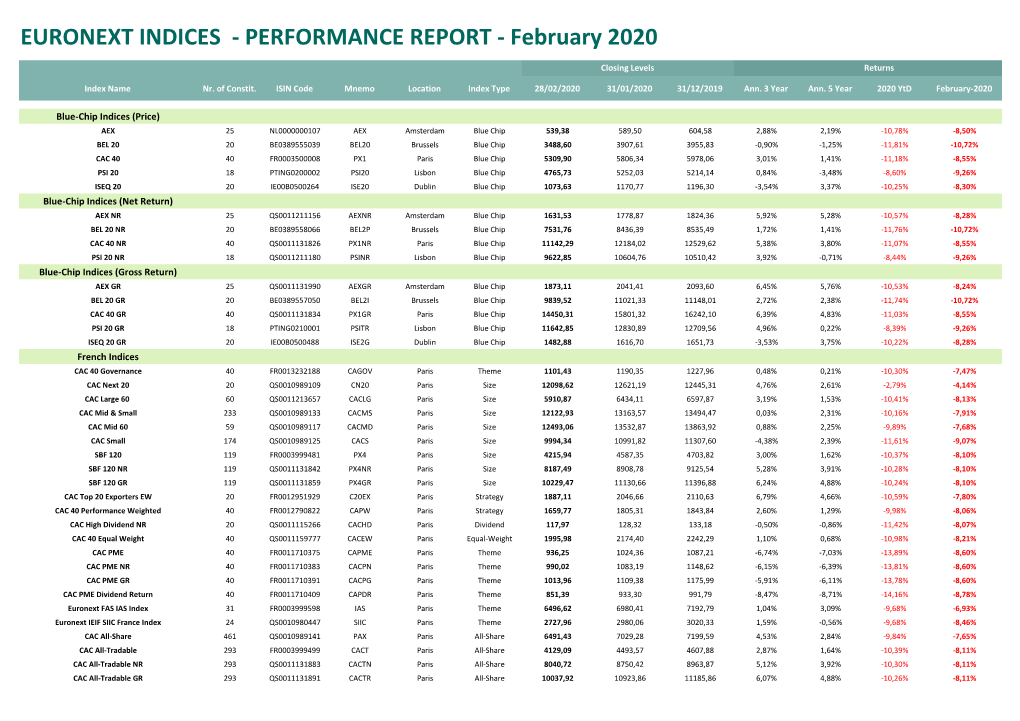

EURONEXT INDICES - PERFORMANCE REPORT - February 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2009 Annual Report

2009 ANNUAL REPORT UNIBAIL-RODAMCO / 2009 ANNUAL REPORT 1 Profile 2 Message from the CEO 4 Message from the Chairman of the Supervisory Board 6 Strategy & key figures Stock market performance PROFILE 10 & shareholding structure 2009 Unibail-Rodamco is Europe’s leading listed commercial property company ANNUAL with a portfolio valued at €22.3 billion on December 31, 2009. REPORT A clear strategy The Group is the leading investor, operator and developer of large shopping centres in 14 An unprecedented climate Europe. Its 95 shopping centres, 47 of which receive more than 7 million visits per annum, 12 16 Expertise in retail operations are generally located in major continental European cities with superior purchasing power 18 Differentiation: the key to success and extensive catchment areas. The Group continuously reinforces the attractiveness of 22 An attractive development pipeline 24 Financial firepower for future growth its assets by upgrading the layout, renewing the tenant mix and enhancing the shopping 26 Talented, motivated teams experience. Present in 12 European Union countries, Unibail-Rodamco is a natural business partner for any retailer seeking to penetrate or expand in this market and for any public or Business private institution interested in developing large, integrated retail schemes. Overview A commitment to value creation The Group is also a key player in the Paris region office market, where it focuses on modern, efficient buildings of more than 10,000 m2. Finally, in joint venture with the Paris Chamber 32 Shopping Centres of Commerce and Industry, Unibail-Rodamco owns, operates and develops the major 30 34 France 36 Netherlands convention and exhibition centres of the Paris region. -

ENGIE General Shareholders' Meeting of 20 May 2021

Press release 20 May 2021 ENGIE General Shareholders’ Meeting of 20 May 2021 Approval by shareholders of all resolutions including: • Appointment of Catherine MacGregor to the Board of Directors • Appointment of Jacinthe Delage as Director representing employee shareholders to the Board of Directors • Payment of the dividend of 0.53 euro per share on May 26 ENGIE General Shareholders’ Meeting was held on 20 May 2021 at the Espace Grande Arche in La Défense, under the chairmanship of Jean-Pierre Clamadieu. The Meeting was held without the physical presence of the shareholders due to the health context and was broadcasted live on the website www.engie.com. Shareholders approved the appointment of Catherine MacGregor to the Board of Directors. Among the two candidates representing employee shareholders, the choice fell on Jacinthe Delage who received the highest number of votes. Stéphanie Besnier was also appointed as the French State's representative on the Board of Directors by ministerial order dated 19 May 2021, replacing Isabelle Bui. With these appointments, the Board is now composed of 14 members, 60% of whom are independent according to the rules of the Afep-Medef code, and 43% are women (50% within the meaning of the relevant legislation). The other resolutions, notably those on the financial statements and income allocation for the 2020 financial year, were also approved. The dividend was set at 0.53 euro per share and will be paid on 26 May. To encourage the dialogue with the Group, and in addition to the legal provisions for written questions, shareholders were able to send questions via a dedicated online platform, including during the meeting. -

Jcdecaux Wins Unibail-Rodamco-Westfield Contract for the Two Largest UK Shopping Malls

JCDecaux wins Unibail-Rodamco-Westfield contract for the two largest UK shopping malls Paris, October 8th, 2018 – JCDecaux S.A. (Euronext Paris: DEC), the number one outdoor advertising company worldwide, announces that it has won the contract for the in centre advertising at Westfield London and Westfield Stratford City, the premium retail, shopping and leisure destinations in London – ranked number one and two for mall retail spend in the UK. The contract follows a competitive tender and is for a term of 8.5 years. JCDecaux will take over the contract in November and will manage internal advertising opportunities across the two malls, comprising 180 screens in a 100% digital environment. With the addition of Westfield London and Westfield Stratford City, JCDecaux’s portfolio will now cover all 25 of London’s top retail zones (source CACI). Westfield London and Westfield Stratford City deliver 52 million digital weekly viewed impressions (source: Route 27). Paul Buttigieg, Director of Commercial Partnerships, Shopping Centre Management, Unibail-Rodamco-Westfield, said: “JCDecaux’s expertise in selling the London and international luxury audience means they are ideally placed to share our vision for the Westfield London and Westfield Stratford City advertising portfolio. JCDecaux brings the scale, digital expertise and data insight to understand our audience and to develop our offer further. This partnership with JCDecaux will give advertisers a new opportunity to reach influential and affluent audiences at multiple touchpoints in London and will benefit Westfield shoppers with relevant and engaging advertising content on the screens.” Jean-François Decaux, Co-Chief Executive Officer of JCDecaux, said: “We are delighted to be working in partnership with Unibail-Rodamco-Westfield, the premier global developer and operator of flagship shopping destinations to develop advertising opportunities in their market-leading malls. -

The Last Platform of the World's First Semi-Submersible Floating Wind

Windplus is a consortium between EDP Renováveis, Engie, Repsol and Principle Power The last platform of the world’s first semi-submersible floating wind farm sets sail • The platform will travel from the Galician town of Ferrol to its final location 20 km off the Portuguese coast. • The two previous platforms – featuring the world’s largest offshore wind turbine on a floating foundation - are now fully installed at the wind farm, supplying energy to Portugal’s electricity network. • With a total installed capacity of 25 MW, WindFloat Atlantic is the first floating wind farm in continental Europe. Lisbon, 28 May 2020: The WindFloat Atlantic project is taking one of the final steps towards becoming fully operational. The last of the three pre-assembled wind turbine platforms making up the project has left the Port of Ferrol today, heading for its final destination 20 km off the coast of Portugal at Viana do Castelo, in a journey that will take three days. This operation will be completed by hooking up this last unit to the pre-laid mooring system and connecting it to the rest of the offshore wind farm. This third platform will be installed next to the other two units, which are already up and running and supplying energy to the Portuguese electricity grid. Transporting each of the three WindFloat Atlantic floating structures is a milestone in itself, as it sidesteps the need for towing craft designed specifically for this process and makes it possible for the project to be replicated elsewhere. The floating structure –measuring 30 m high and with a 50 m distance between each of its columns – can support the world’s largest commercially available wind turbines, of 8.4 MW production capacity each, on a floating structure. -

Registration Document

2016 REGISTRATION DOCUMENT 2016 REGISTRATION DOCUMENTREGISTRATION 1 4 GROUP OVERVIEW 3 SUSTAINABLE DEVELOPMENT 161 1.1 Klépierre’s strategy at a glance 4 4.1 An ambitious strategy and an integrated organization 162 1.2 Key figures 5 4.2 Operational and sustainable excellence at the heart 1.3 Stock market and shareholder base 9 of our strategy 172 1.4 Background 10 4.3 Klépierre, a company that is committed throughout its value chain 188 1.5 Property portfolio as of December 31, 2016 11 4.4 Employees, one of Klépierre’s main assets 196 1.6 Simplified organization chart as of December 31, 2016 23 4.5 Methodology, Concordance table and verification Competitive position 24 1.7 by independent third party 202 1.8 Main risk factors 25 5 2 CORPORATE GOVERNANCE 211 BUSINESS FOR THE YEAR 39 5.1 Management and oversight of the Company 212 2.1 Shopping center operations overview 40 5.2 Compensation and benefits of executive 2.2 Business activity by region 44 corporate officers 232 2.3 Investments, developments and disposals 51 2.4 Consolidated earnings and cash-flow 54 2.5 Parent company earnings and distribution 56 2.6 Property portfolio valuation 57 6 2.7 EPRA performance indicators 61 SHARE CAPITAL, SHAREHOLDING, 2.8 Financial policy 64 GENERAL MEETING OF SHAREHOLDERS 261 2.9 Governance 67 6.1 Share capital and Shareholding 262 2.10 Events subsequent to the accounting cut-off date 67 6.2 General Meeting of Shareholders 278 2.11 Outlook 67 7 3 GENERAL ADDITONAL INFORMATION 303 FINANCIAL STATEMENTS 69 7.1 General information 304 3.1 Consolidated -

Download the Press Release

Press release Nov. 25, 2015 ENGIE’s first LNG cargo for Beijing city unloaded in Caofeidian terminal, aiming to contribute to Beijing city’s gas demand during the winter season November 25, 2015, the first cargo of LNG provided by ENGIE Group (former GDF SUEZ Group) to Beijing Gas Group, acting as a direct buyer, unloaded at PetroChina’s Caofeidian LNG receiving terminal. This shipment was transported by the LNG carrier named <GDF SUEZ POINT FORTIN> which total storage capacity amounts 154,200 cubic meters. After unloading, storage and gasification in Caofeidian LNG receiving terminal, the natural gas will be transported to Beijing via Yongtangqin pipeline. This gas is a supplementary source for Beijing City’s winter season, contributing to Beijing city’s gas demand and security of supply during the 2015-2016 heating season. This delivery is the first case among all Chinese LNG buyers, of third party reception and further transport in pipeline infrastructures and, as such, a clear sign of the steps taken by Chinese Authorities towards open and fair access mechanisms. This LNG delivery is the result of the contract signed on June 30, 2015 in Paris between Beijing Gas Group and ENGIE Group under the witness of Chinese Prime Minister Li Keqiang and French Prime Minister Manuel Valls. This agreement is one part of the cooperations between ENGIE and Beijing Enterprises Group (BEG), carrying out cooperation in LNG and other related fields. Jean-Marc Guyot, President & CEO of ENGIE China said: “this is an important milestone of ENGIE’s development in China. Through this LNG supply, we are pleased that ENGIE can contribute to China's growing demand and efforts towards clean energy.” GDF SUEZ CORPORATE HEADQUARTERS Tour T1 – 1 place Samuel de Champlain – Faubourg de l’Arche - 92930 Paris La Défense cedex - France Tel + 33(0)1 44 22 00 00 GDF SUEZ SA WITH CAPITAL OF €2,435,285,011 – RCS NANTERRE 542 107 651 About ENGIE in China ENGIE has been present in China for over 40 years. -

Evidence on Taxing Transactions in Modern Markets∗

Sand in the Chips? Evidence on Taxing Transactions in Modern Markets∗ Jean-Edouard Colliard and Peter Hoffmanny First version: December 2012 This version: May 30, 2014 Abstract We present evidence on the causal impact of financial transaction taxes on market quality in a modern market structure by exploiting the introduction of such a levy in France on August 1st, 2012. Our evidence suggests that the substantial changes in market structure over the past decades play an important role in reassessing the long-standing idea of the FTT. While we document a surprisingly mild impact on exchange-based trading due to exemptions for liquidity provision, off-exchange trading declined by 40%, and the largest OTC trades virtually disappeared. This suggests that market segmentation poses a considerable challenge to current policy proposals. Journal of Economic Literature Classification Number: G10, G14, G18, H32. Keywords: Financial transaction tax, OTC markets, liquidity, high-frequency trading. ∗We would like to thank Bruno Biais, Fany Declerck, Hans Degryse, Laurent Grillet-Aubert, Philipp Hartmann, Frank de Jong, Simone Manganelli, Elvira Sojli as well as seminar and conference participants at the French Treasury, Autorit´edes March´esFinanciers (AMF), ECB, VU University Amsterdam, the Banque de France Workshop on Algorithmic and High Frequency Trading, the 6th Erasmus Liquidity Conference and the Arne Ryde Workshop for comments and suggestions. The views expressed in this paper are the authors' and do not necessarily reflect those of the European Central Bank or the Eurosystem. yEuropean Central Bank, Financial Research Division. E-mail: [email protected] and [email protected]. Contact author: Peter Hoffmann, ECB, Kaiserstrasse 29, D-60311 Frankfurt am Main, Germany. -

Financial Market Data for R/Rmetrics

Financial Market Data for R/Rmetrics Diethelm Würtz Andrew Ellis Yohan Chalabi Rmetrics Association & Finance Online R/Rmetrics eBook Series R/Rmetrics eBooks is a series of electronic books and user guides aimed at students and practitioner who use R/Rmetrics to analyze financial markets. A Discussion of Time Series Objects for R in Finance (2009) Diethelm Würtz, Yohan Chalabi, Andrew Ellis R/Rmetrics Meielisalp 2009 Proceedings of the Meielisalp Workshop 2011 Editor Diethelm Würtz Basic R for Finance (2010), Diethelm Würtz, Yohan Chalabi, Longhow Lam, Andrew Ellis Chronological Objects with Rmetrics (2010), Diethelm Würtz, Yohan Chalabi, Andrew Ellis Portfolio Optimization with R/Rmetrics (2010), Diethelm Würtz, William Chen, Yohan Chalabi, Andrew Ellis Financial Market Data for R/Rmetrics (2010) Diethelm W?rtz, Andrew Ellis, Yohan Chalabi Indian Financial Market Data for R/Rmetrics (2010) Diethelm Würtz, Mahendra Mehta, Andrew Ellis, Yohan Chalabi Asian Option Pricing with R/Rmetrics (2010) Diethelm Würtz R/Rmetrics Singapore 2010 Proceedings of the Singapore Workshop 2010 Editors Diethelm Würtz, Mahendra Mehta, David Scott, Juri Hinz R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer School and Workshop 2011 Editor Diethelm Würtz III tinn-R Editor (2010) José Cláudio Faria, Philippe Grosjean, Enio Galinkin Jelihovschi and Ri- cardo Pietrobon R/Rmetrics Meielisalp 2011 Proceedings of the Meielisalp Summer Scholl and Workshop 2011 Editor Diethelm Würtz R/Rmetrics Meielisalp 2012 Proceedings of the Meielisalp Summer Scholl and Workshop 2012 Editor Diethelm Würtz Topics in Empirical Finance with R and Rmetrics (2013), Patrick Hénaff FINANCIAL MARKET DATA FOR R/RMETRICS DIETHELM WÜRTZ ANDREW ELLIS YOHAN CHALABI RMETRICS ASSOCIATION &FINANCE ONLINE Series Editors: Prof. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

INDEX RULE BOOK Leverage, Short, and Bear Indices

INDEX RULE BOOK Leverage, Short, and Bear Indices Version 20-02 Effective from 15 May 2020 indices.euronext.com Index 1. Index Summary 1 2. Governance and Disclaimer 8 2.1 Indices 8 2.2 Administrator 8 2.3 Cases not covered in rules 8 2.4 Rule book changes 8 2.5 Liability 8 2.6 Ownership and trademarks 8 3. Calculation 9 3.1 Definition and Composition of the Index 9 3.2 Calculation of the Leverage Indices 9 3.3 Calculation of the Bear and Short Indices 9 3.4 Reverse split of index level 10 3.5 Split of index level 10 3.6 Financing Adjustment Rate (FIN) 10 4. Publication 11 4.1 Dissemination of Index Values 11 4.2 Exceptional Market Conditions and Corrections 11 4.3 Announcement Policy 14 5. ESG Disclosures 15 1. INDEX SUMMARY Factsheet Leverage, Short and Bear indices Index names Various based on AEX®, BEL 20®, CAC 40®, PSI 20® and ISEQ® Index type Indices are based on price index versions or Net return index or Gross return index versions. Administrator Euronext Paris is the Administrator and is responsible for the day-to-day management of the index. The underlying indices have independent Steering Committees acting as Independent Supervisor. Calculation Based on daily leverage. May include spread on interest rate or Financing Adjustment rate in the calculation Rule for exceptional trading Either suspend or reset if underlying index moved beyond certain threshold. See reference circumstances table. 1 Mnemo Full name Underlying Factor Rule for ISIN Base level index exceptional and date trading circumstances AEX® based AEXLV AEX® Leverage AEX® 2 Suspend if Underlying QS0011095898 1,000 at Index < 75% of close 31Dec2002 of previous day AEXNL AEX® Leverage AEX® NR 2 Suspend if Underlying QS0011216205 1,000 at NR Index < 75% of close 31Dec2002 of previous day AEXTL AEX® Leverage AEX® GR 2 Suspend if Underlying QS0011179239 1,000 at GR Index < 75% of close 31Dec2002 of previous day AEX3L AEX® NR 3 Reset if Underlying QS0011230115 10,000 at AEX® X3 Leverage Index < 85% of close 31Dec2008 NR of previous day. -

Execution Version

Execution Version GUARANTEED SENIOR SECURED NOTES PROGRAMME issued by GOLDMAN SACHS INTERNATIONAL in respect of which the payment and delivery obligations are guaranteed by THE GOLDMAN SACHS GROUP, INC. (the “PROGRAMME”) PRICING SUPPLEMENT DATED 23rd SEPTEMBER 2020 SERIES 2020-12 SENIOR SECURED EXTENDIBLE FIXED RATE NOTES (the “SERIES”) ISIN: XS2233188510 Common Code: 223318851 This document constitutes the Pricing Supplement of the above Series of Secured Notes (the “Secured Notes”) and must be read in conjunction with the Base Listing Particulars dated 25 September 2019, as supplemented from time to time (the “Base Prospectus”), and in particular, the Base Terms and Conditions of the Secured Notes, as set out therein. Full information on the Issuer, The Goldman Sachs Group. Inc. (the “Guarantor”), and the terms and conditions of the Secured Notes, is only available on the basis of the combination of this Pricing Supplement and the Base Listing Particulars as so supplemented. The Base Listing Particulars has been published at www.ise.ie and is available for viewing during normal business hours at the registered office of the Issuer, and copies may be obtained from the specified office of the listing agent in Ireland. The Issuer accepts responsibility for the information contained in this Pricing Supplement. To the best of the knowledge and belief of the Issuer and the Guarantor the information contained in the Base Listing Particulars, as completed by this Pricing Supplement in relation to the Series of Secured Notes referred to above, is true and accurate in all material respects and, in the context of the issue of this Series, there are no other material facts the omission of which would make any statement in such information misleading. -

Structures De Gouvernance Des Sociétés Cotées Radiographie

Structures de gouvernance des sociétés cotées Radiographie Observatoire Capital humain Centre de Gouvernement d'Entreprise Octobre 2015 Second line optional lorem ipsum B Subhead lorem ipsum, date quatueriure Mesurer pour comprendre, comprendre pour agir, agir pour progresser Sommaire Executive Summary 2 Préambule 4 1. Radiographie des conseils 7 Introduction 7 Typologie des conseils 8 Indépendance des administrateurs 12 Féminisation des conseils 14 Internationalisation des conseils 18 Distribution par âge et par ancienneté 20 Cumul des mandats 22 Mercato 2014-2015 25 Rémunérations des administrateurs 29 Evaluation des conseils 38 2. Les comités du Conseil 42 Introduction 43 Comités spécialisés 45 3. Assemblées générales 2015 52 Introduction 53 Nature des résolutions 54 Résultats des votes 56 Facteurs d'influence 66 Liste des sociétés 70 Structures de gouvernance des sociétés cotées - Radiographie 1 Executive Summary Des pratiques globalement en ligne avec les codes de gouvernance, mais des différences marquées selon l'indice de cotation Nous sommes très heureux de vous présenter la Nous étudierons les comités spécialisés, leur fréquence radiographie de la gouvernance des sociétés cotées et leur composition, ainsi que la distribution des rôles 2015, issue de l’analyse des pratiques de gouvernement des administrateurs en leur sein. d’entreprise de plus de 300 sociétés cotées au marché Le chapitre relatif aux assemblées générales 2015 Euronext de la Bourse de Paris. analysera près de 5 700 résolutions présentées lors Le gouvernement d’entreprise désigne les modes de 318 assemblées générales en rapprochant les taux de fonctionnement des organes d'administration et d’approbation, la nature des résolutions, la structure de surveillance d’une organisation et leurs relations actionnariale des sociétés et les recommandations de avec la direction et les actionnaires.