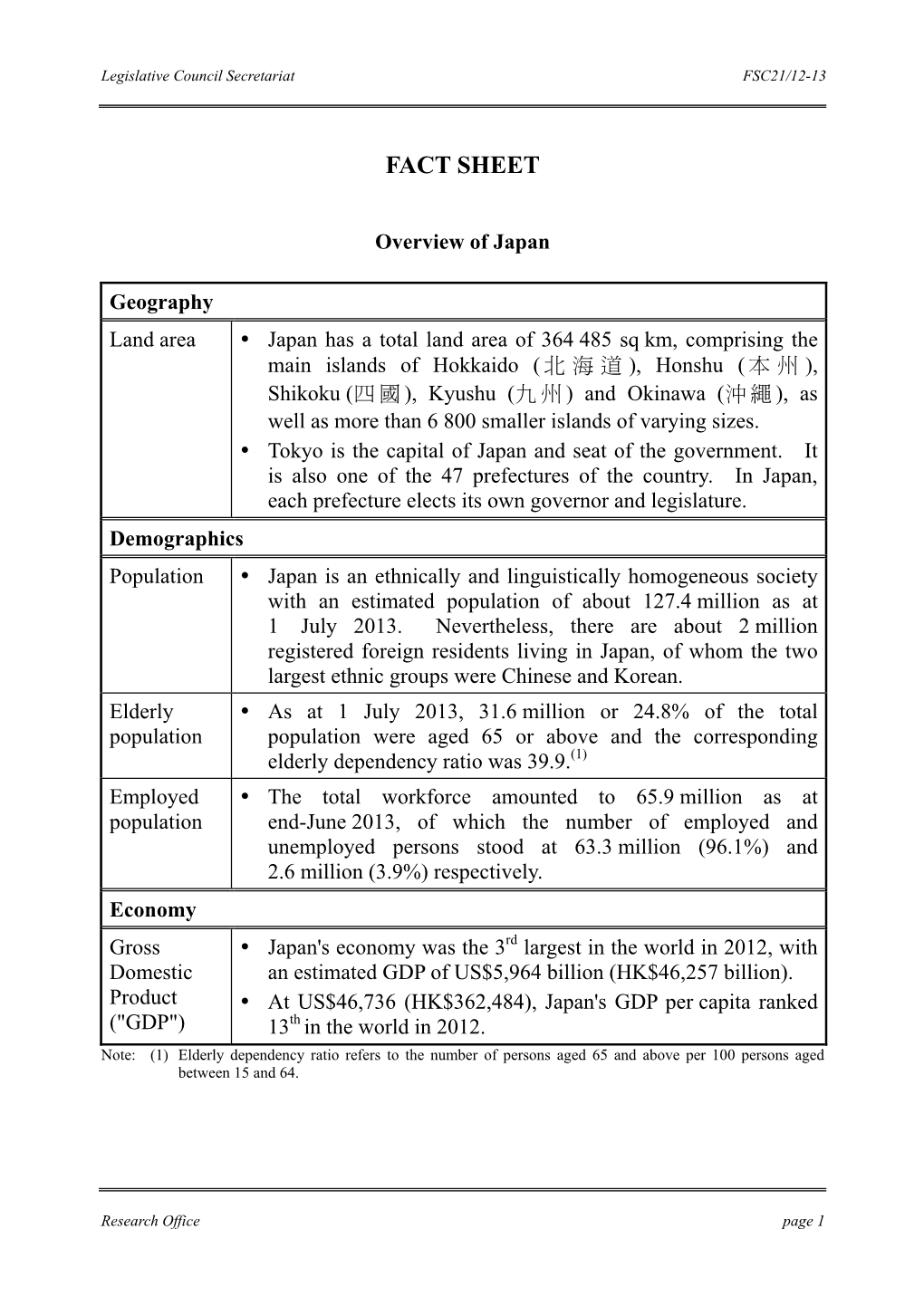

Fact Sheet Entitled "Overview of Japan" Prepared by the Legislative

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

La's Little Tokyo Unveils Eco Plan Japan Marks 3.11 Anniversary Film

_________THE NATIONAL NEWSPAPER_OF THE .JACL _________ l.A.'s Little Tokyo Unveils Eco Plan Japan Marks 3.11 Anniversary Film 'Stories From Tohoku' Captures 3.11 Aftermath #3229/VOL. 158, No.5 ISSN: 0030-8579 WWW.PACIFICCITIZEN.ORG March 21-April 3, 2014 2 March 21-April 3, 2014 COMMENTARY PACIFIC e CITIZEN HOW TO REACH US Spring campaign Aids P.C.'s Future Email: [email protected] Online: www.pacificcitizen.org Tel: (213) 620-1767 Fax: (213) 620-1768 Mail: 250 E. FirstSt., Suite 301 s I begin my second year outcomes, directors can make adjustments through a process called Los Angeles, CA 90012 on the editorial board of "forecasting." The catch is, you can only make changes in your STAFF A the Pacific Citizen, I am forecast if it improves the bottom line. So, if you start a new program Executive Editor reminded of my days as a journalist or if you won't need to spend next month's budgeted program Allison Haramoto working at the Rafu Shimpo, the supplies, then you can add that revenue or remove those expenses. Reporter Japanese American daily newspaper But you can't add expenses without at least adding the same amount Nalea J. Ko in Los Angeles. III revenue. Business Manager Truth be told, it was my first And, of course, being at a nonprofit means there is an indelible Susan Yokoyama full-time job, and it took a while to fundraising component to your work. Production Artist get my head out of the fog of life Which brings me to the P.C. -

Japan Joint Nuclear Energy Action Plan

United States -Japan Joint Nuclear Energy Action Plan 1. Introduction 1.1 Background and Objective President Bush of the United States and Prime Minister Koizumi of Japan have both stated their strong support for the contribution of nuclear power to energy security and the global environment. Japan was the first nation to endorse President Bush's Global Nuclear Energy Partnership. During the June 29,2006 meeting between President Bush and Prime Minister Koizumi, "We discussed research and development that will help speed up fnt breeder reactors and new types of reprocessing so that we cmt help deal with the cost of globalization when it comes to energy; make ourselves more secure, economicallyIas well n make us less dependent on hycirocmbons ..... " (I) "U.S.Japanpmtnershipstamis n one of the most accomplished bilateral relationship in history. They reviewed with great sarisfaction the broadened and enhunced cooperuh'on achieved in the alliance Mder their joint steward~hip, and together heralded a new U.S.Japan Alliance of Glohal Cooperation for the 21st Cenhuy. " (2) On January 9,2007, Samuel W. Bodman, Secretary of Energy of the United States, and Akira Amari, Minister of Economy, Trade and Industry of Japan, met in Washingtun, D.C. to review their current and prospective cooperative activities in the energy field. The Secretary and the Minister agreed that both sides are committed to collaboration on the various aspects of the civilian nuclear fuel cycle. They agreed that the United States and Japan would jointly develop a civil nuclear energy action plan that would support such collaboration. Tbe plan would focus on: (a) research and development activities under the Global Nuclear Energy Partnership initiative that will build upon the significant civilian nuclear energy technical cooperation already underway; (b) collaboration on policies and programs that support the cowtrwtion of new nuclear power plants; and (c) regulatory and nonproliferation-related exchanges. -

JAPAN LABOR BULLETIN Vol.36 - No.09, September

JAPAN LABOR BULLETIN Vol.36 - No.09, September JAPAN LABOR BULLETIN ISSUED BY THE JAPAN INSTITUTE OF LABOUR Vol.36 - No.09 September 1997 CONTENTS General Survey Preliminary Release of the 1997 White paper Working Conditions and the Labor Market Outcome of a Special Survey of the Labor Force Survey in 1997 Human Resources Management Fifty Five Percent of Big Companies Have an Early-Retirement Preferential Program: Preliminary Results from the 1997 Employment Management Survey Labor-Management Relations Tekko Roren Shifting to Multiple-Year Agreements 1997 Shunto Wage Talks Settled with Greater Emphasis on Bonuses Public Policy First Female Administrative Vice Minister for Labor Special Topic "Personal Rights" in the Workplace: The Emerging Law Concerning Sexual Harassment in Japan Statistical Aspects Recent Labor Economy Indices Trends in the Percentage of Those Who were Became Unemployed in the Last Year by Current Employments Status - 1 - JAPAN LABOR BULLETIN Vol.36 - No.09, September New Minister of Labour Prime Minister Ryutaro Hashimoto reshuffled his Cabinet on September 11 with the inauguration of the second Hashimoto Cabinet, Bunmei Ibuki, a member of the LDP, was appointed as the new Minister of Labour, replacing former Labour Minister Yutaka Okano. Ibuki was born in Kyoto city in 1938. After graduating from the Kyoto University, he joined the Ministry of Finance and was attached to the Budget Bureau and the International Finance Bureau. Before entering politics in 1983, Ibuki also served as a Private Secretary to the Minister of Finance. With his experience as the vice minister for Ministry of Health and Welfare, he is well-versed in policy matters, especially social welfare. -

The Limits of Forgiveness in International Relations: Groups

JANUS.NET, e-journal of International Relations E-ISSN: 1647-7251 [email protected] Observatório de Relações Exteriores Portugal del Pilar Álvarez, María; del Mar Lunaklick, María; Muñoz, Tomás The limits of forgiveness in International Relations: Groups supporting the Yasukuni shrine in Japan and political tensions in East Asia JANUS.NET, e-journal of International Relations, vol. 7, núm. 2, noviembre, 2016, pp. 26- 49 Observatório de Relações Exteriores Lisboa, Portugal Available in: http://www.redalyc.org/articulo.oa?id=413548516003 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative OBSERVARE Universidade Autónoma de Lisboa e-ISSN: 1647-7251 Vol. 7, Nº. 2 (November 2016-April 2017), pp. 26-49 THE LIMITS OF FORGIVENESS IN INTERNATIONAL RELATIONS: GROUPS SUPPORTING THE YASUKUNI SHRINE IN JAPAN AND POLITICAL TENSIONS IN EAST ASIA María del Pilar Álvarez [email protected] Research Professor at the Faculty of Social Sciences of the University of Salvador (USAL, Argentina) and Visiting Professor of the Department of International Studies at the University T. Di Tella (UTDT). Coordinator of the Research Group on East Asia of the Institute of Social Science Research (IDICSO) of the USAL. Postdoctoral Fellow of the National Council of Scientific and Technical Research (CONICET) of Argentina. Doctor of Social Sciences from the University of Buenos Aires (UBA). Holder of a Master Degree on East Asia, Korea, from Yonsei University. Holder of a Degree in Political Science (UBA). -

Roster of Winners in Single-Seat Constituencies No

Tuesday, October 24, 2017 | The Japan Times | 3 lower house ele ion ⑳ NAGANO ㉘ OSAKA 38KOCHI No. 1 Takashi Shinohara (I) No. 1 Hiroyuki Onishi (L) No. 1 Gen Nakatani (L) Roster of winners in single-seat constituencies No. 2 Mitsu Shimojo (KI) No. 2 Akira Sato (L) No. 2 Hajime Hirota (I) No. 3 Yosei Ide (KI) No. 3 Shigeki Sato (K) No. 4 Shigeyuki Goto (L) No. 4 Yasuhide Nakayama (L) 39EHIME No. 4 Masaaki Taira (L) ⑮ NIIGATA No. 5 Ichiro Miyashita (L) No. 5 Toru Kunishige (K) No. 1 Yasuhisa Shiozaki (L) ( L ) Liberal Democratic Party; ( KI ) Kibo no To; ( K ) Komeito; No. 5 Kenji Wakamiya (L) No. 6 Shinichi Isa (K) No. 1 Chinami Nishimura (CD) No. 2 Seiichiro Murakami (L) ( JC ) Japanese Communist Party; ( CD ) Constitutional Democratic Party; No. 6 Takayuki Ochiai (CD) No. 7 Naomi Tokashiki (L) No. 2 Eiichiro Washio (I) ㉑ GIFU No. 3 Yoichi Shiraishi (KI) ( NI ) Nippon Ishin no Kai; ( SD ) Social Democratic Party; ( I ) Independent No. 7 Akira Nagatsuma (CD) No. 8 Takashi Otsuka (L) No. 3 Takahiro Kuroiwa (I) No. 1 Seiko Noda (L) No. 4 Koichi Yamamoto (L) No. 8 Nobuteru Ishihara (L) No. 9 Kenji Harada (L) No. 4 Makiko Kikuta (I) No. 2 Yasufumi Tanahashi (L) No. 9 Isshu Sugawara (L) No. 10 Kiyomi Tsujimoto (CD) No. 4 Hiroshi Kajiyama (L) No. 3 Yoji Muto (L) 40FUKUOKA ① HOKKAIDO No. 10 Hayato Suzuki (L) No. 11 Hirofumi Hirano (I) No. 5 Akimasa Ishikawa (L) No. 4 Shunpei Kaneko (L) No. 1 Daiki Michishita (CD) No. 11 Hakubun Shimomura (L) No. -

Examining the Influences of Yutori Education in Japan

EXAMINING THE INFLUENCES OF YUTORI EDUCATION IN JAPAN ON OPPORTUNITY TO LEARN (OTL) AND STUDENT ACHIEVEMENT ON THE TIMSS: A MULTIPLE COHORT ANALYSIS by Meiko Lin Dissertation Committee: Professor Madhabi Chatterji, Sponsor Professor Oren Pizmony-Levy Approved by the Committee on the Degree of Doctor of Education Date May 16, 2018 Submitted in partial fulfillment of the Requirements for the Degree of Doctor of Education in Teachers College, Columbia University 2018 ABSTRACT EXAMINING THE INFLUENCES OF YUTORI EDUCATION IN JAPAN ON OPPORTUNITY TO LEARN (OTL) AND STUDENT ACHIEVEMENT ON THE TIMSS: A MULTIPLE COHORT ANALYSIS Meiko Lin The purpose of this study was to explore the effects of yutori reforms on Opportunity to Learn (OTL), as defined by Stevens’ (1993, 1996) multidimensional framework, and to examine how the changes in OTL may have subsequently affected Japanese 8th graders’ mathematics achievement as measured by the Trends in Mathematics and Science Study (TIMSS). This dissertation was a mixed-methods, multi- cohort study combining analyses of archival documents and interview-based data with analyses of quantitative TIMSS data on OTL and student achievement in mathematics in selected years. The study used three waves of TIMSS data (1999, 2003, and 2007) to examine the effects of yutori reforms on OTL levels at the classroom level over time, and their corresponding influence on student achievement levels on the TIMSS assessment with Hierarchical Linear Models (HLM). The three overarching findings of this study were: (a) the yutori -

Plans for the Fourth G20 Summit: Co-Chaired by Canada and Korea

Plans for the Fourth G20 Summit: Co-chaired by Canada and Korea in Toronto, June 26-27, 2010 Jenilee Guebert Director of Research, G20 Research Group January 22, 2010 Plans for the Fourth G20 Summit: Co-chaired by 7. Appendices 35 Canada and Korea in Toronto, June 26-27, 2010 1 List of Meetings 35 List of Acronyms and Abbreviations 2 Leaders 35 Preface 3 Ministerials 35 1. Background 3 Deputies 36 2. Agenda and Priorities 4 G20 Leaders’ Experience 37 Global Imbalances 5 List of G20 Finance Ministers and Central Bank Stimulus and Exit Strategies 5 Governors, 1999-2009 37 Regulation and Supervision 8 Members of G20, Gleneagles Dialogue and Major Debts 11 Economies Forum 41 Accounting 12 G20 Leaders’ Biographies 41 Offshore Jurisdictions and Tax Havens 13 Statistical Profiles 46 Executive Compensation 15 Argentina 46 Levies on Banks 18 Australia 48 Currencies and Exchange Rates 19 Brazil 49 Hedge Funds 21 Canada 50 Reform of the International Financial Institutions 22 China 52 Trade 23 France 53 Climate Change 24 Germany 55 Development 25 India 56 3. Participants 25 Indonesia 57 4. Implementation and Preparations 26 Italy 59 Implementation 26 Japan 60 Preparatory Meetings 28 Mexico 62 Preparations 28 Russia 63 Other Meetings 31 Saudi Arabia 65 5. Site 31 South Africa 66 Next Summit 32 South Korea 68 6. Civil Society and Other G20 Related Activities 34 Turkey 69 United Kingdom 71 United States 72 European Union 74 Key sources 75 List of Acronyms and Abbreviations AIMA Alternative Investment Management Association ASEAN Association of South -

Members of the Strategic Headquarters for the Promotion of an Advanced Information and Telecommunications Network Society

Members of the Strategic Headquarters for the Promotion of an Advanced Information and Telecommunications Network Society Director-General: Shinzo ABE Prime Minister Vice Director-Generals: Sanae TAKAICHI Minister of State for Okinawa and Northern Territories Affairs, Science and Technology Policy, Innovation, Gender Equality, Social Affairs and Food Safety Yasuhisa SHIOZAKI Chief Cabinet Secretary Yoshihide SUGA Minister of Internal Affairs and Communications Minister of State for Decentralization Reform, Privatization of the Postal Services Akira AMARI Minister of Economy, Trade and Industry Members: Jinen NAGASE Minister of Justice Taro ASO Minister for Foreign Affairs Koji OMI Minister of Finance Bunmei IBUKI Minister of Education, Culture, Sports, Science and Technology Hakuo YANAGISAWA Minister of Health, Labour and Welfare Norihiko AKAGI Minister of Agriculture, Forestry and Fisheries Tetsuzo FUYUSHIBA Minister of Land, Infrastructure and Transport Masatoshi WAKABAYASHI Minister of the Environment, Minister of Charge of Global Environmental Problems Yuriko KOIKE Minister of Defense Kensei MIZOTE Minister of State, Chairman of the National Public Safety Commission Minister of State for Disaster Management Yuji YAMAMOTO Minister for Financial Services Hiroko OTA Minister of State for Economic and Fiscal Policy Yoshimi WATANABE Minister of State for Regulatory Reform (Experts) Kunio ISHIZUKA President, Mitsukoshi, Ltd. Hiroyuki ITAMI Professor, Hitotsubashi University Tamotsu UENO President, Tosei Electrobeam Co., Ltd. Nagaaki OHYAMA -

Cyberprzestrzeń W Krajach Orientu: Wolność I Zniewolenie

UNIWERSYTET ŁÓDZKI Katedra Bliskiego Wschodu i Północnej Afryki Cyberprzestrzeń w krajach Orientu: wolność i zniewolenie pod redakcją Marty Woźniak i Doroty Ściślewskiej Łódź 2014 © Copyright by Katedra Bliskiego Wschodu i Północnej Afryki UŁ, 2014 RECENZENT dr hab. Rafał Ożarowski dr Izabela Kończak REDAKTORZY dr Marta Woźniak mgr Dorota Ściślewska PROJEKT OKŁADKI mgr Edyta Bednarek SKŁAD I ŁAMANIE mgr Dorota Ściślewska Katedra Bliskiego Wschodu i Północnej Afryki UŁ ul. Narutowicza 59a, 90-131 Łódź e-mail: [email protected] www.kbwipa.uni.lodz.pl ISBN 978-83-63547-06-6 Spis treści Wstęp ................................................................................................................................................. 4 CZĘŚĆ I BLISKI WSCHÓD .................................................................................................................... 7 Karol Dobosz, Wpływ technologii informacyjnych na wybory prezydenckie w Iranie ................... 8 Marcin Godziński, Wpływ mediów społecznościowych na rozwój Arabskiej Wiosny Ludów ..... 17 Paweł Ciuksza, Rozwój biznesu internetowego w krajach MENA ................................................ 28 Katarzyna Peszyńska-Drews, Cyberterroryzm w regionie Bliskiego Wschodu ............................ 36 CZĘŚĆ II DALEKI WSCHÓD ............................................................................................................... 45 Tomasz Janyst, Kontrola Internetu w Chinach: prawo, instytucje, technologia .......................... 46 Joanna Dobkowska, Niespójna -

Gulf Arabs Try to Avert Egypt's Energy Crunch

Local9 FRIDAY, MARCH 14, 2014 News Gulf Arabs try to avert in brief Egypt’s energy crunch Emergency landing for Kuwait Airways plane averted KUWAIT: A Kuwait Airways plane coming from Doha Kuwait, Saudi, UAE rush to provide oil aid to Egypt requested an emergency landing at Kuwait International Airport yesterday evening. The pilot of CAIRO: Arab countries will extend aid to the army deposed Islamist President energy needs for the summer. Fuel subsi- Flight #618 called KIA air traffic control and requested Egypt in the form of petroleum products Mohamed Morsi after mass protests. dies cost Egypt’s government $15 billion support for an emergency landing after the indicator until at least September, Finance Minister “Arab aid for petroleum products offered a year, a fifth of the state budget. The light for the landing gear failed to come on as he read- Hany Kadry Dimian said yesterday, a to Egypt will continue until next money keeps pump prices well below ied for the approach to land. The pilot eventually flew in move that will help avert an energy September or October,” Dimian, who market values, giving Egyptians no incen- low over the airport and through visual report from crunch expected in the summer when took office last month in a surprise cabi- tive to curb their consumption. Egypt also watchers on the ground was able to confirm that the consumption soars. Saudi Arabia, the net reshuffle, said in a text message to requires liquefied natural gas (LNG) for landing gear in fact had descended. The plane landed United Arab Emirates and Kuwait have Reuters. -

The Statesman's Yearbook

THE STATESMAN’S YEARBOOK 2010 ‘Nothing is so fatal to the progress of the human mind as to suppose our views of science are ultimate; that there are no mysteries in nature; that our triumphs are complete; and that there are no new worlds to conquer.’ Humphry Davy (1810) Editors Frederick Martin 1864–1883 Sir John Scott-Keltie 1883–1926 Mortimer Epstein 1927–1946 S. H. Steinberg 1946–1969 John Paxton 1969–1990 Brian Hunter 1990–1997 Barry Turner 1997–0000 Credits Publisher Hazel Woodbridge (London) Airie Stuart (New York) Editor Barry Turner Editorial Assistant Jill Fenner Senior Research Editor Nicholas Heath-Brown Research Judith Frazer Chris Wellbelove Ben Eastham Daniel Smith Richard German Saif Ullah Liane Jones Justine Foong James Wilson Robert McGowan Matthew Lane Tobias Bracey Martha Nyman Sharita Oomeer Index Richard German Print Production Phillipa Davidson-Blake Michael Card Design Jim Weaver Online Production Semantico Technical Support Jiss Jacob Marketing Charley Holyhead (London) Denise De La Rosa (New York) email: [email protected] THE STATESMAN’S YEARBOOK THE POLITICS, CULTURES AND ECONOMIES OF THE WORLD 2010 Edited by BARRY TURNER © Macmillan Publishers Ltd 2009 Softcover reprint of the hardcover 1st edition 2009 978-0-230-20602-1 All rights reserved. No reproduction, copy or transmission of this publication may be made without written permission. No portion of this publication may be reproduced, copied or transmitted save with written permission or in accordance with the provisions of the Copyright, Designs and Patents Act 1988, or under the terms of any licence permitting limited copying issued by the Copyright Licensing Agency, Saffron House, 6-10 Kirby Street, London EC1N 8TS. -

FEATURE: Preventing Misconduct in Research Activities 2007

Japan Society for the Promotion of Science FEATURE: Preventing Misconduct in Research Activities R T O P I C S ● Preventing Misconduct in Research Activities ................................................................. 2 ● Presentation Ceremony Held for 2006 International Prize for Biology ................... 5 ● FoS Symposia Held with Germany, America and France ............................................. 5 ● A-HORCs Meeting and Northeastern Asian Symposium .............................................. 6 ● Earthquake Workshop Held with LIPI in Indonesia ........................................................ 7 No.19 ● Japan-Australia Symposium on Earth Systems and Nanomaterials ......................... 7 ● NIH-JSPS Symposium Held on Biomedical Science ....................................................... 7 2007 ● Japan-Germany Colloquium on Robotics .......................................................................... 8 Spring ● Fifth JSPS Forum Held in France ........................................................................................... 8 ● JUNBA: First Academia Summit and Symposium ........................................................... 9 ● Pre-Departure Seminar and Alumni Evening in UK ....................................................... 9 ● Science Dialogue ........................................................................................................................ 10 ● Message from Former JSPS Fellow ......................................................................................