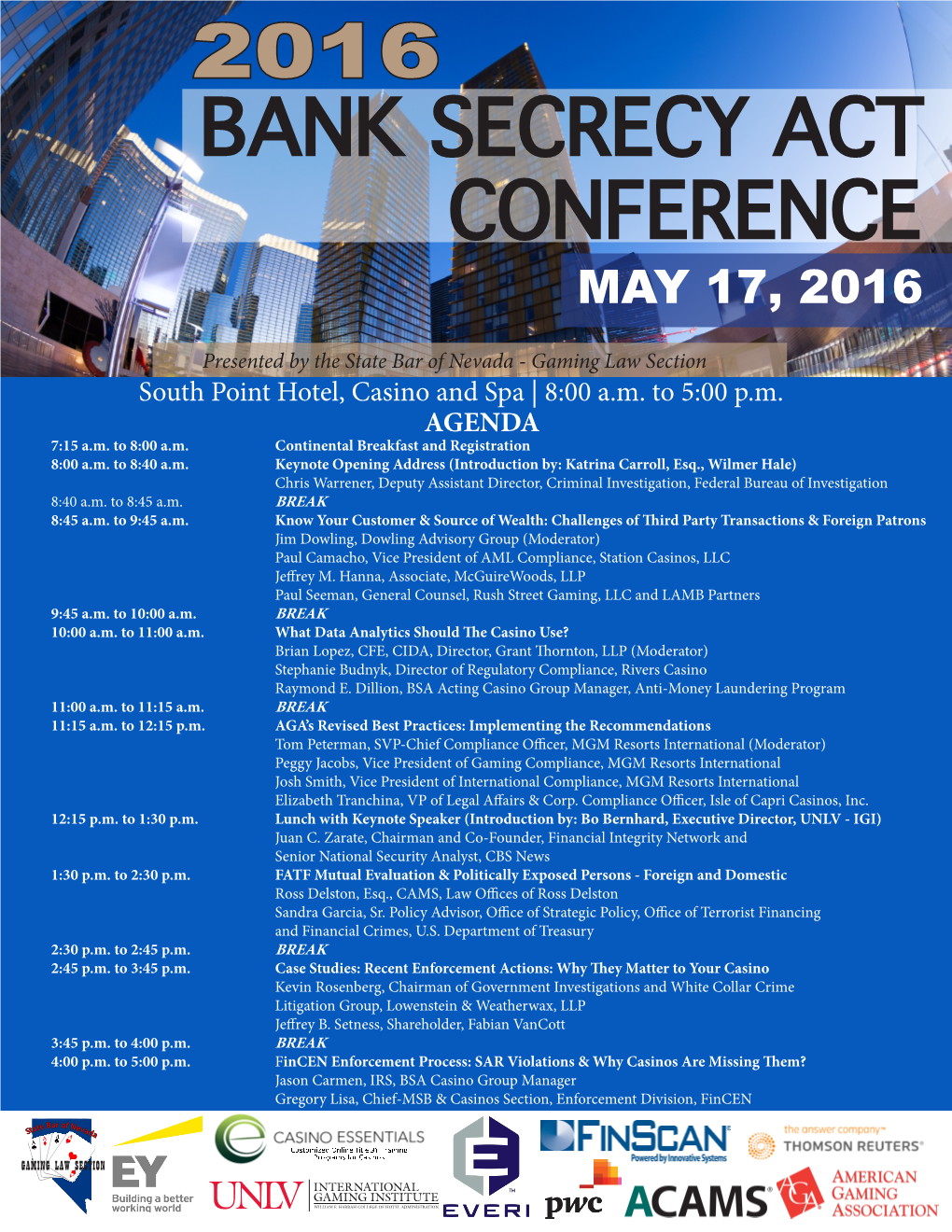

Bank Secrecy Act 2016 Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alliances and Partnerships in American National Security

FOURTH ANNUAL TEXAS NATIONAL SECURITY FORUM ALLIANCES AND PARTNERSHIPS IN AMERICAN NATIONAL SECURITY ETTER-HARBIN ALUMNI CENTER THE UNIVERSITY OF TEXAS AT AUSTIN OCTOBER 12, 2017 8:30 AM - 8:45 AM Welcome by William Inboden, Executive Director of the Clements Center for National Security, and Robert Chesney, Director of the Robert Strauss Center for International Security and Law 8:45 AM - 10:00 AM • Panel One: Defense Perspectives Moderator: Aaron O’Connell, Clements Center and Department of History Aaron O'Connell is an Associate Professor of History at the University of Texas at Austin and Faculty Fellow at the Clements Center. Previously, he served as Director for Defense Policy & Strategy on the National Security Council at the White House, where he worked on a range of national security matters including security cooperation and assistance, defense matters in Africa, significant military exercises, landmine and cluster munitions policy, and high-technology matters affecting the national defense, such as autonomy in weapon systems. Dr. O’Connell is also the author of Underdogs: The Making of the Modern Marine Corps, which explores how the Marine Corps rose from relative unpopularity to become the most prestigious armed service in the United States. He is also the editor of Our Latest Longest War: Losing Hearts and Minds in Afghanistan, which is a critical account of U.S. efforts in Afghanistan since 2001. He has also authored a number of articles and book chapters on military affairs and the representations of the military in U.S. popular culture in the 20th century. His commentary has appeared in The New York Times, The Washington Post, Foreign Affairs, and The Chronicle of Higher Education. -

The Japan-U.S. Counterterrorism Alliance in an Age of Global Terrorism

The Japan-U.S. Counterterrorism Alliance In an Age of Global Terrorism by Juan C. Zarate MARCH 2016 CENTER FOR STRATEGIC AND INTERNATIONAL STUDIES 1 Acknowledgements In 2013, the Sasakawa Peace Foundation, Sasakawa USA, and the Center for Strategic and International Studies (CSIS) established a bilateral commission of distinguished policymakers and scholars to develop a strategic vision for the U.S.-Japan alliance. This report is intended to inform the commissioners’ findings, as well as the general public. The author and CSIS thank the Sasakawa Peace Foundation in Japan and Sasakawa USA for their generous support. The author thanks Claire McGillem for her vital research support as well as Andrew Chapman and Tetsuro Sone for assisting with production of this report. 2 About the Author Juan Zarate is a senior adviser at the Center for Strategic and International Studies (CSIS), Chairman and Co-Founder of the Financial Integrity Network, the Senior National Security Analyst for CBS News, and a Visiting Lecturer of Law at the Harvard Law School. Mr. Zarate also serves as the Chairman and Senior Counselor for the Foundation for Defense of Democracies’ Center on Sanctions and Illicit Finance (CSIF) and a Senior Fellow to the Combating Terrorism Center at West Point. Mr. Zarate served as the Deputy Assistant to the President and Deputy National Security Advisor for Combating Terrorism from 2005 to 2009, and was responsible for developing and implementing the U.S. Government’s counterterrorism strategy and policies related to transnational security threats. Mr. Zarate was the first ever Assistant Secretary of the Treasury for Terrorist Financing and Financial Crimes where he led domestic and international efforts to attack terrorist financing, the innovative use of Treasury’s national security-related powers, and the global hunt for Saddam Hussein’s assets. -

The Next Terrorist Financiers: Stopping Them Before They Start

THE NEXT TERRORIST FINANCIERS: STOPPING THEM BEFORE THEY START HEARING BEFORE THE TASK FORCE TO INVESTIGATE TERRORISM FINANCING OF THE COMMITTEE ON FINANCIAL SERVICES U.S. HOUSE OF REPRESENTATIVES ONE HUNDRED FOURTEENTH CONGRESS SECOND SESSION JUNE 23, 2016 Printed for the use of the Committee on Financial Services Serial No. 114–94 ( U.S. GOVERNMENT PUBLISHING OFFICE 25–849 PDF WASHINGTON : 2017 For sale by the Superintendent of Documents, U.S. Government Publishing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate Nov 24 2008 16:41 Aug 16, 2017 Jkt 025849 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 K:\DOCS\25849.TXT TERI HOUSE COMMITTEE ON FINANCIAL SERVICES JEB HENSARLING, Texas, Chairman PATRICK T. MCHENRY, North Carolina, MAXINE WATERS, California, Ranking Vice Chairman Member PETER T. KING, New York CAROLYN B. MALONEY, New York EDWARD R. ROYCE, California NYDIA M. VELA´ ZQUEZ, New York FRANK D. LUCAS, Oklahoma BRAD SHERMAN, California SCOTT GARRETT, New Jersey GREGORY W. MEEKS, New York RANDY NEUGEBAUER, Texas MICHAEL E. CAPUANO, Massachusetts STEVAN PEARCE, New Mexico RUBE´ N HINOJOSA, Texas BILL POSEY, Florida WM. LACY CLAY, Missouri MICHAEL G. FITZPATRICK, Pennsylvania STEPHEN F. LYNCH, Massachusetts LYNN A. WESTMORELAND, Georgia DAVID SCOTT, Georgia BLAINE LUETKEMEYER, Missouri AL GREEN, Texas BILL HUIZENGA, Michigan EMANUEL CLEAVER, Missouri SEAN P. DUFFY, Wisconsin GWEN MOORE, Wisconsin ROBERT HURT, Virginia KEITH ELLISON, Minnesota STEVE STIVERS, Ohio ED PERLMUTTER, Colorado STEPHEN LEE FINCHER, Tennessee JAMES A. HIMES, Connecticut MARLIN A. STUTZMAN, Indiana JOHN C. -

Committee on Financial Services 2129 Rayburn House Office Building Washington, D.C

JEB HENSARLING, TX , CHAIRMAN MAXINE WATERS, CA, RANKING MEMBER United States House of Representatives Committee on Financial Services 2129 Rayburn House Office Building Washington, D.C. 20515 M E M O R A N D U M To: Members of the Committee on Financial Services From: FSC Majority and Minority Staff Date: June 22, 2016 Subject: June 23, 2016, Task Force to Investigate Terror Financing hearing entitled “The Next Terrorist Financiers: Stopping Them Before They Start” The Task Force to Investigate Terrorism Financing will hold a hearing entitled “The Next Terrorist Financiers: Stopping Them Before They Start” on Thursday, June 23, 2016, at 10:00 a.m. in Room 2128 of the Rayburn House Office Building. This will be a one-panel hearing with the following witnesses: • Mr. Juan C. Zarate, Chairman and Senior Counselor, Center on Sanctions and Illicit Finance at the Foundation for Defense of Democracies; and Senior Adviser, Center for Strategic and International Studies • The Honorable Jimmy Gurulé, Law Professor, Notre Dame Law School • Mr. John Cassara, former U.S. Intelligence Officer and Treasury Special Agent • Professor Celina B. Realuyo, Professor of Practice, William J. Perry Center for Hemispheric Defense Studies, National Defense University • Mr. Douglas Farah, President, IBI Consultants LLC; Senior Non-Resident Associate, Americas Program, Center for Strategic and International Studies and Senior Fellow, International Assessment and Strategy Center Introduction This memorandum provides summaries of ten hearings, in reverse chronological order, held by the House Financial Services Committee’s Task Force to Investigate Terrorism Financing over a two-year period. It is intended to support a final summation hearing of the Task Force, which will be held June 23, 2016.1 June 8, 2016: “The Enemy in Our Backyard: Examining Terror Funding Streams from South America” Overview. -

2017 Framlxpo on Numerous Media Programs Including CNN, 60 Minutes, Good Morning America, C-SPAN’S Washington Journal, and the Oprah Winfrey Show

GUEST SPEAKERS CHRIS SWECKER Financial Crimes Consultant and Attorney Assistant Director, FBI (retired) Former Global Security Director, Bank of America Chris Swecker has more than 30 years of experience in law enforcement, national security, legal, and corporate security/risk management. Chris served 24 years with the Federal Bureau of Investigation (FBI) before retiring as one of the bureau’s top officials. As Assistant Director, Chris was responsible for eight FBI divisions encompassing more than half of the FBI’s total resources. He led all FBI criminal investigations including money laundering, organized crime/drug trafficking and financial crime matters; established and led several crime focused national task forces; and testified before Congress on numerous financial crime issues such as identity theft, crimes against children, mortgage fraud, human trafficking, financial crimes, information privacy and data compromise, crimes on the Internet, drug trafficking and gangs. Swecker received the prestigious Presidential Rank Award for his service in Iraq and as Special Agent in Charge of the NC Office. He has appeared as a guest 2017 FRAMLxpo on numerous media programs including CNN, 60 Minutes, Good Morning America, C-SPAN’s Washington Journal, and The Oprah Winfrey Show. Chris is a frequent public speaker on financial crimes, money laundering and cyber crimes. Annual User Conference STEPHANIE BROOKER Partner at Gibson, Dunn & Crutcher LLP; Former Director, Enforcement Division, FinCEN Former Chief, Asset Forfeiture and Money; Laundering Section, U.S. Attorney’s Office for the District of Columbia Prior to joining Gibson Dunn in 2016, Ms. Brooker served as the Director of the Enforcement Division at the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) and as Chief of the Asset Forfeiture and Money Laundering Section at the U.S. -

The Honorable Juan C. Zarate

The Honorable Juan C. Zarate Juan Zarate is the Chairman and Co-Founder of the Financial Integrity Network, the Senior National Security Analyst for CBS News, and a Visiting Lecturer of Law at the Harvard Law School. Mr. Zarate also serves as the Chairman and Senior Counselor for the Foundation for Defense of Democracies’ Center on Sanctions and Illicit Finance (CSIF), a Senior Adviser at the Center for Strategic and International Studies (CSIS), and a Senior Fellow to the Combating Terrorism Center at West Point. Mr. Zarate served as the Deputy Assistant to the President and Deputy National Security Advisor for Combating Terrorism from 2005 to 2009, and was responsible for developing and implementing the U.S. Government’s counterterrorism strategy and policies related to transnational security threats. Mr. Zarate was the first ever Assistant Secretary of the Treasury for Terrorist Financing and Financial Crimes where he led domestic and international efforts to attack terrorist financing, the innovative use of Treasury’s national security-related powers, and the global hunt for Saddam Hussein’s assets. Mr. Zarate is a former federal prosecutor who served on terrorism prosecution teams prior to 9/11, including the investigation of the USS Cole attack. Mr. Zarate has earned numerous awards for his work, including the Treasury Medal. Mr. Zarate sits on several boards, including HSBC’s global Financial System Vulnerabilities Committee (FSVC) and the HBMX FSVC, the Vatican’s Financial Information Authority (AIF), the Board of Advisors to the Director of the National Counterterrorism Center (NCTC), the George Washington University’s Center for Cyber & Homeland Security, America Abroad Media’s (AAM) Board of Advisors, the RANE Network Board, the Aspen Institute’s Homeland Security Group, and the Coinbase Board of Advisors. -

The Cyber Financial Wars on the Horizon: the Convergence of Financial and Cyber Warfare and the Need for a 21St Century National Security Response

The Cyber Financial Wars on the Horizon: The Convergence of Financial and Cyber Warfare and the Need for a 21st Century National Security Response Juan C. Zarate Foreword by Stewart Baker July 2015 FOUNDATION FOR DEFENSE OF DEMOCRACIES FOUNDATION The Cyber Financial Wars on the Horizon: The Convergence of Financial and Cyber Warfare and the Need for a 21st Century National Security Response Juan C. Zarate Foreword by Stewart Baker July 2015 FDD PRESS A division of the FOUNDATION FOR DEFENSE OF DEMOCRACIES Washington, DC This report is included in the monograph, Cyber-Enabled“ Economic Warfare: An Evolving Challenge,” edited by Dr. Samantha Ravich and published by the Hudson Institute. The Cyber Financial Wars on the Horizon Table of Contents Foreword .......................................................................................................................................... 3 Introduction ..................................................................................................................................... 4 The Evolution of the Cyber Financial Threat .................................................................................... 6 The Cyber Financial Battles Underway ........................................................................................... 11 Cyber Tools and Actors...................................................................................................................................13 Private and Public Sector Response................................................................................................ -

Countering Violent Extremism (CVE) Subcommittee

Name (TO List) Component 1')(6) Odom, Maria CISOMB Veitch, Alexandra OLA Ramanathan, Sue OLA Neffenger, Pete TSA Kerlikowske, Gil CBP Saldana, Sarah ICE Clancy, Joseph usss Rodriguez, Leon USCIS Gowadia, Huban DNDO Deyo, Russ MGMT Brinsfield, Kathy OHA Chavez, Rich OPS Bersin, Alan PLCY/OIA Bradsher, Tanya OPA Bunnell, Stevan E OGC Cantor, Jonathan PRIV Mack, Megan CRCL McNamara, Phil IGA Neuman, Karen PRIV Patrick, Connie FLETC Fugate, Craig FEMA Zukunft, Paul F ADM USCG Brothers, Reginald S&T Taylor, Francis X l&A Spaulding, Suzanne NPPS/OUS Name (CC list) Component Silvers, Robert DSEC Rezmovic, Jeffrey DSEC Singleton, Kathy L OCFO Simpkins, Lauren OCFO Carey, Holly OCFO DHS-001-425-006890 Page 1 of 4 Name Component Email Christian Marrone HQ 1')(6) Paul Rosen HQ Rob Silvers HQ Leonard Joseph ICE Kim O'Connor ESEC Michael Coen FEMA Mary Peterson l&A Alaina Clark IGA Vince Micone MGMT David Hess NPPA Meghan Ludtke OGC Terri Cheshire OHA Rvan Ramsev OLA Timothv Quinn CBP Ste oh en Schorr CBP Tom McDaniels TSA Alan Metzler TSA Marv Krui;,er DNDO Tammv Howard OPA Todd Heinz OPS Hollv Canevari PLCY Jordan Gottfried PRIV Christina Murata S&T CAPT Michael Ryan USCG Juliet Choi USCIS Britton Yee usss David Gersten CVE Gary Merson CISOMB Pamela Jastal FLETC George Kovatch FLETC James Dinneen PSO Sarah Mon1 enthau HSAC-IGA Admiral Joanna Nunan MIL Veronica Venture CRCL DHS-001-425-006891 Page 2 of 4 !Name I component I Email DHS-001-425-006892 Page 3 of 4 !Name I component I Email DHS-001-425-006893 Page 4 of 4 Penland Marineka ~0)(6) F rom,"1,)( ) 6 1 "Guiler Hadlev <1rl ICb>C6> I TOl(b)(6) I ''Tarpley, Kyle </0 "Rezmovic, Jeffrey cc.fbk61 • "Hopkins, Brian </Q p,)(6) I Subject: Boston CVE Panel Date: 2014/04/10 10:48:03 Type: Note.EnterpriseVault.Shortcut Here is a bit more info if you want to pass along: Here is the link to the event S2 will be joining Monaco: https: //forum.