Evidence on Taxing Transactions in Modern Markets∗

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2009 Annual Report

2009 ANNUAL REPORT UNIBAIL-RODAMCO / 2009 ANNUAL REPORT 1 Profile 2 Message from the CEO 4 Message from the Chairman of the Supervisory Board 6 Strategy & key figures Stock market performance PROFILE 10 & shareholding structure 2009 Unibail-Rodamco is Europe’s leading listed commercial property company ANNUAL with a portfolio valued at €22.3 billion on December 31, 2009. REPORT A clear strategy The Group is the leading investor, operator and developer of large shopping centres in 14 An unprecedented climate Europe. Its 95 shopping centres, 47 of which receive more than 7 million visits per annum, 12 16 Expertise in retail operations are generally located in major continental European cities with superior purchasing power 18 Differentiation: the key to success and extensive catchment areas. The Group continuously reinforces the attractiveness of 22 An attractive development pipeline 24 Financial firepower for future growth its assets by upgrading the layout, renewing the tenant mix and enhancing the shopping 26 Talented, motivated teams experience. Present in 12 European Union countries, Unibail-Rodamco is a natural business partner for any retailer seeking to penetrate or expand in this market and for any public or Business private institution interested in developing large, integrated retail schemes. Overview A commitment to value creation The Group is also a key player in the Paris region office market, where it focuses on modern, efficient buildings of more than 10,000 m2. Finally, in joint venture with the Paris Chamber 32 Shopping Centres of Commerce and Industry, Unibail-Rodamco owns, operates and develops the major 30 34 France 36 Netherlands convention and exhibition centres of the Paris region. -

ENGIE General Shareholders' Meeting of 20 May 2021

Press release 20 May 2021 ENGIE General Shareholders’ Meeting of 20 May 2021 Approval by shareholders of all resolutions including: • Appointment of Catherine MacGregor to the Board of Directors • Appointment of Jacinthe Delage as Director representing employee shareholders to the Board of Directors • Payment of the dividend of 0.53 euro per share on May 26 ENGIE General Shareholders’ Meeting was held on 20 May 2021 at the Espace Grande Arche in La Défense, under the chairmanship of Jean-Pierre Clamadieu. The Meeting was held without the physical presence of the shareholders due to the health context and was broadcasted live on the website www.engie.com. Shareholders approved the appointment of Catherine MacGregor to the Board of Directors. Among the two candidates representing employee shareholders, the choice fell on Jacinthe Delage who received the highest number of votes. Stéphanie Besnier was also appointed as the French State's representative on the Board of Directors by ministerial order dated 19 May 2021, replacing Isabelle Bui. With these appointments, the Board is now composed of 14 members, 60% of whom are independent according to the rules of the Afep-Medef code, and 43% are women (50% within the meaning of the relevant legislation). The other resolutions, notably those on the financial statements and income allocation for the 2020 financial year, were also approved. The dividend was set at 0.53 euro per share and will be paid on 26 May. To encourage the dialogue with the Group, and in addition to the legal provisions for written questions, shareholders were able to send questions via a dedicated online platform, including during the meeting. -

Jcdecaux Wins Unibail-Rodamco-Westfield Contract for the Two Largest UK Shopping Malls

JCDecaux wins Unibail-Rodamco-Westfield contract for the two largest UK shopping malls Paris, October 8th, 2018 – JCDecaux S.A. (Euronext Paris: DEC), the number one outdoor advertising company worldwide, announces that it has won the contract for the in centre advertising at Westfield London and Westfield Stratford City, the premium retail, shopping and leisure destinations in London – ranked number one and two for mall retail spend in the UK. The contract follows a competitive tender and is for a term of 8.5 years. JCDecaux will take over the contract in November and will manage internal advertising opportunities across the two malls, comprising 180 screens in a 100% digital environment. With the addition of Westfield London and Westfield Stratford City, JCDecaux’s portfolio will now cover all 25 of London’s top retail zones (source CACI). Westfield London and Westfield Stratford City deliver 52 million digital weekly viewed impressions (source: Route 27). Paul Buttigieg, Director of Commercial Partnerships, Shopping Centre Management, Unibail-Rodamco-Westfield, said: “JCDecaux’s expertise in selling the London and international luxury audience means they are ideally placed to share our vision for the Westfield London and Westfield Stratford City advertising portfolio. JCDecaux brings the scale, digital expertise and data insight to understand our audience and to develop our offer further. This partnership with JCDecaux will give advertisers a new opportunity to reach influential and affluent audiences at multiple touchpoints in London and will benefit Westfield shoppers with relevant and engaging advertising content on the screens.” Jean-François Decaux, Co-Chief Executive Officer of JCDecaux, said: “We are delighted to be working in partnership with Unibail-Rodamco-Westfield, the premier global developer and operator of flagship shopping destinations to develop advertising opportunities in their market-leading malls. -

The Last Platform of the World's First Semi-Submersible Floating Wind

Windplus is a consortium between EDP Renováveis, Engie, Repsol and Principle Power The last platform of the world’s first semi-submersible floating wind farm sets sail • The platform will travel from the Galician town of Ferrol to its final location 20 km off the Portuguese coast. • The two previous platforms – featuring the world’s largest offshore wind turbine on a floating foundation - are now fully installed at the wind farm, supplying energy to Portugal’s electricity network. • With a total installed capacity of 25 MW, WindFloat Atlantic is the first floating wind farm in continental Europe. Lisbon, 28 May 2020: The WindFloat Atlantic project is taking one of the final steps towards becoming fully operational. The last of the three pre-assembled wind turbine platforms making up the project has left the Port of Ferrol today, heading for its final destination 20 km off the coast of Portugal at Viana do Castelo, in a journey that will take three days. This operation will be completed by hooking up this last unit to the pre-laid mooring system and connecting it to the rest of the offshore wind farm. This third platform will be installed next to the other two units, which are already up and running and supplying energy to the Portuguese electricity grid. Transporting each of the three WindFloat Atlantic floating structures is a milestone in itself, as it sidesteps the need for towing craft designed specifically for this process and makes it possible for the project to be replicated elsewhere. The floating structure –measuring 30 m high and with a 50 m distance between each of its columns – can support the world’s largest commercially available wind turbines, of 8.4 MW production capacity each, on a floating structure. -

Registration Document

2016 REGISTRATION DOCUMENT 2016 REGISTRATION DOCUMENTREGISTRATION 1 4 GROUP OVERVIEW 3 SUSTAINABLE DEVELOPMENT 161 1.1 Klépierre’s strategy at a glance 4 4.1 An ambitious strategy and an integrated organization 162 1.2 Key figures 5 4.2 Operational and sustainable excellence at the heart 1.3 Stock market and shareholder base 9 of our strategy 172 1.4 Background 10 4.3 Klépierre, a company that is committed throughout its value chain 188 1.5 Property portfolio as of December 31, 2016 11 4.4 Employees, one of Klépierre’s main assets 196 1.6 Simplified organization chart as of December 31, 2016 23 4.5 Methodology, Concordance table and verification Competitive position 24 1.7 by independent third party 202 1.8 Main risk factors 25 5 2 CORPORATE GOVERNANCE 211 BUSINESS FOR THE YEAR 39 5.1 Management and oversight of the Company 212 2.1 Shopping center operations overview 40 5.2 Compensation and benefits of executive 2.2 Business activity by region 44 corporate officers 232 2.3 Investments, developments and disposals 51 2.4 Consolidated earnings and cash-flow 54 2.5 Parent company earnings and distribution 56 2.6 Property portfolio valuation 57 6 2.7 EPRA performance indicators 61 SHARE CAPITAL, SHAREHOLDING, 2.8 Financial policy 64 GENERAL MEETING OF SHAREHOLDERS 261 2.9 Governance 67 6.1 Share capital and Shareholding 262 2.10 Events subsequent to the accounting cut-off date 67 6.2 General Meeting of Shareholders 278 2.11 Outlook 67 7 3 GENERAL ADDITONAL INFORMATION 303 FINANCIAL STATEMENTS 69 7.1 General information 304 3.1 Consolidated -

Download the Press Release

Press release Nov. 25, 2015 ENGIE’s first LNG cargo for Beijing city unloaded in Caofeidian terminal, aiming to contribute to Beijing city’s gas demand during the winter season November 25, 2015, the first cargo of LNG provided by ENGIE Group (former GDF SUEZ Group) to Beijing Gas Group, acting as a direct buyer, unloaded at PetroChina’s Caofeidian LNG receiving terminal. This shipment was transported by the LNG carrier named <GDF SUEZ POINT FORTIN> which total storage capacity amounts 154,200 cubic meters. After unloading, storage and gasification in Caofeidian LNG receiving terminal, the natural gas will be transported to Beijing via Yongtangqin pipeline. This gas is a supplementary source for Beijing City’s winter season, contributing to Beijing city’s gas demand and security of supply during the 2015-2016 heating season. This delivery is the first case among all Chinese LNG buyers, of third party reception and further transport in pipeline infrastructures and, as such, a clear sign of the steps taken by Chinese Authorities towards open and fair access mechanisms. This LNG delivery is the result of the contract signed on June 30, 2015 in Paris between Beijing Gas Group and ENGIE Group under the witness of Chinese Prime Minister Li Keqiang and French Prime Minister Manuel Valls. This agreement is one part of the cooperations between ENGIE and Beijing Enterprises Group (BEG), carrying out cooperation in LNG and other related fields. Jean-Marc Guyot, President & CEO of ENGIE China said: “this is an important milestone of ENGIE’s development in China. Through this LNG supply, we are pleased that ENGIE can contribute to China's growing demand and efforts towards clean energy.” GDF SUEZ CORPORATE HEADQUARTERS Tour T1 – 1 place Samuel de Champlain – Faubourg de l’Arche - 92930 Paris La Défense cedex - France Tel + 33(0)1 44 22 00 00 GDF SUEZ SA WITH CAPITAL OF €2,435,285,011 – RCS NANTERRE 542 107 651 About ENGIE in China ENGIE has been present in China for over 40 years. -

Evidence on Taxing Transactions in Modern Markets∗

Sand in the Chips? Evidence on Taxing Transactions in Modern Markets∗ Jean-Edouard Colliard and Peter Hoffmanny First version: December 2012 This version: May 30, 2014 Abstract We present evidence on the causal impact of financial transaction taxes on market quality in a modern market structure by exploiting the introduction of such a levy in France on August 1st, 2012. Our evidence suggests that the substantial changes in market structure over the past decades play an important role in reassessing the long-standing idea of the FTT. While we document a surprisingly mild impact on exchange-based trading due to exemptions for liquidity provision, off-exchange trading declined by 40%, and the largest OTC trades virtually disappeared. This suggests that market segmentation poses a considerable challenge to current policy proposals. Journal of Economic Literature Classification Number: G10, G14, G18, H32. Keywords: Financial transaction tax, OTC markets, liquidity, high-frequency trading. ∗We would like to thank Bruno Biais, Fany Declerck, Hans Degryse, Laurent Grillet-Aubert, Philipp Hartmann, Frank de Jong, Simone Manganelli, Elvira Sojli as well as seminar and conference participants at the French Treasury, Autorit´edes March´esFinanciers (AMF), ECB, VU University Amsterdam, the Banque de France Workshop on Algorithmic and High Frequency Trading, the 6th Erasmus Liquidity Conference and the Arne Ryde Workshop for comments and suggestions. The views expressed in this paper are the authors' and do not necessarily reflect those of the European Central Bank or the Eurosystem. yEuropean Central Bank, Financial Research Division. E-mail: [email protected] and [email protected]. Contact author: Peter Hoffmann, ECB, Kaiserstrasse 29, D-60311 Frankfurt am Main, Germany. -

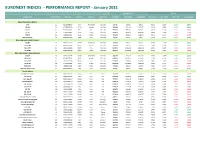

EURONEXT INDICES - PERFORMANCE REPORT - January 2021

EURONEXT INDICES - PERFORMANCE REPORT - January 2021 Closing Levels Returns Index Name Nr. of Constit. ISIN Code Mnemo Location Index Type 1/29/2021 12/31/2020 12/31/2020 Ann. 3 Year Ann. 5 Year 2021 YtD January 2021 Blue-Chip Indices (Price) AEX 25 NL0000000107 AEX Amsterdam Blue Chip 637,11 624,61 624,61 4,36% 8,12% 2,00% 2,00% BEL 20 20 BE0389555039 BEL20 Brussels Blue Chip 3623,60 3621,28 3621,28 -4,12% 0,78% 0,06% 0,06% CAC 40 40 FR0003500008 PX1 Paris Blue Chip 5399,21 5551,41 5551,41 -0,51% 4,10% -2,74% -2,74% PSI 20 18 PTING0200002 PSI20 Lisbon Blue Chip 4794,55 4898,36 4898,36 -5,40% -1,09% -2,12% -2,12% ISEQ 20 20 IE00B0500264 ISE20 Dublin Blue Chip 1231,18 1288,72 1288,72 2,39% 3,15% -4,46% -4,46% OBX Price index 25 NO0007035376 OBXP Oslo Blue Chip 471,53 469,24 469,24 1,291% 7,01% 0,49% 0,49% Blue-Chip Indices (Net Return) AEX NR 25 QS0011211156 AEXNR Amsterdam Blue Chip 1960,58 1922,11 1922,11 7,13% 11,22% 2,00% 2,00% BEL 20 NR 20 BE0389558066 BEL2P Brussels Blue Chip 7933,79 7924,32 7924,32 -1,98% 3,23% 0,12% 0,12% CAC 40 NR 40 QS0011131826 PX1NR Paris Blue Chip 11519,19 11831,28 11831,28 1,61% 6,44% -2,64% -2,64% PSI 20 NR 18 QS0011211180 PSINR Lisbon Blue Chip 9964,13 10179,88 10179,88 -2,44% 1,78% -2,12% -2,12% Blue-Chip Indices (Gross Return) AEX GR 25 QS0011131990 AEXGR Amsterdam Blue Chip 2257,47 2213,17 2213,17 7,64% 11,72% 2,00% 2,00% BEL 20 GR 20 BE0389557050 BEL2I Brussels Blue Chip 10425,53 10410,61 10410,61 -1,16% 4,15% 0,14% 0,14% CAC 40 GR 40 QS0011131834 PX1GR Paris Blue Chip 15034,98 15436,40 15436,40 2,48% -

ENGIE Makes Further Progress on Execution of Strategic Plan with Sale of 11.5% of Grtgaz to Caisse Des Dépôts and CNP Assurances

Press release 30 July 2021 ENGIE makes further progress on execution of strategic plan with sale of 11.5% of GRTgaz to Caisse des Dépôts and CNP Assurances ENGIE makes further progress on the execution of its strategic plan towards rebalancing exposure from French gas networks towards renewables and other infrastructure assets. ENGIE, Caisse des Dépôts and CNP Assurances have signed a binding agreement for the sale of a 11.5% ENGIE stake in GRTgaz SA (“GRTgaz”) to Caisse des Dépôts and CNP Assurances. GRTgaz owns and operates the largest French gas transmission network and is currently owned c. 75% by ENGIE and c. 25% by Caisse des Dépôts and CNP Assurances (which also own 17.8% of Elengy1, with the remainder owned by GRTgaz). This agreement values the GRTgaz group's total equity at €9.75 billion for an enterprise value of €14.6 billion, implying a valuation to RAB2 of 148%, and highlights the role of gas networks in France as key enablers of the energy transition. Along with a strong focus on safe and affordable gas transport, GRTgaz is innovating and adapting its network and facilities to increase the use of renewable gases in the system and is supporting various activities linked to the development of renewable gases : methanisation, pyro-gasification, hydrothermal gasification and hydrogen. This partial reduction in ENGIE’s holding will be accompanied by a simplification of the GRTgaz group structure which will lead to GRTgaz owning 100% of Elengy, up from currently c. 82%. As a result upon completion, ENGIE and Caisse des Dépôts with CNP Assurances will hold c. -

EURONEXT INDICES - PERFORMANCE REPORT - July 2018

EURONEXT INDICES - PERFORMANCE REPORT - July 2018 Closing Levels Returns Index Name Nr. of Constit. ISIN Code Mnemo Location Index Type 31/07/2018 29/06/2018 29/12/2017 Ann. 3 Year Ann. 5 Year 2018 YtD Jul-18 Blue-Chip Indices (Price) AEX 25 NL0000000107 AEX Amsterdam Blue Chip 574.25 551.68 544.58 5.06% 9.20% 5.45% 4.09% BEL 20 20 BE0389555039 BEL20 Brussels Blue Chip 3899.04 3719.86 3977.88 1.19% 7.93% -1.98% 4.82% CAC 40 40 FR0003500008 PX1 Paris Blue Chip 5511.30 5323.53 5312.56 2.74% 6.66% 3.74% 3.53% PSI 20 18 PTING0200002 PSI20 Lisbon Blue Chip 5619.80 5528.50 5388.33 -0.56% -0.36% 4.30% 1.65% Blue-Chip Indices (Net Return) AEX NR 25 QS001121156 AEXNR Amsterdam Blue Chip 1664.06 1598.34 1549.11 8.34% 12.32% 7.42% 4.11% BEL 20 NR 20 BE0389558066 BEL2P Brussels Blue Chip 8132.42 7758.69 8146.80 3.91% - -0.18% 4.82% CAC 40 NR 40 QS0011131826 PX1NR Paris Blue Chip 11253.04 10868.22 10639.79 5.21% 9.18% 5.76% 3.54% PSI 20 NR 18 QS0011211180 PSINR Lisbon Blue Chip 10943.99 10766.20 10207.93 2.39% 2.18% 7.21% 1.65% Blue-Chip Indices (Gross Return) AEX GR 25 QS0011131990 AEXGR Amsterdam Blue Chip 1895.76 1820.83 1758.42 8.80% 12.76% 7.81% 4.12% BEL 20 GR 20 BE0389557050 BEL2I Brussels Blue Chip 10492.32 10010.14 10437.99 4.91% - 0.52% 4.82% CAC 40 GR 40 QS0011131834 PX1GR Paris Blue Chip 14429.61 13935.39 13533.27 6.27% 10.26% 6.62% 3.55% PSI 20 GR 18 PTING0210005 PSITR Lisbon Blue Chip 13083.37 12870.83 12092.81 3.38% 3.04% 8.19% 1.65% French Indices CAC 40 Governance 40 FR0013232188 CAGOV Paris Theme 1187.19 1150.91 1210.38 2.70% 6.87% -

ENGIE and BNP Paribas Factor Sign a Partnership to Provide Greater Assistance to Mid-Size Companies

Paris, December 2, 2015 Press release ENGIE and BNP Paribas Factor sign a partnership to provide greater assistance to mid-size companies ENGIE and BNP Paribas Factor are partnering to set up a pilot collaborative reverse factoring program on an international scale. In early 2015, energy sector leader ENGIE embarked upon a study to find the best business solution as support for its suppliers. The resulting study showed the interest of “reverse factoring” to achieve this end, especially for mid-size companies. After consulting with market players, the Group chose the reverse factoring service of BNP Paribas Factor to offer ENGIE suppliers short-term financing at a single, most attractive rate. Suppliers subscribing to the program will be able to send their invoices electronically to ENGIE and receive immediate payment without waiting for payment dates, thus benefiting from immediate liquidity to extend and develop their activity. The program’s first phase will cover up to 8,000 French suppliers and will be offered in early 2016 for durations of six to ten months. The program will also enable ENGIE to enhance its purchasing management and stabilize its supply chain. The objective is to extend the arrangement to all Group entities in France, in anticipation of its international development. “This reverse factoring program fits perfectly with ENGIE’s desire to be a responsible partner in the life of mid-size companies. We work on a daily basis with a large number of companies and are aware of our impact on these partners’ development. Today, we anticipate their needs by offering them an innovative cash-management solution,” explains Sergio Val, Senior Vice President, Corporate, in charge of the ENGIE Group’s M&A, Financing and Treasury Division. -

Registration Document Annual Financial Report

REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT 2015 CERTAIN PRELIMINARY INFORMATION ABOUT THIS ANNUAL REPORT 1 THE AXA GROUP 3 1.1 Selected consolidated fi nancial data 4 1 1.2 Information on the Company 6 1.3 Activity report 20 CONTENTS 1.4 Liquidity and capital resources 89 CORPORATE GOVERNANCE 95 2.1 Corporate offi cers, executives and employees 96 2.2 Full disclosure on executive compensation and share ownership 115 2 2.3 Major shareholders and related party transactions 145 2.4 The offer and listing 152 REGULATION, RISK FACTORS 153 Certain disclosures about market risks and related matters 3 3.1 Regulation 154 3.2 Risk factors 160 3.3 Quantitative and qualitative disclosures about risk factors 177 3.4 Investment community and organization 194 CONSOLIDATED FINANCIAL STATEMENTS 197 4.1 Consolidated statement of fi nancial position 198 4 4.2 Consolidated statement of income 200 4.3 Consolidated statement of comprehensive income 201 4.4 Consolidated statement of changes in equity 202 4.5 Consolidated statement of cash fl ows 206 4.6 Notes to the Consolidated Financial Statements 208 4.7 Report of the Statutory Auditors on the Consolidated Financial Statements 343 CERTAIN ADDITIONAL INFORMATION 345 5.1 Charter 346 5 5.2 Description of AXA’s share capital 350 APPENDICES 351 Appendix I Chairman of the Board of Directors’ report 352 A Appendix II Management’s annual evaluation of Internal Control Over Financial Reporting 362 Appendix III Statement of the person responsible for the Annual Report 365 Appendix IV Financial authorizations 366