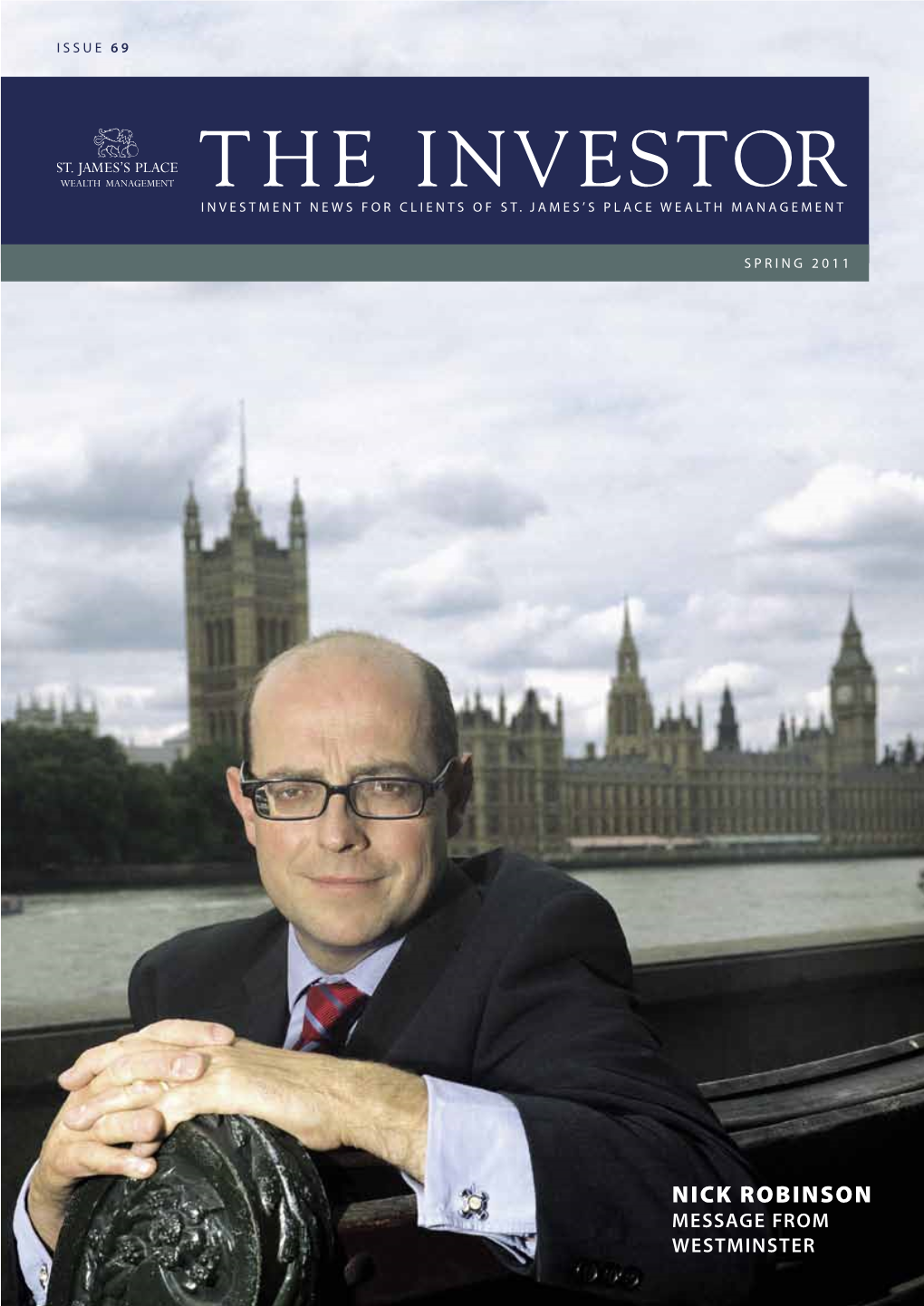

Nick Robinson Message from Westminster

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

'Pinkoes Traitors'

‘PINKOES AND TRAITORS’ The BBC and the nation, 1974–1987 JEAN SEATON PROFILE BOOKS First published in Great Britain in !#$% by Pro&le Books Ltd ' Holford Yard Bevin Way London ()$* +,- www.pro lebooks.com Copyright © Jean Seaton !#$% The right of Jean Seaton to be identi&ed as the author of this work has been asserted in accordance with the Copyright Designs and Patents Act $++/. All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the publisher of this book. A CIP catalogue record for this book is available from the British Library. ISBN +4/ $ /566/ 545 6 eISBN +4/ $ /546% +$6 ' All reasonable e7orts have been made to obtain copyright permissions where required. Any omissions and errors of attribution are unintentional and will, if noti&ed in writing to the publisher, be corrected in future printings. Text design by [email protected] Typeset in Dante by MacGuru Ltd [email protected] Printed and bound in Britain by Clays, Bungay, Su7olk The paper this book is printed on is certi&ed by the © $++6 Forest Stewardship Council A.C. (FSC). It is ancient-forest friendly. The printer holds FSC chain of custody SGS-COC-!#6$ CONTENTS List of illustrations ix Timeline xvi Introduction $ " Mrs Thatcher and the BBC: the Conservative Athene $5 -

Ull History Centre: Papers of Alan Plater

Hull History Centre: Papers of Alan Plater U DPR Papers of Alan Plater 1936-2012 Accession number: 1999/16, 2004/23, 2013/07, 2013/08, 2015/13 Biographical Background: Alan Frederick Plater was born in Jarrow in April 1935, the son of Herbert and Isabella Plater. He grew up in the Hull area, and was educated at Pickering Road Junior School and Kingston High School, Hull. He then studied architecture at King's College, Newcastle upon Tyne, becoming an Associate of the Royal Institute of British Architects in 1959 (since lapsed). He worked for a short time in the profession, before becoming a full-time writer in 1960. His subsequent career has been extremely wide-ranging and remarkably successful, both in terms of his own original work, and his adaptations of literary works. He has written extensively for radio, television, films and the theatre, and for the daily and weekly press, including The Guardian, Punch, Listener, and New Statesman. His writing credits exceed 250 in number, and include: - Theatre: 'A Smashing Day'; 'Close the Coalhouse Door'; 'Trinity Tales'; 'The Fosdyke Saga' - Film: 'The Virgin and the Gypsy'; 'It Shouldn't Happen to a Vet'; 'Priest of Love' - Television: 'Z Cars'; 'The Beiderbecke Affair'; 'Barchester Chronicles'; 'The Fortunes of War'; 'A Very British Coup'; and, 'Campion' - Radio: 'Ted's Cathedral'; 'Tolpuddle'; 'The Journal of Vasilije Bogdanovic' - Books: 'The Beiderbecke Trilogy'; 'Misterioso'; 'Doggin' Around' He received numerous awards, most notably the BAFTA Writer's Award in 1988. He was made an Honorary D.Litt. of the University of Hull in 1985, and was made a Fellow of the Royal Society of Literature in 1985. -

20Entrepreneurial Journalism

Journalism: New Challenges Edited by: Karen Fowler-Watt and Stuart Allan Journalism: New Challenges Edited by: Karen Fowler-Watt and Stuart Allan Published by: Centre for Journalism & Communication Research Bournemouth University ISBN: 978-1-910042-01-4 [paperback] ISBN: 978-1-910042-00-7 [ebook-PDF] ISBN: 978-1-910042-02-1 [ebook-epub] http://microsites.bournemouth.ac.uk/cjcr/ Copyright © 2013 Acknowledgements Table of contents Introduction Karen Fowler-Watt and Stuart Allan Section One: New Directions in Journalism 1 A Perfect Storm 1 Stephen Jukes 2 The Future of Newspapers in a Digital Age 19 Shelley Thompson 3 International News Agencies: Global Eyes 35 that Never Blink Phil MacGregor 4 Impartiality in the News 64 Sue Wallace 5 Current Affairs Radio: Realigning News and 79 Comment Hugh Chignell 6 Radio Interviews: A Changing Art 98 Ceri Thomas 7 The Changing Landscape of Magazine 114 Journalism Emma Scattergood 8 Live Blogging and Social Media Curation 123 Einar Thorsen 9 Online News Audiences: The Challenges 146 of Web Metrics An Nguyen ii Table of contents 10 The Camera as Witness: The Changing 162 Nature of Photojournalism Stuart Allan and Caitlin Patrick Section Two: The Changing Nature of News Reporting 11 Truth and the Tabloids 183 Adam Lee – Potter 12 Irreverence and Independence? The Press 192 post–Leveson Sandra Laville 13 Editorial Leadership in the Newsroom 201 Karen Fowler-Watt and Andrew Wilson 14 Investigative Journalism: Secrets, Salience 220 and Storytelling Kevin Marsh 15 Journalists and their Sources: The Twin 241 Challenges of Diversity and Verification Jamie Matthews 16 News and Public Relations: A Dangerous 258 Relationship Kevin Moloney, Dan Jackson and David McQueen 17 Political Reporting: Enlightening Citizens 281 or Undermining Democracy? Darren G. -

Independent Television Producers in England

Negotiating Dependence: Independent Television Producers in England Karl Rawstrone A thesis submitted in partial fulfilment of the requirements of the University of the West of England, Bristol for the degree of Doctor of Philosophy Faculty of Arts and Creative Industries, University of the West of England, Bristol November 2020 77,900 words. Abstract The thesis analyses the independent television production sector focusing on the role of the producer. At its centre are four in-depth case studies which investigate the practices and contexts of the independent television producer in four different production cultures. The sample consists of a small self-owned company, a medium- sized family-owned company, a broadcaster-owned company and an independent- corporate partnership. The thesis contextualises these case studies through a history of four critical conjunctures in which the concept of ‘independence’ was debated and shifted in meaning, allowing the term to be operationalised to different ends. It gives particular attention to the birth of Channel 4 in 1982 and the subsequent rapid growth of an independent ‘sector’. Throughout, the thesis explores the tensions between the political, economic and social aims of independent television production and how these impact on the role of the producer. The thesis employs an empirical methodology to investigate the independent television producer’s role. It uses qualitative data, principally original interviews with both employers and employees in the four companies, to provide a nuanced and detailed analysis of the complexities of the producer’s role. Rather than independence, the thesis uses network analysis to argue that a television producer’s role is characterised by sets of negotiated dependencies, through which professional agency is exercised and professional identity constructed and performed. -

*^" •'•"Jsbfc''""^.' •'' '"'V^F' F'7"''^^?!CT

*^" •'•"JSBfc''""^.' •'' '"'V^f' f'7"''^^?!CT 1 AJR Information Volume XLV No. 1 January 1990 £3 (to non-members) Don't miss £4m needed to extend the Homes Back to the future P-3 AJR residential care appeal Sir Sigmund Sternberg visits Help us to meet the challenge Day Centre p. 8 he AJR together with CBF Residendal Care and Housing Association have risen to the challenge AJR Residential of the 1990s and beyond with the preparadon of a five year plan for extending and refurbishing Care Appeal - the homes, whose history now goes back more than thirty years. The plan provides for: How to T contribute . * 21 new sheltered accommodation units P-9 * 13 new rooms with toilet facilities * 102 rooms to be provided with toilet facilides * 15 rooms to offer nursing facilities The AJR through its AJR Charitable Trust has undertaken responsibility for mounnng the appeal to raise the funds for this project. Moreover, in order to permit an immediate start on the implementation of the plan the Trust has underwritten the first £500 000 of the cost. Thus work has already started on the first phase. Higher expectations Our homes offer sheltered accommodation, residendal care and full nursing care for about 250 people, a considerable number, but not enough to meet current needs. They have been shining examples of their kind, comparing favourably with others around the country. But higher standards are now expected, which means that new rooms must be built with private toilets and showers, and these facilities must be added to existing rooms. Residents are now older at the time of admission and average age in the homes has risen to 85. -

Escape Velocity: Growing Salford's Digital and Creative Economy

December 2017 ESCAPE VELOCITY: Growing Salford’s Digital & Creative Economy Max Wind-Cowie RESPUBLICA RECOMMENDS Acknowlegements As part of the research for this report, ResPublica interviewed a wide range of third party, industry and Governmental stakeholders with relevant expertise in the digital, media and creative industries. The report recommendations have benefited from the collective insight of many of our interviewees. However, the content and views contained in this report are those of ResPublica and do not necessarily reflect the policy positions of wider stakeholders. We would like to thank the author of this report, Max Wind-Cowie, for providing the original content before his secondment to the National Infrastructure Commission in August 2017. Special thanks to Justin Bentham, Strategic Economic Growth Manager, Salford City Council for his research and analysis. We would also like to thank Mark Morrin, Principle Research Consultant, ResPublica, for his contributions to final drafting and editing. About ResPublica The ResPublica Trust (ResPublica) is an independent non-partisan think tank. Through our research, policy innovation and programmes, we seek to establish a new economic, social and cultural settlement. In order to heal the long-term rifts in our country, we aim to combat the concentration of wealth and power by distributing ownership and agency to all, and by re-instilling culture and virtue across our economy and society. Escape Velocity Contents Foreword 2 1. Introduction 5 2. The Salford Story 9 Anchor institutions and economic clusters 11 The BBC as a key anchor institution 14 Beyond the BBC 17 Beyond broadcast 19 Beyond MediaCityUK 20 A cluster with real impact 22 Achieving escape velocity 23 3. -

The Educational Backgrounds of Leading Journalists

The Educational Backgrounds of Leading Journalists June 2006 NOT FOR PUBLICATION BEFORE 00.01 HOURS THURSDAY JUNE 15TH 2006 1 Foreword by Sir Peter Lampl In a number of recent studies the Sutton Trust has highlighted the predominance of those from private schools in the country’s leading and high profile professions1. In law, we found that almost 70% of barristers in the top chambers had attended fee-paying schools, and, more worryingly, that the young partners in so called ‘magic circle’ law firms were now more likely than their equivalents of 20 years ago to have been independently-educated. In politics, we showed that one third of MPs had attended independent schools, and this rose to 42% among those holding most power in the main political parties. Now, with this study, we have found that leading news and current affairs journalists – those figures who are so central in shaping public opinion and national debate – are more likely than not to have been to independent schools which educate just 7% of the population. Of the top 100 journalists in 2006, 54% were independently educated an increase from 49% in 1986. Not only does this say something about the state of our education system, but it also raises questions about the nature of the media’s relationship with society: is it healthy that those who are most influential in determining and interpreting the news agenda have educational backgrounds that are so different to the vast majority of the population? What is clear is that an independent school education offers a tremendous boost to the life chances of young people, making it more likely that they will attain highly in school exams, attend the country’s leading universities and gain access to the highest and most prestigious professions. -

OF the 1980S

THAT MADE THE HOME COMPUTER REVOLUTION OF THE 1980s 23 THAT MADE THE HOME COMPUTER REVOLUTION OF THE 1980s First published in 2021 by Raspberry Pi Trading Ltd, Maurice Wilkes Building, St. John’s Innovation Park, Cowley Road, Cambridge, CB4 0DS Publishing Director Editors Russell Barnes Phil King, Simon Brew Sub Editor Design Nicola King Critical Media Illustrations CEO Sam Alder with Brian O Halloran Eben Upton ISBN 978-1-912047-90-1 The publisher, and contributors accept no responsibility in respect of any omissions or errors relating to goods, products or services referred to or advertised in this book. Except where otherwise noted, the content of this book is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported (CC BY-NC-SA 3.0). Contents Introduction. 6 Research Machines 380Z. 8 Commodore PET 2001. 18 Apple II. 36 Sinclair ZX80 and ZX81. 46 Commodore VIC-20 . 60 IBM Personal Computer (5150). 78 BBC Micro . 90 Sinclair ZX Spectrum. 114 Dragon 32. 138 Commodore 64. 150 Acorn Electron . .166 Apple Macintosh . .176 Amstrad CPC 464. 194 Sinclair QL . .210 Atari 520ST. 222 Commodore Amiga. 234 Amstrad PCW 8256. 256 Acorn Archimedes . .268 Epilogue: Whatever happened to the British PC? . .280 Acknowledgements . 281 Further reading, further viewing, and forums. 283 Index . .286 The chapters are arranged in order of each computer’s availability in the UK, as reflected by each model’s date of review in Personal Computer World magazine. Introduction The 1980s was, categorically, the best decade ever. Not just because it gave us Duran Duran and E.T., not even because of the Sony Walkman. -

Preface Church of All Saints in the Vendée

Church of All Saints in the Vendée “To know and to share Jesus Christ” February 2016 CONTACTS: Priest: Reverend Caroline Sackley: Vicarage: 27, rue de Malvoisine, 85110 St Vincent Sterlanges: Phone no: 02 51 46 39 51 mobile: 06 73 94 40 01 e-mail addresses: [email protected] and [email protected] In Revd Caroline's absence and/or in case of emergency, please contact any of the following: Church Wardens: Barbara Kenyon: Phone no: 02 51 40 51 59, email: [email protected] Doug Green: 05 49 72 18 46, email: [email protected] Reader: John Matthews: Phone no: 05 49 75 29 71, e-mail: [email protected] Website: www.allsaintsvendee.fr Preface I am writing this on a cold, grey day in January, and after such a mild December who knows what the weather will be like in February? Thankfully I am in our own home so am curled up in front of the wood burner! But my prayers are with those who are so affected by the floods in the UK and the refugees and other homeless people who are in such desperate conditions. Thank you all that have supported our appeals for goods for the refugees and for money. Polly and I are making sure that it all gets to the right places to be moved onwards. Healthwise I am very much better and I want to thank you all for your prayers and support. I hope you enjoyed the story of the ladies toilet in last month’s Grapevine! I will be remembering that I am only a part time, house for duty Priest this year if Bob has anything to do with it. -

1979-Pages.Pdf

HSIktVHJM RadioTimes 35 MARYLEBONE HIGH STREET, LONDON W1M 4AA. TEL 01-580 5577. Published ON THURSDAY BY BBC Publications. VOL 223 No 2894 © BBC 1979 In the week of a General Election RADIOTIMES provides some of the electoral background to aid listeners and viewers sitting up all night. And, of course, there is the usual wide variety of BBCtv and Radio programmes this week. itzmaurice conserver, "":' 'and thus' has an eye trained to recognise the fake. He presents a new BBC2 series The Genuine Article; David Benedictus finds out about his provenance 4 John Tooley h is General Administrator I ** PM '..," Administrator Royal Opera �..'.",.,',"'.,..',..',,"'...',".'."','..',",..'".,.".,,.,., ":"ii:'\..ilH House Covent Garden. David Gillard follows him through a working day 9 Looking forward to the Bath Festival 13 Peter Seabrook writes on annuals. Bill Sowerbutts answers questions 14 The Leader of the Labour Party, James Callaghan, 0 La Boheme (9.10 BBC2) * The News Huddlines » , . and the Leader of concludes Opera Month. (10.2 Radio 2) embarks NEXT WEEK the on a seventh series. Conservatives, Month Margaret Thatcher 17 0 BBC2's Opera continues with a Bolshoi Map of the 18 marginals of Mick Brown visits production 0 Ten Years of THURSDAY Khovanshchina (8.10, also four marginal Yesterday's Witness are � BBC2's Douglas Sirk constituencies 19 on Radio 3). See page 35. renewed on BBC2 (7.40). film season starts with 0 The last of The Roger Woddis day 0 Film director Douglas Written on the Wind World on the Election 29 Embassy Sirk is profiled and Shockproof, both in Films Professional Snooker in Behind the Mirror Midweek Cinema by is featured Sheridan Morley 29 Championship (10.30 BBC2). -

Determination and Career Aspirations

IN THIS ISSUE An exclusive interview with BBC Political Editor, Nick Robinson AUTUMN 2014 | ISSUE 5 Olivia Lambley IntoUniversity Nottingham East Determination and career aspirations Sophie Count travelled to Nottingham When asked about other parts of the Vicky cites the University Mentoring Scheme recently to visit a student called Olivia and her IntoUniversity programme that she particularly as a part of the IntoUniversity programme that mother, Vicky, during an Academic Support enjoyed, Olivia spoke with excitement about the Olivia has particularly benefitted from. ‘She’s really session at IntoUniversity’s Nottingham East trips the class took to the University of Nottingham enjoyed working with Annie and having that one- centre. Olivia has been attending Academic where they participated in a graduation-style to-one time. I’ve read the letters that they have Support at IntoUniversity Nottingham East ceremony to celebrate the achievements of a sent to each other and I was very impressed with since November 2012 and is 11 years old. She Primary FOCUS Week and were even allowed to the way Olivia described everything – her writing recently made the transition between primary ‘throw the hats in the air’ as they graduated. Visiting was really grown up and descriptive which I’ve and secondary school, and started Nottingham Contemporary art gallery and Magna never seen before – it’s beautiful.’ Sophie Count at Nottingham Academy this autumn. Science Adventure Centre were some of Olivia’s The most important thing about IntoUniversity other highlights of her time so far at the centre. Sophie has been a Fundraising Olivia’s Story for Vicky is that the staff ‘seem to see the potential Officer at IntoUniversity The most striking thing about Olivia is definitely in Olivia… They just see everything that I can see since November 2013 and is responsible for individual her ambition. -

One of the Oldest Former BBC Employees Visits Salford – Page 8

The newspaper for BBC pensioners – with highlights from Ariel online Tales from a past era One of the oldest former BBC employees visits Salford – page 8 August 2012 • Issue 6 bbC financial Sketchy results memories Sale of tVC Page 2 Page 6 Page 9 NEWS • MEMoriES • ClaSSifiEdS • Your lEttErS • obituariES • CroSPEro 02 uPdatE froM thE bbC executive board’s pay to the average BBC employee. The director general’s salary was 15.1 times more than the average BBC publishes 2011/12 median earnings within the BBC. This figure takes into account that Mark Thompson surrendered a month’s pay last year, along annual report with some others on the executive board and BBC Trustees. Thompson’s successor, George Entwistle, The BBC’s annual report, which was published on 16 July, ‘highlights a year of change for the will earn 11 times median pay. BBC, but also a year of outstanding creativity and achievement’, according to the outgoing Patten told journalists that the Trust is putting a cap on the difference between the director general, Mark Thompson. executive board’s pay and median earnings. But he said that it doesn’t have a specific target. ‘On-air this year we have seen a of their amazing summer with the most The total paid to stars earning more than ‘I don’t think it makes sense as we don’t strengthening of drama across television comprehensive coverage of an Olympic £1m was £9.69m – down from £14.65m know what talent we have to recruit,’ he said. and radio. Highlights have included Call the games we will have ever seen.’ the year before – while 16 stars earned more He said that many people will work at Midwife and Sherlock on BBC One, The Shadow than £500,000.