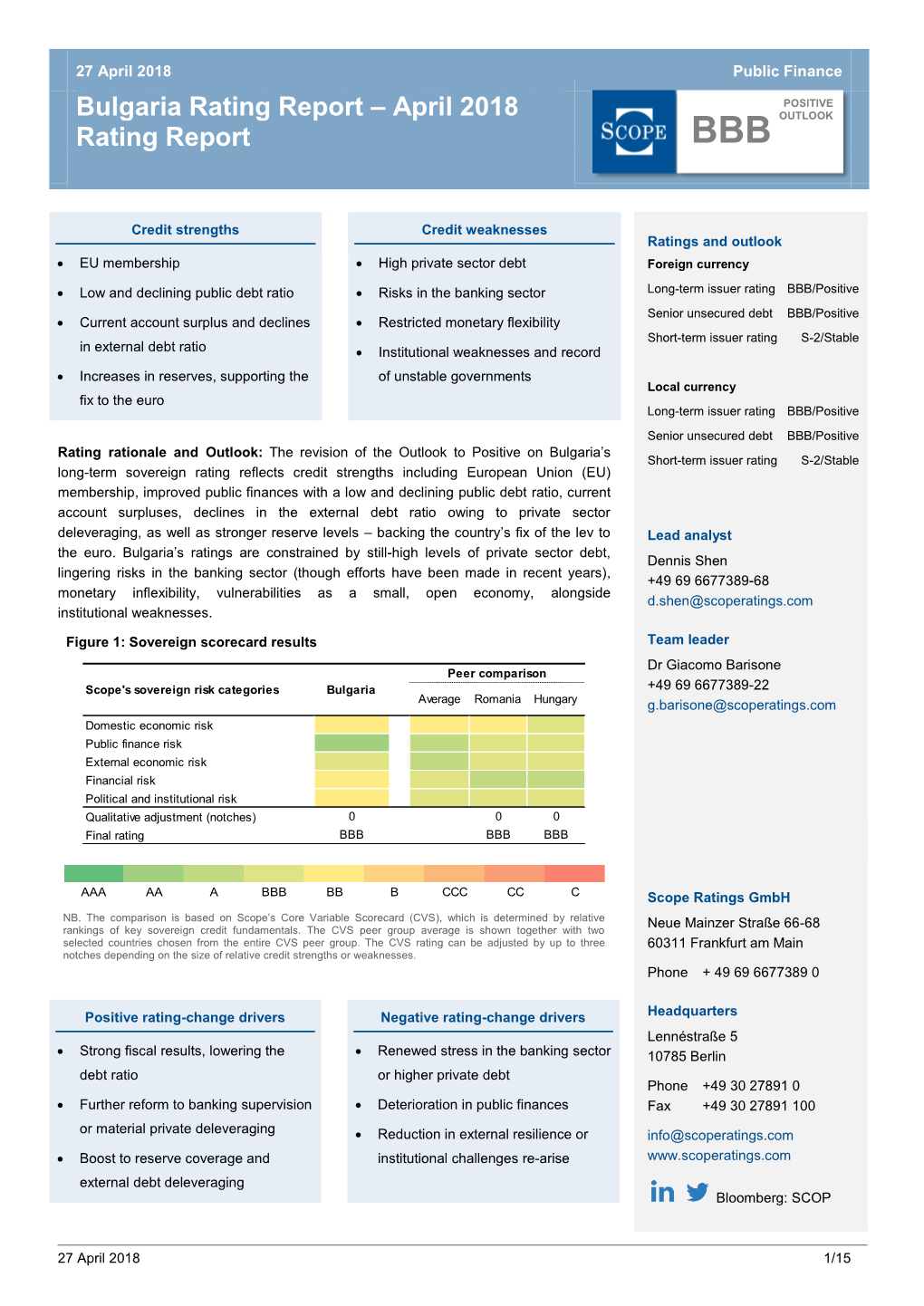

Bulgaria Rating Report – April 2018 POSITIVE Bulgariarating Rating Report Report – April 2018 OUTLOOK Rating Report BBB

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Title the Currency Board and Bulgaria's Accession to The

The Currency Board and Bulgaria's Accession to the European Title Monetary Union Author(s) IALNAZOV, Dimiter; NENOVSKY, Nikolay The Kyoto University Economic Review (2002), 70(1-2): 31- Citation 48 Issue Date 2002-03 URL https://doi.org/10.11179/ker1926.70.31 Right Type Departmental Bulletin Paper Textversion publisher Kyoto University The Currency Board and Bulgaria's Accession to the European Monetary Union by Dimiter IALNAZOV 本 a n d Nikolay NENOVSKY* * Introduction At its Helsinki summit of IO ・11 December 1999, the European Council decided to exュ tend invitation for accession negotiations to six European nations'), thereby increasing the numュ ber of countries likely to join the European Union (EU) in the first decade of the XXI century 2 to twelve ). The prospects of EU membership have raised the question of how new members will move on towards adopting the euro by full membership in the European Monetary Union (EMU). In particular, the discussion has focused on the optimal exchange rate regime in preparュ ing for EMU accession. Some preliminary results suggest that Central and East European counュ tries (CEECs) preparing to join the euro zone are faced with a trade-off between low inflation and exchange rate stability. These countries may choose either the former by adopting inflation targeting combined with a flexible exchange rate system, or the latter by pegging their national currencies to the euro (Frensch, pp. 175 ・179). Presently three of the accession countries - Bulgaria, Estonia, and Lithuania 一have curュ 3 rency board a 汀angements (CBAs) pegging their national currencies to the euro ). -

Focus on European Economic Integration 2/08

OESTERREICHISCHE NATIONALBANK EUROSYSTEM FOCUS ON EUROPEAN ECONOMIC INTEGRATION 2/08 FOCUS ON EUROPEAN ECONOMIC INTEGRATIONFOCUS ON EUROPEAN Stability and Security. 2/08 Contents Editorial 5 Recent Economic Developments Developments in Selected Countries 8 Compiled by Antje Hildebrandt and Josef Schreiner Studies Real Estate, Construction and Growth in Central and Eastern Europe: Impact on Competitiveness? 52 Balázs Égert, Reiner Martin Housing Loan Developments in the Central and Eastern European EU Member States 73 Zoltan Walko The OeNB Euro Survey in Central, Eastern and Southeastern Europe – The 2008 Spring Wave Update 83 Sandra Dvorsky, Thomas Scheiber, Helmut Stix Financial Sector Development in Serbia: Closing Ranks with Peers 94 Stephan Barisitz, Sándor Gardó Highlights The 62nd East Jour Fixe of the Oesterreichische Nationalbank Soaring Prices in Emerging Europe: Temporary Phenomenon or Lasting Challenge? 122 Compiled by Markus Eller with input from Claudia Zauchinger Selected Abstracts 143 2 FOCUS ON EUROPEAN ECONOMIC INTEGRATION 2/08 Contents Statistical Annex Maria Dienst, Angelika Knollmayer and Andreas Nader Gross Domestic Product 146 Industrial Production 146 Average Gross Wages 146 Unemployment Rate 147 Industrial Producer Price Index 147 Consumer Price Index 147 Trade Balance 148 Current Account Balance 148 Net Foreign Direct Investment 148 Reserve Assets Excluding Gold 148 Gross External Debt 149 General Government Balance 149 Gross General Government Debt 149 Broad Money 150 Official Key Interest Rate 150 Exchange Rate 150 Notes Legend, Abbreviations and Definitions 152 List of Studies and Special Reports Published in Focus on European Economic Integration 155 Periodical Publications of the Oesterreichische Nationalbank 156 Addresses of the Oesterreichische Nationalbank 159 The views expressed are those of the authors and need not necessarily coincide with the views of the Oesterreichische Nationalbank. -

CONVERGENCE REPORT May 2010 CONVERGENCEREPORT Ma Y 2010Y CONVERGENCE REPORT MAY 2010

EN EUROPEAN CENTRAL BANK CONVERGENCE REPORT MAY 2010 CONVERGENCE REPORT CONVERGENCE M A Y 2010 CONVERGENCE REPORT MAY 2010 In 2010 all ECB publications feature a motif taken from the €500 banknote. © European Central Bank, 2010 Address Kaiserstrasse 29 60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Website http://www.ecb.europa.eu Fax +49 69 1344 6000 All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. The cut-off date for the statistics included in this issue was 23 April 2010. ISSN 1725-9312 (print) ISSN 1725-9525 (online) CONTENTS CONTENTS 1 INTRODUCTION 5 6 EXAMINATION OF COMPATIBILITY OF NATIONAL LEGISLATION WITH 2 FRAMEWORK FOR ANALYSIS 7 THE TREATIES 235 2.1 Economic convergence 7 6.1 Bulgaria 235 2.2 Compatibility of national 6.2 Czech Republic 238 legislation with the Treaties 15 6.3 Estonia 242 6.4 Latvia 243 3 THE STATE OF ECONOMIC 6.5 Lithuania 246 CONVERGENCE 31 6.6 Hungary 248 6.7 Poland 252 4 COUNTRY SUMMARIES 39 6.8 Romania 256 4.1 Bulgaria 39 6.9 Sweden 261 4.2 Czech Republic 40 4.3 Estonia 42 GLOSSARY 265 4.4 Latvia 44 4.5 Lithuania 46 4.6 Hungary 47 4.7 Poland 49 4.8 Romania 50 4.9 Sweden 52 5 EXAMINATION OF ECONOMIC CONVERGENCE 55 5.1 Bulgaria 55 5.2 Czech Republic 73 5.3 Estonia 89 5.4 Latvia 111 5.5 Lithuania 131 5.6 Hungary 149 5.7 Poland 167 5.8 Romania 185 5.9 Sweden 203 ANNEX STATISTICAL METHODOLOGY OF CONVERGENCE INDICATORS 219 ECB Convergence Report May 2010 3 ABBREVIATIONS COUNTRIES BE Belgium LU Luxembourg BG Bulgaria HU Hungary CZ Czech Republic MT Malta DK Denmark NL Netherlands DE Germany AT Austria EE Estonia PL Poland IE Ireland PT Portugal GR Greece RO Romania ES Spain SI Slovenia FR France SK Slovakia IT Italy FI Finland CY Cyprus SE Sweden LV Latvia UK United Kingdom LT Lithuania OTHERS BIS Bank for International Settlements b.o.p. -

Of the Bulgarian National Bank ______3 I

Strategy for Bulgarian National Bank Development between 2004 and 2009 Strategy for Bulgarian National Bank Development between 2004 and 2009 Sofia, September 2004 1 Strategy for Bulgarian National Bank Development between 2004 and 2009 B U L G A R I A N N A T I O N A L B A N K M A N A G E M E N T 2 Strategy for Bulgarian National Bank Development between 2004 and 2009 G O V E R N I N G C O U N C I L O F T H E B U L G A R I A N N A T I O N A L B A N K Ivan Iskrov Governor Tsvetan Manchev Deputy Governor Emilia Milanova Deputy Governor Bojidar Kabaktchiev Deputy Governor Nikolay Nenovsky Garabed Minassian Statty Stattev 3 Abbreviations BIS Bank for International Settlements, Basel, Switzerland BISERA Banking Integrated System for Electronic Transfers BNB Bulgarian National Bank BORICA Banking Organization for Payments Initiated by Cards CPSS Committee on Payment and Settlement Systems ЕC European Commission ЕCB European Central Bank ЕSCB European System of Central Banks ЕU European Union EMU Economic and Monetary Union EMV standard Europay−MasterCard−Visa standard ERM II Exchange Rate Mechanism II IMF International Monetary Fund IOSCO International Organization for Governmental Securities Commissions IT information technologies NCBs national central banks RINGS Real Time Gross Settlement System SDDS Special Data Dissemination Standard TARGET Trans-European Automated Real-time Gross Settlement Express Transfer Strategy for Bulgarian National Bank Development between 2004 and 2009 © Bulgarian National Bank, 2004 The contents may be quoted or reproduced without further permission. -

Competitiveness and Ease of Doing Business in Bulgaria and EU Maria

Competitiveness and Ease of Doing Business in Bulgaria and EU Maria Papanikolaou March 2014 International Hellenic University ABSTRACT The present dissertation titled as “The economic performance and development of Bulgaria in terms of competitiveness (GCI) and easy of doing business (EDB) in comparison with European Union and the countries of Black Sea region” was worked out in the frames of the curriculum of postgraduate studies as a part of the “MA program in Black Sea Cultural Studies”, in the School of Humanities, of the International Hellenic University during the academic year 2010-2011. The Master's dissertation aims to apply a certain methodology and approach in the analysis of the economic development of Bulgaria and to demonstrate reasonably original research. More analytically, the master thesis conducts a thorough comparative method, through a series of annual reports, by using two specific financial indexes; the Global Competitiveness Index (GCI) of the World Economic Forum for the period 2004-2011, and the Easy of Doing Business Index of the World Bank for the period 2006-2011, in order to evaluate economic performance of Bulgaria –as it is strongly affected by various special circumstances such as the worldwide Financial Crisis 2007 till now– in comparison with the performance of the European Union (EU27) and the group of Black Sea countries (BS10), in specific areas of economic interest. In the end, total evaluation and assessment of undertaking takes place, with consecutive report of helpful conclusions. It must be noted, that the hall comparative analysis of the economic performance and development of Bulgaria in terms of competitiveness (GCI) and easy of doing business (EDB) in comparison with European Union and the countries of Black Sea region necessitated the construction of a series of tables and charts where the best and the worst values are remarked. -

N a T O's G L O B a L M I S S I O N I N T H E

THE MANFRED WÖRNER FELLOWSHIP OF NATO 1998-1999 THE ATLANTIC CLUB OF BULGARIA NN AA TT OO’’ss GG LL OO BB AA LL MM II SS SS II OO NN II NN TT HH EE 2211SSTT CC EE NN TT UU RR YY STRATEGIC STUDY Supported by: THE GERMAN MARSHALL FUND OF THE UNITED STATES Project Director and Author of the Text: Dr. Stefan Popov Working Group: Dr. Lyubomir Ivanov Dr. Solomon Passy Marianna Panova, MIA Marin Mihaylov Sofia May 2000 THE ATLANTIC CLUB OF BULGARIA 1998-1999 MANFRED WŐRNER FELLOWSHIP N A T O ’ s G L O B A L M I S S I O N I N T H E 2 1 S T C E N T U R Y Table of Contents ABSTRACT 1 PREFACE 3 ACKNOWLEDGMENTS 4 INTRODUCTION 5 THE ENLARGEMENT DEBATE IN THE 1990s 8 Historical Context: Setting the Stage 8 Critical Position Toward the Debate 11 Europe: Divided or United? 14 Extended Deterrence vs. Diminished Credibility 16 Military Doctrine vs. Military Spending 18 Expanded NATO, Expanded Security Risks? 19 Russia: Friend or Foe? 21 American “Manifest Destiny” 22 Summary Reflection on the Enlargement Debate 24 CONCEPTUAL DIMENSIONS: DEFENSE VS. SECURITY 27 Ideal Types Approach in International Affairs 27 A Concise Definition of the 1989 Epochal Change 30 Subject-Origin of Threat 33 Risky Factors and Situations 40 NATO’s Fundamental Identity Dilemma 44 Remark on a Negative Perception of Enlargement 46 Summary Reflection on Conceptualizing Security 48 HISTORICAL DIMENSIONS: THE YUGOSLAV WARS 52 The Early Yugoslav Crisis: A New Institutional Chaos 52 (a) Confusion Regarding Fundamentals 53 (b) European Institutions: Taken by Surprise 55 (c) UN and the Others 58 (d) Diagnosis: Institutional Paralysis 60 Kosovo: A New Kind of War 62 ____________________________________________________________________________________________________________ NATO’s GLOBAL MISSION IN THE 21ST CENTURY THE ATLANTIC CLUB OF BULGARIA 1998-1999 MANFRED WŐRNER FELLOWSHIP (a) A New Concept of Security Implied 63 (b) Human rights vs. -

Challenges, Actors and Practices of Non-Formal and Informal Learning

European Trade Union Institute Bd du Roi Albert II, 5 1210 Brussels Belgium Tel.: +32 (0)2 224 04 70 Fax: +32 (0)2 224 05 02 [email protected] www.etui.org Challenges, actors and practices of non-formal and informal learning and its validation in Europe Challenges, actors and Renaud Damesin, Jacky Fayolle, Nicolas Fleury, practices of non-formal Mathieu Malaquin and Nicolas Rode and informal learning and This book presents, in a European perspective, a comprehensive survey of practices and issues arising in the area of validation of non-formal and informal learning (NFIL). The survey is based on updated results of a project conducted in 2011 and 2012 its validation in Europe for the European Trade Union Confederation (ETUC) by a team from Groupe ALPHA with funding from the European Commission’s Employment DG. In a context where — the dynamic management of vocational pathways and transitions has been attracting Renaud Damesin, Jacky Fayolle, Nicolas Fleury, increasing attention, NFIL recognition can benefit a wide range of social groups, in particular the most vulnerable. Mathieu Malaquin and Nicolas Rode Challenges, actors and practices of non-formal of non-formal and practices actors Challenges, in Europe validation and its learning and informal and N. Rode M. Malaquin N. Fleury, Fayolle, R. Damesin, J. After a survey of the main NFIL issues and diverse national experiences as regards validation, the book describes these issues in the context of European challenges and policies on education and training, drawing attention to common problems encountered in implementing NFIL validation frameworks and processes, as well as to specific instances of successful implementation programmes. -

3. Economic Activity

2/2008 EconomicEconomic ReviewReview 2/2008 BULGARIAN NATIONAL BANK Bulgarian monetary policy regime seeks national currency stability with a view to price stability. The BNB quar- terly Economic Review presents information and analysis of balance of payments dynamics, monetary and credit aggregates, their link with the development of the real economy, and their bearing on price stability. External envi- ronment is also analyzed since the Bulgarian economy is influenced by international economic fluctuations. This publication contains quantitative assessments of the development in major macroeconomic indicators in the short run: inflation, economic growth, monetary and credit aggregate dynamics and interest rates. The Economic Review, issue 2/2008 was presented to the BNB Governing Council at its 3 July 2008 meeting. It employs statistical data published up to 27 June 2008. The estimates and projections published in this issue should not be regarded as advice or recommendation. Ex- clusively the information user is liable for any consequences thereof. The Economic Review is available at the BNB website, Periodical Publications sub-menu. Please address notes, comments and suggestions to the BNB Economic Research and Projections Directorate at 1000 Sofia, 1, Knyaz Alexander I Square, or to [email protected]. ISSN 1312 – 420X © Bulgarian National Bank, 2008 This issue includes materials and data received up to 9 July 2008. The contents of the BNB Economic Review may be quoted or reproduced without further permission. Due acknowledgment is requested. Elements of the 1999 issue banknote with a nominal value of 20 levs are used in cover design. Bulgarian National Bank 2 Contents Summary .......................................................................................................................................................... 5 1. -

Bulgarian National Bank

BulgarianBulgarian NationalNational BankBank ANNUALANNUAL REPORTREPORT •• 20092009 Published by the Bulgarian National Bank 1, Knyaz Alexander I Square, 1000 Sofia Tel.: (+359 2) 9145 1351, 9145 1209, 9145 1231, 9145 1978 Fax: (+359 2) 980 2425, 980 6493 Printed in the BNB Printing Centre © Bulgarian National Bank, 2010 ISSN 1313-1494 Materials and information in the BNB 2009 Annual Report may be quoted or reproduced without further permission. Due acknowledgment is requested. Website: www.bnb.bg The cover shows an engraving of the BNB building from the 1938 banknote with a nominal value of 5000 levs. Honourable Chairman of the National Assembly, Honourable People’s Representatives, Under the provisions of Article 1, paragraph 2 and Article 51 of the Law on the Bulgarian National Bank, I have the honour of presenting the Bank’s 2009 Annual Report. Ivan Iskrov Governor of the Bulgarian National Bank BNB Governing Council BNB Governing Sitting from left to right: Kalin Hristov, Ivan Iskrov, Rumen Simeonov, Dimitar Kostov Standing from left to right: Oleg Nedyalkov, Penka Kratunova, Statty Stattev Governing Council Ivan Iskrov Governor Dimitar Kostov Deputy Governor Banking Department Rumen Simeonov Deputy Governor Banking Supervision Department Kalin Hristov* Deputy Governor Issue Department Penka Kratunova Statty Stattev Oleg Nedyalkov * As of 23 October 2009 Kalin Hristov is a Deputy Governor heading the Issue Department. Until 22 October 2009 Tsvetan Manchev was a Deputy Governor heading the Issue Department. Organisational Structure -

Convergence Report June 2014

CONVERGENCE REPORT XXX XXXXXX 2014 JUNE 2014 EN CONVERGENCE REPORT JUNE 2014 In 2014 all ECB publications feature a motif taken from the €20 banknote. © European Central Bank, 2014 Address Kaiserstrasse 29 60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Website http://www.ecb.europa.eu Fax +49 69 1344 6000 All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. The cut-off date for the statistics included in this issue was 15 May 2014. ISSN 1725-9525 (online) ISSN 1725-9525 (epub) ISBN 978-92-899-1324-9 (online) ISBN 978-92-899-1346-1 (epub) EU catalogue number QB-AD-14-001-EN-N (online) EU catalogue number QB-AD-14-001-EN-E (epub) CONTENTS CONTENTS 1 INTRODUCTION 5 2 FRAMEWORK FOR ANALYSIS 7 2.1 Economic convergence 7 2.2 Compatibility of national legislation with the Treaties 18 3 THE STATE OF ECONOMIC CONVERGENCE 37 4 COUNTRY SUMMARIES 51 4.1 Bulgaria 51 4.2 Czech Republic 53 4.3 Croatia 55 4.4 Lithuania 57 4.5 Hungary 59 4.6 Poland 61 4.7 Romania 63 4.8 Sweden 65 5 EXAMINATION OF ECONOMIC CONVERGENCE 67 5.1 Bulgaria 67 5.2 Czech Republic 85 5.3 Croatia 103 5.4 Lithuania 121 5.5 Hungary 141 5.6 Poland 161 5.7 Romania 179 5.8 Sweden 197 5.9 Statistical methodology of convergence indicators 213 6 EXAMINATION OF COMPATIBILITY OF NATIONAL LEGISLATION WITH THE TREATIES 231 6.1 Bulgaria 231 6.2 Czech Republic 235 6.3 Croatia 239 6.4 Lithuania 240 6.5 Hungary 245 6.6 Poland 250 6.7 Romania 254 -

Downloading the Document As the Collections of Federal Reserve Chairmen, a Pdf

bulletin newsletter from the eabh 01 2015 eabh (The European Association for Banking and Financial History e.V.) Contents Edtiorial 2 New research 3 Apostolides / Tanatar Baruh 3 Bonin 13 Depner 22 Batiz-Lazo 26 On the future of economic history 30 Tortella 30 Bonin 33 New members 41 Archives' news 43 Workshop reports 62 New books 77 eabh noticeboard 81 In memoriam 89 Front page illustration: Richard McBurney, Grand Creative, www.grand-creative.com ISSN 2219-0643 Key title: Bulletin (European Association Banking and Financial History) Editors: Damir Jelic, Carmen Hofmann Assistant Editor: Gabriella Massaglia Language Editor: Jonathan Ercanbrack eabh (The European Association for Banking and Financial History e.V.) Geleitsstrasse 14 D-60599 Frankfurt am Main Mail: [email protected] Tel: +49 69 97 20 33 09 www.bankinghistory.org 1 On behalf of the board of management of eabh I would like to thank Damir Jelic for his commit- ment, continued support over the years and his Editorial personal contribution that made the bulletin a success. Dear members; though the editors changed and the cover is all new; rest assured that our intention did not change: the promotion of archi- val work lies at the heart of the Association and Dear colleagues and friends, its bulletin. Accurate and accessible records of past activities are the indispensable foundation The first edition of the eabh bulletin was pub- for a global financial system. eabh's main ob- lished in May 1999 in connection with the eabh jective is to strengthen the position of archives annual conference in Amsterdam. It contained within their institutions and to the ouside. -

Future Euro Area Membership of Bulgaria in Terms of the Business Cycle

FUTURE EURO AREA MEMBERSHIP OF BULGARIA IN TERMS OF THE BUSINESS CYCLE Head Assist. Prof. Ivan K. Todorov1, PhD Aleksandar D. Aleksandrov2, PhD Student Kalina L. Durova3, PhD Student Faculty of Economics, South-West University ‘N. Rilski’ – Blagoevgrad, Department of Finance and Accounting Abstract: In the present paper, vector autoregression (VAR) is used to assess the extent to which Bulgaria’s economic cycle is synchronized with the one of the euro area (EA). The main fiscal and monetary factors affecting the coordination of the business cycles of Bulgaria and the EA are identified. Recommendations for macroeconomic policies are formulated to support the synchronization of Bulgaria’s economic cycle with the one of the EA and to prepare our country for the adoption of the euro. Keywords: Bulgaria, membership, euro area, business cycles, synch- ronization. JEL: E32, E42, E50. * * * Introduction hirteen new Member States (NMS) joined the European Union (EU) during the last three enlargements in 2004, 2007, and 2013 – Poland, T the Czech Republic, Hungary, Slovakia, Slovenia, Lithuania, Latvia, Estonia, Malta, Cyprus, Bulgaria, Romania, and Croatia. Seven of the coun- tries were already members of the euro area (EA) – Slovenia, Malta, Cyprus, Slovakia, Estonia, Latvia, and Lithuania. The other six countries – Poland, the Czech Republic, Hungary, Romania, Bulgaria, and Croatia, in compliance 1 E-mail: [email protected] 2 E-mail: [email protected] 3 E-mail: [email protected] Economic Archive 4/2018 3 with the EU accession agreements signed by them, had to accept the single European currency after meeting certain requirements (the Maastricht conve- rgence criteria).