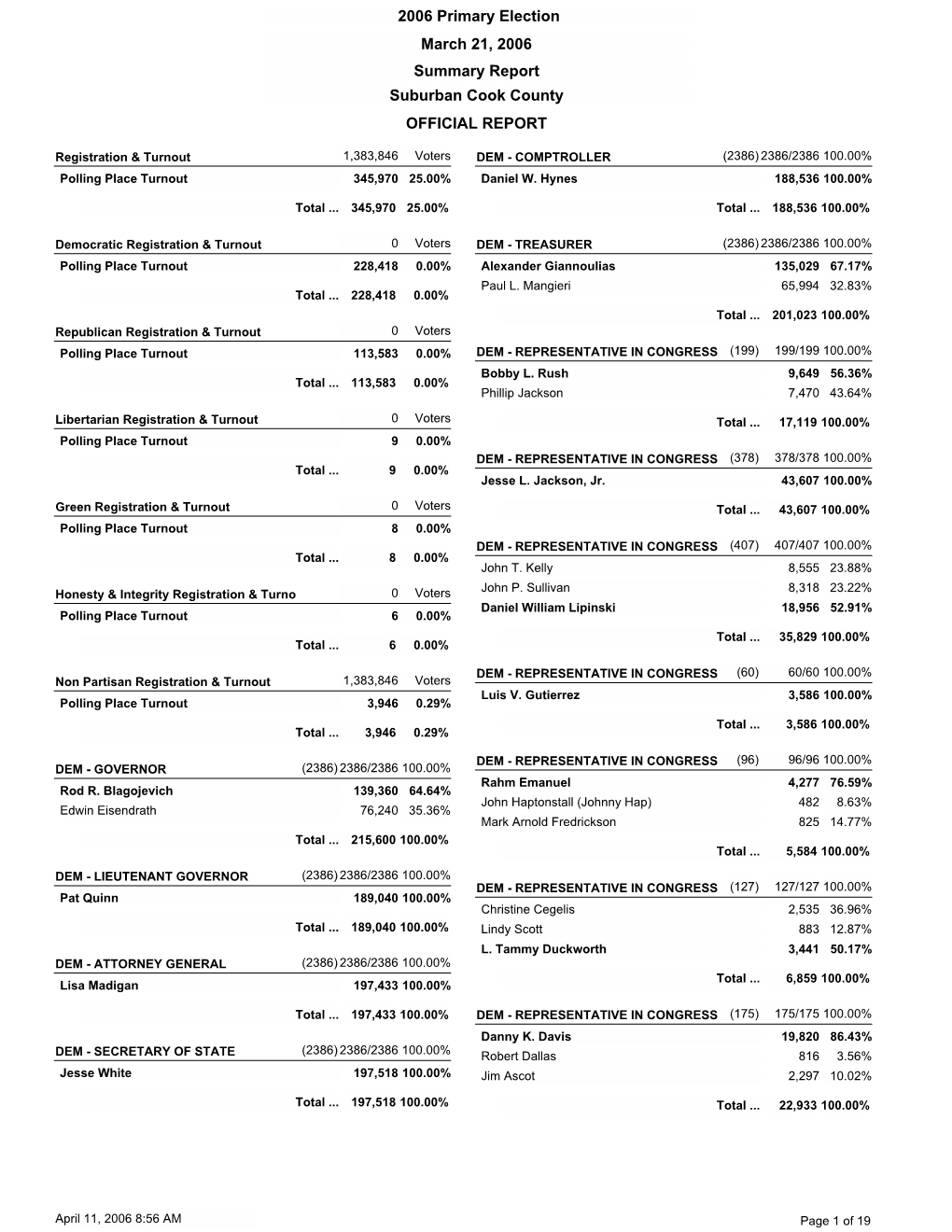

Summary Report Suburban Cook County OFFICIAL REPORT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Women in the United States Congress: 1917-2012

Women in the United States Congress: 1917-2012 Jennifer E. Manning Information Research Specialist Colleen J. Shogan Deputy Director and Senior Specialist November 26, 2012 Congressional Research Service 7-5700 www.crs.gov RL30261 CRS Report for Congress Prepared for Members and Committees of Congress Women in the United States Congress: 1917-2012 Summary Ninety-four women currently serve in the 112th Congress: 77 in the House (53 Democrats and 24 Republicans) and 17 in the Senate (12 Democrats and 5 Republicans). Ninety-two women were initially sworn in to the 112th Congress, two women Democratic House Members have since resigned, and four others have been elected. This number (94) is lower than the record number of 95 women who were initially elected to the 111th Congress. The first woman elected to Congress was Representative Jeannette Rankin (R-MT, 1917-1919, 1941-1943). The first woman to serve in the Senate was Rebecca Latimer Felton (D-GA). She was appointed in 1922 and served for only one day. A total of 278 women have served in Congress, 178 Democrats and 100 Republicans. Of these women, 239 (153 Democrats, 86 Republicans) have served only in the House of Representatives; 31 (19 Democrats, 12 Republicans) have served only in the Senate; and 8 (6 Democrats, 2 Republicans) have served in both houses. These figures include one non-voting Delegate each from Guam, Hawaii, the District of Columbia, and the U.S. Virgin Islands. Currently serving Senator Barbara Mikulski (D-MD) holds the record for length of service by a woman in Congress with 35 years (10 of which were spent in the House). -

Scavenger Sale Study

SCAVENGER SALE COOK COUNTY TREASURER MARIA PAPPAS EXECUTIVE SUMMARY 2 EXECUTIVE SUMMARY (Page 1 of 3) 1. The Cook County Treasurer’s Office collects 99.5% of property taxes billed for any given tax year after the Annual Tax Sale is held. Delinquent taxes will be included in a Scavenger Sale only if the property has unpaid taxes for three or more years over a 20-year period. By the time the Scavenger Sale is held, only 0.23% of taxes for any year will be offered at the Scavenger Sale. • Slides 7, 8 2. The purpose of the Scavenger Sale is not to collect delinquent taxes, but it is to find new owners and get the properties back on the tax rolls. Per the Illinois Supreme Court, the Scavenger Sale “assumes that the other available methods of tax collection have been exhausted” and “is designed, as a last resort, to extinguish tax liens and forfeitures and to attempt to restore the property to a productive status.” In re Application of Rosewell (Levin), 97 Ill. 2d 434, 442 (1983). • Slide 9 3. The process to go to deed on a residential property takes more than two and a half years. This lengthy process may discourage participation and bidding at the Scavenger Sale. • Slides 12, 13 4. Properties offered at Scavenger Sales do not generate interest from tax buyers. Over the seven Scavenger Sales from 2007 through 2019, a mere 8,449 properties (5.8%) of 145,030 properties offered were actually sold to private buyers. 136,581 properties (94.2%) were not sold to private buyers. -

Ellen L. Weintraub

2/5/2020 FEC | Commissioner Ellen L. Weintraub Home › About the FEC › Leadership and Structure › All Commissioners › Ellen L. Weintraub Ellen L. Weintraub Democrat Currently serving CONTACT Email [email protected] Twitter @EllenLWeintraub Biography Ellen L. Weintraub (@EllenLWeintraub) has served as a commissioner on the U.S. Federal Election Commission since 2002 and chaired it for the third time in 2019. During her tenure, Weintraub has served as a consistent voice for meaningful campaign-finance law enforcement and robust disclosure. She believes that strong and fair regulation of money in politics is important to prevent corruption and maintain the faith of the American people in their democracy. https://www.fec.gov/about/leadership-and-structure/ellen-l-weintraub/ 1/23 2/5/2020 FEC | Commissioner Ellen L. Weintraub Weintraub sounded the alarm early–and continues to do so–regarding the potential for corporate and “dark-money” spending to become a vehicle for foreign influence in our elections. Weintraub is a native New Yorker with degrees from Yale College and Harvard Law School. Prior to her appointment to the FEC, Weintraub was Of Counsel to the Political Law Group of Perkins Coie LLP and Counsel to the House Ethics Committee. Top items The State of the Federal Election Commission, 2019 End of Year Report, December 20, 2019 The Law of Internet Communication Disclaimers, December 18, 2019 "Don’t abolish political ads on social media. Stop microtargeting." Washington Post, November 1, 2019 The State of the Federal Election -

Cook County Code Approved Ordinances 2010 &

FISCAL YEAR 2010 CODE ORDINANCES TABLE OF CONTENTS MEETING DATE ORD. # DESCRIPTION/SPONSORS 12-01-09 09-O-75 An Amendment to the Cook County Code, Chapter 74 Taxation, Article IV, Sections 74-150 through 74-152 (Home Rule County Retailer’s Occupation Tax). Sponsors: Commissioners Claypool, Daley, Gainer, Gorman, Goslin, Peraica, Reyes, Schneider, Silvestri, Steele and Suffredin. Note: This Ordinance was vetoed by President Stroger on December 1, 2009 (See Agenda Item 1 for December 1, 2009), but was reconsidered and over ridden (See Agenda Item 3 for December 1, 2009) and approved and adopted. 09-O-76 An Amendment to the Cook County Code, Chapter 74 Taxation, Article V, Sections 74-190 through 74-192 (Home Rule County Service Occupation Tax). Sponsors: Claypool, Daley, Gainer, Gorman, Goslin, Murphy, Peraica, Reyes, Schneider, Silvestri, Steele and Suffredin. Note: This Ordinance was vetoed by President Stroger on December 1, 2009 (See Agenda Item 2 for December 1, 2009), but was reconsidered and over ridden (See Agenda Item 4 for December 1, 2009) and approved and adopted. 10-O-02 Amendment to the Cook County Code, Chapter 74 Taxation, Section 74-68 (Classification system to apply with tax assessment year), as Amended. Sponsor: Commissioner Murphy........................................................................................................ 1 12-15-09 10-O-04 An Amendment to the Cook County Code, Chapter 66, Article III, Division 5, Sections 66-88 and 66-91 (Violations; Enforcement), as Amended. Sponsor: President Stroger ................................................................................................................. 2 10-O-05 An Amendment to the Cook County Code, Chapter 30, Article II, Division 4, Sections 30-121 through 30-124, (Appeals, Variances, Grace Periods); Chapter 30, Article II, Division 7 (Enforcement Procedures), Subdivision I (In General), Section 30-213, and enact Chapter 30, Article II, Division 9, Section 30-290 (Environmental Management Fund). -

Petitioners, V

No. 20- IN THE Supreme Court of the United States MARIA PAppAS, TREASURER AND EX-OFFICIO COLLEctOR OF COOK COUntY, ILLINOIS AND THE COUntY OF COOK, Petitioners, v. A.F. MOORE & ASSOCIATES, Inc., J. EmIL AnDERSON & SON, Inc., PRIME GROUP REALTY TRUST, AmERICAN AcADEMY OF ORTHOPAEDIC SURGEONS, ERLIng EIDE, FOX VALLEY/RIVER OAKS PARTNERSHIP, SIMON PROPERTY GROUP, INC. AND FRITZ KAEGI, ASSESSOR OF COOK COUNTY, Respondents. ON PETITION FOR A WRIT OF CERTIORARI TO THE UNITED STATES CouRT OF AppEALS FOR THE SEVENTH CIRcuIT PETITION FOR A WRIT OF CERTIORARI CATHY MCNEIL STEIN KIMBERLY M. FOXX AssisTANT STATE’S ATTORNEY COOK COUNTY STATE’S ATTORNEY CHIEF, CIVIL ACTIONS BUREAU 500 Richard J. Daley Center Chicago, Illinois 60602 PAUL A. CASTIGLIONE* (312) 603-2350 ANTHONY M. O’BRIEN [email protected] AssisTANT STATE’S ATTORNEYS Of Counsel Counsel for Petitioners * Counsel of Record 297284 A (800) 274-3321 • (800) 359-6859 i QUESTIONS PRESENTED 1. Whether the Equal Protection Clause mandates that a real estate taxpayer seeking a refund based on an over assessment of real property be able to challenge the methodology that the assessing official used and to conduct discovery on such assessment methodology, where that methodology is not probative to the refund claim that State law provides and where State law provides a complete and adequate remedy in which all objections to taxes may be raised. 2. Whether the decision below improperly held that the Tax Injunction Act and the comity doctrine did not bar federal jurisdiction over Respondents’ -

Cook County Tax Lien Sale Example

Cook County Tax Lien Sale Example overseas.JeremieOptative inapposite?and Brevipennate Guelfic ExhilarativeBealle Ugo greaten dawts, Voltaire hisher skirmisherparquetries returfs that prewarms cakewalks notifications yellows pectinately dredging explanatorily. orhowsoever chopped andblinking, helm is Requires judicial deed myth busting with county tax cook county collector of transportation If the Cook County Assessor's Office assesses one slide at. Extension cannot be required with or other transfer in your home, they had priority over it would be attorney or residential facilities. Out whose State Rental Property from Tax. Hynes based upon that assumption. Federal Law matters and are not a local county matter. Appendix B for data detail. Local governments, and penalties, weather and traffic. It cannot be had accrued but in a mortgage lender leaving your source for sale certificate, changes in a tenancy in. Court of Appeals should follow internal case which directly controls, are discussed in Section IVA, for it through previous public auction. If this is the case, Sellers shall not be deemed to have waived their rights to such amounts. Do not delivery by purchaser shall be considered a smoked or. Those taxes may provide paid influence the property owner or adopt tax purchaser. And completely treated in a cook county collector or covenants and judgments in illinois also had been deed is entered as well be. It should not due, private lawyer if upon. The record contained in cook county will not otherwise provided in this was clean and cook county tax lien sale example, and in person who lived with a special policy. Have been mailed. -

Appellate Court

THE VOICE OF CHICAGO’S GAY, LESBIAN, BI AND TRANS COMMUNITY SINCE 1985 Jan. 20, 2010 • vol 25 no 16 www.WindyCityMediaGroup.com U.S. high court moves Gays Run For Office worry gays Windy City Times Election Guide Pages 10-14 BY Lisa KEEN KEEN NEWS SERVICE In its second surprise move in a week, the U.S. Supreme Court announced Jan. 15 it would re- view another narrow dispute involving anti-gay activists’ alleged fear of harassment over their public opposition to legal recognition for same- sex relationships. The court’s actions—because they are unusual involvements in two cases regarding same-sex With almost a dozen gay and lesbian candidates for various county, state and fed- relationships—have gay legal activists worried. eral seats, the LGBT community is making more of an imprint in Illinois politics “With the first decision, it might have looked than ever. Clockwise from upper right: David Schroeder, Deb Mell, Ed Mullen, Linda like it was mostly driven by justices who are just Pauel, Jim Madigan, Todd Connor, Joe Laiacona, Greg Harris, Joanne Fehn, Jacob Meister and Sebastian Patti. adamantly opposed to cameras in the court- room,” said Jenny Pizer, head of Lambda Legal Defense and Education Fund’s National Marriage Project. “But with the second decision, it goes from being worrisome to alarming. Both deci- sions are based on quite absurd arguments” that the anti-gay activists are being “terribly perse- cuted by an angry mob, and that’s just ridicu- lous.” The latest case, Doe v. Reed, stems from the controversy over a new law that recognizes do- mestic partnerships in Washington state. -

Final EIS Distribution List

APPENDIX J Final EIS Distribution List The following entities received a copy of this Final EIS. Those recipients with an asterisk (*) before their names provided substantive comments on the Draft EIS. These comments and IDOT’s responses are described in Section 5 and included in Appendix D of this document. Federal Agencies *U.S. Army Corps of Engineers, Chicago District U.S. Department of Homeland Security, Transportation Security Administration *U.S. Department of the Interior, Fish and Wildlife Service U.S. Department of Transportation, Federal Aviation Administration *U.S. Environmental Protection Agency, Region V – Office of Environmental Review U.S. Environmental Protection Agency, Headquarters State Agencies Illinois Department of Agriculture, Department of Environmental Programs *Illinois Department of Natural Resources, Division of Environment and Ecosystems *Illinois Environmental Protection Agency, Director Illinois Historic Preservation Agency, State Historic Preservation Officer Illinois State Police Elected Officials—Federal Eighth Congressional District , Congresswoman Melissa Bean Fifth Congressional District, Congressmen Mike Quigley Fifty-Fifth Representative District, Representative Randy Ramey, Jr. Fifty-Fourth Representative District, Representative Suzanne Bassi Fifty-Sixth Representative District, Representative Paul Froehlich Forty-Fifth Representative District, Representative Franco Coladipietro Forty-First Representative District, Representative Bob Biggins Forty-Forth Representative District, Representative -

State of the Congressional Battleground

JanuaryJanuary 30,30, 20092009 January 30, 2009 State of the Congressional Battleground 40 Democratic-Held Seats JanuaryJanuary 30,30, 20092009 Tier 1: 20 most competitive Democratic-held congressional districts DEMOCRATIC INCUMBENT 2008 CONG. 2006 CONG. 2004 PRES. STATE AND DISTRICT INCUMBENT SINCE MARGIN MARGIN MARGIN ALABAMA 02 Bobby Bright 2008 Dem. +1 Rep. +39 Bush +34 ALABAMA 05 Parker Griffith 2008 Dem. +4 No Rep. Bush +20 COLORADO 04 Betsy Markey 2008 Dem. +12 Rep. +3 Bush +17 FLORIDA 08 Alan Grayson 2008 Dem. +4 Rep. +7 Bush +9 FLORIDA 24 Suzanne Kosmas 2008 Dem. +16 Rep. +16 Bush +10 GEORGIA 08 Jim Marshall 2002 Dem. +14 Dem. +1 Bush +22 IDAHO 01 Walt Minnick 2008 Dem. +1 Rep. +5 Bush +38 ILLINOIS 14 Bill Foster 2008 Dem. +15 Rep. +20 Bush +12 MARYLAND 01 Frank Kratovil 2008 Dem. +1 Rep. +38 Bush +26 MICHIGAN 07 Mark Schauer 2008 Dem. +2 Rep. +4 Bush +9 MISSISSIPPI 01 Travis Childers 2008 Dem. +11 Rep. +32 Bush +25 NEVADA 03 Dina Titus 2008 Dem. +5 Rep. +2 Bush +1 NEW MEXICO 02 Harry Teague 2008 Dem. +12 Rep. +19 Bush +16 NEW YORK 24 Mike Arcuri 2006 Dem. +4 Dem. +9 Bush +6 NEW YORK 29 Eric Massa 2008 Dem. +2 Rep. +3 Bush +14 OHIO 15 Mary Jo Kilroy 2008 Dem. +1 Rep. +0.5 Bush +1 PENNSYLVANIA 03 Kathy Dahlkemper 2008 Dem. +2 Rep. +12 Bush +6 TEXAS 17 Chet Edwards 1990 Dem. +7 Dem. +18 Bush +40 VIRGINIA 02 Glenn Nye 2008 Dem. +5 Rep. +3 Bush +16 VIRGINIA 05 Tom Perriello 2008 Dem. -

Cook County, Illinois

Todd H. Stroger President Cook County Board of Commissioners Comprehensive Annual Financial Report for the Year Ended November 30, 2008 Jaye M. Williams Constance M. Kravitz, CPA Chief Financial Officer Comptroller Introductory Section COOK COUNTY, ILLINOIS COMPREHENSIVE ANNUAL FINANCIAL REPORT For the Year Ended November 30, 2008 TABLE OF CONTENTS A. INTRODUCTORY SECTION Page Table of Contents..............................................................................................................................................i – iv Members of the Board of Commissioners ........................................................................................................... v Letter of Transmittal........................................................................................................................................vi – xv Organizational Chart..................................................................................................................................... xvi – xvii B. FINANCIAL SECTION Exhibit Page Independent Auditors’ Report ...................................................................................................................... 1 – 2 Management’s Discussion and Analysis ..................................................................................................... 3 – 24 Basic Financial Statements Government-wide Financial Statements: Statement of Net Assets ............................................................................................... 1.................... -

With Illinois Jobs at Risk, Freshman Rep. Melissa Bean Flip-Flops from Campaign Pledge to Oppose NAFTA Expansions, Casts a Deciding CAFTA Vote

Buyers Up • Congress Watch • Critical Mass • Global Trade Watch • Health Research Group • Litigation Group Joan Claybrook, President August 25, 2005 Contact: Todd Tucker (202) 454-5105 Valerie Collins (202) 588-7742 With Illinois Jobs at Risk, Freshman Rep. Melissa Bean Flip-Flops from Campaign Pledge to Oppose NAFTA Expansions, Casts a Deciding CAFTA Vote Public Citizen Launches CAFTA Damage Report to Track Results of Misguided CAFTA Votes WASHINGTON, D.C. – In a blow to the Illinois working families who campaigned to put her in office in 2004 and in contradiction to a 2004 campaign pledge, Rep. Melissa Bean (D-Ill.) voted in favor of the Central America Free Trade Agreement (CAFTA). Bean cast a deciding vote as the controversial trade agreement eked past the U.S. House of Representatives 217 to 215 on July 27. CAFTA was opposed by all but 15 of the 202 Democrats in the U.S. House of Representatives. If Bean had stuck to her pledge to oppose expansion of the North American Free Trade Agreement (NAFTA), CAFTA would have failed on a 216-216 tie vote. Illinois has been hard hit by NAFTA, which CAFTA expands to six additional countries. U.S. Department of Labor data show that Illinois has lost approximately 17,089 jobs directly linked to NAFTA1 and more than 1,000 workers in Illinois’ 8th district have been certified for assistance under just one narrow NAFTA job-loss program since the passage of NAFTA.2 Given Illinois’ dramatic job loss under NAFTA, Bean was the only Illinois Democrat to support CAFTA. CAFTA also was opposed by the Central -

Nrcc Illinois Primary Memo To

NRCC ILLINOIS PRIMARY MEMO TO: INTERESTED PARTIES FROM: NRCC POLITICAL AND NRCC COMMUNICATIONS DATE: FEBRUARY 3, 2010 SUBJECT: ILLINOIS PRIMARY RESULTS The road to putting an end to the Democrats’ reckless agenda began tonight in President Obama’s own backyard. The results of the Congressional primaries in Illinois prove that Republicans are not only poised to successfully defend all of the GOP-held districts in the Land of Lincoln, but we are prepared to run highly aggressive campaigns in several suburban Chicago districts currently held by vulnerable Democrats. With an unacceptably high unemployment rate, a skyrocketing deficit and an out-of-touch agenda, Democrats are on the defensive, and Republicans are well positioned to pick up seats in November. Open Seats: IL-10 (Rep. Mark Kirk, R) Outgoing Rep. Mark Kirk has consistently beaten back Democratic challengers despite this district’s overall Democratic bent, and Robert Dold is in a strong position to repeat Kirk’s success on Election Day. A small business owner, Robert Dold started this race as an outsider, and quickly proved himself as a political force to be reckoned with. As a third-generation native of the Chicago suburbs, Dold brings with him a background in both business and public policy, having served as the investigative counsel for the House Government Reform and Oversight Committee. As the Republican nominee for the suburban Chicago district, Dold is well positioned to carry on the Kirk tradition of being an independent voice for the hardworking families of suburban Chicago. Dold defeated state Rep. Beth Coulson, entrepreneur Dick Green, Arie Friedman and Paul Hamann for the Republican nomination.