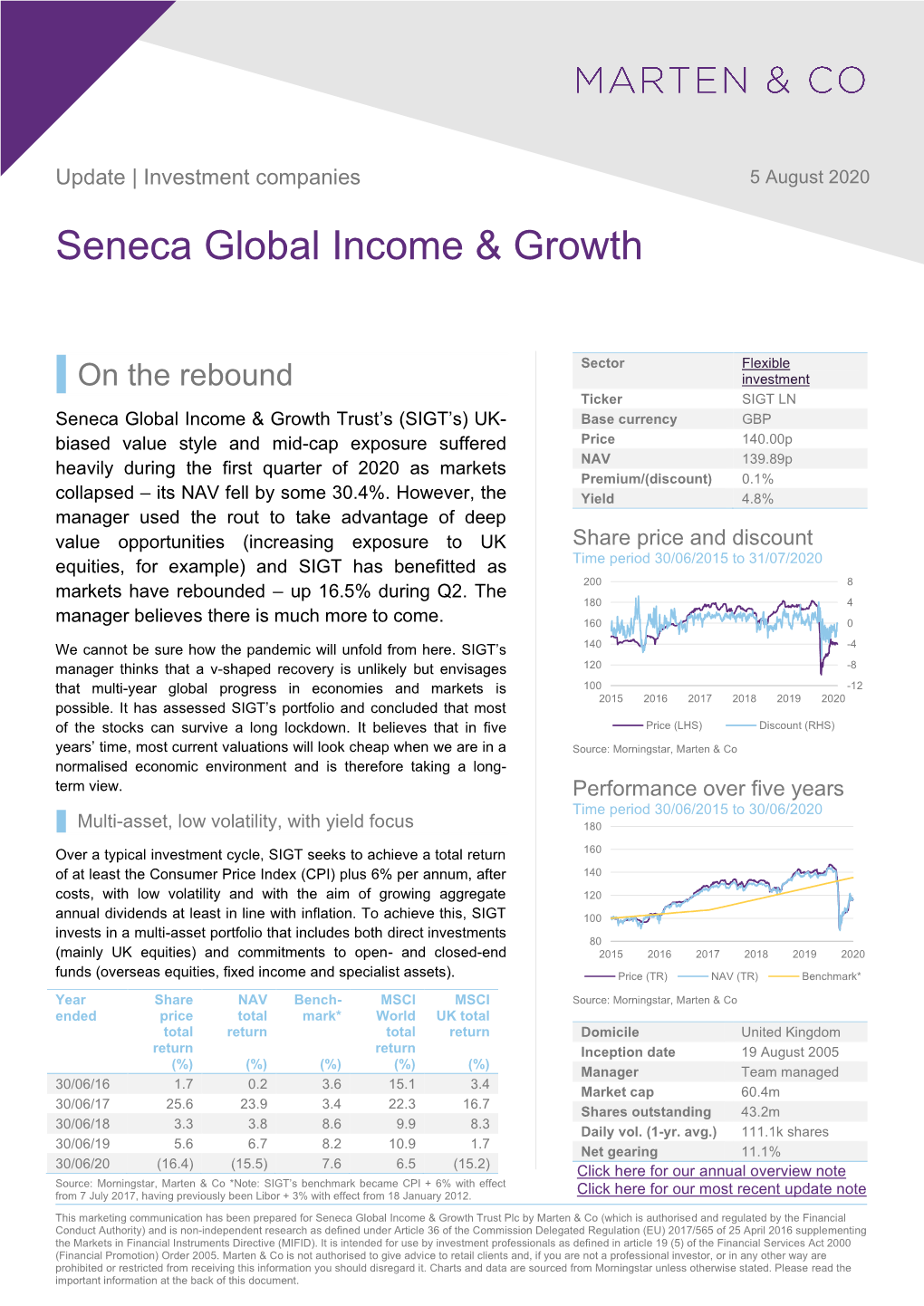

Seneca Global Income & Growth Trust

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hipgnosis Songs Fund Limited

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take or the contents of this Prospectus, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank, solicitor, accountant, or other appropriate independent financial adviser, who is authorised under the Financial Services and Markets Act 2000 (the “FSMA”) if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. A copy of this document, which comprises a prospectus relating to Hipgnosis Songs Fund Limited (the “Company”) in connection with the issue of Issue Shares in the Company and their admission to trading on the Main Market and to listing on the premium listing category of the Official List, prepared in accordance with the Prospectus Rules of the FCA made pursuant to section 73A of the FSMA, has been filed with the Financial Conduct Authority in accordance with Rule 3.2 of the Prospectus Rules. The Prospectus has been approved by the FCA, as competent authority under the Prospectus Regulation and the FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Accordingly, such approval should not be considered as an endorsement of the issuer, or of the quality of the securities, that are the subject of this Prospectus; investors should make their own assessment as to the suitability of investing in the Issue Shares. The Issue Shares are only suitable for investors: (i) who understand the potential risk of capital loss and that there may be limited liquidity in the underlying investments of the Company; (ii) for whom an investment in the Issue Shares is part of a diversified investment programme; and (iii) who fully understand and are willing to assume the risks involved in such an investment programme. -

Distressing Debt Seek out Shares in the Lowest Quality Companies; Verdad Compared Equity Performance with Credit the Worst-Of-The-Worst, If You Like

TIPS IDEAS FARM want to play the ‘dash for trash’ should simply the issue price. A similar story was found when Distressing debt seek out shares in the lowest quality companies; Verdad compared equity performance with credit the worst-of-the-worst, if you like. However, quality based on the scores of rating agencies. ALGY HALL ignoring ‘quality’ when it comes to buying Here the research found share performance t’s been a tough time for short sellers lately. beaten-up stocks (the kind of shares found on started to deteriorate when ratings fell below a IThe ‘dash for trash’ that I wrote about in this these pages in our tables of shorts, downgrades high single B rating. The annualised equity return column last week, has been indiscriminate. and 52-week lows) is rarely wise. from stocks in the least creditworthy category Even real no-hoper shares have benefited. The Intrigued by the price movement of bankrupt- (CC and below) was a negative 34 per cent. most headline-grabbing example of investors’ company stocks, Verdad – a US investment firm This research holds an important lesson for willingness to overlook all fundamentals in their that specialises in investing in the shares of investors targeting the grubbier end of this recov- hunt for ‘trash’ has been the strong performance cheap, indebted, smaller companies – trawled its ery. Rather than buying the worst-of-the-worst, of shares in US companies that have already database. It looked for the long-term relationship it’s the best-of-the-worst that should provide the declared bankruptcy or are about to (Hertz, JC between share price performance and the level optimal trade-off between risk and reward. -

Invesco UK 2 Investment Series Annual Report 2019

01 Front Cover_Layout 1 02-Jul-19 11:48 AM Page 1 Invesco UK 2 Investment Series Annual Report Including Long Form Financial Statements Issued July 2019 For the year 1 April 2018 to 31 March 2019 02 Aggregate_Layout 1 02-Jul-19 11:48 AM Page 1 Contents Invesco UK 2 Investment Series (the “Company”) 02 Report of the Authorised Corporate Director (the “Manager”)* 06 Notes applicable to the financial statements of all Sub-Funds 13 Invesco Income Fund (UK) 14 Strategy, review and outlook* 15 Comparative tables 19 Portfolio statement* 23 Financial statements 32 Distribution tables 34 Invesco UK Enhanced Index Fund (UK) 35 Strategy, review and outlook* 36 Comparative tables 39 Portfolio statement* 43 Financial statements 51 Distribution tables 52 Invesco UK Strategic Income Fund (UK) 53 Strategy, review and outlook* 54 Comparative tables 58 Portfolio statement* 61 Financial statements 70 Distribution tables 72 Regulatory Statements 72 Statement of Manager's responsibilities 72 Statement of Depositary’s responsibilities 72 Depositary’s Report to Shareholders 73 Independent Auditors’ Report 75 General Information * These collectively comprise the Authorised Corporate Director’s Report. 01 Invesco UK 2 Investment Series 02 Aggregate_Layout 1 02-Jul-19 11:48 AM Page 2 Invesco UK 2 Investment Series (the “Company”) Report of the Authorised Corporate Director (the “Manager”) The Company Remuneration Policy (Unaudited) The Invesco UK 2 Investment Series is an investment On 18 March 2016, Invesco Fund Managers company with variable capital, incorporated in England Limited (the “Manager”) adopted a remuneration and Wales on 11 April 2003. policy consistent with the principles outlined in the European Securities and Markets Authority (ESMA) The Company is a “UCITS Scheme” and an “Umbrella Guidelines, on sound remuneration policies under Company” (under the OEIC Regulations) and therefore the UCITS Directive (the "Remuneration Policy"). -

Interim Report and Financial Statements

Fidelity Investment Funds Interim Report and Financial Statements For the six months ended 31 August 2020 Fidelity Investment Funds Interim Report and Financial Statements for the six month period ended 31 August 2020 Contents Director’s Report* 1 Statement of Authorised Corporate Director’s Responsibilities 2 Director’s Statement 3 Authorised Corporate Director’s Report*, including the financial highlights and financial statements Market Performance Review 4 Summary of NAV and Shares 6 Accounting Policies of Fidelity Investment Funds and its Sub-funds 9 Fidelity American Fund 10 Fidelity American Special Situations Fund 12 Fidelity Asia Fund 14 Fidelity Asia Pacific Opportunities Fund 16 Fidelity Asian Dividend Fund 18 Fidelity Cash Fund 20 Fidelity China Consumer Fund 22 Fidelity Emerging Asia Fund 24 Fidelity Emerging Europe, Middle East and Africa Fund 26 Fidelity Enhanced Income Fund 28 Fidelity European Fund 30 Fidelity European Opportunities Fund 32 Fidelity Extra Income Fund 34 Fidelity Global Dividend Fund 36 Fidelity Global Enhanced Income Fund 38 Fidelity Global Focus Fund 40 Fidelity Global High Yield Fund 42 Fidelity Global Property Fund 44 Fidelity Global Special Situations Fund 46 Fidelity Index Emerging Markets Fund 48 Fidelity Index Europe ex UK Fund 50 Fidelity Index Japan Fund 52 Fidelity Index Pacific ex Japan Fund 54 Fidelity Index Sterling Coporate Bond Fund 56 Fidelity Index UK Fund 58 Fidelity Index UK Gilt Fund 60 Fidelity Index US Fund 62 Fidelity Index World Fund 64 Fidelity Japan Fund 66 Fidelity Japan Smaller -

FTSE UK Index Series – Indicative Quarterly Review Changes September 2020

Press Release 26 August 2020 FTSE UK Index Series – Indicative Quarterly Review Changes September 2020 FTSE Russell, the global index provider, advises of the following indicative changes to the FTSE 100 and FTSE 250, based on data as at Friday 21 August. PLEASE NOTE: The actual review of the FTSE UK Index Series will be conducted using data as at market close on Tuesday 1 September 2020. Confirmed rebalance changes will be announced after market close on Wednesday 2 September 2020. Indicative FTSE 100 Additions (in alphabetical order) Indicative FTSE 100 Deletions (in alphabetical order) • B&M European Value Retail • ITV Indicative FTSE 250 Additions (in alphabetical order) Indicative FTSE 250 Deletions (in alphabetical order) • CMC Markets • B&M European Value Retail • Diversified Gas & Oil • Bank of Georgia Group • Hipgnosis Songs Fund C * • Equiniti Group • Indivior • Go-Ahead Group • ITV • Hammerson • JPMorgan Euro Small Co. Trust • PayPoint • Premier Foods • PPHE Hotel Group • Vectura Group *Hipgnosis Songs Fund C is a secondary line of Hipgnosis ENDS For further information: Global Media Lucie Holloway/ Oliver Mann +44 (0)20 7797 1222 [email protected] 1 Press Release Notes to editors: FTSE Russell is revising the timing of its publication of indicative changes to the FTSE 100 and FTSE 250, starting from this September’s quarterly review and on an on-going basis. Instead of publishing indicative changes via a press release two trading days prior to the final results announcement, FTSE Russell will now publish its indicative changes via a press release after market close in the week prior. For the September review, this means that we will publish indicative positions on Wednesday, 26th August, based on closing prices from Friday 21st August. -

Hipgnosis Songs

Disclosure – Non-Independent Marketing Communication This is a non-independent marketing communication commissioned by Hipgnosis Songs. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research. Update Hipgnosis Songs 19 September 2019 Summary Hipgnosis Songs Fund (SONG) is a £409m market cap listed fund, aiming to achieve income and capital growth by owning songwriters’ music royalties. The managers (The Analysts: Family (Music) Ltd) believe that, aside from being able to buy these royalties from William Heathcoat Amory songwriters on a gross yield of c. 8%, investors should benefit rf om trends and active +44 (0)203 384 8795 management, which will increase the level of income (and capital value) over time. Pascal Dowling The managers are aiming for total returns of greater than 10%, and have +44 (0)203 384 8869 demonstrated their ability to invest the fund’s capital relatively quickly – no mean feat in a market where there are no formal brokers or “exchange” for royalties. Merck Thomas McMahon, CFA Mercuriadis leads the management team, and he is clearly a music industry +44 (0)203 795 0070 “insider”; we understand his relationships have been key to accessing the quality of the portfolio that SONG has built up so far. William Sobczak +44 (0)203 598 6449 Having spoken to the team, they tell us that royalties from the copyright of songs tend to be relatively predictable – certainly after the first hreet years when the “buzz” has Callum Stokeld largely subsided. -

Investec Funds Series I Annual Report and Accounts for the Year Ended 30 September 2018 REPORT and ACCOUNTS Investec Funds Series I Annual Report and Accounts

OEIC | REPORT AND ACCOUNTS INVESTEC FUNDS SERIES I Investec Funds Series i Annual Report and Accounts For the year ended 30 September 2018 REPORT AND ACCOUNTS Investec Funds Series i Annual Report and Accounts Cautious Managed Fund* 2-4 Diversifi ed Income Fund* 5-7 Enhanced Natural Resources Fund* 8-10 Global Multi-Asset Total Return Fund* 11-13 UK Alpha Fund* 14-16 UK Equity Income Fund* 17-19 UK Smaller Companies Fund* 20-23 UK Special Situations Fund* 24-26 Portfolio Statements per Fund* 27-59 Authorised Corporate Director’s Report* 60-61 Statement of Depositary’s Responsibilities and Report to Shareholders 62 Independent Auditor’s Report 63-64 Statement of Authorised Corporate Director’s Responsibilities65 Comparative Tables 66-90 Financial Statements 91-178 Securities Financing Transactions (‘SFTs’) 179 Other Information180 Glossary 181-183 Directory 184 * The above information collectively forms the Authorised Corporate Director’s Report Investec Funds Series i 1 REPORT AND ACCOUNTS Cautious Managed Fund Summary of the Fund’s investment objective and policy The Fund aims to provide income and long-term capital growth. The Fund seeks to invest conservatively around the world in a diverse range of shares of companies (up to 60% of the Fund’s value at any time) and bonds (contracts to repay borrowed money which typically pay interest at fi xed times). The Fund may invest in other assets such as cash, other funds and derivatives (fi nancial contracts whose value is linked to the price of an underlying asset). The Investment Manager is free to choose how the Fund is invested and does not manage it with reference to an index. -

The VT Redlands Portfolios

The VT Redlands Portfolios What are the VT Redlands Portfolios? The VT Redlands Portfolio funds each invest in one of four defined “asset classes” namely the Equity, Multi-Asset, Property and Fixed Income categories. Each fund carries a prescribed Risk Profile on a scale of 1 to 7 – with for example Equity being the highest at a factor 5. Each one is used as a building block in the creation of bespoke risk rated investment portfolios for clients of David Williams IFA. By combining the four VT Redlands funds with other asset classes such as With Profits/ Smoothed Managed and Structured Equity funds, our clients can enjoy the benefits of a very wide level of diversification within their portfolios. This reduces volatility and creates the potential for rewarding rates of return year after year. Each Portfolio fund is constructed as a Fund of Funds providing access to the “best of the best” sector funds from a huge investment universe. The Portfolios are designed to meet their objectives as efficiently as possible whilst keeping costs to a minimum and are run according to a strict risk-control criteria. Typically, 15 to 25 different funds are held in each portfolio, with each one in turn managed by leading investment houses such as Fundsmith, Fidelity and Invesco as well as specialist boutiques including Ruffer, Fulcrum and Somerset. Underlying funds have exposure to a great many shares, bonds and other assets, Therefore, a single investment into one of the Redlands Portfolios gives a spread across a myriad of different holdings, countries and investment styles. -

Hipgnosis Songs Fund Limited

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take or the contents of this Prospectus, you are recommended to seek your own independent financial advice immediately from your stockbroker, bank, solicitor, accountant, or other appropriate independent financial adviser, who is authorised under the Financial Services and Markets Act 2000 (the ‘‘FSMA’’) if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. A copy of this document, which comprises a prospectus relating to Hipgnosis Songs Fund Limited (the ‘‘Company’’) in connection with the issue of Shares in the Company, prepared in accordance with the Prospectus Rules of the UK Listing Authority made pursuant to section 73A of the FSMA, has been filed with the Financial Conduct Authority in accordance with Rule 3.2 of the Prospectus Rules. The Shares are only suitable for investors: (i) who understand the potential risk of capital loss and that there may be limited liquidity in the underlying investments of the Company; (ii) for whom an investment in the Shares is part of a diversified investment programme; and (iii) who fully understand and are willing to assume the risks involved in such an investment programme. It should be remembered that the price of the Shares and the income from them can go down as well as up. Applications will be made for the Shares to be admitted to the premium equity closed-ended investment funds category of the Official List of the UK Listing Authority and to be admitted to trading on the Premium Segment of the Main Market of the London Stock Exchange. -

Annual Report 2020

Don’t Stop Believin’ • Something Just Like This • Shape Of You • Girls Like You • Don’t Let Me Down • Castle On The Hill • Sweet Dreams (Are Made Of This) • What About Us • Love Yourself • In My Blood • Closer • No Tears Left To Cry • High Hopes • Look What You Made Me Do • There’s Nothing Holdin’ Me Back • Beautiful Trauma • What Lovers Do • Treat You Better • Uptown Funk • Photograph • Havana • Happier • Separate Ways/Worlds Apart • Faithfully • Breathin • Livin’ On A Prayer • Wanted Dead Or Alive • Single Ladies (Put A Ring On It) • Anyway You Want It • God Is A Woman • River • Locked Out Of Heaven • Roses • Shallow • Sick Boy • Love Me Again • Supermarket Flowers • Paris • Break Up With Your Girlfriend, I’m Bored • Smooth • Set Fire To The Rain • Skin• Umbrella • Close To Me • Green Light • Galway Girl • Feels • Rockabye • I Don’t Wanna Live Forever • #Selfie •We Are Young • Stone In Love • All Time Low • These Days • Best Of Me • It’s My Life • You Give Love A Bad Name • Baby • Just The Way You Are • Handclap • Great Are You Lord When • I Was Your Man • Eraser • Dive • Cold Water • 2002 • Symphony • Moves Like Jagger • Issues • Open Arms • New Man • Trumpets • Back To Black • Know No Better • Rise • 2U • What Do You Mean? • Mama • Marry You • Nothing Breaks Like A Heart • So Far Away • Don’t Wanna Know • Lost In Japan • Hey Look Ma, I Made It • All We Know • Wait • Live In The Moment • Here Comes The Rain Again •Let’s Stay Together • Treasure • Wheel In The Sky • Heart’s Don’t Break Around Here • Despacito (Remix) • Stitches • We -

J O Hambro Capital Management UK Umbrella Fund 2019 Interim Report (Unaudited) for the Six Months Ended 30 June 2019 Contents

J O Hambro Capital Management UK Umbrella Fund 2019 Interim Report (Unaudited) for the six months ended 30 June 2019 www.johcm.com Contents Authorised Corporate Director’s Report 1 Accounting Policies 2 JOHCM UK Dynamic Fund, including Financial Statements 3 JOHCM UK Equity Income Fund, including Financial Statements 17 JOHCM UK Opportunities Fund, including Financial Statements 33 JOHCM Global Opportunities Fund, including Financial Statements 47 Further information 58 Appendix I – Securities Financing Transactions Regulation 59 Directory 63 Authorised Corporate Director’s report for the six-month period ended 30 June 2019 General information With effect from 6 June 2019, JOHCM Funds (UK) Limited The J O Hambro Capital Management UK Umbrella Fund was appointed as the Authorised Corporate Director of the (‘the Company’) is an open-ended investment company Company. Prior to 6 June 2019 the Investment Manager, (‘OEIC’) with variable capital. The Company is registered J O Hambro Capital Management Limited, was the and authorised in the United Kingdom by the Financial Authorised Corporate Director. Conduct Authority (‘the FCA’). The Company has been established as a UCITS scheme in the form of an umbrella As at 30 June 2019 there were no cross-investments company, currently with four separate sub-funds (the where one Sub-Fund invested into another Sub-Fund of the “Sub-Funds”). Company. A new Sub-Fund, JO Hambro Capital Management Global Further information on the Company can be found on Opportunities Fund, was launched on 3 May 2019. page 58. Each Sub-Fund has an individual investment objective Statement of Authorised Corporate Director and policy. -

The VT Redlands Portfolios

The VT Redlands Portfolios What are the VT Redlands Portfolios? The VT Redlands Portfolio funds each invest in one of four defined “asset classes” namely the Equity, Multi-Asset, Property and Fixed Income categories. Each fund carries a prescribed Risk Profile on a scale of 1 to 7 – with for example Equity being the highest at a factor 5. Each one is used as a building block in the creation of bespoke risk rated investment portfolios for clients of David Williams IFA. By combining the four VT Redlands funds with other asset classes such as With Profits/ Smoothed Managed and Structured Equity funds, our clients can enjoy the benefits of a very wide level of diversification within their portfolios. This reduces volatility and creates the potential for rewarding rates of return year after year. Each Portfolio fund is constructed as a Fund of Funds providing access to the “best of the best” sector funds from a huge investment universe. The Portfolios are designed to meet their objectives as efficiently as possible whilst keeping costs to a minimum and are run according to a strict risk-control criteria. Typically, 15 to 25 different funds are held in each portfolio, with each one in turn managed by leading investment houses such as Fundsmith, Fidelity and Invesco as well as specialist boutiques including Ruffer, Fulcrum and Somerset. Underlying funds have exposure to a great many shares, bonds and other assets, Therefore, a single investment into one of the Redlands Portfolios gives a spread across a myriad of different holdings, countries and investment styles.