Office of the Project Officer Kedla Opencast Project, Hazaribagh Area Po: Kedla, Dist.:Ramgarh, Pin-825325

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

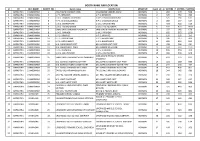

Booth Name and Location

BOOTH NAME AND LOCATION id PC BLK_NAME BOOTH_NO build_name BOOTH_LOC SENSITIVE build_id m_VOTERS f_VOTERS VOTERS 1 BARKATHA CHANDWARA 1 AAGANBADI KENDRA HARLI AAGANBADI KENDRA HARLI NORMAL 1 282 276 558 2 BARKATHA CHANDWARA 2 U.P.S. BIRSODIH U.P.S. BIRSODIH NORMAL 2 376 350 726 3 BARKATHA CHANDWARA 3 U.M.S. CHAMGUDOKHURD U.M.S. CHAMGUDOKHURD NORMAL 3 325 290 615 4 BARKATHA CHANDWARA 4 N.P.S. CHAMGUDOKALA N.P.S. CHAMGUDOKALA NORMAL 4 280 257 537 5 BARKATHA CHANDWARA 5 U.M.S. CHARKIPAHRI U.M.S. CHARKIPAHRI NORMAL 5 493 420 913 6 BARKATHA CHANDWARA 6 U.M.S. DIGTHU GAIDA U.M.S. DIGTHU GAIDA NORMAL 6 539 470 1009 7 BARKATHA CHANDWARA 7 SAMUDAYIK BHAWAN POKDANDA SAMUDAYIK BHAWAN POKDANDA NORMAL 7 337 341 678 8 BARKATHA CHANDWARA 8 U.M.S. PIPRADIH U.M.S. PIPRADIH NORMAL 8 605 503 1108 9 BARKATHA CHANDWARA 9 U.P.S. ARNIYAO U.P.S. ARNIYAO NORMAL 9 139 120 259 10 BARKATHA CHANDWARA 10 U.P.S. BANDACHAK U.P.S. BANDACHAK NORMAL 10 246 217 463 11 BARKATHA CHANDWARA 11 U.P.S. GARAYANDIH U.P.S. GARAYANDIH NORMAL 11 409 404 813 12 BARKATHA CHANDWARA 12 M.S. KANKO EAST PART M.S. KANKO EAST PART NORMAL 12 498 436 934 13 BARKATHA CHANDWARA 13 M.S. KANKO WEST PART M.S. KANKO WEST PART NORMAL 13 594 507 1101 14 BARKATHA CHANDWARA 14 U.P.S. KURMIDIH U.P.S. KURMIDIH NORMAL 14 195 159 354 15 BARKATHA CHANDWARA 15 U.M.S. -

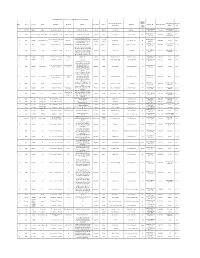

Sl.No. Area Project Village Vill-Address Khata-No Plot Nos

Employment Details for the Year 2018-19 (Jan'19 To March'19) Relation Name of Person offered with the Place of Posting Designati Sl.No. Area Project Village Vill‐Address Khata‐No Plot Nos. Block‐Name District F/H‐Name Empl.Ref. No. Empl‐Letter‐Date Employment Land‐ (Area) on Owner PD/MP/Apptt/Land Security Deptt. CCL 1 Hazaribagh Kedla OC Kedla PO ‐ Kedla PS ‐ Mandu 15 951(P),955,959,960,962. Mandu Ramgarh Mohan Turi S/o Kamal Turi Self 02.01.2019 Cat‐I (T) Loser/L‐428 (HQ)Ranchi PD/MP/Apptt/Land P&IR Deptt. 2 M&A Amrapali Binglat, Saradhu,Honhe PO ‐ Kasiyadih PS ‐ Tandwa 45,31,31,2,53,46 413,305,305,1422,222, 568 Tandwa Chatra Narsingh Saw S/o Iswari Saw Self 11.01.2019 Cat‐I (T) Loser/L‐438 CCL,(HQ)Ranchi 344,345,354,376,389,472,689,842, PO ‐ Ganeshpur PS ‐Balumath & 973,1014,1422,22,25,28,56,58,185, Balumath & Latehar & PD/MP/Apptt/Land 3 M&A Magadh Ara, Kundi & Saradhu 132,4,4,254 Umesh Kumar S/o Keshwari Saw Self 11.01.2019 Rajhara Cat‐I (T) Tandwa 145,162,311,205,247,317,227,352, Tandwa Chatra Loser/L‐440 107,144(P),144(P),107,677. PD/MP/Apptt/Land Security Deptt. CCL 4 Kuju Topa Orla & Topa PO ‐ Topa PS ‐Mandu 19,76,58,58,59,28. 58,1053/2,670/8,670/4,863, 29. Mandu Ramgarh Binod Karmali S/o Mahaveer Karmali Self 15.01.2019 Cat‐I (T) Loser/L‐445 (HQ)Ranchi 36,91,176,178,282,327,342,355,362, 428,501,677,709,28,47,227,251,256, 267,326,358,376,399,400,429,502, PD/MP/Apptt/Land Security Deptt. -

Coalmine Methane Under Indian Mining Scenario

Coalmine Methane Under Indian Mining Scenario CMM under Indian Mining Scenario • In India coal is a reliable energy resource due to limited availability of petroleum and natural gas. • Coal based non-conventional energy is poised to play a major role in India as : 9 It would bridge the gap between demand and availability of conventional energy source 9 International trading scenario in energy sector has been stormy 9 Environmental concerns has given impetus to clean coal technologies. • Under the scenario, Coalbed Methane (CBM) and its subsets like Coal Mine Methane (CMM) and Abandoned Mine Methane (AMM) may find important place in Indian Energy scenario in coming years. CMM under Indian Mining Scenario Development of CBM in India • Out of different sub-sets of Coalbed Methane (CBM), CBM from the deep lying coal deposits (VCBM) has been pursued. • So far 16 Coalbed Methane (VCBM) blocks have been allotted under CBM policy of GoI covering an area of 7807 sq. km and prognosticated CBM resource of 825 BCM. • 10 more blocks have been opened for global bidding. • Several core wells/pilot wells have been drilled in the allotted blocks and are giving encouraging results. • Few operators are planning commercial production from 2007- 08. • The total production potentiality in the allotted blocks is 23 MMSCMD, which is about 10% of the existing Natural Gas demand. CMM under Indian Mining Scenario Coal Mine Methane and Abandoned Mine Methane • Coal Mine Methane (CMM)/ Abandoned Mine Methane (AMM) also subset of CBM is related to mining activities and as per MOU between MoC and MoP&NG, coal producing companies have right of CBM exploitation in their working mines including pre and post mining operations. -

Utilization of Washery Rejects in Generation of Power In

UTILIZATIONUTILIZATION OFOF WASHERYWASHERY REJECTSREJECTS ININ GENERATIONGENERATION OFOF POWERPOWER ININ CENTRALCENTRAL COALFIELDSCOALFIELDS LIMITEDLIMITED by R.P.RITOLIA, CMD, CCL AND A.K.SINGH,DT(O),CCL Central Coalfields Limited CCL in JHARKHAND CCL – LOOKING AHEAD 2016-17 : 115 MT Coal (Terminal Year of XII Plan) 2011-12 : 78 MT Coal (Terminal Year of XI Plan) 2006-07 : 41.32 MT Coal (Terminal Year of X Plan) 2001-02 : 33.81 MT Coal (Terminal Year of IX Plan) Central Coalfields Limited …… THEN & NOW THEN 1956 : Formation Of Public Sector Company – National Coal Development Corporation Ltd. 1972 : Nationalisation of Coking Coal Mines. 1973 : Nationalisation of Non-Coking Coal Mines. 1975 : CENTRAL COALFIELDS LIMITED – Reorganised under Coal India Limited - Holding Company 1986 : Truncation of CCL , Formation of NCL(Singrauli) & MCL (Talcher) INHERITED - a large number of small mines WITH Large workforce RESULTED 9 CCL was left with 55% production capacity with 85% manpower of erstwhile Company 9 Large and productive mines producing high volume (45% production) with less men (15% men) have gone to other Companies NOW : 11 Areas , 63 Mines Presently CCL has … Operating Mines : 63 Mines grouped in 11 Areas (26 Underground + 37 Opencast) Washeries : 7 (4 Medium Coking Coal + 3 Non-Coking Coal) Operating Coalfields: 6 (East Bokaro, West Bokaro, North Karanpura , South Karanpura, Ramgarh, & Giridih) Workshop : 1 Central Workshop (ISO 9001 Certified) + 5 Regional Workshops (3 of them ISO 9001 Certified ) OPERATING COALFIELDS OF CCL COMMAND AREA 6 6. Giridih 4. Wes 1 t Bokaro 1. North Karanpura 4 5 5. East Bokaro 2 3 2. South Karanpura 3. Ramgarh COALFIELDS AREAS 1. -

Officename Chanda B.O Mirzachowki S.O Boarijore B.O Bahdurchak B.O

pincode officename districtname statename 813208 Chanda B.O Sahibganj JHARKHAND 813208 Mirzachowki S.O Sahibganj JHARKHAND 813208 Boarijore B.O Godda JHARKHAND 813208 Bahdurchak B.O Godda JHARKHAND 813208 Beniadih B.O Godda JHARKHAND 813208 Bhagmara B.O Godda JHARKHAND 813208 Bhagya B.O Godda JHARKHAND 813208 Chapri B.O Godda JHARKHAND 813208 Mandro B.O Sahibganj JHARKHAND 813208 Maniarkajral B.O Godda JHARKHAND 813208 Mordiha B.O Godda JHARKHAND 813208 Rangachak B.O Godda JHARKHAND 813208 Sripurbazar B.O Sahibganj JHARKHAND 813208 Thakurgangti B.O Godda JHARKHAND 814101 Bandarjori S.O Dumka JHARKHAND 814101 S.P.College S.O Dumka JHARKHAND 814101 Dumka H.O Dumka JHARKHAND 814101 Dumka Court S.O Dumka JHARKHAND 814102 Amarapahari B.O Dumka JHARKHAND 814102 Bhaturia B.O Dumka JHARKHAND 814102 Danro B.O Dumka JHARKHAND 814102 Sinduria B.O Dumka JHARKHAND 814102 Ramgarah S.O Dumka JHARKHAND 814102 Gamharia B.O Dumka JHARKHAND 814102 Bandarjora B.O Dumka JHARKHAND 814102 Bariranbahiyar B.O Dumka JHARKHAND 814102 Bhalsumar B.O Dumka JHARKHAND 814102 Chhoti Ranbahiyar B.O Dumka JHARKHAND 814102 Ghaghri B.O Dumka JHARKHAND 814102 Kakni Pathria B.O Dumka JHARKHAND 814102 Khudimerkho B.O Dumka JHARKHAND 814102 Kairasol B.O Godda JHARKHAND 814102 Lakhanpur B.O Dumka JHARKHAND 814102 Mahubana B.O Dumka JHARKHAND 814102 Piprakarudih B.O Dumka JHARKHAND 814102 Sushni B.O Dumka JHARKHAND 814103 Kathikund S.O Dumka JHARKHAND 814103 Saldaha B.O Dumka JHARKHAND 814103 Sarsabad B.O Dumka JHARKHAND 814103 Kalajhar B.O Dumka JHARKHAND 814103 T. Daldali B.O Dumka JHARKHAND 814103 Astajora B.O Dumka JHARKHAND 814103 Pusaldih B.O Dumka JHARKHAND 814103 Amgachi B.O Dumka JHARKHAND 814103 B. -

Experimental Studies on Spontaneous Heating Liabilities of Coals of Central Coalfield Limited

EXPERIMENTAL STUDIES ON SPONTANEOUS HEATING LIABILITIES OF COALS OF CENTRAL COALFIELD LIMITED (CCL) A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF BACHELOR IN TECHNOLOGY IN MINING ENGINEERING BY SUBHAM KUMAR BEHERA 111MN0584 DEPARTMENT OF MINING ENGINEERING NATIONAL INSTITUTE OF TECHNOLGY ROURKELA-769008 2015 EXPERIMENTAL STUDIES ON SPONTANEOUS HEATING LIABILITIES OF COALS OF CENTRAL COALFIELD LIMITED (CCL) A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF BACHELOR IN TECHNOLOGY IN MINING ENGINEERING BY SUBHAM KUMAR BEHERA 111MN0584 UNDER THE GUIDANCE OF PROF.D.P.TRIPATHY DEPARTMENT OF MINING ENGINEERING NATIONAL INSTITUTE OF TECHNOLGY ROURKELA-769008 2015 NATIONAL INSTITUTE OF TECHNOLOGY ROURKELA CERTIFICATE This is to certify that the thesis entitled “EXPERIMENTAL STUDIES ON SPONTANEOUSHEATING LIABILITIES OF COALS OF CENTRAL COALFIELD LIMITED (CCL)” submitted by Sri Subham Kumar Behera, 111MN0584 in partial fulfillment of the requirements for the award of Bachelor of Technology degree in Mining Engineering at National Institute of Technology, Rourkela (Deemed University) is an authentic work carried out by him under my supervision and guidance. To the best of my knowledge, the matter embodied in the thesis has not been submitted to any other University/Institute for the award of any Degree or Diploma. Date: PROF. D.P.TRIPATHY Dept. of Mining Engineering National Institute of Technology Rourkela – 769008 i ACKNOWLEDGEMENT I am in great debt to my project supervisor Prof. Debi Prasad Tripathy for his expert guidance and valuable suggestions to fulfill my project work. I express my deep regard to him for the successful completion of this work. -

Offer of Spot E-Auction- 2020-21-Phase-X Dated:- 30Th Januaray 2021 Service Provider :- Mstc Limited Sale of Coal/ Coal Product

OFFER OF SPOT E-AUCTION- 2020-21-PHASE-X DATED:- 30TH JANUARAY 2021 SERVICE PROVIDER :- MSTC LIMITED SALE OF COAL/ COAL PRODUCT BY RAIL MODE (1 Rake = 4,050 Tonnes) PRODUCT GCV / QUANTITY NOTIFIED E-AUCTION CODE SIZE GRADE FOR PRICE RESERVE SIDING E-AUCTION (in PRICE (in (in Rs./Tonne) rakes) Rs./Tonne) New Kuju Siding# 22403 SIZED (-100 MM) W-IV 30 2535 2789 Bachra# NCWC SIZED (-100 MM) Non-Coking Washed Coal 25 2247 2472 Rajdhar# N4346 ROM (-250 MM) 4301-4600 50 1238 1362 Charhi Goodshed# 22403 ROM (-250 MM) W-IV 20 2535 2789 Dhori SDG.1# 22503 ROM (-250 MM) W-V 15 2261 2487 Saunda-B# N4952 SIZED (-100 MM) 4901-5200 30 1767 1944 Jarangdih PF-I# 22503 ROM (-250 MM) W-V 25 2261 2487 # Through Pay-loader loading 195 * Through CHP loading SALE OF COAL BY ROAD MODE SALE PRODUCT GRADE GCV QUANTITY NOTIFIED E-AUCTION FOR SALE POINT POINT CODE SIZE PRICE RESERVE CODE E-AUCTION (in PRICE (in (in Rs./Tonne) Tes) Rs./Tonne) Rajrappa Slurry* 1561 S5861 5801-6100 20000 2747 3022 Kedla Slurry# 1460 S6164 6101-6400 7000 3010 3311 Kedla Slurry# 1460 S5558 5501-5800 8000 2534 2787 Rajrappa Rejects* 1561 R2225 2201-2500 750 546 601 Kedla Rejects# 1460 R3740 3701-4000 10000 1073 1180 Gidi-C# 410 N4043 ROM 4001-4300 30000 1155 1271 Topa OC# 1353 22403 ROM W-IV 10000 2535 2789 Giridih# 1010 N4346 ROM 4301-4600 10000 1238 1362 AADOCM 1666 22301 W-III/STM 5000 3020 3322 SDOCM 1665 22301 W-III/STM 5000 3020 3322 Ashoka Coal Dump (SM)# 1796 N4346 Sized/(-100 mm) 4301-4600 50000 1238 1362 Ashoka Coal Dump (AMLG)# 1797 N4649 ROM 4601-4900 50000 1378 1516 Govindpur Phase II# 803 22403 ROM W-IV 25000 2535 2789 KDH OCP# 640 N4043 ROM 4001-4300 5000 1155 1271 Tapin North # 1431 N4952 ROM 4901-5200 10000 1767 1944 Kedla OCP# 1430 N4346 ROM 4301-4600 2181 1238 1362 Jharkhand# 1410 22403 ROM W-IV 10000 2535 2789 Tetariakhar# 1212 N4043 ROM 4001-4300 45000 1155 1271 Amrapali (SM)# 1115 N3437 Sized/(-100 mm) 3401-3700 200000 990 990 Magadh OC# 1128 N4043 ROM 4001-4300 300000 1155 1155 8,02,931 # Through Pay-loader loading * Through CHP loading NOTE: 1. -

Ara Opencast Project (1.0 Mty)

Draft SCIENTIFIC STUDY OF SOIL EROSION AND PREVENTIVE MEASURES FOR ARA OPENCAST PROJECT (1.0 MTY) OF CENTRAL COALFIELDS LIMITED DUNI N SEPARATOR/DIVIDER BONGAHARA ARA BASTI BAGLATA TOLA CHOWTHA NALA PROP. NO-3 QRY. SEPARATOR/DIVIDER PROP. NO-2 QRY. GARLAND DRAIN SARUBERA GRAVE- GARLAND DRAIN YARD PLANTED DUMP POKHARIA TOLA KAIRAKOCHA STOCKYARD 7 UMP VD DUMARBERA VILL. OB D ATNA PROP. PLANTED DIESEL NO-1 K WATER DUMP TAN AGARIA TOLA EXCA. QRY. PROJECT MPER OFFICE DU STORE SHED DISPEN- /2 SARY NO 6RY EXISTING 16/B QUARRY AR SUB- QU STATION VOID V7 E MAGAZIN ER CM E FEED LEASEHOLD BOUNDARY OFFIC BREAKER BHADAWA STADIUM GIDDI-KEDLA ROAD MURPA BAL VIDYA ARA COLONY A ROAD SCHOOL I.W.S.P GIDDI-KEDL W.BRIDGE D A V SCHOOL PROJ. ARA OCP PLATE-IV IDDI-KEDLA ROADKUJU G ILTAF HUSSAIN Ch.D/man SUB:- P.TOPNO SE(E&M) SARUBERA LANDUSE PLAN. PUSHKAR SE(ENV.) COLONY DILIP RAI HOD(C) SCALE:- NTS V.K.RAI R.D RI.III, C M P D I GONDWANA PLACE (RANCHI) January, 2011 SLOPE STABILITY CELL ENVIRONMENT DIVISION CENTRAL MINE PLANNING & DESIGN INSTITUTE LTD. (A Subsidiary of Coal India Ltd.) GONDWANA PLACE RANCHI – 834031 Draft SCINTIFIC STUDY OF SOIL EROSION AND PREVENTIVE MEASURES FOR ARA OPENCAST PROJECT (1.0 MTY) OF CENTRAL COALFIELDS LIMITED January, 2011 SLOPE STABILITY CELL ENVIRONMENT DIVISION CENTRAL MINE PLANNING & DESIGN INSTITUTE LTD. (A Subsidiary of Coal India Ltd.) GONDWANA PLACE RANCHI – 834031 INDEX Chapter Name of Chapter Page No 1 Background 1 - 3 2 Project Profile 4 - 10 3 Soil Erosion 11 - 31 4 Control Measures 32- 43 5 Cost & conclusion 44- 47 SCIENTIFIC STUDY OF SOIL EROSION AND PREVENTIVE MEASURES FOR ARA OPENCAST PROJECT (1.0 MTY) OF CENTRAL COALFIELDS LIMITED DUNI N SEPARATOR/DIVIDER BONGAHARA ARA BASTI BAGLATA TOLA CHOWTHA NALA PROP. -

Giddi Washery

ENVIRONMENTAL STATEMENT OF GIDDI WASHERY FOR 2016-17 CENTRAL COALFIELDS LIMITED SEPTEMBER 2017 EXECUTIVE SUMMARY E.1 This Annual Environmental Statement Report has been prepared as per Gazette Notification No. GSR 329 (E) dated 13th March, 1993 laid down by Ministry of Environment & Forests. The "Environmental Audit" has been subsequently renamed to "Environmental Statement" vide MOEF Gazette Notification No. GSR 386(E) dated 22nd April, 1993. E.2 The Giddi Washery Project of Central Coalfields Limited (CCL) was commissioned in the year 1970. The project has been designed for 2.50 MTY of ROM (Run of Mines) coal input. The product from the washery is clean coal whereas middling and rejects are by-products. E.3 Quarterly environmental monitoring of Giddi Washery Project has been carried out regularly by CMPDI for air, water and noise parameters. However, of late monitoring is now being done fortnightly by CMPDI from April 2017. The analysis results for the year 2016-17 are enclosed along with this report. E.4 The concentration of SO2, NOx monitored for the Washery and in its ambience is within permissible limits. The concentration of SPM is also mostly within permissible limits. E.5 The noise level has been monitored at various points in the project and the same has been found to be within permissible limits. The water quality has no impact on natural water resources as it is discharged into an abandoned quarry and not outside. E.6 No hazardous waste is being produced either from the production process or from pollution control facilities. E.7 The Environmental Statement for Gidi Washery Project for the year 2016-17 has been presented in Form-V (Part A to Part I) in this report. -

RAMSHOBHA COLLEGE of EDUCATION BANKHETA, CHUTTUPALU, RAMGARH Year of Admission (2014-15) B.Ed

RAMSHOBHA COLLEGE OF EDUCATION BANKHETA, CHUTTUPALU, RAMGARH Year of Admission (2014-15) B.Ed. 1. Student Details: - Number of students course-wise year -wise along with details:- Categary Year of Name of the student (Gen/SC/ST Admissio Contact No./ Admission fee (Receipt No., Sl. No. Father's Name Address Result Percentege admitted /OBC/Othe n Moble No. Date & Amount) rs) MD. NAUSAD CHUTTUPALU,(RANCHI), 1 MD. EKRAM HUSSAIN OBC 2014 Pass 78.4 9608894010 25000 01/06/014(01) HUSSAIN PIN - 835219 SWEETY MADHUPUR, 2 DILIP DESHMUKH Gen 2014 Pass 75 9934182287 30000 26/06/014(02) DESHMUKH (SARAIKELLA), SAKCHI, (JAMSHEDPUR), 3 RAVINDER KAUR VASDEY SINGH GEN. 2014 Pass 77.3 9122936595 30000 26/06/014(03) PIN - 831001 BARKAGAON, GULAM MD (HAZARIBAGH), PIN - 4 MD. TASLIM ANSARI OBC 2014 Pass 78.6 9801045253 30000 26/06/014(04) ZAKIULLAH 825311 BISHUNPUR, (GUMLA), 5 RASHMI KUMARI LAKHAN LAL GEN. 2014 Pass 75.6 9304897721 30000 17/07/014(05) PIN - JHANDA CHOWK, CHANCHAL (RAMGARH), PIN - 829122 6 RAMAN CHOUDHARY GEN. 2014 Pass 68 7033404289 30000 18/07/014(06) KUMARI MUZAFFARPUR, (BIHAR), 7 SHAMBHAVI SUSHIL KUMAR Gen 2014 Pass 83 9472952944 30000 09/07/014(07) PIN - 842001 PATRATU (RAMGARH) 8 RUPA KUMARI BANESHWAR ADHIKARY GEN. 2014 Pass 74.7 9835769555 30000 19/07/014(08) PIN-829118 BARIDIH, YOGENDRA KUMAR ORMANJHI,(RANCHI), PIN 9 SURESH SAHA OBC 2014 Pass 74.2 9798642144 24000 22/07/014(09) SAHU - 835219 PRIYANKA PALLAVI KURU, (LOHARDAGA), 10 NELSON TOPPO ST 2014 Pass 76.4 9199178460 25000 24/07/014(10) TOPPO PIN -835302 PRIYADARSHINI KURU, (LOHARDAGA), 11 NELSON TOPPO ST 2014 Pass 76.2 9973513466 30000 24/07/014(11) MONICA TOPPO PIN -835302 PANKAJ KUMAR ORMANJHI (RANCHI), 12 LAKHAN BEDIA ST 2014 Pass 75.6 9006229227 30000 25/07/014(12) BEDIA PIN-835219 KUNWAR TOLA, KUMARI (RAMGARH), PIN - 13 LT. -

Scanned by Camscanner

Scanned by CamScanner KEDLA OPENCAST PROJECT (1.35 MTPA PEAK) OF M/S CENTRAL COALFIELDS LIMITED LOCATED AT WEST BOKARO COALFIELD IN MANDU DEVELOPMENT BLOCK OF RAMGARH DISTRICT, JHARKHAND - TERMS OF REFERENCE REF: 1. [IA/JH/CMIN/74115/2018 DATED 11.04.2018] [F. NO. 23-244/2018-IA.III (V) ] 2. MINUTES OF 13TH MEETING OF EAC (VIOLATION), 18TH SEPTEMBER 2018 RECOMMENDATIONS OF EAC AND REPLY TO ITS OBSERVATIONS: S. No. Observations and Compliance/Action Taken Recommendations of committee I. Submission of revised pre-feasibility Enclosed as Annexure-I report. II. Surface drainage plan within 2km, Enclosed as Annexure-II 5km and 10km is to be submitted III. Submission of Dump management Enclosed as Annexure-III plan. IV. Forest clearance status. Type of forest land & status of diversion Land in ha. Notified Forest land Stage-I diverted 168.50 Forest land released before 1980 69.57 Area of notified forest land for which NPV 139.00 is paid Area of GMJJ land for which NPV is paid 135.38 Total Forest Land 512.45 Total Non Forest Land 572.04 Total Project Area 1084.49 Stage- I Forest Clearance for 168.50ha. is accorded vide letter no. FC NO. 8-55/2003 FC dated 23rd August, 2004 (Enclosed as Annexure-IV). V. DGMS permission for blasting at Enclosed as Annexure-V project site is to be submitted. VI. Mine water drainage plan along with Enclosed as Annexure-VI protection measures for nearby water VII. Submission of detail plan for rain Proposal has been initiated for the rain water harvesting cum harvesting water. -

Central Coalfields Limited (April, 2019)

Page | 1 Sl. Observation and Reply Page No. No. Reccomendations Submission of revised pre- The revised pre-feasibility report is 1. 3-28 feasibility report. attached as Annexure 1 Surface drainage plan The Surface Drainage Plan within 2 2. within 2km, 5km and 10km km, 5 km and 10 km. Is enclosed 29-30 is to be submitted as Annexure 2 Submission of Dump The dump management plan is 3. 31-33 management plan. attached as Annexure 3 On-line Application made vide proposal no. FP/JH/MIN/3993/2019 on 27.04.2019 for 160.77 Ha (total project area: 173.89 Ha) 4. Forest clearance status. 34-35 land(25.42 – NF. 72.48 – GMJJ and 62.87 – Non-forest land; 13.12 Ha – NF is applied for change in land use). Acknowledgement receipt in Annexure 4. Copy of DGMS permission for DGMS permission for blasting at project site issued on 5. blasting at project site is to 36-40 13.09.2013 is enclosed herewith be submitted. as Annexure 5. Various protection measures taken for near by water bodies are: a) Extension of Bandra Chua nallah drain around KOCP Kuju – Rs 1,29,20,642 - 2016-2017. b) Laying of 6 no humepipe in BandraCHua Nallah – Rs 66,652 - 2014-15. c) Strengthening of Garland Drain around KOCP in South Eastern Side in Kuju Colliery – Mine water drainage plan Rs 3,07,964 - 2014-15. along with protection 6. d) Cleaning of Bandrachua Nallah measures for nearby water & Drain - Rs 1,67,638 - 2014- bodies. 15. e) Cleaning of nallah situated around KOCP Mine – Rs 85,681 - 2015-16.