Genting Singapore

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Singapore Supplementary Budget

Singapore Market Focus Singapore Supplementary Budget Refer to important disclosures at the end of this report DBS Group Research . Equity 27 Mar 2020 Unprecedented anti-viral boost STI : 2,487.56 • Dishing out total handouts of S$55bn, a whopping 11% of GDP • Significant cost savings of 4% cushions STI earnings decline to 5% for 2020F Analyst • Booster shot to Aviation-related, hospitality and retail sectors Janice CHUA +65 6682 3692; [email protected] • Key beneficiaries are SATS, SIA Engineering, Genting, Starhub, MINT, Kee Yan YEO, CMT +65 6682 3706; [email protected] UOB, OCBC Andy SIM, CFA +65 6682 3718; [email protected] Dipping into reserves for an unprecedented relief package. The Singapore Research Team; [email protected] government’s relief package of S$48bn is generous and timely, blowing market expectations. Including February’s Care and Share package of Key Indices S$6bn, the total handout of S$55bn represents an unprecedented 11% of Current % Chng GDP, and more than double the relief package of S$20.5bn dished out STI Index 2,487.56 -0.7% during the Global Financial Crisis. Aimed at saving jobs and supporting FS Small Cap Index 244.02 4.5% industries, this will cushion the recessionary impact as Singaporeans brave USD/SGD Curncy 1.43 -0.1% through this dark period. The impact is broad based, benefiting both Daily Volume (m) 445 consumers and corporates. Daily Turnover (S$m) 676 Lifeline for aviation-related and hospitality industries, which are directly hit Daily Turnover (US$m) 473 by COVID-19. The absence of tourists with several countries in lockdown Source: Bloomberg Finance L.P. -

Singapore's Selected Single Stocks

Exchange Partner Singapore’s Selected Single Stocks SSF Strategies On Lion City’s Blue Chips by Tariq Dennison, +852 9476 2868 © 2020 GFM Group Limited, https:://gfmasset.com Image source: https://www.pinterest.com/pin/162129655305421931/?autologin=true Disclaimer This presentation is for educational and discussion purposes only. Nothing in this presentation is to be taken as investment advice, nor as any recommendation to buy or sell any security or investment property or product. Please consult with GFM or your own investment advisors 1-on-1 before making any investment decisions. GFM does NOT provide any tax or legal advice. Tax strategies in this presentation are based on our experience and believed to be current, but please consult with your own tax advisor for tax advice specific to your situation. GFM Group Limited is an SFC Type 9 Licensed Asset Management firm and is not affiliated with any exchange, brokerage firm, or custodian, including the co-presenters of this seminar. GFM Asset Management LLC, an affiliated company, is a US SEC Registered Investment Advisor. Investing involves risks, including the risk that you may lose some or all the money you invest. GFM is not affiliated with Interactive Brokers LLC, or any other FINRA broker-dealer © 2020 GFM Group 2 Disclaimer by SGX This document/presentation has not been prepared by Singapore Exchange Limited (“SGX”) or any of its affiliates (SGX and its affiliates collectively, the “SGX Group Companies”) and the information in this document/presentation has not been verified by any SGX Group Company. No SGX Group Company endorses or shall be liable for the contents of this document/presentation. -

Singapore Stock Pulse

Daily Focus Singapore Stock Pulse Refer to important disclosures at the end of each report DBS Equity Research 23 Jan 2019 Market Cap: US$37,268m | Average Daily Value: US$70.43m Yeo Kee Yan, CMT [email protected] Singapore Research Team Last Traded Price: S$29.99; Price Target: S$33.20 (Upside 10.7%) Sue LinResearch LIM / Rui CallWen Alert LIM Strong• 1Q18;Stock to keep watch: watch Frasers on Centrepoint dividends Trus aheadt: Hungry for more - raised target price to S$2.40 • 1Q18 earnings were in line; topline driven largely from higher NIM; lower trading gains Ideasoffset ofsome the revenues Day • ActionableCredit ideascosts by at our new analysts low ofbased 23bps, on macro, guidance industry at or20 corporate-25bps possibly developments towards the lower end; still some buffers noted under the Expected Credit Losses line for other assets Stocks to Watch Frasers Centrepoint Trust Keppel Infrastructure Trust Mapletree Logistics Trust • BUYPositive outlook ahead, toplineBUY growth supported by lowerBUY credit costs; dividends Last Traded Price: S$2.27 Last Traded Price: S$0.515 Last Traded Price: S$1.34 shouldPrice be Target sustainable (12-mth) at: S$2.40 S$1.00 perPrice year Target and (12 could-mth): headS$0.58 higher Price Target (12-mth): S$1.50 (Prev S$2.35) Upside 12.5% Upside: 11.7% • UpsideMaint: 5.5%ain BUY; TP at S$33.20 (1.5x FY18 BV); higher dividends and lower credit costsHungry are upside for more risks M&A activity drives interest Hitting new heights • 1Q19 DPU of 3.02 Scts • 4Q18 DPU of 0.93Scts • 3Q19 DPU of 2.00 Scts at a Read more..DBS(+0.7%) in Groupline Research. -

DBS Bank Banks, the Positive Impact on NIM Is Likely to Roll in from 2H17

Singapore Market Focus Singapore Strategy Refer to important disclosures at the end of this report DBS Group Research . Equity 17 Mar 2017 STI : 3,163.52 Banking in on Fed rate hikes The Fed forecasts three rate hikes in 2017 and 2018, Analyst Analyst Janice CHUA +65 6682 3692 Yeo Kee Yan CMT +65 6682 3706 reassures on accommodative policy [email protected] [email protected] Favouring stocks with yield and net cash - Genting Derek TAN +65 6682 3716 Sue Lin LIM +65 8332 6843 Singapore, SGX, ComfortDelgro, Sheng Siong, [email protected] [email protected] China Aviation Oil, Singapore O&G, Sunningdale, Fu Key Indices Yu and OKP Current % Chng Expect banks to enjoy visible NIM uptick in 2H – STI Index 3,137.43 -0.2% pick UOB FS Small Cap Index 391.80 -0.4% USD/SGD Curncy 1.41 0.6% Buy property stocks on pullback - Frasers Daily Volume (m) 2,260 Centrepoint Limited and UOL Daily Turnover (S$m) 1,176 Daily Turnover (US$m) 834 Stay selective on S-REITs - Ascendas REIT, Croesus Source: Bloomberg Finance L.P. Retail Trust, Frasers Logistics & Industrial Trust, Keppel DC REIT and Mapletree Commercial Trust Market Key Data Fed’s hike in the price, reassures on accommodative policy. The (%) EPS Gth Div Yield Federal Reserve raised the Fed funds rate by 25bps to 1% last 2016 (5.0) 3.7 night and sounded off another two more this year, in line with 2017F 15.0 3.7 consensus expectations. Financial markets reacted with the yield 2018F 7.4 3.9 on 10-year US Treasury notes falling 9bps to 2.51%. -

How Has Trump Contracting Covid-19 Affected Markets?

SINGAPORE MARKET HOW HAS TRUMP CONTRACTING TRADING MATTERS SERIES: TRADING FLOWS COVID-19 AFFECTED MARKETS? An overview of the performance DIGITAL ENGAGEMENT TEAM of companies in the market 9 OCTOBER 2020 Straits Times Index Key Events Summary 200 Day MA 3,300 100 Day MA 2 Oct 50 Day MA 3,100 Stocks fall following Trump’s 2,900 positive virus test, but close off the 2,700 worst levels on stimulus hopes 5 Oct 2,500 Dow ends 465 09 Oct 2020: 2,300 points higher 2,532.96 after Trump cleared to leave 2,100 hospital after 3- Jan Feb Mar Apr May Jun Jul Aug Sep Oct 14 Oct night stay Singapore 3Q GDP Release Market Commentary 23 Oct • Straits Times Index current price caught between the 50 Day Moving Average (2,519.16) and 100 Day Singapore Sep Moving Average (2,573.17) CPI Release • Singapore’s GDP likely to contract at a slower pace in 3Q as stringent virus curbs were relaxed (09 Oct, Bloomberg) 30 Oct o Estimate -6.4% yoy for 3Q • CMT, CCT unit holders vote in favour of merger to SG Futures Roll form new REIT (30 Sep, The Straits Times) Date o Merger expected effective Oct 21. CCT's last day of trading expected Oct 16. • Wilmar's YKA listing to help fund 19 investment projects in China (07 Oct, The Business Times) 3 Nov o The IPO will raise 13.9b yuan (S$2.8b) US Presidential o Proposed listing slated to take place by mid- Elections Oct, subject to prevailing market conditions Data extractedfromBloomberg asof previous closing unlessotherwisestated Straits Times Index Components: Movers and Laggards TOP PERFORMING SINCE 05 OCTOBER 2020 LAST -

Stoxx® Singapore 75 Index

STOXX® SINGAPORE 75 INDEX Components1 Company Supersector Country Weight (%) Oversea-Chinese Banking Corp. Banks SG 10.52 DBS Group Holdings Ltd. Banks SG 8.74 Singapore Telecommunications L Telecommunications SG 8.24 United Overseas Bank Ltd. Banks SG 7.60 Jardine Matheson Holdings Ltd. Industrial Goods & Services SG 5.93 Wilmar International Ltd. Food & Beverage SG 3.38 Hongkong Land Holdings Ltd. Real Estate SG 3.04 Keppel Corp. Ltd. Oil & Gas SG 2.72 CapitaLand Ltd. Real Estate SG 2.47 Jardine Strategic Holdings Ltd Industrial Goods & Services SG 2.38 Thai Beverage PCL Food & Beverage SG 2.12 Singapore Exchange Ltd. Financial Services SG 2.00 Singapore Press Holdings Ltd. Media SG 1.99 ComfortDelGro Corp. Ltd. Travel & Leisure SG 1.97 Singapore Airlines Ltd. Travel & Leisure SG 1.92 GLOBAL LOGISTIC PROPS Real Estate SG 1.82 Jardine Cycle & Carriage Ltd. Retail SG 1.63 Ascendas Real Estate Investmen Real Estate SG 1.62 Singapore Technologies Enginee Industrial Goods & Services SG 1.52 CAPITALAND MALL TRUST MGMT Real Estate SG 1.51 Genting Singapore PLC Travel & Leisure SG 1.45 Suntec Real Estate Investment Real Estate SG 1.32 City Developments Ltd. Real Estate SG 1.13 UOL Group Ltd. Real Estate SG 0.99 CapitaLand Commercial Trust Real Estate SG 0.96 Golden Agri-Resources Ltd. Food & Beverage SG 0.91 SembCorp Industries Ltd. Oil & Gas SG 0.88 SINGAPORE POST Industrial Goods & Services SG 0.84 MAPLETREE CHINA COMMERCIAL TRU Real Estate SG 0.82 SATS Industrial Goods & Services SG 0.78 Dairy Farm International Holdi Retail SG 0.75 Noble Group Ltd. -

2011 Annual Report

GENTING SINGAPORE PLC CONTENTS THE GENTING STORY GENTING SINGAPORE 4 CHAIRMAN’S STATEMENT The multinational corporation known as the Genting Group For 25 years, the Company and its subsidiaries (collectively, the of companies began from humble beginnings in 1965. “Group”) have been at the forefront of gaming and integrated A contractor who spoke no English, but only Hokkien, Mandarin, resort development in Australia, the Bahamas, Malaysia, the Malay and Cantonese, the late Tan Sri Lim Goh Tong built his Philippines and the United Kingdom. Today, it is best known for 6 2011 - ENDLESS FUN & CELEBRATION AT RWS business empire with simple principles: humility, discipline and its flagship project, Resorts WorldTM Sentosa (“RWS”), which is conviction. one of the largest fully integrated destination resorts in South East Asia. The self-proclaimed “Chinaman Businessman’’ was ahead of his 8 BOARD OF DIRECTORS time in many ways. He adopted environmental measures, built The Company is listed on the Main Board of the Singapore an integrated resort at Genting Highlands and executed his own Exchange Securities Trading Limited. As at 20 February 2012, succession plan in 2003, when he handed the chairmanship of the the Company had a market capitalisation of S$20.6 billion and 10 MANAGEMENT & CORPORATE INFORMATION Genting Group to his son Tan Sri Lim Kok Thay. ranks among Singapore’s 10 largest companies by market capitalisation. Tan Sri Lim Kok Thay has since taken the company to greater heights with a successful overseas strategy. The Genting Group 11 FINANCIAL HIGHLIGHTS has won international awards for its management leadership, financial prudence and sound investment discipline. -

Jonathan Asherson Joins Sembcorp Industries Board As Independent Director

PRESS RELEASE JONATHAN ASHERSON JOINS SEMBCORP INDUSTRIES BOARD AS INDEPENDENT DIRECTOR SINGAPORE, July 14, 2017 – Sembcorp Industries is pleased to announce the appointment of Jonathan Asherson OBE as an independent director on its board with effect from July 17, 2017. Mr Asherson is Non-executive Chairman of Rolls-Royce Singapore. He brings to the Sembcorp Industries board rich experience in regional strategy and business, as well as in the power and engineering industries. In the course of Mr Asherson’s career, he has been regional director for ASEAN and the Pacific at Rolls-Royce, held positions in Siemens’ industrial power business in China, Malaysia, Germany and the USA, and served as the former president of the British Chamber of Commerce. Mr Asherson is Chairman of the Singapore International Chamber of Commerce, a director of Genting Singapore and an advisory board member of the UK Department for International Trade (Southeast Asia). He is also a council member of the Singapore National Employers’ Federation, an advisor to the Singapore Institute of International Affairs and an advisory committee member for various educational and research institutes in Singapore and the UK. He was appointed as an Officer of the Most Excellent Order of the British Empire (OBE) in 2007 and was awarded the Public Service Medal (Friends of Singapore) at Singapore’s National Day Awards in 2010. Mr Asherson holds a BSc (Hons) degree in Mechanical Engineering from Kingston University and is a chartered engineer. For further details of Mr Asherson’s particulars, please refer to the company’s separate release set out in accordance with the SGXNet Template for the “Appointment of Independent Director”. -

2009 Annual Report

GENTING SINGAPORE PLC 2009 ANNUAL REPORT 2009 ANNUAL REPORT GENTING SINGAPORE PLC (Incorporated in the Isle of Man with Limited Liability No.003846V) ANNUAL REPORT HEAD OFFICE SINGAPORE UNITED KINGDOM 9 Penang Road Resorts World at Sentosa Pte Ltd Genting UK Plc #13-10 Park Mall 8 Sentosa Gateway, Sentosa, Singapore 098269 Circus Casino, Star City, Watson Road, Singapore 238459 Birmingham, B7 5SA, United Kingdom Correspondence address: 39 Artillery Avenue, Sentosa, Singapore 099958 T: +65 6823 9888 T: +65 6577 8888 T: +44 121 325 7760 F: +65 6823 9878 F: +65 65778890 F: +44 121 325 7761 www.gentingsingapore.com www.rwsentosa.com www.gentinguk.com GENTING SINGAPORE PLC (Incorporated in the Isle of Man with Limited Liability No. 003846V) GENTING SINGAPORE PLC We are a global gaming company and one of the worldʼs leading integrated resorts specialists. OUR VISION To be the brand leader in Integrated Resorts destinations. OUR MISSION To provide the most memorable guest experience with innovative and differentiated products and services. CONTENTS Page Page Genting Singapore / Our Mission Financial Statements: Corporate Profile 1 Consolidated Statement of Comprehensive Income 36 Bringing You The Best 2 Statements of Financial Position 37 Genting Premier Brands 3 Consolidated Statement of Cash Flows 38 Corporate Diary 4 Notes To The Financial Statements 40 Corporate Information 5 Independent Auditorʼs Report 80 Directorsʼ Profile 6 Analysis of Shareholdings 81 Senior Management Team 8 Group Offices Chairmanʼs Statement 10 Review of Operations 20 Corporate Social Responsibility 26 Corporate Governance 29 Report of the Directors 33 Cover & Photos The cover depicts the presence of Genting Singapore as a leading global gaming company and one of the worldʼs leading integrated resorts specialists. -

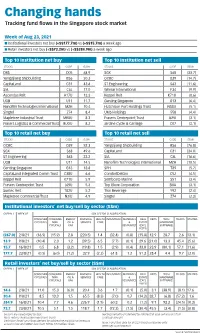

Changing Hands Tracking Fund Flows in the Singapore Stock Market

Changing hands Tracking fund flows in the Singapore stock market Week of Aug 23, 2021 I Institutional investors net buy (+S$177.7m) vs (+S$15.7m) a week ago I Retail investors net buy (+S$73.2m) vs (+S$384.9m) a week ago Top 10 institution net buy Top 10 institution net sell STOCKS CODE (S$M) STOCKS CODE (S$M) DBS D05 68.9 SGX S68 (33.7) Yangzijiang Shipbuilding BS6 50.3 OCBC O39 (14.7) CapitaLand C31 43.6 ST Engineering S63 (11.6) SIA C6L 17.0 Wilmar International F34 (9.9) Ascendas Reit A17U 13.3 Keppel Reit K71U (8.6) UOB U11 11.7 Genting Singapore G13 (6.4) Nanofilm Technologies International MZH 10.4 Hutchison Port Holdings Trust NS8U (5.1) Singtel Z74 8.4 UMS Holdings 558 (4.4) Mapletree Industrial Trust ME8U 8.3 Frasers Centrepoint Trust J69U (3.1) Frasers Logistics & Commercial Trust BUOU 8.2 Jardine Cycle & Carriage C07 (3.1) Top 10 retail net buy Top 10 retail net sell STOCKS CODE (S$M) STOCKS CODE (S$M) OCBC O39 52.3 Yangzijiang Shipbuilding BS6 (76.8) SGX S68 49.6 CapitaLand C31 (34.0) ST Engineering S63 22.2 SIA C6L (16.6) UOB U11 14.5 Nanofilm Technologies International MZH (10.5) Genting Singapore G13 13.8 SPH T39 (5.7) CapitaLand Integrated Comm Trust C38U 6.6 ComfortDelGro C52 (4.5) Keppel Reit K71U 5.9 Sembcorp Marine S51 (3.4) Frasers Centrepoint Trust J69U 5.3 Top Glove Corporation BVA (3.1) Suntec Reit T82U 5.2 Thai Beverage Y92 (2.4) Mapletree Commercial Trust N2IU 4.9 Singtel Z74 (2.3) Institutional investors’ net buy/sell by sector (S$m) OVERALL WEEK OF SGX SECTOR CLASSIFICATION CONSUMER CONSUMER ENERGY FINANCIAL -

2012 Annual Report

THE GENTING STORY The multinational corporation known as the Genting Group of companies started from humble beginnings in 1965. A contractor who spoke no English, but only Hokkien, Mandarin, Malay and CONTENTS Cantonese, the late Tan Sri Lim Goh Tong built his business empire with simple principles: humility, discipline and conviction. The self-proclaimed “Chinaman Businessman’’ was ahead of his time in many ways. He adopted 4 CHAIRMAn’S StatemeNT environmental measures, built an integrated resort at Genting Highlands and executed his own succession plan in 2003, when he handed the chairmanship of the Genting Group to his son Tan Sri Lim Kok Thay. 6 2012 MILESTONES Tan Sri Lim Kok Thay has since taken the company to greater heights with a successful overseas strategy. The Genting Group has won international awards for its management leadership, financial 8 BOARD OF DIRECTORS prudence and sound investment discipline. It is also a corporation that values its employees and gives back to the communities where it operates. 10 MANAGEMENT & CORPOrate INFOrmatiON GENTING SINGAPORE 11 FINANCIAL HIGHLIGHTS For over 25 years, the Company and its subsidiaries (collectively, the “Group”) have been at the forefront of gaming and integrated resort development in Australia, the Bahamas, Malaysia, the ™ Philippines and the United Kingdom. Today, it is best known for its flagship project, Resorts World 12 CORPOrate SOCIAL RESPONSIBILITY Sentosa, which is one of the largest fully integrated destination resorts in South East Asia. The Company is listed on the Main Board of the Singapore Exchange Securities Trading Limited. As at 31 December 2012, the Company had a market capitalisation of S$16.9 billion and ranks among 14 YEAR IN REVIEW Singapore’s largest companies by market capitalisation. -

Board of Directors

Sembcorp Annual Report 2017 SIZE: 210X 297Hmm SY1800851_18-006_ ISO39L GP1B-NCL Sembcorp Annual Report 2017 SIZE: 210X 297Hmm SY1800851_18-006_ ISO39L GP1B-NCL Our Leadership Board of Directors Ang Kong Hua Neil McGregor Margaret Lui Tan Sri Mohd Hassan Marican Chairman Group President & CEO Non-executive & Non-independent Director Non-executive & Independent Director Non-executive & Independent Director Appointed April 1, 2017 Appointed June 1, 2010 Appointed June 16, 2010 Appointed February 26, 2010 As Chairman, Mr Ang is responsible for Mr McGregor is Group President & CEO of Mrs Lui is a member of the board’s Executive Tan Sri Mohd Hassan Marican serves on the leading the board, setting its agenda and Sembcorp Industries. He is a member of the Committee, Executive Resource & board’s Executive Resource & Compensation ensuring its effectiveness in all aspects of its board’s Executive Committee and Technology Compensation Committee, as well as its Committee and Nominating Committee. role. Mr Ang heads the board’s Executive Advisory Panel. He also sits on the board of Nominating Committee. He is Chairman of Sembcorp Marine, a listed Committee, Executive Resource & Sembcorp Marine, a listed subsidiary of subsidiary of Sembcorp Industries. She is Chief Executive Officer and a board Compensation Committee, Nominating Sembcorp Industries, as a non-executive director. member of Azalea Investment Management. Formerly President & CEO of Malaysia’s Committee and Technology Advisory Panel. Mr McGregor brings to Sembcorp a unique In addition, Mrs Lui is a member of the Petroliam Nasional (PETRONAS) from 1995 A well-known corporate figure in Singapore, and varied background spanning business, Singapore Exchange’s (SGX) listings advisory until his retirement in February 2010, Tan Sri Mr Ang brings to Sembcorp many years of rich operations and investment in the energy and committee.