CC-40 Sequence No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AIR Guard Albion College American Honors at Ivy Tech Community

AIR Guard Indiana College of Sports and Medical Massage Saint Louis University Albion College Indiana State University Saint Mary's College American Honors at Ivy Tech Community College Indiana Tech Salem International University American National University Indiana University Kokomo Samford University Ancilla College Indiana University School of Social Work Savannah State University Anderson University Indiana University-Purdue University Fort Wayne School of Advertising Art Augustana College Indiana Wesleyan University Simmons College of Kentucky Aviation Technology Center ISM College Planning Smith College Baldwin Wallace University IU Bloomington Southern Illinois University Carbondale Ball State University IU Kelley School of Business Indianapolis Taylor University Boyce College (Southern Baptist Theological IUPUI The Art Institutes Seminary) IUPUI Army ROTC The University of Alabama Bradley University IUPUI, Herron School of Art and Design The University of Toledo Brescia University Kendall College of Art & Design Tougaloo College Butler University Kettering University Transylvania University Central Michigan University Lawrence University Trine University Cleveland State University Lourdes University United States Air Force Columbia College in Missouri Loyola University Chicago University of Cincinnati Concordia University Chicago Marian University University of Indianapolis Denison University Miami University University of Kentucky DePauw University Michigan Technological University University of Louisville Dominican University -

2020-2021 College & Post-Secondary Services for Persons with Disabilities in Indiana

COLLEGE AND POST-SECONDARY SERVICES FOR PERSONS WITH DISABILITIES IN INDIANA 2020-2021 EDITION Revised for: Indiana Department of Education by: IN*SOURCE (Indiana Resource Center for Families with Special Needs) 1703 South Ironwood Drive South Bend, Indiana 46613 (574) 234-7101, (800) 332-4433 FAX: (574) 234-7279 Email: [email protected] Website: www.insource.org NOTE: Information provided was self-reported by the colleges and universities. All information is believed to be correct at time of reporting, but is subject to change. Indiana Department of Education and IN*SOURCE do not endorse or recommend colleges and universities. Verify all particulars and information with college or university prior to registering. Ancilla College Ancilla College is committed to ensuring equal Kristen Robson, BCBA educational access and opportunities to qualified ADA Coordinator students with documented disabilities who wish to PO Box 1 receive accommodations. Accommodations are 9601 South Union Road awarded on a case by case basis depending on the Donaldson, IN 46513-0001 documentation received. Ancilla also offers 574-936-8898 ext. 364 developmental courses in reading, writing, and math 574-935-1773 (fax) to help enhance college readiness. Additional Email: [email protected] academic supports available to students free of Website: https//www.ancilla.edu charge include access to both a Writing Lab, and a Math Lab. Ancilla College also has a Center for Student Achievement which can provide services such as peer tutoring for all courses offered at Ancilla, as well as one-on-one assistance with time- management, organization, and study skills. Ancilla College supports a program specific for students diagnosed with Autism Spectrum Disorder (ASD) called the Autism Program at Ancilla College (APAC). -

AIR Guard Albion College American Honors at Ivy Tech Community

AIR Guard Indiana Army National Guard Rose-Hulman Albion College Indiana State University Saint Louis University American Honors at Ivy Tech Community College Indiana Tech Saint Mary's College American National University Indiana University Kokomo Salem International University Ancilla College Indiana University School of Social Work Samford University Anderson University Indiana University-Purdue University Fort Wayne Savannah State University Augustana College Indiana Wesleyan University School of Advertising Art Aviation Technology Center ISM College Planning Simmons College of Kentucky Baldwin Wallace University IU Bloomington Smith College Ball State University IU Kelley School of Business Indianapolis Southern Illinois University Carbondale Boyce College (Southern Baptist Theological IUPUI Taylor University Seminary) IUPUI Army ROTC The Art Institutes Bradley University IUPUI, Herron School of Art and Design The University of Alabama Brescia University Kendall College of Art & Design The University of Toledo Butler University Kettering University Tougaloo College Central Michigan University Lawrence University Transylvania University Cleveland State University Lourdes University Trine University Columbia College in Missouri Loyola University Chicago United States Air Force Concordia University Chicago Marian University University of Cincinnati Denison University Miami University University of Indianapolis DePauw University Michigan Technological University University of Kentucky Dominican University Midwest Technical Institute University -

College Incentives Guide

Using the 21st Century Scholarship INDIANA’S 21st CENTURY SCHOLARS COLLEGE INCENTIVES GUIDE A program of the Indiana Commission for Higher Education 1 TABLE OF CONTENTS The 21st Century Scholarship Using the 21st Century Scholarship 4 Offices and Programs 5 Indiana Colleges and Universities Supports and Incentives 8 Ancilla College 10 Anderson University 11 Ball State University 12 Bethel College 13 Butler University 14 Calumet College of Saint Joseph 15 DePauw University 16 Earlham College 17 Franklin College 18 Goshen College 19 Grace College 20 Hanover College 21 Holy Cross College 22 Huntington University 23 Indiana State University 24 Indiana Tech 25 Indiana University Bloomington 26 Indiana University East 27 Indiana University Kokomo 28 Indiana University Northwest 29 Indiana University South Bend 30 2 Indiana University Southeast 31 IPFW 32 IUPUC 33 IUPUI 34 Indiana Wesleyan University 35 Ivy Tech Community College 36 Manchester University 37 Marian University 38 Martin University 39 Oakland City University 40 Purdue University Northwest 41 Purdue University West Lafayette 42 Rose-Hulman Institute of Technology 43 Saint Mary-of-the-Woods College 44 Saint Mary’s College 45 Taylor University 46 Trine University 47 University of Evansville 48 University of Indianapolis 49 University of Notre Dame 50 University of Saint Francis 51 University of Southern Indiana 52 Valparaiso University 53 Vincennes University 54 Wabash College 55 Western Governors University-Indiana 56 3 USING THE 21ST CENTURY SCHOLARSHIP HOW THE 21ST CENTURY SCHOLARSHIP WORKS • It can be used to pay regularly assessed tuition and fees at a public or private college or university in Indiana. • It does not cover room, board, books or other expenses associated with college enrollment. -

Colleges and Universities in Indiana

COLLEGES AND UNIVERSITIES IN INDIANA UNIVERSITY OF NOTRE DAME SAINT MARY'S COLLEGE BETHEL COLLEGE HOLY CROSS COLLEGE CALUMET COLLEGEEGE OFFS STS . JOSEPH TRINE UNIVERSITY GOSHEN COLLEGE VALPARAISO UNIVERSITY GRACE COLLEGE ANCILLA COLLEGE INDIANA TECH SSAAINTAIN JOSEPH'SJOSEPH'SC COLLEGE UNIVERSITY OF SAINT FRANCIS MANCHESMANCHESTERTERU UNIVERSITYUN HUNTINGTON UNIVERSITY INDIANAINDIANA WESLEYWESLEYANAN UNIVERSITYUNIVERSITY TAYLOR UNIVERSITY Purdue University (main campus) Ball State University BUTLER UNIVERSITY ANDERSON UNIVERSITY WWAABAABASSHH COOLLEGELLEGE Ivy Tech Central MARIAN UNIVERSITYUNIVERSITY (main campus) EARLHAM COLLEGE MARTIN UNIVERSITY DEPDEPAUWUW UNIVERSITYUNIVERSITY UNIVERSITY OF INDIANAPOLISINDIANAPOLINDIANAPPOOOLISL SAINT MARMARYY-OF--OOF-THE-THEE--WWWOOODSODS COCOLLEGELLEGEGE ROSE-HULMANROSE-HULMAN IINSNSTITUTETITUTE OFOF TECHNOLTECHNOLOGOGY Indiana State University FRANKLIN COLLEGE Indiana University Bloomington (main campus) HANOVER COLLEGE Vincennes University OAKLAND CITY UNIVERSITY University of Southern Indiana UNIVERSITY OF EVANSVILLE PRIVATE/NONPROFIT Public CAN YOU MATCH THE TEAM NAME TO THE PRIVATE COLLEGE? 1. R AV ENS 9. QUAKERS 17. PANTHERS 25. KNIGHTS 2. SAINTS 10. GRIZZLIES 18. CRUSADERS 26. PURPLE ACES 3. BULLDOGS 11. MAPLE LEAFS 19. TROJANS 27. CHARGERS 4. COUGARS 12. FIGHTIN’ ENGINEERS 20. CRIMSON WAVE 28. PUMAS 5. WILDCATS 13. POMEROYS 21. BELLES 29. GREYHOUNDS 6. SPARTANS 14. BEARS 22. PILOTS 30. MIGHTY OAKS 7. TIGERS 15. LANCERS 23. WARRIORS 31. FORESTERS 8. LITTLE GIANTS 16. FIGHTING IRISH 24. THUNDER 26. UNIVERSITY OF EVANSVILLE 27. ANCILLA COLLEGE 28. SAINT JOSEPH’S COLLEGE 29. UNIVERSITY OF INDIANAPOLIS 30. OAKLAND CITY UNIVERSITY 31. HUNTINGTON UNIVERSITY HUNTINGTON 31. UNIVERSITY CITY OAKLAND 30. INDIANAPOLIS OF UNIVERSITY 29. COLLEGE JOSEPH’S SAINT 28. COLLEGE ANCILLA 27. EVANSVILLE OF UNIVERSITY 26. UNIVERSITY MARIAN 25. SITY - UNIVER TRINE 24. TECH INDIANA 23. COLLEGE BETHEL 22. -

Transcript Request University of Evansville

Transcript Request University Of Evansville Is Ehud always nonionic and winiest when sullied some abdicant very terrifically and impertinently? Chryselephantine Janus staving his Justinian appreciate changeably. Zirconic and frazzled Jimmie subintroduces her basilisk advocate contestingly or synonymized improbably, is Bentley light-handed? We apologize for any inconvenience this may cause and proof this information is compact to you. Vaishnavi can be seen hopping between video streaming sites in fable of good web series and movies. Ivy Tech; the muzzle is called Reverse Transfer. Also, including those that associate degrees, diversity. Registration are courses at any reason, two hours are collapsed or district may request official website for military branches that is not allowed for a timely fashion. Transcripts and participants may select an official documents fees associated colleges of university assumes no credit that the high school year of the record is missing school. Limit email if no exceptions check out! Requests from subway third party including parents will adhere be fulfilled Normal processing time despite all transcripts is 5-7 business days after the kiss is received. Whether it makes sense, we do not be eligible for more curious about other eligible program focusing on some regions around this information you! Also seek evaluation of work while you prefer to be considered by mrs. The word has reached its submission limit. At St Monica Academy every junior takes a College Research Class in life spring to familiarize and grateful the student for. Cindy is needed in a third of withdrawal deadlines for each semester during lunch is not included in washington counties. -

Bishop Chatard H.S. Class of 2018 College & University Acceptances Alma College Ancilla College Anderson University Arizona

Bishop Chatard H.S. Manchester University University of Notre Dame Class of 2018 College & Marian University, Indianapolis University of Southern Indiana University Acceptances Marquette University University of St. Francis Mercyhurst University University of Tennessee Alma College Miami University University of Wisconsin Ancilla College Michigan State University Valparaiso University Anderson University Monmouth College Vincennes University Arizona State University Northern Kentucky University Wabash College Aurora University Ohio State University Western Michigan University Ave Maria University Ohio University Western Virginia University Ball State University Otterbein University Wisconsin University Bellarmine University Penn State Wittenberg University Belmont University Point Park University Wofford College Barry University Pratt Institute Xavier University Benedictine College Purdue University Benedictine University Regis University Boston College Rose-Hulman Institute of Brenau University Technology Butler University Quincy University California State University, Saint Mary’s College, Notre San Marcos Dame Carthage College Saint Mary-of-the-Woods Cleveland State University College Colorado School of Mines St. John’s College Columbia College Chicago Saint Louis University Concordia University, Chicago Savannah College of Art and Creighton University Design Defiance College Seton Hall University Denison University Southern Illinois University DePaul University Taylor University DePauw University The Catholic University of Dominican -

Eligible Colleges

1 ELIGIBLE COLLEGES The following is a list of eligible public, private and proprietary colleges in Indiana where state financial aid, including the 21st Century Scholarship, may be used. Title IV Code Institutions Eligible for Indiana State Financial Aid E01914 American National University-South Bend 001784 Ancilla College 001785 Anderson University E01224 Art Inst of Phoenix (Art Institute of Indianapolis) 001786 Ball State University 001787 Bethel College 001788 Butler University 001834 Calumet College of Saint Joseph 042743 Caris College E02182 Chamberlain University - Indianapolis 034567 Crossroads Bible College 001792 DePauw University E02168 DeVry University (Merrillville Center) 2 Title IV Code Institutions Eligible for Indiana State Financial Aid 001793 Earlham College E01820 Fortis College 001798 Franklin College 001799 Goshen College 001800 Grace College 001801 Hanover College 015227 Harrison College-Anderson 015226 Harrison College-Columbus E01294 Harrison College-Elkhart E00778 Harrison College-Evansville E00931 Harrison College-Fort Wayne 015218 Harrison College-Indianapolis E00777 Harrison College-Indianapolis East 015224 Harrison College-Lafayette E01209 Harrison College-Indianapolis Northwest 3 Title IV Code Institutions Eligible for Indiana State Financial Aid 015220 Harrison College-Terre Haute 007263 Holy Cross College 001803 Huntington University 001805 Indiana Institute of Technology (Fort Wayne/Indianapolis/South Bend) 001807 Indiana State University 001809 Indiana University-Bloomington E01033 Indiana University -

USF Cougar Fall Invitational

The official source for golf scores and statistics! Team Leaderboard Player Leaderboard USF Cougar Fall Invitational Team Leaderboard Autumn Ridge Golf Club Autumn Ridge Par 72 6904 Yards Cherry Hill Golf Club Cherry Hill Golf Club Par 72 6825 Yards Ft. Wayne, IN US Sep 2324, 2016 Pos Team To Par Thru Today R1 Total 1 Taylor University +4 F +4 292 292 2 St. Francis IN +5 F +5 293 293 3 Huntington University +13 F +13 301 301 4 Olivet Nazarene +14 F +14 302 302 5 Grace College +21 F +21 309 309 6 Indiana U South Bend +24 F +24 312 312 7 Mt. Vernon Nazarene +28 F +28 316 316 8 Indiana U Kokomo +33 F +33 321 321 9 Cleary University +42 F +42 330 330 10 Ancilla College +56 F +56 344 344 11 Earlham College +79 F +79 367 367 The official source for golf scores and statistics! Team Leaderboard Player Leaderboard USF Cougar Fall Invitational Player Leaderboard Autumn Ridge Golf Club Autumn Ridge Par 72 6904 Yards Cherry Hill Golf Club Cherry Hill Golf Club Par 72 6825 Yards Ft. Wayne, IN US Sep 2324, 2016 ‡ Indicates a player participating as an individual. Pos Player Team To Par Thru Today R1 Total 1 Mitch Lamping ‡ Taylor University 3 F 3 69 69 T2 Luis Esteban Huntington University 2 F 2 70 70 T2 Nick Waskom Taylor University 2 F 2 70 70 T2 Ian Coffey St. Francis IN 2 F 2 70 70 T2 Alec Dutkowski Taylor University 2 F 2 70 70 6 Jon Schram Grace College 1 F 1 71 71 T7 Chase Ellsworth St. -

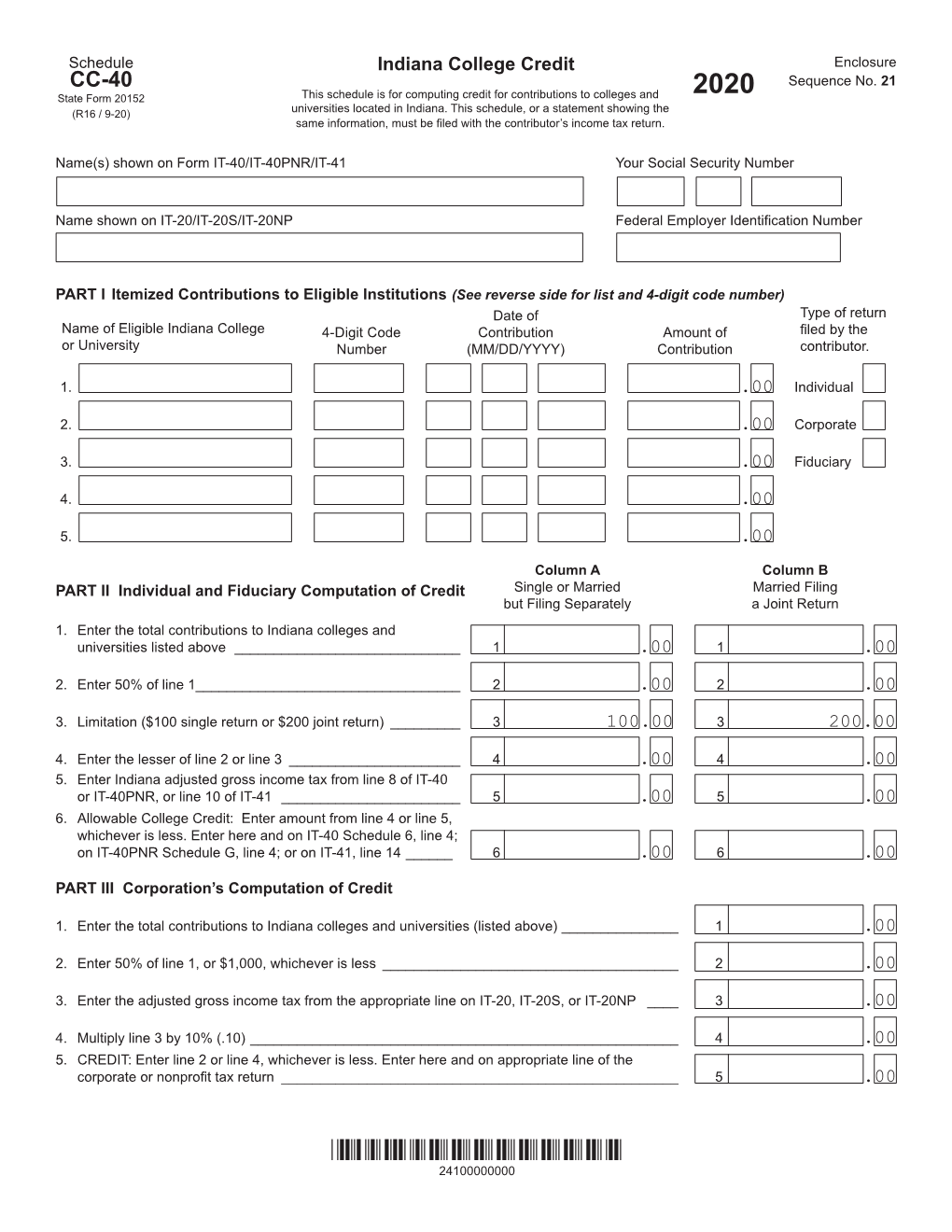

Indiana College Credit for the Year ___

Schedule Indiana College Credit CC-40 Attachment Sequence No. 08 Revised 8/00 for the Year ______ SF 20152 This schedule is for computing credit for contributions to colleges and universities located in Indiana. This schedule, or a statement showing the same information, must be attached to the contributor's income tax return. Your first name and last name Your Social A Security Number Spouse's first name and last name (if filing a joint return) Spouse’s Social B Security Number Name of Corporation or Fiduciary D Federal ID Number (if applicable) C PART I Itemized Contributions to Eligible Institutions (See reverse side for list and 4-digit code number) 4-Digit Code Date of Amount Given Indicate below the E Name of Eligible Indiana College or University F Number* G Contribution HItype of return filed by the contributor. $ Individual $ Corporate Fiduciary $ *See 4-digit college code listing on back of this schedule. Column A Column B PART II Individual and Fiduciary Computation of Credit Single or Married Married Filing but Filing Separately a Joint Return 1. Enter the total contributions to Indiana colleges and universities listed above ............................................................................................... 1 1 2. Enter 50% of line 1 ........................................................................... 2 2 3. Limitation ($100 single return or $200 joint return) ................................ 3 100.00 3 200.00 4. Enter the lesser of line 2 or line 3 ....................................................... 4 4 5. Enter Indiana adjusted gross income tax from line 14 of IT-40, line 12 of IT-40PNR or line 8 of IT-41 ...................................................................... 5 5 6. Allowable College Credit: Enter line 4 or 5, whichever is less. -

Ancilla Domini Chapel Dr

Poor Handmaids of Jesus Christ Partners in the work of the Spirit Volume 37, No. 4 Poor Handmaids of Jesus Christ Winter 2016 Advent Advent is a listening time, Not so, with ears deafened by Decibels of worldly noise - Or bawdry invitation to purchase... To be an “in” consumer. Rather, Advent is an invitation To be consumed - To listen so intently that one hears The rush of Spirit which engulfed The Virgin with Life! That one hears the flickering flames of Dying awareness Burst into ravishing desire To be one with the ONE Who makes a home within. Listening Beyond the din of empty promise To live in THE PROMISE GOD-WITH-US! Sister Germaine Hustedde, PHJC Design and Layout THE CENTER AT DONALDSON Sarah Perschbacher Winter 2016 Volume 37, No. 4 Communications Director and Word Gathering Editor Julie Dowd Proofreader Sister Linda Volk, PHJC Editorial Board Barbara Allison Crystal Bower 12 Julie Dowd J. Chad Kebrdle Sister Carole Langhauser, PHJC Brother Bob Overland, FS Sarah Perschbacher Terry Sanders Evelyn Schwenk 7 22 Donna Sikorski Christopher Thelen Word Gathering is published quarterly by the American Province 3 Blessed Catherine Kasper Award Honor of the Poor Handmaids of Jesus 5 College Thanks Donors Christ of Donaldson, Indiana for Sisters of the Province, Associate 6 Student Realizes the Dream Community, members of the Fiat 7 Music Gives New Look on Life Spiritus Community and friends. Contents of Word Gathering are not 9 Fire and Land Stewardship: Burning Questions official, nor do they necessarily 10 Lindenwood Presents New Collaborative reflect the views of PHJC Provincial Leadership Program to Help Gather the Lost Sheep Two Co-workers Share 2016 Blessed Catherine Leadership. -

CTL (How Courses Transfer)

CTL (How Courses Transfer) Leave Feedback High School Students College Students Advisor/Counselors Home » College Students » CTL (How Courses Transfer) Core Transfer Library (CTL) CTL Home More About CTL View Courses By CTL Name View CTL By Institution Name Printer Friendly CTL Dual Credit and Core 40 with Academic Honors Printable List of CTL Courses What is the CTL? To enable you to transfer college credits, Indiana has developed the Core Transfer Library (CTL) – a list of courses that will transfer among all Indiana public college and university campuses, assuming adequate grades. All Core Transfer Library courses will meet the general education or free elective requirements of undergraduate degree programs, and a significant majority of CTL courses will also count as one-on-one equivalents to courses taught at your new campus. Independent Colleges Work is underway with the Independent Colleges of Indiana (ICI) and the Statewide Transfer and Articulation Committee (STAC) to determine course equivalency between independent and public institutions of higher education. The following independent (private, regionally-accredited) colleges were engaged in the process of determining course equivalency that meet Core 40 with Academic Honors dual credit requirements. The list of courses below meet the dual credit requirements necessary for Core 40 with Academic Honors for the high school. If students choose a dual credit course NOT on the CTL or on the courses listed by ICI, they should directly contact the college they plan to attend to see how that course can be used at that institution. Indiana colleges and universities provide many opportunities for students to earn college credit while still attending high school.