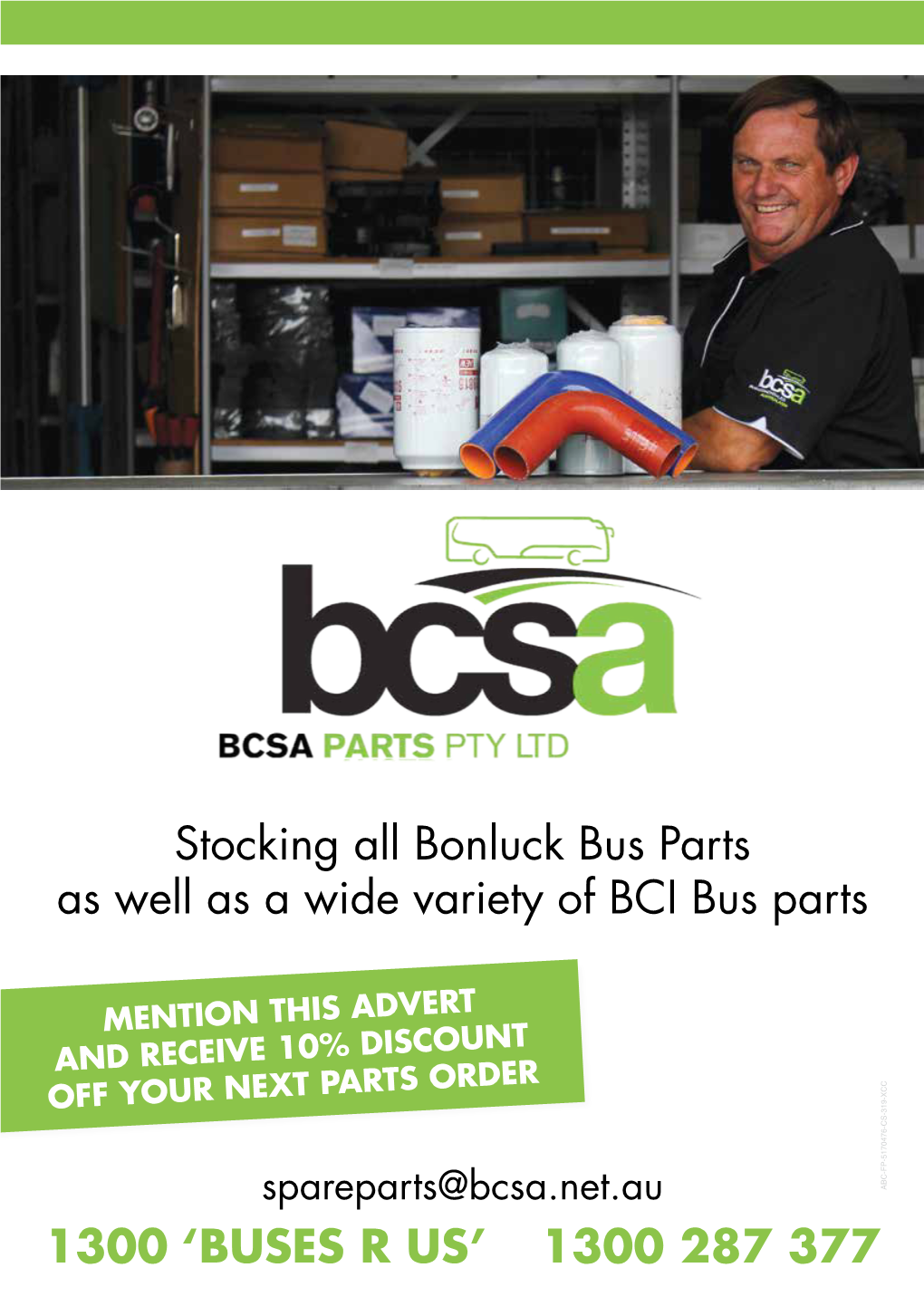

Stocking All Bonluck Bus Parts As Well As a Wide Variety of BCI Bus Parts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Code of Practice

I SEPTEMBER 2007 NATIONAL CODE OF PRACTICE Retrofitting Passenger Restraints to Buses Prepared by Vehicle Design & Research National Transport Commission National Code of Practice for Retrofitting Passenger Restraints in Buses Report Prepared by: Vehicle & Design Research ISBN: 1 921168 04 8 2 NATIONAL CODE OF PRACTICE: RETROFITTING PASSENGER RESTRAINTS TO BUSES FOREWORD The National Transport Commission (NTC) is a statutory body established by an inter-governmental agreement to progress regulatory and operational reform for road, rail and inter-modal transport to deliver and sustain uniform or nationally consistent outcomes. Following the research that was commissioned for the NSW Roads and Traffic Authority (RTA) into the retrofitting of seatbelts for buses and coaches, as well as advice from the Bus Industry Confederation, it was concluded that the original guidelines (“Guidelines for the Voluntary Modification of Existing Buses and Coaches to Improve Occupant Protection”) needed to be revised. These guidelines were originally developed in 1994 by the National Road Transport Commission, the Federal Office of Road Safety and the Australian Bus and Coach Association. The NTC led the review and a Bus Seatbelts Steering Committee was involved in providing key input and overall direction on the review. A Code of Practice, which is intended to replace the original guidelines, has been prepared. It sets out requirements for modification of existing buses with the intention of improving occupant protection in crashes. The Code of Practice has been endorsed by the Bus Seatbelts Steering Committee and by Transport Agency Chief Executives after a period of public/stakeholder consultation. It was approved by the Australian Transport Council in August, 2007. -

Federal Hansard Acronyms List Remember: Ctrl+F for Quick Searches

Federal Hansard Acronyms List Remember: Ctrl+F for quick searches A B C D E F G H I J K L M N O P Q R S T U V W X Y Z A 2.5G [the first packet overlays on 2G networks] 2G second generation [the first generation of digital cellular networks, as opposed to analog] 3G third generation [next generation of cellular networks] 3GPP 3G Partnership Project [global standards body to oversee 3G] 4D meat from dead, dying, diseased or disabled animals 4GL fourth-generation language [computers] A&C automation and control A&D admission and disposition; alcohol and drugs A&E accident and emergency A&RMC formerly Austin & Repatriation Medical Centre [now Austin Health] AA anti-aircraft; Alcoholics Anonymous; Athletics Australia AAA Agriculture Advancing Australia; Australian Automobile Association; Australian Archaeological Association; Australian Airports Association AAAA Aerial Agricultural Association of Australia AAAE Australian Association of Automotive Electricians AAAGP Australian Association of Academic General Practice AAALAC Association for the Assessment and Accreditation of Laboratory Animal Care International AAB Australian Associated Brewers AAC Aboriginal advisory committee; Australian Arabic Council; AARNet Advisory Committee AACAP ATSIC-Army Community Assistance Program AACC Aboriginal Affairs Coordinating Committee [WA]; Australian Association of Career Counsellors AACM Australian Association for Computational Mechanics AACS Australian Associations of Christian Schools [note: Associations—plural] AACV Australian Association of Cattle Veterinarians AAD Australian Antarctic Division [Department of the Environment and Heritage] AADCP ASEAN-Australia Development Cooperation Program [taking over AAECP] AADS advanced air defence simulator AADT average annual daily traffic AaE Australian air Express Pty Ltd AAEC Antarctic Animal Ethics Committee AAECP ASEAN-Australia Economic Cooperation Program [finishes in 2005] AAFCANS Army and Air Force Canteen Service [now known as Frontline Defence Services] AAGP Australian Association of Group Psychotherapists Inc. -

Buses – Global Market Trends

2017 BUSES – GLOBAL MARKET TRENDS Markets – Competition – Companies – Key Figures Extract from the study BUSES – GLOBAL MARKET TRENDS Markets – Competition – Companies – Key figures In all regions across the globe, buses remain the most widespread public transport mode. Their demand goes hand in hand with several, mostly region-specific factors, including demographics, increasing mobility of people and environmental awareness, as well as public funding. Buses are comparatively to other transportation modes cheap and easy to use, since their use does not necessarily require the implementation of a specific infrastructure. This makes buses ideal vehicles for both short- and long-distance services. Based on the current developments, this Multi Client Study offers a comprehensive insight into the structure, volumes and development trends of the worldwide bus market. In concrete terms, the market study “BUSES – GLOBAL MARKET TRENDS” includes: A look at the worldwide market for buses differentiated by region An analysis of the relevant market data including present and future market volumes Information concerning the installed fleet and future procurement potential until 2022 An assessment of current developments and growth drivers of the worldwide bus markets in the individual regions An overview of bus manufacturers including an analysis of the market shares, financial backups as well as a brief description of the current product portfolio and strategy outlook A list of the major production facilities in each of the regions including product range as well as production capacities Presentation of the development stage of alternative propulsions, their manufacturers and their occurrence worldwide The study is available in English from the August 2017 at the price of EUR 3,400 plus VAT. -

TOUGH ACT to FOLLOW Titanium’S Southern Star Is a Tough-As-Nails Offroad Tourer $79,990 the ULTIMATE RV BUYING and SELLING MARKETPLACE $19,990

DIGITAL MAGAZINE ISSUE 261 $6.95 ON SALE 05/07/2021 INCLUDES MOTORHOME & CARAVAN TRADER Built for offroading TOUGH ACT TO FOLLOW Titanium’s Southern Star is a tough-as-nails offroad tourer THE ULTIMATE RV BUYING AND SELLING MARKETPLACE $48,990 $19,990 $79,990 R 2019 AVAN ASPIRE 2021 STAR VISION CAMPER TRAILERS FX 2 2000 winnebago (avida) alpine front tunnel boot battery pack & solar panel 1200kg Tare weight 4 burner gas cooktop cab air conditioning reversing camera 4 berth qld 07 5445 2215 vic 1300 783 318 nsw 02 4948 0433 ,!3BD0A6-aahdbj!:K; Discover Australia by caravan WITH HEMA’S FIRST GOTO GUIDE $39.95 Hema’s Go-To Guide for Caravans is the fi rst in a series of publications designed to provide essential information to those who thirst for new adventures. From windswept grey nomads to sun kissed newly- weds, Hema’s Go-To Guide for Caravans is a vital companion for every kind of caravan-hauling holiday maker. Everything the reader will need to know is presented in an easy-to-read format, with plenty of info-graphics and Hema maps, and advice from an extensive network of industry-leading experts. THE GOTO GUIDE COVERS • Trip Planning • Safety & Security • Preparation • Equipment & Gadgetry • Food & Frivolities • Inspiring Destinations • Maintenance & DIY DRIVE EXPLORE Be prepared to explore with Hema Maps, guides and digital navigation. shop.hemamaps.com NOW AVAILABLE FREE SHIPPING OVER $50 Discover Australia by caravan WITH HEMA’S FIRST GOTO GUIDE $39.95 Hema’s Go-To Guide for Caravans is the fi rst in a series of publications designed to provide essential information to those who thirst for new adventures. -

DEVELOPMENT of an ELECTRIC BUS PROTOTYPE USING LITHIUM-ION BATTERY for THAILAND Suchart Punpaisarn

DEVELOPMENT OF AN ELECTRIC BUS PROTOTYPE USING LITHIUM-ION BATTERY FOR THAILAND Suchart Punpaisarn A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor Philosophy in Electrical Engineering Suranaree University of Technology Academic Year 2018 การพัฒนาต้นแบบรถโดยสารไฟฟ้าที่ใช้แบตเตอรี่ลิเธียมไอออน ส าหรับประเทศไทย นายสุชาต ิ พนั ธ์ุไพศาล วทิ ยานิพนธ์นีเ้ ป็ นส่วนหนึ่งของการศึกษาตามหลกั สูตรปริญญาวศิ วกรรมศาสตรดุษฎีบัณฑิต สาขาวิชาวิศวกรรมไฟฟ้า มหาวทิ ยาลัยเทคโนโลยสี ุรนารี ปีการศึกษา 256 IV ACKNOWLEDGEMENTS This thesis has been made possible through the generosity of several people in various ways. I would like to express my deepest gratitude to my advisor, Assoc. Prof. Dr. Thanatchai Kulworawanichpong for his support, enlightening guidance, inspiration and encouragement throughout the course of this study. Through their supervision, I have learned a lot especially how to be more prudent, selective, reasonable, and critical decision. Their valuable feedback, comments, and suggestions have always been a source of guidance for my improvement in work. I would like to acknowledge financial support from Research and Researchers for Industries of Thailand (Grant ID: PHD5710004) during the period of study. It is my pleasure to express my sincere gratitude to Mr. Christof Dardel and Mr. Peter Baumann at DRIVETEK AG, Switzerland who supported and advised when I did research about the electric bus in Switzerland. He provided the knowledge, technology theory about electric bus. His valuable new technology suggestions has always been a source of guidance for me to improve my knowledge. My sincere appreciation is extended to the committee members of both the proposal and thesis defense for their useful comments and suggestions who served many insightful and useful comments upon the success of this work. -

B7R Range B7R Volvo B7R and B7RLE – Low Entry

VOLVO B7R range B7R Volvo B7R and B7RLE – Low Entry VOLVO B7R. Two axle rear engined chassis: 7 litre engine rated at 290 hp. Overall lengths up to 13.5 meters. Sample layouts. VOLVO B7RLE. Two axle low entry rear engined chassis: 7 litre engine rated at 290 hp. Overall lengths up to 13.5 meters. Sample layouts. Profitable from start to finish Unmatched reliability and class-leading fuel economy – two powerful arguments in favour of the B7R range. Both the Volvo B7R and B7RLE are built to give you the maximum productivity and low whole-life operating costs. High quality in every detail, long service intervals and an efficient spare parts back-up combine to ensure profitable operation and care-free ownership. Volvo B7R and B7RLE are two of Volvo’s most versatile chassis. The B7RLE is mainly intended for city operation while the B7R suits many intercity roles and is an effective coach the world over. Whichever variant you choose you get a chassis fully equipped with Volvo’s safety know-how and care for environment. MEETS EURO 5. The Volvo D7 engine in Volvo B7R and B7RLE uses common rail diesel fuel injection technology for high efficiency, low emissions and low noise. The D7 complies with Euro 5 and EEV (Enhanced Environmental friendly Vehicle) emission requirements but is also available in versions to suit Euro 4 and Euro 3. Green efficiency: efficient and green at the same time With Volvo B7R and B7RLE not only do you get two of the industry’s most reliable chassis RESPONSIVE. -

Quality from Experience CHTC•BONLUCK BUS Co., Ltd

Quality from Experience CHTC•BONLUCK BUS Co., Ltd. (BLK) is a and New Zealand market. shareholding enterprise integrating bus design, R&D, producing and sales. BCSA’s in-house workshop is fitted with the most advanced equipment and staffed by the industry’s BONLUCK (BLK) is the first Bus & Coach leading technicians. manufacturer in China exporting in large quantities to developed countries and regions worldwide. Further more the customer service centre at BCSA also offer extensive service and a fully stocked parts division With a factory that covers a total area of 150,000m2 to ensure that your vehicle is kept in A1 contition. and 30,000m2 of that being dedicated to the workshop and assembly line, having current production capacity One of BCSA top priorities is to enure that your vehicle of 5,000 units annually with the possibility of 10,000 runs reliably, affordably and efficiently. units per year after the planned expansion. With BCSA’s team priding themselves on exceptional A recent partnership between BLK and Bus & Coach Customer Service and an extensive knowledge of the Sales Australasia (BCSA) has facilitated a more industry, make BCSA your first choice when streamlined business model, allowing greater purchasing your next vehicle. input and quality control for the Australian ABC-FP-5170476-CS-318-XCC [email protected] 07 33861034 TRADEBUSES.COM.AU THE BUS YOU WANT IS NOW EASIER TO FIND 1994 Scania K113 Coach 2007 BCI Cruiser Coach 2008 BCI Cruiser 9 • Aus. Autobus chassis • 12.5m length • 48 reclining seats w/ 3-pt lap/sash seat -

Fleet List - 1 January 2014

Fleet List - 1 January 2014 Fleet no. Reg. No. Chassis Type Chassis Number Bodywork Type Body Number Seats First Reg Livery 1 AF61 OXF Scania K360EB 1876341 Plaxton Panther BP02/01 C44Ft Dec-11 the airline 2 BF61 OXF Scania K360EB 1876358 Plaxton Panther BP02/02 C44Ft Dec-11 the airline 3 CF61 OXF Scania K360EB 1876357 Plaxton Panther BP02/03 C44Ft Dec-11 the airline 4 DF61 OXF Scania K360EB 1876361 Plaxton Panther BP02/04 C44Ft Dec-11 the airline 5 EF61 OXF Scania K360EB 1876371 Plaxton Panther BP02/05 C44Ft Dec-11 the airline 6 FF61 OXF Scania K360EB 1876400 Plaxton Panther BP02/06 C44Ft Dec-11 the airline 7 GF61 OXF Scania K360EB 1876649 Plaxton Panther BP02/07 C44Ft Dec-11 the airline 8 HF61 OXF Scania K360EB 1876667 Plaxton Panther BP02/08 C44Ft Dec-11 the airline 9 JF61 OXF Scania K360EB 1876669 Plaxton Panther BP02/09 C44Ft Dec-11 the airline 10 KF61 OXF Scania K360EB 1876657 Plaxton Panther BP02/10 C44Ft Dec-11 the airline 11 LF61 OXF Scania K360EB 1876865 Plaxton Panther BP02/11 C44Ft Dec-11 the airline 12 MF61 OXF Scania K360EB 1876746 Plaxton Panther BP02/12 C44Ft Dec-11 the airline 13 OF61 OXF Scania K360EB 1876748 Plaxton Panther BP02/13 C44Ft Dec-11 the airline 14 PF61 OXF Scania K360EB 1876751 Plaxton PaPanthernther BP02/14 C44Ft Dec-11Dec 11 the airline 15 RF61 OXF Scania K360EB 1876765 Plaxton Panther BP02/15 C44Ft Dec-11 the airline 16 SF61 OXF Scania K360EB 1876874 Plaxton Panther BP02/16 C44Ft Dec-11 the airline 17 TF61 OXF Scania K360EB 1876879 Plaxton Panther BP02/17 C44Ft Dec-11 white generic coach 18 UF61 OXF Scania -

Ccn Tin Importer Im0006021794 430968150000 Daesang Ricor Corporation Im0002959372 003873536000 Westpoint Industrial Sales Co

CCN TIN IMPORTER IM0006021794 430968150000 DAESANG RICOR CORPORATION IM0002959372 003873536000 WESTPOINT INDUSTRIAL SALES CO. INC. IM0002992817 000695510000 ASIAN CARMAKERS CORPORATION IM0002963779 232347770000 STRONG LINK DEVELOPMENT CORPORATION IM0003299511 002624091000 TABAQUERIA DE FILIPINAS INC. IM0003063011 217711150000 ASIAWIDE REFRESHMENTS CORPORATION IM0002963639 001007787000 GX INTERNATIONAL INC. IM0006830714 456650820000 MOBIATRIX INC IM0003014592 002765139000 INNOVISTA TECHNOLOGIES INC. IM0003214699 005393872000 MONTEORO CHEMICAL CORPORATION IM0004340299 000126640000 LINKWORTH INTERNATIONAL INC. IM0006804179 417272052000 EATON INDUSTRIES PHILIPPINES LLC PH IM0002957590 000419293000 ALLEGRO MICROSYSTEMS PHILS. INC. IM0004143132 001030408000 PUENTESPINA ORCHIDS AND TROPICAL IM0003131297 004558769000 ARCHITECKS METAL SYSTEMS INC. IM0003025799 103873913000 MCMASTER INTERNATIONAL SALES IM0002973979 000296020000 CARE PRODUCTS INC IM0003014231 001026198000 INFRATEX PHILIPPINES INC. IM0002962691 000288655000 EURO-MED LABORATORIES PHILS. INC. IM0003031438 006818264000 NORTHFIELDS ENTERPRISES INT'L. INC. IM0003170217 002925850000 KENRICH INT'L . DISTRIBUTOR INC. IM0003259994 000365522000 KAMPILAN MANUFACTURING CORPORATION IM0003132498 103901522000 PEONY MERCHANDISING IM0002959496 204366533000 GLOBEWIDE TRADING IM0002966514 000070213000 NORKIS TRADING CO INC. IM0003232492 000117630000 ENERGIZER PHILIPPINES INC. IM0003131513 000319974000 HI-Q COMMERCIAL.INC IM0003035816 000237662000 PHILIPPINE INTERNATIONAL DEV'T INC. IM0003090795 113041122000 -

Bus & Coach International

BUY AND SELL BUSES WITH AUSTRALIA’S #1 BUS CLASSIFIEDS* BUY More than 340 buses and coaches to choose from SELL Maximise your ads’ exposure online & in ABC magazine. To list your ad call 03 9567 4154 today! INSIDE AUSTRALIA’S LARGEST BUS CLASSIFIEDS THETHE YEARYEAR AHEADAHEAD StateState associationsassociations pplanlan fforor 20152015 ECLECTICECLECTIC ELECTRICSELECTRICS BustechBustech designsdesigns eelectriclectric bbusus MAJORMAJOR MILESTONEMILESTONE Half-centuryHalf-century fforor HHinoino IssueIsIIssssueue 32932 JanuaryJJanuanuu ryy 2015201010 55$ $5.95$5.95 5 inci GSTGGSST PP100008045PP1PP10PPP 00080000080 040454 WIN AN SEE DETAILS INSIDE. WWW.BUSNEWS.COM.AU VALLEY Moonee Valley Coaches proves resilient BUSNEWS.COM.AU THE BUS YOU WANT IS NOW EASIER TO FIND ALREADY 25 UNITS SOLD 2005 MERCEDES BENZ 0500 46, 53 or 57 passenger option. 2007 VOLVO B7R 1999 SCANIA L94 6sp man, 12.5m Mills Tui bodies, 2011 BONLUCK 2007 HINO RB8 1995 MAN 11-190 1995 MOTORCOACH 46/49 lap/sash seat belted Auto,Coach Design body, 8sp manual, 57 passenger recliners, 2 door, Thermo King 8.5m,automatic, 5sp manual,Chiron body, 34 lap sash seat belted 6sp manual, PMC Apollo HI DECK 14.5M fixed lap sash seat belts just A/C, mid toilet, urn, DVD, ducted 28 leather lap sash seat belted 34 lap sash seat belted recliners,toilet, 2 door, body, 34 lap sash Detroit Series 60, retrimmed, Coachair A/C, vac, pull down blinds to salooon, recliners, toilet, A/C, seats,A/C,wheeelchair lift, A/C, underfloor bins, seat belted recliners, Allison auto,62 lap sash underfloor bins, DVD, bull bar, kneel, raise, alloys, many extras, underfloor bins, DVD, LCD screen,rear boot,school many extras, travelled A/C, toilet, DVD, seat belted recliners, tachograph, travelled approx. -

Globe Holidays

Globe Holidays Ltd Unofficial Fleetlist provided by Sheffield Omnibus Enthusiasts Society Metro Trading Estate, Barugh Green, Barnsley, S75 1GU Fleet No Registration Chassis Make and Model Body Make and Model Layout Livery Allocation Note 7025 RU Volvo B12B Caetano Enigma C49FT Globe Holidays Barugh Green BX64 AEV King Long XMQ6130C King Long DP73F white Barugh Green EIG 7401 Volvo B10M-6200 Berkhof Axial C49FLT Globe Holidays Barugh Green ex W324 UEL FN06 FLD Volvo B12B Caetano Levante C70F Globe Holidays Barugh Green FT11 EBT Volvo B9R Plaxton Panther II C44FT Globe Holidays (white/blue) Barugh Green GL19 BES Van Hool EX16M Van Hool C57FT Globe Holidays Barugh Green GT11 EBT Volvo B9R Plaxton Panther II C44FT Globe Holidays (white/blue) Barugh Green KX07 HDF Volvo B12B Plaxton Panther C57F white Barugh Green KX08 HLR Volvo B12B Plaxton Panther C57F white Barugh Green KX10 DVF Alexander Dennis Enviro 300 Alexander Dennis Enviro 300 B45F white Barugh Green KX10 DVG Alexander Dennis Enviro 300 Alexander Dennis Enviro 300 B45F white Barugh Green KX10 DVH Alexander Dennis Enviro 300 Alexander Dennis Enviro 300 B45F white Barugh Green KX10 DVJ Alexander Dennis Enviro 300 Alexander Dennis Enviro 300 B45F white Barugh Green KX60 DVP Alexander Dennis Dart SLF Alexander Dennis Enviro 200 B37F white Barugh Green P229 AUT Volvo B10M-6200 Plaxton Premiere 350 C49FT Globe Holidays Barugh Green PG02 YWA Volvo B12M Jonckheere Mistral C53F Globe Holidays Barugh Green SN55 HSU Alexander Dennis Dart SLF Alexander Dennis Pointer II B38F white Barugh Green TUI 8707 Kassbohrer Setra S315GT-HD Setra C49F Globe Holidays Barugh Green ex RG51 FMX W744 NAS Volvo B10M-6200 Plaxton Prestige C70F white Barugh Green YJ19 BBX Van Hool EX16M Van Hool C57FT Globe Holidays Barugh Green YN06 PFF Volvo B12M Plaxton Panther C70F Globe Holidays Barugh Green YN07 OPG Volvo B12M Plaxton Paragon C50FT Globe of Barnsley (pink/purp Barugh Green named 'Frank Mawby' YN12 CSO Volvo B9R Plaxton Panther C53FT white/blue Barugh Green 20 September 2019 © 2019 Sheffield Omnibus Enthusiasts Society. -

El Mercado De Componentes De Automoción En Australia

ESTUDIOS EM DE MERCADO 2019 El mercado de componentes de automoción en Australia Oficina Económica y Comercial de la Embajada de España en Sídney Este documento tiene carácter exclusivamente informativo y su contenido no podrá ser invocado en apoyo de ninguna reclamación o recurso. ICEX España Exportación e Inversiones no asume la responsabilidad de la información, opinión o acción basada en dicho contenido, con independencia de que haya realizado todos los esfuerzos posibles para asegurar la exactitud de la información que contienen sus páginas. ESTUDIOS EM DE MERCADO 11 de marzo de 2019 Sídney Este estudio ha sido realizado por Marta Picardo Tejera Bajo la supervisión de la Oficina Económica y Comercial de la Embajada de España en Sídney. Editado por ICEX España Exportación e Inversiones, E.P.E., M.P. NIPO: 114-19-038-4 EM EL MERCADO DE COMPONENTES DE AUTOMOCIÓN EN AUSTRALIA Índice 1. Resumen ejecutivo 5 2. Definición de sector 8 2.1. Situación actual de la industria 8 2.2. Partidas arancelarias 10 3. Oferta – Análisis de competidores 13 3.1. Tamaño del mercado 13 3.2. Importaciones 17 3.3. Exportaciones 24 3.4. Producción local 25 3.4.1. Fabricantes de componentes locales 25 3.4.2. Mayoristas de componentes 26 3.4.2.1. Mayoristas de componentes extranjeros establecidos en Australia 27 3.4.2.2. Mayoristas locales de componentes 28 3.4.3. Localización geográfica 28 4. Demanda 30 4.1. Vehículos en Australia 30 4.2. Demanda de componentes 35 4.2.1. Segmentación de la demanda por tipo cliente 35 4.2.2.