[Reserved] Part 1010—General Provisions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![585 Parts 1000–1009[Reserved] Part 1010](https://docslib.b-cdn.net/cover/0336/585-parts-1000-1009-reserved-part-1010-220336.webp)

585 Parts 1000–1009[Reserved] Part 1010

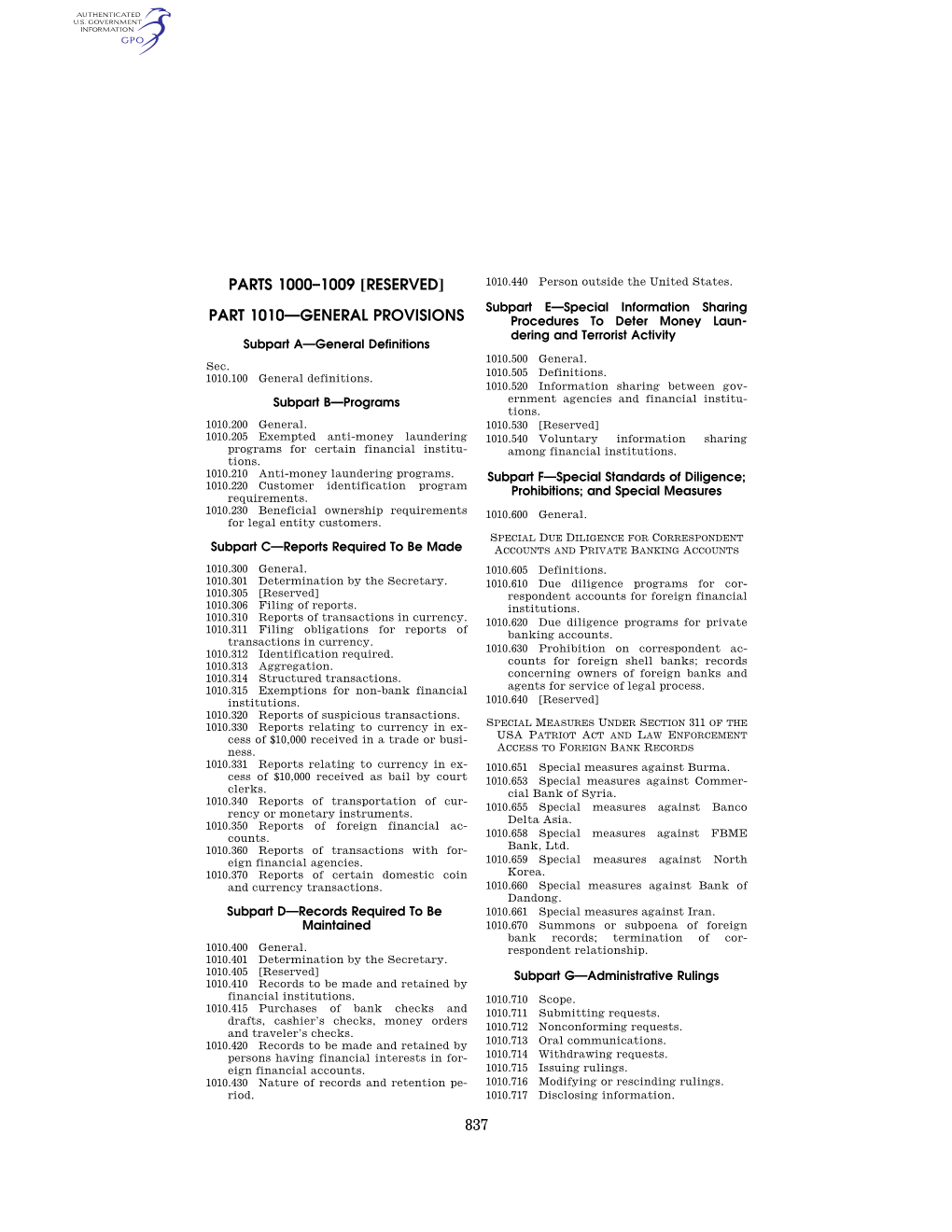

PARTS 1000–1009[RESERVED] 1010.440 Person outside the United States. Subpart E—Special Information Sharing PART 1010—GENERAL PROVISIONS Procedures To Deter Money Laun- dering and Terrorist Activity Subpart A—General Definitions 1010.500 General. Sec. 1010.505 Definitions. 1010.100 General definitions. 1010.520 Information sharing between gov- ernment agencies and financial institu- Subpart B—Programs tions. 1010.530 [Reserved] 1010.200 General. 1010.540 Voluntary information sharing 1010.205 Exempted anti-money laundering among financial institutions. programs for certain financial institu- tions. Subpart F—Special Standards of Diligence; 1010.210 Anti-money laundering programs. Prohibitions; and Special Measures 1010.220 Customer identification program 1010.600 General. requirements. SPECIAL DUE DILIGENCE FOR CORRESPONDENT Subpart C—Reports Required To Be Made ACCOUNTS AND PRIVATE BANKING ACCOUNTS 1010.300 General. 1010.605 Definitions. 1010.610 Due diligence programs for cor- 1010.301 Determination by the Secretary. respondent accounts for foreign financial 1010.305 [Reserved] institutions. 1010.306 Filing of reports. 1010.620 Due diligence programs for private 1010.310 Reports of transactions in currency. banking accounts. 1010.311 Filing obligations for reports of 1010.630 Prohibition on correspondent ac- transactions in currency. counts for foreign shell banks; records 1010.312 Identification required. concerning owners of foreign banks and 1010.313 Aggregation. agents for service of legal process. 1010.314 Structured transactions. 1010.640 [Reserved] 1010.315 Exemptions for non-bank financial SPECIAL MEASURES UNDER SECTION 311 OF THE institutions. USA PATRIOT ACT AND LAW ENFORCEMENT 1010.320 Reports of suspicious transactions. ACCESS TO FOREIGN BANK RECORDS 1010.330 Reports relating to currency in ex- cess of $10,000 received in a trade or busi- 1010.651 Special measures against Burma. -

Policies for Business in the Mediterranean Countries The

Policies for business in the Mediterranean Countries The Syrian Arab Republic C.A.I.MED. Centre for Administrative Innovation in the Euro-Mediterranean Region c/o Formez - Centro Formazione Studi Viale Campi Flegrei, 34 80072 Arco Felice (NA) Italy Tel +39 081 525 0211 Fax +39 081 525 0312 e-mail [email protected] [email protected] The views expressed do not imply the expression of any opinion whatsoever on the part of the United Nations and of Italian Department for Public Administration, Formez and the Campania Ragion Administration CONTENTS 1-The New Reform Trend: towards a market-oriented economy 2-The economy by sectors and ownership 2.1 The severe impact of the Iraqi War on GDP growth 3- Agriculture 3.1- Policies and institutions. 3.2- International cooperation for rural development 4- Industry 4.1- Does reform mean privatization? 5- Foreign Trade 5.1- Institutions and civil society 5.2- Foreign trade regulation 6- Free Trade Zones 7- New Investment Regulation: Law No. 7 of 2000 8- Latest initiatives for private sector development 9-Credit and monetary policy: a fundamental task. 9.1 The liberalization of the Banking Sector 9.2 Modernisation of state credit and monetary system Bibliography 1- The New Reform Trend: towards a market-oriented economy Despite a number of significant reforms and ambitious development projects begun in the early 1990s and currently underway, Syria's economy is still slowed by large numbers of poorly performing public sector firms, low investment levels, and relatively low industrial and agricultural productivity. After the 1996 monetary crisis and a sudden shortage in valuable foreign currency, economic growth slowed to 2.6% annually in the second half of the 1990s. -

Feasibility Study to Develop New Options for Private Sector Investment Financing in the Syrian Arab Republic

Final Report Feasibility Study to develop new options for private sector investment financing in the Syrian Arab Republic EIB Final Report October 2005 - March 2006 Prepared by: Richard Crayne Bruce Harrison Rauf Khalaf Edward Owen With contributions from: Fatma Dirkes, Senior Project Manager, BAI Willemien Libois, Project Manager, BAI Raed Karawani, Legal Consultant Fahed El-Mohamad, Local Expert Bankakademie Damascus Office Bankakademie International Malki, Abdel Mounem Riad Street Sonnemannstr. 9-11 Kouatly Building No. 5 60314 Frankfurt am Main Damascus Germany Syria Phone: +49-69-154008-619 Tel: +693-11-3716332 Fax: +49-69-154008-670 Final Report With further contributions from: Syrian Government: Dr. Abdullah Dardari Deputy Prime Minister, Economic Prime Minister's Office Affairs Nabil Barakat Deputy Head Prime Minister Office SPC Nader Al-Sheikh Ali Director General of International Prime Minister Office SPC Cooperation Marwin Attar Consultant Prime Minister Office SPC Dr. Ghassen Al Habash Deputy Minister Ministry of Economy & Trade Dr. Amir Al Attar Director, Banking Affairs & Insurance Ministry of Economy & Trade Abd Al Razak Abd Al Maged Director, Interior Commerce Ministry of Economy & Trade Ibrahim Ibrahim Manager, Companies Registration Ministry of Economy & Trade Dr. Mohammad Al-Hussein Minister Ministry of Finance Dr. Mohammed Hamandoush Deputy Minister, Public Expenditure Ministry of Finance, CMC1 Mrs. Basmah Hafez Manager Banks & Insurance Ministry of Finance Farouk Ayash Senior Banking Advisor Ministry of Finance Marouf Al Hafez Public Debt Fund Ministry of Finance Omar Al Elabi Public Enterprises Ministry of Finance Nizar Shurbaje Department Revenue Ministry of Finance Mohee Deen Habeeb Treasury Ministry of Finance Jamal Medelgi Income Tax Ministry of Finance Dr. -

Important USA PATRIOT Act Information

520 Madison Avenue New York, NY 10022 212.284.2300 Important USA PATRIOT Act Information Dear Customer, Please review the information provided. It contains important information regarding your account(s) at Jefferies LLC or Jefferies Financial Services, Inc. (collectively “Jefferies” or the “Firm”). Pursuant to U.S. regulations issued under Section 311 of the USA PATRIOT Act, 31 CFR 103.188, Jefferies is prohibited from establishing, maintaining, administrating, or managing a correspondent account for, or on behalf of, the following financial institutions listed below: • Commercial Bank of Syria (including Syrian Lebanese Commercial Bank as well as all branches, offices and subsidiaries of Commercial Bank of Syria operating in Syria or in any other jurisdiction) • FBME Bank Ltd (including all branches, offices and subsidiaries of FBME operating in any jurisdiction, including Tanzania and Cyprus Bank of Dandong (including all subsidiaries, branches, offices and agents of Bank of Dandong Co., Ltd, operating in any jurisdiction Any financial institution in North Korea Any financial institution in Burma (except those exempt under Executive Order 13310) Any financial institution in Iran The regulations also require Jefferies to notify you that your account with our Firm may not be used to provide the above listed financial institutions, or any of their respective branches, offices or subsidiaries, with access to our Firm. If you should have a relationship with any of the above listed financial institutions, or any of their respective branches, offices or subsidiaries, or should you become aware of a relationship with the above listed financial institutions, or any of their respective subsidiaries, please contact our AML Compliance Officer Edward Mannix immediately at 201-761-7794. -

Syria, April 2005

Library of Congress – Federal Research Division Country Profile: Syria, April 2005 COUNTRY PROFILE: SYRIA April 2005 COUNTRY Formal Name: Syrian Arab Republic (Al Jumhuriyah al Arabiyah as Suriyah). Short Form: Syria. Term for Citizen(s): Syrian(s). Capital: Damascus (population estimated at 5 million in 2004). Other Major Cities: Aleppo (4.5 million), Homs (1.8 million), Hamah (1.6 million), Al Hasakah (1.3 million), Idlib (1.2 million), and Latakia (1 million). Independence: Syrians celebrate their independence on April 17, known as Evacuation Day, in commemoration of the departure of French forces in 1946. Public Holidays: Public holidays observed in Syria include New Year’s Day (January 1); Revolution Day (March 8); Evacuation Day (April 17); Egypt’s Revolution Day (July 23); Union of Syria, Egypt, and Libya (September 1); Martyrs’ Day, to commemorate the public hanging of 21 dissidents in 1916 (May 6); the beginning of the 1973 October War (October 6); National Day (November 16); and Christmas Day (December 25). Religious feasts with movable dates include Eid al Adha, the Feast of the Sacrifice; Muharram, the Islamic New Year; Greek Orthodox Easter; Mouloud/Yum an Nabi, celebration of the birth of Muhammad; Leilat al Meiraj, Ascension of Muhammad; and Eid al Fitr, the end of Ramadan. In 2005 movable holidays will be celebrated as follows: Eid al Adha, January 21; Muharram, February 10; Greek Orthodox Easter, April 29–May 2; Mouloud, April 21; Leilat al Meiraj, September 2; and Eid al Fitr, November 4. Flag: The Syrian flag consists of three equal horizontal stripes of red, white, and black with two small green, five-pointed stars in the middle of the white stripe. -

434330Wp0syria10box0327368

43433 Public Disclosure Authorized Public Disclosure Authorized Policy and Regulatory Framework for Microfinance in Syria Public Disclosure Authorized January 2008 Public Disclosure Authorized Policy and Regulatory Framework for Microfinance in Syria i Contents Executive Summary vii Chapter One Changes and Reform in Syria’s Financial Sector 1 A THE GENERAL ECONOMY................................................................................................................. 1 B. FINANCIAL SECTOR OVERVIEW ...................................................................................................... 2 The Central Bank.................................................................................................................................. 3 Interest Rates ....................................................................................................................................... 4 Distribution of Credit............................................................................................................................. 5 C. FINANCIAL SECTOR PROVIDERS .................................................................................................... 8 State-owned Banks .............................................................................................................................. 8 The Commercial Bank of Syria............................................................................................................. 8 Specialized Banks ............................................................................................................................... -

Syria's Economy

Syria’s Economy: PickingSyria’s up the Economy: Pieces Research Paper David Butter Middle East and North Africa Programme | June 2015 Syria’s Economy Picking up the Pieces Contents Summary 2 Introduction 3 Economic Context of the Uprising and the Slide to Conflict 7 Counting the Cost of the Syrian Conflict 12 Clinging on to Institutional Integrity: Current Realities and Possible Scenarios 28 About the Author 29 Acknowledgments 30 1 | Chatham House Syria’s Economy: Picking up the Pieces Summary • The impact on the Syrian economy of four years of conflict is hard to quantify, and no statistical analysis can adequately convey the scale of the human devastation that the war has wrought. Nevertheless, the task of mitigating the effects of the conflict and planning for the future requires some understanding of the core economic issues. • Syria’s economy has contracted by more than 50 per cent in real terms since 2011, with the biggest losses in output coming in the energy and manufacturing sectors. Agriculture has assumed a bigger role in national output in relative terms, but food production has fallen sharply as a result of the conflict. • The population has shrunk from 21 million to about 17.5 million as a result of outward migration (mainly as refugee flows) and more than a quarter of a million deaths. At least a third of the remaining population is internally displaced. • Inflation has averaged 51 per cent between January 2012 and March 2015, according to the monthly data issued by the government, and the Syrian pound has depreciated by about 80 per cent since the start of the conflict. -

Jacques El-Hakim 1 COMMERCIAL LAW 1.1 Banking Law 1.1.1 Licensing Af Private Banks in 1961, Following the Union with Egypt, Bank

Syria Jacques el-Hakim 1 COMMERCIAL LAW 1.1 Banking law 1.1.1 Licensing af private banks In 1961, following the union with Egypt, banks were nationalized in Syria and, except for the Central Bank of Syria, remained private companies subject to commercial law and responsible for their previous debts up to the limits of their assets. In fact they never paid a consistent part of their debts (particularly the agricultural ones) and their previous shareholders were never compensated, as was provided for in the law. After the partition of the two countries, only the "Arab" banks (i.e. banks with mainly Arab shareholders) were denational- ized, but after the socialist revolution of 8 March 1963, they were national- ized again by Legislative Decree No. 27 on 2 May 1963, and merged in a sin- gle bank, the Commercial Bank of Syria (CBS) by Decree of the Minister of Economy and Foreign Trade (the Minister) No. 813 of 29 October 1966. That bank had the monopoly of short-term deposits and credit, together with the Popular Credit Bank, the Agricultural Cooperative Bank, the Industrial Bank and the Real Estate bank; these were all state owned and each had the mo- nopoly of banking in its own field. After the liberalization trend that was initiated in Syria in 2000, a decree of the Minister authorized the opening of private banks in the Free Zones (in Damascus, Aleppo, Tartous and Latakia, governed by Legislative Decree No. 84 of 1972). The regulations applicable to those banks were issued by a Decree of the Minister No. -

The Unintended Consequences of U.S. and European Unilateral Measures on Syria’S Economy and Its Small and Medium Enterprises

The Unintended Consequences of U.S. and European Unilateral Measures on Syria’s Economy and Its Small and Medium Enterprises Samir Aita December 2020 The Unintended Consequences of U.S. and European Unilateral Measures on Syria’s Economy and Its Small and Medium Enterprises Samir Aita December 2020 The Carter Center One Copenhill 453 John Lewis Freedom Parkway Atlanta, GA 30307 [email protected] www.cartercenter.org © 2020 by The Carter Center. All rights reserved. Acknowledgements This paper and the research behind it would not have been possible without the exceptional support of colleagues at the Cercle des Economistes Arabes and the availability of data from the MGAL (MENA Geopolitical Analytical Lens, Independent Consultancy), especially in conducting some of the field interviews. The author is grateful to Rabie Nasr and the Syrian Center for Policy Research (SCPR) as well as to NGO REACH for their inflation data. The author is also grateful to individuals interviewed and those who reviewed chapters during the process of elaboration. The results of some interviews are reproduced as is, unaltered, in separate boxes, and do not necessarily represent the views of the author or The Carter Center. All data are those of the author and the Cercle des Economistes Arabes. Circle of Arab Economists logo About the Author Samir Aita is president of the Cercle des Economistes Arabes; former editor in chief and general manager of “Le Monde diplomatique éditions arabes”; lecturer of political economy at the University of Paris Dauphine, Paris II Sorbonne and Saint Joseph, Beirut; and consultant in economy, finance, labor, and urban planning. -

The Political Economy of the Banking Sector in Syria

The Political Economy of the Banking Sector in Syria Samir AITA Economist, General Manager A Concept mafhoum.com Editor in chief & GM, Le Monde diplomatique editions arabes The Conference on Economic Reforms in Syria, April 10-12, 2008 Pleased do not cite or distribute without author permission Summary In Syria, Banking sector reform has been the flagship action announced by the newly plebiscited President Bashar Assad in 2000. More than 7 years later, new private banks have emerged, taking a significant share of the market. This paper put these developments in the context of Syria political economy. First, the literature on the political economy of the banking sector regulation is reviewed, as well as the literature on Syria political economy, to draw a framework for analysis. The political economy of Syria, with a focus on the banking sector is then analyzed in different phases since the effective independence of the country in 1946. Six such phases are identified evolving from state building and national capitalism, towards the Baath radicalization and the emergence of a strong “power system”, ending in the current phase qualified as “neo- liberal”. A quick review on the political economy of banking sector regulation Finance and Politics cannot be separated, and this statement should be considered from both local and international political perspectives, as well as from the perspective of the historical development of a country. It has in fact been argued (Sylla 2003) that leading economies had experienced at some point a “financial revolution”, i.e. the creation of modern financial systems during brief periods, and that “the cause-effect relationship seems to run from good finance to economic growth/development, not from economic growth/development to good finance (Demirguc-Kunt & Levine 2004). -

An Overview of the Banking System in Syria After a Decade of Unrest

International Journal of Law, Government and Communication (IJLGC) Volume 5 Issue 19 (June 2020) PP. 68-84 DOI 10.35631/IJLGC.519005 International Journal of Law, Government and Communication (IJLGC) Journal Website: http://ijlgc.com/ eISSN: 0128-1763 AN OVERVIEW OF THE BANKING SYSTEM IN SYRIA AFTER A DECADE OF UNREST Omar Farouk Al Mashhour1*, Muhammad Imam Asalie2, Ahmad Shamsul Abd Aziz3, & Nor Azlina Mohd Noor4 1 School of Law, Universiti Utara Malaysia, Malaysia Email: [email protected] 2 Islamic Business School, Universiti Utara Malaysia, Malaysia Email: [email protected] 3 School of Law, Universiti Utara Malaysia, Malaysia Email: [email protected] 4 School of Law, Universiti Utara Malaysia, Malaysia Email: [email protected] * Corresponding Author Article Info: Abstract: Article history: After a decade of crippling international sanctions and devastating conflict, Received date: 02.03.2020 the Syrian economy has been largely in shambles. Nevertheless, the Syrian Revised date: 21.04.2020 banking industry has largely weathered the storm. This article attempts to Accepted date: 20.05.2020 illustrate a comprehensive view of the banking sector in Syria and how well Published date: 10.06.2020 has one of the oldest banking systems in the middle east fared over the years and how has it survived the seemingly insurmountable challenges. To cite this document: Additionally, The article targets to show the role of the central bank of Syria Al Mashhour, O. F., Asalie, M. I., in supervising the banking industry as well as a view on the recent Abd Aziz, A. S., & Mohd, N. A. development of the legal and financial orientation. -

English Khaled Sammani NA the Art of Chocolate Riad Kurdy NA Kurdy Pharma Glass George Salme NA Salme & Co

Facility for Euro-Mediterranean Investment and Partnership • Facility for Euro-Mediterranean Investment and Partnership FEMIP Feasibility Study to develop new options for private sector investment financing in the Syrian Arab Republic Final Report Feasibility Study to develop new options for private sector investment financing in the Syrian Arab Republic EIB Final Report October 2005 - March 2006 Prepared by: Richard Crayne Bruce Harrison Rauf Khalaf Edward Owen With contributions from: Fatma Dirkes, Senior Project Manager, BAI Willemien Libois, Project Manager, BAI Raed Karawani, Legal Consultant Fahed El-Mohamad, Local Expert Bankakademie Damascus Office Bankakademie International Malki, Abdel Mounem Riad Street Sonnemannstr. 9-11 Kouatly Building No. 5 60314 Frankfurt am Main Damascus Germany Syria Phone: +49-69-154008-619 Tel: +693-11-3716332 Fax: +49-69-154008-670 Final Report With further contributions from: Syrian Government: Dr. Abdullah Dardari Deputy Prime Minister, Economic Prime Minister's Office Affairs Nabil Barakat Deputy Head Prime Minister Office SPC Nader Al-Sheikh Ali Director General of International Prime Minister Office SPC Cooperation Marwin Attar Consultant Prime Minister Office SPC Dr. Ghassen Al Habash Deputy Minister Ministry of Economy & Trade Dr. Amir Al Attar Director, Banking Affairs & Insurance Ministry of Economy & Trade Abd Al Razak Abd Al Maged Director, Interior Commerce Ministry of Economy & Trade Ibrahim Ibrahim Manager, Companies Registration Ministry of Economy & Trade Dr. Mohammad Al-Hussein Minister Ministry of Finance Dr. Mohammed Hamandoush Deputy Minister, Public Expenditure Ministry of Finance, CMC1 Mrs. Basmah Hafez Manager Banks & Insurance Ministry of Finance Farouk Ayash Senior Banking Advisor Ministry of Finance Marouf Al Hafez Public Debt Fund Ministry of Finance Omar Al Elabi Public Enterprises Ministry of Finance Nizar Shurbaje Department Revenue Ministry of Finance Mohee Deen Habeeb Treasury Ministry of Finance Jamal Medelgi Income Tax Ministry of Finance Dr.