ANNUAL REPORT 2018 Results Strategy Operations Sustainability Governance & Risk Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Finnish Shopping Centers 2020 Centers Shopping Finnish Finnish Councilfinnish of Shopping Centers • Suomen Kauppakeskusyhdistys Ry

Succesful and evolving shopping center business – the beating heart of community! Menestyvä ja kehittyvä Finnish Shopping Centers 2020 kauppakeskusliiketoiminta – yhdyskunnan sykkivä sydän! Kauppakeskukset Finnish Council of Shopping Centers Annankatu 24, 2. krs. 00100 Helsinki puh. +358 9 4767 5711 www.kauppakeskusyhdistys.fi Finnish Shopping Centers 2020 Centers Shopping Finnish Kauppakeskukset Finnish Shopping Centers 2014 Centers Shopping Finnish Kauppakeskukset www.kauppakeskusyhdistys.fi Finnish Council of Shopping Centers • Suomen Kauppakeskusyhdistys ry Finnish Shopping Centers 2020 Kauppakeskukset 4 5 Introduction The Finnish Shopping Centers 2020 industry review transparency and knowledge of the sector among they are conveniently accessible. The business mix centers is as part of a community structure which is compiled by the Finnish Council of Shopping investors, customers, traders, and the main stake- changes constantly according to customer needs. is conveniently accessible. The key is to create rele- Centers. It provides a package of information on holders in the sector, both in Finland and abroad. Business proprietors are able to operate in an eco- vant spaces for people and to provide a community shopping centers for everyone interested in the logically and socially responsible way. The shopping hub. The ongoing trend is to provide non-retail uses sector. This is already the fourteenth annual review. Shopping centers are adapting to center business in Finland has reached its 30-year by increasing leisure in shopping centers and also Shopping Centers 2020 contains key figures about continuous change anniversary. It is not yet a mature sector, but it is in town centre regeneration. The mixed-use town the business sector as well as standardised intro- an area with continuous development. -

KTI Market Review Spring 2019

KTI Market Review Spring 2019 The invested real estate market continues to grow Property transactions volume remains high Rental growth slowing down in the commercial property market Residential rents continue to increase KTI Market Review Spring 2019 Property transaction volume remains high in Finland. Investor interest is targeted at all sectors and regions. Foreign investor interest remains strong, but domestic players are also active in the transactions market. Strong investor demand and high development volumes contribute to the growth of the invested market. After a short break late in 2018, property yields have continued to compress. During the first quartile of 2018, transactions of the very best properties in the Helsinki CBD have been carried out at record low level yields. In addition to the Helsinki metropolitan area, yields have also decreased in the Tampere and Turku regions. Going forward, construction volumes are expected to decrease from their current high levels. However, commercial property stock continues to increase, as ongoing projects are completed in 2019 and 2020. In residential property development, the decrease in investor demand is slowing down the volumes from their record-high levels of 2018. Despite the decline, residential property construction volumes are expected to remain healthy. In the commercial property rental markets, the strong demand of the previous years is expected to slow down. In the Helsinki CBD, office rents continue to increase, but at a slower pace than in 2017 and 2018. The outlook in the retail market remains more negative, and rents are expected to remain stable in the best areas in Helsinki but to decrease in all other areas. -

Executive Directors Remuneration Rose in Both the Bel 20 and in the Bel Mid, with Bel Mid Directors Seeing a Greater Growth in Average Remuneration

2018 Belgium Spencer Stuart Board Index 2018 belgium spencer stuart board index 1 header (section title) — (remove when section header present) About Spencer StuArt At Spencer Stuart, we know how much leadership matters. We are trusted by organizations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results through the collaborative efforts of a team of experts — now spanning 57 offices, 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assess- ment and many other facets of organizational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2018 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 2 spencer stuart Contents 3 Foreword 4 HigHligHtS 6 in tHe SpotligHt: in tHe new -

Employees 18

This document has been translated from the original document in Japanese (”Yukashouken Houkokusho”), which is legally required for Recruit Holdings as a listed company in Japan to support investment decisions by providing certain information about the Company for the fiscal year ended March 31, 2021 (“FY2020”), under Article 24, Paragraph 1 of the Financial Instruments and Exchange Act of Japan. The Japanese original document was filed to the Director-General of the Kanto Local Finance Bureau in Japan on June 18, 2021. Please refer to “Note Regarding Reference Translation” below as a general warning for this translation document. Document Name Annual Report translated from Yukashouken Houkokusho Filing Date June 18, 2021 Fiscal Year FY2020 (From April 1, 2020 to March 31, 2021) Company Name in English Recruit Holdings Co., Ltd. Title and Name of Hisayuki Idekoba Representative President, CEO and Representative Director of the Board Address of Head Office 8-4-17 Ginza, Chuo-ku, Tokyo, Japan (The above address is a registered headquarters. Actual headquarters operation is conducted in the Contact Location below) Telephone Number +81-3-6835-1111 Contact Person Junichi Arai Corporate Executive Officer Contact Location 1-9-2 Marunouchi, Chiyoda-ku, Tokyo, Japan Definition of Abbreviations In this document, the terms the “Company,” “Recruit Group,” “we,” and “our” refer to Recruit Holdings Co., Ltd. and its consolidated subsidiaries unless the context indicates otherwise. The “Holding Company” refers to Recruit Holdings Co., Ltd. (“Recruit Holdings”) on a standalone basis. The Company’s fiscal year starts on April 1 and ends on March 31 of each year. Accordingly, “FY2020” refers to the period from April 1, 2020 to March 31, 2021. -

Our Business Evolution OUR BUSINESS EVOLUTION / PERFORMANCE HIGHLIGHTS / OUR GROUP STRUCTURE

AT A GLANCE Our Business Evolution OUR BUSINESS EVOLUTION / PERFORMANCE HIGHLIGHTS / OUR GROUP STRUCTURE The 59 Years of Our Corporate History FY2018 Consolidated Revenue 2,310.7bn yen Business fields expansion Digital transformation Globalization Recruit Group was founded in 1960 as a small Recruit Group began using computers at a time In the 2000s, Recruit Group entered the global advertising agency specializing in university when their use was still limited, putting digitization market with a bridal business in China. Although newspapers. Two years later, we published our into practice for increased efciency. Following the this ended as a withdrawal, the failure helped “Invitation to Companies,” a collection of job listings introduction of a supercomputer in the 1980s, we us to shape our mergers and acquisitions (M&A) for university students, through which we established transitioned from paper magazines to online media strategy, and we later succeeded in expanding our business model referred to as the “Ribbon in the 1990s, and then to mobile platforms. Not in the US, Europe, Australia and beyond. The 46% Model.” Since then, we have widened our range of only did this allow for faster and more convenient acquisitions of Indeed in 2012 and Glassdoor in Overseas HR business, while also expanding into the life events delivery of information, but it also transformed how 2018 have led to the successful establishment of feld, including education, housing, automobiles, individual users and enterprise clients interact, our HR Technology business, spearheading the bridal, and the lifestyle feld including travel, dining, through the development of groundbreaking tools growth of the Group as a whole and bringing the and beauty. -

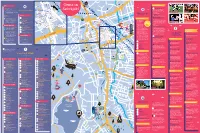

HELSINKI Key Retail Areas & Streets

GLOBAL CITIES RETAIL GUIDE HELSINKI Key Retail Areas & Streets MARKET OVERVIEW Data as of August 2012 KEY AREAS/ CONSUMER MAJOR RETAILERS NEW TYPICAL RENT RANGE OF STREETS/SHOPPING PROFILE PRESENT ENTRANTS FOR UNIT OF 200 UNIT SIZES CENTERS SQM High street district Local shoppers, Stockmann, H&M, Aleksi 13, Kluuvi, Kämp Galleria, Karen Millen, Filippa K, 100-180€/sqm/month 20-3,500 sqm tourists, business Zara, Louis Vuitton, Marimekko French Connection, Tiger (Stockmann density of Sweden department store 50 000 sqm) Kamppi Local shoppers, Bestseller (different stores), Mango, Guess, United Seppälä, Gant 30-170 €/sqm/month 20-1,500 sqm commuters Colors of Benetton, Sisley, Esprit, Brothers, Anttila, Clas Ohlson, Nike, Lidl Forum Local shoppers H&M, Intersport, Lindex, Seppälä, Nilson Shoes, Cubus 80-120 €/sqm/month 10-3,000 sqm Gina Tricot City-Center Local shoppers, Aleksi 13, Gina Tricot, Bestseller (Jack & Jones, Promod, Hard Rock Café, 40-120€/sqm/month 30-1,500 sqm commuters Vero moda), Angry Birds Shop Itis (Shopping Centre) Shoppers from Stockmann, Anttila, Zara, Stadium, H&M New Yorker 30-120 €/sqm/month 10-4,000 sqm* nearby areas Jumbo (Shopping Cen- Family shoppers Prisma, K-Citymarket (Hypermarkets), Stockmann, Core Lifestyle (Apple 30-120 €/sqm/month 10-4,000 sqm* tre) from surrounding H&M, Anttila, Zara, Stadium, Intersport, DinSko Premium Reseller), areas Bottega Verde Sello (Shopping Centre) Local Shoppers, Prisma, K-Citymarket (Hypermarkets), Lidl, Promod 45-55 €/sqm/month 30-3,000 sqm* commuters, Aleksi 13, H&M, Halonen, Clas Ohlson, Stadium, business density Intersport, Esprit, Gant Iso Omena Local Shoppers Prisma, K-Citymarket (Hypermarkets), H&M, Cubus, Guess 35-100 €/sqm/month 30-1,000 sqm* Lindex, Seppälä, Stadium, Specsavers, Sats *excluding hypermarkets CUSHMAN & WAKEFIELD. -

Gems in Seinäjoki

4 <- Vaasa 34 Y Valtionkatu stie 3 ga X Ä 10 en CULTURE, MUSEUMS INFO R Puskantie Gems in C 59 Kokkola -> Vaasantie 6 Emergency 50 A3 Seinäjoki City Theatre Koskenalantie 18 Z Awarded as the 2015 Theater of On call between 8am–8pm, Accommodation CITY CENTER 28 T Seinäjoki the Year. Versatile repertoire. Also p. +358 (0)6 425 5311 Koulukatu 6 58 39 has a lunch restaurant in gorgeous At nighttime between 8pm–8am, 33 surroundings. SJK SEINÄJOEN PALLOKERHO PAUKANEVA p. +358 (0)6 415 4555 22 70 Maamiehenk. Alvar Aallon katu 22 30 72 12 53 62 What to do Keskuskatu -> 37 Seinäjoki City Orchestra Police HOTELS 5 Juhonkatu 4 18 16 <- Kauhajoki Follow the repertoire at www.skor.fi 71 66 49 31 24 Sammonkatu 64 3 D Provincial museum of Tourist information 1 Scandic Seinäjoki <- Kalevankatu55 1 21 19 South Ostrobothnia South Ostrobothnia Tourist Kauppakatu 10 69 AALTO-CENTRE Porvarink. 56 A versatile and extensive museum Service Ltd. Located in the 13 15 6014 67 POHJA 2 Hotel Fooninki area located in the beautiful park area Travel Center (Matkakeskus) 61 1 Verkatehtaankatu 40 DAP The administrative Kaarretie 4 19 52 Ruukintie of Törnävä. The permanent exhibition premises 50 1 Valtionkatu and cultural center SQUASH & BOWLING CENTER THE DUDESONS ACTIVITY PARK 42 in the stone barn is about the past p. +358 (0)6 420 9090 3 Hotel-Restaurant Alma Kutojankatu of Seinäjoki is F 29 and present of Seinäjoki and the Ruukintie 4 20 Kauppakatu 67-> 48 one the most 32 57 Kulmak. substantial works province. -

Press Release

PRESS RELEASE Wereldhave sells Itis and exits Finland Wereldhave has reached agreement to sell the Itis shopping centre in Helsinki to a fund advised by Morgan Stanley Real Estate Investing (MSREI). With this transaction, Wereldhave has made a large step in realising its strategic agenda to focus on convenience centres, whilst improving its risk profile and strengthening the balance sheet. The net price for the shopping centre including the deferred tax liability amounts to € 450m. This reflects a gross price of € 516 million which is 8.5% below the book value at 30 June 2018. The transaction is scheduled for December 2018, subject to completion of the Finnkino development project and antitrust approval. After completion, Wereldhave’s portfolio will be strongly focused on one asset class, with 29 convenience shopping centres in Belgium (7), France (6) and the Netherlands (16). As Itis accounted for 15% of the portfolio, the single asset exposure will decrease to 7%, which improves the risk profile of the Company. Once the disposal of Finland is completed, the LTV is expected to drop by 6%, thus significantly improving the capital structure of Wereldhave. As a result of the completion of the transaction and the associated loss of rental income in December, Wereldhave expects the direct result for 2018 to be between € 3.30 and € 3.35 per share (previously € 3.33 and € 3.38). The dividend can and will be maintained at the current level of € 2.52 in respect of 2018 and 2019. PRESS RELEASE, 18 October 2018 Conference call / webcast Wereldhave will host a brief presentation on this transaction at 10:30 AM CET today through a conference call and webcast. -

Häiriöiden Vähentäminen Kauppakeskuksissa

Häiriöiden vähentäminen kauppakeskuksissa Kiira Hartonen 2019 Laurea Laurea-ammattikorkeakoulu Häiriöiden vähentäminen kauppakeskuksissa Kiira Hartonen Turvallisuusalan koulutusohjelma Opinnäytetyö Toukokuu, 2019 Laurea-ammattikorkeakoulu Tiivistelmä Turvallisuusalan koulutusohjelma Tradenomi (AMK) Hartonen, Kiira Häiriöiden vähentäminen kauppakeskuksissa Vuosi 2019 Sivumäärä 61 Suomen kauppakeskuksissa asioi vuosittain yli 400 miljoonaa kävijää. Samaan aikaan kun kävi- jämäärät ovat kasvaneet ja palvelut monipuolistuneet, myös huumeidenkäyttö on lisääntynyt Suomessa. Lisäksi perättömät huhut leviävät sosiaalisessa mediassa nopeammin kuin koskaan aikaisemmin. Nämä tuovat uudenlaisia haasteita kauppakeskuksille: mikäli kauppakeskuksessa ei osata puuttua häiriöihin ja ennaltaehkäistä niitä tehokkaasti, se saattaa aiheuttaa merkit- tävää haittaa maineelle ja liiketoiminnalle. Opinnäytetyön tarkoituksena on tuottaa kauppakeskuksille ja toimeksiantajalle eli Suomen Kauppakeskusyhdistys ry:lle tietoa siitä, miten ihmisten aiheuttamia häiriöitä voidaan vähen- tää kauppakeskuksissa. Toimintaympäristön hahmottamiseksi selvitettiin, millaisia häiriöitä kauppakeskuksissa esiintyy, miten ne vaikuttavat kauppakeskusten maineeseen ja mikä ai- heuttaa epäsosiaalista käyttäytymistä. Kaikki kauppakeskuksissa häiritseväksi koettu käyttäy- tyminen ei täytä minkään rikoslakirikoksen tai rikkomuksen tunnusmerkistöä, joten niiltä osin häiriöihin puuttumisen oikeutusta tarkasteltiin perusoikeuksien ja muun lainsäädännön näkö- kulmasta. Tutkimus toteutettiin -

Toimitilat.Fi Esite, 10638583, Itäkatu 1, 00930 Helsinki, Toimistotilaa 7

Toimitilaa Itäkatu 1, 00930 Helsinki Vuokrataan 22 m2 työhuone ja 7 m2 työhuone Maksutta käytössä vuonna 2018 remontoidut yhteiset tilat Keittiö WC-tilat 2 neuvottelutilaa Tilatyyppi Toimistotilaa 7 - 22 m² Yhteensä 7 - 22 m² Tilan tarjoaja Itis Shopping Centre p. 358 40 707 9589, p. +358 40 775 7199 [email protected] https://www.itis.fi/fi/yrityksille/toimistotilat Kohdenumero: 10638583 © 2021 Toimitilat.fi Sivu 1/30 Lisätiedot Toimitilaa Itäkatu 1, 00930 Helsinki Kiinteistö Kauppakeskus Itis Pysäköinti Maksuton asiakaspysäköinti 5 tuntia. Henkilökunnan pysäköintiluvalla maksuton pysäköinti 24 tuntia. Palvelut Itiksen kattavat palvelut, mm. 24/7 Turvavalvomo, Info-piste kauppakeskuksen aukioloaikoina, kymmeniä ravintoloita ja kahviloita. Kokoustiloja pieniin ja suuriin tilaisuuksiin. Mahdollisuus tavoittaa kustannustehokkaasti Itiksessä vierailevat ~50 000 asiakasta per päivä. Paljon henkilöstöetuja, mm. alennuksia Itiksen myymälöissä, vuosittainen henkilökuntajuhla. Kulkuyhteydet Oma metro- ja bussiasema. Maksuton pysäköinti, sijainti itäväylän ja Keha I:sen risteyskohdassa. Kohdenumero: 10638583 © 2021 Toimitilat.fi Sivu 2/30 Liite 1 Toimitilaa Itäkatu 1, 00930 Helsinki Tervetuloa Itikseen! Kohdenumero: 10638583 © 2021 Toimitilat.fi Sivu 3/30 Liite 2 Toimitilaa Itäkatu 1, 00930 Helsinki Avautui 1984 120+ myymälää Laajennukset 1992 & 2001 40+ ravintolaa 120 M€ uudistus 2011-14 50+ palvelua Finnkino IMAX Cinema ja 9000 m2 toimistotilaa ravintolauudistus 2018 Stockmann tavaratalo Lidl & S-Market sekä useita erikoisruokakauppoja Oma metro -

Annual Report 2020 Annual Report 2020

Annual Report 2020 Annual Report 2020 Table of contents 10 Years Aperam Journey 4 Message from the Chairman of the Board of Directors 5 Message from the Chief Executive Officer 7 Glossary 9 Management Report 11 Group overview 11 Introduction 11 Business model: how we create value 12 Our history 13 Our operational organisation and facilities 13 Market analysis 17 Market environment 17 Competition 19 Developments regarding trade measures 20 Raw materials and energy 28 Impact of exchange rate movements 29 COVID-19: health and safety, business and accounting review 30 Operational review and liquidity 32 Operational Review 32 Liquidity 39 A strong focus on self-help measures 46 Principal strengths and risks 49 Principal strengths 49 Principal risks and uncertainties related to the Company and the stainless steel and specialty industry 53 Corporate responsibility and Governance 56 Social responsibility 56 Corporate Governance and stakeholder relationships 58 Corporate citizenship 59 Composition of the Board of Directors 61 Composition of the Leadership Team 66 Corporate governance practices 70 Luxembourg Takeover law disclosure 80 Articles of association 82 Compensation 83 Remuneration Policy 83 Remuneration Report 92 Business ethics 97 Environmental responsibility 100 Share capital 104 2 Annual Report 2020 Related Party Transactions 106 Shareholder information 108 Financial Statements 2020 111 Responsibility statement 113 Consolidated Financial statements as of and for the year ended December 31,2020 114 Annual Accounts of the Parent Company as of and for the year ending December 31, 2020 193 Proposed allocation of the 2020 results 215 Disclaimer - Forward Looking Statements In this Annual Report Aperam has made certain forward-looking statements with respect to, among other topics, its financial position, business strategy, projected costs, projected savings, and the plans and objectives of its management. -

Citycon Annual Report 2007 Annual Report Citycon Business and Property Portfolio

Pohjoisesplanadi 35 AB Tel. +358 9 680 36 70 www.citycon.fi FI-00100 Helsinki, Fax +358 9 680 36 788 [email protected] Finland Annual Report 2007 Contents 2007 Citycon in Brief .....................................................................................................................................1 Citycon as an Investment and Information for Shareholders .............................2 CEO’s Review ...........................................................................................................................................4 Business Environment .....................................................................................................................6 Citycon Annual Report Annual Report Citycon Business and Property Portfolio ...............................................................................................9 Finland ....................................................................................................................................................27 Sweden ...................................................................................................................................................30 Baltic Countries ................................................................................................................................32 Human Resources ...........................................................................................................................34 Profit Performance and Financial Position ..................................................................37