Ramesh S/O Krishnan V AXA Life Insurance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![[2020] SGCA 16 Civil Appeal No 99 of 2019 Between Wham Kwok Han](https://docslib.b-cdn.net/cover/5871/2020-sgca-16-civil-appeal-no-99-of-2019-between-wham-kwok-han-155871.webp)

[2020] SGCA 16 Civil Appeal No 99 of 2019 Between Wham Kwok Han

IN THE COURT OF APPEAL OF THE REPUBLIC OF SINGAPORE [2020] SGCA 16 Civil Appeal No 99 of 2019 Between Wham Kwok Han Jolovan … Appellant And The Attorney-General … Respondent Civil Appeal No 108 of 2019 Between Tan Liang Joo John … Appellant And The Attorney-General … Respondent Civil Appeal No 109 of 2019 Between The Attorney-General … Appellant And Wham Kwok Han Jolovan … Respondent Civil Appeal No 110 of 2019 Between The Attorney-General … Appellant And Tan Liang Joo John … Respondent In the matter of Originating Summons No 510 of 2018 Between The Attorney-General And Wham Kwok Han Jolovan In the matter of Originating Summons No 537 of 2018 Between The Attorney-General And Tan Liang Joo John ii JUDGMENT [Contempt of Court] — [Scandalising the court] [Contempt of Court] — [Sentencing] iii This judgment is subject to final editorial corrections approved by the court and/or redaction pursuant to the publisher’s duty in compliance with the law, for publication in LawNet and/or the Singapore Law Reports. Wham Kwok Han Jolovan v Attorney-General and other appeals [2020] SGCA 16 Court of Appeal — Civil Appeals Nos 99, 108, 109 and 110 of 2019 Sundaresh Menon CJ, Andrew Phang Boon Leong JA, Judith Prakash JA, Tay Yong Kwang JA and Steven Chong JA 22 January 2020 16 March 2020 Judgment reserved. Sundaresh Menon CJ (delivering the judgment of the court): Introduction 1 These appeals arise out of HC/OS 510/2018 (“OS 510”) and HC/OS 537/2018 (“OS 537”), which were initiated by the Attorney-General (“the AG”) to punish Mr Wham Kwok Han Jolovan (“Wham”) and Mr Tan Liang Joo John (“Tan”) respectively for contempt by scandalising the court (“scandalising contempt”) under s 3(1)(a) of the Administration of Justice (Protection) Act 2016 (Act 19 of 2016) (“the AJPA”). -

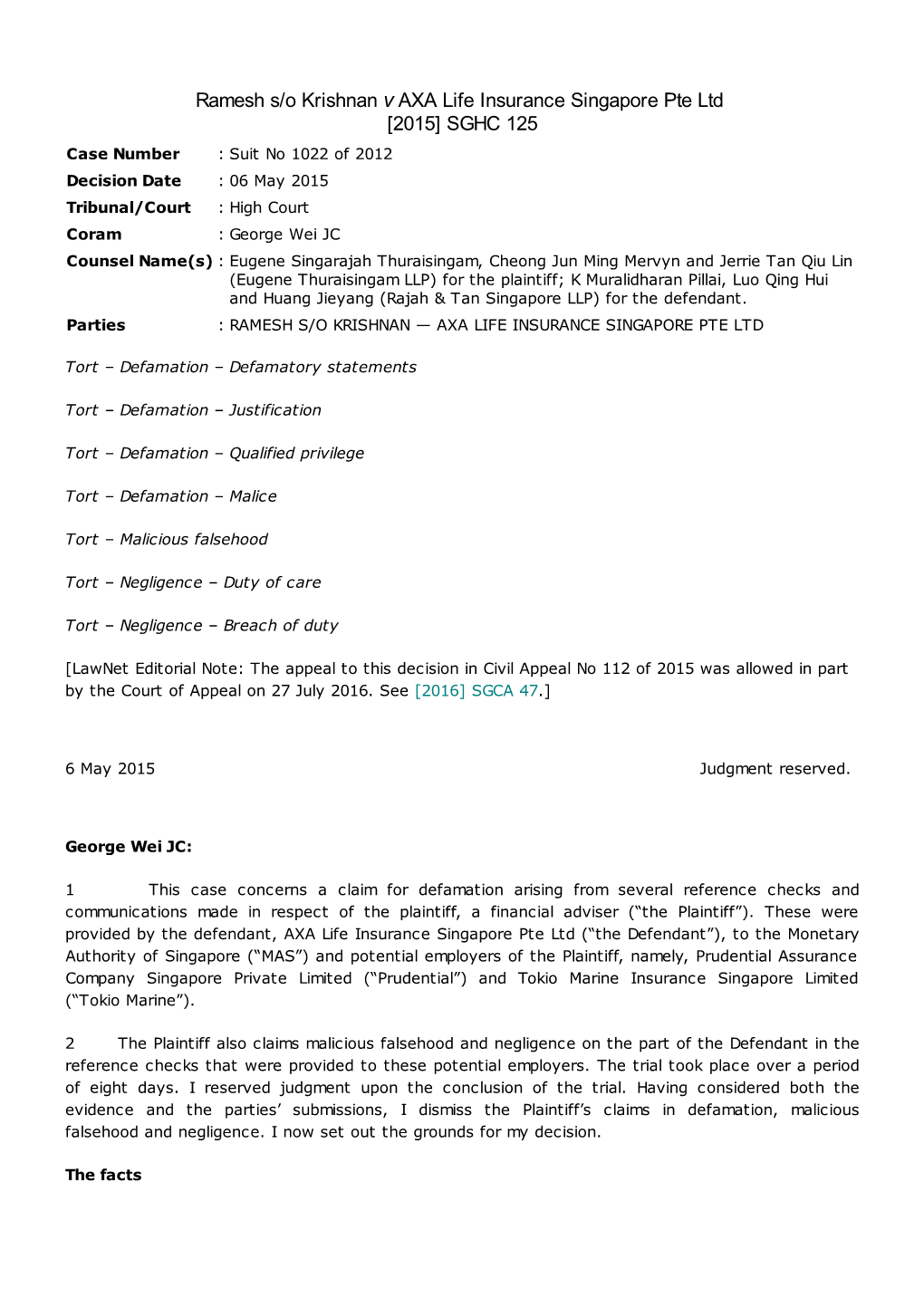

Ramesh S/O Krishnan V AXA Life Insurance Singapore Pte Ltd

IN THE COURT OF APPEAL OF THE REPUBLIC OF SINGAPORE [2016] SGCA 47 Civil Appeal No 112 of 2015 Between RAMESH S/O KRISHNAN … Appellant And AXA LIFE INSURANCE SINGAPORE PTE LTD … Respondent In the matter of Suit No 1022 of 2012 Between RAMESH S/O KRISHNAN … Plaintiff And AXA LIFE INSURANCE SINGAPORE PTE LTD … Defendant JUDGMENT [Tort]—[Negligence]—[Breach of duty] [Tort]—[Negligence]—[Causation] This judgment is subject to final editorial corrections approved by the court and/or redaction pursuant to the publisher’s duty in compliance with the law, for publication in LawNet and/or the Singapore Law Reports. Ramesh s/o Krishnan v AXA Life Insurance Singapore Pte Ltd [2016] SGCA 47 Court of Appeal — Civil Appeal No 112 of 2015 Sundaresh Menon CJ, Chao Hick Tin JA and Steven Chong J 25 November 2015 27 July 2016 Judgment reserved. Sundaresh Menon CJ (delivering the judgment of the court): Introduction 1 Employers often require potential hirees to provide references from their former employers. Such references may serve as a basis for the prospective employer to assess the applicant’s character and abilities, and will likely have at least some, if not significant, bearing on the applicant’s chances of obtaining employment. For this and other reasons, which we will elaborate upon in the course of this judgment, it is important that employers prepare such references, when called upon to do so, in a fair and accurate manner to avoid unjustifiably prejudicing the former employee’s prospects of obtaining fresh employment. Before us, it was accepted that an employer has a duty of care when preparing such a reference. -

The Janus-Faced State: an Obstacle to Human Rights Lawyering in Post-Colonial Asia-Pacific

Title: THE JANUS-FACED STATE: AN OBSTACLE TO HUMAN RIGHTS LAWYERING IN POST-COLONIAL ASIA-PACIFIC Author: Shreyas NARLA Uploaded: 20 September 2019 Disclaimer: The views expressed in this publication are those of the author(s) and do not necessarily reflect the views of LAWASIA or its members. THE JANUS-FACED STATE: AN OBSTACLE TO HUMAN RIGHTS LAWYERING IN POST-COLONIAL ASIA-PACIFIC† Shreyas Narla* Human rights lawyers now constitute an emergent vulnerable class. This is largely on account of the various causes they represent which pits them in opposition to forces of oppression. Such a fault-line and the consequent fallouts can be traced to the historicity and prevalent patterns of governance and administration in a given State, particularly in the postcolonial states of the Asia Pacific. These states, with their shared colonial histories and legacies, have had many conflicting interests to balance and remedy, and yet are confronted with the realities of their multiple stories of oppression and human rights violations of the lawyers challenging them. Human rights lawyers belonging to these states assume a special role and responsibility as they endure much risk in order to course-correct such actions. While non- state actors and private citizens can be brought to book for violations under prevalent laws, the complexity lies where the State itself is the oppressor instead of being the facilitator. The legal impunity that guards such State- sponsored oppression plays a severe deterrent to their lawyering and requires attention, both in terms of data analyses and reformative policy. I. INTRODUCTION The modern State, meant to be a benign protector of the rights of its citizens, is also the harshest oppressor that uses several instrumentalities at its disposal to control and regulate their actions. -

Annual Summaries 2017 Highlights PAGE CONTENTS

ATTORNEY- GENERAL’S CHAMBERS Annual Summaries 2017 Highlights PAGE CONTENTS 04 CIVIL DIVISION 12 CRIMINAL JUSTICE DIVISION 24 FINANCIAL & TECHNOLOGY CRIME DIVISION 32 INTERNATIONAL AFFAIRS DIVISION 44 LEGISLATION DIVISION 54 CORPORATE SERVICES DIVISION 66 CAPABILITIES DEVELOPMENT 80 KNOWLEDGE MANAGEMENT AND LIBRARY 83 STRATEGIC PLANNING AND ORGANISATIONAL EXCELLENCE OFFICE 85 AGC’S TRANSFORMATION JOURNEY M A JOR CASES CIVIL ATTORNEY-GENERAL V EUGENE THURAISINGAM DIVISION A lawyer, Eugene Thuraisingam, published a poem on Facebook publicly alleging that our Judges have subordinated their judicial duty to financial The Civil Division plays a vital role in protecting and advancing the Government’s greed. The poem posed a real risk of undermining public confidence in the administration of justice in Singapore. Thuraisingam was eventually interests, facilitating the administration of justice and upholding the rule of found in contempt of court and fined $6,000. law. The Division advises the Government on wide ranging legal issues and represents the Government in court and other dispute resolution proceedings. AXY AND OTHERS V COMPTROLLER OF INCOME TAX (ATTORNEY-GENERAL, INTERVENER) PENDING GROUNDS OF DECISION AS OF 5 APRIL 2018 This was an appeal against the High Court Judge’s decision (see AXY and others v Comptroller of Income Tax [2017] SGHC 42) concerning the exchange of information between tax authorities for the enforcement of tax laws and prevention of tax evasion. The appellants challenged the decision of the Comptroller of Income Tax to provide banking information to the National Tax Service of Korea under a Singapore-Korea tax treaty and an exchange of information regime under the Income Tax Act (Cap 134, 2008 Rev Ed). -

Official Publication of the Law Society of Singapore | August 2016

Official Publication of The Law Society of Singapore | August 2016 Thio Shen Yi, Senior Counsel President The Law Society of Singapore A RoadMAP for Your Journey The 2016 Mass Call to the Bar will be held this month on 26 Modern psychology tells us employees are not motivated and 27 August over three sessions in the Supreme Court. by their compensation – that’s just a hygiene factor. Pay Over 520 practice trainees will be admitted to the roll of mustn’t be an issue in that it must be fair, and if there is a Advocates & Solicitors. differential with their peers, then ceteris paribus, it cannot be too significant. Along with the Chief Justice, the President of the Law Society has the opportunity to address the new cohort. I Instead, enduring motivation is thought to be driven by three had the privilege of being able to do so last year in 2015, elements, mastery, autonomy, and purpose. There’s some and will enjoy that same privilege this year. truth in this, even more so in the practice of law, where we are first and foremost, members of an honourable The occasion of speaking to new young lawyers always profession. gives me pause for thought. What can I say that will genuinely add value to their professional lives? Making Mastery: The challenge and opportunity to acquire true motherhood statements is as easy as it is pointless. They expertise. There is a real satisfaction in being, and becoming, are soon forgotten, even ignored, assuming that they are really good at something. Leading a cross-border deal heard in the first place. -

Brought to You by the FOCC Marketing Committee 18/19 Freshmen Handbook 2 0 1 9 Message from the Marketing Committee

Brought to you by the FOCC to Brought 18/19 Committee Marketing Freshmen Handbook 2 0 1 9 Message from the Marketing Committee Hi Freshies! When we first started planning this Orientation, we wanted to create an unforgettable Orientation experience filled with laughter, cheer and banter. More importantly, we wanted to give you a taste of the great four years that you will have in NUS Law. The next few years in law school will definitely be tough. It will not be an easy stroll through Botanic Gardens, or a simple dip in the pool at CCAB. However, it will also be an extremely rewarding and fulfilling experience. No matter how tough times get, remember to always be here for each other and support each other. Always remember to take a break and hydrate yourselves. Orientation is just the beginning of all the friends you will make and good times you will have in law school. We hope that you’ve enjoyed Orientation as much as we have. Have the bestest year ahead! With all the love + lawsku muggers + Fu Shan’s Deans Lister Power, Kai Le, Ashley, Fu Shan The Marketing Committee 2018/19 P.S. Join Marketing Committee next year! :DDD 1 Table of Content 03 Getting to know BTC 05 Places to Eat 1 2 Muggers Getting to know BTC 03 Places to Eat 05 Study Areas 07 Useful Links 08 The FOCC 11 Muggers 12 Social Media Feature 13 Copyright and Disclaimer Sponsorship Profiles 14 All rights are reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, by photocopy, recording or otherwise without prior permission from the committee. -

S. No. Name Law Practice 1 A.Revi Shanker S/O K.Annamalai

Annual Election for Council 2021 Category: Middle Nomination Date: 12 October 2020 S. No. Name Law Practice 1 A.Revi Shanker s/o K.Annamalai ARShanker Law Chambers 2 Aaron Kok Ther Chien Holman Fenwick Willan Singapore LLP 3 Aaron Lee Teck Chye Allen & Gledhill LLP 4 Abdul Aziz Bin Abdul Rashid I.R.B. Law LLP 5 Abdul Rahman Bin Mohd Hanipah Abdul Rahman Law Corporation 6 Abdul Wahab Bin Saul Hamid A.W. Law LLC 7 Adam Muneer Yusoff Maniam Drew & Napier LLC 8 Adriel Aloysius Chia Teck Yew Ashurst LLP 9 Ahn Mi Mi Focus Law Asia LLC 10 Aileen Oh Ai Li Fortis Law Corporation 11 Akesh Abhilash Harry Elias Partnership LLP 12 Akshay Kothari Anderson Mori & Tomotsune (Singapore) LLP 13 Alcina Lynn Chew Aiping Tan Kok Quan Partnership 14 Aleksandar Anatoliev Georgiev Rajah & Tann Singapore LLP 15 Alex Yeo Sheng Chye Niru & Co LLC 16 Alexandra Simonetta Jones Gibson, Dunn & Crutcher LLP 17 Allister Brendan Tan Yu Kuan Drew & Napier LLC 18 Alvin Chan Tuan-Tseng (Alvin Zeng Farallon Law Corporation Chuansheng) 19 Alvin Ong Chee Keong (Wang Resource Law LLC Zhiqiang) 20 Amanda Koh Jia Yi Eldan Law LLP 21 Amarjit Singh s/o Hari Singh Amarjit Sidhu Law Practice 22 Amira Nabila Budiyano Gateway Law Corporation 23 Amos Wee Choong Wei DC Law LLC 24 Anand George BR Law Corporation 25 Andre Darius Jumabhoy Peter Low & Choo LLC 26 Ang Ann Liang (Hong Anliang) Allen & Gledhill LLP 27 Ang Chong Yi (Hong Chongyi) RHTLaw Asia LLP 28 Ang Hui Lin, Cheryl Anne (Hong ADTlaw LLC Huilin, Cheryl Anne) 29 Ang Kaili Virtus Law LLP 30 Ang Kim Hock Wong & Leow LLC 31 Ang -

![Public Prosecutor V Muhammad Farid Bin Mohd Yusop [2015] SGCA 12](https://docslib.b-cdn.net/cover/5489/public-prosecutor-v-muhammad-farid-bin-mohd-yusop-2015-sgca-12-5085489.webp)

Public Prosecutor V Muhammad Farid Bin Mohd Yusop [2015] SGCA 12

Public Prosecutor v Muhammad Farid bin Mohd Yusop [2015] SGCA 12 Case Number : Criminal Appeal No 4 of 2014 Decision Date : 11 March 2015 Tribunal/Court : Court of Appeal Coram : Chao Hick Tin JA; Andrew Phang Boon Leong JA; Tay Yong Kwang J Counsel Name(s) : Lau Wing Yum and Lim How Khang (Attorney-General's Chambers) for the appellant; Amolat Singh (Amolat & Partners) and Mervyn Cheong Jun Ming (Eugene Thuraisingam) for the respondent. Parties : Public Prosecutor — Muhammad Farid bin Mohd Yusop Criminal Law – Statutory Offences – Misuse of Drugs Act 11 March 2015 Andrew Phang Boon Leong JA (delivering the grounds of decision of the court): Introduction 1 This was an appeal against the decision of the High Court judge (“the Judge”) in Public Prosecutor v Muhammad Farid bin Mohd Yusop [2014] SGHC 125 (“the Judgment”). The accused (“the Respondent”) had claimed trial to the following charge of trafficking in methamphetamine (which we will hereinafter refer to by its street name “Ice”) under s 5(1)(a) read with s 5(2) of the Misuse of Drugs Act (Cap 185, 2008 Rev Ed) (“the Act”): That you, MOHAMMAD FARID BIN MOHD YUSOP, on 10 March 2011, at about 5.30 a.m., in the vicinity of the traffic junction of Lavender Street and Bendemeer Road, Singapore, inside vehicle SGH3547U, did traffic in a controlled drug specified as a “Class A drug” in the First Schedule to the Misuse of Drugs Act (Cap 185,2008 Rev Ed) (“the Act”), to wit, by having in your possession for the purpose of trafficking, two packets of crystalline substance which was analysed and found to contain not less than 386.7 grams of methamphetamine, without any authorisation under the Act or the regulations made thereunder, and you have thereby committed an offence under s 5(l)(a) read with s 5(2) and punishable under s 33 of the Act, and further upon your conviction under s 5(1) of the Act, you may alternatively be liable to be punished under s 33B of the Act. -

“Kill the Chicken to Scare the Monkeys” Suppression of Free Expression and Assembly in Singapore

HUMAN “Kill the Chicken RIGHTS to Scare the Monkeys” WATCH Suppression of Free Expression and Assembly in Singapore “Kill the Chicken to Scare the Monkeys” Suppression of Free Expression and Assembly in Singapore Copyright © 2017 Human Rights Watch All rights reserved. Printed in the United States of America ISBN: 978-1-6231-35522 Cover design by Rafael Jimenez Human Rights Watch defends the rights of people worldwide. We scrupulously investigate abuses, expose the facts widely, and pressure those with power to respect rights and secure justice. Human Rights Watch is an independent, international organization that works as part of a vibrant movement to uphold human dignity and advance the cause of human rights for all. Human Rights Watch is an international organization with staff in more than 40 countries, and offices in Amsterdam, Beirut, Berlin, Brussels, Chicago, Geneva, Goma, Johannesburg, London, Los Angeles, Moscow, Nairobi, New York, Paris, San Francisco, Sydney, Tokyo, Toronto, Tunis, Washington DC, and Zurich. For more information, please visit our website: http://www.hrw.org DECEMBER 2017 ISBN: 978-1-6231-35522 “Kill the Chicken to Scare the Monkeys” Suppression of Free Expression and Assembly in Singapore Glossary .............................................................................................................................. i Summary ........................................................................................................................... 1 Criminal Penalties for Peaceful Speech ................................................................................... -

Nagaenthran A/L K Dharmalingam V Public Prosecutor and Another Appeal

IN THE COURT OF APPEAL OF THE REPUBLIC OF SINGAPORE [2019] SGCA 37 Criminal Appeal No 50 of 2017 Between Nagaenthran a/l K Dharmalingam … Appellant And Public Prosecutor … Respondent Civil Appeal No 98 of 2018 Between Nagaenthran a/l K Dharmalingam … Appellant And Public Prosecutor … Respondent JUDGMENT [Criminal Law] — [Statutory offences] — [Misuse of Drugs Act] [Administrative Law] — [Judicial review] — [Ambit] [Constitutional Law] — [Judicial Power] ii This judgment is subject to final editorial corrections approved by the court and/or redaction pursuant to the publisher’s duty in compliance with the law, for publication in LawNet and/or the Singapore Law Reports. Nagaenthran a/l K Dharmalingam v Public Prosecutor and another appeal [2019] SGCA 37 Court of Appeal — Criminal Appeal No 50 of 2017 and Civil Appeal No 98 of 2018 Sundaresh Menon CJ, Andrew Phang Boon Leong JA, Judith Prakash JA, Chao Hick Tin SJ and Belinda Ang Saw Ean J 24 January 2019 27 May 2019 Judgment reserved. Sundaresh Menon CJ (delivering the judgment of the court): 1 On 14 November 2012, Parliament passed the Misuse of Drugs (Amendment) Act 2012 (No 30 of 2012) (“the Amendment Act”), which introduced s 33B of the Misuse of Drugs Act (Cap 185, 2008 Rev Ed) (“MDA”). The amendment brought about two significant changes to the legal framework governing the sentencing of certain groups of those convicted of drug trafficking. First, it conferred upon a court the discretion to sentence an offender convicted of a drug trafficking offence that would ordinarily attract the imposition of the mandatory death penalty, to life imprisonment instead if the offender’s involvement in the offence was merely as a courier, as described in s 33B(2)(a), and the Public Prosecutor (“PP”) had issued a certificate of substantive assistance under s 33B(2)(b) in respect of the offender. -

![Chin Bay Ching V Merchant Ventures Pte Ltd [2005]](https://docslib.b-cdn.net/cover/2355/chin-bay-ching-v-merchant-ventures-pte-ltd-2005-6642355.webp)

Chin Bay Ching V Merchant Ventures Pte Ltd [2005]

Chin Bay Ching v Merchant Ventures Pte Ltd [2005] SGCA 29 Case Number : CA 86/2004 Decision Date : 17 May 2005 Tribunal/Court : Court of Appeal Coram : Chao Hick Tin JA; Lai Kew Chai J Counsel Name(s) : Ang Cheng Hock and Eugene Thuraisingam (Allen and Gledhill) for the appellant; Kenny Khoo Ming Siang and Leong Why Kong (Ascentsia Law Corporation) for the respondent Parties : Chin Bay Ching — Merchant Ventures Pte Ltd Tort – Defamation – Injunction – Interlocutory injunctions – Mandatory and prohibitory injunctions – Mandatory injunction requiring retraction of allegedly defamatory statements – Prohibitory injunction restraining future publication of allegedly defamatory statements – Applicable principles for granting interlocutory injunctions in defamation actions Tort – Defamation – Injunction – Interlocutory injunctions – Mandatory injunction requiring retraction of allegedly defamatory statements – Whether court having power to grant such injunctions 17 May 2005 Chao Hick Tin JA (delivering the judgment of the court): 1 This was an appeal against a mandatory injunction and a prohibitory injunction granted by the High Court (see [2005] 1 SLR 328) in an action instituted by the respondent, Merchant Ventures Pte Ltd (“MVP”) against the appellant, Chin Bay Ching (“Chin”) for defamation and malicious falsehood. We heard the appeal on 24 March 2005 and discharged both the injunctions. We now give our reasons. The background 2 MVP is a Singapore company incorporated by Chin. Initially, it had two shareholders, with Chin holding one share and his brother, Chin Bay Fah, the other share. The brothers were also the first directors of MVP. 3 Sometime in 1997, MVP entered into a joint venture with a Chinese company, Zhuhai City Jin Xing Industry & Commerce Company (“Jin Xing”) to develop a golf course, a country club and several bungalow homes (collectively, “the project”) in Zhuhai, the People’s Republic of China. -

TYC Investment Pte Ltd and Others V Tay Yun Chwan Henry and Another

TYC Investment Pte Ltd and others v Tay Yun Chwan Henry and another [2014] SGHC 192 Case Number : Originating Summons No 895 of 2013 Decision Date : 10 October 2014 Tribunal/Court : High Court Coram : Lee Kim Shin JC Counsel Name(s) : Thio Shen Yi, SC, Lim Shaochun, Freddie and Tan Pei Qian, Rachel (TSMP Law Corporation) for the Plaintiffs; Chelva Retnam Rajah, SC, Sayana Baratham and Megan Chia (Tan Rajah & Cheah) for the 1st Defendant; andEugene Thuraisingam and Jerrie Tan Qiu Lin (Eugene Thuraisingam) for the 2nd Defendant. Parties : TYC Investment Pte Ltd and others — Tay Yun Chwan Henry and another Companies – directors – powers – duties Companies – memorandum and articles of association Contract – implied terms [LawNet Editorial Note: The appeal to this decision in Civil Appeal Nos 149 and 150 of 2014 was allowed in part by the Court of Appeal on 13 August 2015. See [2015] SGCA 40.] 10 October 2014 Lee Kim Shin JC: 1 It is a basic principle of company law that a company’s powers of management are reserved to its board of directors, and not its shareholders. This principle is encapsulated in s 157A(1) of the Companies Act (Cap 50, 2006 Rev Ed) (“the Companies Act”). 2 Section 157A(2) of the Companies Act in turn provides that the directors may exercise all of a company’s powers except any power that the Companies Act or the memorandum and articles of association of the company require the company to exercise in general meeting. I will sometimes refer to a company’s memorandum and the articles as the company’s “constitution”.