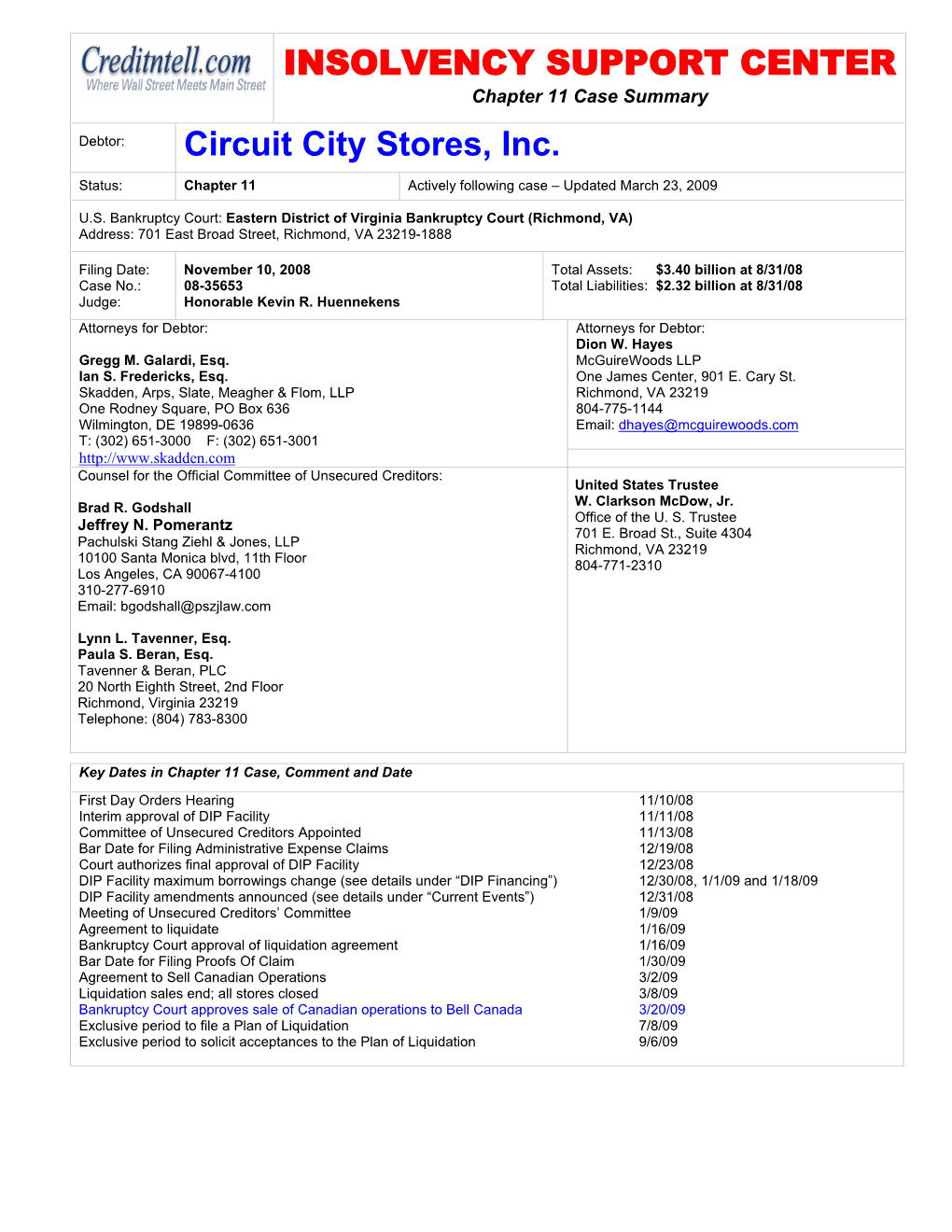

INSOLVENCY SUPPORT CENTER Circuit City Stores, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bell MTS Fibe TV Brochure Instore Printable April1.Indd

Fibe TV & Internet Bell MTS MyAccount Manage your services online, anytime. • Change your TV channels and enjoy them in minutes. • Record your favourite shows while you’re away Fibe TV & from home with MyPVR. • Pay your monthly bill. Internet • Access up to 2 years of billing history. Sign up today at bellmts.ca/myaccount • 4K – with 4x the detail of Full HD, it’s the very best picture quality available.1 • Restart shows in progress or from the past 30 hours.2 • Watch or record up to 4 live HD shows at the same time. • Watch your favourite shows with CraveTM and stream Netflix directly from your set-top box.3 • Worry-free usage with unlimited Internet.4 • Whole Home Wi-Fi – smart and fast Wi-Fi to every room of your home. • Internet access at Bell MTS Wi-Fi hotspots. March, 2019 Channels and pricing listed are subject to change. (1) 4K picture quality requires 4K TV, 4K programming, wired set-top box plus 4K service, and a subscription to Fibe 50 or faster Internet service with Bell MTS. Availability of 4K content is subject to content availability and device capabilities (4K TV). Bell MTS 4K TV Service only available on one TV per household. Residential customers only. (2) Available with select channels/content, excluding US networks and non-local content, and subject to viewing limitations. (3) Netflix and Crave membership required. Crave and all associated logos are trademarks of Bell Media Inc. All rights reserved. (4) Use of the service, including unlimited usage, is subject to compliance with the Bell MTS Terms of Service; BellMTS.ca/legal. -

Nortel Networks Corp. (Re)

Page 1 Case Name: Nortel Networks Corp. (Re) RE:IN THE MATTER OF the Companies' Creditors Arrangement Act, R.S.C. 1985, c. C-36, as amended AND IN THE MATTER OF a Plan of Compromise or Arrangement of Nortel Networks Corporation, Nortel Networks Limited, Nortel Networks Global Corporation, Nortel Networks International Corporation and Nortel Networks Technology Corporation, Applicants APPLICATION UNDER the Companies' Creditors Arrangement Act, R.S.C. 1985, c. C-36, as amended [2009] O.J. No. 3169 55 C.B.R. (5th) 229 2009 CarswellOnt 4467 Court File No. 09-CL-7950 Ontario Superior Court of Justice Commercial List G.B. Morawetz J. Heard: June 29, 2009. Judgment: June 29, 2009. Released: July 23, 2009. (59 paras.) Bankruptcy and insolvency law -- Companies' Creditors Arrangement Act (CCAA) matters -- Ap- plication of Act -- Debtor company -- Motion by applicants for approval of bidding procedure and Sale Agreement allowed -- Applicants had been granted CCAA protection and were involved in in- solvency procedures in four other countries -- Bidding procedures set deadline for entry and in- volved auction -- Sale Agreement was for some of applicants' business units -- Neither proposal in- volved formal plan of compromise with creditors or vote, but CCAA was flexible and could be broadly interpreted to ensure objective of preserving business was met -- Proposal was warranted, beneficial and there was no viable alternative. Page 2 Motion by the applicants for the approval of their proposed bidding process and Sale Agreement. The applicants had been granted CCAA protection and were involved in insolvency proceedings in four other countries. The Monitor approved of the proposal. -

The Royal Gazette Index 2010

The Royal Gazette Gazette royale Fredericton Fredericton New Brunswick Nouveau-Brunswick ISSN 0703-8623 Index 2010 Volume 168 Table of Contents / Table des matières Page Proclamations . 2 Orders in Council / Décrets en conseil . 2 Legislative Assembly / Assemblée législative. 9 Elections NB / Élections Nouveau-Brunswick . 9 Departmental Notices / Avis ministériels . 9 NB Energy and Utilities Board / Commission de l’énergie et des services publics du N.-B. 15 New Brunswick Securities Commission / Commission des valeurs mobilières du Nouveau-Brunswick . 15 Notices Under Various Acts and General Notices / Avis en vertu de diverses lois et avis divers . 15 Sheriff’s Sales / Ventes par exécution forcée . 16 Notices of Sale / Avis de vente . 16 Regulations / Règlements . 19 Corporate Affairs Notices / Avis relatifs aux entreprises . 22 Business Corporations Act / Loi sur les corporations commerciales . 22 Companies Act / Loi sur les compagnies . 58 Partnerships and Business Names Registration Act / Loi sur l’enregistrement des sociétés en nom collectif et des appellations commerciales . 60 Limited Partnership Act / Loi sur les sociétés en commandite . 93 2010 Index Proclamations Right to Information and Protection of Privacy Act / Droit à l’information et la protection de la vie privée, Loi sur le—OIC/DC 2010-381—p. 1656 Acts / Lois (August 18 août) Safer Communities and Neighbourhoods Act / Sécurité des communautés et Civil Forfeiture Act / Confiscation civile, Loi sur la—OIC/DC 2010-314— des voisinages, Loi visant à accroître la—OIC/DC 2010-224—p. 1045 p. 1358 (July 14 juillet) (May 19 mai) Clean Environment Act, An Act to Amend the / Assainissement de Safer Communities and Neighbourhoods Act, An Act to Amend the / Sécurité l’environnement, Loi modifiant la Loi sur l’—OIC/DC 2010-220—p. -

Circuit City

Circuit City The objectives of this case are to improve your understanding of capital structure issues and off balance sheet financing, with an improvement in mastery of cash flow analytics and distortions. Barry M Frohlinger Circuit City Stores Case Barry M Frohlinger copyright 2003 www.learnfrombarry.com 1 Circuit City Stores financial statements are attached. In addition, find financial information on Best Buy, Circuit City’s largest competitor. [We will use the competitor information later for analysis]. You should be aware that Circuit City has a credit card operation, managed by its wholly-owned captive bank while Best Buy does not operate a credit card operation. You will use this case to improve your understanding of capital structure issues and off balance sheet financing. A] Comment on the equity structure change of the Company as of January 24, 1997. B] Identify the amount of off-balance sheet financing for the Company. C] Comment on Circuit City's capital structure decision [including debt, equity, securitization and leasing] versus Best Buy. D] Identify the distortions to Cash Flow from Operations due to off-balance sheet financing. E] Build a simple EXCEL model with VLOOKUP to run a synthetic debt rating for Interest Coverage [EBIT/Interest] and Leverage [Debt/Debt + Minority Interest + Equity] Circuit City Stores Case Barry M Frohlinger copyright 2003 www.learnfrombarry.com 2 Circuit City Stores, Inc. was incorporated in 1949. Its retail operations consist of Circuit City Superstores, Circuit City electronics-only stores and mall-based Circuit City Express stores. Certain of Circuit City Stores, Inc. subsidiaries operate CarMax Auto Superstores, a used-and new-car retail business. -

Broadcasting and Telecommunications Legislative Review

BROADCASTING AND TELECOMMUNICATIONS LEGISLATIVE REVIEW APPENDIX 4 TO SUBMISSION OF CANADIAN NETWORK OPERATORS CONSORTIUM INC. TO THE BROADCASTING AND TELECOMMUNICATIONS LEGISLATIVE REVIEW PANEL 11 JANUARY 2019 BEFORE THE CANADIAN RADIO-TELEVISION AND TELECOMMUNICATIONS COMMISSION IN THE MATTER OF RECONSIDERATION OF TELECOM DECISION 2017-56 REGARDING FINAL TERMS AND CONDITIONS FOR WHOLESALE MOBILE WIRELESS ROAMING SERVICE, TELECOM NOTICE OF CONSULTATION CRTC 2017-259, 20 JULY 2017 SUPPLEMENTAL INTERVENTION OF ICE WIRELESS INC. 27 OCTOBER 2017 TABLE OF CONTENTS EXECUTIVE SUMMARY ...................................................................................................................... 1 1.0 INTRODUCTION .......................................................................................................................... 8 1.1 A note on terminology ................................................................................................................ 9 2.0 SUMMARY OF DR. VON WARTBURG’S REPORT ............................................................... 10 3.0 CANADA’S MOBILE WIRELESS MARKET IS NOT COMPETITIVE .................................. 13 3.1 Canada’s mobile wireless market is extremely concentrated in the hands of the three national wireless carriers ........................................................................................................................ 14 3.2 Mobile wireless penetration rates and mobile data usage indicate that the mobile wireless market is not sufficiently competitive...................................................................................... -

An Introduction to Telecommunications Policy in Canada

Australian Journal of Telecommunications and the Digital Economy An Introduction to Telecommunications Policy in Canada Catherine Middleton Ryerson University Abstract: This paper provides an introduction to telecommunications policy in Canada, outlining the regulatory and legislative environment governing the provision of telecommunications services in the country and describing basic characteristics of its retail telecommunications services market. It was written in 2017 as one in a series of papers describing international telecommunications policies and markets published in the Australian Journal of Telecommunications and the Digital Economy in 2016 and 2017. Drawing primarily from regulatory and policy documents, the discussion focuses on broad trends, central policy objectives and major players involved in building and operating Canada’s telecommunications infrastructure. The paper is descriptive rather than evaluative, and does not offer an exhaustive discussion of all telecommunications policy issues, markets and providers in Canada. Keywords: Policy; Telecommunications; Canada Introduction In 2017, Canada’s population was estimated to be above 36.5 million people (Statistics Canada, 2017). Although Canada has a large land mass and low population density, more than 80% of Canadiansi live in urban areas, the majority in close proximity to the border with the United States (Central Intelligence Agency, 2017). Telecommunications services are easily accessible for most, but not all, Canadians. Those in lower-income brackets and/or living in rural and remote areas are less likely to subscribe to telecommunications services than people in urban areas or with higher incomes, and high-quality mobile and Internet services are simply not available in some parts of the country (CRTC, 2017a). On average, Canadian households spend more than $200 (CAD)ii per month to access mobile phone, Internet, television and landline phone services (2015 data, cited in CRTC, 2017a). -

BCE Inc. 2015 Annual Report

Leading the way in communications BCE INC. 2015 ANNUAL REPORT for 135 years BELL LEADERSHIP AND INNOVATION PAST, PRESENT AND FUTURE OUR GOAL For Bell to be recognized by customers as Canada’s leading communications company OUR STRATEGIC IMPERATIVES Invest in broadband networks and services 11 Accelerate wireless 12 Leverage wireline momentum 14 Expand media leadership 16 Improve customer service 18 Achieve a competitive cost structure 20 Bell is leading Canada’s broadband communications revolution, investing more than any other communications company in the fibre networks that carry advanced services, in the products and content that make the most of the power of those networks, and in the customer service that makes all of it accessible. Through the rigorous execution of our 6 Strategic Imperatives, we gained further ground in the marketplace and delivered financial results that enable us to continue to invest in growth services that now account for 81% of revenue. Financial and operational highlights 4 Letters to shareholders 6 Strategic imperatives 11 Community investment 22 Bell archives 24 Management’s discussion and analysis (MD&A) 28 Reports on internal control 112 Consolidated financial statements 116 Notes to consolidated financial statements 120 2 We have re-energized one of Canada’s most respected brands, transforming Bell into a competitive force in every communications segment. Achieving all our financial targets for 2015, we strengthened our financial position and continued to create value for shareholders. DELIVERING INCREASED -

Circuit City Stores, Inc. V. Adams*

RECENT DEVELOPMENTS Circuit City Stores, Inc. v. Adams* I. NTRODUCTION Employers need no longer worry that the arbitration agreements they include in contracts of employment will be subject to attack) In Circuit City v. Adams,2 the Supreme Court definitively stated that the Federal Arbitration Act (FAA)3 covers binding arbitration clauses in employment contracts, even if the clauses require arbitration of statutory claims.4 The FAA 5 was passed in 1925 to legitimize arbitration as a dispute resolution mechanism and to compel parties who have entered into an arbitration agreement, but who attempt to sue, to resolve their disputes through arbitration.6 To ensure continuity in the enforcement of arbitration agreements, the FAA preempts state laws hostile to arbitration.7 Until now, the precise scope of the FAA's coverage of employment contracts was unknown because of the ambiguous language in the statute's section 1 exemption provision. This exemption provision delineates the types of contracts that are not covered by the FAA, causing the arbitration provision within the contract to be unenforceable. Before Circuit City, the debate over FAA coverage of contracts of employment turned on the meaning of the phrase "engaged in commerce" in section 1. Section 1 states, "nothing herein contained shall apply to contracts of employment of seamen, railroad employees, or any other class of ' 8 workers engaged in interstate commerce. With the exception of the Ninth Circuit,9 all federal circuit courts of appeals that have interpreted the FAA's section 1 exemption language have held that it exempts only employment contracts of workers actually engaged in the transport *121 S. -

LG Electronics U.S.A., Inc., Englewood Cliffs, New Jersey, and Zenith

Before the U.S. DEPARTMENT OF COMMERCE NATIONAL TELECOMMUNICATIONS AND INFORMATION ADMINISTRATION Washington, D.C. 20230 In the Matter of ) ) Implementation and Administration of a ) Docket Number Coupon Program for Digital-to-Analog ) 060512129-6129-01 Converter Boxes ) COMMENTS OF LG ELECTRONICS U.S.A., INC. LG Electronics U.S.A., Inc. (“LG Electronics”) hereby submits these comments in response to the Notice of Proposed Rulemaking (“Notice”) released by the National Telecommunications and Information Administration (“NTIA”) on July 25, 2006,1 concerning the agency’s implementation and administration of the digital-to-analog converter box coupon program mandated by the Digital Television Transition and Public Safety Act of 2005 (the “DTV Act”).2 With a firm deadline now in place for full-power television stations to cease analog broadcasting, it is imperative that the coupon program be conducted in a manner that not only minimizes the burden on those consumers requiring converter boxes but also maximizes the number of Americans able to enjoy the benefits of digital technology. In this regard, LG Electronics applauds NTIA for the comprehensive Notice, which obviously recognizes the critical importance of this final component to the nation’s 1 71 Fed. Reg. 42,067 (July 25, 2006) (“Notice”). 2 Deficit Reduction Act of 2005, Pub. L. No. 109-171, § 3005, 120 Stat. 4, 23-24 (2006) (“DTV Act”). transition to digital television (“DTV”) broadcasting. As a long-time leader in DTV technology and public policy matters, LG Electronics is pleased to respond. I. LG Electronics’ Role in the DTV Transition LG Electronics is the world’s leading manufacturer of television sets and the world’s largest manufacturer of flat-panel displays. -

BCE Inc. 2015 Corporate Responsibility Report

MBLP16-006 • BELL • ANNONCE • LET'S TALK • INFO: MJ/KIM PUBLICATION: MÉTRO TORONTO / CALGARY / EDMONTON / VANCOUVER (WRAP C2) • VERSION: ANGLAISE • FORMAT: 10’’ X 11,5’’ • COULEUR: CMYK • LIVRAISON: 18 JANVIER • PARUTION: 27 JANVIER Today put a little into somebody’s day Today is Bell Let’s Talk Day. For every text, mobile or long distance call made by a subscriber*, and tweet using #BellLetsTalk, Bell will donate 5¢ more to mental health initiatives across the country. #BellLetsTalk *RegularBCE long distance and text message charges Inc. apply. bell.ca/letstalk 2015 Corporate MBLP16-006 Let'sTalk_Metro_ENG_WRAP_C2.indd 1 2016-01-08 09:54 Responsibility Report TOC > Alexander Graham Bell was looking for a new way for people to connect across distances. Little did he know his invention would change the world. What Bell started has transformed the way people interact with each other and the information they need to enrich their lives. As the Canadian steward of Bell’s legacy, BCE is committed to deliver those benefits in the most responsible manner possible. TOC < 2 > BCE at a glance BCE at a glance TEAM MEMBERS Bell named one of 82% of employees are proud to Bell increased investment Bell made a voluntary Reduced lost-time accidents Canada’s Top Employers work for Bell in training by 8% per employee $250 million contribution to by 41% for construction teams solidify pension plan building new networks 82% 8% $250M 41% CUSTOMERS Highly efficient self-serve Bell became #1 TV provider Provided 2-hour appointment Extended retail network Broadband fibre and wireless options used 160 million times in Canada with 2.7 million windows to 600,000 Bell Fibe leadership, adding Glentel networks – including largest by customers subscribers customers outlets to bring total to more Gigabit Fibe and 4G LTE than 2,500 across the country wireless – earn #1 ranking in Canada 160M 2.7M 600,000 2,500 No. -

Circuit City to Sell Private-Label Credit Card Operation to Bank One

Circuit City to Sell Private-Label Credit Card Operation to Bank One RICHMOND, Va. and CHICAGO, Jan. 20, 2004 - Circuit City Stores, Inc. (NYSE:CC) has agreed to sell its private-label credit card operation, including both its private-label Circuit City credit card accounts and its co-branded Circuit City Plus Visa credit card accounts, to Bank One Corporation (NYSE:ONE) for the par value of the receivables, and Circuit City and Bank One will enter into an ongoing arrangement under which Bank One will offer private-label and co-branded credit cards to both new and existing customers. As part of the ongoing relationship, Bank One will compensate Circuit City for each new account opened and provide special financing terms for Circuit City customers. The two companies also plan to jointly develop and introduce new features, products and services to drive additional sales at Circuit City. At Nov. 30, 2003, the private-label operation included receivables and related cash reserves of $1.8 billion and approximately 1.5 million active customers. "This sale further simplifies the investment picture for Circuit City shareholders and allows us to focus our attention on the needed improvements in our retail business," said W. Alan McCollough, chairman, president and chief executive officer of Circuit City Stores, Inc. "At the same time, the agreement with Bank One recognizes the strategic importance of the private-label credit programs to our retail success and the need to ensure a seamless transition for our customers. Bank One supports our commitment to superior customer service and will support special promotional financing programs for qualified customers. -

Has the Retail Apocalypse Hit the DC Area?

POLICY BRIEF Has the Retail Apocalypse Hit the DC Area? Leah Brooks, Urbashee Paul and Rachel Shank APRIL 2018 POLICY BRIEF APRIL 2018 | LEAH BROOKS, URBASHEE PAUL AND RACHEL SHANK1 In 1977, the White Flint Mall opened to great acclaim as Maryland’s premier mall, complete with glass elevators, glamorous anchor stores, and an exciting eatery. Now, more than four decades later, White Flint Mall is situated in a sea of empty parking lots. Except for anchor tenant Lord and Taylor, with which the mall owner is in protracted litigation, the mall sits empty. About a decade before White Flint launched, Northern Virginia’s Tysons Corner Center opened, also to acclaim. Tyson’s Corner has seen continued success,2 welcoming Apple’s flagship store in 2001,3 and Spanx’s first brick and mortar store in 2012.4 The promised increase in walkability ushered in by the Silver Line expansion has heralded opportunity for new residential and commercial development.5 To what extent is this divergence due to e-commerce? The Rise of E-commerce Indeed, there is substantial evidence that brick-and-mortar retail is suffering. CNN Money10 reports that 2017 marked E-commerce dates to 1994, when the New York Times the highest number of retail store closure announcements in reported that Philadelphia’s Phil Brandenberger used his history. Within the past year, once-prominent malls in computer to purchase a Sting album. In the following year, New Jersey and Pennsylvania have closed almost 200 Amazon sold its first book, and Pierre Omidyar founded stores. And the wave seems unlikely to be over: Toys R Us Ebay.6 has recently declared bankruptcy, while long-time anchor tenants Sears, Kmart, J.C.