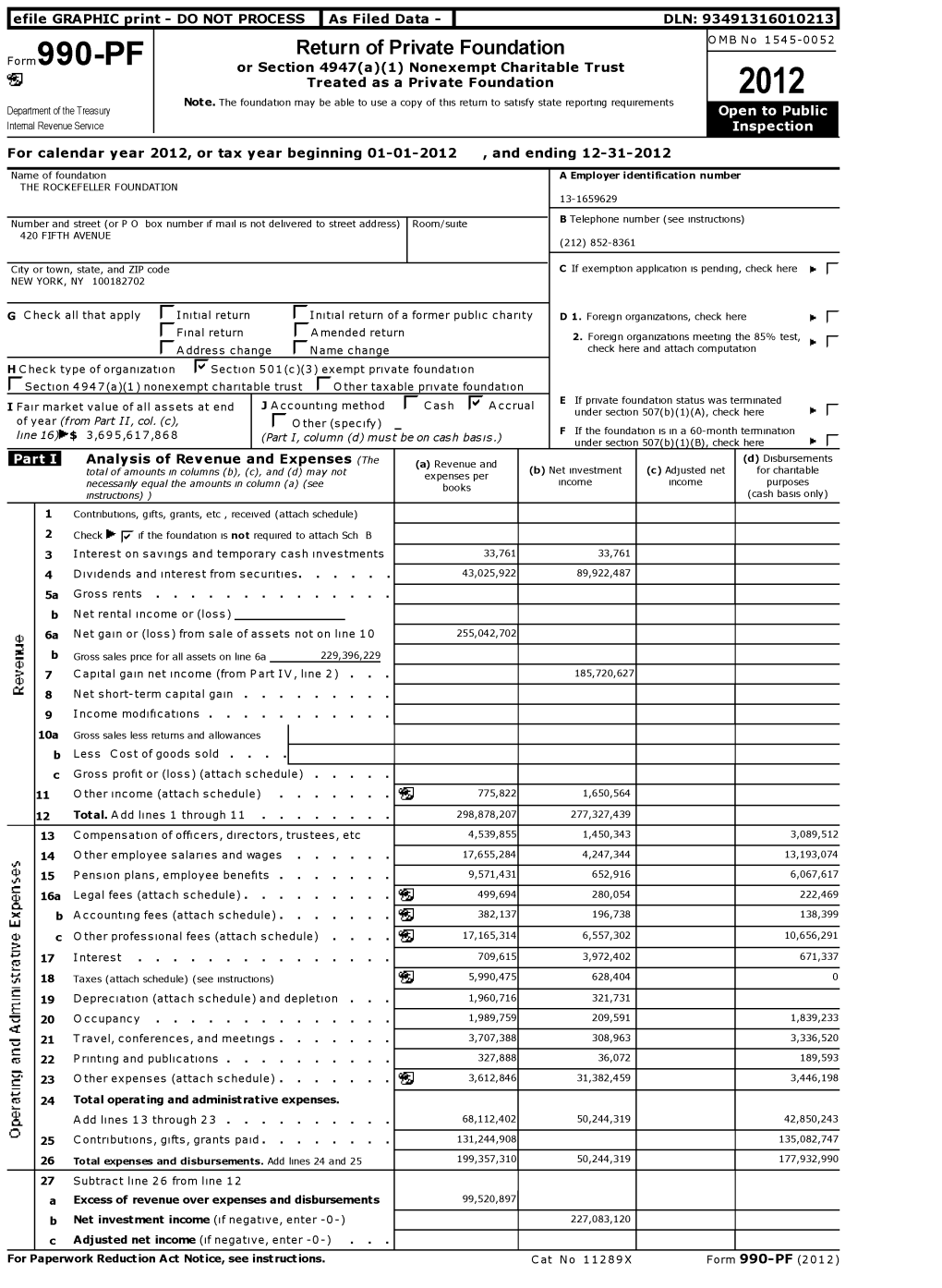

Return of Private Foundation OMB No 1545-0052 Form 990 -PF Or Section 4947 ( A)(1) Nonexempt Charitable Trust ` Treated As a Private Foundation 2012 Note

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Naspers Limited

NASPERS LIMITED (Registration number: 1925/001431/06) and various of its subsidiaries ("NASPERS") MANUAL PREPARED IN ACCORDANCE WITH SECTION 51 OF THE PROMOTION OF ACCESS TO INFORMATION ACT, ACT NO. 2 OF 2000 ("THE ACT") INDEX Page 1. Introduction 3 2. Contact detail 4 3. Guide in terms of section 10 of the Act 5 4. Notice(s) in terms of section 52(2) of the Act 6 5. Information / documents available in accordance with other legislation 7 6. Documents / information held by Naspers in terms of the Act 8 7. Other information 9 8. Availability of the manual 10 9. List of subsidiaries of Naspers 11 10. Form of request 17 11. Prescribed fees 24 2 1. INTRODUCTION The manual is to assist potential requesters as to the procedure to be followed when requesting access to information / documents from Naspers as contemplated in terms of the Act. The manual may be amended from time to time and as soon as any amendments have been finalised the latest version of the manual will be made public. Any requester is advised to contact Gillian Kisbey-Green should he / she require any assistance in respect of the utilisation of this manual and/or the requesting of documents / information from Naspers. The following words will bear the following meaning in this manual :- "the Act" shall mean the Promotion of Access to Information Act, No. 2 of 2000, together with all relevant regulations published; "the/this manual" shall mean this manual together with all annexures thereto as available at the offices of Naspers from time to time; "Naspers" shall mean Naspers Limited, and various of its subsidiaries as set out in part 9, page 11 and further of this manual "SAHRC" shall mean the South African Human Rights Commission. -

Transnational Corporations Investment and Development

Volume 27 • 2020 • Number 2 TRANSNATIONAL CORPORATIONS INVESTMENT AND DEVELOPMENT Volume 27 • 2020 • Number 2 TRANSNATIONAL CORPORATIONS INVESTMENT AND DEVELOPMENT Geneva, 2020 ii TRANSNATIONAL CORPORATIONS Volume 27, 2020, Number 2 © 2020, United Nations All rights reserved worldwide Requests to reproduce excerpts or to photocopy should be addressed to the Copyright Clearance Center at copyright.com. All other queries on rights and licences, including subsidiary rights, should be addressed to: United Nations Publications 405 East 42nd Street New York New York 10017 United States of America Email: [email protected] Website: un.org/publications The findings, interpretations and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the United Nations or its officials or Member States. The designations employed and the presentation of material on any map in this work do not imply the expression of any opinion whatsoever on the part of the United Nations concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. This publication has been edited externally. United Nations publication issued by the United Nations Conference on Trade and Development. UNCTAD/DIAE/IA/2020/2 UNITED NATIONS PUBLICATION Sales no.: ETN272 ISBN: 978-92-1-1129946 eISBN: 978-92-1-0052887 ISSN: 1014-9562 eISSN: 2076-099X Editorial Board iii EDITORIAL BOARD Editor-in-Chief James X. Zhan, UNCTAD Deputy Editors Richard Bolwijn, UNCTAD -

A World-Class Online Data Analytics Event

A World-Class Online Data Analytics Event DataCon Africa Online will boast an inspiring speaker line-up with a comprehensive agenda covering the biggest strategic concerns for leaders in the data and analytics space. Register now to join other senior executives responsible for championing the data agenda, to share insights on the infrastructure, governance, privacy, innovation, culture and leadership required to effectively harness data as a strategic asset. All our speakers have presented at our physical conferences and have been rated extremely highly. All of them are on the data analytics journey and have excellent insights and war stories to share. Current Companies Booked for DataCon Africa Online 2020 A Forbes Arena Holdings absa Aruba Absa Bank (Mauritius) Ashanti-AI ABSA bank Mozambique Assupol Absa Capital Automation Anywhere Absa Life Assurance Kenya Azuro Business Solution Accenture Bad Press Creative Agency AccTech Systems Bayer Ackermans BeBigData ACS Beiersdorf Adapt IT Biotight Logistics Adcorp BITanium Consulting Adept ICT BluHorizon ADP Marine and Modular Britehouse African Bank Calltronix KE Ltd Albi Investment Group Services Capitec Bank Alexander Forbes CEFET Altron Cell C Amazee Metrics Cheil Analytix Engine Cisco Anheuser-Busch InBev Clientele www.datacononline.com Cloudera fraXses (Pty) Ltd Cognizance Data Insights FSCA Collins Foods Gas Co Consumer Good Council of South Africa Gautrain Management Agency Contec Global Info Tech Getsmarter/ 2U Capetown Crystalise -

Business Overview Strategy Group Structure Summarised

Business overview Summarised financial data Naspers is a global internet and entertainment group and one of Income statement data FY16 FY15 FY14 the largest technology investors in the world. We focus on building Year ended 31 March US$m US$m US$m leading companies that empower people and enrich communities. Revenue 5,930 6,569 6,154 EBITDA 423 550 637 We operate in more than 130 countries and markets with long- Trading profit 179 298 394 term growth potential, and we run some of the world's leading Trading margin platforms in internet, video entertainment and media. 3% 5% 6% Core Headline EPS (cents) 298 255 216 Every day, hundreds of millions of people use the products and services of companies that Naspers has invested in, acquired and Balance sheet data* built, including Allegro, Avito, eMAG, Flipkart, letgo, Mail.ru Non-current assets 13,486 10,236 9,515 (LSE: MAIL), Media24, Movile, MultiChoice, OLX, PayU, ShowMax, Current assets 3,237 2,700 2,698 SimilarWeb, and Tencent (SEHK 00700). Total assets 16,723 12,936 12,213 Shareholders’ equity 10,654 6,903 6,477 Naspers is listed on the Johannesburg Stock Exchange (JSE) and has Non-current liabilities 4,023 3,852 3,471 an ADR listing on the London Stock Exchange (LSE). Current liabilities 2,046 2,181 2,265 Equity and liabilities 16,723 12,936 12,213 Strategy NAV/share (cents) 2,379 1,614 1,580 *Core headline earnings per share excludes, amongst other items, fair value Throughout our 100-year history, we have grown by investing in, adjustments required in terms of accounting standard IAS 39, which in our view acquiring and building leading companies. -

Annual Report 2010 N T Ann Rrepo P

AnnualAnn RReReportpop rtt 2010 The Naspers Review of Governance and Financial Notice of Annual Group Operations Sustainability Statements General Meeting 2 Financial highlights 22 Review of operations 42 Governance 74 Consolidated 198 Notice of AGM 4 Group at a glance 24 Internet 51 Sustainability and company 205 Proxy form 6 Global footprInt 30 Pay television 66 Directorate annual financial 8 Chairman’s and 36 Print media 71 Administration and statements managing corporate information director’s report 72 Analysis of 16 Financial review shareholders and shareholders’ diary Entertainment at your fingertips Vision for subscribers To – wherever I am – have access to entertainment, trade opportunities, information and to my friends Naspers Annual Report 2010 1 The Naspers Review of Governance and Financial Notice of Annual Group Operations Sustainability Statements General Meeting Mission To develop in the leading group media and e-commerce platforms in emerging markets www.naspers.com 2 Naspers Annual Report 2010 The Naspers Review of Governance and Financial Notice of Annual Group Operations Sustainability Statements General Meeting kgFINANCIAL HIGHLIGHTS Revenue (R’bn) Ebitda (R’m) Ebitda margin (%) 28,0 6 496 23,2 26,7 6 026 22,6 09 10 09 10 09 10 Headline earnings Core HEPS Dividend per per share (rand) (rand) share (proposed) (rand) 8,84 14,26 2,35 8,27 11,79 2,07 09 10 09 10 09 10 2010 2009 R’m R’m Income statement and cash flow Revenue 27 998 26 690 Operational profit 5 447 4 940 Operating profit 4 041 3 783 Net profit attributable -

FTSE/JSE Top 40

2 FTSE Russell Publications 19 August 2021 FTSE/JSE Top 40 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Absa Group Limited 1.34 SOUTH Glencore 0.75 SOUTH Prosus 1.21 SOUTH AFRICA AFRICA AFRICA Anglo American 9.94 SOUTH Gold Fields 1.57 SOUTH Reinet Investments 0.58 SOUTH AFRICA AFRICA AFRICA Anglo American Platinum 1.37 SOUTH Growthpoint Prop Ltd 0.71 SOUTH Remgro 0.82 SOUTH AFRICA AFRICA AFRICA Anglogold Ashanti 1.56 SOUTH Impala Platinum Hlds 2.63 SOUTH Sanlam 1.51 SOUTH AFRICA AFRICA AFRICA Aspen Pharmacare Holdings 0.87 SOUTH Investec Ltd 0.22 SOUTH Sasol 1.71 SOUTH AFRICA AFRICA AFRICA BHP Group Plc 12.57 SOUTH Investec PLC 0.54 SOUTH Shoprite 1.07 SOUTH AFRICA AFRICA AFRICA BidCorp Ltd 1.45 SOUTH Mondi Plc 2.57 SOUTH Sibanye Stillwater 2.46 SOUTH AFRICA AFRICA AFRICA Bidvest Group 0.91 SOUTH Mr Price Group 0.76 SOUTH Standard Bank Group 2.3 SOUTH AFRICA AFRICA AFRICA British American Tobacco PLC 2.05 SOUTH MTN Group 2.62 SOUTH The Spar Group 0.49 SOUTH AFRICA AFRICA AFRICA Capitec Bank Hldgs Ltd 1.97 SOUTH MultiChoice Group 0.71 SOUTH Vodacom Group 1.08 SOUTH AFRICA AFRICA AFRICA Clicks Group Ltd 0.85 SOUTH Naspers 17.27 SOUTH Woolworths Holdings 0.66 SOUTH AFRICA AFRICA AFRICA Compagnie Financiere Richemont 12.48 SOUTH Nedbank Group 0.86 SOUTH AG AFRICA AFRICA Discovery Ltd 0.73 SOUTH NEPI Rockcastle PLC 0.61 SOUTH AFRICA AFRICA Exxaro Resources 0.59 SOUTH Northam Platinum 1.05 SOUTH AFRICA AFRICA Firstrand Limited 3.7 SOUTH Old Mutual Ltd 0.87 SOUTH AFRICA AFRICA Source: FTSE Russell 1 of 2 19 August 2021 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. -

We Were Cut Off from the Comprehension of Our Surroundings

Black Peril, White Fear – Representations of Violence and Race in South Africa’s English Press, 1976-2002, and Their Influence on Public Opinion Inauguraldissertation zur Erlangung der Doktorwürde der Philosophischen Fakultät der Universität zu Köln vorgelegt von Christine Ullmann Institut für Völkerkunde Universität zu Köln Köln, Mai 2005 ACKNOWLEDGEMENTS The work presented here is the result of years of research, writing, re-writing and editing. It was a long time in the making, and may not have been completed at all had it not been for the support of a great number of people, all of whom have my deep appreciation. In particular, I would like to thank Prof. Dr. Michael Bollig, Prof. Dr. Richard Janney, Dr. Melanie Moll, Professor Keyan Tomaselli, Professor Ruth Teer-Tomaselli, and Prof. Dr. Teun A. van Dijk for their help, encouragement, and constructive criticism. My special thanks to Dr Petr Skalník for his unflinching support and encouraging supervision, and to Mark Loftus for his proof-reading and help with all language issues. I am equally grateful to all who welcomed me to South Africa and dedicated their time, knowledge and effort to helping me. The warmth and support I received was incredible. Special thanks to the Burch family for their help settling in, and my dear friend in George for showing me the nature of determination. Finally, without the unstinting support of my two colleagues, Angelika Kitzmantel and Silke Olig, and the moral and financial backing of my family, I would surely have despaired. Thank you all for being there for me. We were cut off from the comprehension of our surroundings; we glided past like phantoms, wondering and secretly appalled, as sane men would be before an enthusiastic outbreak in a madhouse. -

Dosti Greater Thane Brochure

THE CITY OF HAPPINESS CITY OF HAPPINESS Site Address: Dosti Greater Thane, Near SS Hospital, Kalher Junction 421 302. T: +91 86577 03367 Corp. Address: Adrika Developers Pvt. Ltd., Lawrence & Mayo House, 1st Floor, 276, Dr. D. N. Road, Fort, Mumbai - 400 001 • www.dostirealty.com Dosti Greater Thane - Phase 1 project is registered under MahaRERA No. P51700024923 and is available on website - https://maharerait.mahaonline.gov.in under registered projects Disclosures: (1) The artist’s impressions and stock image are used for representation purpose only. (2) Furniture, fittings and fixtures as shown/displayed in the show flat are for the purpose of showcasing only and do not form part of actual standard amenities to be provided in the flat. The flats offered for sale are unfurnished and all the amenities proposed to be provided in the flat shall be incorporated in the Agreement for Sale. (3) The plans are tentative in nature and proposed but not yet sanctioned. The plans, when sanctioned, may vary from the plans shown herein. (4) Dosti Club Novo is a Private Club House. It may not be ready and available for use and enjoyment along with the completion of Dosti Greater Thane - Phase 1 as its construction may get completed at a later date. The right to admission, use and enjoyment of all or any of the facilities/amenities in the Dosti Club Novo is reserved by the Promoters and shall be subject to payment of such admission fees, annual charges and compliance of terms and conditions as may be specified from time to time by the Promoters. -

APPENDIX a Updated PCIA Workpaper Template

R.02-01-011 ALJ/SCL/jnf APPENDIX A Updated PCIA Workpaper Template R.02-01-011 ALJ/SCL/jnf IOU Total Portfolio Summary XXXX ERRA Forecast Vintage Portfolios CTC- Legacy Incremental by Year Eligible UOG 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total 1. CRS Eligible Portfolio Costs ($000) 2. CRS Eligible Non-Renewable Supply at Generator Meter (GWh) 3. CRS Eligible Renewable Supply at Generator Meter (GWh) 4. CRS Eligible Total Net Qualifying Capacity (MW) 5. CRS Eligible System NQC (System only, No flex or local) 6. CRS Eligible Local NQC (System and local, with or without flex) 7. CRS Eligible Flexible NQC (System and flex only, No local) A-1 R.02-01-011 ALJ/SCL/jnf Indifference Calculation Inputs and Sources XXXX ERRA Forecast Line Description Source of Data Value No. 1. On Peak NP 15 Price ($/MWh) Platt's 2. Off Peak NP 15 Price ($/MWh) Platt's 3. On Peak Load Weight (%) XXXX Recorded Load - On Peak Hours 4. Off Peak Load Weight (%) XXXX Recorded Load - Off Peak Hours 5. Load Weighted Average Price ($/MWh) Line 1 x Line 3 + Line 2 x Line 4 6. REC Benchmark ($/MWh) Energy Division 7. Total "Green" Benchmark ($/MWh) Line 6 + Line 5 8. System RA Benchmark ($/kW-Year) Energy Division 9. Local RA Benchmark ($/kW-Year) Energy Division 10. Flexible RA Benchmark ($/kW-Year) Energy Division 11. Franchise Fees and Uncollectibles Factor [GRC Decision / Advice Letter Reference] A-2 R.02-01-011 ALJ/SCL/jnf Indifference Amount Calculation XXXX ERRA Forecast Line CTC- Legacy Description Equation Unit 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 No. -

India Urban Infrastructure Report 2020

Research India Urban Infrastructure knightfrank.co.in/research Report 2020 Special Focus on Mumbai Transport Infrastructure with Key Impact Markets INDIA URBAN INFRASTRUCTURE REPORT 2020 Mumbai HO Knight Frank (India) Pvt. Ltd. Paville House, Near Twin Towers Off. Veer Savarkar Marg, Prabhadevi Mumbai 400 025, India Tel: +91 22 6745 0101 / 4928 0101 Bengaluru Knight Frank (India) Pvt. Ltd. 204 & 205, 2nd Floor, Embassy Square #148 Infantry Road Bengaluru 560001, India Tel: +91 80 4073 2600 / 2238 5515 Pune Knight Frank (India) Pvt. Ltd. Unit No.701, Level 7, Pentagon Towers P4 Magarpatta City, Hadapsar Pune 411 013, India Tel: +91 20 6749 1500 / 3018 8500 Chennai Knight Frank (India) Pvt. Ltd. 1st Floor, Centre block, Sunny Side 8/17, Shafee Mohammed Road Nungambakkam, Chennai 600 006, India Tel: +91 44 4296 9000 Gurgaon Knight Frank (India) Pvt. Ltd. Office Address: 1505-1508, 15th Floor, Tower B Signature Towers South City 1 Gurgaon 122 001, India Tel: +91 124 4782 700 Hyderabad Knight Frank (India) Pvt. Ltd. SLN Terminus, Office No. 06-01, 5th Floor Survey No. 133, Gachibowli Hyderabad – 500032, India Tel: +91 40 4455 4141 Kolkata Knight Frank (India) Pvt. Ltd. PS Srijan Corporate Park Unit Number – 1202A, 12th Floor Block – EP & GP, Plot Number - GP 2 Sector – V, Salt Lake, Kolkata 700 091, India Tel: +91 33 6652 1000 Ahmedabad Knight Frank (India) Pvt. Ltd. Unit Nos. 407 & 408, Block ‘C’, The First B/H Keshav Baugh Party Plot Vastrapur, Ahmedabad – 380015 Tel: +91 79 4894 0259 / 4038 0259 www.knightfrank.co.in/research 2 INDIA URBAN INFRASTRUCTURE REPORT 2020 CONTENTS 1 2 3 The Urbanisation Challenges of Regulating Phenomenon Sustainability and Urbanisation in India Liveability Page no......................... -

Socio- Political and Administrative History of Ancient India (Early Time to 8Th-12Th Century C.E)

DDCE/History (M.A)/SLM/Paper-XII Socio- Political and Administrative History of Ancient India (Early time to 8th-12th Century C.E) By Dr. Binod Bihari Satpathy 0 CONTENT SOCIO- POLITICAL AND ADMINISTRATIVE HISTORY OF ANCIENT INDIA (EARLY TIME TO 8th-12th CENTURIES C.E) Unit.No. Chapter Name Page No Unit-I. Political Condition. 1. The emergence of Rajput: Pratiharas, Art and Architecture. 02-14 2. The Rashtrakutas of Manyakheta: Their role in history, 15-27 Contribution to art and culture. 3. The Pala of Bengal- Polity, Economy and Social conditions. 28-47 Unit-II Other political dynasties of early medieval India. 1. The Somavamsis of Odisha. 48-64 2. Cholas Empire: Local Self Government, Art and Architecture. 65-82 3. Features of Indian Village System, Society, Economy, Art and 83-99 learning in South India. Unit-III. Indian Society in early Medieval Age. 1. Social stratification: Proliferation of castes, Status of women, 100-112 Matrilineal System, Aryanisation of hinterland region. 2. Religion-Bhakti Movements, Saivism, Vaishnavism, Tantricism, 113-128 Islam. 3. Development of Art and Architecture: Evolution of Temple Architecture- Major regional Schools, Sculpture, Bronzes and 129-145 Paintings. Unit-IV. Indian Economy in early medieval age. 1. General review of the economic life: Agrarian and Urban 146-161 Economy. 2. Indian Feudalism: Characteristic, Nature and features. 162-180 Significance. 3. Trade and commerce- Maritime Activities, Spread of Indian 181-199 Culture abroad, Cultural Interaction. 1 ACKNOWLEDGEMENT It is pleasure to be able to complete this compilation work. containing various aspects of Ancient Indian History. This material is prepared with an objective to familiarize the students of M.A History, DDCE Utkal University on the various aspcets of India’s ancient past. -

Reseteveryday in the Future of Urban Connectivity Stock Image for Representation Purpose Only

#ResetEveryday in the future of urban connectivity Stock image for representation purpose only. IN PARTNERSHIP WITH The Project registered as “Godrej Emerald Thane” with MahaRERA No. P51700000120 available at: http://maharera.mahaonline.gov.in The Sale is subject to terms of Application Form and Agreement for Sale. All specifications of the unit shall be as per the final agreement between the Parties. Recipients are advised to apprise themselves of the necessary and relevant information of the project prior to making any purchase decisions. The upcoming infrastructure facility(ies) mentioned in this document are proposed to be developed by the Government and other authorities and we cannot predict the timing or the actual provisioning of these facility(ies), as the same is beyond our control. We shall not be responsible or liable for any delay or non-provisioning of the same. The official website of Godrej Properties Limited is www.godrejproperties.com. Please do not rely on the information provided on any other website. Situated in the lap of nature, Godrej Emerald lets you bask in the serenity of the beautiful Yeoor hills. Break free and unwind, every day with mesmerizing views and surreal surroundings. The designs, dimensions, facilities, images, specifications, items, electronic goods, additional fittings/fixtures, shades, sizes and colour of the tile and other details shown in the image are only indicative in nature and are only for the purpose of indicating a possible layout and do not form part of standard specification/amenities to be provided in the project. Artist’s impression. Not an actual site photograph. Towards Vasai-Virar RESET EVERYDAY AT A HOME METRO LINE 10 Towards GAIMUKH JUNCTION THAT IS WELL-CONNECTED Western Suburbs STATION MIRA ROAD 14 min drive time from Godrej Emerald$ METRO LINE 4A Highway METRO LINE 10 A SERENE NEIGHBOURHOOD GODREJ Express EMERALD Kasarvadavali Surround yourself with the effervescence of nature.