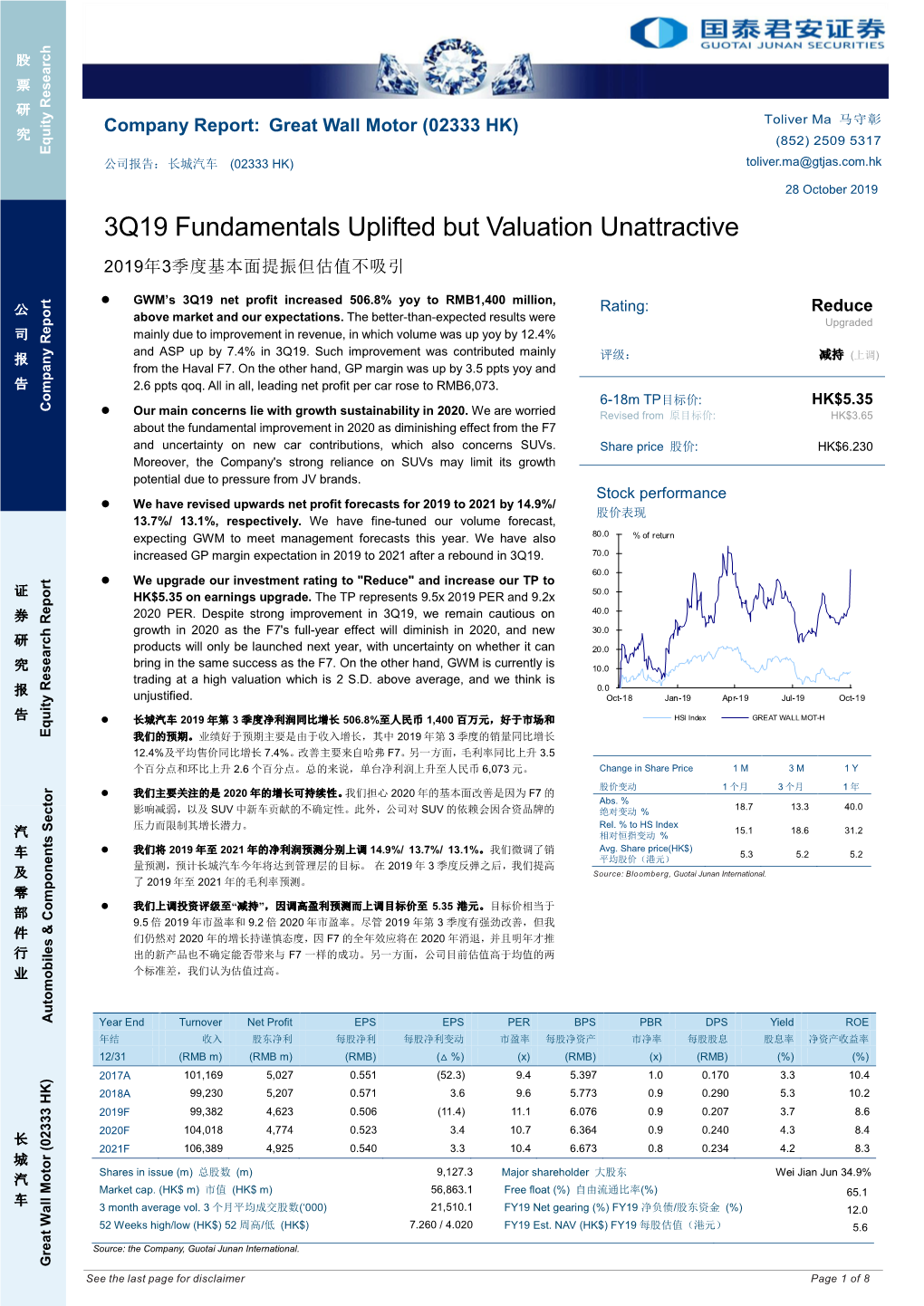

3Q19 Fundamentals Uplifted but Valuation Unattractive 2019年3季度基本面提振但估值不吸引

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

*仅供参考 * for Identification Purpose Only

*仅供参考 * For identification purpose only 2020年3月 Mar. 2020 1 声明 Disclaimer 本介绍片由长城汽车股份有限公司(「公司」)编制,只作企业通讯和一般参考之用。公司无意在任 何司法管辖区使用本介绍片作为出售和招揽他人购买公司任何证券的要约,或用作投资公司证券的决 定基础。未经咨询专业意见的情况下,不得使用或依赖此等全部资料。本介绍纯属简报性质,并非完 整地描述公司、公司业务、目前或过去的经营业绩或业务未来前景。 公司不会为本介绍片发出任何明文或隐含的保证或声明。公司特此强调,不会对任何人使用或依赖本 介绍片的任何资料(财务或其它资料)承担任何责任。 This presentation is prepared by Great Wall Motor Company Limited (the “Company”) and is solely for the purpose of corporate communication and general reference only. The presentation is not intended as an offer to sell, or to solicit an offer to buy or form any basis of investment decision for any class of securities of the Company in any jurisdiction. All such information should not be used or relied on without professional advice. The presentation is a brief summary in nature and do not purport to be a complete description of the Company, its business, its current or historical operating results or its future prospects. This presentation is provided without any warranty or representation of any kind, either expressed or implied. The Company specifically disclaims all responsibilities in respect of any use or reliance of any information, whether financial or otherwise, contained in this presentation. 2 2 业绩摘要 Results Highlights 2019 VS 2018 962.11亿元 营业总收入 992.30亿元 RMB96.211 billion Total operating revenue RMB99.230 billion 105.86万辆 销量 104.37万辆 1,058,648 units Sales volume 1,043,707 units 45.31亿元 净利润 52.48亿元 RMB4.531 billion Net profit RMB5.248 billion 543.99亿元 净资产 526.89亿元 RMB54.399 billion Net assets RMB52.689 billion 33 目录 Contents 行业情况 Auto Industry Overview 公司经营情况 Operations Review 4 第一部分 Section 1 行业情况 Auto Industry Overview 55 行业运行情况 Auto Industry Overview 中国汽车市场正在经历至暗时刻 The PRC’s auto market faced its darkest hour 2018年及2019年全球销量前五国家 单位:百万台 Top 5 countries in terms of global car sales in 2018 and 2019 Mn units 千人保有量仍有增长空间 30 Room for growth for car ownership per 1,000 people 25.8 25 单位:台 units 1,000 20 900 837 17.0 800 700 15 591 589 600 500 10 400 373 5.2 300 5 3.8 3.6 200 173 100 22 0 0 中国 美国 日本 印度 德国 美国U.S. -

2333 a Share Stock Code: 601633

(a joint stock company incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 * For identification purpose only IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the contents of this annual report are true, accurate and complete and do not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. II. All the directors of the Company attended the Board meeting. III. Deloitte Touche Tohmatsu Certified Public Accountants LLP has issued the standard audited report for the Company without qualified opinion. The financial information in the annual report was prepared in accordance with China Accounting Standards for Business Enterprises and the relevant laws and regulations. IV. Wei Jian Jun, person-in-charge of the Company, Li Hong Shuan, person-in-charge of the accounting affairs and Lu Cai Juan, person-in-charge of the accounting department (head of the accounting department), declare that they warrant the truthfulness, accuracy and completeness of the financial report in this annual report. V. Proposal of profit distribution or capitalization of capital reserve during the Reporting Period reviewed by the Board As audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, the net profit of the Group and net profit attributable to shareholders of the Company in 2020 amounted to RMB5,362,490,194.32 and RMB5,362,490,194.32 respectively. The Company has implemented the profit plan for the first three quarters of 2020, pursuant to which it distributed a cash dividend of RMB0.28 (tax inclusive) per share to all shareholders, with a total cash dividend of RMB2,569,266,924.00 (tax inclusive) distributed. -

Olivetree Financial, NDR New York

AMBARELLA.COM AMBARELLA.COM January 15, 2020 COPYRIGHT COPYRIGHT AMBARELLA 2019 Olivetree Financial, NDR New York Louis Gerhardy, Corporate Development 1 Forward-Looking Statements This presentation contains forward-looking statements that are subject to many risks and uncertainties. All statements made in this presentation other than statements of historical facts are forward-looking statements, including, without limitation, statements regarding Ambarella’s strategy, future operations, financial targets, future revenues, projected costs, prospects, plans and objectives for future operations, future product introductions, future rate of our revenue growth, the size of markets addressed by the company's solutions and the growth rate of those markets, technology trends, our ability to address market and customer demands and to timely develop new or enhanced solutions to meet those demands, our ability to achieve design wins, and our ability to retain and expand our customer and partner relationships. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "could," "would," "expects," "plans," "anticipates," "believes," "estimates," "projects," "predicts," "potential," or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. We have based forward-looking statements largely on our estimates of our financial results and our current expectations and projections about future events, markets and financial trends that we believe -

GREAT WALL MOTOR COMPANY LIMITED (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2333)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 長 城 汽 車 股 份 有 限 公 司 * GREAT WALL MOTOR COMPANY LIMITED (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2333) ANNOUNCEMENT OF AUDITED ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2019 The board of directors (the “Board”) of Great Wall Motor Company Limited (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, is prepared with reference to the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of Annual Results. The Company’s 2019 Annual Report will be available for viewing on the websites of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk and of the Company at www.gwm.com.cn. Printed version of the Company’s 2019 Annual Report will also be delivered to the Company’s shareholders. By order of the Board Great Wall Motor Company Limited Xu Hui Company Secretary IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the contents of this annual report are true, accurate and complete and do not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. -

GWM Announces the Global Premier of Haval Concept H & the India

PRESS RELEASE GWM announces the Global Premier of Haval Concept H & the India debut of its Concept Vehicle – Vision 2025 Greater Noida, 5th February 2020: Great Wall Motors, China’s largest SUV manufacturer, today globally premiered its Haval Concept H & announced the India debut of the concept vehicle – Vision 2025, during the press conference organized at Auto Expo – The Motor Show 2020. Emphasizing on the theme of Intelligent Mobility Redefined, GWM had on display among other models - Haval: H9, F7, F7x, F5 and the GWM EV: iQ & R1. At the GWM pavilion on display was a functional area that had a showcase of Lithium Ion Battery, Haval Intelligent Home, Haval Intelligent Safety Display, and Great Wall Autonomous EV. Over the past decade, GWM has invested more than 1.5 billion USD for research the development of cutting-edge technologies such as new energy, intelligent network connection and autonomous driving, and build exclusive platforms and product lineup for new energy vehicles. GWM plans to invest an estimated total of 1 billion USD (approx. INR 7000 cr) in India in a phased manner, covering manufacturing plant, vehicle research and development, production of power batteries and electric drives, vehicle and component manufacturing. At the same time, it plans to provide estimated 3,000 direct employment in a phased manner. Taking the opportunity of the Auto Expo 2020, GWM today made India Debut of its Haval and GWM EV brands and hopes to offer high technology premium products to Indian consumers, and also contribute to Govt vision of a pollution free renewable energy based society. -

Morgan Stanley NDR

AMBARELLA.COM AMBARELLA.COM December 6th & 9th, 2019 COPYRIGHT COPYRIGHT AMBARELLA 2019 Morgan Stanley NDR Frankfurt, Germany and Milan, Italy Dr. Alberto Broggi, GM Ambarella Italy Casey Eichler, CFO Louis Gerhardy, Corporate Development 1 Forward-Looking Statements This presentation contains forward-looking statements that are subject to many risks and uncertainties. All statements made in this presentation other than statements of historical facts are forward-looking statements, including, without limitation, statements regarding Ambarella’s strategy, future operations, financial targets, future revenues, projected costs, prospects, plans and objectives for future operations, future product introductions, future rate of our revenue growth, the size of markets addressed by the company's solutions and the growth rate of those markets, technology trends, our ability to address market and customer demands and to timely develop new or enhanced solutions to meet those demands, our ability to achieve design wins, and our ability to retain and expand our customer and partner relationships. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "could," "would," "expects," "plans," "anticipates," "believes," "estimates," "projects," "predicts," "potential," or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. We have based forward-looking statements largely on our estimates of our financial results and our current expectations -

Corporate, Social and Responsibility Report

(a joint stock company Incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 2 019 Corporate, Social and Responsibility Report * For identification purpose only CONTENTS About This Report 02 Message from Executives 04 A Close Look at Great Wall Motor 06 Corporate Governance 22 Responsibility Management 30 Product Responsibility 34 Responsibility for Employees 49 Social Responsibility 53 Environmental Responsibility 63 ESG Reporting Guide 72 Feedback Form 78 CSR Report 2019 1 About This Report About This Report I. REPORTING PERIOD: V. DEFINITIONS IN THE REPORT This report is the 9th annual corporate social responsibility report issued by Great Wall Motor Company “Great Wall Motor” or Great Wall Motor Company Limited Limited since 2011. This report covers the period from 1 January 2019 to 31 December 2019, with the “Company” or “we” certain information extending to the previous or subsequent years where appropriate. the “Group” the Company and its subsidiaries II. SCOPE OF REPORT: “Great Wall Holdings” Baoding Great Wall Holdings Company Limited (the indirect The scope of report covers the Company and its subsidiaries. Some contents involve Baoding Great Wall controlling shareholder of the Company) and its subsidiaries Holdings Co., Ltd and its subsidiaries. Please refer to the annual report of Great Wall Motor Company Limited for detailed corporate information. VI. NOTE TO THE REPORT III. CONTENTS OF REPORT: Data in this report are sourced from the Company’s audit report, annual report or other statistical documents. This report contains uncertainties about future plan or forecast. This report has not been This report discloses the Company’s information on economic, social and environmental performance reviewed by any independent source and investors are advised to be aware of the risks involved. -

Chinese Vehicle Makers to Tap Potential in Global Markets

16 | Tuesday, June 25, 2019 HONG KONG EDITION | CHINA DAILY BUSINESS Commodity expo to promote trade with South Asian nations KUNMING — Representatives at Yunnan, said Yunnan has become the justended South and Southeast more open with the help of better Asia Commodity Expo and Invest transport infrastructure and a batch ment Fair said the event has of crossborder cooperation pro brought more opportunities to Chi jects. na, South and Southeast Asian Infrastructure interconnectivity countries. has provided more opportunities to The expo, which was held from Thailand, said Sithichai Jindaluang, June 14 to 20 in Kunming, capital of deputy governor of Udon Thani Yunnan province, the country’s province, Thailand. major gateway to Southeast Asia The ChinaLaosThailand Inter and South Asia, has highlighted Chi national Railway Corridor will pro na’s closer ties with the region as it mote trade and investment among pushes forward the Belt and Road the three countries, he said. Initiative. Statistics show that the total trade With six major exhibition areas, volume between Southwest China’s 17 pavilions and 7,500 standard Yunnan province and the five coun booths, the exposition draws exhib tries in the Greater Mekong Subre itors from 74 countries, regions and gion increased 5.6 percent yearon international organizations. A total year in 2018. of 3,348 enterprises from home and Ruwan Edirisingh, president of abroad were present at the expo. the South Asian Association for Regional Cooperation Chamber of Commerce and Industry, said the $6.4 Southeast Asia Commodity Expo billion along with the ChinaSouth Asia Yunnan’s trade with members Exposition has boosted economic of the Association of Southeast exchanges between China and Asian Nations in the first five South Asia, which have maintained months of this year rapid economic growth in recent An employee polishes a Haval H6 sport utility vehicle, manufactured by Great Wall Motors Co, at the 2018 Moscow International Auto years. -

Annual Report

(a joint stock company incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 2 019 ANNUAL REPORT * For identification purpose only IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the contents of this annual report are true, accurate and complete and do not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. II. All the directors of the Company attended the Board meeting. III. Deloitte Touche Tohmatsu Certified Public Accountants LLP has issued the standard audited report for the Company without qualified opinion. The financial information in the annual report was prepared in accordance with China Accounting Standards for Business Enterprises and the relevant laws and regulations. IV. Wei Jian Jun, person-in-charge of the Company, Liu Yu Xin, person-in-charge of the accounting affairs and Lu Cai Juan, person-in-charge of the accounting department (head of the accounting department), declare that they warrant the truthfulness, accuracy and completeness of the financial report in this annual report. V. Proposal of profit distribution or capitalization of capital reserve during the Reporting Period reviewed by the Board As audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, the net profit of the Group and net profit attributable to shareholders of the Company in 2019 amounted to RMB4,530,732,870.30 and RMB4,496,874,893.92 respectively. The Company proposed to declare a cash dividend of RMB2,281,817,250.00, (representing RMB0.25 per share) (tax inclusive) to the shareholders of the Company for the year ended 31 December 2019. -

DEVELOPMENT LIST December 2020 Maxisys Maxisys Region Software Make Description ADAS ADAS PRO

示例 DEVELOPMENT LIST December 2020 MaxiSys MaxiSys Region Software Make Description ADAS ADAS PRO Ultra Version: V1.50 908 Version: V9.02 Highlights: China, 1. Supports calibration function on ACC and FFCM Europe, system for LX, KL, MP, WD, WK, K8 and RU (2020). America, 2. Supports calibration function on DASM system for ADAS Chrysler √ √ Japan, JT, DT, DJ, D2, and JL (2020). Korea, 3. Supports calibration function on DASM system for Australia DT, DJ, D2, DP and JL (2019). 4. Supports online safety diagnostic solutions for 44 models, including DT, BV, K8 and so on in Europe (2018+). China, Ultra Version: V1.20 Europe, 908 Version: V8.40 America, ADAS Mazda Highlights: √ √ Japan, Adds calibration function on ACC, LDW, AVM and BSM Korea, system for Mazda3 and CX-30. Australia Ultra Version: V1.20 908 Version: V14.70 Highlights: 1. Adds calibration function on ACC, LDW, RCW system for 2020 Buick Enclave, Encore, Envision and Regal. China, 2. Adds calibration function on ACC, LDW, RCW Europe, system for 2020 Calidic XT5, CT6, Escalade, Escalade America, ESV, XT4, XT6 and XTS. ADAS GM √ √ Japan, 3. Adds calibration function on ACC, LDW, RCW Korea, system for 2020 Chevrolet S10, Trailblazer, Blazer, Bolt, Australia Malibu, Suburban, Tahoe, Tracker, Traverse and Trax. 4. Adds calibration function on ACC, LDW, RCW system for 2020 GMC Acadia, Sierra, Yukon and Yukon XL. 5. Adds calibration function on ACC, LDW, RCW system for 2020 Holden Colorado, Trailblazer, Acadia, Trax, Commodore, Astra, etc. China, Ultra Version: V1.20 Europe, 908 Version: V8.72 America, Highlights: ADAS Fiat √ √ Japan, Adds online safety diagnosis solution for 18 models in Korea, European region such as GA, BG, GU, FD, TO, NU, 6H, Australia FB, FF, RE, MM, BA, etc. -

Dougherty & Company 4Th Annual Institutional Investor Conference

AMBARELLA.COM September 5, 2019 COPYRIGHT COPYRIGHT AMBARELLA 2019 Dougherty & Company 4th Annual Institutional Investor Conference Casey Eichler, CFO [email protected] 1 Forward-Looking Statements This presentation contains forward-looking statements that are subject to many risks and uncertainties. All statements made in this presentation other than statements of historical facts are forward-looking statements, including, without limitation, statements regarding Ambarella’s strategy, future operations, financial targets, future revenues, projected costs, prospects, plans and objectives for future operations, future product introductions, future rate of our revenue growth, the size of markets addressed by the company's solutions and the growth rate of those markets, technology trends, our ability to address market and customer demands and to timely develop new or enhanced solutions to meet those demands, our ability to achieve design wins, and our ability to retain and expand our customer and partner relationships. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "could," "would," "expects," "plans," "anticipates," "believes," "estimates," "projects," "predicts," "potential," or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. We have based forward-looking statements largely on our estimates of our financial results and our current expectations and projections about future events, markets and financial -

Trump's Secret Iraq Visit Exposed Defeat

WWW.TEHRANTIMES.COM I N T E R N A T I O N A L D A I L Y 16 Pages Price 20,000 Rials 1.00 EURO 4.00 AED 39th year No.13295 Thursday JANUARY 3, 2019 Dey 13, 1397 Rabi’ Al thani 26, 1440 ‘Is anything left for Iran attracts higher Not easy to win Asian Iran to organize exhibition Trump to withdraw foreign tourists despite Cup title, Iran defender of theatrical productions from,’ Zarif asks 2 sanctions 10 Hosseini says 15 at Fajr festival 16 $215m to be earmarked for Anzali See page 2 wetland nano bioremediation SOCIETY TEHRAN — A total mental conditions to stimulate growth deskbudget of 9 trillion ri- of microorganisms and degrade the target Trump’s als (nearly $215 million) will be allocated pollutants. In many cases, bioremediation to implement a scheme on restoration of is less expensive and more sustainable the endangered Anzali wetland in northern than other remediation alternatives. province of Gilan by removing contaminants The scheme was proposed by research- using domestic bioremediation nano-tech- ers at Isfahan Science and Technology nology, ISNA reported on Wednesday. Town and approved by the Department Bioremediation is a process used to of Environment, so a memorandum of secret Iraq treat contaminated water, soil and sub- understanding has been signed to revive surface material, by altering environ- the wetland. 12 ‘Resistance only way for Palestinians visit exposed to regain their rights’ POLITICS TEHRAN — Irani- the only way is to resist and fight to deskan President Hassan regain their rights,” he said during a Rouhani said on Tuesday that resistance meeting with Ziad al-Nakhala, sec- is the only way for Palestinians to fight retary general of the Islamic Jihad the Zionist regime of Israel and regain movement, and his accompanying defeat their rights.