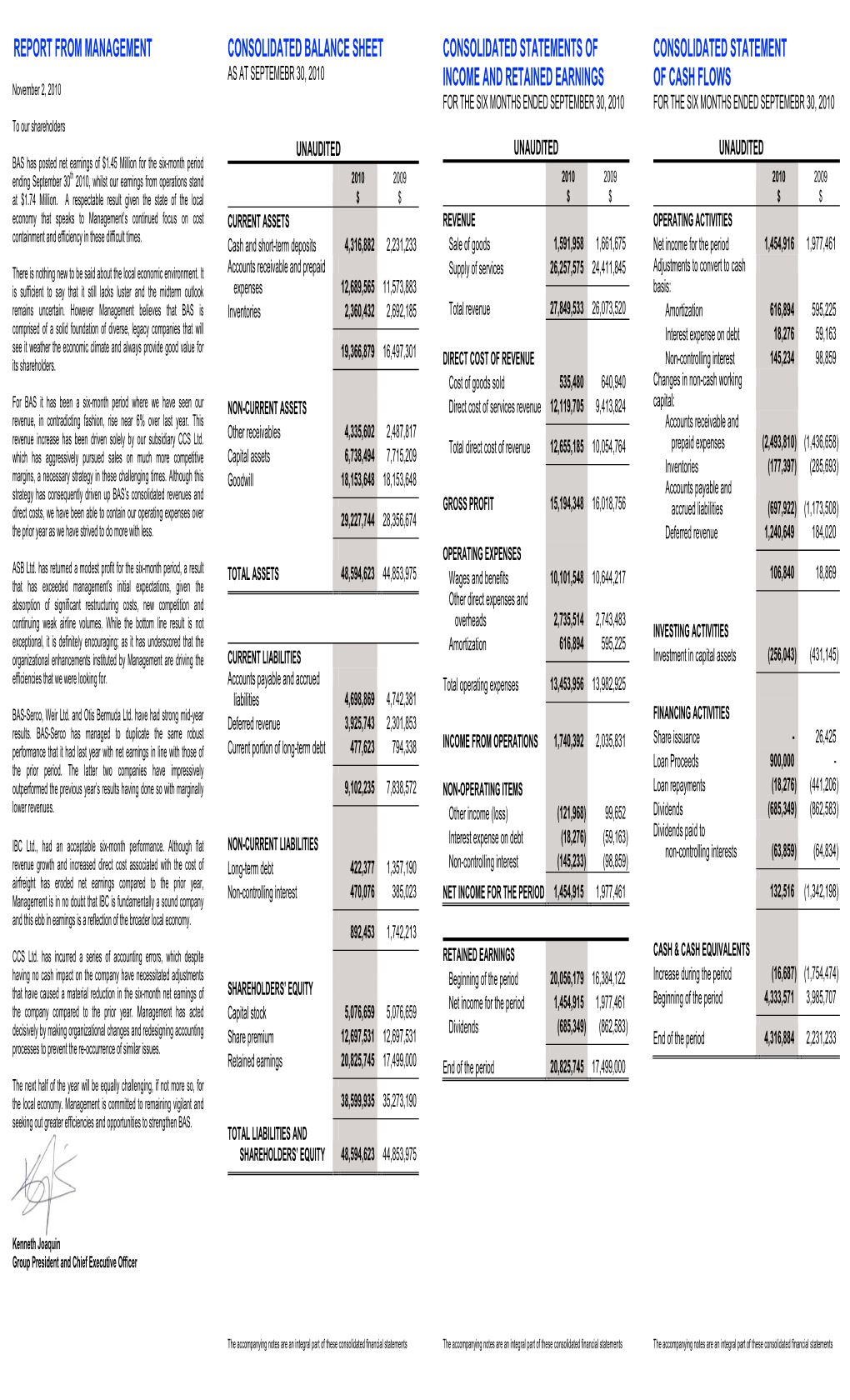

Report from Management Consolidated Balance Sheet Consolidated Statements of Income and Retained Earnings Consolidated Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Business Activity Statements (BAS) Checklist

Business Activity Statements (BAS) Checklist WHAT IS BUSINESS ACTIVITY STATEMENTS (BAS)? Business Activity Statements are used to report and pay to the ATO, Goods and Services Tax (GST) that has been collected and paid by your business, Pay as You Go (PAYG) instalments or withholding, Fuel Tax Credits (FTC) and Fringe Benefits Tax (FBT). You'll also require to submit a BAS, if you're paying a quarterly PAYG instalment. You are liable for submitting BAS to the ATO: 1) If your business is operating in Australia, 2) Even if you did no business during the reporting period. BAS PREPARATION CHECKLIST FOLLOWING IS A USEFUL BAS CHECKLIST: MAKE SURE YOU ARE CLAIMING & DECLARING THE RIGHT AMOUNTS: • Buying and/or trade-in of vehicle • Buying of capital assets e.g. equipment or property • Overseas purchases and customs invoices • Insurances claims and refunds (including Workcover) • Any fuel tax credits (if applicable) • Hire purchase / financial agreements • Any special income • Payroll terminations - tax calculations • Directors/owners loans and the drawings • Government grants • Any other things which would impact on GST ASSURE ALL DATA ENTRY IS COMPLETE & BOOKS ARE RECONCILED: • All banks accounts, credit cards and loans are reconciled • All purchases are entered • Cash expenses are entered relating to the month/quarter • Petty cash is reconciled • Outstanding debtors and creditors are reviewed and reconciled • Any electronic and payroll accounts cleared (if not, justify why not) • Any suspense and POS cleared (if not, justify why not) • Undeposited / cash funds (if not, justify why not) • Reconcile PAYGW (liability) and ATO Accounts • Complete data file auditing process for your software • Check different reports against each other • Check private usage journals are entered www.airanglobal.com REVIEW AUDIT TAX CODES USED: • Ensure GST claimed is on items purchased from Australia and that overseas purchases, where applicable, are listed as GST Free. -

COMPLIANCE REPORT on Bas & Bfrs

COMPLIANCE REPORT ON BAS & BFRS SL No. BAS Title BAS Effective Date Remarks BAS-01 Presentation on Financial Statements Adopted on or after 01.01.07 Applied BAS-02 Inventories Adopted on or after 01.01.07 N/A BAS-07 Statement of Cash Flows Adopted on or after 01.01.99 Applied BAS-08 Accounting Policies, Changes in Accounting Estimates and Errors Adopted on or after 01.01.07 Applied BAS-10 Events after the balance sheet Date Adopted on or after 01.01.07 Applied BAS-11 Construction Contract Adopted on or after 01.01.99 N/A BAS-12 Income Taxes Adopted on or after 01.01.99 Applied BAS-16 Property, Plant & Equipment Adopted on or after 01.01.07 Applied BAS-17 Leases Adopted on or after 01.01.07 N/A BAS-18 Revenue Adopted on or after 01.01.07 Applied BAS-19 Employee Benefits Adopted on or after 01.01.04 Applied BAS-20 Accounting of Government Grants and disclosure of Government Assistance Adopted on or after 01.01.99 Applied BAS-21 Effects of Changes in Foreign Exchange Changes Adopted on or after 01.01.07 Applied BAS-23 Borrowing Cost Adopted on or after 01.01.10 Applied BAS-24 Related Party Disclosure Adopted on or after 01.01.07 N/A BAS-26 Accounting and Reporting by Retirement Benefit Plans Adopted on or after 01.01.07 Applied BAS-27 Consolidated and separate financial statements Adopted on or after 01.01.10 N/A BAS-28 Investments in associates Adopted on or after 01.01.07 N/A BAS-29 Financial reporting in hyperinflationary economics Not yet adopted by ICAB N/A BAS-31 Interest in joint ventures Adopted on or after 01.01.07 N/A BAS-32 Financial -

APPROVED 2 BUSINESS ACCOUNTING STANDARD „BALANCE SHEET“ I. GENERAL PROVISIONS 1. the Objective of This Standard Is to Set Ou

APPROVED by Resolution No. 1 of 18 December 2003 of the Standards Board of the Public Establishment the Institute of Accounting of the Republic of Lithuania 2 BUSINESS ACCOUNTING STANDARD „BALANCE SHEET“ Version effective as from 26 November 2006 (“Valstybės žinios” (Official Gazette), 2004, No. 20-616; 2004, No. 180-6696; 2005, No. 126 (correction); No. 127-4597; No. 130 (correction); 2006, No. 127-4880). I. GENERAL PROVISIONS 1. The objective of this Standard is to set out how information about an entity’s assets, equity and liabilities shall be presented, classified and disclosed. 2. This Standard establishes a procedure of preparing a balance sheet and provides standard forms except for consolidated balance sheets. Standard balance sheet forms are presented in the annexes to this Standard: 2.1. forms for all entities, except for those specified in paragraphs 2.2 and 2.3, are in Annexes 1 and 2; 2.2. forms for entities, whose typical activities are cultivation of biological assets, production and treatment of agricultural produce, processing of agricultural produce of own production and treatment, thereinafter referred to as agricultural entities, are in Annexes 3 and 4; 2.3. a form for state and municipal enterprises is in Annex 5. II. KEY DEFINITIONS Provision – a liability of uncertain amount or timing that can be estimated reliably. Balance sheet – a financial statement presenting all assets, equity and liabilities of an entity as of the last day of the reporting period. Balance sheet date – the last day of the reporting period. Biological assets – plants and animals. Non-current asset – an asset used by an entity for a period longer than one year in order to obtain economic benefits. -

Budget Requirements and Annual Financial Reporting Requirements for Texas Public Community and Junior Colleges

Budget Requirements and Annual Financial Reporting Requirements for Texas Public Community Colleges FY 2014 Due Annually by January 1st Planning and Accountability Texas Higher Education Coordinating Board Harold Hahn, CHAIR El Paso Robert “Bobby” Jenkins Jr., VICE CHAIR Austin David Teuscher, M.D., SECRETARY OF THE BOARD Beaumont Gerald T. Korty, STUDENT MEMBER OF THE BOARD Fort Worth Dora G. Alcala Del Rio Ambassador Sada Cumber Sugarland Christopher M. Huckabee Fort Worth Jacob M. Monty Houston Janelle Shepard Weatherford John T. Steen, Jr. San Antonio Raymund A. Paredes, COMMISSIONER OF HIGHER EDUCATION Mission of the Coordinating Board The Texas Higher Education Coordinating Board’s mission is to work with the Legislature, Governor, governing boards, higher education institutions, and other entities to help Texas meet the goals of the state’s higher education plan, Closing the Gaps by 2015, and thereby provide the people of Texas the widest access to higher education of the highest quality in the most efficient manner. Philosophy of the Coordinating Board The Texas Higher Education Coordinating Board will promote access to quality higher education across the state with the conviction that access without quality is mediocrity and that quality without access is unacceptable. The Board will be open, ethical, responsive, and committed to public service. The Board will approach its work with a sense of purpose and responsibility to the people of Texas and is committed to the best use of public monies. The Coordinating Board will engage in actions that add value to Texas and to higher education. The agency will avoid efforts that do not add value or that are duplicated by other entities. -

Approved 3 Business Accounting Standard

APPROVED by Resolution No. 1 of 18 December 2003 of the Standards Board of the Public Establishment the Institute of Accounting of the Republic of Lithuania 3 BUSINESS ACCOUNTING STANDARD ,,INCOME STATEMENT” Version effective as from 5 January 2007 (“Valstybės žinios” (Official Gazette), 2004, No. 20-616; No. 180- 6697; 2005, No. 130 (correction); 2006, No. 127-4881; 2007, No.1-46). I. GENERAL PROVISIONS 1. The objective of this Standard is to set out how information about an entity’s income earned, expenses incurred and its operating performance during a reporting period shall be presented, classified and disclosed. 2. This Standard establishes a procedure of preparing an income statement, classifying income and expenses into ordinary and extraordinary items and provides standard forms of the income statement, except for consolidated statement. Standard income statement forms are presented in the Annexes to this Standard: 2.1. income statement forms for all entities, except for those specified in paragraphs 2.2 and 2.3, are in Annexes 1 and 2; 2.2. form for entities, whose typical activities are cultivation of biological assets, production and treatment of agricultural produce, processing of agricultural produce of own production and treatment, thereinafter referred to as agricultural entities, is in Annex 3; 2.3. form for state and municipal enterprises is in Annex 1. 3. In exceptional cases income statement forms other than those established in this Standard may be presented if it is necessary in order to present fairly the performance of an entity. II. KEY DEFINITIONS Costs - outflows of assets or services and decreases in the value of assets during the reporting period. -

Asset Intensive

SOLVING THE CHALLENGES IN ASSET-INTENSIVE INDUSTRIES • Commercial Real Estate • Mining and Raw Materials • Oil and Gas • Pulp, Paper, and Packaging Solving Common Challenges Oracle’s Complete in Asset-Intensive Industries Solutions Companies in a variety of industries need to Without the right tools, meeting these manage capital assets effectively to ensure challenges can be incredibly complex and profitability, and those industries all have a time-consuming, draining resources and number of common challenges. hindering business agility. Oracle’s JD Edwards EnterpriseOne solutions 2 Operating and maintaining large, expensive, provide a comprehensive suite of flexible, or remote assets presents many challenges, modular tools to help organizations in from optimizing complex global supply chains asset-intensive industries achieve operational to mitigating the impact of unpredictable excellence, reduce the cost of asset ownership weather events. Poor management of these and management, ensure regulatory operational processes can increase costs compliance and occupational safety, and drive significantly and have a negative impact profitable, sustainable growth. on profitability. Oracle, with more than 30 years of industry Public and legislative pressure to minimize experience, as well as a history of leadership environmental impact is also a major in areas such as big data management, concern for asset-intensive organizations. In mobile solutions, user experience, business addition, companies in asset-intensive reporting, and data access, provides you with industries are under increasing pressure to the best solutions available without the risk maintain exemplary health and safety associated with small niche providers. standards and to proactively protect employees and others engaged with the company from harm and injury. -

General Ledger Manual

GENERAL LEDGER MANUAL Last Manual Update: 15/04/2014 PO Box 911 Warrnambool Vic 3280 • Ph: 03 5562 0700 • Fax: 03 5562 0400 • Email: [email protected] TABLE OF CONTENTS GENERAL LEDGER MANUAL 1 General Ledger Overview 6 Setup Ledger Accounts 8 GL Account File Maintenance 8 Creating New GL Accounts 9 Searching for Ledger Accounts 11 Accounts - Updating Ledger Information 11 Changing Bank Account fields 11 Deleting a Ledger Account 12 Changing a Ledger Account Number 12 Post Ledger Transactions 13 Posting Overview 13 Post Screen 13 Ledger Batch Posts 15 BAS Journals 17 GL Post - Dispersing Journals by Groups 19 Group Postings - Not an Even Split 20 Loading Existing and Reversing Postings 20 Post - Loading entries from an Excel Spreadsheet 21 Debits & Credits 24 Ledger Batch Postings – All Accounts 24 Post Batch Reversal 25 Post - Append Journal Comment 27 Post - Search Screen 27 GL Account Reconciliation 30 Manual Reconciliation 30 Automated Reconciliation 31 Matching the Entries 33 Standing Journals - Setup 35 Standing Journals - Apply 38 Budgets – Overview 40 Creating a New Budget 40 Load an Existing Budget 42 Deleting a Budget 42 Developing Budgets 43 Budgets - Using the Extrapolate Option 43 Budgets - Creating Projections Based on Actual Postings 43 Budgets - Loading Data from Spreadsheets 44 Budgets - Copy Data from another Budget 46 Balance Sheet / Profit & Loss Report Set Up 47 Basic Template for Balance Sheets 47 BS & PL - Creating a Financial Report Layout 47 BS & PL - Report Layout – Column Descriptions 48 Using the Suppress -

Accounting Bookkeeping

FNS40615 Certificate IV in Accounting and FNS40215 Certificate IV in Bookkeeping • Get the skills that employers really want. • Unrivalled support. Delivered with care. • Absolute flexibility. Your way, your terms. Launch your brand new career the right way Monarch Institute is one of very few registered training organisations (RTOs) to offer the TPB (Tax Practitioners Board) approved courses required to become a registered BAS agent or a registered tax agent. Courses are delivered by skilled professionals, senior CPAs and chartered accountants, registered BAS agents and bookkeepers. They have decades of combined experience across an extensive range of industries. The Dual Qualification: Certificate IV Accounting and Bookkeeping (FNS40215 and FNS40615) is a great choice if you want to keep your options open. You’ll graduate with extra skills and knowledge that could help you stand out from single qualification grads in the competitive job market. Study accounting and bookkeeping with us and you’ll get practical training that makes use of industry leading software, like MYOB and Xero. It’s all about making you job-ready from the moment you graduate. What does the course cover? • Establishing solid foundations – • Big bucks for business – payroll, accounting fundamentals activity statements and computing • Show me the money! Financial • Clever calculations and procedures statements and taxation – professional practices Key benefits Learn MYOB or Xero TPB approved course The course includes comprehensive software training This course meets Tax Practitioners Board education resources, and access to the software of your choice requirements for becoming a registered BAS agent. while you’re studying. Government funding Nationally recognised If you live in Victoria or Queensland, you may be The course is nationally recognised under the eligible for government funding. -

La Convergence Aux Pays-Bas

Données financières : enjeux et perspectives 2017 21 septembre 2017 Maison de l’Assurance (FFA) La convergence aux Pays-Bas • Bastiaan GROENVELD • Digital Government Service of the Dutch Ministry of Internal Affairs (Logius) Agenda • Introduction: La convergence aux Pays-Bas • Why SBR? • SBR is about standards • What is SBR? • SBR in the private sector: SBR Banks La convergence aux Pays-Bas • The Netherlands are using XBRL: more than 40 million messages per year (and growing) • XBRL is part of a methodology to reduce the administrative burden and improve innovation in the market place: Standard Business Reporting • SBR is about standardization of data definitions, processes and technology – across domains • SBR is defined, governed and used by the public and private sector Start with Why • Reduction of administrative burden • Transparency • Efficiency • Innovation Standardization of • Data definitions • Processes • Technology • Digitalize processes • Machine-to-machine • Structured data • Digital only SBR is about standards Governance Standardize (harmonize & normalize) Public-private partnership • Data definitions Data • Processes Processes Technology definitions • Technology How SBR uses standards: 1. Use international standards 2. Use local standards 3. Develop standards Network effects • Network effect: the network is more valuable for every participant when it is bigger • Economies of scale: the costs of joining the network decrease SBR as a public-private partnership Regulators Reporting Government entities Standard Business Reporting -

The Balance Sheet a Practical Example & Explanation Financial Services Division

The Balance Sheet A practical example & explanation Financial Services Division Published by the Communications Division for [insert Division Name] Division Department of Education and Early Childhood Development Melbourne February 2011 © State of Victoria (Department of Education and Early Childhood Development) 2011 The copyright in this document is owned by the State of Victoria (Department of Education and Early Childhood Development), or in the case of some materials, by third parties (third party materials). No part may be reproduced by any process except in accordance with the provisions of the Copyright Act 1968 the National Education Access Licence for Schools (NEALS) (see below) or with permission. NEALS is an educational institution situated in Australia which is not conducted for profit, or a body responsible for administering such an institution may copy and communicate the materials, other than third party materials, for the educational purposes of the institution. Authorised by the Department of Education and Early Childhood Development, 2 Treasury Place, East Melbourne, Victoria, 3002. This document is also available on the internet at http://www.education.vic.gov.au/management/financial/ Contents Balance Sheet Example ................................................................................................. 3 1. Introduction ............................................................................................................... 4 2. Accumulated Funds ................................................................................................. -

Accounting and Tax Treatment of the Cash Flow Boost and Jobkeeper

Accounting and Tax Treatment of the Cash Flow Boost and JobKeeper Mark Morris Principal Morris and Associates 16 July 2020 Accounting and Tax Treatment of the Cash Flow Boost and JobKeeper Mark Morris 16 July 2020 Published by Tax & Super Australia Level 13, 303 Collins St, Vic 3000 ABN 96 075 950 284 Reg No: A0033789T This material has been researched, authored, reviewed and produced by the team at Tax & Super Australia. © Taxpayers Australia Limited T/A Tax & Super Australia All information provided in this publication is of a general nature only and is not personal financial or investment advice. It does not take into account your particular objectives and circumstances. No person should act on the basis of this information without first obtaining and following the advice of a suitably qualified professional advisor. To the fullest extent permitted by law, no person involved in producing, distributing or providing the information in this publication (including Tax and Super Australia, each of its directors, councillors, employees and contractors and the editors or authors of the information) will be liable in any way for any loss or damage suffered by any person through the use of or access to this information. The Copyright is owned exclusively by Tax & Super Australia (ABN 96 075 950 284). NOTICE FORBIDDING UNAUTHORISED REPRODUCTION So long as no alterations are made unless approved, you are invited to reprint Editorials provided acknowledgment is given that the Association is the source. No other item covered by copyright may be reproduced or copied in any form (graphic, electronic or mechanical, or recorded on film or magnetic media) or placed in any computer or information transmission or retrieval system unless permission in writing is obtained from Tax & Super Australia. -

Boosting Cash Flow for Employers

Boosting cash flow for employers https://www.ato.gov.au/Business/Business-activity-statements-(BAS)/In- detail/Boosting-cash-flow-for-employers/ Last modified: 21 Apr 2020 QC 61925 Boosting cash flow for employers Legislation has passed to provide temporary cash flow support to small and medium businesses and not-for-profit organisations that: employ staff have been affected by the economic downturn associated with COVID-19 (novel coronavirus). Eligible businesses and not-for-profit (NFP) organisations will receive between $20,000 to $100,000 in cash flow boost amounts by lodging their activity statements up to the month or quarter of September 2020. The cash flow boosts will be delivered as credits in the activity statement system, and will generally be equivalent to the amount withheld from wages paid to employees for each monthly or quarterly period from March to June 2020. In practice, this means you keep the amounts you have withheld from payments for these periods, however, there are some exceptions. An additional cash flow boost will be applied when activity statements for each monthly or quarterly period from June to September 2020 are lodged. These credits are equal to the total boosts credited for March to June 2020. They will be paid out in either two or four instalments depending on your reporting cycle. You must lodge your activity statement to receive the cash flow boosts. On this page: What you need to know Eligibility Delivery of the cash flow boosts Accessing the cash flow boosts 1 of 15 What you will receive Tax consequences See also: COVID-19 JobKeeper Payment Instant asset write-off Backing business investment – accelerated depreciation What you need to know For most businesses, the cash flow boost will automatically be credited to your account when you lodge your activity statement.