; Leverage Trends Driven by Investment

CORPORATES SECTOR IN-DEPTH Nonfinancial Companies – China 24 June 2021 Credit Trend Monitor: Earnings rising with GDP; leverage trends driven by investment TABLE OF CONTENTS » Economic recovery drives revenue and earnings growth; leverage varies. Rising Summary 1 demand for goods and services in China (A1 stable), driven by the country's GDP growth, Auto and auto services 6 will benefit most rated companies this year and next. Leverage trends will vary by sector. Chemicals 8 Strong demand growth in certain sectors has increased investment requirements, which in Construction and engineering 10 turn could slow some companies’ deleveraging efforts. Food and beverage 12 Internet and technology 14 » EBITDA growth will outpace debt growth for auto and auto services, food and Metals and mining 16 beverages, and technology hardware. As a result, leverage will improve for rated Oil and gas 18 companies in these sectors. A resumption of travel, outdoor activities and business Oilfield services 20 operations, with work-from-home options, as the coronavirus pandemic remains under Property 22 control in China will continue to drive demand. Steel, aluminum and cement 24 Technology hardware 26 » Strong demand and higher pricing will support earnings growth for commodity- Transportation 28 related sectors. These sectors include chemicals, metals and mining, oil and gas, oilfield Utilities 30 services, steel, aluminum and cement. Leverage will improve as earnings increase. Carbon Moody's related publications 32 transition may increase investments for steel, aluminum and cement companies. But List of rated Chinese companies 34 rated companies, which are mostly industry leaders, will benefit in the long term because of market consolidation. -

The Late Northern Dynasties Buddhist Statues at Qingzhou and the Qingzhou Style

The Late Northern Dynasties Buddhist Statues at Qingzhou and the Qingzhou Style Liu Fengjun Keywords: late Northern Dynasties Qingzhou area Buddhist statues Qingzhou style In recent years fragmentary Buddhist statues have been Northern Qi period. (3) In the winter of 1979, 40 small frequently unearthed in large numbers in Qingzhou 青州 and large fragmentary statues and some lotus socles were and the surrounding area, including Boxing 博兴, discovered at the Xingguo Temple 兴国寺 site in Gaoqing 高青, Wudi 无棣, Linqu 临朐, Zhucheng 诸 Qingzhou, mainly produced between the end of North- 城, and Qingdao 青岛. Especially notable are the large ern Wei and Northern Qi period. There were also two quantities of statues at the site of the Longxing Temple Buddha head sculptures of the Sui and Tang periods. (4) 龙兴寺 at Qingzhou. The discovery of these statues drew In the 1970s, seven stone statues were discovered at great attention from academic circles. The significance He’an 何庵 Village, Wudi County. Four of them bear of these statues is manifold. I merely intend to under take Northern Qi dates. (5) In November 1987, one single a tentative study of the causes and date of the destruction round Bodhisattva stone sculpture of the Eastern Wei of the Buddhist statues and of the artistic features of the period and one round Buddhist stone sculpture of the Qingzhou style statues. Northern Qi period were discovered on the South Road of Qingzhou. Both works were painted colorfully and I. Fragmentary Buddhist Statues of the Late partly gilt. They were preserved intact and remained Northern Dynasties Unearthed in the Qingzhou Area colorful. -

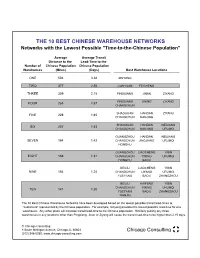

10 BEST CHINESE WAREHOUSE NETWORKS Networks with the Lowest Possible "Time-To-The-Chinese Population"

THE 10 BEST CHINESE WAREHOUSE NETWORKS Networks with the Lowest Possible "Time-to-the-Chinese Population" Average Average Transit Distance to the Lead-Time to the Number of Chinese Population Chinese Population Warehouses (Miles) (Days) Best Warehouse Locations ONE 504 3.38 XINYANG TWO 377 2.55 LIANYUAN FEICHENG THREE 309 2.15 PINGXIANG JINAN ZIYANG PINGXIANG JINING ZIYANG FOUR 265 1.87 CHANGCHUN SHAOGUAN HANDAN ZIYANG FIVE 228 1.65 CHANGCHUN NANJING SHAOGUAN HANDAN NEIJIANG SIX 207 1.53 CHANGCHUN NANJING URUMQI GUANGZHOU HANDAN NEIJIANG SEVEN 184 1.42 CHANGCHUN JINGJIANG URUMQI HONGHU GUANGZHOU LIAOCHENG YIBIN EIGHT 168 1.31 CHANGCHUN YIXING URUMQI HONGHU BAOJI BEILIU LIAOCHENG YIBIN NINE 154 1.24 CHANGCHUN LIYANG URUMQI YUEYANG BAOJI ZHANGZHOU BEILIU KAIFENG YIBIN CHANGCHUN YIXING URUMQI TEN 141 1.20 YUEYANG BAOJI ZHANGZHOU TIANJIN The 10 Best Chinese Warehouse Networks have been developed based on the lowest possible transit lead-times to "customers" represented by the Chinese population. For example, Xinyang provides the lowest possible lead-time for one warehouse. Any other place will increase transit lead-time to the Chinese population. Similarly putting any three warehouses in any locations other than Pingxiang, Jinan or Ziyang will cause the transit lead-time to be higher than 2.15 days. © Chicago Consulting 8 South Michigan Avenue, Chicago, IL 60603 Chicago Consulting (312) 346-5080, www.chicago-consulting.com THE 10 BEST CHINESE WAREHOUSE NETWORKS Networks with the Lowest Possible "Time-to-the-Chinese Population" Best One City -

Towngas China Co Ltd

China / Hong Kong Company Guide Towngas China Co Ltd Version 1 | Bloomberg: 1083 HK Equity | Reuters: 1083.HK Refer to important disclosures at the end of this report DBS Group Research . Equity 21 May 2018 BUY (Initiate coverage) Storing up for growth Last Traded Price ( 18 May 2018):HK$7.90 (HSI : 31,048) First mover advantage in large scale storage facilities Price Target 12-mth: HK$9.00 (14% upside) Dollar margin to remain stable despite winter gas A nalyst shortage Tony WU CFA +852 2971 1708 [email protected] Sales volume to reach CAGR of 14% in FY17-20 Patricia YEUNG +852 28638908 [email protected] Initiate with BUY rating, TP is set at HK$9.00 Price Relative More re-rating to go. Towngas China differs from other gas distributors in its determination to invest in midstream assets. By leveraging on the vast experience and resources of the parent company such as underground storage facility and LNG receiving terminal, it will allow the company to mitigate the dollar margin pressure and we believe the dollar margin will remain stable in FY18. Also, its gas sales volume growth is expected to reach a CAGR of 14% in FY17-20, which will help to drive up the adjusted earnings growth to 14% in FY17-20. This is expected to help the stock re-rate Forecasts and Valuation back to the 15-23x PE range before the oil price collapsed in FY Dec (HK$ m) 2017A 2018F 2019F 2020F 2014 and when volume growth was at double digit. Turnover 8,760 10,120 11,223 12,260 EBITDA 2,619 3,034 3,361 3,663 Where w e differ. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Shengjing Bank Co., Ltd.* (A Joint Stock Company Incorporated in the People's Republic of China with Limited Liability) Stock Code: 02066 Annual Report Contents

Shengjing Bank Co., Ltd.* (A joint stock company incorporated in the People's Republic of China with limited liability) Stock Code: 02066 Annual Report Contents 1. Company Information 2 8. Directors, Supervisors, Senior 68 2. Financial Highlights 4 Management and Employees 3. Chairman’s Statement 7 9. Corporate Governance Report 86 4. Honours and Awards 8 10. Report of the Board of Directors 113 5. Management Discussion and 9 11. Report of the Board of Supervisors 121 Analysis 12. Social Responsibility Report 124 5.1 Environment and Prospects 9 13. Internal Control 126 5.2 Development Strategies 10 14. Independent Auditor’s Report 128 5.3 Business Review 11 15. Financial Statements 139 5.4 Financial Review 13 16. Notes to the Financial Statements 147 5.5 Business Overview 43 17. Unaudited Supplementary 301 5.6 Risk Management 50 Financial Information 6. Significant Events 58 18. Organisational Chart 305 7. Change in Share Capital and 60 19. The Statistical Statements of All 306 Shareholders Operating Institution of Shengjing Bank 20. Definition 319 * Shengjing Bank Co., Ltd. is not an authorised institution within the meaning of the Banking Ordinance (Chapter 155 of the Laws of Hong Kong), not subject to the supervision of the Hong Kong Monetary Authority, and not authorised to carry on banking and/or deposit-taking business in Hong Kong. COMPANY INFORMATION Legal Name in Chinese 盛京銀行股份有限公司 Abbreviation in Chinese 盛京銀行 Legal Name in English Shengjing Bank Co., Ltd. Abbreviation in English SHENGJING BANK Legal Representative ZHANG Qiyang Authorised Representatives ZHANG Qiyang and ZHOU Zhi Secretary to the Board of Directors ZHOU Zhi Joint Company Secretaries ZHOU Zhi and KWONG Yin Ping, Yvonne Registered and Business Address No. -

Cereal Series/Protein Series Jiangxi Cowin Food Co., Ltd. Huangjindui

产品总称 委托方名称(英) 申请地址(英) Huangjindui Industrial Park, Shanggao County, Yichun City, Jiangxi Province, Cereal Series/Protein Series Jiangxi Cowin Food Co., Ltd. China Folic acid/D-calcium Pantothenate/Thiamine Mononitrate/Thiamine East of Huangdian Village (West of Tongxingfengan), Kenli Town, Kenli County, Hydrochloride/Riboflavin/Beta Alanine/Pyridoxine Xinfa Pharmaceutical Co., Ltd. Dongying City, Shandong Province, 257500, China Hydrochloride/Sucralose/Dexpanthenol LMZ Herbal Toothpaste Liuzhou LMZ Co.,Ltd. No.282 Donghuan Road,Liuzhou City,Guangxi,China Flavor/Seasoning Hubei Handyware Food Biotech Co.,Ltd. 6 Dongdi Road, Xiantao City, Hubei Province, China SODIUM CARBOXYMETHYL CELLULOSE(CMC) ANQIU EAGLE CELLULOSE CO., LTD Xinbingmaying Village, Linghe Town, Anqiu City, Weifang City, Shandong Province No. 569, Yingerle Road, Economic Development Zone, Qingyun County, Dezhou, biscuit Shandong Yingerle Hwa Tai Food Industry Co., Ltd Shandong, China (Mainland) Maltose, Malt Extract, Dry Malt Extract, Barley Extract Guangzhou Heliyuan Foodstuff Co.,LTD Mache Village, Shitan Town, Zengcheng, Guangzhou,Guangdong,China No.3, Xinxing Road, Wuqing Development Area, Tianjin Hi-tech Industrial Park, Non-Dairy Whip Topping\PREMIX Rich Bakery Products(Tianjin)Co.,Ltd. Tianjin, China. Edible oils and fats / Filling of foods/Milk Beverages TIANJIN YOSHIYOSHI FOOD CO., LTD. No. 52 Bohai Road, TEDA, Tianjin, China Solid beverage/Milk tea mate(Non dairy creamer)/Flavored 2nd phase of Diqiuhuanpo, Economic Development Zone, Deqing County, Huzhou Zhejiang Qiyiniao Biological Technology Co., Ltd. concentrated beverage/ Fruit jam/Bubble jam City, Zhejiang Province, P.R. China Solid beverage/Flavored concentrated beverage/Concentrated juice/ Hangzhou Jiahe Food Co.,Ltd No.5 Yaojia Road Gouzhuang Liangzhu Street Yuhang District Hangzhou Fruit Jam Production of Hydrolyzed Vegetable Protein Powder/Caramel Color/Red Fermented Rice Powder/Monascus Red Color/Monascus Yellow Shandong Zhonghui Biotechnology Co., Ltd. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated.