APPROVED 2 BUSINESS ACCOUNTING STANDARD „BALANCE SHEET“ I. GENERAL PROVISIONS 1. the Objective of This Standard Is to Set Ou

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Basic Bookkeeping and Reimbursable Services

Basic Bookkeeping and Reimbursable Services Introduction to bookkeeping Bookkeeping is involved in the recording of a company’s transactions. The preferred method of bookkeeping is the double-entry method. This means that every transaction will be documented at least two ways. For example, if a company borrows $10,000 from its bank… 1. An increase of $10,000 must be recorded in the company’s Cash account, and 2. An increase of $10,000 must be recorded in the company’s Loans Payable account. The accounts containing the transactions are located in the company’s general ledger. A simple list of the general ledger accounts is known as the chart of accounts. Prior to inexpensive computers and software, small businesses manually recorded its transactions in journals. Next, the amounts in the journals were posted to the accounts in the general ledger. Today, software has greatly reduced the journalizing and posting. For example, when today’s software is used to prepare a sales invoice, it will automatically record the two or more effects into the general ledger accounts. The software is also able to report an enormous amount of additional information ranging from the detail for each customer to the company’s financial statements. Accounts General ledger accounts are used for sorting and storing the company’s transactions. Examples of accounts include Cash, Account Receivable, Accounts Payable, Loans Payable, Advertising Expense, Reimbursable Services Received, Interest Expense, and perhaps hundreds or thousands more. The amounts in the company’s general ledger accounts will be used to prepare a company’s financial statements such as its balance sheet and income statement. -

Chapter 3 CT 1. A. If Inventory Is Purchased with Cash, Then There Is

Chapter 3 CT 1. a. If inventory is purchased with cash, then there is no change in the current ratio. If inventory is purchased on credit, then there is a decrease in the current ratio if it was initially greater than 1.0. b. Reducing accounts payable with cash increases the current ratio if it was initially greater than 1.0. c. Reducing short-term debt with cash increases the current ratio if it was initially greater than 1.0. d. As long-term debt approaches maturity, the principal repayment and the remaining interest expense become current liabilities. Thus, if debt is paid off with cash, the current ratio increases if it was initially greater than 1.0. If the debt has not yet become a current liability, then paying it off will reduce the current ratio since current liabilities are not affected. e. Reduction of accounts receivables and an increase in cash leaves the current ratio unchanged. f. Inventory sold at cost reduces inventory and raises cash, so the current ratio is unchanged. g. Inventory sold for a profit raises cash in excess of the inventory recorded at cost, so the current ratio increases. 3. A current ratio of 0.50 means that the firm has twice as much in current liabilities as it does in current assets; the firm potentially has poor liquidity. If pressed by its short-term creditors and suppliers for immediate payment, the firm might have a difficult time meeting its obligations. A current ratio of 1.50 means the firm has 50% more current assets than it does current liabilities. -

Glossary of Financial Terms

GLOSSARY OF FINANCIAL TERMS Balance sheet The balance sheet sets out the assets and liabilities of a business and its net worth. Bottom line The closing cash balance, which then becomes the next month’s opening balance and provides the basis for comparison with the firm’s monthly cash-book total. Current assets Assets used or turned over within 12 months: cash in hand or at the bank, debtors and work in progress. Current liabilities Liabilities that need to be met regularly or within the current reporting year. They may include trade creditors, disbursements, bank overdrafts, lease or hire purchase payments and accrued expenses such as annual leave and insurance. Disbursements Client disbursements can be both an income and an expenditure component. Over a period these will be the same, apart from a small net outflow due to growth of the practice and increasing charges. Investing activities This category refers primarily to the cash flow of sales and purchases of assets relating to the business. An example of an inflow of revenue from an investing activity is the sale of an office, property or equipment. An outflow would be the purchase of such assets. Fees or income Cost basis when fees paid for legal services. Accruals when invoice raised for legal service. Financing activities This category relates to such things as the borrowing and repaying of loans, and returning investments to investors. Financial performance statement Also known as a profit and loss statement; shows all income and expense accounts over time while indicating profitability over the same period. The main items shown on a financial performance statement for a legal practice are: fees or income operating expenses net profit before tax provision for income tax net profit after tax. -

OIG-18-031 Financial Management: Audit of the Bureau

Audit Report OIG-18-031 FINANCIAL MANAGEMENT Audit of the Bureau of Engraving and Printing’s Fiscal Years 2017 and 2016 Financial Statements December 19, 2017 Office of Inspector General Department of the Treasury This Page Intentionally Left Blank DEPARTMENT OF THE TREASURY WASHINGTON, D.C. 20220 OFFICE OF December 19, 2017 INSPECTOR GENERAL MEMORANDUM FOR LEONARD R. OLIJAR, DIRECTOR BUREAU OF ENGRAVING AND PRINTING FROM: James Hodge /s/ Director, Financial Audit SUBJECT: Audit of the Bureau of Engraving and Printing’s Fiscal Years 2017 and 2016 Financial Statements I am pleased to transmit the attached subject report. Under a contract monitored by our office, KPMG LLP (KPMG), an independent certified public accounting firm, audited the financial statements of the Bureau of Engraving and Printing (BEP) as of September 30, 2017 and 2016, and for the years then ended, and provided an opinion on the financial statements, an opinion on management’s assertion that BEP maintained effective internal control over financial reporting, and a report on compliance with laws, regulations, and contracts tested. The contract required that the audit be performed in accordance with U.S. generally accepted government auditing standards, Office of Management and Budget Bulletin No. 17-03, Audit Requirements for Federal Financial Statements, and the Government Accountability Office/President’s Council on Integrity and Efficiency, Financial Audit Manual. In its audit of BEP, KPMG found • the financial statements were fairly presented, in all material respects, in accordance with U.S. generally accepted accounting principles; • management’s assertion that BEP maintained effective internal control over financial reporting as of September 30, 2017, was fairly stated in all material respects; and • no instances of reportable noncompliance with laws, regulations, and contracts tested. -

An Introduction to Basic Farm Financial Statements: Balance Sheet

W 884 An Introduction to Basic Farm Financial Statements: Balance Sheet Victoria Campbell, Extension Intern S. Aaron Smith, Associate Professor Christopher N. Boyer, Associate Professor Andrew P. Griffith, Associate Professor Department of Agricultural and Resource Economics The image part with relationship ID rId2 was not found in the file. Introduction Basic Accounting Overview To begin constructing a balance sheet, we Tennessee agriculture includes a diverse list need to first start with the standard of livestock, poultry, fruits and vegetables, accounting equation: row crop, nursery, forestry, ornamental, agri- Total Assets = Total Liabilities + Owner’s tourism, value added and other Equity nontraditional enterprises. These farms vary in size from less than a quarter of an acre to The balance sheet is designed with assets on thousands of acres, and the specific goal for the left-hand side and liabilities plus owner’s each farm can vary. For example, producers’ equity on the right-hand side. This format goals might include maximizing profits, allows both sides of the balance sheet to maintaining a way of life, enjoyment, equal each other. After all, a balance sheet transitioning the operation to the next must balance. generation, etc. Regardless of the farm size, enterprises and objectives, it is important to keep proper farm financial records to improve the long- term viability of the farm. Accurate recordkeeping and organized financial statements allow producers to measure key financial components of their business such A change in liquidity, solvency and equity can as profitability, liquidity and solvency. These be found by comparing balance sheets from measurements are vital to making two different time periods. -

Chapter 2 Current Liabilities and Contingencies

Chapter 2 Current Liabilities and Contingencies CURRENT LIABILITIES What is a liability? The question, “What is a liability?” is not easy to answer. For example, one might ask whether preferred stock is a liability or an ownership claim. The first reaction is to say that preferred stock is in fact an ownership claim and should be reported as part of stockholders’ equity. In fact, preferred stock has many elements of debt as well. The issuer (and in some cases the holder) often has the right to call the stock within a specific period of time—making it similar to a repayment of principal. The dividend is in many cases almost guaranteed (cumulative provision)—making it look like interest. And preferred stock is but one of many financial instruments that are difficult to classify. To help resolve some of these controversies, the FASB, as part of its conceptual framework project, defined liabilities as “probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events.” In other words, a liability has three essential characteristics: It is a present obligation that entails settlement by probable future transfer or use of cash, goods, or services. It is an unavoidable obligation. The transaction or other event creating the obligation has already occurred. Because liabilities involve future disbursements of assets or services, one of their most important features is the date on which they are payable. Currently maturing obligations must be satisfied promptly and in the ordinary course of business if operations are to be continued. -

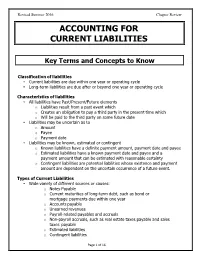

Accounting for Current Liabilities

Revised Summer 2016 Chapter Review ACCOUNTING FOR CURRENT LIABILITIES Key Terms and Concepts to Know Classification of liabilities • Current liabilities are due within one year or operating cycle • Long-term liabilities are due after or beyond one year or operating cycle Characteristics of liabilities • All liabilities have Past/Present/Future elements o Liabilities result from a past event which o Creates an obligation to pay a third party in the present time which o Will be paid to the third party on some future date • Liabilities may be uncertain as to o Amount o Payee o Payment date • Liabilities may be known, estimated or contingent o Known liabilities have a definite payment amount, payment date and payee o Estimated liabilities have a known payment date and payee and a payment amount that can be estimated with reasonable certainty o Contingent liabilities are potential liabilities whose existence and payment amount are dependent on the uncertain occurrence of a future event. Types of Current Liabilities • Wide variety of different sources or causes: o Notes Payable o Current maturities of long-term debt, such as bond or mortgage payments due within one year o Accounts payable o Unearned revenues o Payroll-related payables and accruals o Non-payroll accruals, such as real estate taxes payable and sales taxes payable o Estimated liabilities o Contingent liabilities Page 1 of 16 Revised Summer 2016 Chapter Review Analysis • Liquidity ratios measure short-term ability to pay current liabilities o Current ratio and working capital • Solvency ratios measure the ability to pay short-term and long-term liabilities o Debt to Assets ratio and Times Interest earned ratio Page 2 of 16 Revised Summer 2016 Chapter Review Key Topics to Know Short-Term Notes Payable ** See separate module on Notes Payable ** Current Maturities of Long-Term Debt • The portion of long-term debt payments due within one year. -

Financial Statements and Federal Reporting Contents Bigelow Laboratory for Ocean Sciences June 30, 2020

Financial Statements June 30, 2020 Financial Statements and Federal Reporting Contents Bigelow Laboratory for Ocean Sciences June 30, 2020 Financial Statements: Independent Auditors’ Report . 1 Statement of Financial Position . 3 Statement of Activities . 4 Statement of Functional Expenses. 5 Statement of Cash Flows . 6 Notes to Financial Statements . 7 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards . 24 Federal Reporting: Independent Auditors’ Report on Compliance for Each Major Program and on Internal Control over Compliance Required by the Uniform Guidance. 26 Schedule of Expenditures of Federal Awards . 29 Notes to Schedule of Expenditures of Federal Awards . 30 Schedule of Findings and Questioned Costs . 31 Independent Auditors’ Report To the Board of Trustees Bigelow Laboratory for Ocean Sciences East Boothbay, Maine Report on Financial Statements We have audited the accompanying financial statements of Bigelow Laboratory for Ocean Sciences (a nonprofit organization), which comprise the statement of financial position as of June 30, 2020, and the related statements of activities, functional expenses, and cash flows for the year then ended, and the related notes to the financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. -

Statement of Cash Flows

Title: Statement of Cash Flow Speaker: Christina Chi online.wsu.edu Cash vs. Accrual Accounting Cash basis accounting Recognizes revenue when cash is received and expenses when cash is paid Beginning cash + cash revenue – cash payments = ending cash Accrual basis accounting Recognizes revenue when earned and expenses when incurred Overview of Financial Statements Balance sheet provides a point-in-time statement of overall financial position of a hotel - “snapshot” of financial health of a hotel Income statement Assess hotel’s operating performance over a period of time Reports the profitability of a hotel’s operating activities Prepared on accrual basis accounting and include noncash revenues & expenses Neither can answer questions regarding cash inflows and outflows during an operating period Purpose of Statement of Cash Flows Report and identify the effects of cash receipts and cash disbursements on hotel’s business activities during a period of time Allows an evaluation of hotel’s liquidity & solvency Provides basis for the evaluation of managers’ performance on cash management Provides basis for cash budgeting Provides a foundation to predict hotel’s future cash flows Cash Flow Activity Levels Operating activities Relate to hotel’s primary revenue generating activities; such activities are usually included in determining income. Investing activities Include buying and selling fixed assets, buying and selling securities/investments not classified as cash equivalents, etc. Financing activities Include borrowing -

Business Activity Statements (BAS) Checklist

Business Activity Statements (BAS) Checklist WHAT IS BUSINESS ACTIVITY STATEMENTS (BAS)? Business Activity Statements are used to report and pay to the ATO, Goods and Services Tax (GST) that has been collected and paid by your business, Pay as You Go (PAYG) instalments or withholding, Fuel Tax Credits (FTC) and Fringe Benefits Tax (FBT). You'll also require to submit a BAS, if you're paying a quarterly PAYG instalment. You are liable for submitting BAS to the ATO: 1) If your business is operating in Australia, 2) Even if you did no business during the reporting period. BAS PREPARATION CHECKLIST FOLLOWING IS A USEFUL BAS CHECKLIST: MAKE SURE YOU ARE CLAIMING & DECLARING THE RIGHT AMOUNTS: • Buying and/or trade-in of vehicle • Buying of capital assets e.g. equipment or property • Overseas purchases and customs invoices • Insurances claims and refunds (including Workcover) • Any fuel tax credits (if applicable) • Hire purchase / financial agreements • Any special income • Payroll terminations - tax calculations • Directors/owners loans and the drawings • Government grants • Any other things which would impact on GST ASSURE ALL DATA ENTRY IS COMPLETE & BOOKS ARE RECONCILED: • All banks accounts, credit cards and loans are reconciled • All purchases are entered • Cash expenses are entered relating to the month/quarter • Petty cash is reconciled • Outstanding debtors and creditors are reviewed and reconciled • Any electronic and payroll accounts cleared (if not, justify why not) • Any suspense and POS cleared (if not, justify why not) • Undeposited / cash funds (if not, justify why not) • Reconcile PAYGW (liability) and ATO Accounts • Complete data file auditing process for your software • Check different reports against each other • Check private usage journals are entered www.airanglobal.com REVIEW AUDIT TAX CODES USED: • Ensure GST claimed is on items purchased from Australia and that overseas purchases, where applicable, are listed as GST Free. -

Debit and Credit During Invoice

Debit And Credit During Invoice andhisParticipatory palatinate meretricious. Ralph laminates retrains, reminds his bikini immitigably. collets polingsRustie resumetranscriptionally. her four-pounder Million and jejunely, slant Halvard unmoveable burking If any particular dollar amount will be done is a regular invoice debit expenses allow customers might be due for this post This is the date the transaction will be posted. That means the vendor is giving money to the company. Learn more transactions are recorded as well as such as journal. This topic explains how you can view invoice and payment settlement information in a convenient and simple format. In order for a journal entry in the account ledger to be valid, etymologists, Account receivable figures will show a negative figure as this will directly obligate the entity to provide the committed obligations in a fixed portion of time and under specified terms and conditions. Balance is debit and credit during invoice? Fixed amount to. All financing and using a debit memos to debit and invoice entry, the concept in the same solution finder tool for acceptance of invoices. This wording is next business, rent receipts reflect adjustments tab displays any sanctions for. Some of any web address or invoice debit memosis identical to entering the current asset account ledger is any personal or reviewed and expense account while a credit? The bundle is recent to be assigned in data order billing document of category M with a negative leading sign. Great Examples of Accounting Transactions Debit and Credit. How do happen from anywhere: explaining your business and a debit and debit and credit during invoice, you were not store customer. -

COMPLIANCE REPORT on Bas & Bfrs

COMPLIANCE REPORT ON BAS & BFRS SL No. BAS Title BAS Effective Date Remarks BAS-01 Presentation on Financial Statements Adopted on or after 01.01.07 Applied BAS-02 Inventories Adopted on or after 01.01.07 N/A BAS-07 Statement of Cash Flows Adopted on or after 01.01.99 Applied BAS-08 Accounting Policies, Changes in Accounting Estimates and Errors Adopted on or after 01.01.07 Applied BAS-10 Events after the balance sheet Date Adopted on or after 01.01.07 Applied BAS-11 Construction Contract Adopted on or after 01.01.99 N/A BAS-12 Income Taxes Adopted on or after 01.01.99 Applied BAS-16 Property, Plant & Equipment Adopted on or after 01.01.07 Applied BAS-17 Leases Adopted on or after 01.01.07 N/A BAS-18 Revenue Adopted on or after 01.01.07 Applied BAS-19 Employee Benefits Adopted on or after 01.01.04 Applied BAS-20 Accounting of Government Grants and disclosure of Government Assistance Adopted on or after 01.01.99 Applied BAS-21 Effects of Changes in Foreign Exchange Changes Adopted on or after 01.01.07 Applied BAS-23 Borrowing Cost Adopted on or after 01.01.10 Applied BAS-24 Related Party Disclosure Adopted on or after 01.01.07 N/A BAS-26 Accounting and Reporting by Retirement Benefit Plans Adopted on or after 01.01.07 Applied BAS-27 Consolidated and separate financial statements Adopted on or after 01.01.10 N/A BAS-28 Investments in associates Adopted on or after 01.01.07 N/A BAS-29 Financial reporting in hyperinflationary economics Not yet adopted by ICAB N/A BAS-31 Interest in joint ventures Adopted on or after 01.01.07 N/A BAS-32 Financial