Chester High Conviction Fund January 2020 Market Commentary

Total Page:16

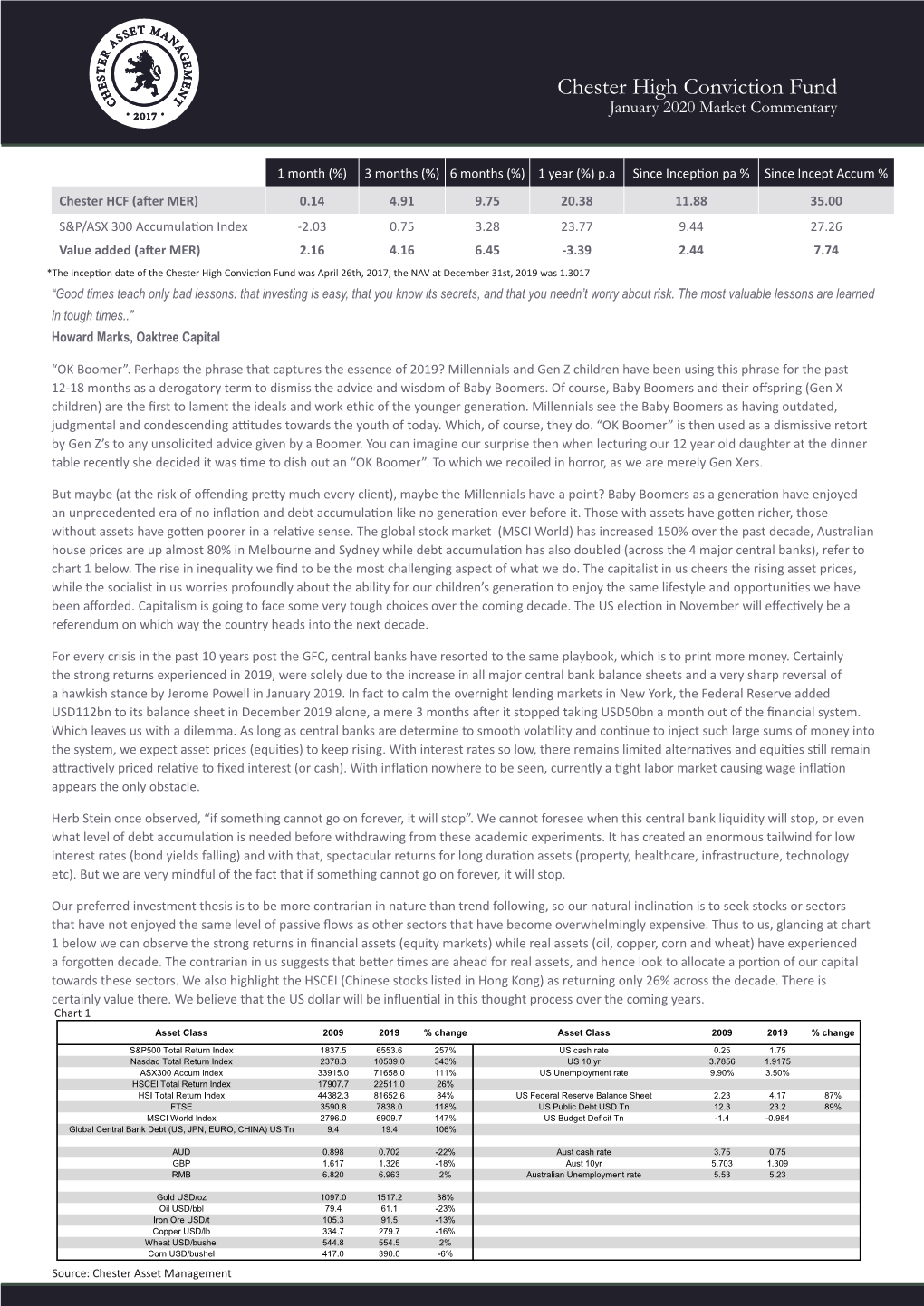

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tassal Group Limited Macquarie Connections Australian Emerging

Tassal Group Limited Macquarie Connections Australian Emerging Leaders Conference (Hilton Hotel, Sydney ) 7th May 2009 Presenter: Mark Ryan CEO and Managing Director Tassal Group Limited 1 Agenda 3 Tassal Overview 3 Strategy 3 How Are We Tracking? 3 Financial Performance 3 Hatchery 3 Marine 3 Processing 3 Branding 3 Revenue 3 Risk Management 3 ESG 3 Competitive Advantages 3 Economic Conditions & Outlook 3 Conclusions 3 Appendices 2 Overview Tassal Group Limited in FY2009… 3 Australia’s leading aquaculture company 3 Benefitinggg from strong domestic and g lobal demand 3 Well positioned to escalate key export market penetration 3 Leading branding 3 Delhflfdddddflivering strong growth in financial performance and increased dividends for shareholders 3 Continued reduction in cost of production and automated processing driving transition to global best practice 3 Significant capital investment undertaken targeted at growth, innovation, efficiency and risk mitigation 3 Low gearing profile and ample debt facility head room 3 Balance sheet well capitalised and positioned to support continued growth 3 No change to previous earnings guidance for FY2009 3 Strategic Plan FY2015 3 Strategic Plan FY2015 in place – we clearly understand where Tassal is heading … there is a plan in place and we are achieving the hurdles set 3 Strategy - Global cost competitiveness in both aquaculture production and processing, together with achieving premium returns from our sales and marketing initiatives 3 FY2009 Focus – to build on our FY2008 achievements to drive -

ASD NTA & Allotment Notice

Friday, 8 March 2019 ASD NTA & Allotment Notice Smartshares Limited would like to report details of the Units on Issue for the Australian Dividend Fund (ASD) as at 7 March 2019. Units on Issue: 15,304,541 Units Allotted/(Redeemed): - Net Tangible Assets (NTA): $1.61250 Tracking Difference: 1.04% The objective of the Australian Dividend Fund (ASD) is to provide a return that closely matches the return on the S&P/ASX Dividend Opportunities Index. The S&P/ASX Dividend Opportunities Index comprises the 50 highest yielding common stocks from the Australian equity market. The following companies are currently held in the Fund: Code Security description ABC Adelaide Brighton Ltd. APA APA Group API Australian Pharmaceutical Industries Ltd. ASL Ausdrill Ltd. AST AusNet Services Ltd. ASX ASX Ltd. AWC Alumina Ltd. BEN Bendigo and Adelaide Bank Ltd. CBA Commonwealth Bank of Australia CCL Coca-Cola Amatil Ltd. CTX Caltex Australia Ltd. CWN Crown Resorts Ltd. DLX DuluxGroup Ltd. DOW Downer EDI Ltd. ECX Eclipx Group Ltd. FMG Fortescue Metals Group Ltd. GUD G.U.D. Holdings Ltd. GWA GWA Group Ltd. HVN Harvey Norman Holdings Ltd. IAG Insurance Australia Group Ltd. ILU Iluka Resources Ltd. ING Inghams Group Ltd. IPH IPH Ltd. JBH JB Hi-Fi Ltd. LLC Lendlease Group MFG Magellan Financial Group Ltd. MIN Mineral Resources Ltd. MMS McMillan Shakespeare Ltd. MQG Macquarie Group Ltd. MTS Metcash Ltd. NEC Nine Entertainment Co. Holdings Ltd. NHC New Hope Corporation Ltd. PDL Pendal Group Ltd. PMV Premier Investments Ltd. RIO Rio Tinto Ltd. www.smartshares.com RRL Regis Resources Ltd. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Report for Tassal Operations Pty Ltd: North West Bay, MF 94 Sheppards Full Assessment Against Aquaculture Stewardship Council (ASC) Salmon Standard V1.0

SCS Global Services Report Report for Tassal Operations Pty Ltd: North West Bay, MF 94 Sheppards Full Assessment Against Aquaculture Stewardship Council (ASC) Salmon Standard V1.0 Tassal Operations Pty Ltd 2 Salamanca Square, Battery Point, Hobart 7004, Australia USING: ASC Salmon Standard V1.0 June 2012 AUDITORS: Dr. Sabine Daume, D.B. O’Sullivan ONSITE DATES: 10-12th March, 2014 Prepared by: SCS Global Services (SCS), an ASI-Accredited Conformity Assessment Body (#ASC-ACC-005) Sustainable Seafood Program NATURAL RESOURCE DIVISION Email: [email protected] 2000 Powell Street, Ste. 600, Emeryville, CA 94608 USA +1.510.452.8000 main | +1.510.452.8001 fax www.SCSglobalServices.com ASC FULL ASSESSMENT REPORT- TASSAL- NORTH WEST BAY Table of Contents 1 Summary ............................................................................................................................................... 4 2 Historical Background of Farm and Farming Area ................................................................................ 4 3 Scope ..................................................................................................................................................... 6 4 Audit Plan .............................................................................................................................................. 6 4.1 Previous Audits ............................................................................................................................. 6 4.2 Names of the Auditors ................................................................................................................. -

Hush, and Hear Amalgamated's Charms Who Wants Golden Dividends?; Blog Links ASX Half-Year Result BHP Half-Year Result IRESS Fu

WEEkly REviEW | ISSUE 362a | 16–22 February 2013 CONTENTS IN THIS ISSUE STOCK REVIEWS Hush, and hear Amalgamated’s charms STOCK ASX CODE REcoMMENdaTioN PAGE Greg Hoffman Amalgamated Holdings AHD Long Term Buy 2 Greg Hoffman explains why this owner of hotels, cinemas and a skiing stock UPdates resort may be just the ticket for those looking for a steady, growing ARB Corp ARP Hold 3 dividend. (p2) Amcor AMC Avoid 4 ANZ Bank ANZ Avoid 5 Who wants golden dividends?; Blog links ASX ASX Hold 5 Australand ASSETS AAZPB Sell 6 Gaurav Sodhi BHP Billiton BHP Hold 7 Below is a list of Doddsville and Bristlemouth blog articles published BlueScope Steel BSL Hold 8 by our analysts this week. (p25) Boart Longyear BLY Avoid 8 Brambles BXB Avoid 9 ASX half-year result BWP Trust BWP Long Term Buy 9 Coca-Cola Amatil CCL Hold 10 James Carlisle Infigen Energy IFN Hold 11 Competition and weak market sentiment took a bite out of ASX’s InvoCare IVC Hold 11 revenue in the first half, but today’s result left plenty of room for IRESS IRE Hold 12 optimism. (p5) Monadelphous MND Avoid 13 NAB CPS NABPA Avoid 14 Platinum Asset Management PTM Hold 15 BHP half-year result ResMed RMD Long Term Buy 16 Gaurav Sodhi Rio Tinto RIO Hold 17 Good results were only part of the story, with management preparing Sunland Group SDG Hold 17 the business for a different world. (p7) Sonic Healthcare SHL Hold 18 Servcorp SRV Hold 19 Sirtex Medical SRX Hold 20 IRESS full-year result Suncorp Group SUN Hold 21 Jason Prowd Tassal Group TGR Hold 21 A growing market for its wealth management software failed to offset Treasury Group TRG Hold 22 lower demand for its market data products both here and abroad. -

Ngs Super Portfolio Holdings Disclosure

NGS SUPER PORTFOLIO HOLDINGS DISCLOSURE DEFENSIVE - ACCUMULATION Effective date: 31 DEC 2020 AUSTRALIAN SHARES A2 MILK CO LTD ABACUS PROPERTY GROUP REIT ACCENT GROUP LTD ADAIRS LTD ADBRI LTD AFTERPAY LTD AGL ENERGY LTD AINSWORTH GAME TECHNOLOGY LTD ALACER GOLD CORP ALE PROPERTY GROUP REIT ALS LTD ALTIUM LTD ALUMINA LTD AMA GROUP LTD AMCOR PLC AMP LTD ANSELL LTD APA GROUP STAPLED SECURITY APPEN LTD ARB CORP LTD ARISTOCRAT LEISURE LTD ASALEO CARE LTD ASX LTD ATLAS ARTERIA STAPLED SECURITY AUB GROUP LTD AUCKLAND INTL AIRPORT LTD AURELIA METALS LTD AUSNET SERVICES AUSSIE BROADBAND Issued by NGS Super Pty Limited ABN 46 003 491 487 AFSL No 233 154 the trustee of NGS Super ABN 73 549 180 515 ngssuper.com.au 1300 133 177 NGS SUPER – PORTFOLIO HOLDINGS DISCLOSURE 1 DEFENSIVE - ACCUMULATION Effective date: 31 DEC 2020 AUST AND NZ BANKING GROUP AUSTAL LTD AUSTRALIAN FINANCE GROUP LTD AUSTRALIAN PHARMA INDUS LTD AUSTRALIAN VINTAGE LTD AVENTUS GROUP REIT AVITA MEDICAL INC BABY BUNTING GROUP LTD BANK OF QUEENSLAND LTD BAPCOR LTD BEACH ENERGY LTD BEACON LIGHTING GROUP LTD BEGA CHEESE LTD BENDIGO AND ADELAIDE BANK BHP GROUP LTD BINGO INDUSTRIES LTD BLACKMORES LTD BLUESCOPE STEEL LTD BORAL LTD BRAMBLES LTD BRAVURA SOLUTIONS LTD BREVILLE GROUP LTD BRICKWORKS LTD BWP TRUST REIT CALTEX AUSTRALIA LTD CAPITOL HEALTH LTD CAPRAL LTD CAPRICORN METALS LTD CARDNO LTD CARNARVON PETROLEUM LTD CARSALES.COM LTD CASH CEDAR WOODS PROPERTIES LTD CENTURIA INDUSTRIAL REIT CENTURIA METROPOLITAN REIT CHALLENGER LTD CHAMPION IRON LTD CHARTER HALL GROUP REIT CHARTER HALL LONG -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

2018 for Personal Use Only Use Personal for Company Directory

Annual Report 2018 For personal use only Company Directory Directors Stock Exchange Listing Allan McCallum, Dip.Ag Science, FAICD (Chairman) Tassal Group Limited is listed on the Australian Securities Exchange. Trevor Gerber, B.Acc CA (SA) The Home Exchange is Melbourne, Victoria. Christopher Leon, BScEng, MEngSci, FAICD ASX Code: TGR Mark Ryan, B.Com, CA, MAICD, FAIM (Managing Director) John Watson, AM Share Registry Register of Securities is held at the following address: Chief Executive Officer Computershare Investor Services Pty Limited Mark Ryan, B.Com, CA, MAICD, FAIM Yarra Falls Company Secretary 452 Johnston Street Abbotsford Monika Maedler, BEc, LLB, FCIS Victoria 3067 Registered Office* Enquiries (within Australia) 1300 850 505 Enquiries (outside Australia) 61 3 9415 4000 Level 9 Investor Enquiries Facsimile 61 3 9473 2555 1 Franklin Wharf Website www.computershare.com Hobart Tasmania 7000 Executive Directory Telephone (03) 6244 9099 Facsimile (03) 6244 9002 Mark Ryan Managing Director and E-mail [email protected] Chief Executive Officer Website www.tassalgroup.com.au Mark Asman Head of Aquaculture ABN 15 106 067 270 Andrew Creswell Chief Financial Officer (*Also principal administration office) Ben Daley Head of Supply Chain and Auditors Commercial Services Deloitte Touche Tohmatsu Dale Williams Head of Sales and Marketing Level 8 22 Elizabeth Street Hobart Tasmania 7000 Bankers Westpac Banking Corporation Level 7 150 Collins Street Melbourne Victoria 3000 BankWest Level 6 600 Bourke Street Melbourne Victoria 3000 Coöperatieve -

Commsec Margin Lending Approved Securities List

Accepted ASX Listed Equities as at 21 September 2021 Buffer - 5% Subject to change at the discretion of CommSec Margin Lending Maximum Gearing Ratio - 90% LVR Changes Changes since the last Approved Securities List was published are outlined in the below table: ASX Securities ASX Code Security Name Change Previous Portfolio LVR New Portfolio LVR AST AUSNET SERVICES LIMITED Capped LVR 75% 75% BGL BELLEVUE GOLD LIMITED New LVR 0% 40%* SXL SOUTHERN CROSS MEDIA GROUP LIMITED Uncapped LVR 40%* 40%* QLTY BETASHARES GLOBAL QUALITY LEADERS ETF LVR Increase 65% 70% CLNE VANECK GLOBAL CLEAN ENERGY ETF New LVR 0% 65% *Available via facilities with PLVR enabled only ASX Portfolio Standard Single Stock ASX Portfolio Standard Single Stock Code Security Name LVR LVR LVR Code Security Name LVR LVR LVR A200 BETASHARES AUSTRALIA 200 ETF 80% 75% 70% BNKS BETASHARES GLOBAL BANKS ETF 70% 65% 60% A2M THE A2 MILK COMPANY LIMITED 55% 50% 45% BOQ BANK OF QUEENSLAND LIMITED 70% 65% 60% AAA BETASHARES AUSTRALIAN HIGH INTEREST CASH ETF 90% 85% 80% BOQPE BANK OF QUEENSLAND LIMITED 70% 65% 60% AAC AUSTRALIAN AGRICULTURAL COMPANY LIMITED 50% 45% 40% BOQPF BANK OF QUEENSLAND LIMITED 70% 65% 60% ABA AUSWIDE BANK LTD 50% 45% 40% BPT BEACH ENERGY LIMITED 50% 45% 40% ABC ADELAIDE BRIGHTON LIMITED 60% 55% 50% BRG BREVILLE GROUP LIMITED 65% 60% 55% ABP ABACUS PROPERTY GROUP 65% 60% 55% BSL BLUESCOPE STEEL LIMITED 70% 65% 60% ACDC ETFS BATTERY TECH & LITHIUM ETF 60% 55% 50% BVS BRAVURA SOLUTIONS LIMITED 45% 40% 35% AD8 AUDINATE GROUP LIMITED 40% 0% 0% BWP BWP TRUST 70% 65% 60% ADH ADAIRS LIMITED 45% 40% 35% BWX BWX LIMITED 45% 40% 35% ADI APN INDUSTRIA REIT 60% 55% 50% BXB BRAMBLES LIMITED 80% 75% 70% AEF AUSTRALIAN ETHICAL INVESTMENT LIMITED 40% 35% 30% CAJ CAPITOL HEALTH LIMITED 40% 0% 0% AFG AUSTRALIAN FINANCE GROUP LTD 40% 35% 30% CAR CARSALES.COM LIMITED. -

View Annual Report

A positive year of transition... Tassal Group Limited 2004 Annual Report Premium fresh Atlantic Salmon destined for both discerning domestic and export markets. … has seen Tassal successfully consolidate two underperforming Salmon operations, emerge from Receivership as the country’s largest salmon producer and begin the transition to world’s best practice. A strategy of “seafood excellence, business excellence” premised on a strong risk mitigation focus, has led to gains from reduced growing and processing costs as a result of improved fi sh management practices, processing effi ciencies and capital expenditure initiatives. This transition from past to present to future will mean... … successfully competing with global salmon players. Tassal is now repositioning itself to be globally cost competitive using global technology, automation and improved work practices that lead to… Continually investing in processing automation technology underpins the drive for global cost competitiveness. Automated feeding practices underpin Tassal’s drive to reduce costs and enhance fish performance. … growth, both top and bottom line, from domestic and export markets. In FY2004, Tassal was able to achieve improved growth and survivability. The risk mitigation focus and rationalised value-adding processing environment is allowing Tassal to generate improved economies of scale, and that means… … it must exploit current and new price-premium niche markets for Atlantic Salmon and Trout. Tassal is striving to strengthen its position in the value chain and to enhance its profitability by continuing its focus on fresh packed whole fish and value- added products. There is more to do, and the transition has only just begun… Fresh packed whole fish and value added products lay at the core of the company’s product range. -

Dover Region - MF 209 Stringers and MF 201 Redcliffs Full Assessment Against Aquaculture Stewardship Council (ASC) Salmon Standard V1.0

SCS Global Services Report Report for Tassal Operations Pty Ltd: Dover Region - MF 209 Stringers and MF 201 Redcliffs Full Assessment Against Aquaculture Stewardship Council (ASC) Salmon Standard V1.0 Tassal Operations Pty Ltd Level 9, 1 Franklin Wharf, Hobart 7000 Australia USING: ASC Salmon Standard V1.0 June 2012 AUDITORS: Juan Aguirre, James McNaughton and Dr. Sabine Daume ONSITE DATES: 26-27th May 2014 FINAL REPORT ISSUED: 4th September 2014 Prepared by: SCS Global Services (SCS) ASC-Accredited Conformity Assessment Body (#ASC-ACC-005) Sustainable Seafood Program Email: [email protected] 2000 Powell Street, Ste. 600, Emeryville, CA 94608 USA +1.510.452.8000 main | +1.510.452.8001 fax www.SCSglobalServices.com 2000 Powell Street, Ste. 600, Emeryville, CA 94608 USA +1.510.452.8000 main | +1.510.452.8001 fax www.SCSglobalServices.com ASC FULL ASSESSMENT REPORT- TASSAL- DOVER Table of Contents 1 Summary ............................................................................................................................................... 5 2 Historical Background of Farm and Farming Area ................................................................................ 7 3 Scope ................................................................................................................................................... 10 4 Audit Plan ............................................................................................................................................ 10 4.1 Previous Audits ..........................................................................................................................