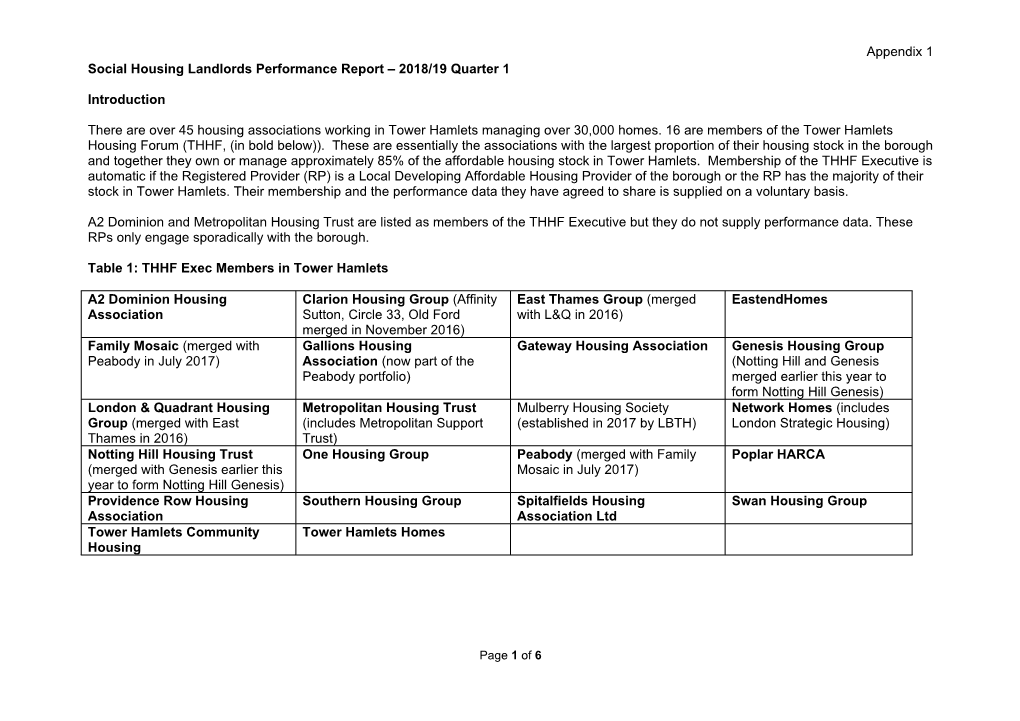

Appendix 1 Social Housing Landlords Performance Report – 2018/19 Quarter 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Housing Association Residents Extend Rent and Service Charge Strikes Date: 1St June 2021

Release: Immediate Release Subject: Housing Association Residents Extend Rent and Service Charge Strikes Date: 1st June 2021 A group of tenants and residents are to begin a coordinated rent and service charge strike from Thursday 1st July 2021 in protest over various landlords’ failings, and because of the extreme barriers they have faced when trying to engage their landlords to resolve their issues. Within a week of launching the support group, membership had grown to fifty. Complaints from the group range from incorrect service charge statements, insufficient information about the service charges, disrepairs relating to their homes or estates, and failures to make reasonable adjustments for those with disabilities. The tenants and residents within the coordinating group all reside in housing association properties. Attempts to address the issues directly with their landlords, and in some cases through other routes have been futile. One member of the group commented: “I am in despair as to how to stop these atrocious companies any other way. We’ve experienced diabolical rip-offs, incompetence and lies. They have damaged our lives for years and years. Many thousands of tenants across the sector experience endless failed attempts to get their problem sorted out. We are ground down. “I honestly can't see how anything other than withholding money is going to stop them. Even when the Social Housing White Paper is made law, I don’t believe that there is any other way to hold these massive, powerful corporations to account” Councillors and members of Parliament complain that they experience the same difficulties as tenants and residents when trying to engage with the associations, or are misled about the work done to address issues. -

New London Awards Publication

[email protected] 05 Jul 2018 NEW LONDON 2018/2019 [email protected] 05 Jul 2018 NEW LONDON 2018/2019 A selection of the best newly completed and upcoming projects in the capital, chosen for their architectural quality and wider contribution to London’s built environment. 02 The selection process 04 Foreword and New Londoner 06 Special Prizes 12 Conservation & Retrofit 24 Culture & Community 34 Education 46 Homes 54 Hotels & Hospitality 60 Housing 74 Masterplans & Area Strategies 82 Meanwhile 88 Mixed-Use 100 Offices 110 Public Spaces 118 Retail 124 Transport & Infrastructure 130 Wellbeing 136 Workplaces 146 Sponsors 155 Index This catalogue is published by NLA to coincide with the New London Awards 2018 Category intros by David Taylor, editor, New London Quarterly Editorial Team: Barbara Chesi, Mark Cox, Lucie Murray, Merry Arnold, Jenine Hudson, Molly Nicholson Design: 401 © New London Architecture, July 2018 NLA, The Building Centre, 26 Store Street, London WC1E 7BT www.newlondonarchitecture.org @nlalondon #NLAwards2018 1 [email protected] 05 Jul 2018 The selection process The New London Awards, launched eight years The Mayor’s Prize this year has been awarded by ago by New London Architecture (NLA), is the Mayor of London to the scheme that best London’s annual celebration of the best reflects the Mayor’s ambition for ‘Supporting architecture, planning and construction projects Diversity’, as expressed through the Good that enhance the capital’s wider social and Growth by Design programme – where schemes economic wellbeing, supported by the Mayor of are actively designed for different needs. London. Additional accolades include the Sustainability Prize, awarded to an exemplar project in From green spaces and small community creating a more sustainable low-carbon city, and projects, to major housing schemes and the People’s Choice, voted for by Londoners. -

Our List of Registered Providers and Local Authorities

Nationwide public sector eligibility list The public sector bodies to whom the use of this framework agreement is open, include without limitation: 1. Central government departments & their executive agencies: a list of such departments and executive agencies can be found at http://www.cabinetoffice.gov.uk/government-business/government-ministers- responsibilities.aspx 2. Non-departmental public bodies (NDPBs): a list of NDPBs can be found at annex A to the Public Bodies Directory 2007 published by the Cabinet Office) which can be found at https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/506070/An nex_-_Public_Bodies_Reform_Programme_Update_16_Dec_2015.pdf 3. All Local Authorities, (as defined in Regulation 3(2) to 3(5) inclusive of the Utilities Contracts Regulations 2006 (as amended by the Public Contracts Regulations 2015)) and all and any subsidiaries and joint-venture vehicles of those local authorities, including, but not limited to, all listed on this website: https://www.lgbce.org.uk/records- and-resources/local-authorities-in-england 4. All National Health Service (NHS) bodies, including, but not limited to, NHS Trusts as defined in the Regulation 2 of the Public Contract Regulations 2015 which, in turn, includes: 4.1. Acute trusts; 4.2. Trusts operating community hospitals and the provider functions of primary care trusts; 4.3. Primary care trusts; 4.4. Care trusts; 4.5. Care trusts plus; 4.6. Ambulance trusts; 4.7. Mental health trusts; 4.8. Strategic health authorities; 4.9. Special health authorities; 4.10. Community health councils; 4.11. Local health boards; 4.12. NHS foundation trusts; 4.13. -

The Housing Quality Network Annual Conference 2020: Back from the Brink Thursday 16 July

The Housing Quality Network annual conference 2020: Back from the brink Thursday 16 July Working out how the housing sector can bounce back from COVID-19? Worrying what the economic impact will be for our organisations, residents and communities? Wondering if we can make the world a better place once the dust has settled? Seeking clarity amidst the confusion? At a time when there are no simple answers to life’s big questions, HQN’s first virtual annual conference will provide the accurate information and expert guidance you need to make informed decisions for the future – direct from the decision makers. This year’s conference couldn’t be better timed as the housing sector seeks certainty on how to emerge from the COVID-19 crisis in a way that balances the health and wellbeing of employees, residents and our communities with the viability of organisations. 09:45 Registration director at Altair International (Africa) 10:20 Welcome and introduction Alistair McIntosh, CEO, HQN 11:30 Interval 10:30 KEYNOTE: International voices: 11:35 Breakouts: How housing providers from different parts of the world have responded to Care and repair the challenges posed by COVID-19 How well did the housing sector and other momentous events respond to the COVID-19 crisis? Jo Miller, Chief Executive, Hutt Can we be proud of the frontline City Council (New Zealand), help and support we offered our Wendy Hayhurst, Chief residents? We celebrate those that Executive, Community Housing made a difference while Industry Association (Australia), highlighting some key lessons to Henk Korevaar, Co-Founder, be learned and future CorpoNet (Netherlands), opportunities. -

Organization A2dominion Housing Group Ltd Aberdeen Standard

Social Housing Annual Conference Thursday 9th November 200 Aldersgate, London EC1A 4HD. Sample delegate list (1 November 2017) T: +44 (0)207 772 8337 E: [email protected] Organization Job Title A2Dominion Housing Group Ltd Group Chief Exec Aberdeen Standard Investments Sales Director - Liquidity Solutions Aberdeen Standard Investments Institutional Business Development Manager Aberdeen Standard Investments Investment director, credit Accent Group Chief Executive Accent Group Executive Director of Finance & Corporate Services Al Bawardi Critchlow Managing Partner Aldwyck Housing Group Group Director of Finance Aldwyck Housing Group Group Chief Executive Aldwyck Housing Group Group chief executive Allen & Overy LLP Senior Associate Allen & Overy LLP Associate Allen & Overy LLP Consultant Altair Partner Altair Director Altair Director Altair Consultant Anchor Trust Financial Director Anthony Collins Solicitors LLP Partner Anthony Collins Solicitors LLP Partner Arawak Walton Housing Association Finance Director Arawak Walton Housing Association Deputy CEO and Executive Director, Resources ARK Consultancy Senior Consultant Assured Guaranty Director Aster Group Group chief executive Baily Garner LLP Partner Barclays Head of Social Housing, Barclays Barclays Relationship Director, Barclays Barclays Director, Barclays Barclays Director, Barclays PLC Bartra Capital Property CEO Black Country Housing Group Board Member BOARD Sector Lead – Commercial Property and Construction BOARD Business Development Manager Bond Woodhouse Managing -

Annual Report and Financial Statements 2020 - 2021 at a Glance

Annual report and financial statements 2020 - 2021 At a glance G1/V2 Regulatory rating £144.7m 1,631 Surplus before tax FTE staff A- (stable) S&P rating £923.3m 3,822 A (stable) Available liquidity Homes let Fitch rating 779 947 1,342 Plots acquired Starts on site Homes completed 66,537 17,402 £21bn Properties owned Unencumbered Value of properties or managed properties Board, Executive Directors and Advisers Contents Board Executive Board Strategic report Ian Ellis Kate Davies (Chair) Paul Phillips Welcome from the Chair 1 Fred Angole Andy Belton Chief Executive’s introduction 3 (appointed 20 August 2020) Katie Bond Strategic context 4 Stephen Bitti Carl Byrne Jenny Buck Where we work 9 (resigned 15 September 2020) Elly Hoult (appointed 30 April 2020) Key performance indicators 10 Elaine Bucknor John Hughes Chief Financial Officer's report 11 Linde Carr Vipul Thacker Kate Davies (Chief Executive) Mark Vaughan Governance Jane Hollinshead Jeremy Stibbe (resigned 31 May 2020) The Board and Committees 23 Bruce Mew The Executive Board 25 Arike Oke Company Secretary (appointed 17 December 2020) Andrew Nankivell Statement of Board’s responsibilities 28 Alex Phillips (Senior Independent Director) Financial Paul Phillips statements (Chief Financial Officer) Richard Powell Independent auditor's report to the members 33 Statement of comprehensive income 41 Registered office and head office Registrations Statement of changes in reserves 42 Bruce Kenrick House Registered Society Number: 7746 Statement of financial position 44 2 Killick Street Registered Provider Number: 4880 London N1 9FL A charity exempt from registration. Statement of cash flow 45 Regulated by the Regulator of Social Housing. -

2018/19 Annual Report and Financial Statements Around £105.3M 24.7% £20Bn Surplus Operating 64,000 Before Tax Margin Properties Owned Or Managed

2018/19 Annual report and financial statements around £105.3m 24.7% £20bn Surplus Operating 64,000 before tax margin Properties owned or managed Value of properties Available 2,031 liquidity Homes £775m completed Unencumbered 16,000 properties 2018 /19 Annual report & financial statements Contents Introduction 1 Strategic report 3 Governance 20 Independent auditors’ report to the members 30 Financial statements 38 Consolidated and NHG statement of comprehensive income for the year ended 31 March 2019 39 Statement of changes in reserves 40 Consolidated and NHG statement of financial position as at 31 March 2019 42 Consolidated statement of cash flows for the year ended 31 March 2019 43 Notes to the financial statements for the year ended 31 March 2019 44 Registered office Registrations Independent Principal Principal and head office auditors solicitors bankers Bruce Kenrick House Registered Society Number: BDO LLP Devonshires Solicitors LLP Barclays Bank PLC 2 Killick Street 7746 Statutory Auditors 30 Finsbury Circus Business Banking London N1 9FL Registered Provider Number: 55 Baker Street London Floor 28 Tel: 020 3815 0000 4880 London EC2M 7DT 1 Churchill Place www.nhggroup.org.uk A charity exempt from W1U 7EU London 2018 registration. Regulated by the E14 5HP /19 Regulator of Social Housing. Annual report & financial statements Introduction Mildmay, London Borough of Hackney 2018 /19 Annual Strategic report Financial statements Notes to the financial statements report & 1 financial Introduction Governance Independent auditors’ report statements Chair’s welcome I am pleased to introduce the 2018/19 annual new homes and started over 1,000 homes on I am delighted with the way in which the board report and financial statements, our first since site. -

Annual Report 2017/18

Annual report 2017/18 Foreword During the year, EastendHomes has continued Earlier this year EastendHomes worked It’s a pleasure to welcome to explore ways to provide new, desperately closely with our regulator, the Regulator of you to the Annual Report for needed, genuinely affordable homes for local Social Housing, who conducted an ‘In Depth people. This year we have added a small Assessment’ (IDA), which looked in detail at 2017/18. I hope that you number of new homes to our housing stock, how we are run, with a particular focus on will find it to be an interesting the first properties we have acquired in Bow governance and financial viability. All housing (though close to our existing Mile End estates). associations are required to undergo an IDA Contents and informative read. The Board is currently working on ambitious approximately every three years, and I am plans to introduce many more new homes in pleased to report that following the review, Introduction 4 It has been a busy year, understandably the borough. A priority of the Board is that there was no change to our rating and we overshadowed by the horrors of the tragic fire wherever possible these new homes should be were found to be compliant with both our Community events 6 at Grenfell Tower. Subsequently Government let at genuinely affordable social rents. governance and our financial viability. Performance 8 and all housing providers have been reviewing 2017 also saw the start of our new repairs and Finally, I would like to thank all my fellow everything they do to make sure that all maintenance contract, led by Morgan Sindall Board Members for their hard work during this Repairs 12 tenants’ homes and buildings are as safe as Property Services. -

Final Programme Admission Particulars (NHG)

PROGRAMME ADMISSION PARTICULARS NOTTING HILL GENESIS (incorporated in England with limited liability under the Co-operative and Community Benefit Societies Act 2014 with registration number 7746 and registered with the Regulator of Social Housing under the Housing and Regeneration Act 2008, as amended by the Localism Act 2011, with number 4880) £2,000,000,000 SECURED NOTE PROGRAMME Under this £2,000,000,000 Secured Note Programme (the Programme), Notting Hill Genesis (the Issuer) may from time to time issue Notes (the Notes) as agreed between the Issuer and the relevant Dealer (as defined below). The maximum aggregate principal amount of all Notes from time to time outstanding under the Programme will not exceed £2,000,000,000, subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and any additional Dealer appointed under the Programme from time to time by the Issuer (each a Dealer and together the Dealers), which appointment may be for a specific issue or on an ongoing basis. References in these Programme Admission Particulars to the relevant Dealer shall, in the case of an issue of Notes being (or intended to be) subscribed for by more than one Dealer, be to all Dealers agreeing to subscribe for such Notes. An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see "Risk Factors" below. Application has been made to the London Stock Exchange plc (the London Stock Exchange) for Notes issued under the Programme during the period of 12 months from the date of these Programme Admission Particulars to be admitted to trading on the London Stock Exchange's International Securities Market (the ISM). -

Developing the Homes and Creating the Places That London Needs

DEVELOPING THE HOMES AND CREATING THE PLACES THAT LONDON NEEDS FINAL RESULTS 31 MARCH 2019 DEVELOPING THE HOMES AND CREATING THE PLACES THAT LONDON NEEDS 1 OUR INVESTMENT CASE Proven Market Strong Knowledge strategy opportunity partnerships and experience Focused on London with an Chronic shortage of homes A respected partner to our A highly motivated team increasing commitment to in London and strong build stakeholders, encouraging with extensive experience the delivery of build to rent to rent investor demand new opportunities to work of planning and complex homes together construction in London Substantial Reduced Quality Growing pipeline risk and service business Development pipeline Forward funded build to Delivering quality homes Ability and desire to of 4,900 homes rent transactions reducing to a diverse customer increase output to meet representing £1.6 billion debt and improving risk mix with a 99 per cent significant housing need of future revenue profile recommendation rate in in London 2018 1 2 OUR BUSINESS MODEL OUR KEY RESOURCES AND RELATIONSHIPS RESOURCES RELATIONSHIPS Land Our people Land owners Our customers Knowledge Respected brand Local authorities Build to rent investors Construction expertise Strong balance sheet Housing associations Supply chain WHAT WE DO AND HOW WE CREATE VALUE LAND PLANNING DESIGN CONSTRUCTION SALES ACQUISITION Buying the right Using our Developments that Controlling the Reducing risk, land in the right knowledge to work fit in with local process with driving capital locations across with partners and communities and in-house expertise returns and London optimise policy meet the needs to deliver a quality delivering compliant schemes of customers product excellent customer on programme service 3 AMBITION AND STRATEGY OUR AMBITION There is a chronic shortage of new homes in London. -

Together with Tenants Early Adopters Please See Below the List of Early

Together with Tenants early adopters Please see below the list of early adopters who signed up to support Together with tenants before 4 April 2019. 1. A2Dominion 2. Accent Group 3. Accord 4. Advance 5. Alpha Living 6. Anchor Hanover 7. Arawak Walton 8. Arhag 9. Aspire Housing 10. Believe Housing 11. Bernicia 12. Beyond Housing 13. Black Country Housing Group 14. Bolton at Home 15. Broadacres 16. Broadland Housing Association 17. Byker Community Trust 18. Calico Homes 19. Cheltenham Borough Homes 20. CHP 21. Clarion Housing Group 22. Coastline 23. Cobalt Housing 24. Colne 25. Community Gateway Association Preston 26. Connexus 27. Cornwall Rural Housing Association 28. Cotman Housing Association 29. County Durham Housing Group 30. Crosby Housing Association 31. Cross Keys Homes 32. Derwent Living 33. EMH Group 34. English Rural 35. Evolve Housing + Support 36. Futures Housing Group 37. Gateway Housing 38. Gentoo 39. Gloucester City Homes 40. Great Places Housing Group 41. Greenfields Community Housing National Housing Federation Tel 020 7067 1010 Registered Office: Lion Court, 25 Procter Street, London WC1V 6NY Lion Court Fax 020 7067 1011 25 Procter Street [email protected] National Housing Federation Limited, trading as National Housing Federation London, WC1V 6NY www.housing.org.uk A company with limited liability Registered in England No 302132 42. Guinness Partnership 43. Hastoe 44. Havebury Housing Partnership 45. Home Group 46. Incommunities 47. Irwell Valley Housing 48. Islington and Shoreditch Housing Association 49. Jigsaw Housing Group 50. Johnnie Johnson Housing 51. Lincolnshire Housing Partnership 52. LiveWest 53. Livin 54. Living+ 55. Local Space 56. -

On Site Units Recorded Between Jan-18 and Feb

Start on Site units recorded between Jan-18 and Feb-18 wth 10 or more units Reference: FOI MGLA 130618-4761 Notes: [1] Figures are provisional pending the publication of the GLA official statistics in August 2018. [2] Supported housing schemes have been redacted from the list Project title borough Lead_Organisation_Name dev_org_name planning_permission_ref SoS approval Total start Social Rent Other London Shared Other TBC erence date on sites (and LAR at Affordable Living Rent Ownership Intermedia benchmark Rent te s) Redacted Lewisham One Housing Group Limited One Housing Group Limited 30/01/2018 34 0 34 0 0 0 0 Redacted Lewisham One Housing Group Limited One Housing Group Limited 30/01/2018 19 0 0 0 19 0 0 Redacted Lambeth Network Housing Group Limited Network Housing Group Limited 05/01/2018 40 0 40 0 0 0 0 Redacted Tower Hamlets Islington and Shoreditch Housing Association Limited Islington and Shoreditch Housing Association Limited 02/01/2018 35 0 35 0 0 0 0 Chobham Manor, Newham Newham London & Quadrant Housing (L&Q) 24/01/2018 163 0 75 0 88 0 0 County House - LLR Bromley Hyde Housing Association Limited 29/01/2018 76 0 0 76 0 0 0 Doncaster Drive Ealing London Borough of Ealing 31/01/2018 10 0 0 0 10 0 0 1 Station Square Haringey Newlon Housing Trust HGY/2016/3932 24/01/2018 117 0 0 0 117 0 0 Gallions Phase 1 Newham Notting Hill Housing Trust 14/00664/OUT 29/01/2018 165 4 38 50 73 0 0 Cannons Wharf Lewisham London & Quadrant Housing (L&Q) 30/01/2018 84 0 22 0 62 0 0 Royal Wharf Phase 4 Newham Notting Hill Housing Trust 15/00577/VAR