John Brooks CV

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TALES from the KPMG SKUNK WORKS: the BASIS-SHIFT OR DEFECTIVE-REDEMPTION SHELTER by Calvin H

(C) Tax Analysts 2005. All rights reserved. does not claim copyright in any public domain or third party content. TALES FROM THE KPMG SKUNK WORKS: THE BASIS-SHIFT OR DEFECTIVE-REDEMPTION SHELTER By Calvin H. Johnson Table of Contents Calvin H. Johnson is professor of law at the Uni- versity of Texas at Austin. This report arises out of his I. Was FLIP/OPIS Fair Game? ............433 testimony before the U.S. Senate Permanent Subcom- A. Description of the FLIP/OPIS Basis-Shift mittee on Investigation hearings on the role of profes- Shelter ........................ 433 sionals in the U.S. tax shelter industry. Prof. Johnson has agreed to serve as an expert for plaintiffs who B. The Heart of the Shelter ............ 435 bought KPMG shelters and seek recovery of costs. He C. The Paramount Substance-Over-Form thanks James Martens and Samuel Buell for comments Doctrines ....................... 438 on an earlier draft, but acknowledges responsibility II. FLIP/OPIS and Professional Standards ... 440 for errors. A. The One-in-Three Chance Test ........ 440 In this report, Johnson argues that the basis-shift or B. One-in-Three Applied to Outcomes .... 441 defective-redemption shelter, called FLIP or OPIS by III. Concluding Remarks ................ 442 KPMG, was an early product of KPMG’s endeavor to develop complete tax packages that could be sold for KPMG, the fourth largest accounting firm, is negoti- multimillion-dollar fees to many customers. The ating with the Justice Department over the terms by which it might avoid criminal indictment for its conduct FLIP/OPIS shelter gives a rare opportunity, he says, to 1 see both KPMG internal deliberations and also the arising out of its tax shelters. -

Neoliberalism and the Environmental Movement: Contemporary Considerations for the Counter Hegemonic Struggle Austen K

CORE Metadata, citation and similar papers at core.ac.uk Provided by CU Scholar Institutional Repository University of Colorado, Boulder CU Scholar Undergraduate Honors Theses Honors Program Spring 2016 Neoliberalism and the Environmental Movement: Contemporary Considerations for the Counter Hegemonic Struggle Austen K. Bernier University of Colorado, Boulder, [email protected] Follow this and additional works at: http://scholar.colorado.edu/honr_theses Part of the Environmental Studies Commons, Political Economy Commons, and the Politics and Social Change Commons Recommended Citation Bernier, Austen K., "Neoliberalism and the Environmental Movement: Contemporary Considerations for the Counter Hegemonic Struggle" (2016). Undergraduate Honors Theses. Paper 1013. This Thesis is brought to you for free and open access by Honors Program at CU Scholar. It has been accepted for inclusion in Undergraduate Honors Theses by an authorized administrator of CU Scholar. For more information, please contact [email protected]. Neoliberalism and the Environmental Movement: Contemporary Considerations for the Counter- Hegemonic Struggle By Austen K. Bernier University of Colorado at Boulder A Thesis Submitted to the University of Colorado at Boulder in partial fulfillment of the requirements to receive Honors designation in Environmental Studies May 2016 Thesis Advisors: Liam Downey, Department of Sociology, Committee Chair David Ciplet, Department of Environmental Studies Dale Miller, Department of Environmental Studies © 2016 by Austen Bernier All rights reserved ii Abstract This thesis proposes a conceptual framework for understanding how neoliberalism has decreased the ability of environmental movements to manifest changes in political economic structure or spur state action on environmental issues that might be antagonistic to the neoliberal order. Karl Marx and Karl Polanyi have developed reputable theories that describe social movements as exercising a degree of control over political economy. -

Getting Acquainted with VAT (C) Tax Analysts 2011

Introduction: Getting Acquainted With VAT (C) Tax Analysts 2011. All rights reserved. does not claim copyright in any public domain or third party content. By Martin A. Sullivan Martin A. Sullivan is a contributing editor to Tax Analysts. Until recently, most talk about a value added tax in the United States was an academic exercise. Policy experts kept telling anyone who would listen that we could boost our competitive- ness if some form of a VAT was used to replace all, or at least the worst parts, of our clunky income tax. But there was no pressing need for a VAT and no political incentive to undertake the arduous task of orchestrating a major tax reform. But times are changing. Between the 2007 and 2010 fiscal years, the national debt increased from 36 percent to 62 percent of gross national product. And matters are only getting worse. America is relentlessly moving toward the edge of a fiscal abyss. In Wash- ington, while our leaders may talk tough, they are not taking action. To avoid upsetting voters, they are careful not to even hint at spending cuts or tax increases of the size needed to make a real dent in the problem. With no limit on the national credit card, the daily push and pull of politics continues unhindered by the impending crisis. Our system of checks and balances and the usual political gridlock are partly to blame. Also part of the mix is our national mental block about the federal debt. The tough choices that must be made are outside the scope of current political discourse. -

San Mateo County

san mateo county the newsletter for the Libertarian Party of San Mateo County independence day 2013 image: Robert Santorelli jefferson weeping by Judge Andrew Napolitano Do you have more personal liberty today than on the Fourth of July 2012? When Thomas Jefferson wrote the Declaration of Independence, he used language that has become iconic. He wrote that we are endowed by our Creator with certain inalienable rights, and among them are life, liberty and the pursuit of happiness. Not only did he write those words, but the first Congress adopted them unanimously, and they are still the law of the land today. By acknowledging that our rights are inalienable, Jefferson’s words and the first federal statute recognize that our rights come from our humanity – from within us – and not from the government. The government the Framers gave us was not one that had the power and ability to decide how much freedom each of us should have, but rather one in which we individually and then collectively decided how much power the government should have. That, of course, is also recognized in the Declaration, wherein Jefferson wrote that the government derives its powers from the consent of the governed. To what governmental powers may the governed morally consent contents in a free society? We can consent to the powers necessary to protect us from force and fraud, and to the means of revenue to pay for a government to exercise those powers. But no one can jefferson weeping ........... 111 consent to the diminution of anyone else’s natural rights, because, contact us ……….................... -

The 1812 Streets of Cambridgeport

The 1812 Streets of Cambridgeport The Last Battle of the Revolution Less than a quarter of a century after the close of the American Revolution, Great Britain and the United States were again in conflict. Britain and her allies were engaged in a long war with Napoleonic France. The shipping-related industries of the neutral United States benefited hugely, conducting trade with both sides. Hundreds of ships, built in yards on America’s Atlantic coast and manned by American sailors, carried goods, including foodstuffs and raw materials, to Europe and the West Indies. Merchants and farmers alike reaped the profits. In Cambridge, men made plans to profit from this brisk trade. “[T]he soaring hopes of expansionist-minded promoters and speculators in Cambridge were based solidly on the assumption that the economic future of Cambridge rested on its potential as a shipping center.” The very name, Cambridgeport, reflected “the expectation that several miles of waterfront could be developed into a port with an intricate system of canals.” In January 1805, Congress designated Cambridge as a “port of delivery” and “canal dredging began [and] prices of dock lots soared." [1] Judge Francis Dana, a lawyer, diplomat, and Chief Justice of the Massachusetts Supreme Judicial Court, was one of the primary investors in the development of Cambridgeport. He and his large family lived in a handsome mansion on what is now Dana Hill. Dana lost heavily when Jefferson declared an embargo in 1807. Britain and France objected to America’s commercial relationship with their respective enemies and took steps to curtail trade with the United States. -

Kruzelnick V. Napolitano Summons & Complaint

ESX-L-006413-20 09/28/2020 9:56:03 AM Pg 1 of 19 Trans ID: LCV20201705443 ESX-L-006413-20 09/28/2020 9:56:03 AM Pg 2 of 19 Trans ID: LCV20201705443 DIEGO O. BARROS, ESQ, 182412017 JOSEPH & NORINSBERG, LLC 110 East 59th Street, Suite 3200 New York, New York 10022 Tel: (212) 227-5700 Fax: (212) 656-1889 Email: [email protected] Attorneys for Plaintiff --------------------------------------------------------------------X JAMES KRUZELNICK, SUPERIOR COURT OF NEW JERSEY LAW DIVISION ESSEX COUNTY Plaintiff, Docket No.: -against- COMPLAINT ANDREW NAPOLITANO, JURY TRIAL DEMANDED Defendant. --------------------------------------------------------------------X Plaintiff JAMES KRUZELNICK, by his attorneys JOSEPH & NORINSBERG, LLC, brings this action against defendant ANDREW NAPOLITANO, alleging, on personal knowledge as to him and on information and belief as to all other matters, as follows: JURY DEMAND 1. Plaintiff demands a trial by jury on all issues so triable. JURISDICTION AND VENUE 2. This Court has personal jurisdiction over the Defendant in that on the date of the incidents described herein, defendant owned real property in the State of New Jersey, committed the unlawful acts alleged herein at said property, and is subject to the Court’s Jurisdiction. 3. This Court has jurisdiction over this action because the amount of damages Plaintiff seeks exceeds the jurisdictional limits of all lower courts which would otherwise have jurisdiction. 1 ESX-L-006413-20 09/28/2020 9:56:03 AM Pg 3 of 19 Trans ID: LCV20201705443 4. Venue for this action is proper in the County of Sussex, pursuant to R. 4:3-2 in that venue is properly laid in the county in which the cause of action arose. -

Scholars Criticize International Tax

CURRENT AND QUOTABLE (C) Tax Analysts 2015. All rights reserved. does not claim copyright in any public domain or third party content. tax notes™ Scholars Criticize International profits as a share of GDP — at 9.8% — are nearly at all-time highs.2 Their U.S. taxes as a share of GDP Tax Reform Proposals are just 1.9%, which are near all-time lows.3 [See Figure below] And U.S. corporate taxes as a share of federal revenue have plummeted from 32.1% in This letter to Congress from 24 international tax 4 experts expresses opposition to international tax 1952 to 10.6% last year. Finally, the number of reform proposals under consideration that would cross-border acquisitions involving U.S. and other establish a territorial tax system and a low deemed OECD countries has remained relatively constant repatriation tax rate of 14 percent on $2.1 trillion in over the last decade — U.S. firms acquired 324 existing offshore profits. The letter also summarizes OECD firms in 2006 and 238 in 2014 and OECD research showing that there is no factual basis for firms acquired 311 U.S. firms in 2006 and 226 in the assertion that U.S. multinationals cannot com- 2014.5 pete globally because of the U.S. tax system and U.S. tax rates. There is no factual basis for the assertion that U.S. multinationals cannot compete globally because of the U.S. tax system. The effective tax rates on their Dear Member of Congress: worldwide income, including U.S. taxes, are typi- As legal scholars, economists and practitioners cally far below the 35% statutory rate — at one-half who are experts on international tax issues, we are the 35% rate or even less, according to some esti- writing to express our opposition to current propos- mates. -

The Viability of the Fair Tax

The Fair Tax 1 Running head: THE FAIR TAX The Viability of The Fair Tax Jonathan Clark A Senior Thesis submitted in partial fulfillment of the requirements for graduation in the Honors Program Liberty University Fall 2008 The Fair Tax 2 Acceptance of Senior Honors Thesis This Senior Honors Thesis is accepted in partial fulfillment of the requirements for graduation from the Honors Program of Liberty University. ______________________________ Gene Sullivan, Ph.D. Thesis Chair ______________________________ Donald Fowler, Th.D. Committee Member ______________________________ JoAnn Gilmore, M.B.A. Committee Member ______________________________ James Nutter, D.A. Honors Director ______________________________ Date The Fair Tax 3 Abstract This thesis begins by investigating the current system of federal taxation in the United States and examining the flaws within the system. It will then deal with a proposal put forth to reform the current tax system, namely the Fair Tax. The Fair Tax will be examined in great depth and all aspects of it will be explained. The objective of this paper is to determine if the Fair Tax is a viable solution for fundamental tax reform in America. Both advantages and disadvantages of the Fair Tax will objectively be pointed out and an educated opinion will be given regarding its feasibility. The Fair Tax 4 The Viability of the Fair Tax In 1986 the United States federal tax code was changed dramatically in hopes of simplifying the previous tax code. Since that time the code has undergone various changes that now leave Americans with over 60,000 pages of tax code, rules, and rulings that even the most adept tax professionals do not understand. -

On the Margin

© 2020 Tax Analysts. All rights reserved. Analysts does not claim copyright in any public domain or third party content. ON THE MARGIN tax notes federal High Tax, Low Tax? Comparing Income Tax and Wealth Tax Rates by Erin Melly and Alan D. Viard Without taking a position on the merits of wealth taxation,1 we provide a framework for properly interpreting wealth tax rates and their relationship to income tax rates. Because wealth taxes impose a flow of taxes on a stock of wealth, they cannot be properly stated without specifying a time unit. For example, the top tax rate in the wealth tax proposal by Sen. Elizabeth Warren, D-Mass., is not 6 percent but is instead 6 percent per year. No time units are required for income tax rates, for which a flow of taxes is imposed on a flow of income. We discuss how to translate wealth tax rates into equivalent income tax rates for both safe and Erin Melly is a research associate and Alan D. risky assets. We show that apparently low wealth Viard is a resident scholar at the American tax rates are equivalent to apparently high income Enterprise Institute. They thank Karlyn tax rates and vice versa. Bowman, Alex Brill, Jason Saving, and Michael We critically assess the public and political Strain for helpful comments. discussion of wealth tax rates. We find that the In this article, Melly and Viard clarify the media and the candidates have a mixed record fundamental differences between wealth tax regarding the clarity and accuracy of their rates and income tax rates, and they critique the public discussion of wealth tax rates. -

Open PDF File, 134.33 KB, for Paintings

Massachusetts State House Art and Artifact Collections Paintings SUBJECT ARTIST LOCATION ~A John G. B. Adams Darius Cobb Room 27 Samuel Adams Walter G. Page Governor’s Council Chamber Frank Allen John C. Johansen Floor 3 Corridor Oliver Ames Charles A. Whipple Floor 3 Corridor John Andrew Darius Cobb Governor’s Council Chamber Esther Andrews Jacob Binder Room 189 Edmund Andros Frederick E. Wallace Floor 2 Corridor John Avery John Sanborn Room 116 ~B Gaspar Bacon Jacob Binder Senate Reading Room Nathaniel Banks Daniel Strain Floor 3 Corridor John L. Bates William W. Churchill Floor 3 Corridor Jonathan Belcher Frederick E. Wallace Floor 2 Corridor Richard Bellingham Agnes E. Fletcher Floor 2 Corridor Josiah Benton Walter G. Page Storage Francis Bernard Giovanni B. Troccoli Floor 2 Corridor Thomas Birmingham George Nick Senate Reading Room George Boutwell Frederic P. Vinton Floor 3 Corridor James Bowdoin Edmund C. Tarbell Floor 3 Corridor John Brackett Walter G. Page Floor 3 Corridor Robert Bradford Elmer W. Greene Floor 3 Corridor Simon Bradstreet Unknown artist Floor 2 Corridor George Briggs Walter M. Brackett Floor 3 Corridor Massachusetts State House Art Collection: Inventory of Paintings by Subject John Brooks Jacob Wagner Floor 3 Corridor William M. Bulger Warren and Lucia Prosperi Senate Reading Room Alexander Bullock Horace R. Burdick Floor 3 Corridor Anson Burlingame Unknown artist Room 272 William Burnet John Watson Floor 2 Corridor Benjamin F. Butler Walter Gilman Page Floor 3 Corridor ~C Argeo Paul Cellucci Ronald Sherr Lt. Governor’s Office Henry Childs Moses Wight Room 373 William Claflin James Harvey Young Floor 3 Corridor John Clifford Benoni Irwin Floor 3 Corridor David Cobb Edgar Parker Room 222 Charles C. -

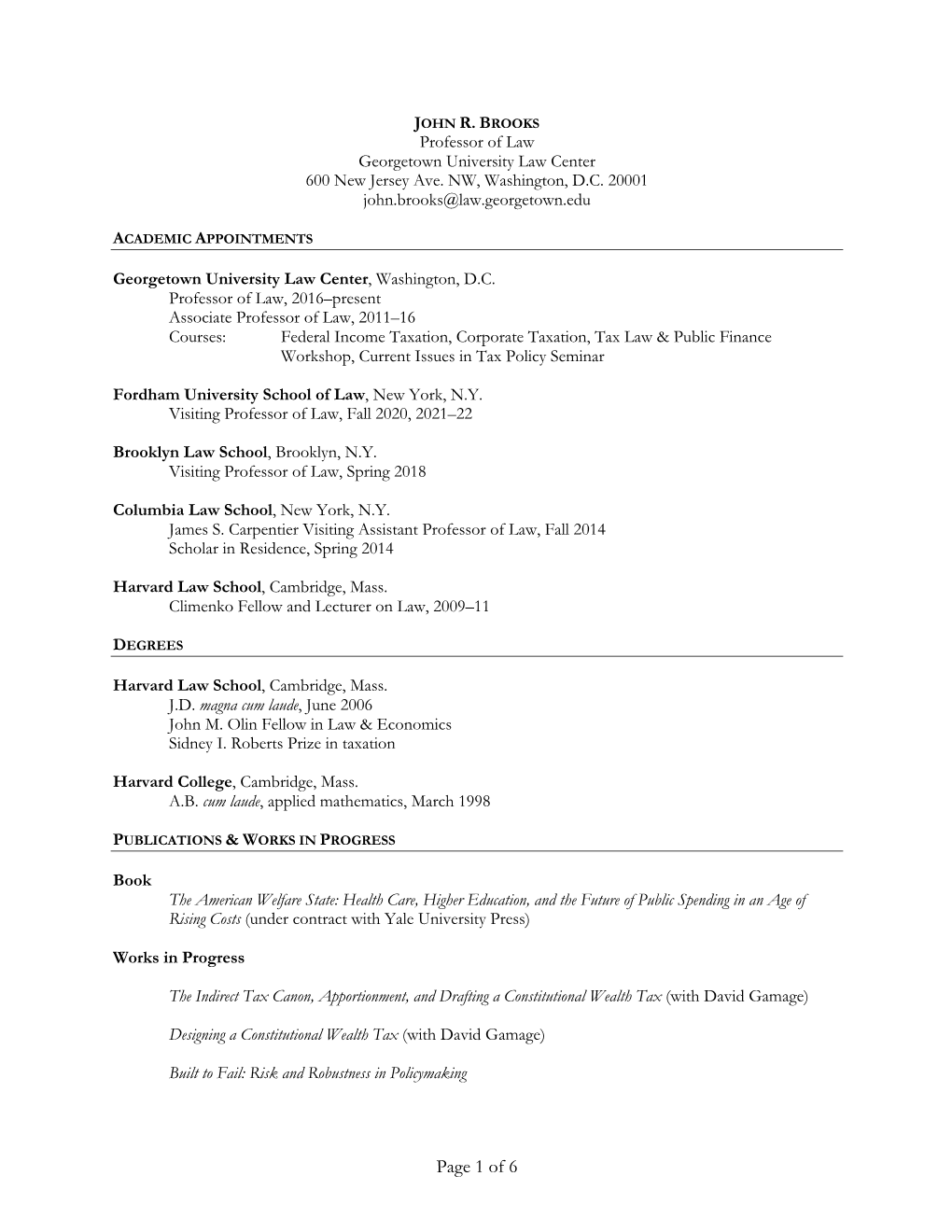

CV in PDF Format

PROFESSOR TODD J. ZYWICKI GEORGE MASON UNIVERSITY FOUNDATION PROFESSOR OF LAW GEORGE MASON UNIVERSITY SCHOOL OF LAW 3301 N. FAIRFAX DR. ARLINGTON, VA 22201 703-993-9484 [email protected] Web Page: http://mason.gmu.edu/~tzywick2/ PUBLICATIONS BOOKS CONSUMER CREDIT AND THE AMERICAN ECONOMY (with Thomas Durkin, Gregory Elliehausen, and Michael Staten), (Oxford University Press, 2014). PUBLIC CHOICE CONCEPTS AND APPLICATIONS IN LAW (with Maxwell Stearns) (West Publishing, 2009). Editor, The Rule of Law, Freedom, and Prosperity, 10 SUPREME COURT ECONOMIC REVIEW (Chicago: University of Chicago Press, 2003. 278 pp. ISBN: 0-226-99962-9). • Reviewed by Professor William A. Fischel, 14(6) LAW AND POLITICS BOOK REV. 493-97 (June 2004). ARTICLES AND BOOK CHAPTERS Bruno Leoni's Legacy and Continued Relevance, __ J. PRIVATE ENTERPRISE __ (Forthcoming 2015). Commentary on CFPB Report: Data Point: Checking Account Overdraft (with G. Michael Flores). Price Controls on Payment Card Interchange Fees: The U.S. Experience (with Geoffrey Manne and Julian Morris), ICLE Financial Regulatory Research Program White Paper 2014-2 (2014). Behavior, Paternalism, and Policy: Evaluating Consumer Financial Protection, __ NYU J. L. & LIBERTY __ (forthcoming 2014). Keynote Address: Is There a George Mason School of Law and Economics? __ J. LAW, ECONOMICS & POLICY __ (Forthcoming 2014). Uncertainty, Evolution, and Behavioral Economic Theory (with Geoffrey Manne), __ J. LAW, ECONOMICS & POLICY __ (Forthcoming 2014). Overdraft Protection and Consumer Protection: A Critique of the CFPB's Analysis of Overdraft Programs (with G. Michael Flores and Brian M. Deignan), 33(3) BANKING AND FINANCIAL SERVICES POLICY REPORT 10 (March 2014). The Consumer Financial Protection Bureau, in PERSPECTIVES ON DODD-FRANK AND FINANCE (Forthcoming 2014, MIT Press). -

Tax Experimentation

Florida Law Review Volume 71 Issue 1 Article 2 Tax Experimentation Michael Abramowicz Follow this and additional works at: https://scholarship.law.ufl.edu/flr Part of the Tax Law Commons Recommended Citation Michael Abramowicz, Tax Experimentation, 71 Fla. L. Rev. 65 (). Available at: https://scholarship.law.ufl.edu/flr/vol71/iss1/2 This Article is brought to you for free and open access by UF Law Scholarship Repository. It has been accepted for inclusion in Florida Law Review by an authorized editor of UF Law Scholarship Repository. For more information, please contact [email protected]. Abramowicz: Tax Experimentation TAX EXPERIMENTATION Michael Abramowicz* Abstract Random experiments could allow the government to test tax policies before they are enacted into general law. Such experiments can be revenue-neutral, with the tax authority ensuring ex post that average tax revenues received from taxpayers in the treatment and control groups are equal. Taxpayers might thus volunteer even for experiments that would broaden the tax base, for example by eliminating deductions. Continued participation by taxpayers in such experiments would indicate that the proposed reforms are efficient at least if externalities are disregarded. Non-revenue-neutral experiments raise greater concerns about horizontal inequity, but they may be helpful in addressing questions about effects of tax rates and in increasing participation. INTRODUCTION .......................................................................................66 I. REVENUE-NEUTRAL TAX EXPERIMENTS ..................................76 A. A Hypothetical Experiment ..............................................76 1. The Potential Benefit to Taxpayers...........................76 2. Adjustments to Ensure Revenue Neutrality ..............77 3. Evaluation of Experimental Success.........................80 4. Enhancement of Experimental Interpretability...........................................................81 a. Varying the Treatment .......................................83 b.