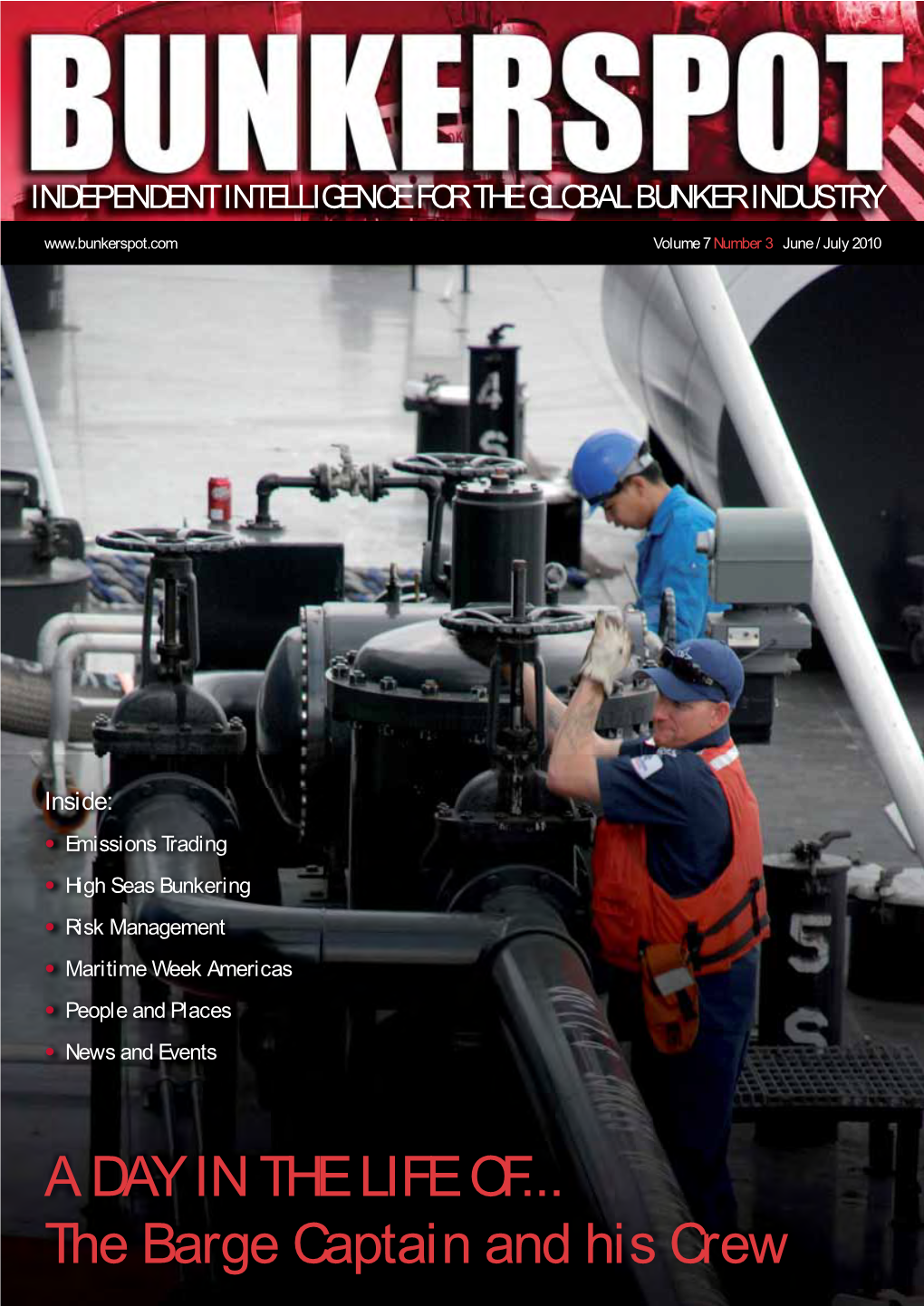

A DAY in the LIFE OF... the Barge Captain and His Crew Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economic and Social Council Distr.: General 29 June 2004 English Original: English/French/Spanish

United Nations E/CN.5/2004/INF/1 Economic and Social Council Distr.: General 29 June 2004 English Original: English/French/Spanish Commission for Social Development Forty-second session 4-13 and 20 February 2004 List of delegations Liste des délégations Lista de las delegaciones Note: Delegations are requested to send their corrections to the following list in writing to the Secretary of the Commission, room S-2950F, Secretariat Building. Note: Les délégations sont priées d’envoyer leurs corrections à la présente liste, par écrit à La Secrétaire de la Commission, bureau S-2950F, Bâtiment du Secrétariat. Note: Se ruega a las delegaciones se sirvan enviar sus correcciones a la siguiente lista, por escrito, a la Secretaría de la Comisión, oficina S-2950F, edificio de la Secretaría. Chairman: Mr. Jean-Jacques Elmiger (Switzerland) Vice-Chairpersons: Mr. Prayono Atiyanto (Indonesia) Mr. Carlos Enrique García González (El Salvador) Ms. Ivana Grollová (Czech Republic) Mr. Mwelwa C. Musambachime (Zambia) 04-41271 (E) 090704 *0441271* E/CN.5/2004/INF/1 MEMBERS MEMBRES MIEMBROS COUNTRY REPRESENTATIVE ALTERNATES ADVISERS PAYS REPRESENTANT SUPPLEANTS CONSEILLERS PAIS REPRESENTANTE SUPLENTES CONSEJEROS Argentina S.E. Sr. Domingo Cullen Sr. Luis Norberto Ivancich Sr. Martín García Moritán Sra. María Fabiana Loguzzo Austria H.E. Mr. Gerhard Ms. Gerda Vogl Pfanzelter Ms. Eveline Hönigsperger Ms. Silvia Moor Ms. Irene Slama Ms. Iris Dembsher Bangladesh H.E. Mr. Iftekhar Ahmed Ms. Samina Naz Chowdhury Belarus H.E. Mr. Aleg N. Ivanou Ms. Anzhela K. Karnyaluk Mr. Andrei A. Taranda Benin Bulgaria Ms. Ivanka Hristova Mr. Stefan Tafrov Mr. Rayko Raytchev Mr. Nikolay Anguelov Ms. -

United Nations

A/61/2 United Nations Report of the Security Council 1 August 2005-31 July 2006 General Assembly Official Records Sixty-first Session Supplement No. 2 (A/61/2) General Assembly Official Records Sixty-first Session Supplement No. 2 (A/61/2) Report of the Security Council 1 August 2005-31 July 2006 United Nations • New York, 2006 A/61/2 Note Symbols of United Nations documents are composed of capital letters combined with figures. Mention of such a symbol indicates a reference to a United Nations document. Documents of the Security Council (symbol S/...) are normally published in quarterly Supplements to the Official Records of the Security Council. The date of the document indicates the supplement in which it appears or in which information about it is given. The resolutions of the Security Council are published in yearly volumes of Resolutions and Decisions of the Security Council. ISSN 0082-8238 Contents Chapter Page Introduction ................................................................... 1 Part I Activities relating to all questions considered by the Security Council under its responsibility for the maintenance of international peace and security I. Resolutions adopted by the Security Council during the period from 1 August 2005 to 31 July 2006................................................................... 23 II. Statements made by the President of the Security Council during the period from 1 August 2005 to 31 July 2006 .................................................... 27 III. Official communiqués issued by the Security Council during the period from 1 August 2005 to 31 July 2006 ................................................................ 30 IV. Monthly assessments by former Presidents of the work of the Security Council for the period from 1 August 2005 to 31 July 2006 .............................................. -

Turkish Migration Conference 2016 Book of Abstracts

The Migration Conference 2017 Programme and Abstracts Book Compiled by Fethiye Tilbe, Ibrahim Sirkeci, Mehtap Erdogan TRANSNATIONAL PRESS LONDON 2017 The Migration Conference 2017 - Programme and Abstracts Book Compiled by Fethiye Tilbe, Ibrahim Sirkeci, Mehtap Erdogan Copyright © 2017 by Transnational Press London All rights reserved. First Published in 2017 by TRANSNATIONAL PRESS LONDON in the United Kingdom, 12 Ridgeway Gardens, London, N6 5XR, UK. www.tplondon.com Transnational Press London® and the logo and its affiliated brands are registered trademarks. This book or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in a book review or scholarly journal. Requests for permission to reproduce material from this work should be sent to: [email protected] Paperback ISBN: 978-1-910781-68-5 Cover Design: Nihal Yazgan @nihalidea.com Conference website: www.migrationcenter.org CONTENT: SESSIONS AND TIMETABLE Welcome by the chairs ........................................................................................... vi Main Speakers: ...................................................................................................... vii ORGANISING TEAM........................................................................................... ix Conference Chairs .................................................................................................. ix Conference Advisory Committee ........................................................................... -

Economic and Social Council Distr.: General 10 June 2004 English Original: English/French/Spanish

United Nations E/CN.9/2004/INF/1 Economic and Social Council Distr.: General 10 June 2004 English Original: English/French/Spanish Commission on Population and Development Thirty-seventh session 22-26 March and 6 May 2004 List of delegations Liste des délégations Lista de las delegaciones Note: Delegations are requested to send their corrections to the following list in writing to the Secretary of the Commission, room S-2950A, Secretariat Building. Note: Les délégations sont priées d’envoyer leurs corrections à la présente liste, par écrit à la Secrétaire de la Commission, bureau S-2950A, bâtiment du Secrétariat. Nota: Se ruega a las delegaciones se sirvan enviar sus correcciones a la siguiente lista, por escrito, a la Secretaría de la Comisión, oficina S-2950A, edificio de la Secretaría. Chairperson: Alfredo Chuquihuara (Peru) Vice-Chairpersons: Khondker M. Talha (Bangladesh) Gediminas Šerkšnys (Lithuania) Kitty van der Heijden (Netherlands) Vice-Chairman-cum-Rapporteur: Mohamed Elfarnawany (Egypt) 04-38815 (E) 160604 *0438815* E/CN.9/2004/INF/1 MEMBERS MEMBRES MIEMBROS COUNTRY REPRESENTATIVE ALTERNATES ADVISERS PAYS REPRESENTANT SUPPLEANTS CONSEILLERS PAIS REPRESENTANTE SUPLENTES CONSEJEROS Austria Mr. Martin Meisel Ms. Alexandra Werba H.E. Mr. Gerhard Ms. Ulrike Plichta Pfanzelter Mr. Wolfgang Lutz Bangladesh H.E. Mr. Iftekhar Ahmed Mr. Khondker M. Talha Chowdhury Belgium H.E. Mr. Jean de Ruyt Mr. Bruno van der Pluijm Mrs. Thérèse Delvaux Mrs. Nicole Malpas Mr. Ronald Schoenmaeckers Bolivia H.E. Sr. Ernesto H.E. Sr. Erwin Ortiz Aranibar Gandarillas Quiroga Sr. René Pereira Morató Sr. Ruddy José Flores Monterrey Botswana H.E. Mr. Alfred M. Dube Mr. -

Co-Ordinated By

Co-ordinated by: Last updated: February 2019 Julia Zelvenska Head of Legal Support and Litigation European Council on Refugees and Exiles (ECRE) Rue Royale 146, 1st floor 1000 Brussels, Belgium Tel: +32 (2) 212 0814 Fax: +32 (2) 514 5922 E-mail: [email protected] CONTENTS A. Introduction Preface i European Council on Refugees and Exiles (ECRE) ii Introduction to ELENA iii B. Countries Austria 1 Belgium 8 Bosnia-Herzegovina 13 Bulgaria 15 Croatia 19 Cyprus 23 Czech Republic 26 Denmark 28 Estonia 32 Finland 34 France 37 Germany 47 Greece 57 Hungary 62 Iceland 65 Ireland 68 Italy 73 Latvia 87 Lithuania 89 Luxembourg 91 Malta 94 The Netherlands 97 Norway 102 Poland 108 Portugal 111 Romania 114 Russia 117 Serbia 121 Slovak Republic 125 Slovenia 128 Spain 133 Sweden 145 Switzerland 153 Turkey 156 Ukraine 159 United Kingdom 161 C. UNHCR Offices 165 D. Format of the country chapters In general the country chapters are structured as follows: I. ELENA NATIONAL COORDINATOR Name and address of the person who serves as the contact and coordination person for the ELENA network for the country in question. II. NATIONAL UMBRELLA ORGANISATIONS / REFUGEE COUNCILS National umbrella organisations of voluntary agencies, counselling offices and lawyers who exercise a coordinating function. III. ORGANISATIONS SUPPORTING ASYLUM SEEKERS Voluntary agencies, counselling centres and other humanitarian organisations dealing with counselling, housing, financial support, integration and other social problems of asylum seekers during the asylum procedure. IV. ORGANISATIONS PROVIDING ADVICE TO ASYLUM SEEKERS Non-Governmental Organisations and voluntary agencies providing legal advice and assistance to asylum seekers. -

Elena Co-Ordinators

Co-ordinated by: Last updated: August 2019 ELENA CO-ORDINATORS The ECRE Secretariat coordinates the European Legal Network on Asylum (ELENA), aided by national coordinators. In addition to sharing and gathering information at the national level, the coordinators are available to respond to individual information requests. Julia Zelvenska Head of Legal Support and Litigation European Council on Refugees and Exiles (ECRE) Rue Royale 146, 1st floor 1000 Brussels, Belgium Tel: + 32 (0)2 212 0814 Fax: + 32 (0)2 514 5922 E-mail: [email protected] Austria Czech Republic Olivia Schöfl Hana Frankova Diakonie Flüchtlingsdienst OPU (Organisation for Aid to Refugees) Bürgerstraße 21, 6020 Innsbruck Kovářská 4, Prague 9, 19 00 Tel: +43 (0) 1 405 62 95 Tel: +420 730 158 781 or 779 Fax: +43 (0) 512 29 71 27 E-mail: [email protected] E-mail: [email protected] Denmark Lina Hössl-Neumann Lene Mølgaard Kristensen Caritas Austria Danish Refugee Council Albrechtskreithgasse 19 Borgergade 10 A-1160 Vienna DK- 1300 Copenhagen Tel: +43 664 82 669 34, Tel.: +45 (33) 73 52 92 Fax: +43 (0) 1/488 31-9400 Fax: +45 (33) 91 45 07 E-mail: lina-malin.neumann@caritas- E-Mail: [email protected] austria.at Estonia Belgium Liina Laanpere Tristan Wibault Parda 4, 10117 Tallinn Cabinet d'avocats du Quartier des Tel: +372 644 5148 Libertés Fax: +372 646 5148 Rue du Congrès, 49 E-mail: [email protected] 1000 Bruxelles Tel.: +32 2 588 10 22 Finland Fax : 02 / 210.02.09 Marjaana Laine [email protected] Refugee Advice Centre Finland Kaisaniemenkatu 4 A, 6th floor Bulgaria 00100 Helsinki Iliana Savova Finland Bulgarian Helsinki Committee Tel.: +358 (0) 75 7575 123 1, Uzundjovska Street, Sofia 1000 Fax. -

United Nations

... ... UNITED NATIONS Distr .. Limited 7 October 2004 PROTOCOL AND LIAISON LIST OF DELEGATIONS TO THE FIFTY-NINTB SESSION OF THE GENERAL ASSEMBLY I. MEMBERSTATFS pqgc pqgr Afghanistan ......................................................................... 5 Cyprus .............................................................................. 33 ...................................................................... 5 Cmh Republic ............................ .......................... 34 Algeria ............................................................................... 6 Democratic People's Republic of Andorra............................................................................... 7 Dcnmarlc....................................... Angola ................................................................................ 7 Djibouti ........................................ Antigua and Barbuda .......................................................... 8 Dominica .......................................................................... 37 ....................................................................... 8 ....................................................................... 9 .................... ..................................................................... 9 .................... .............................................................................. 10 El Salvador........................ Azerbaijan ........................................................................ 12 Bahamas .......................................................................... -

Co-Ordinated By

Co-ordinated by: Last updated: November 2017 NB The list of the ELENA coordinators is up-to-date as of May 2018 Julia Zelvenska Head of Legal Support and Litigation European Council on Refugees and Exiles (ECRE) Rue Royale 146, 1st floor 1000 Brussels, Belgium Tel: +32 (2) 212 0814 Fax: +32 (2) 514 5922 E-mail: [email protected] CONTENTS A. Introduction Preface i European Council on Refugees and Exiles (ECRE) ii Introduction to ELENA iii B. Countries Austria 1 Belgium 8 Bosnia-Herzegovina 14 Bulgaria 15 Croatia 18 Cyprus 21 Czech Republic 23 Denmark 25 Estonia 29 Finland 30 France 32 Germany 42 Greece 51 Hungary 56 Iceland 60 Ireland 63 Italy 68 Latvia 81 Lithuania 83 Luxembourg 85 Malta 88 The Netherlands 91 Norway 96 Poland 102 Portugal 104 Romania 107 Russia 110 Serbia 114 Slovak Republic 118 Slovenia 120 Spain 124 Sweden 136 Switzerland 144 Turkey 147 Ukraine 150 United Kingdom 152 C. UNHCR Offices 156 D. Format of the country chapters In general the country chapters are structured as follows: I. ELENA NATIONAL COORDINATOR Name and address of the person who serves as the contact and coordination person for the ELENA network for the country in question. II. NATIONAL UMBRELLA ORGANISATIONS / REFUGEE COUNCILS National umbrella organisations of voluntary agencies, counselling offices and lawyers who exercise a coordinating function. III. ORGANISATIONS SUPPORTING ASYLUM SEEKERS Voluntary agencies, counselling centres and other humanitarian organisations dealing with counselling, housing, financial support, integration and other social problems of asylum seekers during the asylum procedure. IV. ORGANISATIONS PROVIDING ADVICE TO ASYLUM SEEKERS Non-Governmental Organisations and voluntary agencies providing legal advice and assistance to asylum seekers. -

Greece - 197 Years of Independence

INE ’CLOCK N SUPPLEMENTS Greece - 197 Years of Independence H.E. Mr. Vassilis Papadopoulos, Congratulatory message Ambassador of Hellenic Republic in Romania: from Romania’s Ministry of Foreign Affairs: Romania and Greece, traditional friends and Sharing a common history since ancient allies, enhance their relationship in all fields of times, Romania and Greece are proudly honoring mutual interest, towards a prosperous future today the past for projecting an within the EU enhanced partnership in the future g Page 4 g Page 4 The Positive Impetus Christodoulos Seferis, President of the Hellenic Romanian Bilateral Chamber of Commerce: of Bilateral Economic & Commercial Greece - one of the most Relations Continues modern member states of the European Union g Page 6 g Page 7 PAGE 4 SPECIAL NINE O’CLOCK • FRIDAY-SUNDAY, MARCH 23-25 2018 H.E. Mr. Vassilis Papadopoulos, Ambassador of Hellenic Republic in Romania: Romania and Greece, traditional friends and allies, enhance their relationship in all fields of mutual interest, towards a prosperous future within the EU On the 25th of March, we, the Greek the Trilateral Format of the Ministers Tourist Offices of Romania, Greece steadi- people, celebrate the 197th anniversary of Foreign Affairs of Greece, Bulgaria and ly remains a summer destination for the 1821 Revolution against the Ottoman Romania (held in Bucharest), Ministers more than 1,3 million Romanian rule that led to the founding of the Hellenic Kotzias, Zaharieva and Melescanu stressed tourists. The flights between Bucharest Republic. In Romania, the celebration has a once more our three countries’ firm support and Athens are frequent, since 3 airline special significance for the Greek people, for a stronger, consolidated, cohesive and companies are currently connecting the two since the first heroic battles took place here, prosperous European Union and under- capitals. -

Safe! Social Map

Safe! Social Map Safe and Adequate Return, Fair Treatment and Early Identification of Victims of Trafficking from Third Countries outside the EU December 2018 Acknowledgements This social map was developed in co-creation by La Strada International and CoMensha in the Netherlands, within the framework of the project SAFE! - Safe and Adequate Return, Fair Treatment and Early Identification of Victims of Trafficking from Third Countries outside the EU. La Strada International will publish the social map on its www.lastradainternational.org and will ensure that it will be regularly updated. The Safe! project was co-financed by the Asylum Migration and Integration Fund (AMIF) of the European Union, the Dutch Ministry of Justice and Security and the Dutch Ministry for Welfare Health and Sport. The Safe! project was coordinated by the Dutch shelter organisation HVO-Querido and consisted of a unique consortium comprising the following organisations: Animus Association | La Strada Bulgaria, IOM Bulgaria, National Commission for Combating Traffic in Human Beings in Bulgaria, IOM Hungary, National Police Hungary, CoMensha (Dutch Coordination Centre against Human Trafficking), FairWork, Humanitas Rotterdam, IOM Netherlands, National Police Netherlands, La Strada International and Open Gate | La Strada North Macedonia. The Safe! project was co-financed by the Asylum Migration and Integration Fund (AMIF) of the European Union, the Dutch Ministry of Justice and Security and the Dutch Ministry for Welfare Health and Sport 2 Safe! Social Map La Strada International, December 2018 3 Safe! Social Map La Strada International, December 2018 4 Safe! Social Map La Strada International, December 2018 Non-governmental organisations (NGOs) specialised in early identification, safe return and reintegration support to victims of trafficking The social map covers the following European countries: 1. -

Permanent Missions to the United Nations

Permanent Missions to the United Nations ST/SG/SER.A/293 Executive Office of the Secretary-General Protocol and Liaison Service Permanent Missions to the United Nations Nº 293 March 2005 United Nations, New York Note: This publication is prepared by the Protocol and Liaison Service for information purposes only. The listings relating to the permanent missions are based on information communicated to the Protocol and Liaison Service by the permanent missions, and their publication is intended for the use of delegations and the Secretariat. They do not include all diplomatic and administrative staff exercising official functions in connection with the United Nations. Further information concerning names of members of permanent missions entitled to diplomatic privileges and immunities and other mission members registered with the United Nations can be obtained from: Protocol and Liaison Service Room S-201 Telephone: (212) 963-7174 Telefax: (212) 963-1921 United Nations, New York All changes and additions to this publication should be communicated to the above Service and are recorded in a weekly addendum. Contents I. Member States maintaining permanent missions at Headquarters Afghanistan.......... 2 Democratic People’s Kenya ............. 138 Albania .............. 4 Republic Kuwait ............ 140 Algeria .............. 5 of Korea ......... 70 Kyrgyzstan ........ 141 Andorra ............. 7 Democratic Republic Lao People’s Angola .............. 8 of the Congo ..... 71 Democratic Antigua Denmark ........... 72 Republic ........ 142 and Barbuda ..... 10 Djibouti ............ 74 Latvia ............. 143 Argentina ........... 11 Dominica ........... 75 Lebanon........... 144 Armenia ............ 13 Dominican Lesotho ........... 145 Australia............ 14 Republic ......... 76 Liberia ............ 146 Austria ............. 16 Ecuador ............ 79 Libyan Arab Azerbaijan.......... 18 Egypt............... 80 Jamahiriya ...... 147 Bahamas............ 19 El Salvador ......... 82 Liechtenstein ..... -

Argo Group Limited

Global Emerging Markets Specialist Argo Group Limited 33-37 Athol Street, Douglas, Isle of Man, IM1 1LB T: +3 572 266 8900, F: +3 572 244 5177 December 2010 0 Contents • Introduction to Argo • The Market Opportunity • Strategies • Investment Process • Track Record • The Fund Range • Key Managers & Achievements 1 Introduction to Argo • Tracing its roots back to 2000, Argo Group Limited is an alternative investment management group offering a multi-strategy investment platform in global Emerging Markets (EM): its shares are quoted on AIM. The two principal operating subsidiaries are Argo Capital Management (Cyprus) Limited, the investment manager to the funds and Argo Capital Management Limited, the London-based investment advisory company. These companies are individually or collectively referred to as “Argo”. • Argo is a fundamental value investor that aims to deliver low volatility, double-digit absolute returns by utilising an array of different strategies including fixed income relative value, special situations, local currencies and rates, private equity, real estate, high yield corporate credit and distressed debt. • Argo manages five funds and has one of the longest investment track records in its peer group. • Argo manages The Argo Fund, the award-winning Argo Global Special Situations Fund and the Argo Capital Partners Fund, which is a private equity fund. Argo Capital Management Property Limited, an affiliate company, manages the closed-end AIM listed Argo Real Estate Opportunities Fund Limited. • Argo also manages the Argo Distressed Credit Fund (ADCF). Launched in 2008 in the middle of the crisis designed to take advantage of deep value opportunities in the credit markets. It invests in stressed and distressed credit opportunities using bottom-up, fundamental analysis.