Complaint.) the Defendant AMC T9 Entities Exploited Their Vertically-Integrated Corporate Structure to Combine Both The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Go-Giver Ch1.Pdf

The Go-Giver A Little Story About A Powerful Business Idea By Bob Burg and John David Mann Excerpted from The Go-Giver. Published by Portfolio / Penguin. Copyright Bob Burg and John David Mann, 2007-2013. 1: The Go-Getter If there was anyone at the Clason-Hill Trust Corporation who was a go-getter, it was Joe. He worked hard, worked fast, and was headed for the top. At least, that was his plan. Joe was an ambitious young man, aiming for the stars. 4 Still, sometimes it felt as if the harder and faster he worked, the further away his goals appeared. For such a 6 dedicated go-getter, it seemed like he was doing a lot of going but not a lot of getting. 8 Work being as busy as it was, though, Joe didn’t have 9 much time to think about that. Especially on a day like today—a Friday, with only a week left in the quarter and a critical deadline to meet. A deadline he couldn’t afford not to meet. Today, in the waning hours of the afternoon, Joe decided it was time to call in a favor, so he placed a phone call— but the conversation wasn’t going well. “Carl, tell me you’re not telling me this . .” Joe took a breath to keep the desperation out of his voice. “Neil Hansen?! Who the heck is Neil Hansen? . Well I don’t 1 21066_01_1-134_r4mw.indd 1 h 9/25/07 1:12:57 PM THE GO-GIVER care what he’s offering, we can meet those specs . -

The Walking Dead

Trademark Trial and Appeal Board Electronic Filing System. http://estta.uspto.gov ESTTA Tracking number: ESTTA1080950 Filing date: 09/10/2020 IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD Proceeding 91217941 Party Plaintiff Robert Kirkman, LLC Correspondence JAMES D WEINBERGER Address FROSS ZELNICK LEHRMAN & ZISSU PC 151 WEST 42ND STREET, 17TH FLOOR NEW YORK, NY 10036 UNITED STATES Primary Email: [email protected] 212-813-5900 Submission Plaintiff's Notice of Reliance Filer's Name James D. Weinberger Filer's email [email protected] Signature /s/ James D. Weinberger Date 09/10/2020 Attachments F3676523.PDF(42071 bytes ) F3678658.PDF(2906955 bytes ) F3678659.PDF(5795279 bytes ) F3678660.PDF(4906991 bytes ) IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD ROBERT KIRKMAN, LLC, Cons. Opp. and Canc. Nos. 91217941 (parent), 91217992, 91218267, 91222005, Opposer, 91222719, 91227277, 91233571, 91233806, 91240356, 92068261 and 92068613 -against- PHILLIP THEODOROU and ANNA THEODOROU, Applicants. ROBERT KIRKMAN, LLC, Opposer, -against- STEVEN THEODOROU and PHILLIP THEODOROU, Applicants. OPPOSER’S NOTICE OF RELIANCE ON INTERNET DOCUMENTS Opposer Robert Kirkman, LLC (“Opposer”) hereby makes of record and notifies Applicant- Registrant of its reliance on the following internet documents submitted pursuant to Rule 2.122(e) of the Trademark Rules of Practice, 37 C.F.R. § 2.122(e), TBMP § 704.08(b), and Fed. R. Evid. 401, and authenticated pursuant to Fed. -

Frequencies Between Serial Killer Typology And

FREQUENCIES BETWEEN SERIAL KILLER TYPOLOGY AND THEORIZED ETIOLOGICAL FACTORS A dissertation presented to the faculty of ANTIOCH UNIVERSITY SANTA BARBARA in partial fulfillment of the requirements for the degree of DOCTOR OF PSYCHOLOGY in CLINICAL PSYCHOLOGY By Leryn Rose-Doggett Messori March 2016 FREQUENCIES BETWEEN SERIAL KILLER TYPOLOGY AND THEORIZED ETIOLOGICAL FACTORS This dissertation, by Leryn Rose-Doggett Messori, has been approved by the committee members signed below who recommend that it be accepted by the faculty of Antioch University Santa Barbara in partial fulfillment of requirements for the degree of DOCTOR OF PSYCHOLOGY Dissertation Committee: _______________________________ Ron Pilato, Psy.D. Chairperson _______________________________ Brett Kia-Keating, Ed.D. Second Faculty _______________________________ Maxann Shwartz, Ph.D. External Expert ii © Copyright by Leryn Rose-Doggett Messori, 2016 All Rights Reserved iii ABSTRACT FREQUENCIES BETWEEN SERIAL KILLER TYPOLOGY AND THEORIZED ETIOLOGICAL FACTORS LERYN ROSE-DOGGETT MESSORI Antioch University Santa Barbara Santa Barbara, CA This study examined the association between serial killer typologies and previously proposed etiological factors within serial killer case histories. Stratified sampling based on race and gender was used to identify thirty-six serial killers for this study. The percentage of serial killers within each race and gender category included in the study was taken from current serial killer demographic statistics between 1950 and 2010. Detailed data -

Adoption Tax Benefits: an Overview

Adoption Tax Benefits: An Overview Updated May 18, 2020 Congressional Research Service https://crsreports.congress.gov R44745 SUMMARY R44745 Adoption Tax Benefits: An Overview May 18, 2020 The federal government supports adoption in two primary ways: federal grants to state governments and tax benefits for individual taxpayers that help offset the costs of adopting a Margot L. Crandall-Hollick child. This report focuses on federal adoption tax benefits, which consist of an adoption tax credit Acting Section Research and an income tax exclusion for employer-provided adoption assistance. Manager The adoption tax credit helps qualifying taxpayers offset some of the costs of adopting a child. Although the credit may be claimed for nearly all types of adoptions (excluding the adoption of a spouse’s child), there are some special rules related to claiming the credit for international adoptions and for adoptions of children with special needs (generally children whom the state child welfare agency considers difficult to place for adoption). In 2020, taxpayers may be able to receive an adoption credit of up to $14,300 (this amount is annually adjusted for inflation). The credit is reduced for taxpayers with income over $214,520 and is phased out completely for taxpayers with more than $254,520 in income (these amounts are subject to annual inflation adjustment). The adoption credit is not refundable. However, the credit may be carried forward and claimed on future tax returns for up to five years after initially claimed. In addition, taxpayers whose employers offer qualifying adoption assistance programs as a fringe benefit may not have to pay income taxes on some or all of the value of this benefit. -

Dead Man Talking

STJHUMRev Vol. 5-1 1 Dead Man Talking C. Scott Combs Scott Combs is an Assistant Professor in the English Department at St. John’s University. “He’s dead now, except for he’s breathing.” The Killers (1946) O ne way to introduce film studies as its own unique discipline is by sharing a part of my own research. As a graduate student at UC Berkeley, I wrote on some of the perdurable ways that American cinema has visualized the process of dying. Titled Final Touches: Registering Death in American Cinema, my dissertation studies how American movies see dying by focusing on key moments of technological shift within cinema history, like the transition to story films around 1908, or the transition to synchronized sound around 1928. My emphasis throughout is on “dying,” not “death.” Unlike the still images of painting and photography, the moving image records time. It would therefore seem more capable of apprehending the process between alive and dead, and thus of harnessing the death moment as something visible, certifiable, immediately recognizable to audiences. But exactly because it is so bent on showing process, the movie camera inherits the more general problem of how to determine when and whether death has occurred. The solutions cinema has improvised to fill this gap—to confirm and finalize death—have been under-theorized and deserve to be studied carefully. Early filmmakers intuited the camera’s potential for seeing dying, a fact supported by the very ubiquity of one-shot films made before 1905—in the US, France, and Denmark, mainly—that variously purported to show bodies at the moment they ceased to function voluntarily. -

Religious-Verses-And-Poems

A CLUSTER OF PRECIOUS MEMORIES A bud the Gardener gave us, A cluster of precious memories A pure and lovely child. Sprayed with a million tears He gave it to our keeping Wishing God had spared you If only for a few more years. To cherish undefiled; You left a special memory And just as it was opening And a sorrow too great to hold, To the glory of the day, To us who loved and lost you Down came the Heavenly Father Your memory will never grow old. Thanks for the years we had, And took our bud away. Thanks for the memories we shared. We only prayed that when you left us That you knew how much we cared. 1 2 AFTERGLOW A Heart of Gold I’d like the memory of me A heart of gold stopped beating to be a happy one. I’d like to leave an afterglow Working hands at rest of smiles when life is done. God broke our hearts to prove to us I’d like to leave an echo He only takes the best whispering softly down the ways, Leaves and flowers may wither Of happy times and laughing times The golden sun may set and bright and sunny days. I’d like the tears of those who grieve But the hearts that loved you dearly to dry before too long, Are the ones that won’t forget. And cherish those very special memories to which I belong. 4 3 ALL IS WELL A LIFE – WELL LIVED Death is nothing at all, I have only slipped away into the next room. -

Introduction to Law and Legal Reasoning Law Is

CHAPTER 1: INTRODUCTION TO LAW AND LEGAL REASONING LAW IS "MAN MADE" IT CHANGES OVER TIME TO ACCOMMODATE SOCIETY'S NEEDS LAW IS MADE BY LEGISLATURE LAW IS INTERPRETED BY COURTS TO DETERMINE 1)WHETHER IT IS "CONSTITUTIONAL" 2)WHO IS RIGHT OR WRONG THERE IS A PROCESS WHICH MUST BE FOLLOWED (CALLED "PROCEDURAL LAW") I. Thomas Jefferson: "The study of the law qualifies a man to be useful to himself, to his neighbors, and to the public." II. Ask Several Students to give their definition of "Law." A. Even after years and thousands of dollars, "LAW" still is not easy to define B. What does law Consist of ? Law consists of enforceable rule governing relationships among individuals and between individuals and their society. 1. Students Need to Understand. a. The law is a set of general ideas b. When these general ideas are applied, a judge cannot fit a case to suit a rule; he must fit (or find) a rule to suit the unique case at hand. c. The judge must also supply legitimate reasons for his decisions. C. So, How was the Law Created. The law considered in this text are "man made" law. This law can (and will) change over time in response to the changes and needs of society. D. Example. Grandma, who is 87 years old, walks into a pawn shop. She wants to sell her ring that has been in the family for 200 years. Grandma asks the dealer, "how much will you give me for this ring." The dealer, in good faith, tells Grandma he doesn't know what kind of metal is in the ring, but he will give her $150. -

Read It Here

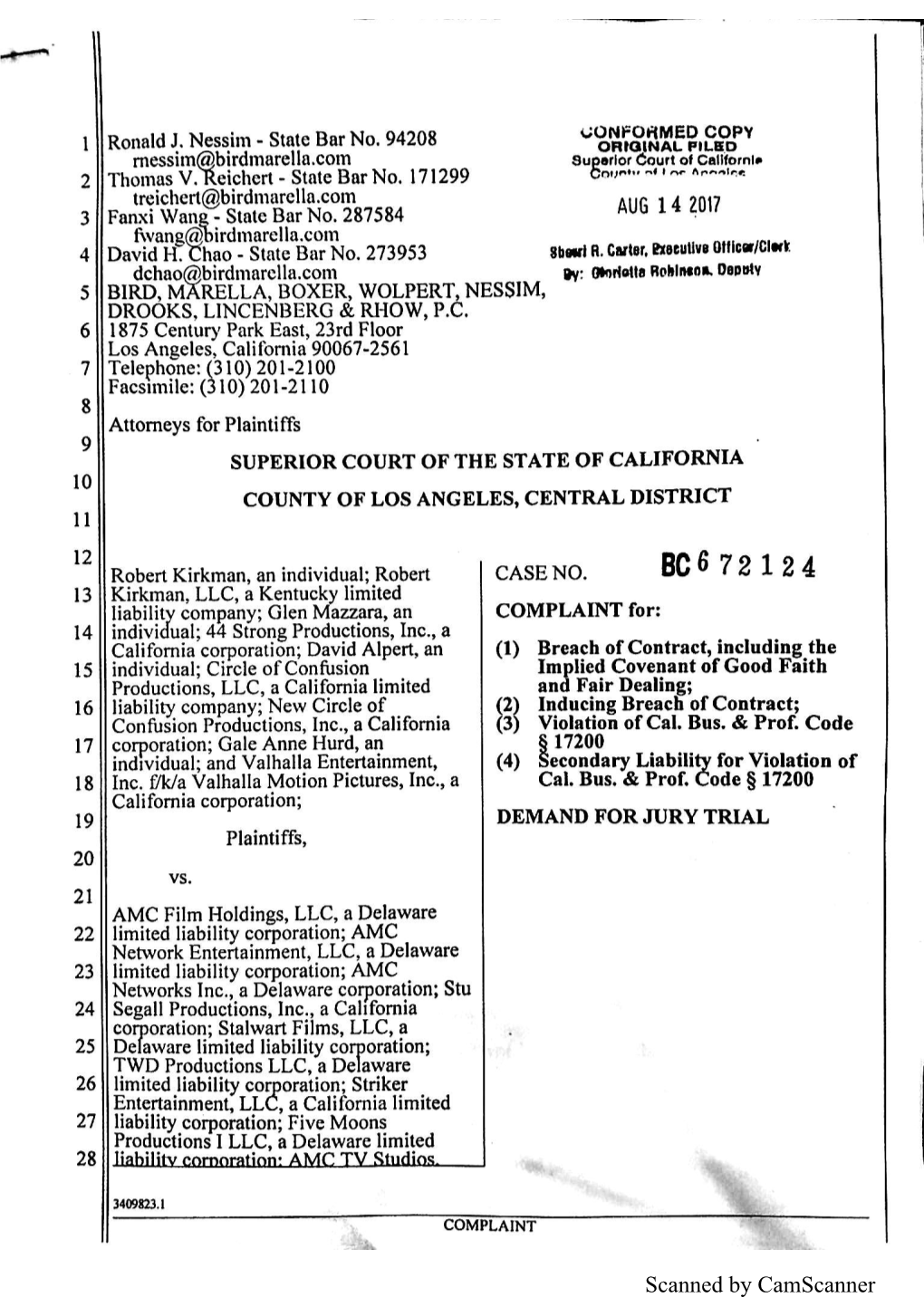

1 Ronald J. Nessim - State Bar No. 94208 com 2 Thomas V - State BarNo. 171299 J^ F 7584 om 4 David - State Bar No. 273953 irdmarella.com 5 BIRD, BOXER, WOLPERT, NESSIM, DROOKS, LINCENBERG & RHOW, P.C. 6 1875 Century Park East,23rd Floor Los Angeles, California 90067 -25 6I 7 Telephone: (3 I 0) 201-2100 Facsimile: (3 10) 201-2110 I Attorneys for Plaintiffs 9 SUPERIOR COURT OF THE STATE OF CALIFORIIIA 10 COUNTY OF LOS ANGELES, CENTRAL DISTRICT 1t l2 Robert Kirkman, an individual; Robert CASE NO. l3 Kirkman, LLC, a Kentucky limited liability company; Glen Mazzara, an COMPLAINT for: t4 individual; 44 Strong Productions, Inc., a California corporation; David Alpert, an (1) Breach of Contract, including the 15 individual; Circle of Confusion Implied Covenant of Good Faith Productions, LLC, a California limited and Fair Dealing; t6 liability company; New Circle of (2) Inducing Breach of Contract; Confusion Pioductions, Inc., a California (3) Violation of Cal. Bus. & Prof. Code t7 corporation; Gale Anne Hurd, an $ 17200 individual; and Valhalla Entertainment, (4) Secondary Liabitify for Violation of 18 Inc. flkla Valhalla Motion Pictures, Inc., a Cal. Bus. & Prof. Code $ 17200 California corporation; 19 DEMAND FOR JURY TRIAL Plaintiffs, 20 Deadline VS 2t AMC Film Holdings, LLC, a Delaware 22 limited liability corporation; AMC Network Entertainment, LLC, a Delaware 23 limited liability corporation; AMC Networks Inc., a Delaware corporation; Stu 24 Segall Productions, Inc., a California corporation; Stalwart Films, LLC, a 25 Delaware limited liability corporation; TWD Productions LLC, a Delaware 26 limited liability corporation; Striker Entertainment, LLC, a California limited 27 liability corporation; Five Moons Productions I LLC, a Delaware limited 28 3409823.1 COMPLAINT 1 LLC, a Delaware limited liability corporation, flW a AMC Television 2 Productions LLC; Crossed Pens Development LLC, a Delaware limited a J liability corporation; and DOES 1 through 40, 4 Defendants. -

Judge, Jury, and Executioner: Why Private Parties Have Standing to Challenge an Executive Order That Prohibits ICTS Transactions with Foreign Adversaries

American University Law Review Volume 69 Issue 6 Article 4 2020 Judge, Jury, and Executioner: Why Private Parties Have Standing to Challenge an Executive Order That Prohibits ICTS Transactions with Foreign Adversaries Ari K. Bental American University Washington College of Law Follow this and additional works at: https://digitalcommons.wcl.american.edu/aulr Part of the Law and Politics Commons, and the President/Executive Department Commons Recommended Citation Bental, Ari K. (2020) "Judge, Jury, and Executioner: Why Private Parties Have Standing to Challenge an Executive Order That Prohibits ICTS Transactions with Foreign Adversaries," American University Law Review: Vol. 69 : Iss. 6 , Article 4. Available at: https://digitalcommons.wcl.american.edu/aulr/vol69/iss6/4 This Comment is brought to you for free and open access by the Washington College of Law Journals & Law Reviews at Digital Commons @ American University Washington College of Law. It has been accepted for inclusion in American University Law Review by an authorized editor of Digital Commons @ American University Washington College of Law. For more information, please contact [email protected]. Judge, Jury, and Executioner: Why Private Parties Have Standing to Challenge an Executive Order That Prohibits ICTS Transactions with Foreign Adversaries Abstract On May 15, 2019, President Donald Trump, invoking his constitutional executive and statutory emergency powers, signed Executive Order 13,873, which prohibits U.S. persons from conducting information and communications technology and services (ICTS) transactions with foreign adversaries. Though the executive branch has refrained from publicly identifying countries or entities as foreign adversaries under the Executive Order, observers agree that the Executive Order’s main targets are China and telecommunications companies, namely Huawei, that threaten American national security and competitiveness in the race to provide the lion’s share of critical infrastructure to support the world’s growing 5G network. -

Reemployment Assistance Resource Guide - COVID-19

Reemployment Assistance Resource Guide - COVID-19 Updated: December 30, 2020 FLORIDA DEPARTMENT OF ECONOMIC OPPORTUNITY | 107 East Madison St. Tallahassee, FL Reemployment Assistance Frequently Asked Questions and Additional Resources Table of Contents: Eligibility (updated 12/30/2020) ................................................................................................................. 2 General Reemployment Assistance Questions (updated 6/5/2020) ...................................................... 5 Reemployment Assistance Waivers (updated 12/30/2020) ..................................................................... 7 COVID-19 and Reemployment Assistance (updated 9/4/2020) .............................................................. 9 CARES Act (updated 12/1/2020) .............................................................................................................. 13 Applying for Reemployment Assistance (updated 12/30/2020) ............................................................ 17 CONNECT (updated 12/30/2020) .............................................................................................................. 24 Receiving Reemployment Assistance Benefits (updated 6/5/2020) ................................................... 30 Adjudication (updated 6/5/2020) ............................................................................................................. 34 Appeals (updated 6/5/2020) .................................................................................................................... -

Terminator and Philosophy

ftoc.indd viii 3/2/09 10:29:19 AM TERMINATOR AND PHILOSOPHY ffirs.indd i 3/2/09 10:23:40 AM The Blackwell Philosophy and Pop Culture Series Series Editor: William Irwin South Park and Philosophy Edited by Robert Arp Metallica and Philosophy Edited by William Irwin Family Guy and Philosophy Edited by J. Jeremy Wisnewski The Daily Show and Philosophy Edited by Jason Holt Lost and Philosophy Edited by Sharon Kaye 24 and Philosophy Edited by Richard Davis, Jennifer Hart Weed, and Ronald Weed Battlestar Galactica and Philosophy Edited by Jason T. Eberl The Offi ce and Philosophy Edited by J. Jeremy Wisnewski Batman and Philosophy Edited by Mark D. White and Robert Arp House and Philosophy Edited by Henry Jacoby Watchmen and Philosophy Edited by Mark D. White X-Men and Philosophy Edited by Rebecca Housel and J. Jeremy Wisnewski ffirs.indd ii 3/2/09 10:23:40 AM TERMINATOR AND PHILOSOPHY I'LL BE BACK, THEREFORE I AM Edited by Richard Brown and Kevin S. Decker John Wiley & Sons, Inc. ffirs.indd iii 3/2/09 10:23:41 AM This book is printed on acid-free paper. Copyright © 2009 by John Wiley & Sons. All rights reserved Published by John Wiley & Sons, Inc., Hoboken, New Jersey Published simultaneously in Canada No part of this publication may be reproduced, stored in a retrieval system, or trans- mitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com. -

On the Auto Body, Inc

FINAL-1 Sat, Oct 14, 2017 7:52:52 PM Your Weekly Guide to TV Entertainment for the week of October 21 - 27, 2017 HARTNETT’S ALL SOFT CLOTH CAR WASH $ 00 OFF 3 ANY CAR WASH! EXPIRES 10/31/17 BUMPER SPECIALISTSHartnetts H1artnett x 5” On the Auto Body, Inc. COLLISION REPAIR SPECIALISTS & APPRAISERS MA R.S. #2313 R. ALAN HARTNETT LIC. #2037 run DANA F. HARTNETT LIC. #9482 Emma Dumont stars 15 WATER STREET in “The Gifted” DANVERS (Exit 23, Rte. 128) TEL. (978) 774-2474 FAX (978) 750-4663 Open 7 Days Now that their mutant abilities have been revealed, teenage siblings must go on the lam in a new episode of “The Gifted,” airing Mon.-Fri. 8-7, Sat. 8-6, Sun. 8-4 Monday. ** Gift Certificates Available ** Choosing the right OLD FASHIONED SERVICE Attorney is no accident FREE REGISTRY SERVICE Free Consultation PERSONAL INJURYCLAIMS • Automobile Accident Victims • Work Accidents Massachusetts’ First Credit Union • Slip &Fall • Motorcycle &Pedestrian Accidents Located at 370 Highland Avenue, Salem John Doyle Forlizzi• Wrongfu Lawl Death Office INSURANCEDoyle Insurance AGENCY • Dog Attacks St. Jean's Credit Union • Injuries2 x to 3 Children Voted #1 1 x 3” With 35 years experience on the North Serving over 15,000 Members •3 A Partx 3 of your Community since 1910 Insurance Shore we have aproven record of recovery Agency No Fee Unless Successful Supporting over 60 Non-Profit Organizations & Programs The LawOffice of Serving the Employees of over 40 Businesses STEPHEN M. FORLIZZI Auto • Homeowners 978.739.4898 978.219.1000 • www.stjeanscu.com Business