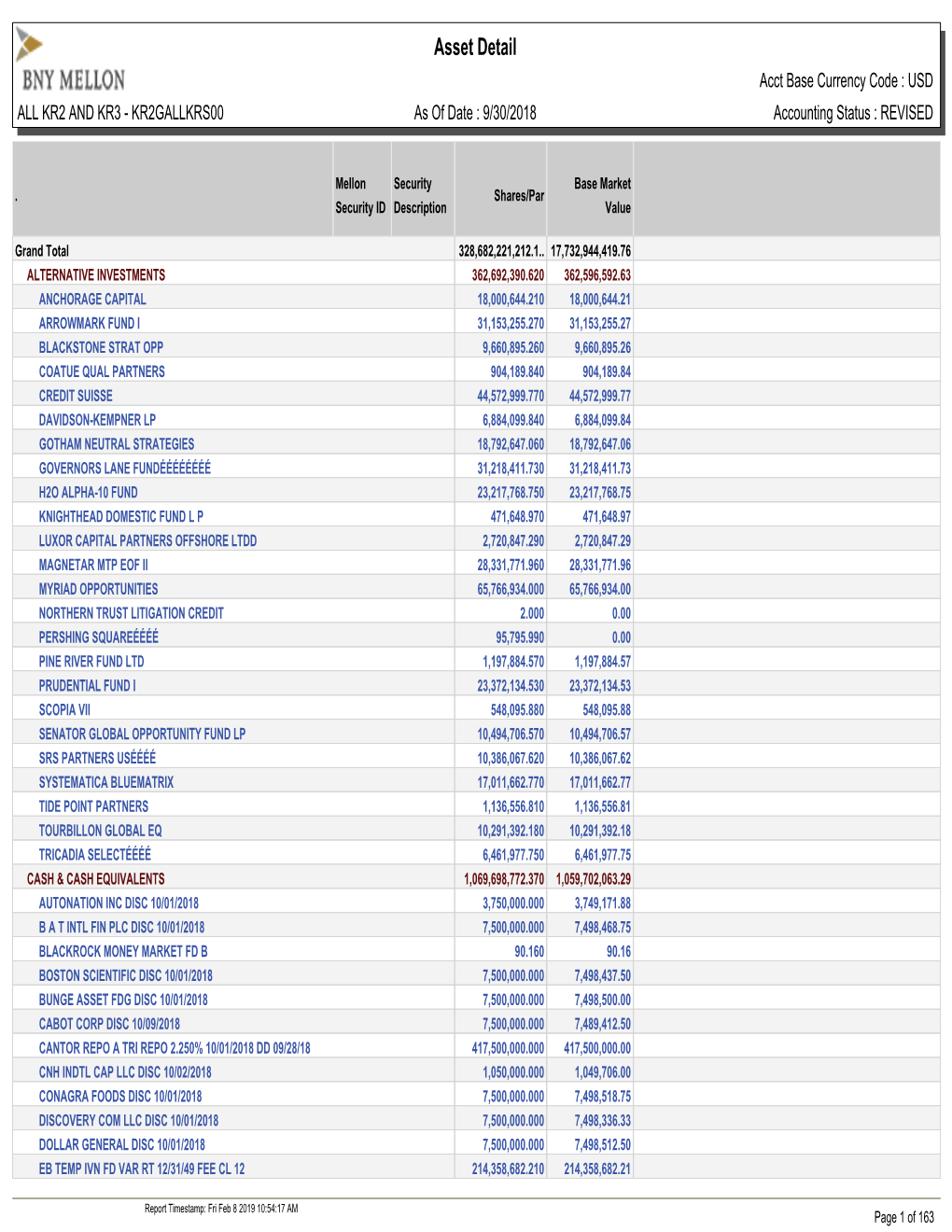

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 9/30/2018 Accounting Status : REVISED

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary Analgesics Dec2019

Status as of December 31, 2019 UPDATE STATUS: N = New, A = Advanced, C = Changed, S = Same (No Change), D = Discontinued Update Emerging treatments for acute and chronic pain Development Status, Route, Contact information Status Agent Description / Mechanism of Opioid Function / Target Indication / Other Comments Sponsor / Originator Status Route URL Action (Y/No) 2019 UPDATES / CONTINUING PRODUCTS FROM 2018 Small molecule, inhibition of 1% diacerein TWi Biotechnology / caspase-1, block activation of 1 (AC-203 / caspase-1 inhibitor Inherited Epidermolysis Bullosa Castle Creek Phase 2 No Topical www.twibiotech.com NLRP3 inflamasomes; reduced CCP-020) Pharmaceuticals IL-1beta and IL-18 Small molecule; topical NSAID Frontier 2 AB001 NSAID formulation (nondisclosed active Chronic low back pain Phase 2 No Topical www.frontierbiotech.com/en/products/1.html Biotechnologies ingredient) Small molecule; oral uricosuric / anti-inflammatory agent + febuxostat (xanthine oxidase Gout in patients taking urate- Uricosuric + 3 AC-201 CR inhibitor); inhibition of NLRP3 lowering therapy; Gout; TWi Biotechnology Phase 2 No Oral www.twibiotech.com/rAndD_11 xanthine oxidase inflammasome assembly, reduced Epidermolysis Bullosa Simplex (EBS) production of caspase-1 and cytokine IL-1Beta www.arraybiopharma.com/our-science/our-pipeline AK-1830 Small molecule; tropomyosin Array BioPharma / 4 TrkA Pain, inflammation Phase 1 No Oral www.asahi- A (ARRY-954) receptor kinase A (TrkA) inhibitor Asahi Kasei Pharma kasei.co.jp/asahi/en/news/2016/e160401_2.html www.neurosmedical.com/clinical-research; -

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 12/31/2018 Accounting Status : REVISED

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 12/31/2018 Accounting Status : REVISED Mellon Security Base Market . Shares/Par Security ID Description Value Grand Total 337,341,374,122.6.. 16,678,734,053.79 ALTERNATIVE INVESTMENTS 383,172,041.330 382,375,079.30 ANCHORAGE CAPITAL 1,974,352.480 1,974,352.48 ARROWMARK FUND I 144,927,230.580 144,927,230.58 BLACKSTONE STRAT OPP 8,576,532.030 8,576,532.03 COATUE QUAL PARTNERS 904,189.840 904,189.84 CREDIT SUISSE 34,074,860.110 34,074,860.11 DAVIDSON-KEMPNER LP 6,884,099.840 6,884,099.84 GOTHAM NEUTRAL STRATEGIES 18,837,376.670 18,837,376.67 GOVERNORS LANE FUNDÉÉÉÉÉÉÉÉ 29,561,278.010 29,561,278.01 H2O ALPHA-10 FUND 23,932,037.510 23,932,037.51 KNIGHTHEAD DOMESTIC FUND L P 471,648.970 471,648.97 LUXOR CAPITAL PARTNERS OFFSHORE LTDD 2,978,710.270 2,978,710.27 MAGNETAR MTP EOF II 25,879,631.530 25,879,631.53 MYRIAD OPPORTUNITIES 64,294,675.000 64,294,675.00 NORTHERN TRUST LITIGATION CREDIT 2.000 0.00 PERSHING SQUAREÉÉÉÉ 95,795.990 0.00 PINE RIVER FUND LTD 603,724.620 603,724.62 PRUDENTIAL FUND I 701,164.040 0.00 SCOPIA VII 548,095.880 548,095.88 SRS PARTNERS USÉÉÉÉ 11,179,090.320 11,179,090.32 TOURBILLON GLOBAL EQ 491,660.730 491,660.73 TRICADIA SELECTÉÉÉÉ 6,255,884.910 6,255,884.91 CASH & CASH EQUIVALENTS 927,419,647.320 916,686,158.35 AUTOLIV ASP INC DISC 01/02/2019 500,000.000 499,375.00 BLACKROCK MONEY MARKET FD B 90.160 90.16 CANTOR REPO A TRI REPO 2.450% 01/02/2019 DD 12/28/18 295,700,000.000 295,700,000.00 CASH COLL WITH STATE STREET 190,000.000 190,000.00 -

Respirerx Pharmaceuticals Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K [X] Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2018 OR [ ] Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission file number 1-16467 RespireRx Pharmaceuticals Inc. (Exact name of registrant as specified in its charter) Delaware 33-0303583 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 126 Valley Road, Suite C Glen Rock, New Jersey 07452 (Address of principal executive offices, including zip code) (201) 444-4947 (Registrant’s telephone number, including area code) Securities registered under Section 12(b) of the Act: None Securities registered under Section 12(g) of the Act: Common Stock, $0.001 par value (Title of Class) Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES [ ] NO [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ] Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

Galien Forum & Prix Galien

Report October 26, 2017 New York City Galien Forum & Prix Galien USA 2017 Cures will emerge when physician-scientists partner with pharmaceutical companies to expose and target the Achilles heel of disease. The Prix Galien rewards those at the forefront of this battle. Michael Brown, Nobel Laureate & Professor, The sixth annual Galien Forum took place on According to Steven Pearson, President of University of Texas, Southwestern Medical Center October 26, 2017 at the Alexandria Center for the Institute for Clinical and Economic Review, Life Science in New York City, followed by the “the stimulating ferment created by bringing ~ eleventh annual Prix Galien USA Awards together the academic superstars and the The Galien Foundation Ceremony in the iconic blue-whale room of the innovative companies in attendance was a real amplifies the connection American Museum of Natural History. reminder to me of how exciting, vital, and between academia and deeply honorable the drug discovery process industry so that innovation Forum participants tackled the most pressing is. It was particularly meaningful for me to help can fulfill its potential and issues in healthcare and R&D today, and the improve the human bring the conversation about drug pricing into ceremony recognized and honored the figurative this arena.” Panelists also included Peter condition. – and occasionally literal – blood, sweat, and Bach, Director for the Center for Health Policy Olivia Flatto, President, tears that go into creating innovation to improve & Outcomes at Memorial Sloan -

Drug & Device Pipeline News

CenterWatch Join the CenterWatch Community! Weekly October 5, 2020 COVID-19 Update…2 Industry Briefs …4 Trend of Longer Trial Timelines is Likely Up and Coming…6 Drug & Device Pipeline News…11 to Continue Thirty-eight drugs and devices have By Charlie Passut formance will really come from our ability to entered a new trial phase this week. linical trial timelines have been best manage complexity, customization and JobWatch…13 lengthening since 2014 and with fragmentation,” Getz said last week at the C COVID-19 conditions forcing adap- Outsourcing in Clinical Trials USA virtual con- tation and adoption of new technologies ference. “These macro trends are inevitable.” 15TH ANNUAL and processes, the trend is likely to continue, But other complications “are actually FDA INSPECTIONS vSUMMIT if not accelerate. challenging and conspiring against our bold While the primary response to the development ambitions. They all suggest Tuesday, Nov. 17 – Wednesday, Nov. 18, 2020 pandemic represented important, and that our programs are actually getting lon- Please join us in celebrating 15 years of bringing together industry and the FDA in sometimes transformational, changes in ger. If you look at individual tasks and phase- harmonious collaboration. trials, those changes “will likely contribute specific cycle times, you’ll see that they’re all REGISTER TODAY to even greater complexity and increased increasing in length and we’re seeing high levels of customization and operating frag- levels if not higher levels of variation, that is mentation,” says Kenneth Getz, director one of the macro trends that we’re seeing. FREE WEBINAR of the Tufts Center for the Study of Drug Protocol complexity and customization OCTOBER Development (CSDD). -

Cardiol Therapeutics Inc. | CRDL-TSX Initiating Coverage

Cardiol Therapeutics Inc. | CRDL-TSX Initiating Coverage March 25, 2021 Douglas W. Loe, PhD MBA | Managing Director & Analyst | [email protected] | 416.365.9924 Siew Ching Yeo | Research Associate | [email protected] | 416.365.8018 CRDL-TSX Initiating Coverage on Cardiovascular/Inflammatory Rating: Speculative BUY Disease-Focused Cannabidiol Developer with a Speculative Target: $12.50 BUY Rating Price: $4.47 We are initiating coverage on ON-based cannabinoid and cardiopulmonary disease- Return: 180% focused drug developer Cardiol Therapeutics with a Speculative BUY rating and a Valuation: NPV, 20 EPS, 12.5x one-year PT of $12.50. The firm already has manufacturing and commercial alliances EV/EBITDA (F2027 in place for its ultrapure cannabidiol formulation Cortalex, which was launched last estimates) quarter through Shoppers Drug Mart/Loblaw’s (L-T, NR) Medical Cannabis by Shoppers portal and which is produced through manufacturing & supply alliances with ON-based Dalton Pharma Services (Private) and with DE-based Purisys (the cannabinoid production division of pharmaceutical ingredients manufacturer Noramco), and which should generate top-line growth through that channel while cannabidiol-focused clinical activities transpire in the background, as we will describe. Valuation summary: Our valuation is based on NPV (using a discount rate of 35% for which we have a downward bias once Cardiol commences Phase II/III CardiolRx testing) and multiples of our F2027 EBITDA/EPS forecasts ($201.8M & $3.25, respectively), themselves based on our expectations for cannabidiol to generate profitable growth from Cortalex, plus from future cannabidiol/CardiolRx sales into inflammatory heart disease markets, including diastolic heart failure and acute myocarditis, along with addressing the acute inflammatory response to COVID-19 infection in patients with either co-presenting or prior history of cardiovascular disease (see below). -

2020 December

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 12/31/2020 Accounting Status : PRELIMINARY Mellon Security Base Market . Shares/Par Security ID Description Value ALTERNATIVE INVESTMENTS ARROWMARK FUND I 552,069,089.000 552,069,089.00 BLACKSTONE STRAT OPP 2,525,216.120 2,525,216.12 GOVERNORS LANE FUNDÉÉÉÉÉÉÉÉ 358,526.780 358,526.78 LUXOR CAPITAL PARTNERS OFFSHORE LTDD 1,459,032.030 1,459,032.03 MAGNETAR MTP EOF II 35,678,607.620 35,678,607.62 MYRIAD OPPORTUNITIES 48,648,563.010 48,648,563.01 NORTHERN TRUST LITIGATION CREDIT 2.000 0.00 PINE RIVER FUND LTD 139,672.780 139,672.78 SRS PARTNERS USÉÉÉÉ 5,994,083.350 5,994,083.35 TOTAL ALTERNATIVE INVESTMENTS 646,872,792.690 646,872,790.69 CASH & CASH EQUIVALENTS ABN AMRO FDG USA DISC 01/04/2021 3,600,000.000 3,598,695.00 ABN AMRO FDG USA DISC 02/08/2021 2,600,000.000 2,598,700.00 ATLANTIC ASSET DISC 02/10/2021 3,800,000.000 3,797,973.34 AUSTRALIA & NZ BK DISC 03/17/2021 2,700,000.000 2,698,582.50 BANK OF MONTREAL DISC 01/05/2021 3,850,000.000 3,848,272.85 BARCLAYS BANK DISC 01/11/2021 3,750,000.000 3,748,031.25 BARCLAYS BANK DISC 03/16/2021 2,800,000.000 2,798,180.00 BLACKROCK MONEY MARKET FD B 94.450 94.45 BPCE DISC 03/03/2021 3,900,000.000 3,897,102.08 CANTOR REPO A TRI REPO 0.100% 01/04/2021 DD 12/30/20 290,200,000.000 290,200,000.00 CNH/USD SPOT OPTION 2021 PUT APR 21 006.650 ED 041521 2,324,300.000 0.00 COLLATERALIZED CP DISC 02/17/2021 1,200,000.000 1,199,488.00 CONAGRA FOODS DISC 01/05/2021 1,537,000.000 1,536,684.06 EB TEMP IVN FD VAR RT 12/31/49 -

INSIDE with a New Index

FEBRUARY 8 , 2016 BIOTECH’S MOST RESPECTED NEWS SOURCE FOR MORE THAN 20 YEARS VOLUME 24, NO. 6 WORST START TO A YEAR MONEY RAISED BY BIOTECH: 2016 VS. 2015 Performance of biopharmaceutical Jan. 1 – Feb. 4, 2016: $3,696M sector nosedives in January Jan. 1 – Feb. 5, 2015: $6,191M By Peter Winter, Editor 4500 4,263 The fact that approximately 95 percent of the 353 public 4000 biopharmaceutical companies tracked by the BioWorld Stock Report saw their share price values fall in January emphasizes 3500 just how brutal the equity markets have been so far this year. The prevailing conditions bring back memories of the chaotic markets 3000 experienced back in 2008 during the global financial meltdown. 2500 This time around the markets have been derailed by fears of a flagging global economy and a world drowning in an oversupply 2000 1,794 of crude oil with producers unwilling to turn off the tap. Millions 1500 In this highly volatile environment investors have moved to the 1,306 1,239 sidelines and sold off their holdings in a number of sectors, 1000 including health care. 596 689 500 WORST STARTS 0 The industry has certainly got off to one of its worst starts to a Public Public/ Private year with the final iteration of the BioWorld Blue Chip Biotech Offerings Other* Biotechs Index, which comprises 20 of the leading companies ranked by market cap, closing January down a staggering 22.5 percent in * Includes financings of public biotech firms with the exceptions of value. (See BioWorld Blue Chip Biotech Index, p. -

Name of Faculty Or Presenter Reported Financial Relationship Consultant/Independent Contractor: Biodelivery Sciences Inc., Pfizer, U.S

The faculty reported the following financial relationships or relationships to products or devices they or their spouse/life partner have with commercial interests related to the content of this CME activity: Name of Faculty or Presenter Reported Financial Relationship Consultant/Independent Contractor: BioDelivery Sciences Inc., Pfizer, U.S. Worldmeds Jeremy A. Adler, MS, PA-C Speaker's Bureau: BioDelivery Sciences Charles E. Argoff, MD Nothing to disclose Consultant/Independent Contractor: Honoraria from Biohaven Pharmaceutical Company for advisory board consultation Honoraria: Honoraria from Biohaven Pharmaceutical Company for advisory board consultation Cynthia E. Armand, MD Advisory Board: Honoraria from Biohaven Pharmaceutical Company for advisory board consultation Diana Atashroo MD, FACOG Nothing to disclose Consultant/Independent Contractor: Axial Healthcare Inc Honoraria: Auburn University/AL Dept of MH Speaker's Bureau: Purdue Pharma LP Timothy J. Atkinson, PharmD, BCPS, CPE Other/Royalty (Describe): Rockpointe Inc Carol Barch Advisory Board: Theranica Robert Barkin Nothing to disclose Michael C. Barnes Nothing to disclose Jeffrey J . Bettinger, PharmD Nothing to disclose Jennifer Bolen, JD Consultant/Independent Contractor: Paradigm Healthcare Michael M. Bottros, MD Nothing to disclose Abigail Brooks Nothing to disclose Consultant/Independent Contractor: Baux Bio, Acacia, Takeda, Merck, AcelRx, Pfizer, Pacira, NEMA Research Grant/Research Support: Acacia, Baux Bio, Takeda, AcelRx, Pacira, Pfizer-Grants are to the institution Keith A. Candiotti, MD Advisory Board: Takeda, Acacia Jorge F. Carrillo, MD Consultant/Independent Contractor: Abbvie Paul J. Christo, MD, MBA Consultant/Independent Contractor: Eli Lilly, GSK Consumer Healthcare Jamie Clapp, PT, DPT, OCS Nothing to disclose Michael R. Clark, MD, MPH, MBA Nothing to disclose Corinne E. -

An Investor's Guide to Understanding Gene Therapy

U.S. Research Published by Raymond James & Associates Healthcare October 11, 2017 Initiation of Coverage Reni Benjamin, Ph.D., (212) 883-4615, [email protected] Bin Lu, Ph.D., Sr. Res. Assoc., (212) 883-6548, [email protected] Biotechnology: Initiating Coverage ________________________________________________________________________________ An Investor’s Guide to Understanding Gene Therapy: A Paradigm Shift Whose Time Has Come Initiating Coverage of Spark Therapeutics, REGENXBIO, Voyager Therapeutics, and Adverum Biotechnologies at Outperform; Audentes Therapeutics at Market Perform Please read domestic and foreign disclosure/risk information beginning on page 234 and Analyst Certification on page 234. © 2017 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. All rights reserved. International Headquarters: The Raymond James Financial Center | 880 Carillon Parkway | St. Petersburg, Florida 33716 | 800-248-8863 Raymond James U.S. Research Contents Executive Summary .............................................................................................. 3 Gene Therapy 101 ................................................................................................ 7 Gene Therapy Players ........................................................................................... 8 A Brief History of Gene Therapy: More Than Two Decades of Ups and Downs ................................................ 11 Recent Clinical Successes / Setbacks ................................................................. -

CEO INVESTOR CONFERENCE February 13-14, 2017 • the Waldorf Astoria New York

CEO INVESTOR CONFERENCE February 13-14, 2017 • The Waldorf Astoria New York bio.org/CEO • #BIOCEO16 bio.org/CEO • #BIOCEO17 CEO INVESTOR CONFERENCE Now in its 19th year, the BIO CEO & Investor Conference WHY ATTEND? is one of the largest investor • EXPERIENCE the largest, unbiased forum where institutional conferences focused on investors, industry analysts, and senior biotechnology executives shape the future investment landscape of the industry. established and emerging publicly traded and select • HEAR Washington’s perspective on how the Trump Administration will address ACA, CMS and PDUFA VI. private biotech companies. • EVALUATE fresh investment opportunities including compatible, complementary and competitive companies. • LEARN about the hottest clinical developments and industry catalysts by attending the conference’s therapeutic workshops and business roundtables. • ATTEND fireside chats with CEOs who will share their recent company successes, what keeps the C-suite up at night, and where the industry’s leading companies are headed in 2017. • GAIN ACCESS to BIO’s One-on-One Partnering system for scouting potential investments and deal partners, optimizing your time at the event. • HEAR presentations from more than 175 established public and private biotech companies and non-profit funding organizations, including many you won’t hear from at other investor conferences. • GET THE PULSE of the current and proposed investment trends in biotechnology. • NETWORK with peers, investors, and potential partners attending the conference and our exclusive receptions. 2 bio.org/CEO CEO INVESTOR CONFERENCE 2017 FIRESIDE CHAT SPEAKERS Fireside Chats feature candid discussions between biopharma executives, Wall Street analysts, and other high-level industry experts. Hear about recent company Giovanni Caforio, MD Tony Coles, MD Chief Executive Officer, Chairman and Chief successes, what keeps the Bristol-Myers Squibb Executive Officer, C-suite up at night, and Yumanity Therapeutics where the industry’s leading companies are headed in 2017. -

Partnering in the Pharma World: BIO-Europe® and Industry Trends 2017 Update

Partnering in the Pharma World: BIO-Europe® and Industry Trends 2017 Update #BIOEUROPE Introduction When I walk through the bustling partnering halls startups and potential partners. While we won’t at BIO-Europe®, filled with the buzz of hundreds be lifting the curtain of each partnering booth of voices pitching assets and collaborating on individually, this report will provide an aggregate opportunities, I imagine lifting the curtains and view of developing trends. connecting all the dots that are placed across the map of the partnering universe. Which We first looked at this data in-depth last year; it was therapeutic areas grab the most attention? Who a multi-year analysis examining event data from will strike a strategic partnership based on one 2012–2015, or, one hundred thousand meetings. of their meetings? What are the implications of This year’s report adds 2016 data to that aggregate, those meetings for the real world – for therapies, revisiting the alliances, dealmaking activity, and treatments and cures? opportunities that continue to turn the wheel of drug development at each BIO-Europe international Just last year, BIO-Europe attendees sent nearly partnering event. 110,000 meeting requests, which resulted in over 20,000 meetings. This included meetings between Anna Chrisman private and public companies, between pharma and Group Managing Director biotech, and first connections between emerging EBD Group Alliances are an intrinsic component of the pharma years past to analyze this crucial aspect of the industry, allowing companies to maximize value partnering process, before wrapping up with the and mitigate risk of their internal R&D investments.