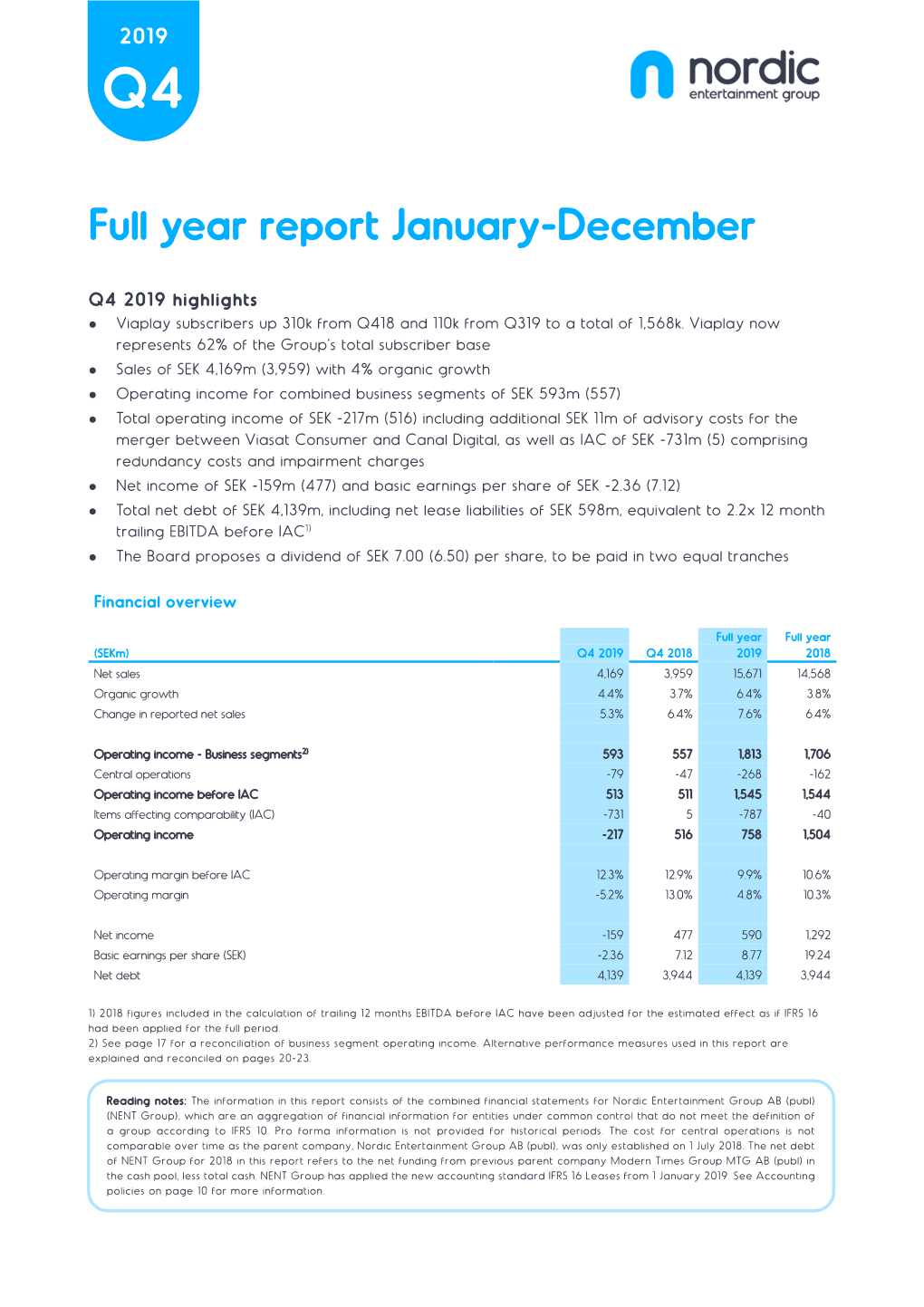

Full Year Report January-December

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Viaplay Included in Bahnhof's Top-Tier TV Package and Available As Add-On Subscription • Bahnhof to Distribute NENT Grou

• Viaplay included in Bahnhof’s top-tier TV package and available as add-on subscription • Bahnhof to distribute NENT Group’s premium V channels for the first time • Partnership reflects NENT Group’s unique content offering and strategic focus on long-term distribution deals Nordic Entertainment Group (NENT Group), the Nordic region’s leading streaming company, has extended and expanded its distribution agreement with Swedish broadband and IPTV provider Bahnhof. NENT Group’s Viaplay streaming service will continue to be available to Bahnhof’s 350,000 customers in Sweden as an add-on subscription, and Viaplay’s TV & Movie package will now be included in Bahnhof’s top-tier TV offering, TV Stor. In addition, Bahnhof customers can add NENT Group’s premium V film and sports channels to their subscriptions for the first time, and the recently launched V Sport Extra channel will be included in the TV Stor package. NENT Group’s Swedish channels TV3, TV6, TV8 and TV10 will remain part of all Bahnhof’s TV packages. Kim Poder, NENT Group Chief Commercial Officer: “Our content offering is in a class of its own, and we are delighted to expand this relationship with Bahnhof, which is one of Sweden’s fastest growing operators. We have recently renewed our Swedish rights to the Premier League until 2028, we will be the home of FIS winter sports from 2021 and we continue to invest in Viaplay originals, the best Hollywood films and series, and high-quality kids content. We want Viaplay and our unique content to be as widely available as possible, and we are constantly exploring new ways to bring them to even more homes.” Jon Karlung, CEO, Bahnhof: “I am excited that we now have one of Sweden’s strongest entertainment offerings, thanks to our newly expanded agreement with NENT Group.” The partnership with Bahnhof reflects NENT Group’s strategic focus on long-term distribution deals that ensure the broad availability of its streaming services and TV channels across the Nordic region. -

2018-Channel-Guide.Pdf

CHANNEL GUIDE Additional Packages Multi-Sport Pack ™ DISH Movie Pack Requires subscription to America’s Top 120 Plus or higher package. 15 movie channels and 1000s of titles available On Demand. beIN SPORTS SAP 392 Crime & Investigation 249 EPIX 1 380 Packages beIN SPORTS en Español 873 Big Ten Network 405 EPIX 2 381 Big Ten Network 410 EPIX Hits 382 Bases Loaded/Buzzer Beater/Goal Line 403 FXM 384 CHANNEL GUIDE FOX Sports 2 149 Hallmark Movies & Mysteries 187 Longhorn Network1 407 HDNet Movies 130 MLB Network 152 IndiePlex 378 MLB Strike Zone 153 MGM 385 designed NBA TV SAP 156 MoviePlex 377 NFL Network 154 PixL SAP 388 NFL RedZone 155 RetroPlex 379 NHL Network 157 Sony Movie Channel 386 Outside TV 390 STARZ Encore Suspense 344 Pac-12 Network 406 STARZ Kids & Family SAP 356 Packages Pac-12 Network 409 Universal HD 247 with you SEC Network 404 SEC Network SAP 408 1 Only HD for live events. Plus over 25 Regional Sports Networks TheBlaze 212 designedin mind. HBO (E) SAP 300 Fox Soccer Plus 391 HBO2 (E) SAP 301 HBO Signature SAP 302 HBO (W) SAP 303 with you HBO2 (W) SAP 304 HBO Family SAP 305 HBO Comedy SAP 307 HBO Zone SAP 308 24/7 HBO Latino 309 Customer in mind. Support Cinemax (E) SAP 310 Cinemax (W) SAP 311 MoreMax SAP 312 ActionMax SAP 313 5StarMax SAP 314 Cinemáx 315 99% Signal SAP Showtime (E) 318 * Showtime (W) SAP 319 Reliability Showtime Too SAP 320 Showtime Showcase SAP 321 Showtime Extreme SAP 322 Showtime Beyond SAP 323 The Movie Channel (E) SAP 327 The Movie Channel Xtra (E) SAP 328 FLIX 333 STARZ Encore (E) SAP 340 STARZ -

Money for Nothing the Billion-Dollar Pirate Subscription IPTV Business

Money for Nothing The Billion-Dollar Pirate Subscription IPTV Business August 2020 Table of Contents Executive Summary 1 The Troubling History of Television Piracy 4 The Pirate Subscription IPTV Ecosystem 6 The Profitability of Pirate Subscription IPTV Services 12 Splitting the Billion-Dollar Pie 14 Conclusion 23 Appendix: The Players Behind the PS IPTV Ecosystem 25 Table of Figures Figure 1 – Sample PS IPTV storefront, landing page 7 Figure 2 – Sample PS IPTV storefront, sales pitch 7 Figure 3 – Sample PS IPTV service, live TV 8 Figure 4 – Sample PS IPTV service, movies 8 Figure 5 – Sample PS IPTV Facebook advertisement 9 Figure 6 – PS IPTV Ecosystem 11 Figure 7 – Content theft 25 Figure 8 – Content distribution, subscription IPTV 26 Money for Nothing: The Billion-Dollar Pirate Subscription IPTV Business i Executive Summary onsumers have more high-quality entertainment to watch on their television sets, computers, tablets, and phones than ever before. But while consumers can select from an ever-growing Cvariety of legal services, illegal streaming services have emerged in their shadow, leveraging stolen content and off-the-shelf streaming technologies to deliver entertainment at a fraction of the cost of legitimate content providers. The most virulent and fast-growing illegal streaming enterprise is the pirate subscription Internet Protocol Television (PS IPTV) Service. This type of service mimics the practices of legitimate streaming services. It charges by the month or by the year – typically, about $10 - $15 per month. And for that low price, it provides the customer with thousands of channels of linear television from around the world, and often with tens of thousands of titles for video on demand, including movies still showing in theaters and every episode of entire TV series. -

Katso Televisiota, Maksukanavia Ja Makuunin Vuokravideoita 4/2017 Missä Ja Millä Vain

KATSO TELEVISIOTA, MAKSUKANAVIA JA MAKUUNIN VUOKRAVIDEOITA 4/2017 MISSÄ JA MILLÄ VAIN. WATSON TOIMII TIETOKONEELLA, TABLETISSA JA ÄLYPUHELIMESSA SEKÄ TV-TIKUN TAI WATSON-BOKSIN KANSSA TELEVISIOSSA. WATSON-PERUSPALVELUN KANAVAT 1 Yle TV1 12 FOX WATSONISSA 2 Yle TV2 13 AVA MYÖS 3 MTV3 14 Hero 4 Nelonen 16 Frii MAKUUNIN 5 Yle Fem / SVT World 18 TLC UUTUUSLEFFAT! 6 Sub 20 National Geographic 7 Yle Teema Channel 8 Liv 31 Yle TV1 HD 9 JIM 32 Yle TV2 HD Powered by 10 TV5 35 Yle Fem HD 11 KUTONEN 37 Yle Teema HD Live-tv-katselu. Ohjelma/ohjelmasarjakohtainen tallennus. Live-tv-katselu tv-tikun tai Watson-boksin kautta. Ohjelma/ohjelmasarjakohtainen tallennus. Live-tv-katselu Watson-boksin kautta. Ohjelma/ohjelmasarjakohtainen tallennus. Vain live-tv-katselu Watson-boksin kautta. Vain live-tv-katselu. KANAVAPAKETTI €/KK, KANAVAPAIKKA, KANAVA Next 21 Discovery Channel C 60 C More First Sports 121 Eurosport 1 HD *1 0,00 € 22 Eurosport 1 C 61 C More First HD 8,90 € 122 Eurosport 2 HD 23 MTV C 62 C More Series 123 Eurosport 2 24 Travel Channel C 63 C More Series HD 159 Fuel TV HD 25 Euronews C 64 C More Stars 160 Motors TV HD 27 TV7 C 66 C More Hits 163 Extreme Sports HD Start 33 MTV3 HD *1 C 67 SF Kanalen 200 Nautical Channel 0,00 € C 75 C More Juniori Base 126 MTV Live HD *1 C More Sport S Pakettiin sisältyy oheisella 8,90 € 150 VH1 Swedish 40 SVT1 4,30 € 41 SVT2 24,95 € tunnuksella merkityt 151 Nick Jr. -

Levira DTT Programmid 09.08.21.Xlsx

Digilevi programmid seisuga 7.september 2021 Multipleks 1 / 2 LCN SID PMT TV Programm Operaator Video Audio Subtiitrid EPG HbbTV DVB [161] - eesti [730] - eesti (Stereo 192 Kbps) 1 1 290 ETV Levira [550] - AVC (720x576i) DVB [162] - vene Jah Jah [731] - *hollandi (Stereo 128 Kbps) DVB [163] - *hollandi DVB [171] - eesti [806] - eesti (Stereo 192 Kbps) 2 2 307 ETV2 Levira [561] - AVC (720x576i) DVB [172] - vene Jah Jah [807] - *hollandi (Stereo 128 Kbps) Multipleks 1 DVB [173] - *hollandi 6 3 206 Digilevi info Levira [506] - AVC (720x576i) [603] - eesti (Stereo 112 Kbps) - - Jah DVB [181] - eesti [714] - vene (Stereo 192 Kbps) DVB [182] - vene 7 34 209 ETV+ Levira [401] - AVC (720x576i) [715] - eesti (Stereo 128 Kbps) Jah Jah DVB [183] -* hollandi [716] - *hollandi (Stereo 128 Kbps) DVB [184] - eesti 12 38 202 Duo 5 Elisa Klassik [502] - AVC (720x576i) [605] - eesti (Stereo 192 Kbps) - Jah 13 18 273 TV6 Elisa Klassik [529] - AVC (720x576i) [678] - eesti (Stereo 192 Kbps) - Jah [654] - inglise (Stereo 192 Kbps) 20 12 267 Duo 3 Elisa Klassik [523] - AVC (720x576i) Videos Jah [655] - vene (Stereo 128 Kbps) [618] - inglise (Stereo 192 Kbps) 22 23 258 Duo 6 Elisa Klassik [514] - AVC (720x576i) Videos Jah [619] - vene (Stereo 128 Kbps) [646] - inglise (Stereo 128 Kbps) 26 10 265 Discovery Elisa Klassik [521] - AVC (720x576i) Videos Jah [647] - vene (Stereo 128 Kbps) [662] - inglise (Stereo 128 Kbps) 28 14 269 Animal Planet Elisa Klassik [525] - AVC (720x576i) - Jah Multipleks 2 [663] - vene (Stereo 128 Kbps) [658] - inglise (Stereo 128 Kbps) -

Africa Kagiso Digital Primedia Broadcasting APAC Asia

Africa Kagiso Digital Primedia Broadcasting APAC Asia MediaCorp Oceania AXR PTE LTD Grant Broadcasters Light FM Nine Radio Nova Entertainment Pty Ltd Southern Cross Austereo Totally Media Pty Ltd South Asia Gaana Hungama Digital Entertainment Media Corp Canada Bell Media Canadian Broadcasting Corporation Quebecor Stingray Digital Europe Karnaval Radio Kerry AdTonos Number One Media Group Radioline Capital Radio NRG Media Talpa Radio Deezer Prisa Radio Williams Broadcasting Grupo Renascenca PRS Digital Srl Zemeho iVoox Global Podcasting Service RADIOCORP LATAM Grupo RPP Radio Alvorada Acir SAT S.A de CV GTB Radiodifusores SRL RADIOS IMC Audio Video SA de CV Jovem Pan Radiopolis Blink 102 FM Imagen Radios Grupo Globo Cadena Radial Costarricense MIX 102.1FM RIO Radio Zocalo S.A de CV CRP Radios MK Publicita Propaganda e PublicidadeRadiodifusora Ltda Queretaro S.A. de C.V. Dial Brazil MobRadio Sistema Vida Colombia S.A. Estereo Azul, S.A. Nova Brasil Televisao Atalaia Ltda Futbol de Primera MVS Radio Mexico TV ACCION Grupo ABC Radio NRM Web SA DE CV Wicca E.U. Grupo BluRadio Prisa Radio Mexico Radio Grupo Grada Producciones Wilvin SA Sistema O POVO de Radios Grupo Radio Centro JB FM Sua Musica Grupo Radiodifusoras Capital Palco MP3 MENA Anghami Go Alive Media TIM Media United States Emmis Radio LLC M&M Media 977Music.com Entercom Mapleton Communications AEIBO LLC Entravision Communications Max Media America Multimedios ESPN Radio Corporate Midwest Adams Radio Group LLC First Media Radio Milner Broadcasting All Pro Broadcasting Inc Flood Communications LLC Mood Media Beasley Mezzanine Fox News Network LLC Neuhoff Communications Bloomberg GateHouse Media Newsweb Radio Bonneville GOW Communications NOBEX Buck Owens One Company Inc. -

“Television of the Future”? Netflix, Quality and Neophilia in the TV Debate Matrizes, Vol

Matrizes ISSN: 1982-2073 ISSN: 1982-8160 [email protected] Universidade de São Paulo Brasil Castellano, Mayka; Meimaridis, Melina The “television of the future”? Netflix, quality and neophilia in the TV debate Matrizes, vol. 15, no. 1, 2021, pp. 195-222 Universidade de São Paulo São Paulo, Brasil DOI: https://doi.org/10.11606/issn.1982-8160.v15i1p195-222 Available in: https://www.redalyc.org/articulo.oa?id=143067575010 How to cite Complete issue Scientific Information System Redalyc More information about this article Network of Scientific Journals from Latin America and the Caribbean, Spain and Journal's webpage in redalyc.org Portugal Project academic non-profit, developed under the open access initiative 195 “Television of the future”? Netflix, quality, and neophilia in the TV debate A “televisão do futuro”? Netflix, qualidade e neofilia no debate sobre TV MAYKA CASTELLANOa Universidade Federal Fluminense, Graduate Program in Communication. Niterói – RJ, Brazil MELINA MEIMARIDISb Universidade Federal Fluminense, Graduate Program in Communication. Niterói – RJ, Brazil ABSTRACT a Professor of the Graduate Program in Communication In this article, we investigate Netflix, questioning the expectations of the public and the and the Department critics regarding changes that arise from the introduction of this service in the market. of Cultural and Media Studies of the Universidade From the analysis of trade press coverage, access data, and the company’s investment Federal Fluminense. Orcid: trends, we inquire what types of TV consumption experiences are at stake in the discourse https://orcid.org/0000- 0003-4401-5979. E-mail: promoted by analysts and novelty enthusiasts. We also discuss how evaluations on these [email protected] platforms renew the ongoing controversies about television quality. -

BT TV Adopts Telestream Vantage for Enhanced Multiscreen OTT Media

Vantage Case Study: BT TV Deliver Ingest Monetize Edit BT TV Adopts Telestream Vantage for Enhanced Multiscreen OTT Media Processing Leading UK Telco service provider enhances business agility with Telestream; Introduces robust multiscreen services to better serve millions of consumers “BT TV evaluated all of the The Company available transcoding options BT TV is a subscription IPTV service offered by BT, a division of United and found that Vantage offered Kingdom telecommunications company BT Group, and was originally high quality content in the widest launched as BT Vision in December 2006. As of the end of 2017, BT TV has range of multiscreen formats, with 1.8 million customers. media processing times that are significantly faster than any other BT TV provides on-demand content, 30 entertainment channels (18 of which platform. are available in HD), nine children’s channels, 11 Movie channels (Sky Movies) and five live sports channels (BT Sport & Sky Sports). BT Sport channels are — Peter Harvey, Head of Content available in SD and HD through IPTV signals. BT Sport, ESPN and AMC from Operations (VOD and Digital BT are now available in non-fibre areas over IPTV using copper multicast Media) at BT Technology. where available. As BT TV transmits channels and content through IPTV, BT requires custom- ers to sign up to the BT Broadband internet and phone service to use BT TV, with connection via BT’s official router, BT Home Hub. The Challenge BT TV operates in a fierce commercial environment. One where broadcasters compete daily for viewing audiences – ultimately, they compete for eyeballs. -

Earnings Release

Earnings Release 4Q18 1 +8,5% +24% Number of corporate clients grows by 24% 39% Uberlândia – MG, March 2019 – Algar Telecom, a telecom services company in the corporate (B2B) and retail (B2C) segments, Recurring EBITDA margin releases its earnings for the fourth quarter of from the Telecom segment 2018 (4Q18). reaches 39% The Company’s individual and consolidated financial statements were prepared according to the accounting practices adopted in Brazil, which comprise the provisions of the corporate law, provided for by Law 6,404/76 amended by Laws 11,638/07 and 11,941/09, and the accounting pronouncements, interpretations and guidelines issued by the Accounting +11% Pronouncement Committee (“CPC”), approved by the Brazilian Securities and Exchange Recurring profitability of 11% Commission (“CVM”) and the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”). Unless stated otherwise, comparisons relate to the 4th quarter of 2017 (4Q17). Investor Relations Contacts ri.algartelecom.com.br [email protected] (+55 34) 3256-2978 Rua José Alves Garcia, 415 – Uberlândia - MG 2 4Q18 HIGHLIGHTS TELECOM B2B Algar Telecom closes 2018 with 6 new regional offices, 5 of which to serve the 18 new locations in the Northeast region. The number of B2B clients grew by 9.9%, 24.1% of which in the corporate market, and gross revenue increased by 6.9% from 4Q17. B2C The YoY broadband revenue increased by 3.5% in 4Q18. STRONG FINANCIAL PERFORMANCE The net operating revenue from the Telecom segment grew by 5.0% (YoY) in 4Q18 and 6.8% in 2018. The consolidated recurring EBITDA increased by 6.6% (YoY), with a margin of 32.7%, versus 31.8% in 4Q17. -

Remote User Guide Safety Instructions You Must Keep Safety in Mind While Using This Device

Remote User Guide Safety Instructions You must keep safety in mind while using this device. Keep these and any other instructions for future reference. Observe Warnings: Carefully follow all warnings on the device and in the operating instructions. Heat: Do NOT place the device near heat sources such as radiators, stoves, heat registers, or other appliances that produce heat. Care and Use Cleaning: Do NOT use liquid, abrasive, solvent, or aerosol cleaners. Use a damp cloth for cleaning. When Not in Use: Remove the batteries if this device is to be left unattended or unused for a long period of time. Refer servicing to qualifi ed personnel when a solid object or liquid has fallen onto or into the device. Do NOT attempt to service this device. Refer all servicing to qualifi ed personnel. Opening covers other than the battery cover will void the warranty. Publishing Information Copyright © 2010. EchoStar Technologies L.L.C., Englewood, Colorado 80112. All rights reserved. The information in this User Guide may change without notice. Revisions may be issued to tell you about such changes. Address comments or questions about this User Guide to [email protected] or Technical Publications, EchoStar Technologies L.L.C, 90 Inverness Drive Circle East, Englewood, Colorado 80112. Document Number: 177526 Printed in DISH Network is a trademark and service mark of DISH Network. All product names, trade names, or corporate names mentioned in this User Guide are acknowledged to be the proprietary property of the registered owners. Confi guring the 20.0 Remote The 20.0 remote does not require any confi guration. -

Channel Lineup Card.Indd

CHANNEL GUIDE Packages designed with you in mind. 290+ EPIX DRIVE-IN 292 mtvU 366 truTV 242 America’s Top 250 Channels ESPN 140 NASA 286 Turner Classic Movies SAP 132 ESPN2 143 National Geographic 197 TV Games Network 399 240+ ESPNEWS 142 Nat Geo WILD 190 TVG2 398 SAP America’s Top 200 Channels ESPNU 141 NBA TV 156 TV Land 106 Estrella TV 852 NBC Universo 838 UniMas 271 + America’s Top 120 190 EVINE Live 134 NBCSN 159 Univision Deportes SAP 856 PLUS Channels FETV 82 Newsmax 216 Univision East 270 + FM 243 NFL Network 154 Univision West 828 TM 50 Flex Pack Food Network 110 NHL Network 157 Uplifting Entertainment 188 Channels SAP SAP FOX Business Network 206 Nick/Nick at Nite (E) 170 USA 105 FOX News Channel 205 Nick/Nick at Nite (W) 171 VH1 SAP 162 A&E 118 Fox Sports 1 150 Nick Jr. 169 Viceland 121 AMC 131 Fox Sports 2 149 Nick Music 368 Victory 265 American Heroes Channel 195 Freeform 180 Nicktoons 178 V-ME 846 Animal Planet 184 FSTV 9415 Olympic Channel 389 WE tv 128 AXS TV 167 Fuse 164 Outdoor Channel 396 Weather Channel 214 BabyFirstTV SAP 823 FX SAP 136 OWN: Oprah Winfrey Network 189 WeatherNation 215 BBC America 135 FXM 384 Oxygen 127 WGN America 239 BeautyIQ 73 FXX 125 Pac-12 Network 406 World Fishing Network 394 beIN SPORT SAP 392/781 FYI 119 Pac-12 Network 409 Z Living 191 beIN SPORTS en Español SAP 873 Galavision 273 Paramount Network 241 BET 124 Gem Shopping Network 229 Pay-Per-View Guide 500 BET Gospel 362 getTV 373 PixL SAP 388 BET Her 251 Golf Channel 401 Pop 117 BET Jams 365 Great American Country 165 QVC SAP 137 BET Soul -

Telia Company – Annual and Sustainability Report 2019

BRINGING THE WORLD CLOSER ANNUAL AND SUSTAINABILITY REPORT 2019 CONTENT OUR COMPANY Telia Company in one minute ................................................ 4 2019 in brief ............................................................................ 6 How we create value ............................................................. 8 Comments from the CEO ..................................................... 10 Trends and strategy .............................................................. 12 DIRECTORS' REPORT Group development ............................................................. 16 Country development .......................................................... 32 Sustainability ....................................................................... 41 Risks and uncertainties ....................................................... 62 CORPORATE GOVERNANCE Corporate Governance Statement ....................................... 70 Board of Directors ............................................................... 82 Group Executive Management ............................................ 84 FINANCIAL STATEMENTS Consolidated statements of comprehensive income .......... 86 Consolidated statements of financial position .................... 87 Consolidated statements of cash flows .............................. 88 Consolidated statements of changes in equity ................... 89 Notes to consolidated financial statements ........................ 90 Parent company income statements.................................. 182 Parent company