SRI LANKA EXPORT DEVELOPMENT ACT, No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Design, Development and Evaluation of Erlotinib-Loaded Hybrid Nanoparticles for Targeted Drug Delivery to Nonsmall Cell Lung Cancer" (2015)

University of Tennessee Health Science Center UTHSC Digital Commons Theses and Dissertations (ETD) College of Graduate Health Sciences 5-2015 Design, Development and Evaluation of Erlotinib- Loaded Hybrid Nanoparticles for Targeted Drug Delivery to NonSmall Cell Lung Cancer Bivash Mandal University of Tennessee Health Science Center Follow this and additional works at: https://dc.uthsc.edu/dissertations Part of the Pharmaceutics and Drug Design Commons Recommended Citation Mandal, Bivash , "Design, Development and Evaluation of Erlotinib-Loaded Hybrid Nanoparticles for Targeted Drug Delivery to NonSmall Cell Lung Cancer" (2015). Theses and Dissertations (ETD). Paper 166. http://dx.doi.org/10.21007/etd.cghs.2015.0196. This Dissertation is brought to you for free and open access by the College of Graduate Health Sciences at UTHSC Digital Commons. It has been accepted for inclusion in Theses and Dissertations (ETD) by an authorized administrator of UTHSC Digital Commons. For more information, please contact [email protected]. Design, Development and Evaluation of Erlotinib-Loaded Hybrid Nanoparticles for Targeted Drug Delivery to NonSmall Cell Lung Cancer Document Type Dissertation Degree Name Doctor of Philosophy (PhD) Program Pharmaceutical Sciences Research Advisor George C. Wood, Ph.D. Committee Himanshu Bhattacharjee, Ph.D. James R. Johnson, Ph.D. Timothy D. Mandrell, Ph.D. Duane D. Miller, Ph.D. DOI 10.21007/etd.cghs.2015.0196 This dissertation is available at UTHSC Digital Commons: https://dc.uthsc.edu/dissertations/166 Design, Development and Evaluation of Erlotinib-Loaded Hybrid Nanoparticles for Targeted Drug Delivery to Non-Small Cell Lung Cancer A Dissertation Presented for The Graduate Studies Council The University of Tennessee Health Science Center In Partial Fulfillment Of the Requirements for the Degree Doctor of Philosophy From The University of Tennessee By Bivash Mandal May 2015 Portions of Chapter 1 © 2013 by Elsevier. -

Shoukei Matsumoto

Shoukei Matsumoto . ’ Translated by Ian Samhammer Illustrated by Kikue Tamura Contents Introduction Understanding Cleaning Useful Items 1 The Kitchen, Bathroom and Toilet 2 Other Parts of the Home 3 Personal Items 4 Repairs and Maintenance 5 Outside the Home 6 Body and Mind When the Cleaning is Finished Follow Penguin A MONK’S GUIDE TO A CLEAN HOUSE AND MIND Shoukei Matsumoto is a Shin-Buddhist monk and the representative of the Buddhist Youth Association of Komyoji. He graduated from Tokyo University’s School of Religious Studies and completed his MBA at the Indian School of Business. Selected to attend the Forum of Young Economic Leaders in 2013, Matsumoto has created a ‘temple café’ and an ‘online temple’, Higan-ji, where he offers people a way to rebuild traditional Buddhism through new media. Introduction I’m a Buddhist monk at Komyoji Temple in Kamiyacho, Tokyo, Japan. I entered Komyoji Temple in 2003, becoming a monk in the Jodo Shinshu Hongwanji sect. A monk’s day begins with cleaning. We sweep the temple grounds and gardens, and polish the main temple hall. We don’t do this because it’s dirty or messy. We do it to eliminate the gloom in our hearts. When you visit a temple, you feel a blissful tension in the tranquil space. The gardens are well tended and spotless, without a single leaf on the ground. Inside the main temple hall, you naturally sit tall and feel alert. These things serve to calm the mind. We sweep dust to remove our worldly desires. We scrub dirt to free ourselves of attachments. -

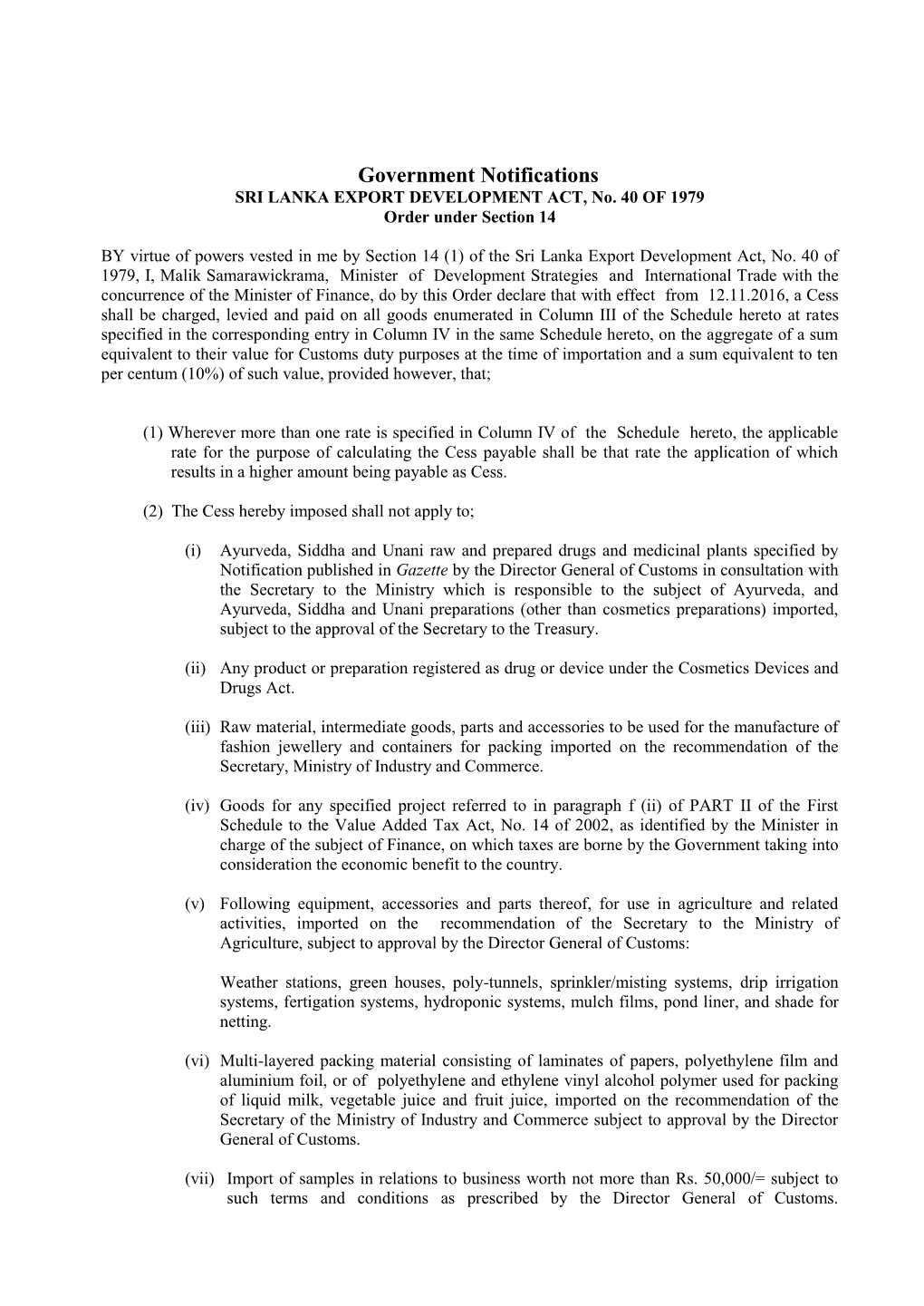

2014 Budget Proposals – Import Cess

HS HS Code(II) Hdg(I) Description (III) Rate of Cess(IV) Unit 1st Crieteria 2nd criteria 02.01 Meat of bovine animals, fresh or chilled. 0201.10 - Carcasses and half-carcasses 30% or Rs. 225/= per kg kg 30% 225 0201.20 - Other cuts with bone in 30% or Rs. 225/= per kg kg 30% 225 0201.30 - Boneless 30% or Rs. 225/= per kg kg 30% 225 02.02 Meat of bovine animals, frozen. 0202.10 - Carcasses and half-carcasses 30% or Rs. 225/= per kg kg 30% 225 0202.20 - Other cuts with bone in 30% or Rs. 225/= per kg kg 30% 225 0202.30 - Boneless 30% or Rs. 225/= per kg kg 30% 225 02.03 Meat of swine, fresh, chilled or frozen. - Fresh or chilled : 0203.11 -- Carcasses and half-carcasses 30% or Rs. 225/= per kg kg 30% 225 0203.12 -- Hams, shoulders and cuts thereof, with bone in 30% or Rs. 225/= per kg kg 30% 225 0203.19 -- Other 30% or Rs. 225/= per kg kg 30% 225 - Frozen : 0203.21 -- Carcasses and half-carcasses 30% or Rs. 225/= per kg kg 30% 225 0203.22 -- Hams, shoulders and cuts thereof, with bone in 30% or Rs. 225/= per kg kg 30% 225 0203.29 -- Other 30% or Rs. 225/= per kg kg 30% 225 02.04 Meat of sheep or goats, fresh, chilled or frozen. 0204.10 - Carcasses and half-carcasses of lamb, fresh or chilled 30% or Rs. 225/= per kg kg 30% 225 - Other meat of sheep, fresh or chilled: 0204.21 -- Carcasses and half-carcasses 30% or Rs. -

Sri Lanka Tea Board As Wholly of Sri Lankan ---- Rs

1A Import Cess changes with effect from 09th November 2012 1 Schedule 02.01 Meat of bovine animals, fresh or chilled. 0201.10 - Carcasses and half-carcasses 30% or Rs. 200/= per kg 0201.20 - Other cuts with bone in 30% or Rs. 200/= per kg 0201.30 - Boneless 30% or Rs. 200/= per kg 02.02 Meat of bovine animals, frozen. 0202.10 - Carcasses and half-carcasses 30% or Rs. 200/= per kg 0202.20 - Other cuts with bone in 30% or Rs. 200/= per kg 0202.30 - Boneless 30% or Rs. 200/= per kg 02.03 Meat of swine, fresh, chilled or frozen. - Fresh or chilled : 0203.11 -- Carcasses and half-carcasses 30% or Rs. 200/= per kg 0203.12 -- Hams, shoulders and cuts thereof, with bone in 30% or Rs. 200/= per kg 0203.19 -- Other 30% or Rs. 200/= per kg - Frozen : 0203.21 -- Carcasses and half-carcasses 30% or Rs. 200/= per kg 0203.22 -- Hams, shoulders and cuts thereof, with bone in 30% or Rs. 200/= per kg 0203.29 -- Other 30% or Rs. 200/= per kg 02.04 Meat of sheep or goats, fresh, chilled or frozen. 0204.10 - Carcasses and half-carcasses of lamb, fresh or chilled 30% or Rs. 200/= per kg - Other meat of sheep, fresh or chilled: 0204.21 -- Carcasses and half-carcasses 30% or Rs. 200/= per kg 0204.22 -- Other cuts with bone in 30% or Rs. 200/= per kg 0204.23 -- Boneless 30% or Rs. 200/= per kg 0204.30 - Carcasses and half-carcasses of lamb, frozen 30% or Rs. -

Common Fund for Commodities

Discover Technical Paper No. 56 natural fibres 2009 COMMON FUND FOR COMMODITIES PROCEEDINGS OF THE SYMPOSIUM ON NATURAL FIBRES Rome 20 October 2008 FAO, Rome Supported by the Common Fund for Commodities The Symposium and publication of the Proceedings is sponsored by the CFC and FAO. This document is published without formal editing. Any presentation or part of it, published in these Proceedings, represents the opinion of the author(s) and does not necessarily reflect the official policy of sponsoring organizations, or the institution within which the presenter is affiliated unless this is clearly specified. Additionally, the author(s) is/are fully responsible for the contents of the presentation and for any claim or disclaim therein. Common Fund for Commodities Stadhouderskade 55, 1072 AB Amsterdam, The Netherlands Postal Address: PO Box 74656, 1070 BR Amsterdam, The Netherlands Tel: (31-20) 5754949 E.mail: [email protected] Fax: (31-20) 6760231 website: www.common-fund.org Copyright © Common Fund for Commodities 2009 The contents of this report may not be reproduced, stored in a data retrieval system or transmitted in any form or by any means without prior written permission of the Common Fund for Commodities, except that reasonable extracts may be made for the purpose of comment or review provided the Common Fund for Commodities is acknowledged as the source. COMMON FUND FOR COMMODITIES PROCEEDINGS OF THE SYMPOSIUM ON NATURAL FIBRES Rome 20 October 2008 iii Contents FOREWORD iv OVERVIEW OF THE SYMPOSIUM v PRÉSENTATION GÉNÉRALE -

The Hachijō Language of Japan: Phonology and Historical Development

THE HACHIJŌ LANGUAGE OF JAPAN: PHONOLOGY AND HISTORICAL DEVELOPMENT A DISSERTATION SUBMITTED TO THE GRADUATE DIVISION OF THE UNIVERSITY OF HAWAI‘I AT MĀNOA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY IN LINGUISTICS MAY 2019 By David Joseph Iannucci Dissertation Committee: Lyle Campbell, Chairperson Robert Blust Shōichi Iwasaki Rory Turnbull Masato Ishida Dedicated to my two grandfathers, who valued education. James E. ‘Jack’ Iannucci (1914–1991) Frank A. Ventrola (1910–1979) i Acknowledgments I wish to acknowledge the following important people: Alexander Vovin, who inspired this work with an offhand comment, for teaching me Old Japanese, Classical Japanese, and Old Okinawan, and for recommending (before this work was started) that I buy an electronic handwriting-recognizing multi-dictionary of the kind that the Japanese seem to love. I picked up the Brain, made by Sharp. It was a crucial tool that I might not have realized I needed if not for Sasha’s suggestion, and without which I honestly wonder if I could possibly have completed this research. I feel privileged to have studied with him, and had the chance to join the group of students and hangers-on, of which he was the center, who would gather for lifting a glass after hours while talking about East Asian linguistics. Tim Vance, for teaching a stimulating course on Japanese phonology and morphophonology at ex- actly the time when I needed to review these topics in detail in order to do my own work. Ms. Mari Kikuchi, publisher of the Nankai Times newspaper in Hachijōjima, for interesting but too-brief dis- cussions of island history, and pointers to literature. -

Clearance of Credit Items

eleD$€, t'r ffoeD{str e}}€reD eqee}hCIe@dqo Spui,6Lo$ u)$glr$ arguuniGs $m:mr*isonLb trIlr{}ItTs ,tND EIP{}RI-S C {}r"l'R{}L t}Ep,\ttT"}IEIt. Qoo 75 - 1r'3, e:g$ &og, So. 75 - ll3, lq5rir ronE, ).r, --i- I i. I liir)t',i' od@:d oo:*ac$$g, Cg4trnatt oiqr-d, 1 ir:tirt. llrriirii:':. .ec.:5bd. ffim, era.sffi, 5S9, e*a:€& 01, €,-r.tr&* 6f$. g.Gu, 5i9.. &qlll$rir.l_cl" f irrk Slrt*" Pt}.fl*s:559.l_qtrylgjl @od eoroo \ OsA cbtocs \ rECDt't/t0Da2lNoL' ffi"";* i ?,Tr*,** i ffi]*.o4.2azl Director General Sri Lanka Customs CEOs of all Comrnercial Banks Dear Sir/ Madam Clearance of Credit Items The fbllowing direction is issued under the power vested in Lnports and Exports (Contr"ol) Act IrIo.l of 1969 and in terrns of Regulations No. 2i of the Gazette Extraordinary No. 2l84l2l dated July 16.2020. You are kindly hereby infbnned that Tariff Determination Committee (TDC) has decided to release items fi'om Sri Lanka Customs, specified in the Schedule II of Imports and Exports (Control) Regulations No. 04 of 2020 published in the Gazette Extraordinary No. 2l\4l2l dated July 16,2A20, as arnended and irnported without adhering to credit terms specified in above regulations while charging appropriate penalty as specified in the Customs Ordinance. This dilection shall be implernented with irnmediate efTect. T V D Dam*yanthi S. Karunarathne Controller Geoeral Enclosed: the Gazette Extrzordinarv No. 218421 dated Julv 16.2020. g6eueo &,neus#:* Telephonr {}.@6d lsaeerqis6ft E-Mail dep*npt(jlltuct.ik co#cargCI ) orero den6:rd ) ocdd ) r :126774 I 23:4386 0r r 2128486 sOA Cn* llteb ffi--,t0r f;ro"H;Hfl5;ltt*lor m****l http:.#w*r-rimexport. -

Certified Product List by Manufacturer

HACCP INTERNATIONAL FOOD-SAFE EQUIPMENT, MATERIALS and SERVICES List of certified products by manufacturer FZP (Food Zone Primary) items are suitable for use in the food zone and are suitable for contact with food. Examples of products that may be classified FZP: Disposable gloves, probe thermometers, conveyor belts, piping bags, utensils, cutting boards, servingware, ice making equipment, carcass tags, baking paper, food storage containers. FZS (Food Zone Secondary) items are suitable for touching food contact surfaces but are not expected to touch food during normal conditions of use. Examples of products that may be classified FZS: Cleaning cloths and non-woven wipes, scour pads, hard surface sanitisers, drum covers, brush-ware, food packaging labels, washing-up detergent. SSZ (Splash or Spill Zone) items are suitable for use in food handling areas such as kitchens, production areas and processing areas, but are not suitable for coming directly into contact with food or items that will touch food. Examples of products that may be classified SSZ: Floor mats, hand-soap dispensers, rapid-closing doors, light fittings, extraction hoods, mops, floor surfacing materials, hair nets, insect control units. NFZ (Non Food Zone) items are items that are suitable for use in and around food handling facilities and that make a contribution to food safety but that are not suitable for use in areas where open (unpackaged) food is handled. Examples of products that may be classified NFZ: Rodenticides, temperature monitoring software, laboratory equipment -

PERSONAL NARRATIVE of a PILGRIMAGE to AL-MADINAH & MECCAH Vol

PERSONAL NARRATIVE OF A PILGRIMAGE TO AL-MADINAH & MECCAH vol. i BY RICHARD F. BURTON CHAPTER I. TO ALEXANDRIA. A few Words concerning what induced me to a Pilgrimage. IN the autumn of 1852, through the medium of my excellent friend, the late General Monteith, I offered my services to the Royal Geographical Society of London, for the purpose of removing that opprobrium to modern adventure, the huge white blot which in our maps still notes the Eastern and the Central regions of Arabia. Sir Roderick I. Murchison, Colonel P. Yorke and Dr. Shaw, a deputation from that distinguished body, with their usual zeal for discovery and readiness to encourage the discoverer, honoured me by warmly supporting, in a personal interview with the then Chairman of the then Court of Directors to the then Honourable East India Company, my application for three years' leave of absence on special duty from India to Maskat. But they were unable to prevail upon the said Chairman, the late Sir James Hogg, who, remembering the fatalities which of late years have befallen sundry soldier-travellers in the East, refused his sanction, alleging as a reason that the contemplated journey was of too dangerous a nature. In compensation, however, for the disappointment, I was allowed the additional furlough of a year, in order to pursue my Arabic studies in lands where the language is best learned. What remained for me but to prove, by trial, that what might be perilous to other travellers was safe to me? The "experimentum crucis" was a visit to Al-Hijaz, at once the most difficult and the most dangerous point by which a European can enter Arabia. -

The Gazette of the Democratic Socialist Republic of Sri Lanka EXTRAORDINARY

I fldgi ( ^I& fPoh - YS% ,xld m%cd;dka;s%l iudcjd§ ckrcfha w;s úfYI .eiÜ m;%h - 2020'04'16 1A PART I : SEC. (I) - GAZETTE EXTRAORDINARY OF THE DEMOCRATIC SOCIALIST REPUBLIC OF SRI LANKA - 16.04.2020 Y%S ,xld m%cd;dka;%sl iudcjd§ ckrcfha .eiÜ m;%h w;s úfYI The Gazette of the Democratic Socialist Republic of Sri Lanka EXTRAORDINARY wxl 2171$5 - 2020 wfm%a,a ui 16 jeks n%yiam;skaod - 2020'04'16 No. 2171/5 - THURSDAY, APRIL 16, 2020 (Published by Authority) PART I : SECTION (I) — GENERAL Government Notifi cations IMPORTS AND EXPORTS (CONTROL) ACT, NO. 1 OF 1969 Order under Section 2 REGULATIONS made by the Minister under Section 20 read with Sub section (3) of Section 4 and Section 14 of the Imports and Exports (Control)Act, No. 1 of 1969 as amended by Act No. 48 of 1985 and No. 28 of 1987. MAHINDA RAJAPAKSA, Minister of Finance, Economic and Policy Development. Ministry of Finance, Economic and Policy Development, Colombo 01, April 16, 2020. 1A- PG 004944 — 617 (04/2020) This Gazette Extraordinary can be downloaded from www.documents.gov.lk 2A I fldgi ( ^I& fPoh - YS% ,xld m%cd;dka;s%l iudcjd§ ckrcfha w;s úfYI .eiÜ m;%h - 2020'04'16 PART I : SEC. (I) - GAZETTE EXTRAORDINARY OF THE DEMOCRATIC SOCIALIST REPUBLIC OF SRI LANKA - 16.04.2020 REGULATIONS 1. These Regulations may be cited as the Imports and Exports (Control) Regulations No. 01 of 2020. 2. The Special Import License and Payment Regulations No. -

HACCP International

Product Register by Manufacturer/Provider Tue, 22 Dec 2020 16:00:04 +1100 Client Name Certificate Number Product Range Heading Food Zone Class Product Name 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotchbrick™ Griddle Scrubber Pads, Sponge - Scourers 9537 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ General Purpose Pads, Sponge - Scourers Scourer 9650 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ General Purpose Pads, Sponge - Scourers Scrubbing Pad 9664 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ Low Scratch Scour Pads, Sponge - Scourers Pad 2000HEX 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ Light Duty Pads, Sponge - Scourers Cleansing Pad 98, 98-P 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ Heavy Duty Pads, Sponge - Scourers Scouring Pad 86, 86CC 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ General Purpose Pads, Sponge - Scourers Scrub Pad 9650 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia Pacific Scotch-Brite ™ Hand FZS (Food Zone Secondary) Scotch-Brite™ Light Duty Scrub Pads, Sponge - Scourers Sponge 63 3M Asia Pacific (APAC) I-PE-635-3M-4-RG-05 Asia -

Weighing Scale

This week we are launching Wikivoyage . Join us in creating a free travel guide that anyone can edit. Weighing scale From Wikipedia, the free encyclopedia Jump to: navigation, search Emperor Jahangir (reign 1605 - 1627) weighing his son Shah Jahan on a weighing scale by artist Manohar (AD 1615, Mughal dynasty, India). A weighing scale (usually just "scales" in UK and Australian English, "weighing machine" in south Asian English or "scale" in US English) is a measuring instrument for determining the weight or mass of an object. A spring scale measures weight by the distance a spring deflects under its load. A balance compares the torque on the arm due to the sample weight to the torque on the arm due to a standard reference weight using a horizontal lever. Balances are different from scales, in that a balance measures mass (or more specifically gravitational mass), where as a scale measures weight (or more specifically, either the tension or compression force of constraint provided by the scale). Weighing scales are used in many industrial and commercial applications, and products from feathers to loaded tractor-trailers are sold by weight. Specialized medical scales and bathroom scales are used to measure the body weight of human beings. Contents 1 History 2 Balance o 2.1 Analytical balance 3 Scales o 3.1 Spring scales o 3.2 Pendulum balance scales o 3.3 Electronic analytical "balance" scale o 3.4 Strain gauge scale o 3.5 Hydraulic or pneumatic scale 4 Testing and certification 5 Supermarket/retail scale 6 Sources of error 7 Symbolism 8 See also 9 Footnotes 10 External links History Balance scale in the Egyptian Book of the Dead The balance scale is such a simple device that its usage likely far predates the evidence.