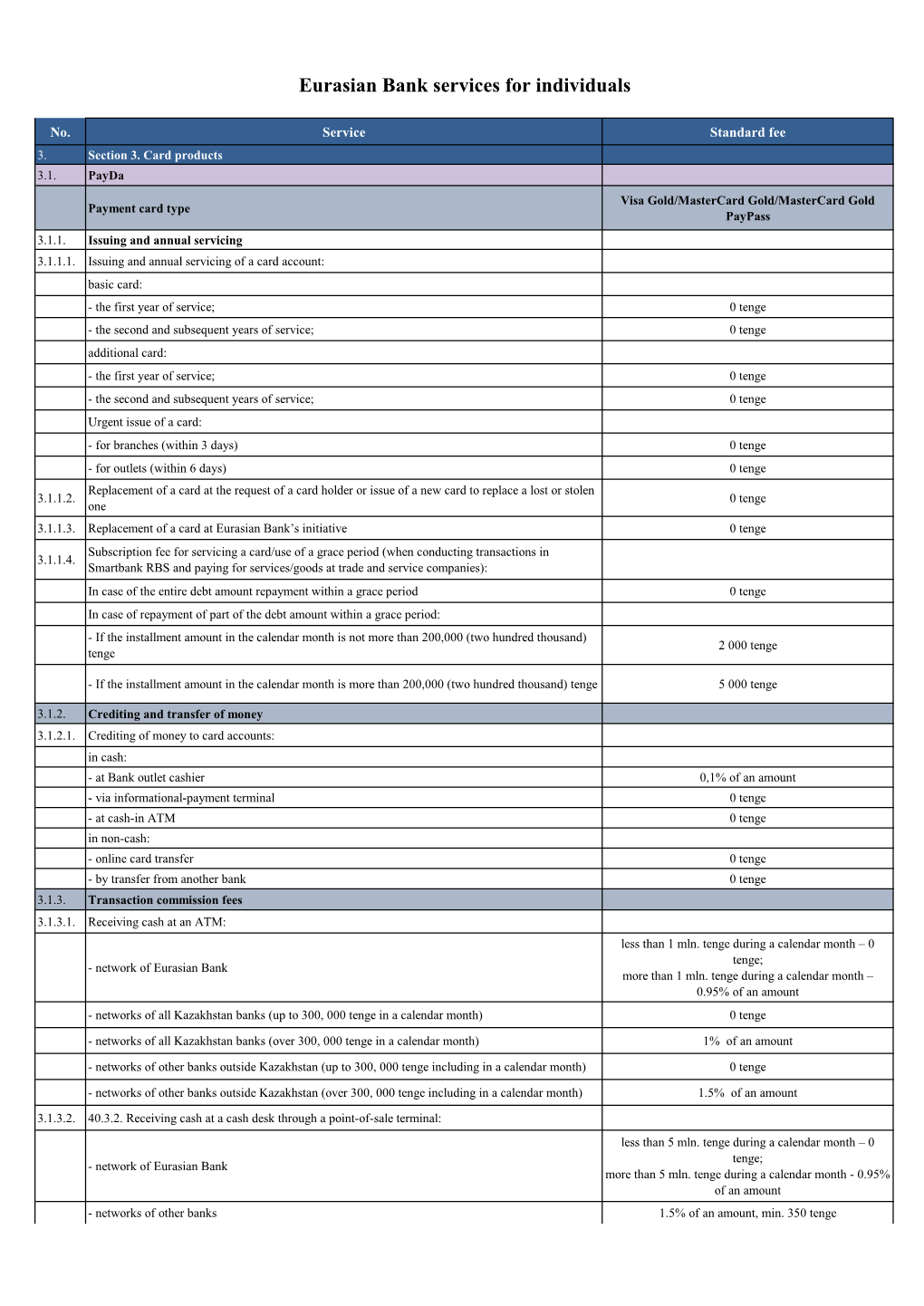

Eurasian Bank Services for Individuals

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HALYK AR English Version Final 28 04 18.Cdr

ANNUAL REPORT 1 2017 1 2 3 4 5 AT A GLANCE BUSINESS MODEL CHAIRMAN OF THE BOARD'S CHAIRPERSON OF THE BOARD OF DIRECTORS 4 8 STATEMENT MANAGEMENT BOARD'S 19 11 REVIEW 15 6 7 8 9 10 MANAGEMENT BOARD KEY EVENTS IN 2017 AWARDS MACROECONOMIC FINANCIAL REVIEW 25 31 35 AND BANKING REVIEW 43 38 11 12 13 14 15 BUSINESS REVIEW RISK MANAGEMENT SOCIAL REPORT CORPORATE GOVERNANCE RESPONSIBILITY STATEMENT 49 60 69 78 93 16 17 18 OUTLOOK CONSOLIDATED FINANCIAL INFORMATION 96 STATEMENTS AND INDEPENDENT FOR SHAREHOLDERS AUDITORS' REPORT FOR THE 186 YEARS ENDED 31 DECEMBER 2017, 2016 AND 2015 100 1 BE THE LEADER! LEAD FROM THE FRONT! AT A GLANCE FLAGSHIP The word flagship denotes the lead ship in a fleet. The name is usually given to the best and largest ships, expeditions and taskforces. A flagship, as a rule, is a command and control ship for a commander, flag officer or headquarters and display's the senior officer's flag. 4 FINANCIAL HIGHLIGHTS1 NUMBER OF CUSTOMERS/ACCOUNTS AT YEAR-END Key ratios Halyk Bank + Kazkommertsbank Halyk Bank Key figures at year-end 01.01.2018 01.01.2017 01.01.2018 01.01.2018 01.01.2017 KZT mln US$ mln* KZT mln US$ mln* Retail accounts, mln 8.5 5.9 5.4 Loans to customers 3,251,102 9,783 2,319,583 6,960 Corporate clients 3,935 1,672 1,621 Total assets 8,857,781 26,654 5,348,483 16,048 Payment cards, mln 9.0 6.3 5.5 Amounts due to customers 6,131,750 18,451 3,820,662 11,464 Retail loans, mln 0.9 0.68 0.67 Debt securities issued 962,396 2,896 584,933 1,755 Mortgage loans 40,761 20,012 21,455 Amounts due to credit institutions 255,151 -

Central Securities Depository JSC

Central Securities Depository JSC AAAnnnnnnuuuaaalll RRReeepppooorrrttt 222000000666 Almaty 2007 Annual 2006 Report of Central Securities Depository JSC Table of Contents I. SHAREHOLDERS AND CHARTER CAPITAL ............................................................. 3 SHAREHOLDERS ...................................................................................................................... 3 CHARTER CAPITAL.................................................................................................................. 4 II. DEPOSITORY ACTIVITIES............................................................................................ 5 CLIENTS .................................................................................................................................. 5 CLIENT ACCOUNTS AND SUB-ACCOUNTS ................................................................................ 7 NOMINAL HOLDING ................................................................................................................ 7 Summary............................................................................................................................. 7 State Securities ................................................................................................................... 9 Non-State Securities ........................................................................................................... 9 Securities Issued Under Foreign Laws ............................................................................ 10 -

From Two to Six People of 350-550 Kilograms

1 BOLD ACCOMPLISHMENTS from two to six people of 350-550 kilograms The first woman to fly in a hot air balloon was1784 the 19-year-old Frenchwoman Elisabeth Thible. The flight was made in a hot air balloon called La Gustave in 1784 and lasted 45 minutes. The opera singer dressed as the goddess Minerva bravely climbed into it, amazing the crowd. A confident ascent Hot air balloons lift from two to six people into the air with a maximum payload of 350-550 kilograms. The world record holder is a 35-seat balloon with a two-story gondola. 2 2 4 Glossary 6 Chairman of the Board of Directors 8 Board of Directors 12 Chairman of the Bank's Management Board 14 Management Board of the Bank 21 Executive Summary 23 Shareholders and Capital. Dividend Policy 25 A Brief History of Bank CenterCredit 27 Overview of the macroeconomics and banking sector of the Republic of Kazakhstan 30 Review of Financial Performance 38 Overview of Core Operations 56 Risk Management System 60 Internal Control and Audit System 63 Information on the amount and composition of remuneration for members of the Board of Directors and the Management Board of the Bank for 2017. 64 Social Responsibility and Environmental Protection 69 Corporate Governance 77 Subsidiaries 79 Key Goals and Objectives for 2018 80 Information for Shareholders 83 Independent Auditors Report 2 3 1 ADB Asian Development Bank 2 ABS Automated banking system 3 Colvir ABS/Colvir Banking System Colvir is the Bank's current IT platform 4 AIS LEA Automated Information System for Law Enforcement Agencies 5 Damu EDF JSC / Damu Fund Damu Enterprise Development Fund JSC 6 ATM (Eng. -

Eurasian Bank JSC Unconsolidated Financial Statements for the Year

Eurasian Bank JSC Unconsolidated Financial Statements for the year ended 31 December 2015 Eurasian Bank JSC Contents Independent Auditors’ Report Unconsolidated Statement of Profit or Loss and Other Comprehensive Income 5 Unconsolidated Statement of Financial Position 6 Unconsolidated Statement of Cash Flows 7 Unconsolidated Statement of Changes in Equity 8-9 Notes to the Unconsolidated Financial Statements 10-84 Eurasian Bank JSC Unconsolidated Statement of Financial Position as at 31 December 2015 2015 2014 Note KZT'000 KZT'000 ASSETS Cash and cash equivalents 12 73,681,092 109,816,471 Financial instruments at fair value through profit or loss 13 143,133,179 4,025,156 Available-for-sale financial assets 14 5,966,872 5,913,836 Deposits and balances with banks 15 6,978,553 13,429,798 Loans to customers 16 660,268,816 582,292,908 Held-to-maturity investments 17 23,196,649 35,184,257 Investment in subsidiary 18 7,097,853 5,607,853 Current tax asset 2,235,201 2,145,193 Property, equipment and intangible assets 19 24,822,425 22,558,807 Net assets receivable from merged subsidiary 18 11,779,202 - Other assets 20 12,378,960 24,070,624 Total assets 971,538,802 805,044,903 LIABILITIES Financial instruments at fair value through profit or loss 13 165,039 - Deposits and balances from banks 21 6,832,453 3,317,312 Amounts payable under repurchase agreements 22 2,648,490 7,353,570 Current accounts and deposits from customers 23 638,770,135 543,556,833 Debt securities issued 24 164,624,569 103,242,607 Subordinated debt securities issued 25 21,061,452 -

Eurasian Bank JSC Consolidated Financial Statements for the Year

Eurasian Bank JSC Consolidated Financial Statements for the year ended 31 December 2016 Eurasian Bank JSC Contents Independent Auditors’ Report Consolidated Statement of Profit or Loss and Other Comprehensive Income ................................................................ 9 Consolidated Statement of Financial Position ............................................. 10 Consolidated Statement of Cash Flows ................................................. 11-12 Consolidated Statement of Changes in Equity ...................................... 13-14 Notes to the Consolidated Financial Statements ................................. 15-101 «КПМГ Аудит» жауапкершілігі KPMG Audit LLC шектеулі серіктестік 050051 Almaty, 180 Dostyk Avenue, 050051 Алматы, Достық д-лы 180, E-mail: [email protected] Тел./факс 8 (727) 298-08-98, 298-07-08 Independent Auditors’ Report To the Board of Directors of Eurasian Bank JSC Opinion We have audited the consolidated financial statements of Eurasian Bank JSC and its subsidiary (the “Group”), which comprise the consolidated statement of financial position as at 31 December 2016, the consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising significant accounting policies and other explanatory information. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at 31 December 2016, and its consolidated financial performance -

KPMG in Kazakhstan and Central Asia May 2019 Kpmg.Kz

Private equity market in Kazakhstan KPMG in Kazakhstan and Central Asia May 2019 kpmg.kz 2 Private equity market in Kazakhstan Welcome statement Dear partners, investors and colleagues, Welcome. It gives me great pleasure to welcome you on pages of this report which analyses the private equity market in Kazakhstan. The goal of Kazyna Capital Management (KCM) today is to develop the private equity infrastructure in Kazakhstan; therefore, it is highly important for the Company to gain an understanding of the current state of the market and to determine the necessary steps that need to be taken to foster its development. Ardak Kassymbek One factor constraining the development of the private equity industry in Kazakhstan is a lack of information. Extensive work has been undertaken as part of preparing this report to collect and analyse information. For example, for the first time ever private equity market players and businesspersons have been interviewed to ascertain current issues and to elaborate recommendations to develop the market. Moreover, it is the first time that quantitative data on the size of the private equity market and its role in Kazakhstan’s economy will be presented to the public. This report is the first public analytical material of its kind related to the private equity market in Kazakhstan, and we hope that it will provide both domestic and foreign investors with the information they need to understand the industry and to help improve the market ecosystem to facilitate its further growth. We are very proud of this initiative and strongly believe that the report will be useful for professional market players and a wider audience. -

Global Finance Names the World's Best Trade Finance Providers 2017

Global Finance Names The World’s Best Trade Finance Providers 2017 NEW YORK, January 18, 2017 – Global Finance has named the 17th annual World’s Best Trade Finance Providers in 9 regions, 83 countries and globally in an exclusive survey to be published in the February 2017 issue. The honorees were revealed at an awards luncheon today in About Global Finance Madrid during the BAFT Europe Bank to Bank Forum. Global Finance, founded in The editorial review board of Global Finance selected the best trade 1987, has a circulation of 50,000 and readers in 192 finance providers based on input from industry analysts, corporate countries. Global Finance’s executives and technology experts. In addition, a poll of Global Finance’s audience includes senior readership was conducted in order to increase the accuracy and reliability corporate and financial officers responsible for making of the results. Criteria for choosing the winners included: transaction investment and strategic volume, scope of global coverage, customer service, competitive pricing decisions at multinational and innovative technologies. companies and financial institutions. Its website — GFMag.com — offers analysis “The rise of anti-globalist political movements and the election of and articles that are the heritage populists who express anti-trade sentiments has enormous potential of 30 years of experience in international financial to re-shape the landscape of global trade,” said Joseph D. Giarraputo, markets. Global Finance is publisher and editorial director of Global Finance. “At the same time, headquartered in New York, China’s currency, now in the IMF’s SDR basket, is strengthening Asia’s with offices around the world. -

Eurasian Bank JSC Unconsolidated Financial Statements for the Year

Eurasian Bank JSC Unconsolidated Financial Statements for the year ended 31 December 2014 Eurasian Bank JSC Contents Independent Auditors’ Report Unconsolidated Statement of Profit or Loss and Other Comprehensive Income 5 Unconsolidated Statement of Financial Position 6 Unconsolidated Statement of Cash Flows 7 Unconsolidated Statement of Changes in Equity 8-9 Notes to the Unconsolidated Financial Statements 10-81 Eurasian Bank JSC Unconsolidated Statement of Financial Position as at 31 December 2014 2014 2013 Note KZT'000 KZT'000 ASSETS Cash and cash equivalents 11 109,816,471 81,014,159 Financial instruments at fair value through profit or loss 12 4,025,156 - Available-for-sale financial assets 13 5,913,836 10,979,872 Deposits and balances with banks 14 13,429,798 2,598,850 Loans to customers 15 582,292,908 426,513,718 Held-to-maturity investments 16 35,184,257 23,462,306 Investment in subsidiary 17 5,607,853 5,607,853 Current tax asset 2,145,193 1,271,228 Property, equipment and intangible assets 18 22,558,807 19,465,126 Other assets 19 24,070,624 13,356,178 Total assets 805,044,903 584,269,290 LIABILITIES Financial instruments at fair value through profit or loss 12 - 2,278 Deposits and balances from banks 20 3,317,312 12,608,055 Amounts payable under repurchase agreements 21 7,353,570 8,803,285 Current accounts and deposits from customers 22 543,556,833 401,781,105 Debt securities issued 23 103,242,607 32,910,768 Subordinated debt securities issued 24 26,028,695 35,669,288 Other borrowed funds 25 37,862,573 21,410,349 Deferred tax -

Eurasian Bank JSC Unconsolidated Financial Statements for The

Eurasian Bank JSC Unconsolidated Financial Statements for the year ended 31 December 2019 Eurasian Bank JSC Contents Independent Auditors’ Report Unconsolidated Statement of Profit or Loss and Other Comprehensive Income 9 Unconsolidated Statement of Financial Position 10 Unconsolidated Statement of Cash Flows 11-12 Unconsolidated Statement of Changes in Equity 13-14 Notes to the Unconsolidated Financial Statements 15-98 «КПМГ Аудит» жауапкершілігі KPMG Audit LLC шектеулі серіктестік A25D6T5 Almaty, Kazakhstan Қазақстан A25D6T5 Алматы, 180 Dostyk Avenue, Достық д-лы 180, E-mail: [email protected] Тел./факс 8 (727) 298-08-98 Independent Auditors’ Report To the Shareholder and the Board of Directors of Eurasian Bank Joint Stock Company Opinion We have audited the unconsolidated financial statements of Eurasian Bank Joint Stock Company (the “Bank”), which comprise the unconsolidated statement of financial position as at 31 December 2019, the unconsolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising significant accounting policies and other explanatory information. In our opinion, the accompanying unconsolidated financial statements present fairly, in all material respects, the unconsolidated financial position of the Bank as at 31 December 2019, and its unconsolidated financial performance and its unconsolidated cash flows for the year then ended in accordance with International Financial Reporting Standards (“IFRS”). Basis for Opinion We conducted -

Annual Report to Intentions Intentions From

T T R ANNUAL REPO ANNUAL 2011 from INTENTIONS to LIFE LIFE ANNUAL REPORT to INTENTIONS INTENTIONS from total pages: 124 ANNUAL REPORT 2011 from INTENTIONS to LIFE CONTENTS: EURASIAN BANK HIGHLIGHTS 2 LETTER FROM THE CHIEF EXECUTIVE OFFICER 5 MANAGEMENT TEAM 9 5-YEAR SELECTED IFRS CONSOLIDATED FINANCIALS 10 1 SUMMARY OF CONSOLIDATED PERFORMANCE 13 MARKET ENVIRONMENT 13 BUSINESS SEGMENTS 15 2 fiNANciAL STATEMENT 23 STATEMENT OF INCOME 2011 VS. 2010 23 BALANCE SHEET HIGHLIGHTS 2011 VS 2010 27 STATEMENT OF INCOME 2010 VS. 2009 33 BALANCE SHEET HIGHLIGHTS 2010 VS 2009 38 3 RECENT DEVELOPMENTS 43 RECENT DEVELOPMENTS 43 CORPORATE GOVERNANCE 44 MANAGEMENT BOARD 46 FORWARD LOOKING STATEMENTS 51 Independent Auditors’ Report 53 4 RISK MANAGEMENT 55 COMPANY INFORMATION 61 5 CONSOLidATED FINANciAL STATEMENTS 63 ANNUAL REPORT from INTENTIONS to LIFE 2011 Financial figures in this annual report are taken from the corresponding year’s audited consolidated financial statements and their accompanying notes. Numbers may be rounded or represented graphically. Totals and percent changes presented in the document reflect the calculations of the unrounded numbers, and may be different from the calculations performed on the rounded figures. The reader should read the accompanying audited financial statements and notes for the 2010-2011 years. Prior years audited financial statements are available on tenge tends to trade in a fairly stable range against the US the company website (www.eubank.kz). For simplification, dollar, there was a one time devaluation from 120 tenge to the annual report presents data in millions of tenge, and on the US dollar to 150 tenge to the US dollar in February 2009. -

Eurasian Natural Resources Corporation PLC

Transforming Resources Eurasian Natural Resources Corporation PLC Admission to the Official List and to trading on the London Stock Exchange Prospectus Sole Global Coordinator, Sponsor and Joint Bookrunner: Joint Bookrunners: Eurasian Natural Resources Corporation PLC T: +44 (0) 20 7389 1440 www.enrc.com 4052 EUR04 Prospectus_Cover_FINA1 1 22/11/07 18:10:36 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to what action you should take, you should immediately seek your own financial advice from your stockbroker, bank manager, solicitor or other suitable independent professional adviser who specialises in advising on the acquisition of shares and other securities. This document (the ‘‘Prospectus’’), which comprises a prospectus relating to Eurasian Natural Resources Corporation PLC (the ‘‘Company’’), was prepared in accordance with the Prospectus Rules made under Section 73A of the Financial Services and Markets Act 2000 (‘‘FSMA’’) and Commission Regulation 809/2004/EC (the ‘‘EU Prospectus Regulations’’) and will be approved as such by the Financial Services Authority of the United Kingdom (the ‘‘Financial Services Authority’’). A copy of this document will be filed with the Financial Services Authority in accordance with Part 7 of the EU Prospectus Regulations. This document will be made available to the public in accordance with Part 8 of the EU Prospectus Regulations by the same being made available, free of charge, at the Company’s registered office and at the London offices of Jones Day, details of which are set out on page 26 of this document. Application will be made to the Financial Services Authority and the London Stock Exchange for the Ordinary Shares, issued and to be issued in connection with the Global Offer, to be admitted to listing on the Official List and to trading on the London Stock Exchange’s main market for listed securities (‘‘Admission’’). -

Eurasian Bank JSC Consolidated Financial Statements for the Year

Eurasian Bank JSC Consolidated Financial Statements for the year ended 31 December 2019 Eurasian Bank JSC Contents Independent Auditors’ Report Consolidated Statement of Profit or Loss and Other Comprehensive Income 9 Consolidated Statement of Financial Position 10 Consolidated Statement of Cash Flows 11-12 Consolidated Statement of Changes in Equity 13-14 Notes to the Consolidated Financial Statements 15-97 «КПМГ Аудит» жауапкершілігі KPMG Audit LLC шектеулі серіктестік A25D6T5 Almaty, Kazakhstan Қазақстан A25D6T5 Алматы, 180 Dostyk Avenue, Достық д-лы 180, E-mail: [email protected] Тел./факс 8 (727) 298-08-98 Independent Auditors’ Report To the Shareholder and the Board of Directors of Eurasian Bank Joint Stock Company Opinion We have audited the consolidated financial statements of Eurasian Bank Joint Stock Company and its subsidiaries (the “Group”), which comprise the consolidated statement of financial position as at 31 December 2019, the consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year then ended, and notes, comprising significant accounting policies and other explanatory information. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at 31 December 2019, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards (“IFRS”). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report.