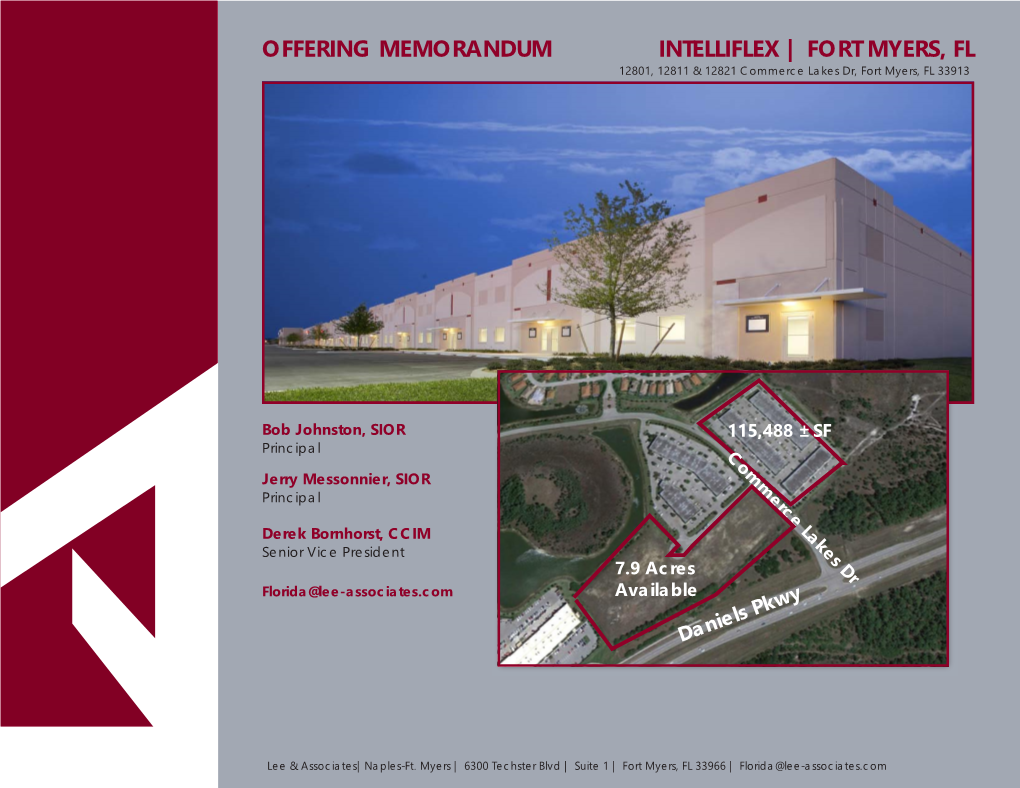

Intelliflex | Fort Myers, Fl Offering Memorandum and Disclaimer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Air Travel Consumer Report

U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: December 2013 1 Flight Delays October 2013 12 Months ending October 2013 1 Mishandled Baggage October 2013 1 Oversales 3rd Quarter 2013 January – September 2013 2 Consumer Complaints October 2013 (Includes Disability and Discrimination Complaints) Customer Service Reports to the Dept. of Homeland Security3 October 2013 Airline Animal Incident Reports4 October 2013 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov/ 2 Data compiled by the Aviation Consumer Protection Division. Website: http://www.dot.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division TABLE OF CONTENTS Section Section Page Page Flight Delays (continued) Introduction Table 11 24 2 List of Regularly Scheduled Flights with Tarmac Flight Delays Delays Over 3 Hours, By Carrier Explanation 3 Table 11A 25 Table 1 4 List of Regularly Scheduled International Flights with Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Carrier Operations Arriving On Time, by Carrier Table 12 26 Table 1A 5 Number and Percentage of Regularly Scheduled Flights Overall Percentage of Reported Flight With Tarmac Delays of 2 Hours or More, By Carrier Operations Arriving On Time and Carrier Rank, Footnotes 27 by Month, Quarter, and Data Base to Date Appendix -

Charter Report - 2012 Prospectuses

CHARTER REPORT - 2012 PROSPECTUSES Total No. Of Type of Aircraft # PC No. Charter Operator* Carrier* Origin Destination Beginning Date Ending Date Remarks/Indirect Carriers Flights of seats McDonnellMD83 12 001 Club Med Sales, Inc. Allegiant Air, LLC LAX ZIH 5/5/2012 8/18/2012 16 w/150 or 166 sts B737-300 12 002 Airline Brokers Company, Inc. Sky King, Inc. MIA HAV-CFG 2/2/2012 2/28/2012 24 w/136 seats B-737-400 12 003 Marazul Charters, Inc. Sky King MIA HAV 2/1/2012 3/31/2012 50 w/146 seats B-737-800 12 004 Marazul Charters Delta Air Lines, Inc. MIA HAV 2/1/2012 3/31/2012 34 w/158 seats 737-300 12 005 Public Charters, Inc. Atlas Air EWR GRB 1/13/2012 1/15/2012 Football Playoffs 2 w/253 seats B737-400 12 006 C&T Charters Inc. Sky King Inc. MIA-JFK-ORD CMW-HAV 2/4/2012 10/28/2012 248 w/150 psgrs. StudentCity.com, Inc. dba B737-800 12 007 GradCity.com Miami Air International DTW-EWR-LGA PUJ-NAS-CUN 2/24/2012 4/12/2012 13 w/173 seats B737-400 12 008 Airline Brokers Company, Inc. Sky King, Inc. MIA HAV-CFG 3/1/2012 3/31/2012 27 w/146 seats OST 1 1/9/2014 CHARTER REPORT - 2012 PROSPECTUSES 12 009 Cancelled Boeing 737-300 12 010 Collegiate Athletic Travel, Inc. Southwest Airlines, Co. EWR IND 2/3/2012 2/6/2012 Super Bowl 2 w/137 seats 737-800 12 011 Royal Beach Casino Miami Air International, Inc. -

Update to FAA Historical Chronology, 1997-2011

1997-2014 Update to FAA Historical Chronology: Civil Aviation and the Federal Government, 1926-1996 (Washington, DC: Federal Aviation Administration, 1998) 1997 January 2, 1997: The Federal Aviation Administration (FAA) issued an airworthiness directive requiring operators to adopt procedures enabling the flight crew to reestablish control of a Boeing 737 experiencing an uncommanded yaw or roll – the phenomenon believed to have brought down USAir Flight 427 at Pittsburgh, Pennsylvania, in 1994. Pilots were told to lower the nose of their aircraft, maximize power, and not attempt to maintain assigned altitudes. (See August 22, 1996; January 15, 1997.) January 6, 1997: Illinois Governor Jim Edgar and Chicago Mayor Richard Daley announced a compromise under which the city would reopen Meigs Field and operate the airport for five years. After that, Chicago would be free to close the airport. (See September 30, 1996.) January 6, 1997: FAA announced the appointment of William Albee as aircraft noise ombudsman, a new position mandated by the Federal Aviation Reauthorization Act of 1996 (Public Law 104-264). (See September 30, 1996; October 28, 1998.) January 7, 1997: Dredging resumed in the search for clues in the TWA Flight 800 crash. The operation had been suspended in mid-December 1996. (See July 17, 1996; May 4, 1997.) January 9, 1997: A Comair Embraer 120 stalled in snowy weather and crashed 18 miles short of Detroit [Michigan] Metropolitan Airport, killing all 29 aboard. (See May 12, 1997; August 27, 1998.) January 14, 1997: In a conference sponsored by the White House Commission on Aviation Safety and Security and held in Washington, DC, at George Washington University, airline executives called upon the Clinton Administration to privatize key functions of FAA and to install a nonprofit, airline-organized cooperative that would manage security issues. -

Aviation Regulatory Update Digest

January 6, 2014 AVIATION REGULATORY UPDATE DOT DENIES REQUEST TO EXTEND EFFECTIVE DATE OF NEW SIGNAGE RULE FOR WHEELCHAIR STOWAGE; DELAYS ENFORCEMENT UNTIL APRIL 12, 2014 On January 9, 2014, the DOT denied petitions filed by Airlines for America (A4A) and IATA requesting additional time to comply with 14 C.F.R. 382.67(c), which requires carriers to install a sign or placard prominently on the door of any closet designated as priority space for the stowage of manual passenger wheelchairs. The Petitioners had requested the DOT delay the effective date of the new rule until October 13, 2014. Although DOT denied the request for additional time to comply with the new rule, it did decide to delay enforcement of the rule until April 12, 2014 based on the presented argument that carriers - particularly foreign carriers - would need more than 60 days to comply with the rule. The DOT did not, however, agree that a lengthy delay of the effective date was necessary, noting that it had been advised that the process of obtaining FAA approval for the new signage would not exceed one month, and further remarking that foreign carriers should experience similar timeframes. The DOT further clarified that it would only require English to be used on the required signage, though it encouraged the additional use of any other language predominantly used by carriers to communicate with passengers. Finally, the DOT noted that, once the Enforcement Office began assessing the need for enforcement action against carriers who have not complied, the office would take into account all documented efforts made by carriers to meet the terms of the rule in a timely manner and to obtain approval by their civil aviation authority to install the required signage. -

E-Link Volume 2, 4Th Quarter, 2012 Robert M

e-Link Volume 2, 4th Quarter, 2012 Robert M. Ball, A.A.E., Executive Director e-Link is a quarterly newsletter for our tenants, vendors and business partners to stay linked in with the projects, accomplishments and development at Southwest Florida International Airport and Page Field. The News-Press Media Group selected Bob Ball as the 2012 Person of the Year for his leadership at the Lee County Port Authority. The Person of the Year award is given to someone who makes a difference in the community and impacts the future of everyone in Southwest Florida. During Bob’s 20 years at LCPA, he has overseen the $438 million New Terminal Complex project at Southwest Florida International Airport and the revitalization of Page Field. The economic impact from our airports is nearly $3.9 billion annually to the region. October 2012 MetJet began new nonstop service to Green Bay, Wis. on Oct. 10. Weekly fl ights will be operated by Sun Country Airlines through season. Southwest Florida International Airport was presented the Airport Safety Mark of Distinction Award by the Federal Aviation Administration (FAA). This award is given annually to airports in the southeastern United States that have demonstrated the advancement of safety through daily practices and training programs. In order to be considered for this award, an airport must be nominated by an FAA Certifi cation Inspector. Southwest Florida International Airport held its tri-annual Airport Emergency Training Exercise on Oct. 23 with the help of 46 mutual aid agencies and 450 volunteers. The Federal Aviation Administration requires commercial airports, like RSW, to hold a Full-scale Mass Casualty Incident (MCI) Exercise every three years in order to hold its Part 139 operating certifi cate. -

Air Travel Consumer Report

U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: January 2014 1 Flight Delays November 2013 12 Months Ending November 2013 1 Mishandled Baggage November 2013 1 Oversales 3rd Quarter 2013 January – September 2013 2 Consumer Complaints November 2013 (Includes Disability and Discrimination Complaints) Customer Service Reports to the Dept. of Homeland Security3 November 2013 Airline Animal Incident Reports4 November 2013 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov/ 2 Data compiled by the Aviation Consumer Protection Division. Website: http://www.dot.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division This report is dedicated to Sam Podberesky, Assistant General Counsel for Aviation Enforcement and Proceedings, who retired on January 14, 2014, after more than 42 years of exceptional Federal service. TABLE OF CONTENTS Section Section Page Page Flight Delays (continued) Introduction Table 11 24 2 List of Regularly Scheduled Flights with Tarmac Flight Delays Delays Over 3 Hours, By Carrier Explanation 3 Table 11A 25 Table 1 4 List of Regularly Scheduled International Flights with Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Carrier Operations Arriving On Time, by Carrier Table 12 26 Table 1A 5 Number and Percentage of Regularly Scheduled -

Bonita Professional Park Offering Memorandum

OFFERING MEMORANDUM BONITA PROFESSIONAL PARK 28321-341 S. TAMIAMI TRL, BONITA SPRINGS, FL 34134 BEFORE AFTER Bob Johnston, SIOR Principal [email protected] Direct: (239) 210-7601 Bonita Springs Gulf of Mexico Naples Lee & Associates|Naples-Ft. Myers | 6300 Techster Blvd | Suite 1 | Fort Myers, FL 33966 | [email protected] BONITA PROFESSIONAL PARK | FORT MYERS, FL OFFERING MEMORANDUM AND DISCLAIMER Lee & Associates|Naples-Ft. Myers (“Agent”) has been engaged by the owner (“Seller”) as the exclusive agent for the sale of Bonita Professional Park in Bonita Springs, Florida (the “Property”). The Property is being offered for sale in an “as-is, where-is” condition and Seller and Agent make no representations or warranties as to the accuracy of the information contained in this Offering Memorandum. Neither the enclosed materals nor any information contained herein is to be used for any other purpose or made available to any other person without the express written consent of the Seller. Seller reserves the right, at its sole and absolute discretion, to withdraw the Property from the market at any time and for any reason. Seller and Agent each expressly reserves the right, at their sole and absolute discretion, to reject any and all expressions of interest or offers regarding the Property and/or to terminate discussions with any entity at any time, with or without notice. This offering is made subject to omissions, correction of errors, change of price or other terms, prior sale or withdrawal from the market without notice. Agent is not authorized to make any representations or agreements on behalf of Seller. -

(Washington, DC: Federal Aviation Administration, 1998) 1997

1997-2017 Update to FAA Historical Chronology: Civil Aviation and the Federal Government, 1926-1996 (Washington, DC: Federal Aviation Administration, 1998) 1997 January 2, 1997: The Federal Aviation Administration (FAA) issued an airworthiness directive requiring operators to adopt procedures enabling the flight crew to reestablish control of a Boeing 737 experiencing an uncommanded yaw or roll – the phenomenon believed to have brought down USAir Flight 427 at Pittsburgh, Pennsylvania, in 1994. Pilots were told to lower the nose of their aircraft, maximize power, and not attempt to maintain assigned altitudes. (See August 22, 1996; January 15, 1997.) January 6, 1997: Illinois Governor Jim Edgar and Chicago Mayor Richard Daley announced a compromise under which the city would reopen Meigs Field and operate the airport for five years. After that, Chicago would be free to close the airport. (See September 30, 1996.) January 6, 1997: FAA announced the appointment of William Albee as aircraft noise ombudsman, a new position mandated by the Federal Aviation Reauthorization Act of 1996 (Public Law 104-264). (See September 30, 1996; October 28, 1998.) January 7, 1997: Dredging resumed in the search for clues in the TWA Flight 800 crash. The operation had been suspended in mid-December 1996. (See July 17, 1996; May 4, 1997.) January 9, 1997: A Comair Embraer 120 stalled in snowy weather and crashed 18 miles short of Detroit [Michigan] Metropolitan Airport, killing all 29 aboard. (See May 12, 1997; August 27, 1998.) January 14, 1997: In a conference sponsored by the White House Commission on Aviation Safety and Security and held in Washington, DC, at George Washington University, airline executives called upon the Clinton Administration to privatize key functions of FAA and to install a nonprofit, airline-organized cooperative that would manage security issues. -

E-Link Volume 2, 3Rd Quarter, 2012 Robert M

e-Link Volume 2, 3rd Quarter, 2012 Robert M. Ball, A.A.E., Executive Director e-Link is a quarterly newsletter for our tenants, vendors and business partners to stay linked in with the projects, accomplishments and development at Southwest Florida International Airport and Page Field. July 2012 ¾ The Florida Department of Transportation (FDOT) honored the Lee County Port Authority with the 2012 Outstanding Commercial Service Airport of the Year Award for Southwest Florida International Airport (RSW). The airport was presented this top award at the Florida Airports Council Annual Conference in Naples. This is the fourth time that RSW has received this prestigious honor. ¾ Southwest Florida International Airport launched its Facebook page on July 19, 2012. This social media tool allows LCPA to support its goal to increase awareness and visibility of Southwest Florida International Airport in the global marketplace. It will help LCPA engage with an interactive customer base to promote branding, while building on our reputation as a world-class airport. You can like us on Facebook at http://www.facebook.com/flyRSW ¾ MetJet announced it will begin weekly nonstop service to Green Bay, Wis. The flights operate on Wednesdays from Oct. 10, 2012 through April 15, 2013. This is the first time that RSW has flights to this popular Midwest destination. ¾ Spirit Airlines announced they will double their service at RSW for the winter season by adding daily nonstop service on Nov. 8, 2012 to Boston and Minneapolis. They will also offer three weekly flights to Dallas/Fort Worth International Airport. ¾ WestJet announced weekly flights between RSW and Ottawa starting on Dec. -

E-Link Volume 3, 2Nd Quarter, 2013 Robert M

e-Link Volume 3, 2nd Quarter, 2013 Robert M. Ball, A.A.E., Executive Director e-Link is a quarterly newsletter for our tenants, vendors and business partners to stay linked in with the projects, accomplishments and development at Southwest Florida International Airport and Page Field. April 2013 ¾ The South Road Re-alignment project, which redirects traffic connecting between U.S. 41 and Metro Parkway away from the Page Park community to Danley Drive along the south side of Page Field, has been completed. It also includes additional parking for Jerry Brooks Park, eliminating the need for park patrons to cross a busy roadway, and provides better roadway access to the south side of the airport. ¾ Base Operations at Page Field was rated among the top 30 percent of fixed-base operators according to a prestigious international survey conducted by Aviation International News (AIN). The 2013 FBO Survey is conducted annually and asked pilots, flight attendants and dispatchers to provide feedback on the level of customer care at individual business and general aviation service providers throughout the U.S., Canada, Mexico, South and Central America and the Caribbean. This is the first time the Lee County Port Authority FBO has been recognized in the AIN survey. AIN conducted the online survey to qualified subscribers and asked them to evaluate FBOs they visited the previous year in four categories: line service (fueling, towing, storage and crew support); passenger amenities (customer service, waiting areas, arrival greeters and assistance with baggage); pilot amenities (rest areas, courtesy cars and hotel reservation services arranged by customer service representatives); and facilities (friendly and functional building, aircraft hangar space and aircraft ramp parking). -

1997-2016 Update to FAA Historical Chronology: Civil Aviation and the Federal Government, 1926-1996 (Washington, DC: Federal Aviation Administration, 1998)

1997-2016 Update to FAA Historical Chronology: Civil Aviation and the Federal Government, 1926-1996 (Washington, DC: Federal Aviation Administration, 1998) 1997 January 2, 1997: The Federal Aviation Administration (FAA) issued an airworthiness directive requiring operators to adopt procedures enabling the flight crew to reestablish control of a Boeing 737 experiencing an uncommanded yaw or roll – the phenomenon believed to have brought down USAir Flight 427 at Pittsburgh, Pennsylvania, in 1994. Pilots were told to lower the nose of their aircraft, maximize power, and not attempt to maintain assigned altitudes. (See August 22, 1996; January 15, 1997.) January 6, 1997: Illinois Governor Jim Edgar and Chicago Mayor Richard Daley announced a compromise under which the city would reopen Meigs Field and operate the airport for five years. After that, Chicago would be free to close the airport. (See September 30, 1996.) January 6, 1997: FAA announced the appointment of William Albee as aircraft noise ombudsman, a new position mandated by the Federal Aviation Reauthorization Act of 1996 (Public Law 104-264). (See September 30, 1996; October 28, 1998.) January 7, 1997: Dredging resumed in the search for clues in the TWA Flight 800 crash. The operation had been suspended in mid-December 1996. (See July 17, 1996; May 4, 1997.) January 9, 1997: A Comair Embraer 120 stalled in snowy weather and crashed 18 miles short of Detroit [Michigan] Metropolitan Airport, killing all 29 aboard. (See May 12, 1997; August 27, 1998.) January 14, 1997: In a conference sponsored by the White House Commission on Aviation Safety and Security and held in Washington, DC, at George Washington University, airline executives called upon the Clinton Administration to privatize key functions of FAA and to install a nonprofit, airline-organized cooperative that would manage security issues. -

Air Travel Consumer Report

U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: February 2014 1 Flight Delays December 2013 12 Months Ending December 2013 1 Mishandled Baggage December 2013 January-December 2013 1 th Oversales 4 Quarter 2013 January – December 2013 2 Consumer Complaints December 2013 (Includes Disability and January – December 2013 Discrimination Complaints) Customer Service Reports to the Dept. of Homeland Security3 December 2013 Airline Animal Incident Reports4 December 2013 January – December 2013 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov/ 2 Data compiled by the Aviation Consumer Protection Division. Website: http://www.dot.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division TABLE OF CONTENTS Section Section Page Page Flight Delays (continued) Introduction Table 11 25 2 List of Regularly Scheduled Flights with Tarmac Flight Delays Delays Over 3 Hours, By Carrier Explanation 3 Table 11A 26 Table 1 4 List of Regularly Scheduled International Flights with Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Carrier Operations Arriving On Time, by Carrier Table 12 27 Table 1A 5 Number and Percentage of Regularly Scheduled Flights Overall Percentage of Reported Flight With Tarmac Delays of 2 Hours or More, By Carrier Operations Arriving On Time and Carrier