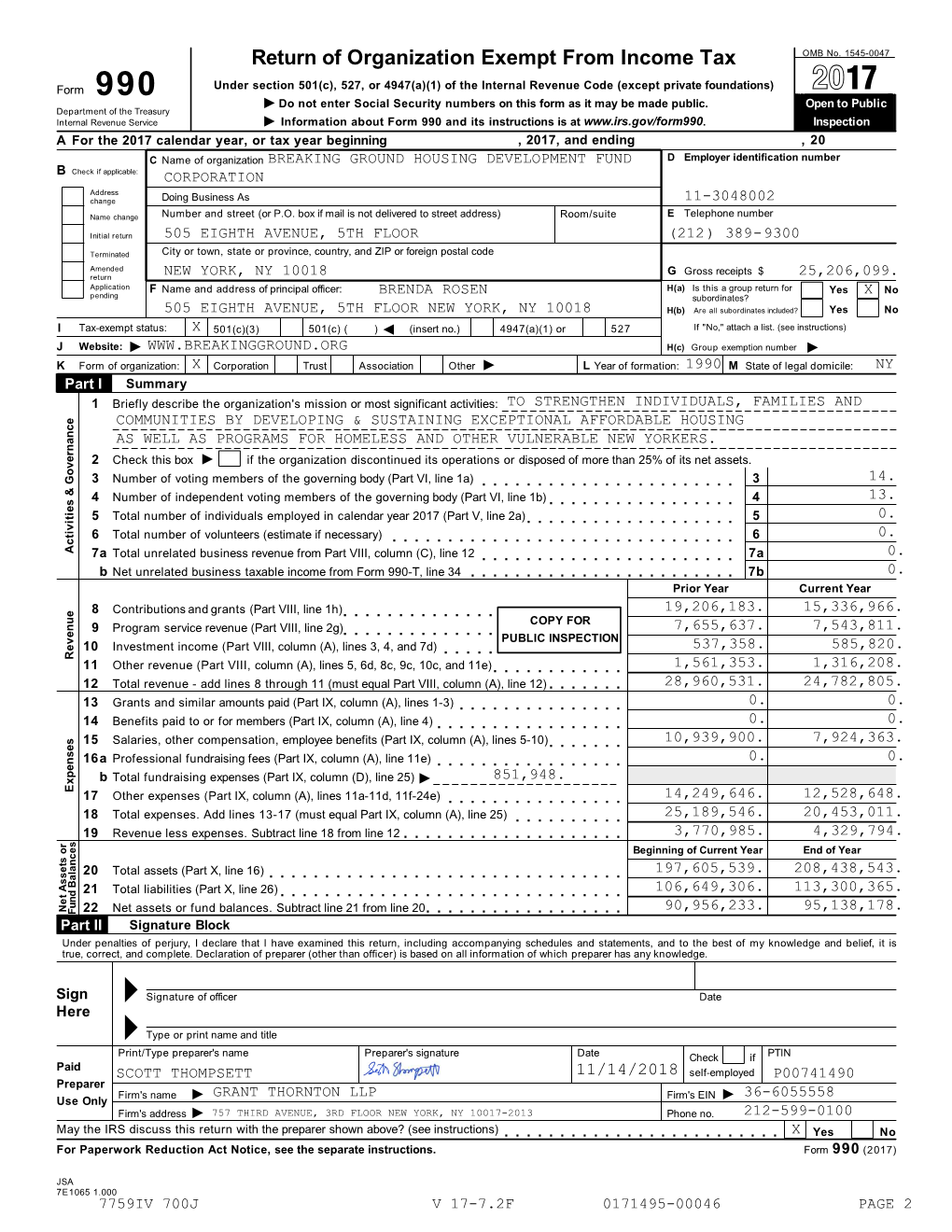

2017 990 Breaking Ground HDFC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Breaking Ground in Sheridan 2016 Has Been a Busy Year for Habitat for Humanity of Metro Denver

habitat newsletter | summer 16 breaking ground in Sheridan 2016 has been a busy year for Habitat for Humanity of Metro Denver. We’ve been building, renovating and repairing homes from Castle Rock to Montbello – and many neighborhoods in between! But we’re not stopping there… we’re excited to announce that construction is about to begin on Sheridan Square, our largest development in our 37-year history. Located on a 4.35-acre former elementary school site in the city of Sheridan (near Federal & Hampden), our plans include the construction of 63 energy-efficient homes built over the next four years. These homes will take the collective work of more than 40,000 volunteers, and will provide stable and affordable housing for ap- proximately 130 adults and 225 children. Sheridan Square will forever transform the City of Sheridan. Its 63 new homes will add 6% more owner-occupied housing units to the city, creating long-term and stable homeownership within this community. Sheridan Square will also provide roughly $77,000 in property taxes to the city each year. This transformative community would not be possible without the generous lead funding from Wells Fargo Community Foundation, Arapahoe County Housing and Community Development Services, U.S. Department of Housing and Urban Development, and Ed and Roxanne Fie Anderson. “I can honestly say that because Habitat provided letter stability; it helped me secure a future.” from our CEO Dear Friends, Habitat for Humanity is having a great year as we ramp up our efforts to serve more than 120 families in 2016. However, “The number of as Denver continues to top the “Best Places to Live” lists, our growing population is putting intense pressure on housing inventory. -

Ten Affordable Housing Projects

Urban Land Magazine Americas Asia Pacific Europe Foundation Join ULI Custom Search INDUSTRY SECTORS CAPITAL MARKETS TRENDS SUSTAINABILITY DEVELOPMENT PLANNING/DESIGN INSIDE ULI ULI MEETING RECAPS Urban Land > Planning & Design > ULX: Ten Affordable Housing Projects ULX: Ten Affordable Housing Projects Recent Trending Most Shared By Ron Nyren As part of responsible property investing, building owners July 9, 2018 Text Size: A A A are poised to benefit from benchmarking their energy Print Email Share Facebook LinkedIn Twitter per… https://t.co/9iKnJYPiuD 1 hour ago RT @ColgateCCS: We've partnered with @UrbanLandInst High-quality design and low-cost housing are not incompatible. The gray housing projects of the past are to provide an online course for Colgate students giving way to more artful buildings with landscaped courtyards and rooftop gardens, colorful facades, and interested in learning about commercia… varied forms. Housing authorities and developers alike are aware of the importance of providing access to 20 hours ago natural light, not just for individual units and communal spaces, but also for corridors. Spaces for gathering RT @HistColumbia: We're excited to host the and interacting are crucial for building a sense of community, as are connections to the surrounding urban @UrbanLandInst Coffee & Conversations series at Seibels House on 10/23 - learn more and registe… fabric. 20 hours ago The following ten projects—all built during the past five years—showcase a variety of design strategies that make inventive use of their project budgets. They include LGBT-friendly housing for seniors, a textile mill View on Twitter adapted to serve as apartments, supportive housing for military veterans and the formerly homeless, and historic cottages restored after Hurricane Katrina. -

Northwest Community Land Trust “SHARED EQUITY HOMEOWNERSHIP in the AFFORDABLE HOUSING CONTINUUM”

SHARED EQUITY HOMEOWNERSHIP IN THE AFFORDABLE HOUSING CONTINUUM STABILITY – EQUITY – ECONOMIC GROWTH Northwest Community Land Trust Coalition CONTENTS Northwest residents impacted by rising housing costs . 2 Building a region everyone can afford . 3 Shared equity homeownership: the community land trust model . 4 A bridge to traditional homeownership . 5 Affordable homeownership plays a key role in the housing continuum . 6 Stability and economic growth for families and communities . 7 Homeowner stories . 9 NORTHWEST RESIDENTS IMPACTED BY RISING HOUSING COSTS Advocates Urge Oregon to Act to Ease Housing Crisis Public News Service April 11, 2017 Long wait lists for affordable housing in IF Can Olympia Solve Seattle’s Housing Crisis? Post Register Caroline Halter, Washington March 23, 2017 State Wire, February 19, 2016 Housing Crisis Mayors Cry Out for Affordable “Ugly And Getting Uglier” Housing in County Matt Rosenberg, Lens, Gary Bégin, Lake Chelan Mirror June 6, 2016 September 7, 2016 The Hidden Reason Report Looks at Lack of Affordable Housing Behind Seattle’s Patty Hastings, The Columbian, June 2, 2016 Skyrocketing Housing Costs Kathleen Richards, Affordable Housing Leaders ‘Fired Up’ The Stranger, Over Economic Crisis July 29, 2015 Flathead Beacon May 28, 2016 page 1 page 2 BUILDING A REGION SHARED EQUITY HOMEOWNERSHIP: EVERYONE CAN AFFORD THE COMMUNITY LAND TRUST MODEL Homeownership Benefits People, Homeownership organizations often Shared equity through a community land In shared equity homeownership, Jobs and Economic Growth have significant waiting lists and a 1:10 trust is a model of affordable homeownership homeowners are an essential part of A safe place to live is an essential start . -

Accomplishments More Than 30 Years of Innovative Programs That Transform People, Buildings and Communities

Accomplishments Housing Breaking Ground operates over 4,000 units of permanent and transitional housing in New York City, Connecticut, and upstate New York. Our network of well-designed, affordable apartments — linked to the services people need to maintain their housing, restore their health, and regain their economic independence — has enabled more than 15,000 individuals More than 30 Years of Innovative to overcome or avoid homelessness. Programs That Transform People, Cost Effectiveness Buildings and Communities It surprises many to learn that supportive housing is less Since 1990, Breaking Ground has pioneered the most expensive than leaving homeless men and women to suffer successful and effective strategy to address chronic on the streets. But the truth is, not only is living on the streets homelessness. Our combination of street outreach and dangerous and detrimental to a person’s health, it often leads transitional and permanent supportive housing has become to high consumption of costly public services. the gold standard, replicated worldwide. Cost category Average annual costs Average annual cost We are also committed to preventing homelessness among incurred by a person incurred by a person living in living on the street supportive housing at-risk populations. We have always included affordable State psychiatric $19,418 $750 apartments for low-income working New Yorkers in our developments; in 2020, the average annual income for this Single adult shelter $5,591 $164 group of residents was just $25,547. Family shelter $1,502 $10 Jail $1,708 $410 Whether they have transitioned from life on Medicaid $19,069 $18,134 the streets or escaped the struggle to find an affordable apartment, thousands upon Cash assistance $2,375 $2,094 Food stamps $1357 $1,793 thousands of New Yorkers have found a home Supportive Housing $0 $17,566 with Breaking Ground. -

Ohio Hub Connector Keeping HUD Partners Connected

Ohio Hub Connector Keeping HUD Partners Connected DIRECTOR’S CORNER Summer 2012 “Breaking Ground – effectively and efficiently deal Columbus office, we ask for your with the dramatic increase in FHA patience. We anticipate that the Inside this issue: Delivering Results.” insured applications. impact on processing times for By Randolph Wilson “Breaking Ground – Delivering applications already in the queue Reducing Regula- 2 As many of our active FHA multi- Results” has been rolled out na- will be nominal and we believe tory Burden family lenders know, the Depart- tionally in “Waves”. Wave One that the long term benefit will far ment took a critical look at its un- was rolled out in the San Antonio, outweigh any short term inconven- Energy Efficient 2 derwriting process last year and in Denver, and Greensboro, Balti- ience. late FY 2011 and early FY 2012 more and Chicago offices in late Finally, for our industry partners Hopeton Village 3 rolled out new initiative known as FY 2011 and early FY 2012. Our that operate on the Department’s “Breaking Ground – Delivering Cleveland Program Center was servicing side, do not feel left out. St. Paul Village 3 Results.” included in Wave 4 and completed Similar to the efforts occurring on “Breaking Ground – Delivering the process earlier this our Production side, the Depart- Cleveland Grant Results” is a national redesigning month. Wave 5, which includes ment has begun the initial roll out Opportunities 4 of the Department’s underwriting the Columbus office, began on of a companion initiative to retool process to better meet the needs of th Paperwork Monday, May 14 . -

1 • NEW: Neighborhood Coordination Officer Updates • New

CITY OF NEW YORK MANHATTAN COMMUNITY BOARD FOUR nd th 330 West 42 Street, 26 floor New York, NY 10036 tel: 212-736-4536 fax: 212-947-9512 www.nyc.gov/mcb4 BURT LAZARIN Chair JESSE R. BODINE District Manager DISTRICT SERVICE CABINET MEETING Date: Wednesday, March 21, 2018 Time: 10:00 AM Place: Community Board 4 Office 330 West 42nd Street (8/9 Aves.) 26th Floor AGENDA District Issues NYPD (10th, 13th, Midtown South Precinct, Midtown North Precinct, Traffic) • All Precincts • Top three collision prone locations\type\causes in CB4 for the last 30 days • Midtown South: 31st Street & 8th Avenue, 34th Street & 8th Avenue, and 42nd Street & 8th Avenue. The type of accidents were side swipes due to driver’s inattention • Top three quality of life complaints- Noise, Homeless and Traffic • Top Three Major Crimes- Robberies, Assault, and unattended grand larceny • Update and data on Vision Zero initiatives in the District- Vision Zero has been enforced on 8th and 9th Avenue. As a result of this, summons for drivers who failed to yield has gone up to 4%. Summonses were given to drivers who failed to yield, and resulted in collisions. Summonses have gone up to 7% for improper turns, and 6% in speeding zones. Injuries have gone down to 12.5%. For the Vision Zero initiatives, auxiliary police officers are doing cross walk management. This consists of officers using lighted savers, wearing reflective vests and handing out flyers. • NEW: Neighborhood Coordination Officer Updates • Midtown South: NCO program will not be issued in Midtown South until end of the year. -

Breaking Ground New Models That Deliver Energy Solutions to Low-Income Customers

BREAKING GROUND NEW MODELS THAT DELIVER ENERGY SOLUTIONS TO LOW-INCOME CUSTOMERS BY COREINA CHAN, KENDALL ERNST, AND JAMES NEWCOMB O Y M UN ARBON K T C C A I O N R I W N E A M STIT U T R R O O AUTHORS & ACKNOWLEDGMENTS AUTHORS ACKNOWLEDGMENTS Coreina Chan, Kendall Ernst, and James Newcomb Thank you to the diverse group of organizations who participate in e-Lab Leap. * Authors listed alphabetically. All authors from Rocky Mountain Institute unless otherwise noted. Thank you also to the experts and innovators who provided perspective and insight into this brief report. They include: CONTACTS Coreina Chan, [email protected] Isaac Baker, Co-Director, Co-op Power Kendall Ernst, [email protected] Susan Spencer, CEO, ROCSPOT Kieran Coleman, Associate, Rocky Mountain Institute Mcgowan Southworth, Founding Partner, Brooklyn Power SUGGESTED CITATION Herve Touati, Managing Director, Rocky Mountain Institute Coreina Chan, Kendall Ernst, and James Newcomb, Chris Neidl, Director, Solar One Breaking Ground: New Models That Deliver Energy Danny Kennedy, Managing Director, CalCEF Solutions to Low-Income Customers Cisco DeVries, CEO, Renew Financial (Rocky Mountain Institute, 2016), Umber Bawa, CEO, Rabble http://www.rmi.org/elab_leap_resources. Karl Rabago, Executive Director, Pace Energy and Climate Center EDITORIAL/DESIGN Editorial Director: Cindie Baker DISCLAIMER Editor: Laurie Guevara-Stone e-Lab is a joint collaboration, convened by RMI, with Art Director: Romy Purshouse participation from stakeholders across the electricity Design: Marijke Jongbloed industry. e-Lab is not a consensus organization, and the views expressed in this document are not intended Images courtesy of iStock unless otherwise noted. -

Breaking Ground on a Transformative Regional Housing Approach Seizing the Opportunity of the Bay Area Housing Finance Authority

Breaking Ground on a Transformative Regional Housing Approach Seizing the Opportunity of the Bay Area Housing Finance Authority When we look ahead 20 or 30 years, we see a Bay Area that works for all — where residents earn a living wage that pays for stable, decent homes, leaving them free to contribute to our society, economy and culture. We see a region not held back by crushing affordability and homelessness crises, able to rise to other challenges — from climate change to racial injustice — while ensuring our region can meet the needs and seize the opportunities of a dynamic future. BAHFA embraces a regional approach to transform how the Bay Area advances social and racial equity and delivers on housing affordability and stability at scale. No longer must To break ground on this new 109 jurisdictions each try to solve the region’s housing and transformative approach made homelessness crises on its own. Through a historic partner- ship between local and regional Bay Area elected leaders possible by BAHFA, we need a and the California Legislature, BAHFA was established in seed investment of $23.5 million 2019 (AB 1487, Chiu). Jointly governed by the Association of to launch five pilot programs Bay Area Governments and the Metropolitan Transportation that will support Bay Area Commission, BAHFA is designed to advance the “3 Ps”: residents today, while putting us protect current residents from displacement, preserve on the path to long-term change. existing affordable housing, and produce new housing at These resources are essential all income levels. BAHFA is equipped with a powerful set of for BAHFA to begin achieving the funding and finance tools to be deployed efficiently, equita- bly and creatively across the nine-county region, including goals it was designed to meet. -

Breaking Ground: Chinese Investment in U.S

An Asia Society Special Report Special Society An Asia For more information, visit Asiasociety.org/ChinaRealEstate An Asia Society Special Report Breaking Ground: Chinese Investment in U.S. Real Estate Asia Society Reports on Chinese Investment in the U.S ROSEN I MARGON I SAKAMOTO I TAYLOR I SAKAMOTO MARGON Breaking Ground: Preparing Asians and Americans for a Shared Future Chinese Investment in U.S. Real Estate Asia Society is the leading educational organization dedicated to promoting mutual understanding and strengthening partnerships among peoples, leaders and institutions of Asia and the United States in a global context. Across the fields of arts, business, culture, education, and policy, the Society provides insight, generates ideas, and promotes collaboration to address present challenges and create a shared future. Founded in 1956 by John D. Rockefeller 3rd, Asia Society is a nonpartisan, nonprofit institution with headquarters in New York, and offices in Hong Kong, Houston, Los Angeles, Manila, Mumbai, San Francisco, Seoul, Shanghai, Sydney, Washington, DC and Zurich. KENNETH ROSEN, ARTHUR MARGON, RANDALL SAKAMOTO, & JOHN TAYLOR 1 | ASIA SOCIETY BREAKING GROUND: CHINESE INVESTMENT IN U.S. REAL ESTATE BREAKING GROUND: Chinese Investment in U.S. Real Estate KENNETH ROSEN, ARTHUR MARGON, RANDALL SAKAMOTO, & JOHN TAYLOR May 2016 AN ASIA SOCIETY SPECIAL REPORT PRODUCED IN COLLABORATION WITH ROSEN CONSULTING GROUP © 2016 Asia Society. All Rights Reserved. Asia Society Northern California 500 Washington Street, Suite 350 San Francisco, CA 94111 Asia Society Southern California 244 S. San Pedro St., Suite 201 Los Angeles, CA 90012 Asia Society New York 725 Park Avenue New York, NY 10021 Partner Organizations Asia Society is the leading educational organization dedicated to promoting mutual understanding and strengthening partnerships among peoples, leaders and institutions of Asia and the United States in a global context. -

Creating Quality Supportive Housing for Aging Tenants New York City’S Supportive Housing Aging Learning Collaborative Core Competencies Checklist & Resource Guide

Home to Stay: Creating Quality Supportive Housing for Aging Tenants New York City’s Supportive Housing Aging Learning Collaborative Core Competencies Checklist & Resource Guide Acknowledgments CSH wishes to thank the following members of the CSH Aging Learning Collaborative for their partnership, expertise and significant contributions to this guide: • Lorraine Coleman Acacia Network/ • Mario Arias, Goddard Riverside Promesa Community Center • Theresa Green-Lynch Acacia • Kimberly Joy, Goddard Riverside Network/ Promesa Community Center • Jeff Nemetsky, Brooklyn Community • Caroline Astacio, Project Find Housing and Services, Inc. (BCHS) • David Gillcrist, Project Find • Chloe Marin, Breaking Ground • Susan Dan, Project Renewal • Claire Sheedy, Breaking Ground • India Wright, Project Renewal • Claire Hilger, Catholic Charities • Laura Jervis, West Side Federation for • Jerry Jennings, Community Access Senior & Supportive Housing (WSFSSH) • Ashely Tierno, Goddard Riverside • Paul Freitag, WSFSSH Community Center We also thank all of the CSH staff and following individuals for their time in reviewing this document. • Karen Taylor, New York City Department for the Aging • Lindsay Goldman, The New York Academy of Medicine • Caitlyn Smith, The New York Academy of Medicine This Core Competencies Checklist & Resource Guide is made possible through the generous support of Mizuho USA Foundation, Inc. of Mizuho Bank, and The Fan Fox and Leslie R. Samuels Foundation, Inc. About this Guide Very little is known about the homeless aging population, referred to as the “invisible population”1 and even less is known about those aging in place within supportive housing and older/elderly adults in institutions who, if provided with long-term supportive services, would be able to return to the community. Historically, the phenomena of homelessness amongst the elderly have not received the same attention from researchers as homeless youth and families; nor have efforts to stem the tide of chronic homelessness among older adults been sufficiently chronicled. -

Building Better City-CLT Partnerships a Program Manual for Municipalities and Community Land Trusts John Emmeus Davis Rick Jacob

Building Better City-CLT Partnerships A Program Manual for Municipalities and Community Land Trusts John Emmeus Davis Rick Jacobus Maureen Hickey © 2008 Lincoln Institute of Land Policy Lincoln Institute of Land Policy Working Paper The findings and conclusions of this paper are not subject to detailed review and do not necessarily reflect the official views and policies of the Lincoln Institute of Land Policy. Please do not photocopy without permission of the Institute. Contact the Institute directly with all questions or requests for permission. [email protected] Lincoln Institute Product Code: WP08JD1 i Abstract The number of community land trusts (CLTs) in the United States has grown rapidly in recent years, due largely to the expanding investment and involvement of local govern- ment. Municipalities are supporting CLT start-ups, CLT projects, CLT operations, and the equitable taxation of resale-restricted CLT homes. This city-CLT partnership is still evolving, however, with municipal officials and CLT practitioners still exploring the most effective ways of working together. The present manual is necessarily a work in progress, documenting the “best” practices devised to date. These are practices that use public resources to expand a CLT’s holdings, while respecting what makes a CLT unique and while addressing a municipality’s reasonable concerns about a CLT’s performance and sustainability. ii About the Authors John Emmeus Davis was one of the co-founders of Burlington Associates in 1993. He previously served as the housing director and enterprise community coordinator for the City of Burlington, Vermont. He has worked as a community organizer and nonprofit ex- ecutive director in East Tennessee and as a technical assistance provider for community land trusts and other nonprofit community development organizations throughout the United States. -

Housing Overview 26 Buildings and Over 4,000 Units of Housing

Housing Overview 26 buildings and over 4,000 units of housing PERMANENT SUPPORTIVE & WORKFORCE HOUSING | NEW YORK CITY 1 2 3 4 5 6 7 TIMES SQUARE THE DOROTHY ROSS PRINCE GEORGE THE CHRISTOPHER SCHERMERHORN BROOK THE LEE Manhattan | Opened 1991 FRIEDMAN RESIDENCE Manhattan | Opened 1999 Manhattan | Opened 2004 Brooklyn | Opened 2009 Bronx | Opened 2010 Manhattan | Opened 2010 Manhattan | Opened 1996 • 652 Units • 416 Units • 207 Units (includes 40 • 217 Units • 190 Units • 263 Units • Low-income working • 178 Units • Low-income working transitional units) • Low-income working • Low-income working • Low-income working persons and formerly • Low-income working persons and formerly • Low-income working persons (many in arts and persons and formerly persons, formerly homeless homeless single adults persons (many in arts and homeless single adults persons, formerly homeless entertainment industry), homeless single adults single adults and vulnerable • Owned and managed by entertainment industry), • Owned and managed by single adults and vulnerable and formerly homeless • Owned and managed by youth (many of whom have Breaking Ground seniors and people living Breaking Ground youth (many of whom have single adults Breaking Ground aged out of foster care) with HIV/AIDS aged out of foster care) • Social services provided • Social services provided by • Owned and managed by • Social services provided by • Owned and managed by by the Center for Urban • Managed by Breaking CUCS • Owned and managed by Breaking Ground BronxWorks Breaking Ground Ground Breaking Ground Community Services (CUCS) • Listed on the National • Social services provided by • Breaking Ground’s first • Social services provided by • Breaking Ground’s first • Owned and social services Register of Historic Places • Social services provided by CUCS and The Actors Fund residence in the Bronx CUCS and The Door provided by The Actors Fund • The historic Prince George CUCS and Good Shepherd residence and still the • Breaking Ground’s first new 2,400 sq.