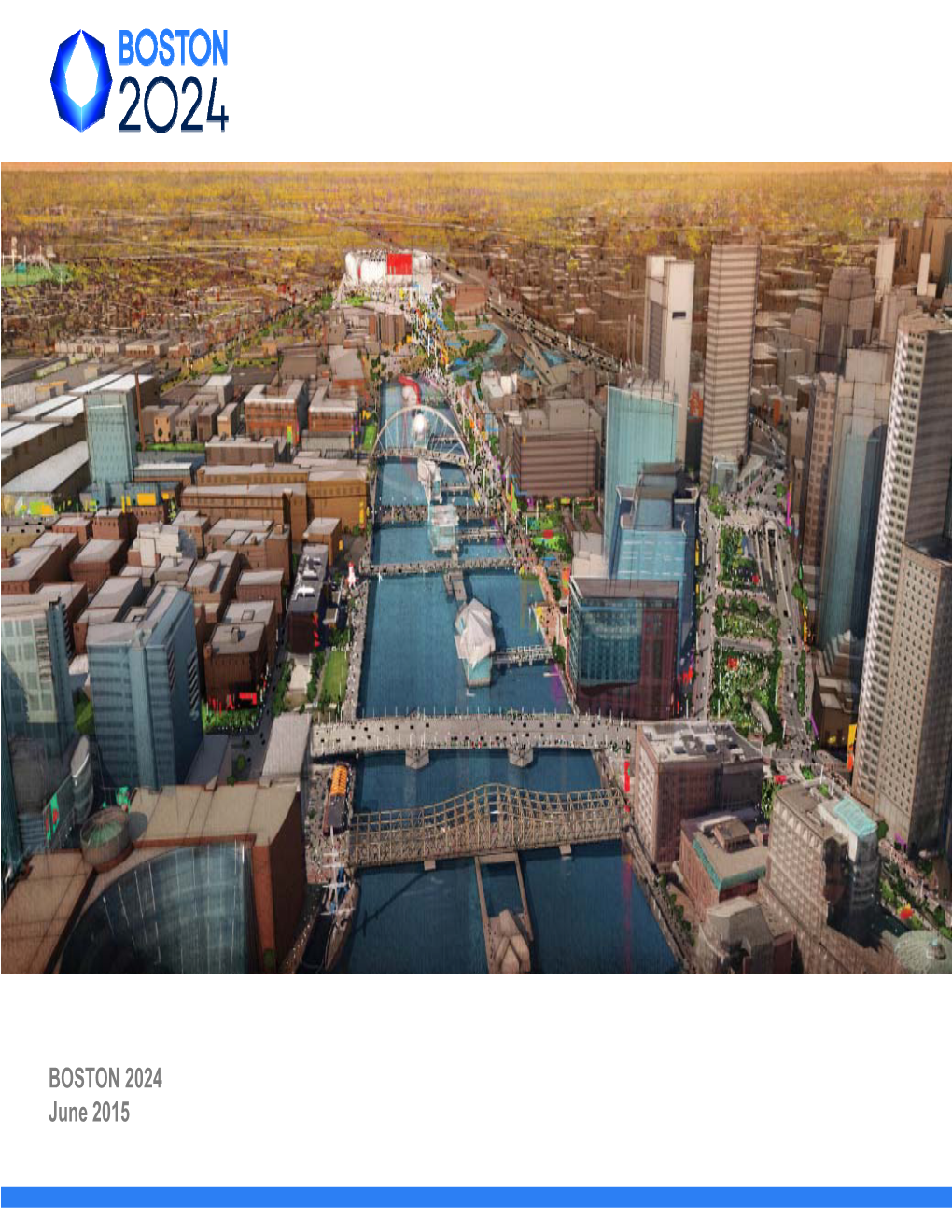

BOSTON 2024 June 2015 Agenda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Check out Our Graduation Special! Pages 4

Black Cyan Magenta Yellow CONGRATULATIONS, CLASS OF 2018 CONGRATULATIONS, CLASS OF 2018 CONGRATULATIONS,Check Out Our Graduation Special! CLASS Pages OF 42018 – 9 BOOK YOUR POST IT Call Your Advertising Rep T IMES -F REE P RESS (781)485-0588 East BostonWednesday, June 20, 2018 NE Association of EAST BOSTON HIGH SCHOOL 2018 GRADUATION Schools and John Nucci receives life Colleges grants saving kidney transplant EBHS accreditation By John Lynds Abrams was a kidney donor match. Nucci, 66, suffers from By John Lynds Life has come full circle for Polycystic Kidney Disease, With nearly 300 students East Boston’s John Nucci and the same kidney disease that graduating East Boston High Kerri Abrams, who owns Kin- killed his dad at the age of 64. School (EBHS) last Friday ship Florist in Revere. He and Abrams underwent the and a four-year graduation Thirty-five years ago lifesaving kidney transplant rate hovering at 75 percent, Abrams’ parents, Kim and Al, surgery Tuesday. students, faculty and staff were political supporters and “My kidneys went from have had a lot to celebrate this friends of Nucci's. At the time 12 percent down to 2 percent school year. neither Nucci nor the Abrams since February,” said an emo- EBHS recently added yet could have ever guessed near- tional Nucci on the eve of another reason to pull out ly four decades later that Kim his surgery Monday evening. the proverbial party hats as and Al’s daughter would do- “Kerri is just an amazing and the New England Associa- nate her kidney to help save brave woman. -

Summer Guide

@summerboston 2011 Summer Guide City of Boston Thomas M. Menino, Mayor It is my great pleasure to welcome you to another exciting summer in the City of Boston. From traditional favorites like the Swan Boats and the Freedom Trail, to newer attractions like the Boston Cyberarts Festival and the Extreme Sailing Series at Boston Harborfest, our city has something for everyone. Boston is where history meets innovation. To keep up with our unique cultural landscape, I invite you to follow us @summerboston. There, you will find the the latest Thomas M. Menino information on free events, parades, festivals and more. Mayor of Boston For those who prefer more traditional methods of receiving information, please call 617-635-3911 or visit www.cityofboston.gov/summer. I hope to see you this summer! Thomas M. Menino Mayor of Boston Mayor Menino is excited to launch @summerboston! Follow it for continuous updates about all the fun summer summerboston activities for the whole family to enjoy here in Boston. @ Thank you to our sponsors: 2. May 1st - August 7th May 1st Chihuly, Through the GREASE --May-- Looking Glass Wang Theatre, World-famous glass artist Citi Performing Arts Center, Dale Chihuly, has revolution- 270 Tremont St., Boston. 1 p.m and 6 p.m. $. ized the art of blown glass Various Dates in May 617-482-9393 Frog Pond Yoga and moving it into the realm of www.citicenter.org Tai Chi Classes large-scale sculpture and Honoring the tranquility of establishing the use of glass, May 1st the reflecting pool, weekly an inherently fragile but also B.B. -

Boston Police Announced the Arrest of Douars Trying to Fight an Unknown, I' Michael C

Bulk Rate CR Presort COMMUN ITY NEWSPAPER U.S. Postage Paid • COMPANY Tabloid Communications Country's rowdy edge JUNE 18 - 24 , 1996 • Vol. 1 , No. 9 • 80 Pages • Two Sections, One Supplement • 50¢ SEE ARTS Menino joins . A·B police target graffiti 'taggers' foes of Crittenton plan to develop open land Mayor urges alternative sites be examined for development By Linda Rosencrance TAB Staff Writer ayor Thomas M. Menino has agreed to support members of the Oak Square com M munity who oppose plans by the Crittenton Hastings House to develop more than three ac~ of open space to create subsidiz.ed hoot_ing. Until last week, the mayor had refused to talce a stand on the issue, saying that Crittenton Hastings House had not yet provided the city with any plans for the project. He also urged Crittenton officials to discuss their pro posal with the community. The mayor's decision to oppose the plans comes after widespread, forceful neighborhood opposition to Crittenton's plans to build 18-20 units of affordable housing on the wooded parcel of land adjoining its IO Perthshire Road facility. ''Last Thursday I got a call from Mayor Menino say ing he was going to support our position to preserve the open space," said Jeanne Demers, an attorney who is the chairwoman of the Crittenton Woods Committee, HOUSE, page 33 Police officer Louis Relerford walks in front or a wall that makes the issue clear: Graffiti is a blight on the loc:al scene. A concerted effort that taps members of the Police Department and the loc:al b11Sint$ community is set to begin this summer. -

The American Legion 49Th National Convention

Old Ironsides Paul Revere’s U.S.S. CONSTITUTION : A record you will read with pride the story of your Legion, from its conception in 1919 to the present, and its continuing battle for a better America In peace and war outstanding praise J. EDGAR HOOVER: “ The American Legion Story by Raymond Moley, Jr., is an excellent book . read Mr. Moley’s interesting narrative is to ADMIRAL ARLEIGH BURKE : “A wonder- To in this century.” ful book ... as the years go by, people forget what relive the history of our nation happened, why it happened and who did it. And so this exciting history ... is now particularly timely.” GENERAL LUCIUS D. CLAY: I have en- joyed The American Legion Story very much. Not RICHARD M. NIXON : “A truly splendid job until I read [it] did I fully realize the constructive of weaving the history of a great organization into role it has played in our national life.” the history of America’s emergence as a world power.” Order a copy for your home, and your post, today DAVIS: through The American Legion National Emblem JOHNE. “The American Legion Story Sales Division, P.O. Box 1055, Indianapolis, Indiana is that all should are one Americans know, and we 46206, Att: Mr. Raymond Moley, Jr. pleased that it is now available in a factual and forthright manner in this fine new book.” THE AMERICAN LEGION STORY (NO. 75199) SENATOR GEORGE MURPHY: An ex- Each $4.50 Prepaid cellent, factual report of what one great civic and 5 to 99 copies, each $4.25 Prepaid patriotic minded organization can do for its country.” 100 or more copies, each $3.75 F.O.B. -

Making Sense of the Eighth Over Garbage

THE OF AUTUMN mCo mmunity Newspaper Company www.townonline.com/allstonbrighton SEPTEMBER 8 - 14, 1998 Vol. 3, No. 21 II 88 Pages • Two Sections 50¢ Grouchy Making sense of the Eighth over garbage Yearly trash problem has residents split qver city citations By Linda Rosencrance TAB Staff Writer t's September and that means two things to residents of Allston I and Brighton - the return of college students and tons of trash - heaps and heaps of the stuff, littering front lawns, blocking sidewalks and spilling out on lo the streets. Old mattresses, chairs, sofas, tables, desks, crates and bags on top of bags of who-knows-what are left behind by last year's contingent of students, no longer wanted by the new tenants. For as long as anyone can remember residents and city offi cials have been trying to figure out ways Lo keep the lid on the situation. Unhappy residents say they have only one option - call the city's Code Enforcement Office and com plain about particularly disgusting areas. Inspectors from that office f:tien go out and issue tickets - that carry fines with them for various infractions - to the offending prop erty owner. The city figures that by hitting the landlords in their pocketbooks, maybe they'll change their ways and make more of an effort to let their tenants know how to properly dis pose of the trash. And it seems to be working, said James Cahill, directorof Code Enforcement. TRASH, page 13 Parade preview• The 15th annual Allston- • Brighton Parade takes With one week to go, place this Sunday, Sept. -

The Joints Are Jumpin.'

Dorchester Reporter “The News and Values Around the Neighborhood” Volume 30 Issue 25 Thursday, June 20, 2013 50¢ MOUNTAINTOP MOMENT FOR clAss OF ’13 Dems gearing up for Markey as he and GOP’s Gomez near finish line Us senate vote is Tuesday By Gintautas Dumcius news eDitor In the wake of primaries in US Senate and state Senate races, and a general election for a state Senate seat, Dorchester and Mattapan voters will go to the polls next week for the third time in three months. This time, on June 25, it’ll be to choose John Kerry’s successor. US Rep. Ed Markey, a Malden Democrat, and newcomer Gabriel Gomez, a Cohasset Republican, are the two candidates on the ballot, survivors of the April 30 primary that winnowed the fields on either side. The public’s interest in the special election – set in motion in December when Kerry was tapped as President Obama’s chief diplomat – has been sluggish by most accounts. Voter listlessness was on display on Sunday at Roxbury Community College where the candidates faced off in a forum put together by MassVOTE Elizabeth Seton Academy’s class of 2013 posed for a photo outside of the school on Thurs., May and other groups. About 70 people trickled into the 26. Hoang Ngan Hong Tran delivered the valedictory address during the graduation ceremony at college’s media arts auditorium to watch Markey and St. Gregory’s Church. A full list of graduates from Seton Academy and several other Boston high Gomez hammer away at each other. -

C:\My Documents\Dailey

The Pennsylvania State University The Graduate School College of Communications THE NEW CATHEDRALS: THE SPORTS STADIUM AND MASS MEDIA’S ROLE IN FACILITATING NEW CONSTRUCTION A Thesis in Mass Communication by Robert C. Trumpbour © 2001 Robert C. Trumpbour Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy December 2001 We approve the thesis of Robert C. Trumpbour. Date of Signature _____________________________ _____________________ Richard L. Barton Professor of Communications Associate Dean of Graduate Studies and Research Thesis Adviser Chair of Committee _____________________________ ______________________ Suzanna DeBoef Associate Professor of Political Science _____________________________ ______________________ Patrick Parsons Associate Professor of Communications _____________________________ ______________________ Ronald A. Smith Professor Emeritus of Exercise and Sport Science iii Abstract Stadium construction has occurred at record-breaking level in major metropolitan areas of the United States in the last decade. This dissertation traces media coverage of stadium construction policy throughout the twentieth century and the beginning of the twenty-first century, focusing specifically on newspaper coverage of this issue. The hypothesis that media practitioners in smaller metropolitan areas will be more likely to privilege voices supporting new stadium construction is examined. The case study method is utilized and content analysis is employed to determine media coverage trends in major American metropolitan areas. Cincinnati and Pittsburgh are examined as small market cities, while Boston and New York are explored as larger market cities. Evidence is provided that larger markets adopt a more critical position than small market cities regarding new stadium construction in newspaper opinion content. Large market publications are similar to smaller market counterparts in providing greater opportunity for expression to pro-stadium voices. -

Boston Neighborhood Network Dear Friends

Transition Years 2007–2012 Boston Neighborhood Network Dear Friends “As I approach 3025 Washington Street to go to work, I picture this scene years ago when the Orange Line was running—tracks high above the street, the train rattling out of Egleston Station past a grand old building that looked like a church on the outside, but on the inside housed massive converters to power the trains,” reflects Curtis Henderson, BNN General Manager. This imposing edifice, vital to the community since 1909, was left vacant when the elevated train tracks were torn down and created a stain on the neighborhood. But today we are part of something different—a beautifully rehabilitated building that has preserved its architectural integrity and brought it into the 21st century with green technology—a building alive with learning, creating and sharing—BNN’s home, the Charles J. Beard II Media Center. Youth and seniors and everyone in between, from every corner of the city, use this state-of-the art media center to learn the latest communications technology and to create TV program- ming they share on our channels and on our website. Our mobile production truck, parked in our backyard, cruises the city covering events in every community Board of Directors and our satellite dish on the roof of the building brings down programming of interest to Bostonians. Boston Neighborhood Network News celebrated its 25th year FY 2007 – 2012 on BNN’s News and Information channel and is going stronger than ever, with web-streamed programs and a dynamic companion website. Kenan Bigby It took hard work, dedication and perseverance from people who care about the revitalization of a neighborhood, who care about bridging the digital divide and who care about preserving our first amendment rights to complete this project and we thank them all: our Board of Directors, staff, members, partners, supporters, col- Reebee Garofalo laborators and funders. -

Mario Real Estate

BOOK YOUR POST IT Call Your Advertising Rep T IMES -F REE P RESS (781)485-0588 East BostonWednesday, August 1, 2018 East Boston High student picked Thank You Dinner Former New England Patriot star for the Umana Tedy Bruschi holds party at Cunard Tavern Fellowship By John Lynds “When we were asked for the first time if we could han- By John Lynds Those who walked into the dle the thank you and reunion Cunard Tavern in East Bos- dinner for the team we were East Boston High School ton last Thursday night were thrilled to do it,” said Pino. student David Pacheco, who greeted by a familiar face. “It’s a cause that’s important is heading into his senior year Playing host and seating to me because my wife Lau- in the fall, has been picked hungry patrons was none oth- ren had surgery to close a hole to serve in this year’s Mario er than former New England in her heart very similar to the Umana Fellowship in Public Patriot star and three-time one which caused Tedy (Brus- Service. Super Bowl champion Tedy chi) to have a stroke. Pacheco, whose family Bruschi. Lauren Pino has run the immigrated from El Salvador No, the former Patriot in- Boston Marathon three times last year, is currently partici- side linebacker has not found for Tedy’s Team while Chef pating in the prestigious pub- a new career working at the Pino has run the Marathon lic service fellowships this popular Eastie eatery. once for the team. summer. -

Jan. 21 – the Boston.Gov Or 617-635-1880

Dorchester Reporter “The News and Values Around the Neighborhood” Volume 37 Issue 1 Thursday, January 2, 2020 50¢ Walsh says new ordinance will boost the city’s wetlands resilience BY KATIE TROJANO REPORTER STAFF Asserting that “climate change is the defining chal- lenge of our time,” Mayor Martin Walsh signed the Local Wetland Ordinance during a visit to Roslindale last week. It’s an initiative, he said, that “gives us greater power to protect our wetlands in the face of a changing climate. Madison Park students celebrated the opening of a new gift shop that they will run on Dec. 18. From left, “We’re using natural green space to protect our Ann-Laurie Desilus, Ginet Castillo, Sara Herrera, Gerald Santana, Ayanna Brice, Irani Perez, Samantha neighborhoods from storms, floods, and heat waves. Disla, Briannalyz Ruiz, Enaira Uribe. … and this ordinance shows what we can accom- plish when we work together,” he added, “securing a strong, resilient future for Boston. This work has Unions to help Madison Park students been a priority for my administration, and I’m proud to sign this important ordinance with our partners.” create and maintain their own business The mayor also noted that the ordinance is stricter than statewide standards. BY DANIEL SHEEHAN thanks to a $10,000 donation from low teacher Francisco Torres, The City Council unanimously approved the law REPORTER STAFF the Dorchester-based painters said in an interview that “the early last month. It protects flood-prone areas and It was all business at Madison union, will provide Madison Park vision for the store is always adjoining upland areas across the city. -

Marquis Is in the ‘Hood! by Jeanne Brady

VOL. 121 - NO. 24 BOSTON, MASSACHUSETTS, JUNE 16, 2017 $.35 A COPY Marquis is in the ‘hood! by Jeanne Brady Last week, we had the very real Rokeach family home in Brook- pleasure of meeting the faces of lyn. With older brothers off at Marquis Health Services: CEO school and younger sister a Norman Rokeach, LNHA (Li- baby, Rokeach was tasked to sit censed Nursing Home Adminis- with his grandparents nightly trator), and Regional Director of for four years. While this chore Operations Stacey Rebelo, RN. may have turned some kids Since the sale of the North off, Rokeach found his calling End Nursing Home was fi nal- (“When I grow up, I want to ized in January, Marquis has take care of people!”) and has been busy doing their home- dedicated himself since to pro- work while Partners/Spaulding viding not only healthcare, but continues to run operations also comfortable, caring homes in the leased-back facility. for seniors in need. He says, Marquis expects to take over “Understand that this is an operations in November of this CEO Norman Rokeach industry [where] we are dealing year when Spaulding’s Brighton Marquis Health Services with people’s lives, understand facility renovation is completed. that we are in it for the residents So, what are they up to now and one of the family-owned facili- who live here; this is their home, what can we expect? ties in Rockland, MA, buying it and our job is to make their First a little background on two years later in 2013. -

Copyright by Benjamin Dylan Lisle 2010

Copyright by Benjamin Dylan Lisle 2010 The Dissertation Committee for Benjamin Dylan Lisle certifies that this is the approved version of the following dissertation: “‘You’ve Got to Have Tangibles to Sell Intangibles’: Ideologies of the Modern American Stadium, 1948-1982” Committee: ____________________________ Jeffrey Meikle, Supervisor ____________________________ Janet Davis ____________________________ Steven Hoelscher ____________________________ Michael Kackman ____________________________ Janice Todd “‘You’ve Got to Have Tangibles to Sell Intangibles’: Ideologies of the Modern American Stadium, 1948-1982” by Benjamin Dylan Lisle, B.A.; M.A. Dissertation Presented to the Faculty of the Graduate School of The University of Texas at Austin in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy The University of Texas at Austin May 2010 Dedication In memory of Madge Lisle, who stoked my interest in the world of things. Acknowledgements Thank you to all who have played their part in the realization of this study. The network of family, friends, colleagues, students, and mentors who have inspired, supported, challenged, and refined it is broad. There are, of course, countless people who have influenced it in subtle ways. But there are also many who have influenced it much more directly. Most immediately were those on my dissertation committee. Jeff Meikle has long provided me an intellectual model of how American Studies can unlock and energize our understanding of the past. His close reading of my work—from my first year at Texas to the final word of my dissertation—was invaluable. I can hardly express how grateful I am for that. I was further blessed by the influence of others at the university, as examples of both committed teaching and vibrant scholarship.