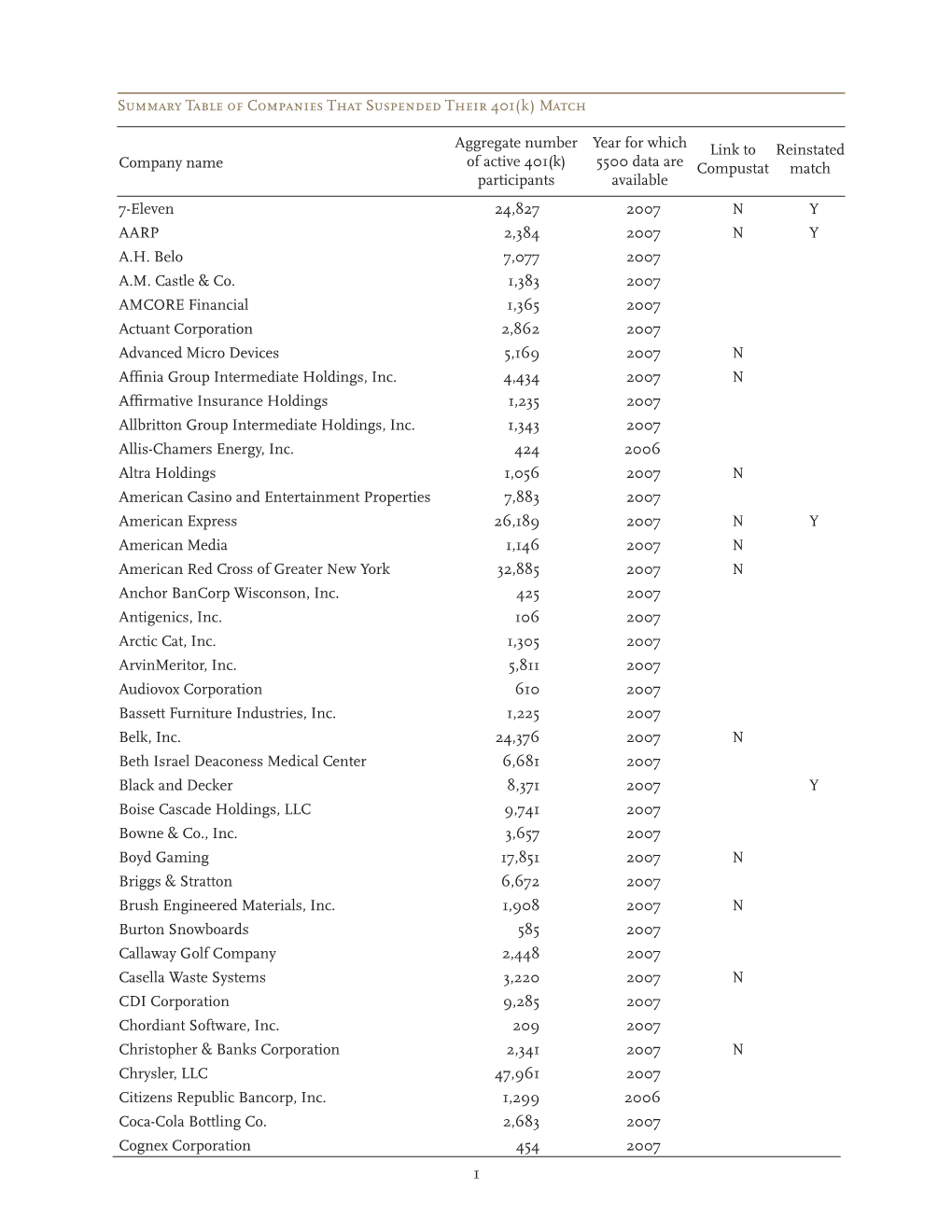

Summary Table of Companies That Suspended Their 401(K) Match

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Marginable OTC Stocks

List of Marginable OTC Stocks @ENTERTAINMENT, INC. ABACAN RESOURCE CORPORATION ACE CASH EXPRESS, INC. $.01 par common No par common $.01 par common 1ST BANCORP (Indiana) ABACUS DIRECT CORPORATION ACE*COMM CORPORATION $1.00 par common $.001 par common $.01 par common 1ST BERGEN BANCORP ABAXIS, INC. ACETO CORPORATION No par common No par common $.01 par common 1ST SOURCE CORPORATION ABC BANCORP (Georgia) ACMAT CORPORATION $1.00 par common $1.00 par common Class A, no par common Fixed rate cumulative trust preferred securities of 1st Source Capital ABC DISPENSING TECHNOLOGIES, INC. ACORN PRODUCTS, INC. Floating rate cumulative trust preferred $.01 par common $.001 par common securities of 1st Source ABC RAIL PRODUCTS CORPORATION ACRES GAMING INCORPORATED 3-D GEOPHYSICAL, INC. $.01 par common $.01 par common $.01 par common ABER RESOURCES LTD. ACRODYNE COMMUNICATIONS, INC. 3-D SYSTEMS CORPORATION No par common $.01 par common $.001 par common ABIGAIL ADAMS NATIONAL BANCORP, INC. †ACSYS, INC. 3COM CORPORATION $.01 par common No par common No par common ABINGTON BANCORP, INC. (Massachusetts) ACT MANUFACTURING, INC. 3D LABS INC. LIMITED $.10 par common $.01 par common $.01 par common ABIOMED, INC. ACT NETWORKS, INC. 3DFX INTERACTIVE, INC. $.01 par common $.01 par common No par common ABLE TELCOM HOLDING CORPORATION ACT TELECONFERENCING, INC. 3DO COMPANY, THE $.001 par common No par common $.01 par common ABR INFORMATION SERVICES INC. ACTEL CORPORATION 3DX TECHNOLOGIES, INC. $.01 par common $.001 par common $.01 par common ABRAMS INDUSTRIES, INC. ACTION PERFORMANCE COMPANIES, INC. 4 KIDS ENTERTAINMENT, INC. $1.00 par common $.01 par common $.01 par common 4FRONT TECHNOLOGIES, INC. -

2019 Corporate Sustainability Report

2019 CORPORATE SUSTAINABILITY REPORT RELEASE DATE: MAY 2020 2019 Corporate Sustainability Report 1 A MESSAGE FROM OUR CEO Opening Letter During 2019, we proudly celebrated KEMET’s centennial as a integration of our supply chain and visionary, worldwide organization dedicated to making the world become one of the first companies a better, safer, more connected place to live. But the scale of to claim a “conflict-free” distinction our achievement didn’t happen overnight. From our humble by the U.S. Securities and Exchange Commission (SEC). origins in the simple workshop of a young, entrepreneurial inventor in Cleveland, Ohio to our rise as a global leader in Controlling our supply chain was as much an ethical choice the electronics industry, KEMET’s technological advances as a business decision. Globally, the major source of tantalum have made possible communication satellites, cellphones, is in the Democratic Republic of Congo (DRC), and media supersonic jets, space stations, personal computers, and reports disturbing conditions in mining operations there, and electric cars — innovations that touch every household, helping often a disregard for human rights. We took an early leadership improve our lives. position in the industry on the issue of obtaining certified conflict-free minerals. In doing so, we established an initiative In very real ways, the story of how we got here is the story of in 2012 that would provide oversight in tantalum operations the creation of the modern world. It is a story about technology and ensure that standards of production would not falter. and dedicated people, whose ingenuity and perseverance KEMET also helped to establish the Kisengo Foundation, which shaped our success. -

Multilayer Ceramic Capacitors One World. One KEMET

Multilayer Ceramic Capacitors High Temperature celamic thermometer Electronic Components One world. One KEMET. Multilayer Ceramic Capacitors High Temperature Table of Contents Page Why Choose KEMET ........................................................................................................................................................ 3 Surface Mount Devices .................................................................................................................................................... 5 Standard Products High Temperature 150ºC, X8L Dielectric, 10 – 50 VDC (Commercial & Automotive Grade) ........................................................5 High Temperature 150ºC, Ultra-Stable X8R Dielectric, 25 – 100 VDC (Commercial & Automotive Grade) ................................18 High Temperature 175ºC, X7R Dielectric, 16 – 200 VDC (Industrial Grade) ...............................................................................30 High Temperature 200ºC, C0G Dielectric, 10 – 200 VDC (Industrial Grade) ..............................................................................42 HV-HT Series, High Voltage, High Temperature 200°C, C0G Dielectric, 500 – 2,000 VDC (Industrial Grade) ..........................55 KPS HT Series, High Temperature 150°C, X8L Dielectric, 10 – 50 VDC (Commercial & Automotive Grade) ............................71 Pulse Discharge, High Voltage, High Temperature 200ºC, C0G Dielectric, 1,000 – 3,500 VDC (Industrial Grade) ...................79 Flex Mitigation Solutions KPS HT Series, High -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case4:14-cv-03264-DMR Document1 Filed07/18/14 Page1 of 48 1 Joseph R. Saveri (State Bar No. 130064) Andrew M. Purdy (State Bar No. 261912) 2 James G. Dallal (State Bar No. 277826) JOSEPH SAVERI LAW FIRM, INC. 3 505 Montgomery Street, Suite 625 San Francisco, California 94111 4 Telephone: (415) 500-6800 Facsimile: (415) 395-9940 5 Email: [email protected] [email protected] 6 [email protected] 7 Attorneys for Individual and Representative Plaintiff Chip-Tech, Ltd. 8 [Additional Counsel Listed on Signature Page] 9 10 UNITED STATES DISTRICT COURT 11 NORTHERN DISTRICT OF CALIFORNIA 12 CHIP-TECH, LTD., Case No. 13 Plaintiff, and on behalf of all ANTITRUST CLASS ACTION others similarly situated, COMPLAINT 14 v. 15 PANASONIC CORPORATION; PANASONIC JURY TRIAL DEMANDED 16 CORPORATION OF NORTH AMERICA; SANYO ELECTRIC GROUP, LTD.; SANYO 17 ELECTRONIC DEVICE (U.S.A.) CORPORATION; TAIYO YUDEN CO., LTD.; 18 TAIYO YUDEN (USA) INC.; NEC TOKIN CORPORATION; NEC TOKIN AMERICA, 19 INC.; KEMET CORPORATION; KEMET ELECTRONICS CORPORATION; NIPPON 20 CHEMI-CON CORPORATION; UNITED CHEMI-CON CORPORATION; HITACHI 21 CHEMICAL CO., LTD.; HITACHI CHEMICAL COMPANY AMERICA, LTD.; NICHICON 22 CORPORATION; NICHICON (AMERICA) CORPORATION; AVX CORPORATION; 23 RUBYCON CORPORATION; RUBYCON AMERICA INC.; ELNA CO., LTD.; ELNA 24 AMERICA INC.; MATSUO ELECTRIC CO., LTD.; TOSHIN KOGYO CO., LTD.; VISHAY 25 INTERTECHNOLOGY, INC.; SAMSUNG ELECTRO-MECHANICS; SAMSUNG 26 ELECTRO-MECHANICS AMERICA, INC.; ROHM CO., LTD.; and ROHM 27 SEMICONDUCTOR U.S.A., LLC, 28 Defendants. Case No. ANTITRUST CLASS ACTION COMPLAINT Case4:14-cv-03264-DMR Document1 Filed07/18/14 Page2 of 48 1 Plaintiff Chip-Tech, Ltd. -

Vishay Intertechnology, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2009 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to _______ Commission file number 1-7416 Vishay Intertechnology, Inc. (Exact name of registrant as specified in its charter) Delaware 38-1686453 (State or other jurisdiction of (IRS employer identification no.) incorporation or organization) 63 Lancaster Avenue Malvern, Pennsylvania 19355-2143 (Address of principal executive offices) (610) 644-1300 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.10 par value New York Stock Exchange (Title of class) (Exchange on which registered) Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Note – Checking the box above will not relieve any registrant required to file reports under Section 13 or 15(d) of the Exchange Act from their obligations under those Sections. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

M&A Financial Advisory Deal List

www.sullcrom.com N E W YORK WASHINGTON, D.C. L O S ANGELES PALO ALTO LONDON PARIS FRANKFURT BRUSSELS TOKYO HONG KONG BEIJING MELBOURNE SYDNEY Copyright © 2021 Sullivan & Cromwell LLP / Attorney Advertising. Prior results do not guarantee a similar outcome. S&C’S LEADING FINANCIAL ADVISORY EXPERIENCE Commercial Real Estate Lazard as financial adviser to Brookfield Property Partners’ (“BPY”) J.P. Morgan as exclusive financial adviser to Chesapeake Lodging Deutsche Bank and Goldman Sachs as financial advisers to (Bermuda) special committee in connection with Brookfield Asset Trust (U.S.) in its $2.7 billion acquisition by Park Hotels & Resorts Unibail-Rodamco (France) in its $24.7 billion acquisition of Management’s (Canada) $6.5 billion pending acquisition of the limited (U.S.) (2019) Westfield Corporation (Australia) (2017) partnership units of BPY (2021) Houlihan Lokey as financial adviser to the Special Committee of Lazard as financial adviser to the Special Committee of the Board Evercore as financial adviser to Annaly Capital Management (U.S.) the Board of Directors of HomeFed Corporation (U.S.) in of Directors of Phillips Edison Grocery Center REIT (PECO) (U.S.) in its $2.3 billion pending sale of its Commercial Real Estate connection with HomeFed’s acquisition by Jefferies (U.S.) (2019) in connection with PECO’s $1 billion acquisition of real estate business to Slate Asset Management (Canada) (2021) assets and the third party asset management business of its Citigroup and Goldman Sachs as financial advisers to LaSalle sponsor and external adviser, Phillips Edison Limited Partnership Goldman Sachs as financial adviser to CoStar Group (U.S.) in its Hotel Properties (U.S.) in its $4.8 billion acquisition by affiliates of (U.S.) (2017) $6.9 billion proposed acquisition of CoreLogic, later withdrawn Blackstone Real Estate Partners VIII (U.S.), later withdrawn (2018) (2021) UBS as financial adviser to the special committee of American J.P. -

Unregistered 6 ADMOS Advanced Monolithic Systems

页码,1/23 以文本方式查看主题 - 中国电子技术论坛 (http://bbs.elecfans.com/index.asp) -- 半导体技术天地 (http://bbs.elecfans.com/list.asp?boardid=63) ---- ic厂家图标标志及官方网站资料全集(按字母顺序排序) (http://bbs.elecfans.com/dispbbs.asp?boardid=63&id=2352) -- 作者:admin -- 发布时间:2008-7-21 13:15:15 -- ic厂家图标标志及官方网站资料全集(按字母顺序排序) ic厂家图标标志及官方网站资料全集(按字母顺序排序) 序号 厂家LOGO 厂家名称缩写 厂家全称 厂家网址 1 A-DATA A-Data Technology http://www.adata.com/ 2 AAT Advanced Analog Technology, Inc. http://www.aatech.com.tw/ 3 ANALOGICTECH Advanced Analogic Technologies http://www.analogictech.com/ 4 ALD Advanced Linear Devices http://www.aldinc.com/ 5 AMD Advanced Micro Devices http://www.amd.com UnRegistered 6 ADMOS Advanced Monolithic Systems http://www.advanced-monolithic.com/ 7 A-POWER Advanced Power Electronics Corp. http://www.a-power.com.tw/ file://C:\DOCUME~1\ADMINI~1\LOCALS~1\Temp\FB13BUO5.htm 2010-5-5 页码,2/23 8 ADPOW Advanced Power Technology http://www.advancedpower.com/ 9 ASI Advanced Semiconductor http://www.advancedsemiconductor.com/ 10 AEROFLEX Aeroflex Circuit Technology http://www.aeroflex.com/ 11 AGERE Agere Systems http://www.agere.com/ 12 HP Agilent(Hewlett-Packard) http://www.semiconductor.agilent.com/ 13 ALLEGRO Allegro MicroSystems http://www.allegromicro.com/ 14 ALSC Alliance Semiconductor Corporation http://www.alsc.com/ 15 AOSMD Alpha & Omega Semiconductors http://www.aosmd.com/ 16 ALPHAUnRegisteredAlpha Industries http://www.alphaind.com 17 ALTERA Altera Corporation http://www.altera.com file://C:\DOCUME~1\ADMINI~1\LOCALS~1\Temp\FB13BUO5.htm 2010-5-5 页码,3/23 18 AMICC AMIC Technology http://www.amictechnology.com/ -

KEMET CORP Form 8-K Current Event Report Filed 2019-05-22

SECURITIES AND EXCHANGE COMMISSION FORM 8-K Current report filing Filing Date: 2019-05-22 | Period of Report: 2019-05-22 SEC Accession No. 0000887730-19-000028 (HTML Version on secdatabase.com) FILER KEMET CORP Mailing Address Business Address KEMET TOWER KEMET TOWER CIK:887730| IRS No.: 570923789 | State of Incorp.:DE | Fiscal Year End: 0331 ONE EAST BROWARD ONE EAST BROWARD Type: 8-K | Act: 34 | File No.: 001-15491 | Film No.: 19844295 BLVD., 2ND FLOOR BLVD., 2ND FLOOR SIC: 3670 Electronic components & accessories FORT LAUDERDALE FL FORT LAUDERDALE FL 33301 33301 954-766-2800 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (date of earliest event reported): May 22, 2019 KEMET Corporation (Exact name of registrant as specified in its charter) Delaware 001-15491 57-0923789 (State of incorporation) (Commission File Number) (IRS Employer Identification No.) KEMET Tower, One East Broward Blvd., Fort Lauderdale, Florida 33301 (Address of principal executive offices) (Zip Code) (954) 766-2800 Registrant’s telephone number, including area code Not Applicable (Former name or former address, if changed since last report) ------------------------------------------------------------- Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation -

Financial Highlights

Financial Highlights Fiscal years ended March 31 (Dollars in thousands) 2017 2018 2019 Net Sales (1) $ 757,338 $ 1,200,181 $ 1,382,818 Adjusted Operating Income* (1) $ 66,976 $ 142,105 $ 237,235 Stockholders’ Equity (1) $ 155,569 $ 463,875 $ 639,415 *Adjusted Operating Income and Adjusted EBITDA are reconciled to GAAP measures on pages 56 – 59 in the 2019 Form 10-K. (1) Fiscal year ended March 31, 2018 and March 31, 2017 adjusted due to the adoption of Accounting Standard Codification (“ASC”) 606, Revenue from Contracts with Customers (“ASC 606”). Refer to Note 1, “Organization and Significant Accounting Policies” in the 2019 Form 10-K. Cash and Cash Equivalents Working Capital Adjusted EBITDA (in Millions) (in Millions) (in Millions) 450 450 450 $391(1) 400 400 400 $364 350 350 350 300 $287 300 300 $290 $248 (1) 250 250 250 $208 $192 (1) 200 200 200 150 150 150 $110 $105 (1) 100 100 100 50 50 50 0 0 0 FY17 FY18 FY19 FY17 FY18 FY19 FY17 FY18 FY19 Catalogs and Technical Data COMPONENTEDGE 3D Models, Specifications, Made for Engineers and Search by Engineers search.kemet.com engineeringcenter.com DEAR KEMET SHAREHOLDER, .(0(7FHOHEUDWHGLWVFHQWHQQLDO\HDULQ¿VFDO\HDUE\GHOLYHULQJ UHFRUG¿QDQFLDOUHVXOWV.(0(7¶V¿VFDO\HDUUHVXOWVGHPRQVWUDWH WKHIXQGDPHQWDOVWUHQJWKRIRXUEXVLQHVVDFURVVDEURDGUDQJHRI HOHFWURQLFVVHJPHQWV+LJKOLJKWVLQFOXGH •$FKLHYHGDLQFUHDVHLQVDOHVRYHU¿VFDO\HDU WRELOOLRQDQLQFUHDVHRIPLOOLRQ •*$$3JURVVPDUJLQLQFUHDVHGRYHU¿VFDO\HDU •$GMXVWHG(%,7'$JUHZFRPSDUHGWR¿VFDO\HDUWRPLOOLRQ •(DUQLQJVSHUVKDUHZHUHXSWRRQDQRQ*$$3EDVLV YHUVXVLQ¿VFDO\HDUDQGLQ¿VFDO\HDU -

Symbol Name Margin Country Tier 1 Tier 1

Symbol Name Margin Country Tier 1 Tier 1 (%) Tier 2 Tier 2 (%) .A Agilent Technologies Inc 20 US 50000 20 50000 + 40 .AA Alcoa Corporation 20 US 100000 20 100000 + 25 .AABA Altaba 20 US 100000 20 100000 + 25 .AAG American Airlines Group Inc 20 US 100000 20 100000 + 25 .AAL Anglo American PLC 20 UK 100000 20 100000 + 25 .AAOG Anglo African Oil & Gas 20 UK 100000 20 100000 + 25 .AAPL Apple Inc 20 US 50000 20 50000 + 25 .ABBV AbbVie 20 US 50000 20 50000 + 25 .ABC AmerisourceBergen Corp 20 US 50000 20 50000 + 40 .ABF Associated British Foods PLC 20 UK 100000 20 100000 + 25 .ABMD ABIOMED Inc 20 US 50000 20 50000 + 40 .ABX Barrick Gold Corp 20 US 100000 20 100000 + 25 .ACA Credit Agricole SA 20 EU 100000 20 100000 + 40 .ACAL Acacia Mining 25 UK 200000 25 200000 + 40 .ACB.US Aurora Cannabis 20 US 100000 20 100000 + 50 .ADBE Adobe Systems Inc 20 US 50000 20 50000 + 25 .ADM Admiral Group PLC 20 UK 100000 20 100000 + 40 .ADS Adidas AG 20 EU 50000 20 50000 + 25 .AF Air France-KLM 20 EU 100000 20 100000 + 40 .AGK Aggreko PLC 20 UK 100000 20 100000 + 40 .AGN Allergan PLC 20 US 50000 20 50000 + 25 .AHT Ashtead Group PLC 20 UK 100000 20 100000 + 25 .AIG American International Group Inc. 20 US 100000 20 100000 + 25 .AIR Airbus Group NV (FR) 20 EU 50000 20 50000 + 25 .AKS AK Steel Holding Corp 20 US 100000 20 100000 + 33 .ALB Albemarle Corp. 20 US 50000 20 50000 + 25 .ALGN Align Technology Inc. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Case No. ANTITRUST CLASS ACTION COMPLAINT Kit A

Case3:14-cv-03698 Document1 Filed08/14/14 Page1 of 33 1 Kit A. Pierson Brent W. Johnson 2 COHEN MILSTEIN SELLERS & TOLL PLLC 3 1100 New York Ave., NW Suite 500 West 4 Washington, DC 20005 Telephone: (202) 408-4600 5 Facsimile: (202) 408-4699 Email: [email protected] 6 [email protected] 7 Attorneys for Representative Plaintiff 8 Schuten Electronics, Inc. 9 [Additional Counsel Listed on Signature Page] 10 UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF CALIFORNIA 11 12 SCHUTEN ELECTRONICS, INC., Case No. 13 Plaintiff, and on behalf of all ANTITRUST CLASS ACTION 14 others similarly situated, COMPLAINT v. 15 AVX CORPORATION; ELNA AMERICA INC.; 16 HITACHI CHEMICAL CO., LTD.; HITACHI JURY TRIAL DEMANDED CHEMICAL COMPANY AMERICA, LTD.; 17 KEMET CORPORATION; KEMET ELECTRONICS CORPORATION; MATSUO 18 ELECTRIC CO., LTD.; NEC TOKIN CORPORATION; NEC TOKIN AMERICA, INC.; 19 NICHICON CORPORATION; NICHICON (AMERICA) CORPORATION; NIPPON CHEMI- 20 CON CORPORATION; PANASONIC CORPORATION; PANASONIC CORPORATION 21 OF NORTH AMERICA; ROHM CO., LTD.; ROHM SEMICONDUCTOR U.S.A., LLC, 22 RUBYCON CORPORATION; RUBYCON AMERICA INC.; ELNA CO., LTD.; SANYO 23 ELECTRIC GROUP, LTD.; SANYO ELECTRONIC DEVICE (U.S.A.) 24 CORPORATION; SAMSUNG ELECTRO- MECHANICS; SAMSUNG ELECTRO- 25 MECHANICS AMERICA, INC.; TAIYO YUDEN CO., LTD.; TAIYO YUDEN (USA) INC.; TOSHIN 26 KOGYO CO., LTD.; UNITED CHEMI-CON CORPORATION; and VISHAY 27 INTERTECHNOLOGY, INC. 28 Defendants. Case No. ANTITRUST CLASS ACTION COMPLAINT Case3:14-cv-03698 Document1 Filed08/14/14 Page2 of 33 1 Plaintiff Schuten Electronics, Inc. (“Plaintiff”), individually and on behalf of a class of all 2 others similarly situated, brings this action for treble damages under the antitrust laws of the 3 United States against Defendants, and demands a jury trial. -

KEMET Electronics Annual Report 2004

Annual Report 2004 Highlights of Fiscal 2004 Years ended March 31, (Dollars in thousands except per share data) 2002 2003 2004 Net sales $508,555 $447,332 $ 433,882 Net loss $ (27,289) $ (55,988) $(111,975) Net loss per share, diluted $ (0.32) $ (0.65) $ (1.30) Net cash provided by (used in) operating activities $ (34,219) $ 43,710 $ 38,452 Cash and cash equivalents, short-term investments, and investments in marketable securities $234,622 $263,585 $ 271,284 Stockholders’ equity $855,045 $793,275 $ 684,478 $1,500 $900 1,200 675 $5 900 4 450 3 600 2 225 300 1 0 0 0 ‘00 ‘01 ‘02 ‘03 ‘04 ‘00 ‘01 ‘02 ‘03 ‘04 -1 -2 ‘00 ‘01 ‘02 ‘03 ‘04 Net Sales Earnings (Loss) Per Share— Stockholders’ Equity (In Millions) Diluted (In Millions) Dear Fellow Shareholders: Fiscal 2004 was a year of significant progress for KEMET as we prepare our company for success in the global electronics industry of the future. Success in this rapidly changing, global industry depends upon technological strength, superior product quality, cost competitiveness, and unparalleled integration with our customers. Key actions were taken over the last year in each of these areas that will be instrumental to our future success. Building on our technology foundation, we launched a record number of new products in fiscal 2004, including our newest generation of KEMET Organic capacitors and KEMET Multi-Polymer-Anode capacitors, a line of wet tantalum capacitors, and a commercial-off-the-shelf (COTS) capacitor line. These products included many first to market offerings.