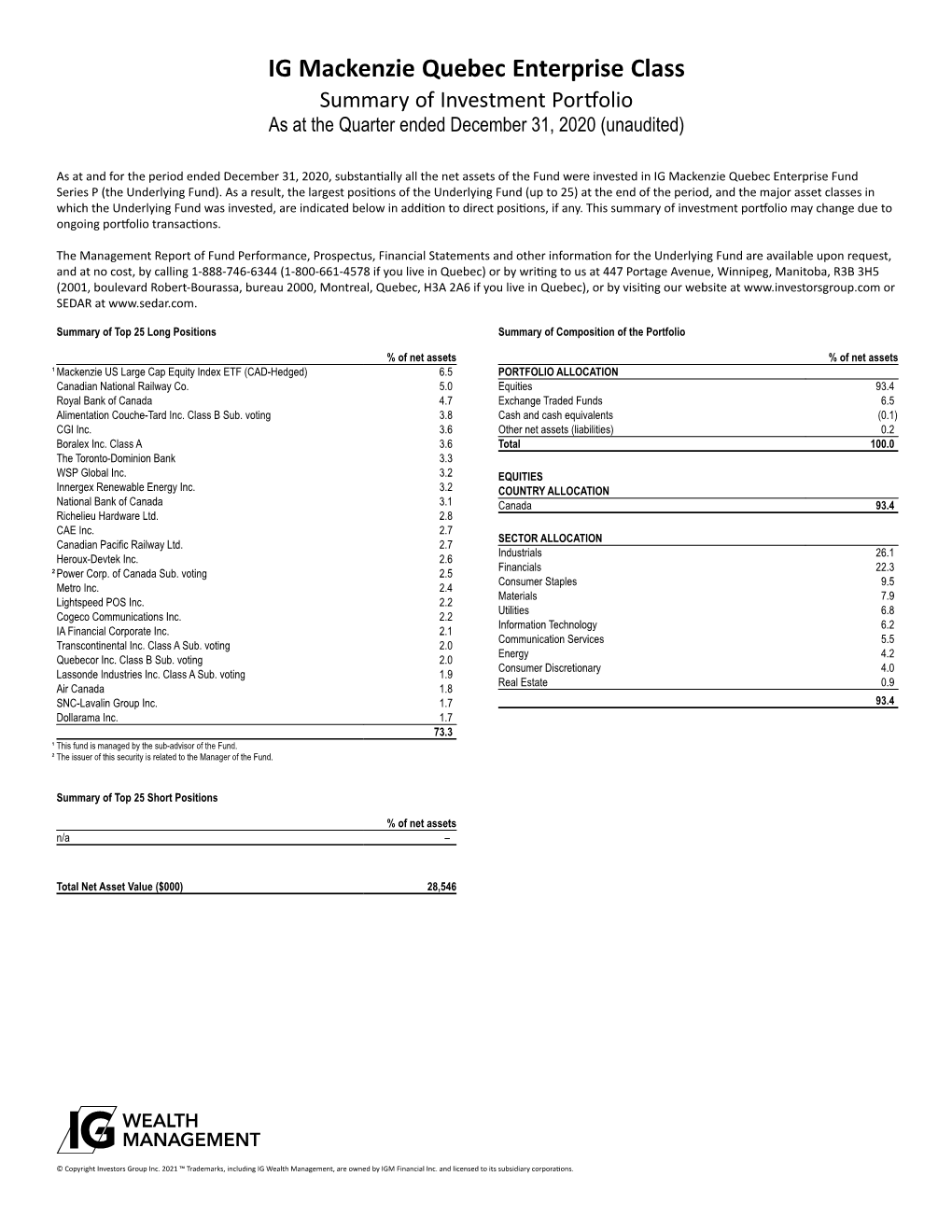

IG Mackenzie Quebec Enterprise Class Summary of Investment Portfolio As at the Quarter Ended December 31, 2020 (Unaudited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dynamic Power Canadian Growth Fund

SUMMARY OF INVESTMENT PORTFOLIO As at March 31, 2021 The Summary of Investment Portfolio may change due to ongoing portfolio transactions. Updates are available quarterly on our website at www.dynamic.ca 60 days after quarter end, except for June 30, which is the fiscal year end, when they are available after 90 days. The total net asset value of the Fund as at March 31, 2021 was $646,062,000. Percentage of net Percentage of net By Asset Type asset value † Top 25 Holdings asset value † Equities 97.2 Intact Financial Corporation 5.6 Cash and Short Term Instruments (Bank Overdraft) 2.9 Canadian National Railway Company 5.4 Other Net Assets (Liabilities) -0.1 West Fraser Timber Co. Ltd. 5.0 Facebook, Inc., Class "A" 4.2 Microsoft Corporation 4.2 Percentage of net Canadian Pacific Railway Limited 4.1 By Country / Region (1) asset value † Alphabet Inc., Class "C" 4.0 Canada 57.2 National Bank of Canada 4.0 United States 40.0 Amazon.com, Inc. 3.7 Cash and Short Term Instruments (Bank Overdraft) 2.9 Trisura Group Ltd. 3.6 NVIDIA Corporation 3.5 Percentage of net Toronto-Dominion Bank (The) 3.1 By Industry (1)(2) asset value † Brookfield Asset Management Inc., Class "A" 3.1 Financials 26.4 Sherwin-Williams Company (The) 3.0 Information Technology 17.7 Apple Inc. 3.0 Consumer Discretionary 14.6 Visa Inc., Class "A" 2.9 Industrials 14.1 Cash and Short Term Instruments (Bank Overdraft) 2.9 Communication Services 8.2 Royal Bank of Canada 2.9 Materials 7.3 Nuvei Corporation, Subordinated Voting 2.5 Health Care 4.1 Danaher Corporation 2.4 Consumer Staples 3.9 CCL Industries Inc., Class "B" 2.3 Cash and Short Term Instruments (Bank Overdraft) 2.9 CGI Inc. -

Canadian Focus List

RBC Dominion Securities Inc. Canadian Focus List March 1, 2017 | Quarterly Report Portfolio Advisory Group – Equities What’s inside 3 Portfolio positions Waiting for the baton to be passed 4 Sector commentary The Canadian Focus List delivered a solid return amid a search for clarity on U.S. policy direction. 8 Alimentation Couche-Tard Inc. Portfolio increase 9 Canadian National Railway Improved global economic data helped Markets were surprisingly calm during Portfolio increase set the market on an upward trajectory the Portfolio’s winter 2017 quarter with 10 Canadian Pacific Railway Ltd. in early 2016. Despite initial trepidation, volatility holding at historically low the election of a U.S. president set on levels. We believe it is reasonable to Portfolio decrease slashing tax rates, increasing fiscal expect moments of market anxiety in 11 Cott Corporation spending, and cutting regulatory red the months to come as policy-related Portfolio removal tape stoked investor enthusiasm for headlines influence expectations for 12 Dollarama Inc. higher potential corporate earnings future tax rates, fiscal spending levels, and set the stage for the market’s next and regulatory oversight. In such an Portfolio increase leg higher late last year. We have now environment, we believe clients are well 13 Imperial Oil Ltd. entered a period where investors are served by the Focus List’s prudent mix Portfolio removal looking for signs that the baton is in of economically sensitive and defensive 14 Magna International Inc. the process of being passed from policy positions in addition to adherence to Portfolio increase rhetoric to tangible action. the Portfolio’s core tenet of emphasizing high-quality, well-managed businesses. -

Overview of Corporate Financial Reporting CHAPTER 1

cc01OverviewOfCorporateFinancialReporting.indd01OverviewOfCorporateFinancialReporting.indd PagePage 1-11-1 19/01/1819/01/18 2:232:23 PMPM f-0157f-0157 //208/WB02258/9781119407003/ch01/text_s208/WB02258/9781119407003/ch01/text_s CHAPTER 1 kevin brine/Shutterstock Overview of Corporate Financial Reporting Dollar Store Business Is No than $420 million from issuing shares, and it had more than $2.9 billion in sales that year. Small Change Company management is continually looking for ways to increase sales and reduce costs. It recently increased the max- When Salim Rossy opened a general store in Montreal imum price of items from $3 to $4, widening the number of in 1910, he fi nanced it with his earnings from peddling suppliers it can use and boosting the types of products it can items like brooms and dishcloths in the countryside around carry. “Customers are responding positively to the off ering,” Montreal. By the time his grandson Larry took charge in said Neil Rossy, who took over from his father Larry as Chief 1973, S. Rossy Inc. had grown into a chain of 20 fi ve-and- Executive Offi cer in 2016. dime stores, with most items priced at either 5 or 10 cents. In Shareholders and others, such as banks and suppliers, use 1992, the company opened its fi rst Dollarama store, selling all a company’s fi nancial statements to see how the company has items for $1. Today, the business, now called Dollarama Inc., performed and what its future prospects might be. Sharehold- is Canada’s largest dollar store chain. It operates more than ers use them to make informed decisions about things such 1,000 stores in every province and now sells goods between as whether to sell their shares, hold onto them, or buy more. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Power to Do More

2018 2018 Annual Report Annual Report @BoralexInc boralex.com POWER TO DO MORE NOTICE of Annual Meeting of Shareholders Management proxy CIRCULAR 2018 Our thanks to the employees who accepted to appear on the cover page: Van Anh Dang Vu (Kingsey Falls, Québec), Myriam Savage (Thetford Mines, Québec) and Ernani Schnorenberger (Lyon, France). PROFILE Boralex develops, builds and operates renewable energy power facilities in Canada, France, the United Kingdom and the United States. A leader in the Canadian market and France’s largest independent producer of onshore wind power, the Corporation is recognized for its solid experience in optimizing its asset base in four power generation types – wind, hydroelectric, thermal and solar. Boralex has ensured sustained growth by leveraging the expertise and diversification developed for more than 25 years. General HEAD OFFICE WEBSITE www.boralex.com Boralex Inc. Information 36 Lajeunesse Street Kingsey Falls (Québec) Canada J0A 1B0 @BoralexInc Telephone: 819-363-6363 Fax: 819-363-6399 [email protected] BUSINESS OFFICES CANADA UNITED STATES 900 de Maisonneuve Boulevard West 606-1155 Robson Street 39 Hudson Falls Street 24th floor Vancouver, British Columbia South Glens Falls New York Montréal, Québec Canada V6E 1B5 12803 Canada H3A 0A8 Telephone: 1-855-604-6403 United States Telephone: 514-284-9890 Telephone: 518-747-0930 Fax: 514-284-9895 201-174 Mill Street Fax: 518-747-2409 Milton, Ontario Canada L9T 1S2 Telephone: 819-363-6430 | 1-844-363-6430 FRANCE UNITED KINGDOM 71, rue Jean-Jaurès -

Expansion in Full Swing

20 Expansion 20 in full swing Positioning for sustainable growth LE MEILLEUR DE NOS Management FORCES Information CIRCULAR NOTICE of Annual Meeting of Shareholders Notice of Annual Meeting of Shareholders Dear shareholders, We invite you to attend Boralex Inc.’s 2020 annual meeting of shareholders. Items of business When The meeting will be held for the following purposes: May 5, 2021 1. Receive the consolidated financial statements of the 11:00 a.m. (Eastern Daylight Time) Corporation for the financial year ended December 31, 2020 and the independent auditor’s report thereon 2. Elect the directors 3. Appoint the independent auditor Where 4. Adopt a non-binding advisory resolution, the text of which is Virtual meeting via live audio webcast at reproduced on page 15 of the management information circular, https://web.lumiagm.com/262304484 accepting our approach to executive compensation 5. Adopt a resolution, the text of which is reproduced on page 156 of the management information circular, reconfirming and renewing the shareholder rights plan adopted by the board of directors on March 1, 2018 Materials A notice of availability of proxy materials 6. Consider any other business that may properly come before the for our 2020 annual meeting is being meeting or any adjournment thereof. mailed to shareholders on or about March 26, 2021. Notice-and-Access We are providing access to the meeting This year, as permitted by Canadian corporate and securities Materials, the Financial Statements and regulators, Boralex Inc. is using notice-and-access to deliver the annual report to both our registered management information circular of Boralex Inc. -

Frontiers Canadian Equity Pool Interim Management Report of Fund Performance

Frontiers Canadian Equity Pool Interim Management Report of Fund Performance for the period ended February 29, 2016 All figures are reported in Canadian dollars unless otherwise noted. This interim management report of fund performance contains financial highlights but does not contain either the complete interim or annual financial statements of the investment fund. If you have not received a copy of the interim financial reports with this interim management report of fund performance, you can get a copy of the interim financial reports or annual financial statements at your request, and at no cost, by calling us toll-free at 1-888-888-3863, by writing to us at Renaissance Investments, 1500 Robert-Bourassa Boulevard, Suite 800, Montreal, QC, H3A 3S6, by visiting the SEDAR website at sedar.com, or by visiting renaissanceinvestments.ca. Unitholders may also contact us using one of these methods to request a copy of the investment fund’s proxy voting policies and procedures, proxy voting disclosure record, or quarterly portfolio disclosure. Management Discussion of Fund Performance . Results of Operations CIBC Asset Management Inc. (CAMI,theManager, or Portfolio Global economic growth remained slow over the period. Concerns Advisor), Picton Mahoney Asset Management (Picton Mahoney), about China’s economic growth and U.S. Federal Reserve Board Triasima Portfolio Management Inc. (Triasima), Connor, Clark & Lunn policy were the two largest factors weighing on the global economic Investment Management Ltd. (CC&L) and Foyston, Gordon & Payne outlook. Commodity prices continued to fall, worsened by a Inc. (Foyston) provide investment advice and investment management strengthening U.S. dollar. Slow global growth and plunging oil prices services to Frontiers Canadian Equity Pool (the Pool). -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Fund Profile

Manulife Fidelity True North GIF Select GIF SELECT InvestmentPlus (F-Class) · Performance as at August 31, 2021 · Holdings as at July 31, 2021 GROWTH OF $10,000 ± INVESTMENT OBJECTIVE The Fund aims to achieve long-term capital growth. It invests primarily in equity securities of Canadian companies. CALENDAR RETURNS % 2012 2013 2014 2015 2016 2017 2018 2019 2020 8.75 22.79 13.77 -1.64 10.32 5.26 -4.68 17.68 10.45 COMPOUND RETURNS % 1 mth 3 mths 6 mths YTD 1 yr 3 yrs 5 yrs 10 yrs Incept. 2.57 7.23 16.72 19.94 29.16 12.86 9.80 9.50 8.96 ASSET ALLOCATION % GEOGRAPHIC ALLOCATION % SECTOR ALLOCATION % OVERVIEW Inception Date: October 18, 2010 Asset Class: Canadian Equity Net Assets: $261.5 million Risk: Medium Legend Weight % Name Legend Weight % Name Legend Weight % Name Low High 97.70 Equities 92.36 Canada 31.22 Financials Fund Status: Open * 2.95 Cash and equivalents 5.96 United States 15.47 Industrials 0.01 Fixed income 1.03 Bermuda 13.35 Information tech. Management Fee: 1.45% 0.22 Israel 9.13 Materials Management Expense Ratio1: 2.05% 0.16 Australia 7.70 Cons. discrectionary 0.15 United Kingdom 7.19 Energy AWARDS 0.08 Singapore 5.52 Consumer staples 0.04 Germany 3.86 Communication serv. 3.25 Utilities 1.71 Real Estate 1.59 Health care UNDERLYING FUND INFORMATION TOP 10 HOLDINGS % ® Name: Fidelity True North Fund Royal Bank of Canada 8.36 Underlying Fund Manager: Toronto-Dominion Bank Com New 4.59 Fidelity Investments Canada ULC Shopify Inc. -

La Caisse in Québec

LA CAISSE IN QUÉBEC CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC AR 2015 57 LA CAISSE IN QUÉBEC La Caisse’s achievements in Québec CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC AR 2015 58 La Caisse’s achievements in Québec ANP IM ACTFUL ROLE WITH QUÉBEC’S COMPANIES and economy $15.0 B NW E INVESTMENTS IN THE PAST 550 6 YEARS SMEs THROUGHOUT QUÉBEC THAT PARTNER WITH LA CAISSE 330 BUILDIS NG OWNED OR FINANCED CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC AR 2015 59 AN APPROACH FOCUSED ON FOUR PILLARS G ROWTH OF BUSINESSES PR OJECTS WITH IMPACT In 2015, la Caisse helped further the With two electric public transit systems growth of several Québec businesses, being studied for Montréal and three including WSP Global, D-BOX, Fabritec downtown real estate projects underway, and Agropur Cooperative. la Caisse is making investments that have an impact in Québec. INNOVATION ERNTREP ENEURIAL INITIATIVES One of our priorities is to invest Two major projects were launched in innovative companies and funds in 2015 to help boost the Québec that specialize in innovation, such entrepreneurial culture and ensure as Lightspeed, XPNDCROISSANCE that many more strong businesses and iNovia. are able to fuel the economy. CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC AR 2015 60 La Caisse’s achievements in Québec FOUR FOCUS PILLARS TO MAXIMIZE OUR IMPACT IN QUÉBEC G ROWTH OF BUSINESSES INNOVATION D-BOX Lightspeed A global leader in the development Created in 2005, Lightspeed is one of motion-simulation systems for of the new economy companies recognized the entertainment market, D-BOX met for their strong growth. -

Annual Information Form

ANNUAL INFORMATION FORM FISCAL YEAR ENDED FEBRUARY 2, 2020 April 29, 2020 TABLE OF CONTENTS 1 Explanatory Notes ........................................................................................ 1 2 Corporate Structure ...................................................................................... 3 3 General Development of the Business ....................................................... 4 4 Business of the Corporation ....................................................................... 8 5 Risk Factors ................................................................................................ 20 6 Description of Capital Structure ................................................................ 32 7 Dividends ..................................................................................................... 34 8 Description of Material Indebtedness ....................................................... 34 9 Ratings ......................................................................................................... 37 10 Market for Securities .................................................................................. 40 11 Directors and Officers ................................................................................ 40 12 Audit Committee Information .................................................................... 43 13 Legal Proceedings and Regulatory Actions ............................................ 45 14 Interest of Management and Others in Material Transactions .............. -

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2018 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) TORONTO DOMINION BANK 9,910,190 DOLLARAMA INC 1,209,739 ROYAL BANK OF CANADA 8,917,316 KELT EXPLORATION LTD 1,188,512 SUNCOR ENERGY INC 6,879,833 QUEBECOR INC 1,183,053 BROOKFIELD ASSET MGMT INC 4,896,921 ENERFLEX LTD 1,150,883 CANADIAN NATURAL RESOURCES 4,524,263 FIRST QUANTUM MINERALS LTD 1,145,213 CGI GROUP INC 4,482,828 MULLEN GROUP LTD 1,083,045 CCL INDUSTRIES INC 4,351,728 ENCANA CORP 1,073,348 CONSTELLATION SOFTWARE INC 4,212,781 NUVISTA ENERGY LTD 1,073,050 ROGERS COMMUNICATIONS INC 3,788,734 KINAXIS INC 1,065,983 ALIMENTATION COUCHE-TARD INC 3,581,197 RECIPE UNLIMITED CORP 949,389 CANADIAN NATIONAL RAILWAY CO 3,441,390 PARKLAND FUEL CORP 927,785 CANADIAN PACIFIC RAILWAY LTD 3,240,856 TUCOWS INC 916,541 SUN LIFE FINANCIAL INC 3,236,207 SHOPIFY INC 895,850 TELUS CORP 3,013,785 CANADA GOOSE HOLDINGS INC 883,361 INTACT FINANCIAL CORP 2,802,815 LEON'S FURNITURE LTD 880,407 CANADIAN APARTMENT PPTYS REI 2,498,502 MAJOR DRILLING GROUP INTL INC 856,979 NUTRIEN LTD 2,322,898 SECURE ENERGY SERVICES INC 799,566 FRANCO-NEVADA CORP 2,272,288 EQUITABLE GROUP INC 787,443 PRAIRIESKY ROYALTY LTD 2,065,386 TRICAN WELL SERVICE LTD 782,920 ONEX CORP 2,053,018 CANADIAN UTILITIES LTD 758,952 CANADIAN WESTERN BANK 1,987,108 STANTEC INC 754,132 ENBRIDGE INC 1,953,226 LASSONDE INDUSTRIES INC 745,893 AGNICO EAGLE MINES LIMITED 1,902,362 COGECO COMMUNICATIONS