UIL Accounting 2016 Capital Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

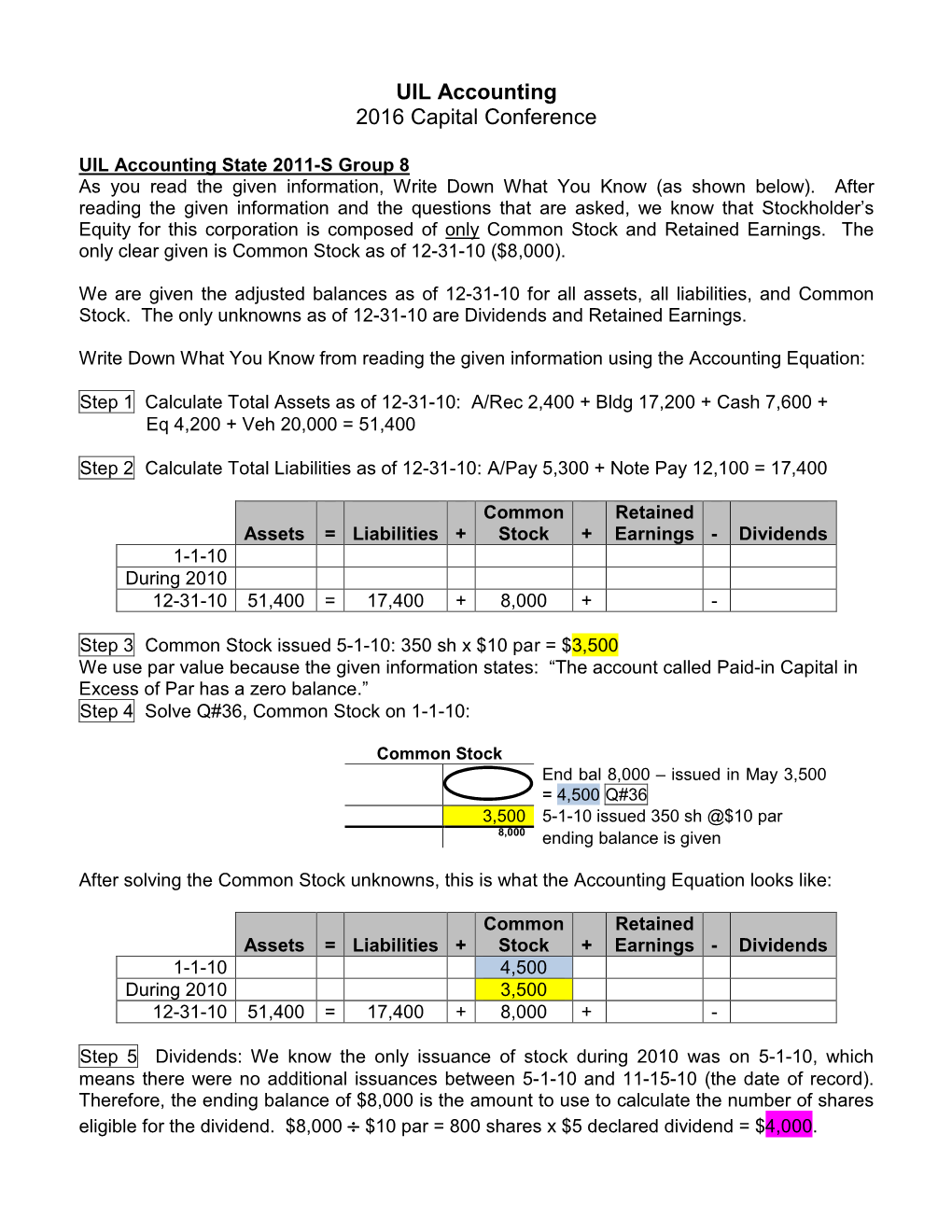

Concepts/Principles, Accounting Equation

Accounting Notes Characteristics of Business Organizations: Sole Proprietorship Partnership Corporation 1) Owner(s) One Owner Two or more Many owners (partners) (shareholders) 2) Life of organization Limited by owners Limited by partners Unlimited choice or death choice or death 3) Personal Liability of Owner is personally Partners are Shareholders Owner(s) for business debt liable personally liable are not personally liable 4) Accounting Status Business is separate Partnership is Corporat ion is from the owner separate from separate from the partners the shareholders Accounting Concepts and Principles: The Entity Concept - An organization is a separate entity from the owner(s) of the organization. The Reliability (Objectivity) Principle - Accounting records and statements should be based on the most reliable data available so that they will be as accurate and useful as possible. The Cost Principle - Acquired assets and services should be recorded at their actual cost not at what they are believed to be worth. The Going-Concern Concept - The assumption that the business will continue operationing for the foreseeable future. The Stable-Monetary Unit Concept - Accounting transaction are recorded in the monetary unit used in the country where the business is located. Page 1 Student Learning Assistance Center, San Antonio College, 2004 Accounting Notes The Accounting Equation: Assets = Liabilities + Owner ˇs Equity Anything that belongs to or A debt owed by the The owners claim to the is owed to the business business to its creditors assets of the business. The assets that are left over after t he liabilities are paid Difference between Accounts Receivable and Notes Receivable: Accounts Receivable - The promise by a customer to pay the business for a service or product provided Note Receivable - The WRITTEN promise for a future collection of cash within a specified period. -

4 Accounting Equation

MODULE - II Journal and Other Subsidiary Books 4 ACCOUNTING EQUATION Notes You have already studied about Dual Aspect Concept and the various basic Accounting terms viz Assets, Liabilities, Capital, Expenses and Revenue. According to this concept, every transaction affects the business in two ways by the same amount. Suppose, a businessman starts his business with ` 3,00,000. In the books of accounts, `3,00,000 will be recorded as an asset (Cash) and equivalent amount will be shown as liability towards the owner. In this example, you have noted that assets are equal to liabilities. We can present it in mathematical form as Assets = Liabilities this mathematical expression is called Accounting Equation. Every transaction has its effect on the Accounting equation in such a manner that both sides remain equal. Now, we shall take different business transactions and see their subsequent effect on the accounting equation. OBJECTIVES After studying this lesson, you will be able to : • state the meaning of accounting equation; • appreciate the importance of accounting equation; • point out the effect of each aspect of a transaction on the accounting equation; • establish that assets are equal to liabilities and capital and • prepare accounting equation from given transactions. 4.1 ACCOUNTING EQUATION The recording of business transaction in books of accounts is based on a fundamental equation called Accounting Equation. Whatever business possesses in the form of assets is financed by proprietor or by outsiders. This equation expresses the equality of assets on one side and the claims of outsiders (liabilities) and owners or proprietors (capital) on the other side. -

When to Debit and Credit in Accounting

When to Debit and Credit in Accounting Journal entries show a firm’s transactions throughout a period of time; for example, when a company purchases supplies a journal entry will show the amount of supplies bought and money spent. According to the practice of double-entry accounting, every journal entry must: • Include at least two distinct accounts with at least one debit and one credit. • Have the total monetary amount of debits equal to the total monetary amount of credits. • Be consistent with the accounting equation, Assets = Liabilities + Equity. (Wild, Shaw, and Chiappetta, 55) An asset is loosely defined as a resource with economic value that a particular firm has, and includes accounts such as cash, accounts receivable, and office supplies. Liabilities are the debts and obligations a company accumulates in operating the business; it includes accounts such as accounts payable, wages payable, and interest payable. Equity represents the amount of ownership in an asset that is not financed through debt. Equity begins with the owner’s capital, which are personal investments of assets by the owner, and grows as revenues are accrued over the course of business operations. Equity shrinks when the owner withdrawals capital and/or expenses are incurred. Thus the accounting equation, Assets = Liabilities + Equity, can be roughly translated as, “things we have are backed by things we owe and things we own.” A chart of accounts, which list commonly used accounts and their type, is included as an appendix in most accounting text books. The following diagram depicts the accounting equation such that equity is broken down into the component accounts of Capital, Withdrawals, Revenue, and Expenses, and illustrates how each type of account reacts to debits and credits. -

ACCT 100 - INTRODUCTION to ACCOUNTING Chapter 2 Analyzing Business Transactions

ACCT 100 - INTRODUCTION TO ACCOUNTING Chapter 2 Analyzing Business Transactions A business transaction is a financial event that changes the resources of a firm. Examples of common business transactions include such things as purchases, sales, payments, and receipts of cash among other things. There are five basic types of accounts. They are summarized in this chapter. We will be using this information to form the foundation for everything else we will be doing over the course of the semester. Assets Properties or things of value owned by a business Examples include cash, equipment, patents, land, supplies, etc. Liabilities Debts or obligations Money that is owed to others Claims of creditors (i.e. someone who you owe money to) against the assets of a business Equity The owner�s rights or claims to the assets of a business (after the creditors) Synonymous with the terms "capital" and "net worth." The owner's investment (adjusted for other things you will learn about) Revenues Amounts earned by a business Can be in the form of cash, credit card receipts, or credit sales to charge customers (who will pay for goods/services at a later time) GAAP says revenues should be recorded when earned, not necessarily when paid When businesses generate revenues, the owner's equity increases Expenses Costs of the business that relate to the earning of revenues Can be in the form of cash, or on account (that will be paid later) GAAP says expenses should be recorded when incurred, not necessarily when paid When businesses incur expenses, -

Financial Accounting Lo1: Identify the Activities and Users Associated with Accounting

ACC101 FALL2020 (11TH ed) Chapter 1 Review FINANCIAL ACCOUNTING LO1: IDENTIFY THE ACTIVITIES AND USERS ASSOCIATED WITH ACCOUNTING Accounting: The information system that identifies, records, and communicates the economic events of an organization to interested users. Two Main Types of Users: 1. Internal Users: Managers who plan, organize, and run a business. Examples: Marketing managers, production supervisors, finance directors, and company officers. 2. External Users: Includes investors who use accounting information to make decisions to buy, hold, or sell stock and creditors who use the accounting information to evaluate the risks of selling on credit or lending money. Other Examples: Taxing Authorities (Ex: IRS), customers, labor unions, and regulatory agencies (Ex: Securities and Exchange Commission (SEC)). LO2: EXPLAIN THE BULDING BLOCKS OF ACCOUNTING: ETHICS, PRINCIPLES, AND ASSUMPTIONS Ethics In Financial Reporting Sarbanes-Oxley Act (SOX): Passed by congress to reduce unethical corporate behavior and decrease the likelihood of future corporate scandals. As a result of SOX…. 1. Top management must now certify the accuracy of financial information. 2. Penalties for fraudulent financial activity are much more severe. 3. The independence of the outside auditors who review the accuracy of corporate financial statements and the oversight role of the board of directors has increased. Standard-Setting Environment 1. GAAP: (Generally Accepted Accounting Principles) rules and concepts that govern financial accounting. It attempts to make information RELEVANT, RELIABLE, and COMPARABLE. Standard-setting bodies that determine these guidelines: • SEC (Securities and Exchange Commission): oversees the U.S. financial markets and accounting standard-setting bodies. • FASB (Financial Accounting Standards Board): The primary accounting standard-setting body in the United States. -

The Balance Sheet, the Income Statement, and the Statement of Cash Flows

1chapter Financial Accounting and Its Environment 1 LEARNING OBJECTIVES 1. Define accounting and identify its objectives. 2. Distinguish among the three major types of accounting. 3. List the three primary financial statements and briefly summarize the information contained in each. 4. Identify financial statement users and the decisions they make. 5. Define generally accepted accounting principles and explain how they are determined. 6. Describe the role of auditing. 7. List the economic consequences of accounting principle choice. 8. Assess the importance of ethics in accounting. INTRODUCTION Jane Johnson is considering selling T-shirts in the parking lot during her university’s football games. Jane, of course, will do this only if she expects to make a profit. To es- timate her profits, Jane needs certain pieces of information, such as the cost of a shirt, the university’s charge for the right to conduct business on its property, the expected selling price, and the expected sales volume. Suppose Jane has developed the follow- ing estimates: Sales price per shirt $ 12 Cost per shirt $ 7 Number of shirts sold per game day 50 University fee per game day $100 Although developing estimates is tricky, let’s take these estimates as given. Based on the estimates, Jane would earn a profit of $150 per game day. $600 (50 ן Sales ($12 Less expenses: $350 (50 ן Cost of merchandise ($7 University fee 100 Total expenses 450 Net income $150 2 Financial Accounting and Its Environment 2 CHAPTER 1 Since this looks like a reasonable profit, Jane puts her plan into action. After her first game day, Jane needs to assess her success (or failure). -

Accounting Equation

CC0 1.0 Universal (CC0 1.0) Public Domain Dedication https://creativecommons.org/publicdomain/zero/1.0/ Accounting Equation Building on the double-entry accounting model By Charles Hoffman, CPA ([email protected]) Last Revised – October 31, 2019 (DRAFT) “I skate to where the puck is going to be, not where it has been.” Wayne Gretzky, legendary Canadian hockey star Executive summary: • The double-entry accounting model and the accounting equation form the core shell for all financial reporting schemes. • This document enhances the accounting equation in two ways. First, it puts these definitions in machine-readable form1. Second, it puts the elements in context by explicitly showing the associations between the defined elements. 1 Human-readable and machine-readable documentation, http://xbrlsite.azurewebsites.net/2019/Core/core- sfac6/ 1 CC0 1.0 Universal (CC0 1.0) Public Domain Dedication https://creativecommons.org/publicdomain/zero/1.0/ Copyright (full and complete release of copyright) All content of this document is placed in the public domain. I hereby waive all claim of copyright in this work. This work may be used, altered or unaltered, in any manner by anyone without attribution or notice to me. To be clear, I am granting full permission to use any content in this work in any way you like. I fully and completely release all my rights to any copyright on this content. If you feel like distributing a copy of this work, you may do so without attribution or payment of any kind. All that said, attribution is appreciated should one feel so compelled. -

Beginning Governmental Accounting

Beginning Governmental 0011 0010 1010 1101 0001 0100Accounting 1011 Presented by: Elizabeth Alba, Instructor Yakima Valley Community College 0011 0010 1010 1101 0001 0100 1011 WMCA Workshop 1 March 19, 2014 2 45 0011 0010 1010 1101 0001 0100 1011 Please turn your cell phone to vibrate mode…. Thank you 12 45 Agenda • Basic Accounting Theory – Understanding the basic accounting equation – Identify asset and liability accounts • Double Entry Accounting – Record transactions using debits and credits – Understand how debits and credits affect accounts • Accounting System and Records – Understand the difference between journals and ledgers – Relate the journals and ledgers to computerized records – Learn the value and purpose of a trial balance • The Basis of Accounting – Define the basis of accounting – Contrast the three common bases of accounting – Understand when to recognize a revenue or expense under the modified accrual basis of accounting. • Budgets – Why are they important – Analysis of the budget Basic Accounting Theory Why Use Accounting? Generally Accepted Accounting Principles (GAAP) is a set of rules for businesses and governments to follow so their financial statements/reports can easily be compared to other businesses. Without GAAP, businesses could record and report data in any manner – making comparison difficult. Government vs. Private Business 0011 0010• Providing 1010 1101 0001services 0100 1011 • Profit driven • Fiscal and operational • Value for the owner or accountability shareholder is a major • Must comply with focus finance related legal • Income is expect to be and contractual issues more than the1 cost • Sometimes Revenues (Revenues must will not cover the cost exceed expenses to be of governmental profitable) 2 activites 45 Understanding the Accounting Equation • The basic accounting equation is the cornerstone of the accounting process. -

The Accounting Equation Slides

Tutorial 1a The Accounting Equation J. E. Cairnes School of Business and Economics NUI Galway J. E. Cairnes School of Business & Economics ASSETS Definition: ‘an asset is owned by its owner and is worth something to its owner’ ‘any right which is of economic value to its owner’ (Gillespie & Lewis, Principles of Financial Accounting) J. E. Cairnes School of Business & Economics ASSETS Fixed Assets (>12mths): • Acquired by the business with the intention of retaining them within the business to help generate profit • Tangible assets (Land and Buildings, Equipment etc.) • Investment property (For rental income or for sale at profit) • Intangible assets (Goodwill, R&D Investment etc.) • Financial assets (Shares in other companies etc.) J. E. Cairnes School of Business & Economics 1 ASSETS Current Assets (<12mths): • Assets which arise from day to day trading activities e.g. cash or assets that the business intends to turn into cash • Stock • Debtors • Cash/Bank • Prepaid expenses J. E. Cairnes School of Business & Economics LIABILITIES Defintions: ‘the source of funds from outsiders’ ‘amounts owed to people or firms outside the business’ (Gillespie & Lewis, Principles of Financial Accounting) J. E. Cairnes School of Business & Economics LIABILITIES Creditors falling due after more than one year: • Long term loans • Debentures Creditors falling due within one year: • Creditors • Short Term Borrowings • Taxation (<12 months) • Accrued Expenses J. E. Cairnes School of Business & Economics 2 Ownership Interest Often referred to as ‘Capital’, ‘Capital Employed’, ‘Equity’ or ‘Shareholders Funds’ The liability of the entity to the owners of the entity J. E. Cairnes School of Business & Economics Ownership Interest Definitions: ‘the owners claim on the business’ ‘the assets less liabilities of the business’ (Gillespie & Lewis; Principles of Financial Accounting) J. -

Slides 1-3 (2M:13S) Welcome to Introduction to Accounting Preparing for a User's Perspective What Are Debits and Credits?

Slides 1-3 (2m:13s) Welcome to Introduction to Accounting Preparing for a User’s Perspective What are debits and credits? Get ready this is kind of an ambitious video in which I am trying to get a lot of things accomplished in a very short period of time but if you will really take the time to fully comprehend this video and really commit to memory all the different slides in this video you will have mastered a major part of an introductory accounting course. Now I don’t know that you can do that, at least not in 10 minutes, but we’re going to give it a shot. Certainly refer to this video as you go back and try to make sure you know your debits and credits and how they fit into the expanded accounting equation. So let’s begin. This is a T-account. T-accounts are used to represent a company’s accounting ledgers. Accountants use ledgers to keep track of each individual account’s balance in dollars. Ledgers simplify math because all increases are on one side and all decreases are on the other side of the ledger account. Entries on the left hand side are called debits. Debit is just another word for left. Entries on the right side are called credits. Credit is just another word for right. Where this gets a little tricky is that some accounts, such as assets, increase with debits whereas other accounts, such as liabilities and equity, increase with credits. Jingle: Debits on the left, credits on the right, debits on the left, credits on the right. -

What Are the 11 Basic Accounting Formulas? ( )

What are the 11 Basic Accounting Formulas? (http://www.entrepreneur-starter-kit.com/accounting-formulas.html ) There are several accounting formulas used to report the financial health of a person or business. These formulas are used to produce the Balance Sheet and Income Statement. Also known as Profit & Loss Statement. Formula 1: The Accounting Equation The accounting equation is a vital formula. For it is the root of accounting. Worth = Assets – Liabilities The accounting formulas needed to produce the Accounting Balance Sheet (The accounting Balance Sheet is one of the main financial statements of a business. The other financial statements are the Income Statement and Cash Flow Statement. The worth of an entity is reported in the balance sheet. The balance sheet is a rearrangement of the accounting equation. http://www.entrepreneur-starter-kit.com/accounting-balance-sheet.html ) are: Formula 2: Current Assets Current assets are the sum of assets that will convert into cash in less than 12 months. Current Assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses Formula 3: Net Fixed Assets Net fixed assets are the book value of fixed assets. Net Fixed Assets = Fixed Assets @ cost – Accumulated Depreciation Formula 4: Total Assets The sum of all assets Total Assets = Current Assets + Other Assets + Net Fixed Assets Formula 5: Current Liabilities Bills due within 12 months of the Balance Sheet date. Current Liabilities = Accounts Payable + Accrued Expenses + Current Portion of Debt + Income Taxes Payable Formula 6: Shareholder’s Equity Shareholder’s equity is the value of the company to its owners. Also called net worth. Shareholder’s Equity = Capital Stock + Retained Earnings Page 1 of 2 Formula 7: Total Liabilities & Equity This is the total obligation plus worth of the entity. -

Asset, Liability, Owner's Equity, Revenue, and Expense Accounts

CHAPTER 1 Assets, Liability, Owner’s Equity, Revenue, and Expense Accounts Asset, Liability, Owner’s Equity, 1 Revenue, and Expense Accounts CHAPTER REVIEW 1. Define and identify asset, liability, and owner’s equity accounts. Assets are cash, properties, or things of values owned by the business. Liabilities are amounts the business owes to creditors. Owner’s equity is the owner’s investment or net worth. 2. Record a group of business transactions, in column form, involving changes in assets, liabilities, and owner’s equity. The accounting equation is stated as assets equals liabilities plus owner’s equity. Under the appropriate classification, a separate column is asset up for each ac- count. Transactions are recorded by listing amounts as either additions to or de- ductions from the various accounts. The equation must always remain in balance. 3. Define and identify revenue and expense accounts. Revenue consists of amounts earned by a business, such as fees earned for performing services, income from selling merchandise, rent income for the use of property, or inter- est earned for lending money. Expenses are the costs of earning revenue—that is, of do- ing business—such as wages expense, rent expense, interest expense, and advertising expense. 4. Record a group of business transactions, in column form, involving all five elements of the fun- damental accounting equation. The accounting equation has been expanded and appears as follows: Assets = Liabilities + Owner’s Equity (Capital) + Revenue – Expenses Accounts are classified and listed under each heading. Transactions are recorded by listing amounts as either addition to or deductions from the various accounts.